TIDMDNA2

RNS Number : 4963I

Doric Nimrod Air Two Limited

12 August 2021

DORIC NIMROD AIR TWO LIMITED

(Legal Entity Identifier: 213800ENH57LLS7MEM48)

ANNUAL FINANCIAL REPORT - CORRECTION

The following amendment has been made to the 'ANNUAL FINANCIAL

REPORT' announcement released on 3 August 2021 at 7.00 a.m. under

RNS No 3198H.

The seventh sentence of the third paragraph of the Chairman's

statement on page 10 should have read: "This unencumbered cash is,

in the absence of any unforeseen costs or event of default,

forecast to grow to approximately GBP25 million by the time the

last Lease expires."

All other details remain unchanged.

The full amended text is shown below.

The Board of the Company is pleased to announce its results for

the year ended 31 March 2021.

To view the Company's Annual Financial Report please follow the

link below:

http://www.rns-pdf.londonstockexchange.com/rns/4963I_1-2021-8-12.pdf

In addition, to comply with DGTR 4.1 please find below the full

text of the annual financial report. The report will also shortly

be available on the Company's website www.dnairtwo.com .

ANNUAL GENERAL MEETING

Notice of the Annual General Meeting of the shareholders of the

Company (the "AGM") will be published in due course.

For further information, please contact:

For administrative and Company information:

JTC Fund Solutions (Guernsey) Limited

+44 (0) 1481 702400

For shareholder information:

Nimrod Capital LLP

+44 (0) 20 7382 4565

OF ANNOUNCEMENT

E&OE - in transmission

Doric Nimrod Air Two Limited

Consolidated Annual Financial Report

From 1 April 2020 to

31 March 2021

DEFINITIONS

" Administrative Subordinated administrative shares

Shares"

"AED" United Arab Emirates dirham

"AGM" Annual general meeting

" ANZ" The Australia and New Zealand Banking Group

Limited

"AR Committee Audit and Risk Committee

"

"Articles Company's Articles of Incorporation

"

"ASKs" Available seat kilometers

"Asset(s) Airbus A380 Aircraft

" or the "Aircraft Air Transport Action Group

"

"ATAG"

"BA" British Airways

"Board " Company's Board of directors

"CDS's" Credit Default Swaps

" Certificates" DNA Alpha Pass Through Certificates issued

in August 2013

"Chair" Chair of the Board

"Code " The UK Corporate Governance Code

"CORSIA " Carbon Offsetting and Reduction Scheme for

International Aviation

"Deloitte Deloitte LLP

"

"DGTRs " Disclosure Guidance and Transparency Rules

"DNA2 " or Doric Nimrod Air Two Limited

the "Company

"

"DNAFA" Doric Nimrod Air Finance Alpha Limited

"Doric LLP" Doric Partners LLP

"Doric" or the Doric GmbH

"Asset Manager"

"DWC" Dubai World Central International Airport

" EETC" or "Certificates" Enhanced equipment trust certificates

" Emirates" or Emirates Airlines

the " Lessee"

" EPS or LPS Earnings / loss per Share

"

"Equity" C Share issue

" ESG " Environmental, Social and Governance

" EU" European Union

" EU ETS " European Union Emission Trading Scheme

"FCA" Financial Conduct Authority

" FRC " Financial Reporting Council

"FVOCI" Fair value through other comprehensive income

" FVTPL" Fair value through profit or loss

" GBP", "GBP" Pound Sterling

or "Sterling"

" GFSC" Guernsey Financial Services Commission

" GHG" Greenhouse gas

"Group" the Company and its subsidiaries

"IAS 1" International Accounting Standard 1 - Presentation

of financial statements

"IAS 8" International Accounting Standard 8 - Accounting

policies

"IAS 16" International Accounting Standard 16 - Property,

Plant and Equipment

"IAS 36" International Accounting Standard 36 - Impairment

of Assets

"IASB " International Accounting Standards Board

"IATA " International Air Transport Association

"ICAO " International Civil Aviation Organization

" IFRIC " International Financial Reporting Interpretations

Committee

"IFRS " International Financial Reporting Standards

" IFRS 13 " IFRS 13 - Fair value measurement

"IFRS 16 " IFRS 16 - Leases

"IPCC " Intergovernmental Panel on Climate Change

"ISAE 3402 " International Standard on Assurance Engagement

3402

"ISTAT " International Society of Transport Aircraft

Trading

"JTC " or "Secretary JTC Fund Solutions (Guernsey) Limited

" or "Administrator

"

"Law " The Companies (Guernsey) Law, 2008, as amended

"Lease(s)" Lease of Aircraft to Emirates

"Loan(s)" Borrowings obtained by the Group to part-finance

the acquisition of Aircraft

"LSE" London Stock Exchange's

"NBV" Depreciated cost

"Nimrod" or "Corporate Nimrod Capital LLP

and Shareholder

Adviser"

"Pandemic" COVID-19 pandemic

"Period" 1 April 2020 until 31 March 2021

"PIES" Public Interest Entities

"PLF" Passenger Load Factor

" Registrar" JTC Registrars Limited

"RPKs" Revenue passenger kilometers

"SAF" Sustainable Aviation Fuel

"SDG" Sustainable Development Goals

"SFS" Specialist Fund Segment

" Shareholders" Shareholders of the Company

" Shares" Ordinary Preference Shares of the Company

"Share Capital" Share capital of the Company

"SID" Senior Independent Director

"Subsidiaries" MSN077 Limited, MSN090 Limited, MSN105 Limited

and DNAFA

"TAP" TAP Air Portugal

"UAE" United Arab Emirates

"UK" United Kingdom

"USD" or "$" US dollars

"VIU" Value-in-use

"WACC" Weighted average costs of capital

" Westpac " Westpac Banking Corporation

SUMMARY INFORMATION

Listing Specialist Fund Segment of the London

Stock Exchange's Main Market

Ticker DNA2

-------------------------------------------

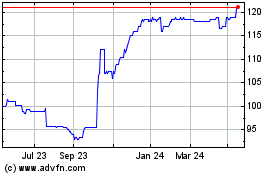

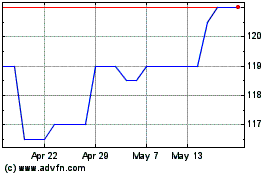

Share Price 76.00 pence (as at 31 March 2021)

73.00 pence (as at 30 July 2021)

-------------------------------------------

Market Capitalisation GBP126.107 million (as at 30 July

2021)

-------------------------------------------

Current / Future Anticipated Current dividends are 4.5 pence per

Dividend quarter per Share (18 pence per annum)

and it is anticipated that this will

continue until the aircraft leases

begin to terminate in 2023

-------------------------------------------

Dividend Payment Dates April, July, October, January

-------------------------------------------

Currency Sterling

-------------------------------------------

Launch Date / Share Price 14 July 2011 / 200 pence

-------------------------------------------

Incorporation and Domicile Guernsey

-------------------------------------------

Aircraft Registration A6-EDP (14 October 2023)

Numbers A6-EDT (2 December 2023)

(Lease Expiry Dates including A6-EDX (1 October 2024)

the 2 year extension) A6-EDY (1 October 2024)

A6-EDZ (12 October 2024)

A6-EEB (9 November 2024)

A6-EEC (30 November 2024)

-------------------------------------------

Asset Manager Doric GmbH

-------------------------------------------

Corporate and Shareholder Nimrod Capital LLP

Adviser

-------------------------------------------

Administrator JTC Fund Solutions (Guernsey) Limited

-------------------------------------------

Auditor Deloitte LLP

-------------------------------------------

Market Makers finnCap Ltd

Investec Bank

Jefferies International Ltd

Numis Securities Ltd

Shore Capital Limited

Winterflood Securities Ltd

-------------------------------------------

SEDOL, ISIN, LEI B3Z6252,GG00B3Z62522, 213800ENH57LLS7MEM48

-------------------------------------------

Year End 31 March

-------------------------------------------

Stocks & Shares ISA Eligible

-------------------------------------------

Website www.dnairtwo.com

-------------------------------------------

COMPANY OVERVIEW

DNA2 is a Guernsey company incorporated on 31 January 2011.

Pursuant to the Company's prospectus dated 30 June 2011, the

Company, on 14 July 2011, raised approximately GBP136 million by

the issue of Shares at an issue price of GBP2 each. The Company's

Shares were admitted to trading on the SFS at 14 July 2011.

The Company raised a further GBP188.5 million from a C Share

fundraising, which closed on 27 March 2012 with the admission of

100,250,000 convertible preference shares to trading on the

SFS.

On 6 March 2013, the Company's C Shares converted into an

additional 100,250,000 Shares. These additional Shares were

admitted to trading on the SFS and rank pari passu with the Shares

already in issue.

As at 30 July 2021, the last practicable date prior to the

publication of this report, the Company's total issued Share

capital consisted of 172,750,000 Shares and these Shares were

trading at 73.00 pence per Share.

Investment Objectives and Policy

The Company's investment objective is to obtain income returns

and a capital return for its Shareholders by acquiring, leasing and

then selling aircraft. The Company receives income from the Lease

rentals paid to it by Emirates, the national carrier owned by the

Investment Corporation of Dubai, based in Dubai, United Arab

Emirates, pursuant to the Leases.

Subsidiaries

The Company has four wholly-owned subsidiaries: MSN077 Limited,

MSN090 Limited, MSN105 Limited and DNAFA which collectively hold

the Assets for the Company.

The first Asset was acquired by MSN077 Limited on 14 October

2011 for a purchase price of $234 million and has been leased to

Emirates for an expected initial term of 10 years to October 2021,

with an extension period of 2 years ending October 2023, with fixed

lease rentals for the duration.

The second Asset was acquired by MSN090 Limited on 2 December

2011 for a purchase price of $234 million and has been leased to

Emirates for an expected initial term of 10 years to December 2021,

with an extension period of 2 years ending December 2023, with

fixed lease rentals for the duration.

The third Asset was acquired by MSN105 Limited on 1 October 2012

for a purchase price of $234 million and has been leased to

Emirates for an expected initial term of 10 years to October 2022,

w ith an extension period of 2 years ending October 2024, in which

rental payments reduce.

The fourth Asset, MSN 106, was acquired by DNAFA on 1 October

2012 for a purchase price of $234 million and has been leased to

Emirates for an expected initial term of 10 years ending October

2022, with an extension period of 2 years ending October 2024, in

which rental payments reduce.

The fifth Asset, MSN 107, was acquired by DNAFA on 12 October

2012 for a purchase price of $234 million and has been leased to

Emirates for an expected initial term of 10 years ending October

2022, with an extension period of 2 years ending October 2024, in

which rental payments reduce.

The sixth Asset, MSN 109, was acquired by DNAFA on 9 November

2012 for a purchase price of $234 million and has been leased to

Emirates for an expected initial term of 10 years ending November

2022, with an extension period of 2 years ending November 2024, in

which rental payments reduce.

The seventh Asset, MSN 110, was acquired by DNAFA on 30 November

2012 for a purchase price of $234 million and has been leased to

Emirates for an expected initial term of 10 years ending November

2022, with an extension period of 2 years ending November 2024, in

which rental payments reduce.

The fourth, fifth, sixth and seventh Assets were acquired by

DNAFA using the proceeds of the issue of the C Shares, together

with the proceeds of equipment notes issued by DNAFA. The equipment

notes were acquired by two separate pass through trusts using the

proceeds of their issue of EETCs. The EETCs, with an aggregate face

amount of approximately $587.5 million were admitted to the

Official List of the UK Listing Authority and to the LSE on 12 July

2012. These four Assets were also leased to Emirates 12 years to

the second half of 2024, with fixed lease rentals for the

duration.

In order to complete the purchase of the related Assets, MSN077

Limited, MSN090 Limited and MSN105 Limited entered into separate

loan agreements with a number of banks (see note 15), each of which

will be fully amortised with quarterly repayments in arrears over

12 years. A fixed rate of interest applies to the Loans except for

50 per cent. of the Loan in MSN090 Limited which has a related

interest rate swap entered into to fix the interest rate. MSN077

Limited drew down $151,047,059 under the terms of the first loan

agreement to complete the purchase of the first Asset; MSN090

Limited drew down $146,865,575 in accordance with the second loan

agreement to finance the acquisition of the second Asset; and

MSN105 Limited drew down $145,751,153 in accordance with the third

loan agreement to finance the acquisition of the third Asset. The

first loan agreement, the second loan agreement and the third loan

agreement are on materially the same terms.

Emirates bears all costs (including maintenance, repair, and

insurance) relating to the Aircraft during the lifetime of the

Leases.

Further information about the construction of these Leases is

available in note 12 to the financial statements.

Distribution Policy

The Company currently targets a distribution of 4.50 pence per

Share per quarter.

There can be no guarantee that dividends will be paid to

Shareholders and, if dividends are paid, as to the timing and

amount of any such dividend. There can also be no guarantee that

the Company will, at all times, satisfy the solvency test required

to be satisfied pursuant to section 304 of the Law, enabling the

directors to effect the payment of dividends.

Performance Overview

All payments by Emirates have, to date, been made in accordance

with the terms of the respective Leases.

During the financial year under review, and in accordance with

the Distribution Policy, the Company declared four interim

dividends of 4.50 pence per Share. Two interim dividends of 4.50

pence per Share have been declared after the reporting period.

Further details of dividend payments can be found on page 25.

Return of Capital

The Company intends to return to Shareholders net capital

proceeds if and when the Company is wound-up (pursuant to a

Shareholder resolution, including the liquidation resolution

below), subject to compliance with the Articles and the applicable

laws (including any applicable requirements of the solvency test

contained therein).

Liquidation Resolution

Although the Company does not have a fixed life, the Articles

require that the directors convene a general meeting of the Company

in June 2025 where an ordinary resolution will be proposed that the

Company proceed to an orderly wind-up. In the event that the

liquidation resolution is not passed, the directors will consider

alternatives for the future of the Company, including re-leasing

the Assets, or selling the Assets and reinvesting the capital

received from the sale of the Assets in other aircraft.

C H A I R ' S S T A TE M ENT

During the Period the Company has declared and paid four

quarterly dividends of 4.5 pence per Share each, a rate of dividend

payment equivalent to 18 pence per Share per annum.

The Company's investment objective is to obtain income returns

and a capital return for its Shareholders by acquiring, leasing and

then selling aircraft. The structures of the operating Leases

relating to the Company's seven Aircraft are described on pages 7

to 9.

The debt portion of the funding is designed to be fully

amortised over the term of the Leases, which would leave the

Aircraft unencumbered on the conclusion of the ultimate Lease.

Emirates bears all costs (including maintenance, repair and

insurance) relating to the Aircraft during the lifetime of the

Leases. At 30 July 2021, the latest practical date prior to this

report, the Company had outstanding debt associated with the

Aircraft totalling USD 157.7 million (15% of the initial balance)

as well as unencumbered cash resources of GBP13.3 million (net of

the upcoming quarterly dividend payable at the end of July which

amounts to approximately GBP7.8m). This unencumbered cash is, in

the absence of any unforeseen costs or event of default, forecast

to grow to approximately GBP25 million by the time the last Lease

expires. At the time of writing the share price is 73 pence,

representing a market capitalisation of GBP126.107 million based on

the 172,750,000 Shares in issue. The Company's first Lease expiry

falls due in October 2023.

All payments by Emirates during the period and throughout the

Leases have been made in accordance with the respective terms of

the Leases. The Company's Aircraft have been stored since March

2020, currently at DWC.

COVID-19 has obviously had a devastating impact globally and has

precipitated the biggest disruption to the global aviation industry

in its entire history, adversely impacting the prospects for many

widebody aircraft, including the A380. The IATA has recently

increased its forecast for an airline industry-wide net loss for

2021 to USD 47.7 billion while many airlines do not anticipate a

full recovery until 2023/4. In the face of such news, it is

reassuring to know that Emirates is one of the world's largest,

most dynamic and stable airlines. Wholly owned by the Government of

Dubai, the airline received financial support from its shareholder

in the third quarter of last year and recent comments give no

indication that further support would not be forthcoming if the

recovery is delayed.

Emirates results for the year to 31 March 2021 reported an

annual loss of USD 5.5 billion, the first non-profitable year in

over three decades. Emirates ended the year with a cash balance of

USD 1 billion. Emirates received capital injections totalling USD

3.1 billion from their ultimate shareholder, the Government of

Dubai. Despite a significant strain on cash assets, Emirates

assured the market that they continued to honour all financial

obligations. Further, Emirates announced that new credit lines and

facilities have been set up to ensure appropriate liquidity is

maintained to mitigate any short term shocks in case the crisis

continues for longer than they anticipate.

Emirates has invested to upgrade its signature A380 experience

with new Premium Economy seats and other product enhancements.

Specifically regarding the A380 Emirates president Sir Tim Clark

recently commented that it "will figure in the Emirates fleet for

the next 15 years" and that "It's hugely popular. 85% of our

profits prior to COVID-19 came from the A380. It was always full

... It was popular in all classes."

Whilst Emirates do not have a formal credit rating, they have

previously issued unsecured USD bonds with maturities in 2023, 2025

and 2028. At the time of writing these instruments are trading at

approximately 101.1, 102.3 and 102.4 cents respectively, equivalent

to USD running yields in the range of roughly 3.8% to 4.4%. Further

details on Emirates and the A380 can be found in the Asset

Manager's report by Doric.

In line with the appraisals obtained last year your Board has

elected to use 'future soft values' for the A380 with the published

figure based on the average of three independent appraisers all of

which have remained the same since the Company's launch. These

values are characterised by less favourable market conditions for

the seller, including but not limited to an imbalance of supply and

demand in the aircraft type. As a result of the COVID-19 pandemic

the vast majority of A380 worldwide remain grounded and therefore,

with a limited number of operators, a high degree of uncertainty

remains over future values. Following a steep decline last year

where the appraised value essentially halved in USD terms the

latest value of the Company's Assets reflects a much more modest

decline of GBP40.5m (approximately 15%) to GBP229.5m on a future

soft value (uninflated) basis. On a USD basis the decline is

approximately 5.6% year-on-year. Based on the current share price

of the Company the market appears to be discounting the latest

appraisal value by in excess of 50%. The Company's quarterly

factsheet provides a useful sensitivity analysis of the potential

returns to Shareholders, after lease expiry, under different

scenarios for A380 appraisal values. Further details on residual

values can be found in notes 2(m), 3 and 10 of the accounts.

The Company's first Lease with Emirates expires in October 2023,

approximately 27 months from now. The redelivery procedure for a

widebody aircraft is complex and highly technical and as we move

closer to the first Lease expiry your Board will provide more

details on the high-level considerations and also the implications

of the various potential outcomes for Shareholders.

This report delivers the second iteration of the company's ESG

Policy. This provides Shareholders with further detail on the

Company's business model and matters such as the environmental and

social considerations of the aviation industry and the importance

of high standards of Corporate Governance. Your Board recognises

the increasing importance of ESG matters in relation to

shareholders' investment considerations and has sought to address

the topic in a pragmatic fashion, as detailed in our ESG report on

page 35.

Doric continues to monitor the Leases and is in frequent contact

with the Lessee and reports regularly to the Board. Nimrod

continues to liaise with Shareholders on behalf of the Board and

has provided valuable feedback on the views of Shareholders in the

current climate.

Shareholders should note that although the underlying cash flows

received and paid during the Period have been received and paid as

anticipated and in accordance with contractual obligations; it may

not be obvious that this is so because of the application of the

accounting treatments for foreign exchange, rental income and

finance costs mandated by IFRS.

For instance, the entirety of the rental income that is

receivable under the 12 year Leases (including advance rental

received as part of the initial acquisition of the Assets) is

credited evenly over each of the 144 months of the Leases. However

rental income has been received in advance of this uniform pattern

in order to match and fund the accelerated payment down of debt.

Thus as at 31 March 2021, some 86% of income receivable under the

Leases has been received, which has funded the payment down of 81%

initial borrowings, whereas under the relevant accounting standard

only some 73% may be recognised. This mismatch in timing between

the receipt and recognition of rental income results in a deferred

income creditor of GBP145.1 million or some 84 pence per share in

the 31 March 2021 balance sheet. This is an artificial accounting

adjustment in the sense that it does not represent a liability to

pay GBP145.1million to third parties. The faster that income is

received and debt repaid the larger the resultant creditor

producing a reduction in reported net asset value.

Similarly, the relevant accounting standards require that

transactions denominated in currencies other than the presentation

currency (including, most importantly, the cost of the Aircraft)

are translated into the presentation currency at the exchange rate

ruling at the date of the transaction whilst monetary items

(including also very significantly, the outstanding borrowings and

the deferred income creditor) are translated at the rate prevailing

on the reporting date. The result is that the figures sometimes

show large mismatches which are reported as unrealised foreign

exchange differences - although the distortive effect becomes less

pronounced over time as debt is paid down.

On an on-going basis and assuming the Lease rental is received,

and the loan payments are made as anticipated, such exchange

differences do not reflect the commercial substance of the

situation in the sense that the key transactions denominated in USD

are in fact closely matched. Rental income received in USD is used

to make loan repayments due which are likewise denominated in USD.

Furthermore, the USD Lease rentals and loan repayments are fixed at

the inception of the respective Leases and are very similar in

amount and timing.

The Board encourages Shareholders to read the Company's

quarterly fact sheets which we believe provide a great deal of

interesting information. We hope these regular reports, in addition

to the communication you receive from Nimrod, are useful and

informative. The directors welcome Shareholder engagement and

feedback and encourage you to contact Nimrod to request a meeting

or to relay any feedback.

Finally, on behalf of the Board, I would like to thank our

service providers for all their help and, most importantly, all

Shareholders for their continuing support of the Company during

these difficult times. I look forward to keeping all Shareholders

up to date with further progress.

Geoffrey Hall

Chair

2 August 2021

ASSET MANAGER'S REPORT

At the request of the directors of the Company, this commentary

has been provided by the Asset Manager of the Company.

COVID-19

The Pandemic continues to impact private and economic life

worldwide. The consequences of COVID-19 are far reaching and

changing at a significant pace. The impact of this Pandemic on the

aviation sector has been significant with a large part of the

global passenger aircraft fleet grounded. This Asset Manager's

report is exclusively based on known facts at the time of writing

and does not seek to draw on any speculation about any possible

future, long-term impacts of the Pandemic on the aviation sector or

the Company specifically and should be read in such context.

1. The Assets

The Group acquired a total of seven Airbus A380-861 aircraft

between October 2011 and November 2012. Each Aircraft is leased to

Emirates - the national carrier owned by the Investment Corporation

of Dubai, based in Dubai, United Arab Emirates - for a term of 12

years from the point of delivery, with fixed Lease rentals for the

duration. In order to complete the purchase of the first three

Aircraft, MSN077 Limited, MSN090 Limited and MSN105 Limited entered

into three separate loans, each of which will be fully amortised

with quarterly repayments in arrears over 12 years.

The net proceeds from the C Share issuance were used to

partially fund the purchase of four of the seven Airbus A380s. In

order to help fund the acquisition of these final four Aircraft,

DNAFA issued two tranches (Class A & Class B) of EETC - a form

of debt security - in June 2012 in the aggregate face value of USD

587.5 million. The Certificates are admitted to the official list

of the Euronext Dublin and to trading on the Main Securities market

thereof. DNAFA used the proceeds from both the equity and the

Certificates to finance the acquisition of four new Airbus A380

aircraft which were then leased to Emirates.

The seven Airbus A380 aircraft bear the manufacturer's serial

numbers (MSN) 077, 090, 105, 106, 107, 109, and 110.

Due to the effects of COVID-19, the Aircraft have been stored

since March 2020, currently at DWC.

Maintenance Status

Emirates maintains its A380 aircraft fleet based on a

maintenance programme according to which minor maintenance checks

are performed every 1,500 flight hours, and more significant

maintenance checks (C checks) at 36-month or 18,000-flight hour

intervals, whichever occurs first.

Due to the continuing Pandemic, Emirates has stored the Aircraft

owned by the Group in Dubai. The Lessee has "a comprehensive

aircraft parking and reactivation programme [in place], that

strictly follows manufacturer's guidelines and maintenance

manuals". In addition, Emirates has enhanced standards and

protocols of their own, to protect and preserve the Assets during

the downtime. This includes the watertight sealing of all apertures

and openings through which environmental factors - sand, water,

birds, and insects - can find their way inside an aircraft. During

parking, maintenance teams complete periodic checks at different

intervals. Depending on the reactivation date of a specific

aircraft, Emirates might defer due maintenance checks, which are

calendar-based, until that time. This would allow the airline to

make use of the full maintenance interval once the operation of a

specific aircraft resumes.

Emirates bears all costs relating to the Aircraft during the

lifetime of the respective Leases (including maintenance, repairs,

and insurance).

Inspections

The Asset Manager conducted physical inspections and records

audits of the Aircraft as per the below table. Due to the storage

of the Aircraft and the protective measures associated with this,

the inspections of the Aircraft were limited to viewing the outside

of the Aircraft from ground level. The condition of the Aircraft -

to the extent visible - and the records were in compliance with the

provisions of the respective Lease agreements.

MSN Last Inspection MSN Last Inspection

077 08/2020 & 03/2021 107 10/2020 & 03/2021

------------------ ---- ------------------

090 03/2021 109 11/2020

------------------ ---- ------------------

105 08/2020 110 11/2020

------------------ ---- ------------------

106 08/2020

------------------ ---- ------------------

2. Market Overview

The impact of COVID-19 on the global economy has been severe,

resulting in an estimated contraction in global GDP of 4.3% for

2020, according to the World Bank. This is expected to be followed

by a recovery in growth of 5.5% in 2021. In its latest economic

impact analysis from April 2021, the ICAO estimates that the full

year 2020 has seen an overall reduction in seats offered by

airlines of 50% compared with the previous baseline forecast for

that year. Furthermore, ICAO anticipates this trend to continue

through 2021 with airlines reducing seats offered by 34% to 39%

compared to 2019 levels. However, the actual impact of COVID-19 on

the airline industry will depend on several factors, including the

duration and magnitude of the outbreak and containment measures,

the degree of consumer confidence in air travel as well as general

economic conditions.

IATA anticipates an airline industry-wide net loss of USD47.7

billion in 2021, according to its latest update from April 2021. On

this occasion it also revised the net loss estimate for the

previous year from nearly USD119 billion to more than USD 126

billion, due to larger than anticipated losses in the final quarter

of 2020.

While air passenger demand began its recovery from the low point

in April 2020, IATA notes that the recovery in air travel has been

stagnating due to the global resurgence of the virus and the

related shutdowns during the fourth quarter of 2020. In total,

industry-wide RPKs fell by 65.9% in 2020 - the largest decline in

the history of aviation. Similarly, industry-wide capacity,

measured in ASKs, contracted by 56.7% last year. As a result, the

worldwide PLF fell by 17.5 percentage points to 65.1%.

Due to their reliance on international long-haul routes, Middle

Eastern carriers like Emirates experienced the greatest decline in

RPKs (-72.2%) of any region in 2020. Capacity also fell by 63.3%

during that period. This resulted in an 18.5 percentage point

decrease in PLF to 57.6%.

The latest IATA passenger traffic data from February 2021

demonstrate renewed weakness in air travel following new variants

of the virus leading to a record-high level of confirmed cases in

January 2021 and governments increasing travel restrictions.

However, global new cases of COVID-19 were on a downward trend in

February, around 40% below the record level from January. Despite

this, RPKs in February contracted by 74.7% compared to pre-crisis

February 2019 levels. This deterioration in the air travel recovery

was primarily driven by domestic markets, especially in China,

where citizens were asked to stay at home during the traditional

Chinese New Year travel period. IATA notes that this decline could

reverse in March with flights scheduled in domestic China rising

above pre-crisis levels.

IATA cautions that vaccine distribution efforts are progressing

slowly. At the end of February, there were only 3.3 doses given per

100 people worldwide. Countries have kept international travel

restricted to avoid importing new variants and because both sides

of the route require low infection rates. Only Africa and the

Middle East have begun to ease flight restrictions as of February

2021.

Source: IATA, ICAO

(c) International Air Transport Association, 2021. Air Passenger

Market Analysis December 2020. Air Passenger Market Analysis

February 2021. Outlook for the Global Airline Industry - Update

April 2021. All Rights Reserved. Available on the IATA Economics

page.

(c) International Civil Aviation Organization. Effects of Novel

Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis,

20 April 2021.

3. Lessee - Emirates

Network

Emirates' recovery efforts continued at the beginning of 2021

with the restart of operations to destinations in the Americas. As

of the beginning of March, Emirates had resumed flights to 10

destinations in North America: Boston, Chicago, Dallas, Houston,

Los Angeles, New York JFK, San Francisco, Seattle, Toronto, and

Washington DC. Emirates also increased the frequencies of its

services to New York, Los Angeles, and Sao Paulo. Additionally,

Emirates announced plans to increase services to the Maldives and

Seychelles ahead of the Easter holiday. Emirates is primarily using

Boeing 777 aircraft to serve these destinations.

However, Emirates has also had to demonstrate flexibility in its

recovering operations amid worsening COVID-19 cases. At the end of

January, the UK restricted the entry of passengers who arrived from

or transited through the UAE to those with British or Irish

passports or UK residency and banned direct flights from the

country. In response, Emirates is providing outbound passenger

services from the UK to Dubai, primarily for UAE residents. By the

end of March 2021, Emirates had restored services to over 120

passenger and cargo destinations worldwide, reaching 42% of its

total capacity compared to the previous year. Emirates operated

flights to 157 destinations in 82 countries before the pandemic

started.

Emirates' president Sir Tim Clark stated in February that the

carrier will recover from the COVID-19 crisis without any

fundamental changes to its business model. Rather, Emirates intends

to use its mix of widebody aircraft to take advantage of

anticipated supply-side shortages in medium- and long-haul sectors

in the coming years. At the same, time he revised his earlier

prediction according to which medium- and long-haul international

traffic would ramp up significantly in July and August this year.

He now expects such developments in the last quarter of 2021: "At

the end of the day, my view is that once

we are through this, demand for air travel will return, consumer

confidence will return."

In February, Emirates announced that it has become among the

first airlines in the world to operate a flight with fully

vaccinated frontline teams across all customer touchpoints,

including check-in and security personnel, as well as engineers,

pilots, and cabin crew. About a month into its vaccination

programme, close to 26,000, or 44%, of Emirates Group's UAE

frontline aviation workforce, which includes Emirates Airline and

air service provider dnata, have already received both doses of the

vaccine.

In March, Emirates and TAP signed a Memorandum of Understanding

(MoU) to expand the codeshare partnership currently in place

between both airlines. TAP passengers will gain access to Emirates'

destinations in East Asia, while Emirates passengers will be able

to access additional domestic destinations in Portugal as well as

to cities in the USA, Canada, Mexico, Brazil, Senegal,

Guinea-Bissau, Guinea-Conakry, Morocco, Tunisia, Gambia, and Cape

Verde. The carriers also intend to explore ways to cooperate on

their respective frequent flyer and stopover programmes.

In April, Emirates commenced trials of IATA's Travel Pass on a

flight from Dubai to Barcelona. The Travel Pass is a mobile

application with an integrated registry of travel requirements

designed to enable passengers to manage their travel in line with

any government requirements for COVID-19 testing or vaccine

information.

Fleet

For the last year or so, Emirates' operations have largely

focused on cargo services using its fleet of Boeing 777 aircraft.

To meet the global demand for the transport of essential supplies,

Emirates SkyCargo introduced freighter services using passenger

aircraft as well as 19 Boeing 777-300ER 'mini-freighters' converted

for cargo operations. Emirates SkyCargo also made use of A380

'mini-freighters' on select cargo charter operations during this

time. As of mid-March, Emirates SkyCargo has operated more than

27,800 cargo-only flights on passenger aircraft, which have

transported more than 100,000 tonnes of essential supplies. In

total, about a third of Emirates' passenger aircraft was used for

cargo operations.

The table below details the passenger aircraft fleet activity as

of 31 March 2021:

Passenger Fleet Activity

Aircraft Type Grounded In Service

-------- ----------

A380 102 15

-------- ----------

777 1 134

-------- ----------

Total 103 149

-------- ----------

% 41 % 59 %

-------- ----------

Source: Cirium as of 31 March 2021

In late January 2021, Boeing announced a further delay to the

777X programme, now pushing the delivery of the first of the type

to at least late 2023. Given the delay, the 777X might not enter

into service with Emirates as late as 2025 and so the carrier now

intends to operate the A380 on trunk routes through to the

mid-2030s with the 777X gradually replacing A380s leaving the

fleet. In this context, Emirates President Sir Tim Clark has even

raised the prospect of switching orders from the 777X to the 787

Dreamliner, a smaller aircraft family compared to the 777X. He also

noted that the use of generally smaller aircraft will result in

slot capacity issues, once traffic levels return after the

Pandemic.

According to the airline's chief operating officer, Emirates is

discussing dates and schedules of new aircraft deliveries with

Airbus and Boeing. Additionally, amid the uncertainty of the new

deliveries, Sir Tim Clark emphasized that the A380 will continue to

play an ongoing role at Emirates for at least another 15 years,

underscoring that the A380 accounted for 85% of profits and was

"always full" prior to the Pandemic.

Key Financials

In the financial year ending 31 March 2021, Emirates recorded

its first loss in over 30 years. Revenues fell 66.4% to AED 30.9

billion (USD 8.4 billion) due to the global Pandemic. As a result,

Emirates recorded a net loss of AED 20.3 billion (USD 5.5 billion)

compared to a profit of AED 1.1 billion (USD 287.7 million) in the

previous financial year.

The number of passengers Emirates carried fell 88% to 6.6

million during the financial year following the suspension of

passenger operations in the early part of the year and the

subsequent sluggish recovery . As a result, Emirates reduced its

ASKs by 83% in the 2020/21 financial year, while RPKs were down by

90%. During this period, Emirates' average PLF fell to 44.3%,

compared to last year's pre-pandemic figure of 78.5%.

In response to the crisis, Emirates took a number of actions to

reduce costs, including reducing its workforce by 32.0%. It also

trimmed its fleet by a net 11 units. This includes five A380. One

was retired during the financial year. A further four were taken

out of operations as they are currently grounded and not expected

to be used before their scheduled retirement dates within the

2021/22 financial year. Additionally, the carrier sought to

restructure certain financial obligations, renegotiate contracts,

and consolidate its operations. Overall, Emirates reduced its total

operating costs by 46.4%. This was attributable to lower nominal

cost in all but one operating cost category. Charges for

depreciation, amortization and impairment increased, and its share

in total operating costs amounted to 42.9%. Jet fuel, traditionally

the single largest cost category with Emirates, represented a share

of 13.9% in the total operating cost. Despite this significant

reduction in operations, the carrier's EBITDA remained positive at

AED 4.6 billion (USD 1.3 billion).

While demand for air passenger travel was down during the

2020/21 financial year, airfreight demand rose strongly. In fact,

Emirates SkyCargo increased its revenues by 52.6% to AED 17.1

billion (USD 4.7 billion) during this period. The volume of cargo

uplifted decreased by 21.6% to 1.9 million tonnes, due to the lower

belly capacity available, while the yield nearly doubled. This

development reflects the extraordinary market situation during the

global Pandemic.

In February 2021, Adel Al Redha, Emirates COO, noted that

freight revenues exceeded the airline's expectations. Revenue from

cargo operations amounted to 56.6% of Emirates' total revenues

during the last financial year, up from 12.8% in the period before.

However, passenger travel revenues appear to be volatile, depending

on the measures taken by countries to overcome the Pandemic.

As of 31 March, Emirates' total liabilities decreased by 11.3%

to AED 131.6 billion (USD 35.9 billion USD) compared to the end of

the previous financial year. Total equity decreased by 14.6% to AED

20.1 billion (USD 5.5 billion) with an equity ratio of 13.3%.

Emirates' cash position amounted to AED 4 billion (USD 1 billion)

at the end of March 2021. This compares to AED 20.2 billion (USD

5.5 billion) in cash assets at the beginning of the 2020/21

financial year. The drop in liquid funds was mainly driven by

ticket refund payments to customers in the amount of AED 8.5

billion (USD 2.3 billion), while the cash flow from operating

activities was AED 4.0 billion (USD 1.1 billion) positive.

On the ongoing financial position of Emirates in light of the

global pandemic, HH Sheikh Ahmed bin Saeed Al Maktoum, chairman and

chief executive of Emirates, stated: " Our top priorities

throughout the year were: the health and wellbeing of our people

and customers, preserving cash and controlling costs, and restoring

our operations safely and sustainably. Emirates received a capital

injection of AED 11.3 billion (USD 3.1 billion) from our ultimate

shareholder, the Government of Dubai... [This] helped us sustain

operations and retain the vast majority of our talent pool."

As at the end of June 2021, Emirates has outstanding USD debt

issuances with maturities in 2023, 2025, and 2028. These respective

bonds were trading at above par (100 cents) each and with running

yields ranging from approximately 3.8% to 4.4% in USD. There has

also been no upward pressure on yields. This level of yields does

not appear to indicate that the market sees any significant

financial stress to the issuer. In its latest annual financial

report the auditor PricewaterhouseCoopers issued an unqualified

audit report and the airline stated it "remains confident to meet

our financial commitments as they fall due in the coming year and

beyond through proactive working capital management and utilisation

of available credit lines and facilities".

Source: Bloomberg, Cirium, Emirates, Khaleej Times

4. Aircraft - A380

As of the end of March 2021, the global A380 fleet consisted of

240 planes with airline operators. Only 23 of these aircraft were

in service, the remainder of the fleet is currently parked due to

COVID-19. The fifteen operators are Emirates (117), Singapore

Airlines (19), Deutsche Lufthansa (14), Qantas (12), BA (12),

Korean Air Lines (10), Etihad Airways (10), Qatar Airways (10), Air

France (9), Malaysia Airlines (6), Thai Airways (6), Asiana

Airlines (6), China Southern Airlines (5), and All Nippon Airways

(3), and Hi Fly (1). Another five aircraft are on order.

In February 2021, Qantas chief executive officer Alan Joyce

contradicted earlier suggestions from experts that the Australian

carrier's parked A380s could be permanently removed from future

fleet plans: "So we do believe that there's a need for that fleet

and we do believe it's going to generate cash, and it's all going

to be about cash when we start up international." The airline is

now planning to restart regular international passenger flights to

most destinations from 31 October 2021.

At the Royal Aeronautical Society conference on 15 March, BA CEO

Sean Doyle confirmed the carrier's intentions to return the A380 to

service, stating that the aircraft type is "an important part of

our fleet, and at the minute our plans are to obviously fly [it

again]". He added that the A380 "works very well in a number of

larger markets". BA has not provided a timeline for the return of

the A380 to operations.

Also in March, Lufthansa Group CEO Carsten Spohr confirmed that

the A380 will be phased out as a part of its fleet remodelling. In

total, Lufthansa plans to reduce its group fleet size by

approximately 200 aircraft (approximately 25% of its current fleet)

by 2023.

Thai Airways International has begun to gauge market interest

for two of its six A380s. In March, the carrier issued a request

for indication of interest for the 2013-built aircraft (MSNs 125

and 131). The carrier added that, given the ongoing preparation of

its rehabilitation plan, it will formally invite bidders to submit

"official proposals" following a court order approving that

plan.

With the final production A380 aircraft ferried to Hamburg in

March for interior outfitting and painting, Airbus will now

concentrate on supporting the in-service fleet of A380s "for as

long as possible", according to its chief executive Guillaume

Faury.

An April analysis report from Cirium stated that, while older

A380 aircraft are more likely to be phased out, airlines will be at

least partially incentivized to retain and operate their A380s for

at least the next five years, because of the cost of an early

phase-out. In fact , the report notes that there have been very few

formal decisions to remove the A380 from fleets since the beginning

of the COVID-19 crisis, with Air France being the only operator to

have explicitly retired aircraft. This is also because, for some

operators, such as BA, Emirates and Qantas, the A380 remains an

important part of the fleet and hub network, as industry experts

state in the report. However, the report adds that growing concerns

around sustainability and other factors could further decrease the

likelihood of a second-hand market developing for the A380.

Regarding Emirates, the report stated that " it remains unclear how

many of Emirates' A380s will return to service - and at what speed"

but the carrier is better positioned than any other carrier to

sustain large-scale A380 fleet capacity.

Source: Cirium

D I R E C T O RS

As at 31 March 2021 the Company had four directors all of whom

were independent and non-executive.

Geoffrey Alan Hall - Chair of the Company and of the Nomination

Committee

Geoffrey Hall has extensive experience in asset management,

having previously been Chief Investment Officer of Allianz

Insurance plc, a major UK general insurance company and an

investment manager at HSBC Asset Management, County Investment

Management, and British Railways Pension Funds. Geoffrey is also a

director and Chair of the Audit and Risk Committee of Doric Nimrod

Air One Limited and of Doric Nimrod Air Three Limited.

Geoffrey earned his master's degree in Geography at the

University of London and is an associate of the CFA Society of the

UK. He is resident in the United Kingdom.

Charles Edmund Wilkinson

Charles Wilkinson is a solicitor who retired from Lawrence

Graham LLP in March 2005. While at Lawrence Graham he specialised

in corporate finance and commercial law, latterly concentrating on

investment trust and fund work.

Charles is Chair of Doric Nimrod Air One Limited and of Doric

Nimrod Air Three Limited and is a director of Landore Resources

Ltd, a Guernsey based mining exploration company. He is resident in

Guernsey.

Suzanne Elaine Procter- SID

Suzie Procter brings over 39 years' experience in financial

markets, with specific expertise in asset management. She was

previously a non-executive director of TR Property Investment Trust

plc, an investment company listed on the FTSE 250 index. Her

executive roles included Partner and member of the Executive

Management Committee at Cantillon Capital Management LLC, Managing

Director of Lazard Asset Management, Head of Institutional Sales at

INVESCO Asset Management, Director and Head of Fixed Income

Business at Pictet International Management Ltd and Head of Fixed

Income at Midland Montagu Asset Management.

Suzie is also the SID of Doric Nimrod Air One Limited and Doric

Nimrod Air Three Limited. She is resident in the United

Kingdom.

Andreas Josef Tautscher - Chair of the AR Committee and the

Management Engagement Committee

Andreas Tautscher brings over 32 years' financial services

experience. He serves as a non-executive director and member of the

Audit Committee of BH Global Limited, a Guernsey closed-ended

investment company whose shares are traded on the Main Market of

the London Stock Exchange. He is also a director and Chair of

Arolla Partners, a leading independent director services business

in the Channel Islands. From 1994 to 2018 Andreas held various

roles at Deutsche Bank and was most recently CEO of the Channel

Islands and Head of Financial Intermediaries for EMEA. He was

previously a non-executive director of the Virgin Group. Andreas

qualified as a Chartered Accountant in 1994.

Andreas is also Chair of the Management Engagement Committees of

Doric Nimrod Air Two Limited and Doric Nimrod Air Three Limited,

and a director of Doric Nimrod Air One Limited and Doric Nimrod Air

Three Limited. He is resident in Guernsey.

SERVICE PROVIDERS

Management and the Delegation of Functions

The directors, whose details are set out on page 18 are

responsible for reviewing the business affairs of the Group in

accordance with the Articles and have overall responsibility for

the Group's activities including all business decisions, review of

performance and authorisation of distributions. The Company has

delegated management of the Group's Aircraft to Doric, which is a

company incorporated in Germany. Further details are outlined below

under the heading Asset Manager. The directors delegate secretarial

and administrative functions to JTC which is a company incorporated

in Guernsey and licensed by the GFSC for the provision of

administration services. The registrar function is delegated to the

Registrar, which is licensed and regulated by the GFSC.

Asset Manager

Doric has been appointed by the Company to provide asset

management services to the Group. Pursuant to the Asset Management

Agreement, Doric will: (i) monitor Emirates' and any subsequent

lessees' performance of its obligations under the Leases and any

subsequent leases respectively (which shall include the obligations

relating to the maintenance of insurance cover); (ii) provide the

Group with information regarding alternatives with respect to any

potential sale or re-lease of the Assets; (iii) carry out mid-lease

inspections of the Assets; (iv) provide the Group with asset

monitoring reports describing the state and any material changes to

the state of the Assets; and (v) liaise, as and when necessary,

with lenders, on all matters relating to the loans and EETCs , as

required.

Doric has further undertaken that it will dedicate sufficient

time and resources as it reasonably believes is required from time

to time to fulfil any contractual arrangements it enters into with

the Company.

The Doric Group is also a member of ISTAT and is a leading

provider of products and services for investors in the fields of

aviation, shipping, renewable energy and real estate. The Doric

Group has an international presence, with offices in Germany, Hong

Kong, the United Kingdom, and the United States, and a

multinational team which offers access to extensive relationship

networks and expert asset knowledge maintaining regulated financial

institutions in Europe. One of the firm's core competencies is its

asset management expertise, which is an integrated part of all

Doric transactions and a cornerstone of the business. For further

information about the Doric Group, please visit www.doric.com .

The aircraft portfolio currently managed by the Doric Group is

valued at $7 billion and consists of 42 aircraft under management.

These aircraft include commercial airliners ranging from ATR

72-500s and the Airbus A320 family, through the Boeing 737, 777,

787 and Airbus A330, up to the Boeing 747-8F and Airbus A380.

The Doric Group has 22 Airbus A380 aircraft currently under

management and is therefore considered well positioned to perform

the technical asset management of this aircraft type.

Corporate and Shareholder Adviser

Nimrod, which is authorised by the FCA has been appointed as the

Corporate and Shareholder Adviser by the Company.

Nimrod was founded in 2008 as an independent organisation which

specialises in generating and sourcing interesting investment

funds, themes and solutions managed by experts in their fields for

the professional investor marketplace. It has launched nine listed

investment companies since its formation and it also provides

investment, marketing, distribution and advisory services to

investment companies and their boards and managers.

Nimrod, together with Doric and Emirates, was awarded the

"Innovative Deal of the Year 2010 award" by the international

aviation magazine Airfinance Journal in recognition of the

innovative financing of an Airbus A380 leased to Emirates by the

first stock market listed aircraft investment vehicle, Doric Nimrod

Air One Limited.

Secretary & Administrator

JTC is an independent provider of institutional and private

client services to clients in numerous jurisdictions and is a

member of the JTC Group. For further information about the JTC

Group, please visit www.jtcgroup.com.

JTC is a Guernsey incorporated company and provides

administration and secretarial services to the Group pursuant to an

Administration and Secretarial Agreement. In such capacity, JTC is

responsible for the general secretarial functions required by the

Law and assists the Group in its compliance with its continuing

legal and regulatory obligations, as well as providing advice on

good corporate governance and best practice for a publicly traded

company.

JTC is also responsible for the Group's general administrative

functions and for the preparation of unaudited half-yearly and

audited annual financial reports, subject to the direction and

oversight of the Board.

Registrar

The Registrar is the Company's CREST compliant registrar. The

Registrar is responsible for the maintenance of the Company's Share

register and for the processing of dividend payments and stock

transfers. The Registrar is licensed and regulated by the GFSC and

further information about The Registrar may be obtained from their

website at www.jtcgroup.com .

Liaison Agent

Amedeo Services (UK) Limited had been appointed by the Company,

pursuant to the Amended Liaison Services Agreement, to act as

Liaison agent. The Board considered that the services of the

Liaison agent were no longer required and the Liaison Services

Agreement was terminated on 21 April 2021.

Review

The Board keeps under review the performance of the Asset

Manager, Corporate and Shareholder Adviser, the Secretary,

Administrator and the Registrar and the powers delegated to each

service provider. In the opinion of the Board, the continuing

appointments of the service providers on the terms agreed is in the

best interest of the Company's Shareholders as a whole.

A full list of the Company's service providers is set out on

page 93.

MANAGEMENT REPORT

A description of important events which have occurred during the

financial year under review, their impact on the performance of the

Group as shown in the consolidated financial statements and a

description of the principal risks and uncertainties facing the

Group are given in the Chair's Statement, Asset Manager's Report,

Statement of Principal Risks and the notes to the consolidated

financial statements contained on pages 62 to 92 and are

incorporated here by reference.

Principal Risks and Uncertainties

The Board has undertaken a robust assessment of the principal

risks facing the Group and has undertaken a detailed review of the

effectiveness of its risk management and internal control systems.

The Board is comfortable that the risks are being appropriately

monitored on a regular basis.

The risks set out below are those which are considered to be the

material risks relating to an investment in the Shares but are not

the only risks relating to the Shares or the Group. Additional

risks and uncertainties of which the Group is presently unaware or

that the Group currently believes are immaterial may also adversely

affect its business, financial condition, results of operations or

the value of the Shares.

The principal risks associated with the Group are:

-- Operational risk: The Board is ultimately responsible for all

operational facets of performance including cash management, asset

management, regulatory and listing obligations. The Group has no

employees and so enters into a series of contracts/legal agreements

with a series of service providers to ensure both operational

performance and the regulatory obligations are met. This risk has

been mitigated by the Group using well established, reputable and

experienced service providers and assessing service providers'

continued appointment on at least an annual basis.

-- Investment risk: There are a number of risks associated with

the Group's Assets in relation to the occurrence of technical

faults with the Assets or actions by third parties causing both

damage to the Assets and also damaging the demand for global air

travel. This risk has been mitigated by the Lessee's contractual

responsibility to insure, repair and maintain the Aircraft for the

duration of the Leases.

-- Borrowings and financing risk: There is a risk that the Group

is exposed to fluctuations in market interest rates and foreign

exchange rates. This risk has been mitigated by ensuring that debt

repayments are made from lease rental revenues received in the

matching currency and by fixing the interest rates on debt and

lease rentals.

-- Credit risk: Emirates is the sole lessee of the Assets and is

headquartered in the Middle East. Should Emirates default on the

rental payments due to domestic events, events in the wider airline

industry or other reasons it is unlikely the Company will be able

to meet its targeted dividends or, in the case of ongoing default,

continue as a going concern. The risk of default is potentially

mitigated by the ability of the Group to sell or re-lease the

Assets in the event of a single default. However, this could be

impacted by market conditions at the time.

-- Secondary market risk: There is a risk that the Group would

not be able to achieve the projected resale value of the Assets due

to changes in demand for second hand aircraft of the type owned by

the Group. The Board monitors, and revises the residual value of

the Aircraft on an annual basis.

-- Regulatory risk: The Group is required to comply with the

DGTRs of the FCA and the requirements imposed by the Law and the

GFSC. Any failure to comply could lead to criminal or civil

proceedings. Although responsibility ultimately lies with the

Board, the Secretary also monitors compliance with regulatory

requirements.

-- Valuation risk : There is a risk that the useful life or

residual value used in determining depreciation are not appropriate

or accurately calculated. The Board assess, based on the latest

forecast valuations, particularly in light of COVID-19, whether the

selected residual values remains as an appropriate basis of

valuation and with consideration to the range of estimates provided

by the external valuers. The Group has a robust audit process to

ensure that valuations accurately reflect the requirements of

IFRS

-- Global Pandemic: The emergence of a global pandemic has had a

profound and negative impact on the operations and performance of

the Group and may directly or indirectly affect some of the other

risks mentioned in this table. The Board and its key service

providers all act to the best of their abilities to protect the

welfare of the various teams involved in the affairs of the Group

to ensure operations are maintained to the extent possible and to

protect and support the Assets of the Group for as long as is

required. Please refer to the Chair's Statement, the Asset

Manager's Report and the going concern statement below for more

information on how the Group is being affected by COVID-19.

Data Protection

The Company has implemented measures designed to ensure its

compliance with the EU General Data Protection Regulation (EU)

2016/679 and associated legislation in Guernsey. The Company has

also issued a privacy notice explaining the data it holds, how the

data is processed and its procedures for processing this data. This

notice is available for review and download at the Company's

website.

Going Concern

The Group's principal activities are set out within the Company

Overview on pages 7 to 9. The financial position of the Group is

set out on page 59. In addition, note 19 to the consolidated

financial statements includes the Group's objectives, policies and

processes for managing its capital, its financial risk management

objectives and its exposures to credit risk and liquidity risk.

The directors in consultation with the Asset Manager are

monitoring the continuous effect of the Pandemic generally on the

aviation industry and specifically on the Group's aircraft values

and the financial wellbeing of its Lessee both now and in the

future. The Pandemic continues to have a pervasive impact on the

global economy and it remains possible that the Group's future

performance could be impacted in this prolonged period of

uncertainty. In many jurisdictions restrictions on the ability of

people to travel still adversely affect the airline sector, and by

extension the aircraft leasing sector. The risk therefore remains

that some airlines may not be able to pay rent as it falls due. The

impact of the Pandemic on the aviation industry has been

significant with a large part of the global passenger aircraft

fleet temporarily grounded. These factors, together with wider

economic uncertainty and disruption, have had an adverse impact on

the future value of the Aircraft owned by the Group, and could also

negatively impact the sale, re-lease, or other disposition of the

relevant Aircraft.

Given the prolonged impact of the Pandemic, increased Lessee

counterparty credit risk remains in existence and there could be

requests for Lease rental deferrals. Reduced rents receivable under

the Leases may not be sufficient to meet the fixed loan or

equipment note interest and regular repayments of debt scheduled

during the life of each Loan and may not provide surplus income to

pay for the Group's expenses and permit the declaration of

dividends.

The option to remarket the Aircraft following a potential event

of default by the Lessee has not been taken into account. The

period of time necessary to successfully complete such a process is

beyond the twelve months forecasting horizon of the going concern

considerations. This applies in particular in times of COVID-19, as

various restrictions are still in place to contain the

Pandemic.

The directors consider that the going concern basis of

accounting remains appropriate. Based on current information the

directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future, although the risk to this is clearly higher

compared to a pre-COVID-19 environment.

Whilst there is some uncertainty as to the airline industry in

general, and specifically Emirates' financial position and credit

risk profile, on the basis that (i) Emirates has shown no intention

of failing to meet its obligations (ii) Emirates has the financial

backing to continue paying these rentals, the directors believe

that it is appropriate to prepare these financial statements under

the going concern basis of preparation.

The directors have considered Emirates' ability to continue

paying the lease rentals over the next 12 months and are satisfied

that the Group can meet its liabilities as they fall due over this

period. Further detail regarding the assumptions adopted when

forming this conclusion can be found in the Viability Statement

below.

Viability Statement

In accordance with Provision 31 of the Code, the directors of

the Company have considered the prospects of the Group over the

period from present until the liquidation resolution is put to

Shareholders six months before the last Lease is due to terminate

in 2024, a period of three years. In choosing the period of

viability for the Group the Board has considered the prospect of

Emirates performing their obligations until the end of their

Leases.

The Board, in assessing the viability of the Group, has paid

particular attention to the principal risks faced by the Group as

disclosed in the Management Report and the notes to the

consolidated financial statements, reviewing on an ongoing basis

the risks faced and ensuring that any mitigation measures in place

are functioning correctly.

In addition, the Board has considered a detailed cash flow

projection for the running costs of the Group and has assumed that

Emirates is a going concern. The Board believes that it is

reasonable to assume as of the date of the approval of the annual

financial report that Emirates will continue with the contracted

lease rental payments due to the following:

-- Emirates continues to be a going concern as at the date of

the Lessee's latest signed annual financial report for the

financial year ended on March 31, 2021.

-- Challenged by an unprecedented drop in passenger air travel

during 2020, the Lessee reacted quickly and temporarily adjusted

its business model with a particular focus on air cargo services.

The high pandemic-driven demand in this space helped the Lessee to

contain its losses in the passenger segment.

-- Although Emirates concluded its last financial year with the

first net loss in more than 30 years and refunded already paid

tickets in the amount of US$ 2.3 billion, it still has a

substantial cash position, which also benefited from the support of

its ultimate shareholder.

-- Emirates confirmed to have access to the capital markets and

was able already able to secure committed offers for the financing

of two upcoming aircraft deliveries.

-- The Government of Dubai has injected capital in the combined

amount of US$3.1 billion into Emirates so far, since the Pandemic

brought global air travel to a near halt. It previously had

publicly confirmed that they will financially support Emirates

during this period.

-- Emirates' listed debt and CDS's are trading at non-distressed

levels, indicating the trust capital markets have in Emirates.

-- As of the date of the annual financial report, the Board is

not aware of a formal request to the Group for a lease payment

deferral or any other efforts that would result in the

restructuring of the existing transaction.

-- Emirates has paid all the lease rentals to the Group in a timely manner.

-- If end of lease negotiations with Emirates have not been

concluded by the end of the terms of each current Lease, the Lease

rentals due under the existing agreements must continue to be

paid.

The Group retains sufficient cash to cover the forecast

operating costs of the Group until the termination date of the

Leases in 2024, assuming receipt of planned rental income.

The directors believe that their assessment of the viability of

the Group over the period chosen was sufficiently robust and

encompassed the risks which would threaten the business model,

future performance, solvency or liquidity of the Group.

As a result of their review, the directors of the Company have a

reasonable expectation that the Group will be able to continue in

operation and meet its liabilities as they fall due until the last

Lease is due to terminate in 2024.

Responsibility Statement

The directors jointly and severally confirm that to the best of

their knowledge:

(a) the financial statements, prepared in accordance with IFRS

give a true and fair view of the assets, liabilities, financial

position and profits of the Group and performance of the Group;

(b) the Management Report includes or incorporates by reference

a fair review of the development and performance of the business

and the position of the Group, together with a description of the

principal risks and uncertainties that it faces; and

(c) the annual report taken as a whole is fair, balanced and

understandable and provides the information necessary for the

Company's Shareholders to assess the Company's and the Group's

position, performance, business model and strategy.

Geoffrey Hall Andreas Tautscher

Chair Director

2 August 2021

Directors Report

The directors present their annual report and audited financial

statements of the Group for the financial year ended 31 March

2021.

Principal Activities and Business Review

The principal activity of the Group is to acquire, lease and

then sell aircraft. The directors do not envisage any change in

these activities for the foreseeable future. A description of the

activities of the Group in the year under review is given in the

Chair's Statement and the Asset Manager's Report respectively on

pages 10 to 12 and 13 to 17.

Status

The Company is a Guernsey domiciled company the Shares of which

are admitted to trading on the SFS. Its registered number is 52985.

The Company operates in accordance with the Law.

Results and Dividends

The results of the Group for the financial year are set out on

page 58.

The Company declared dividends during the financial year under

review as follows:

Quarter End Announcement Date Payment Date Dividend per Share

(pence)

31 March 2020 16 April 2020 30 April 2020 4.50

------------------- ----------------- -------------------

30 June 2020 16 July 2020 31 July 2020 4.50

------------------- ----------------- -------------------

30 September 2020 15 October 2020 30 October 2020 4.50

------------------- ----------------- -------------------

31 December 2020 14 January 2021 29 January 2021 4.50

------------------- ----------------- -------------------

The Company declared the following dividends after the financial

year end:

Announcement Date Payment Date Dividend per Share (pence)

14 April 2021 30 April 2021 4.50

------------------------ ---------------------------

30 July 2021 (expected

15 July 2021 payment date) 4.50

------------------------ ---------------------------

The Company aims to continue to pay quarterly dividends of 4.50

pence per Share, in line with the Distribution Policy. There is no

guarantee that any future dividends will be paid.

Directors

The directors in office are shown on page 18 and all directors

remain in office as at the date of signing of these financial

statements. Further details of the directors' responsibilities are

given on page 24.

No director has a contract of service with the Group, nor are

any such contracts proposed.

The following interests in Shares of the Company are held by

persons discharging directorial responsibility and their persons

closely associated:

Number of Shares Number of Shares

held as at 31 March held as at 30 July

2021 2021

Charles Wilkinson 75,000 75,000

Geoffrey Hall 75,000 75,000

Suzie Procter 35,211 35,211

Andreas Tautscher 6,489 6,489

Other than the above shareholdings, none of the directors nor

any persons connected with them had a material interest in any of

the Company's transactions, arrangements or agreements during the

year and none of the directors has or has had any interest in any

transaction which is or was unusual in its nature or conditions or

significant to the business of the Company, and which was effected

by the Company during the reporting year .

At the financial year end and as at the date of this report,