RNS Number:4999J

Digital Marketing Group PLC

10 December 2007

Date: 10 December 2007

On behalf of: Digital Marketing Group plc ("the Company")

Embargoed until: 0700hrs

Digital Marketing Group plc

Interim Results for the six months ended 30 September 2007

Digital Marketing Group plc (AIM: DIGI), the digital direct marketing

specialists, today announced its interim results for the six months ended 30

September 2007.

Financial Highlights

* Revenues: #22.14m

* Gross Profit: #14.77m

* EBITDA: #3.06m (before charges for share options of #1.01m)

* Profit before tax: #2.49m (before charges for share options and

amortisation)

* Basic EBITDA per share: 5.44p (before charges for share options)

Operational Highlights

* Completion of the acquisitions of Graphico New Media and Hyperlaunch New

Media in June 2007 following the #10m equity raise in May 2007

* Awarded 'Digital Direct Marketing Services Supplier of the Year'

Pro forma Highlights

* Gross Profit up 20% to #16.70m (2006: #13.96m)

* EBITDA up 39% to #3.86m (2006: #2.78m) before central costs and charges

for share options of #1.01m

* EBITDA after central costs before charges for share options up 47% to

#3.48m (2006: #2.36m)

* Profit before tax (before charges for share options and amortisation up

52% to #2.89m (2006: #1.90m)

Commenting on these results, Stephen Davidson, Chairman of Digital Marketing

Group plc, said:

"It is a pleasure to report an excellent set of interim results which re-confirm

the competitiveness of Digital Marketing Group's strategy. Importantly, these

results fulfil our financial goals for the period and we remain highly confident

of delivering the levels of profitability for the full year which meet market

expectations. We also remain confident that we will sustain high levels of

growth into the future."

Ben Langdon, Chief Executive, added:

"Our single minded focus on digital direct marketing has helped us to attract

new blue-chip clients and to generate incremental business from our existing

client base. We continue to benefit from growth in expenditure through digital

channels and are already recognised as leaders in this specialist sector. We

have achieved a lot in a short space of time, and we will continue to achieve a

lot in the future."

Enquiries:

Digital Marketing Group plc www.digitalmarketinggroup.co.uk

Ben Langdon, Chief Executive Officer 01491 615 306

Sarah Guest, Chief Financial Officer 01491 615 306

Cenkos Securities

Adrian Hargrave 0207 397 8900

Redleaf Communications

Emma Kane/ Sanna Lehtinen/Tom Newman 0207 822 0200

CHAIRMAN'S STATEMENT

It is a pleasure to report an excellent set of interim results which re-confirm

the competitiveness of Digital Marketing Group's strategy.

These results represent the performance of the business in the six months to 30

September 2007, a period during which the Company was awarded 'Direct Digital

Marketing Services Supplier of the Year'. The results include a full six months

for HSM Limited (incorporating both HSM Telemarketing and Inbox Digital), Scope

Creative Marketing (trading as Dig for Fire), Cheeze Limited (Cheeze) and

Alphanumeric Group (trading as Jaywing). The results include only three months

for Graphico New Media (Graphico) and Hyperlaunch New Media (Hyperlaunch) as

these companies were acquired at the end of June 2007.

The recent acquisitions of Graphico and Hyperlaunch add important digital skills

to our group. Graphico has strong credentials in web design & build and mobile

marketing. Hyperlaunch has significant online PR and 'buzz marketing' expertise

gained through their specialisation in the music and entertainment industry.

These two businesses are being successfully integrated into our group and are

exceeding expectations in terms of their financial performance.

Financials

We posted revenue of #22.14m, and gross profit (revenue less direct cost of

sales) of #14.77m. EBITDA was #3.06m before charges for share options of #1.01m.

Profit before tax was #2.49m before charges for share options of #1.01m and

amortisation of #0.65m. Basic EBITDA per share (before charges for share

options) was 5.44p.

When looked at on a pro forma basis (an explanation of which is given in the

chief executive's review) for the six months ended 30 September 2007, the

results for Digital Marketing Group plc would have been:

* Gross Profit up 20% to #16.70m (2006: #13.96m)

* EBITDA up 39% to #3.86m before central costs and before charges for

share options (2006: #2.78m)

* EBITDA of #3.48m after central costs up 47% (2006: #2.36m).

* Profit before tax (before charges for share options and amortisation)

up 52% to #2.89m (2006: #1.90m)

We are in a strong position financially. In May 2007, we completed a #10m equity

raise. Our net debt at #4.33m is 45% below our net debt at year end and gearing

(gross debt as % of total equity) decreased to 25% at 30 September 2007 from 47%

at the year end. At present the Group has #6.74m of undrawn borrowing

facilities.

People

On 4th September, we were delighted to welcome Sarah Guest as the Group's new

Finance Director and Company Secretary succeeding Robert Millington. The Board

is grateful for the valued contribution Bob made through the AIM flotation

process and the first phase of the Group's development and wish him every

success with his future endeavours.

Current trading & Outlook

Current trading is strong and our companies have secured significant new

business wins and organic growth. Expenditure on digital marketing remains

buoyant and these results fulfil our financial goals for the period. We remain

highly confident of delivering the levels of profitability for the full year

which meet market expectations. We also remain confident that we will sustain

high levels of growth into the future.

Stephen Davidson

Chairman

10 December 2007

CHIEF EXECUTIVE'S REVIEW

Digital Marketing Group was formed in October 2006. Our business is in very good

shape and performing strongly. We have a clear and competitive proposition with

an integrated platform that generates incremental success over and above the

good levels of organic growth delivered by our businesses.

Our Product and Philosophy

Digital Marketing Group believes that the boundaries between digital and direct

marketing are now blurred.

Good digital marketing is good direct marketing.

We are a digital communications group that uses the principles of direct

marketing to inform everything that we do.

What makes us different?

We are not a marketing services group. We don't make investments in traditional

marketing services businesses.

We specialise in digital communications through the online marketing and online

media skills of four of our businesses: - Inbox Digital, Graphico, Hyperlaunch

and Cheeze. We call this our 'online marketing and media' segment.

We underpin our digital communications expertise with some of the best direct

marketing and data professionals in the UK. HSM and Dig for Fire are our direct

marketing businesses. Jaywing is our data business.

Integration

At the heart of our company is 'Digital Brain', a process which enables the real

time integration of digital, direct marketing and data. This helps us create

unique contact strategies for each individual consumer based on their historical

data and real-time interactions regardless of channel.

We call this 'real-time marketing using real-time channels'.

Processes such as Digital Brain bring the integrated proposition of Digital

Marketing Group to life as clients can easily realise the benefits to be derived

from the real-time coordination of digital, direct marketing and data.

Digital Brain also allows us to market the Group aggressively and we have

recently appointed a Group Marketing Director to focus on maximising

opportunities from marketing to clients who do not currently work with any of

the companies in our group.

Our recent success in winning the prestigious 'Digital Direct Marketing Services

Supplier of the Year' award not only confirms the quality of our product but it

will inevitably benefit the Group's marketing efforts.

Financial Review

The Group was formed in October 2006 with the acquisitions of HSM and Dig for

Fire. In January 2007 we acquired Cheeze and Jaywing and, in June 2007, we

acquired Graphico and Hyperlaunch.

In June 2007 we posted our maiden set of results.

We have now delivered our interim results for the six months to 30 September

2007. The results represent a full six months for HSM, Dig for Fire, Cheeze and

Jaywing and three months' post acquisition results for Graphico and Hyperlaunch.

On this basis the Group achieved:

* #14.77m Gross Profit (revenue less direct cost of sales)

* #3.06m EBITDA before charges for share options

* #2.49m Profit before tax (before charges for share options of #1.01m and

amortisation of #0.65m)

* 5.44p basic EBITDA per share (before charges for share options)

* 0.95p basic earnings per share

Pro forma Basis

As the group was only formed after 30 September 2006 there is no published

comparative financial information available. Therefore throughout the remainder

of this report certain information is provided on a pro forma basis for

illustrative purposes only. This basis attempts to illustrate the group as it

would have been if it had existed previously. The information is based on the

unaudited management accounts of the individual entities prepared under UK GAAP,

time apportioned where appropriate. The information has been adjusted for items

which, in the judgement of the directors, are non recurring, for example excess

management remuneration, and excludes charges in respect of share options. The

information is not necessarily fully consistent in all respects with the

respective statutory accounts and its reliability is accordingly limited

thereby.

When looked at on a pro forma basis the Group's results for the six months

ending 30 September 2007 would have been:

* Gross Profit up 20% to #16.70m (2006: #13.96m)

* EBITDA up 39% to #3.86m before central costs of #0.38m and before

charges for share options of #1.01m (2006: #2.78m)

* EBITDA after central costs but before charges for share options up 47%

to #3.48m (2006: #2.36m)

* Profit before tax (before charges for share options and amortisation) up

52% to #2.89m (2006: #1.90m)

The following table shows an analysis of the results for the six months together

with comparative pro forma information for illustrative purposes on the basis

set out in the segmental performance section.

6mths Sep 6mths Sep 6mths Sep Yr/Yr

07 07 Pro 06 Pro Growth

forma forma

#m #m #m

Revenue 22.14 24.30 20.94 16%

Direct Costs 7.37 7.60 6.98 9%

Gross Profit 14.77 16.70 13.96 20%

Operating expenses, 11.33 12.83 11.18 15%

excluding central costs,

charges for share options,

depreciation, and

amortisation.

EBITDA before central 3.44 3.87 2.78 39%

costs and charges for

share options

Central costs 0.38 0.38 0.42 (9)%

EBITDA before charges for 3.06 3.49 2.36 48%

share options

Depreciation 0.25 0.28 0.24 16%

EBITA before charges for 2.81 3.21 2.12 51%

share options

Net interest expense 0.32 0.32 0.22 45%

Profit before tax before 2.49 2.89 1.90 52%

charges for share options

and amortisation

Net debt at 30 September 2007 stood at #4.33m, a 45% reduction compared to the

year end net debt of #7.91m. Net cash flow from operating activities in six

months was #1.69m with cash and cash equivalents increasing to #5.77m as at 30

September 2007.

These interim results for the Group are consistent with expectations for the

period and we are also highly confident that we will deliver against market

expectations for the full year.

Acquisitions of Graphico and Hyperlaunch

GRAPHICO

History

Graphico was founded in 1990 and had its origins in digital production work for

the music industry.

Using its understanding of digital technology Graphico evolved into web design

and build work for clients. It then broadened its service offer even further and

now offers clients a wide range of strategic and creative services all focused

in the digital space.

Graphico is now best described as a full service creative digital marketing

agency.

The company employs over 70 people in its offices in Newbury, Berkshire.

Over the past 5 years the company has enjoyed rapid growth and achieved industry

recognition for the quality of its product. This year they were voted the UKs

sixth most respected digital agency in New Media Age (NMA) magazine's 'Top

100 Interactive Agencies 2007' report.

Graphico has an enviable reputation for achieving international award

nominations for the work that it produces for its clients. In 2007 to date alone

the Company has won six accolades.

Product

Graphico's core product remains large scale web design and build work for its

clients.

Graphico's range of products and services is of course much broader than this

and encompasses the creation of digital advertising campaigns, strategic

planning and consultancy in the area of digital strategy and the creation of

digital businesses for clients like slicethepie.com.

In addition Graphico have developed a particular expertise in mobile marketing

through its 'Momentum' product which enables clients to create and run

SMS campaigns as well as manage and develop WAP campaigns through one interface.

It has a range of international and blue-chip clients including Pepsi, The

London Eye, Walkers, Universal, Bacardi-Martini, BBC, Chivas Regal and First

Great Western.

Financial Performance

The following table shows the financial contribution of Graphico to the Group's

results, representing 3 months post acquisition trading, together with an

indicative summary of what the contribution would have been on a pro forma basis

to September 2007 and previous year.

GRAPHICO

3mths 6mths Sep 6mths Sep 06 Yr/Yr

07 Growth

Sept 07 Pro forma

Pro forma

Post

Acquisition

#m #m #m

Revenue 1.42 3.12 2.09 49%

Direct Costs 0.20 0.41 0.24 71%

Gross Profit 1.22 2.71 1.85 46%

Operating expenses, 1.00 2.21 1.68 32%

excluding charges for

share options,

depreciation and

amortisation.

EBITDA 0.22 0.50 0.17 194%

Depreciation 0.02 0.04 0.03 33%

Operating profit before 0.20 0.46 0.14 229%

charges for share

options and

amortisation

Note 1 2 2

1. The post acquisition column shows the financial contribution of Graphico to

the Group's results to 30 September 2007 before amortisation of intangible

assets which, in this period amounted to #0.08m.

2. The pro forma Sep 07 and Sep 06 columns are shown for illustrative purposes

only. The information is based on the unaudited management accounts of Graphico

and has been adjusted for items which, in the judgement of the directors, are

considered to be non recurring, for example, excess management remuneration and

excludes charges in respect of group share options.

HYPERLAUNCH

History

Hyperlaunch, began trading in August 2001. The Company's first client was

Columbia Tristar Home Entertainment, a division of Sony.

Since its launch Hyperlaunch has focused on entertainment orientated clients

developing an industry specialism and has won a number of awards particularly

for its work in the music industry.

The Company has serviced most of the top three companies in each of the film,

music, games and publishing sectors resulting in a very high quality client

portfolio.

Recently Hyperlaunch has successfully developed re-usable software libraries and

content management tools, which, when coupled with contracted hosting services,

enables a prompt response to client needs.

Product

The aim of the Company is to generate online product awareness and create a

'buzz'. Clients are presented with a marketing and creative implementation

strategy to ensure that products receive extensive online PR coverage and a

return on investment, above and beyond that which could be achieved through

traditional media.

Hyperlaunch has extensive entertainment product release experience and has an

enviable reputation, particularly within the music industry where it currently

handles around 35% of music chart product releases at any given time.

Opportunities have arisen to build close relationships with clients in these

sectors and the company is therefore often viewed as a trusted partner.

Consequently client retention has been excellent.

Hyperlaunch's reputation as an entertainment specialist has led to brand related

projects for companies including Sony, Philips and Samsung. Often this is

because of experience with 'cutting edge' digital campaigns or because of

capabilities to reach the youth demographic.

With its reputation and the fact that digital marketing is being viewed as an

integral part of the marketing mix, Hyperlaunch is well positioned in the market

place to exploit future opportunities and achieve its ambitions for growth.

Its client base includes blue-chip brands such as Universal Music, Atlantic

Records, Samsung and Warner Bros.

Financial performance

The following table shows the financial contribution of Hyperlaunch to the

Group's results, representing 3 months post acquisition trading, together with

an indicative summary of what the contribution would have been on a pro forma

basis to September 2007 and previous year.

HYPERLAUNCH

3mths 6mths Sep 6mths Sep Yr/Yr Growth

07 Pro 06 Pro

Sept 07 forma forma

Post

Acquisition

#m #m #m

Revenue 0.44 0.90 0.77 17%

Direct Costs 0.01 0.03 0.05 (60)%

Gross Profit 0.43 0.87 0.72 21%

Operating expenses, 0.35 0.65 0.59 10%

excluding charges for

share options,

depreciation and

amortisation.

EBITDA 0.08 0.22 0.13 69%

Depreciation 0.01 0.01 0.00 0%

Operating profit before 0.07 0.21 0.13 62%

charges for share

options and

amortisation

Note 1 2 2

1. *The post acquisition column shows the financial contribution of Hyperlaunch

to the Group's results to 30 September 2007 before amortisation of

intangible assets which, in this period amounted to #0.03m.

2. *The pro forma Sep 07 and Sep 06 columns are shown for illustrative purposes

only. The information is based on the unaudited management accounts of

Hyperlaunch and has been adjusted for items which, in the judgement of the

directors, are considered to be non recurring, for example, excess

management remuneration and excludes charges in respect of group share

options.

Segmental performance

In order to aid shareholders in reviewing our business, we intend to use the

following three segments on an ongoing basis:

1. *'Online marketing and media' (Inbox Digital, Graphico, Hyperlaunch, Cheeze)

2. *'Direct Marketing' (HSM, Dig for Fire)

3. *'Data Services & Consultancy' (Jaywing)

6mths Sep 07 6mths Sep 07 6mths Sep 06 % Growth

Pro forma Pro forma

Gross Profit EBITDA Gross EBITDA Gross EBITDA Gross EBITDA

* Profit * Profit * Profit yr/yr%

yr/yr%

#m #m #m #m #m #m

Online Marketing & Media 4.02 1.14 5.95 1.56 4.66 0.95 28% 65%

Direct Marketing 5.52 1.19 5.52 1.19 4.50 0.95 23% 25%

Data Services & 5.23 1.11 5.23 1.11 4.80 0.88 9% 27%

Consultancy

14.77 3.44 16.70 3.86 13.96 2.78 20% 39%

Central costs - (0.38) - (0.38) - (0.42) - 9%

14.77 3.06 16.70 3.48 13.96 2.36 20% 47%

* EBITDA before charges for share options

The pro forma Sep 07 and Sep 06 columns are shown for illustrative purposes

only. The information in the Sep 07 column represents the information included

in the interim financial information for the group adjusted to include the full

six months activity of Graphico and Hyperlaunch extracted from unaudited

management accounts. The information in the Sep 06 column is based on the

unaudited management accounts of:

*HSM

*Dig For Fire

*Cheeze

*Jaywing

*Graphico

*Hyperlaunch

Both columns have been adjusted for items which, in the judgement of the

directors, are considered to be non-recurring, for example, excess management

remuneration, and exclude charges in respect of group share options.

Online marketing and media

In the six months to 30 September 2007 this segment achieved on a pro forma

basis Gross Profits of #5.95m and EBITDA (before charges for share options) of

#1.56m.

This represents growth in Gross Profits of 28% year on year, and growth in

EBITDA of 65% year on year.

ONLINE MARKETING AND MEDIA

6mths Sep 6mths Sep 07 6mths Sep 06 % Growth

07 Pro forma Pro forma

#m #m #m

Revenue 8.80 10.97 9.25 19%

Direct Costs 4.78 5.02 4.59 9%

Gross Profit 4.02 5.95 4.66 28%

Operating expenses, excluding 2.88 4.39 3.71 18%

charges for share options,

depreciation and amortisation.

EBITDA before charges for 1.14 1.56 0.95 65%

share options

Depreciation 0.08 0.11 0.07 57%

Operating profit before 1.06 1.45 0.88 65%

charges for share options and

amortisation

Direct marketing

In the six months to 30 September 2007 this segment achieved on a pro forma

basis Gross Profits of #5.52m and EBITDA (before charges for share options) of

#1.19m

This represents growth in Gross Profits of 23% year on year, and growth in

EBITDA of 25% year on year.

DIRECT MARKETING

6mths Sep 6mths Sep 06 % Growth

07 Pro forma

#m #m

Revenue 7.28 5.39 35%

Direct Costs 1.76 0.89 98%

Gross Profit 5.52 4.50 23%

Operating expenses, excluding 4.33 3.55 22%

charges for share options,

depreciation and

amortisation.

EBITDA before charges for 1.19 0.95 25%

share options

Depreciation 0.10 0.09 11%

Operating profit before 1.09 0.86 27%

charges for share options and

amortisation

Data services and consultancy

In the six months to September this segment achieved on a pro forma basis Gross

Profits of #5.23m and EBITDA (before charges for share options) of #1.11m.

This represents growth in Gross Profits of 9% year on year, and growth in EBITDA

of 27% year on year.

DATA SERVICES AND CONSULTANCY

6mths Sep 07 6mths Sep 06 Growth

Pro forma Pro forma

#m #m

Revenue 6.98 6.31 11%

Direct Costs 1.75 1.51 16%

Gross Profit 5.23 4.80 9%

Operating expenses, excluding 4.12 3.92 5%

charges for share options,

depreciation and

amortisation.

EBITDA before charges for 1.11 0.88 27%

share options

Depreciation 0.07 0.07 0%

Operating profit before 1.04 0.81 29%

charges for share options and

amortisation

Summary & Outlook

Our strategy remains focused on integrating product and process in order to

achieve continuing new business success. We also have identified some areas

where the group could achieve some rationalisation of its cost base.

We have already achieved significant success in generating new business from

existing clients using the integrated proposition of the group. We are also on

track to meet market expectations in terms of the level of gross profits

achieved through cross-referrals from existing Group clients.

Our single minded focus on digital direct marketing has helped us to attract new

blue-chip clients to the Group, and to generate incremental business from our

existing client base. We continue to benefit from growth in expenditure through

digital channels and are already recognised as leaders in this specialist

sector. We have achieved a lot in a short space of time, and we will continue to

achieve a lot in the future.

In summary, we are pleased that we are comprehensively delivering against our

objectives. We have:

* Acquired six market leading businesses in digital direct marketing

* Met the financial promises and commitments we have made

* Built an integrated platform to deliver digital direct marketing to our

clients

* Gained industry wide recognition for the quality of our product and

services

* Secured new accounts and generated incremental revenue for the Group

* Given ourselves sufficient financial flexibility to exploit suitable

acquisition opportunities that may arise in the digital market space

As I stated in our maiden set of accounts, 'much achieved, much opportunity'.

Ben Langdon

Chief Executive

10 December 2007

Consolidated Income Statement

Unaudited Unaudited Audited

Note Six Six Year

months months

ended

ended 30 ended 30 31

September September March

2006 2007

2007

Total Total Total

#000 #000 #000

Continuing operations

Revenue 2 22,138 - 13,057

Direct costs (7,370) - (4,668)

Gross profit 14,768 - 8,389

Other operating income 16 - 16

Amortisation (648) - (321)

Operating expenses (12,982) - (6,904)

Operating profit 2 1,154 - 1,180

Financial income 64 - 99

Financial expenses (380) - (205)

Net financing costs (316) - (106)

Profit before tax 838 - 1,074

Taxation 3 (301) - (537)

Profit for year from continuing 537 - 537

operations

Discontinued operations

Profit/(loss) for period on - (640) (640)

discontinued operations

Profit/(loss) for the year 537 (640) (103)

attributable to shareholders

Earnings per share 4

From continuing and discontinued

operations

- basic 0.95p (9.95)p (0.55)p

- diluted 0.78p (9.95)p (0.51)p

From continuing operations

- basic 0.95p - 2.87p

- diluted 0.78p - 2.62p

Consolidated Balance Sheet

Unaudited Unaudited Audited

Note 30 30 31 March

September September 2007

2007 2006

#000 #000 #000

Non-current assets

Property, plant and equipment 2,128 3 714

Goodwill 38,712 - 30,734

Other intangible assets 14,083 - 10,215

54,923 3 41,663

Current assets

Inventories 562 - 165

Trade and other receivables 8,539 11 6,102

Cash and cash equivalents 5,765 2,867 5,569

14,866 2,878 11,836

Total assets 69,789 2,881 53,499

Current liabilities

Bank overdraft 6 4,603 - 2,664

Other interest-bearing loans and 6 1,130 - 1,474

borrowings

Trade and other payables 10,277 181 6,980

Contingent consideration 3,100 - -

Tax payable 1,021 - 611

20,131 181 11,729

Non-current liabilities

Other interest-bearing loans and 6 4,362 - 9,339

borrowings

Provisions 450 - 518

Deferred tax liabilities 3,938 - 3,073

8,750 - 12,930

Total liabilities 28,881 181 24,659

Net assets 40,908 2,700 28,840

Equity attributable to

shareholders

Share capital 32,206 3,217 25,063

Share premium account 5,306 - 2,986

Shares to be issued 1,562 - 500

Retained earnings 1,834 (517) 291

Total equity 40,908 2,700 28,840

Consolidated Cash Flow Statement

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 March

September September 2007

2007 2006

#000 #000 #000

Cash flows from operating activities

Profit/(Loss) for the period 537 (640) (103)

Adjustments for:

Depreciation, amortisation and 902 3 487

impairment

Financial income (64) - (99)

Financial expense 380 222 205

Share-based payment expense 1,006 - 271

Taxation 301 - 537

Operating profit/(loss) before changes 3,062 (415) 1,298

in working capital and provisions

(Increase)/decrease in trade and other (629) 1 1

receivables

Increase in inventories (106) - (11)

Increase/(decrease) in trade and other 121 (9) (349)

payables

Cash generated from the operations 2,448 (423) 939

Interest paid (380) - (205)

Interest received 64 65 99

Tax paid (438) - (288)

Net cash inflow/(outflow) from 1,694 (358) 545

operating activities

Cash flows from investing activities

Proceeds from sale of property, plant - - 1,306

and equipment

Acquisitions of subsidiaries, net of (6,378) - (20,662)

cash acquired

Acquisition of property, plant and (333) - (143)

equipment

Net cash outflow from investing (6,711) - (19,499)

activities

Cash flows from financing activities

Proceeds from new loan - - 10,813

Proceeds from the issue of share 9,463 (50) 7,532

capital

Repayment of borrowings (6,189) - -

Payments to redeem share capital - - (50)

Net cash inflow/(outflow) from 3,274 (50) 18,295

financing activities

Net decrease in cash and cash (1,743) (408) (659)

equivalents

Cash and cash equivalents at beginning 2,905 3,564 3,564

of period

Effect of exchange rate fluctuations on - (289) -

cash held

Cash and cash equivalents at end of 1,162 2,867 2,905

period

Cash and cash equivalents comprise:

Cash at bank and in hand 5,765 2,867 5,569

Bank overdrafts (4,603) - (2,664)

Cash and cash equivalents at end of 1,162 2,867 2,905

period

Consolidated Statement of Changes in Equity

Share Share Shares to Retained Total

capital premium be issued earnings #000

#000 account #000 #000

#000

At 31 March 2006 3,267 - - 123 3,390

Redemption of Convertible A (50) - - - (50)

shares

Retained earnings - - - (640) (640)

At 30 September 2006 3,217 - - (517) 2,700

Allotment of 50p Ordinary 21,846 2,986 - - 24,832

shares

Retained earnings - - - 537 537

Credit in respect of share - - - 271 271

based payments

Shares to be issued - - 500 - 500

At 31 March 2007 25,063 2,986 500 291 28,840

Allotment of 50p Ordinary 7,143 2,320 - - 9,463

shares

Retained earnings - - - 537 537

Credit in respect of share - - - 1,006 1,006

based payments

Shares to be issued - - 1,062 - 1,062

At 30 September 2007 32,206 5,306 1,562 1,834 40,908

1 Basis of Preparation

The interim financial statements have been prepared in accordance with

applicable accounting standards and under the historical cost convention. The

interim financial statements do not constitute statutory financial statements in

accordance with section 435 of the Companies Act 2006. The full year figures in

this report are derived from the statutory accounts on which the auditors gave

an unmodified report. The group's statutory financial statements prepared under

International Financial Reporting Standards (IFRS) have been filed with the

Registrar of Companies.

The principal accounting policies of the group have remained unchanged from

those set out in the group's 2007 annual report and financial statements.

The interim financial statements have been reviewed by the company's auditor. A

copy of the auditor's review report is attached to this interim report.

The interim financials statements were approved by the board of directors on 10

December 2007.

2 Segmental reporting

The Group's primary reporting segments are the following business segments:

Continuing operations

Six Months Ended 30 September 2007

Online Direct Data Unallocated Group

Marketing Marketing Services total

and Media Services and

Consultancy

#000 #000 #000 #000 #000

Revenue 8,799 7,286 6,978 (925) 22,138

Direct costs (4,783) (1,764) (1,748) 925 (7,370)

Gross profit 4,016 5,522 5,230 - 14,768

Other operating income - - 16 - 16

Operating expenses (2,978) (4,466) (4,341) (943) (12,728)

excluding depreciation

and amortisation

EBITDA 1,038 1,056 905 (943) 2,056

Depreciation (83) (97) (73) (1) (254)

Operating profit 955 959 832 (944) 1,802

before amortisation

charge

Amortisation charge (217) (162) (269) - (648)

Operating profit 738 797 563 (944) 1,154

Finance income 64

Finance costs (380)

Profit before tax 838

Taxation (301)

Profit for year from 537

continuing operations

The primary reporting segments have changed to reflect the key reporting line of

the group and following the online marketing acquisitions of Graphico New Media

and Hyperlaunch New Media.

There were no results in the comparative period relating to continuing

operations.

Geographical segments

All turnover is derived from and all assets and liabilities are located in, the

United Kingdom.

3 Taxation

Recognised in the income statement

Period ended Period ended Year ended

30 September 30 September 31 March

2007 2006 2007

#'000 #'000 #'000

Current tax expense

Current year 691 - 707

Deferred tax credit

Origination and reversal of temporary (390) - (170)

differences

Total tax in income statement 301 - 537

Reconciliation of total tax charge

Period ended Period ended Year ended

30 September 30 September 31 March

2007 2006

2007

#'000 #'000 #'000

Profit before tax 838 - 1,074

Tax using the UK corporation tax rate of 251 - 322

30%

Non-deductible expenses 50 - 222

Deductions allowable for tax - - (19)

Unused tax losses carried forward - - 76

Utilisation of tax losses - - (40)

Other - - (24)

Total tax in income statement 301 - 537

4 Earnings per share

From continuing and discontinued operations:

Period Period Year ended

ended ended 31 March

30 30 2007

September September

2007 2006

pence per pence per pence per

share share share

Basic 0.95p (9.95)p (0.55)p

Diluted 0.78p (9.95)p (0.51)p

Earnings per share has been calculated by dividing the profit attributable to

shareholders by the weighted average number of ordinary shares in issue during

the year. The numbers used in calculating basic and diluted earnings per share

are reconciled below:

Period ended Period ended Year ended

30 September 30 September 31 March

2007 2006 2007

#000 #000 #000

Profit/(loss) for year attributable to 537 (640) (103)

shareholders

Weighted average number of shares in Number Number Number

issue:

000's 000's 000's

Basic 56,271 6,433 18,686

Adjustment for share options, warrants 12,764 - 1,788

and contingent shares

Diluted 69,035 6,433 20,474

EBITDA per share before charges for share options, from continuing operations:

Period Period Year ended

ended ended 31 March

30 30 2007

September September

2007 2006

pence per pence per pence per

share share share

Basic 5.44p -p 10.37p

Diluted 4.44p -p 9.47p

EBITDA per share before charges for share options has been calculated by

dividing the EBITDA before charges for share options by the weighted average

number of ordinary shares in issue during the year. The numbers used in

calculating basic and diluted EBITDA per share before charges for share options

are reconciled below:

Period ended Period ended Year ended

30 September 30 September 31 March

2007 2006 2007

#000 #000 #000

Profit for year attributable to 537 - 537

shareholders

Taxation 301 - 537

Interest 316 - 106

Amortisation 648 - 321

Depreciation 254 - 166

Charges for share options 1,006 - 271

EBITDA before charges for share options 3,062 - 1,938

5 Acquisitions of subsidiaries

During the period the Group made two acquisitions of subsidiary undertakings.

The net assets acquired, consideration paid, and goodwill arising upon

acquisition of these subsidiary undertakings are detailed in the following note.

A summary of these amounts is shown below:

Summary of the two acquisitions

Acquirees' Fair value Notes Acquisition

book values amounts

adjustments

#000 #000 #000

Acquirees' net assets at the acquisition

date:

Other intangible assets - 4,516 1 4,516

Property, plant and equipment 1,355 - 1,355

Inventories 291 - 291

Trade and other receivables 1,808 - 1,808

Cash and cash equivalents 196 - 196

Bank overdraft (376) - (376)

Trade and other payables (885) - (885)

Other long term loans (868) - (868)

Tax payable (157) - (157)

Deferred tax (11) (1,265) 2 (1,276)

Net identifiable assets and liabilities 1,353 3,251 4,604

Goodwill on acquisition 7,819

12,423

Satisfied by:

Cash consideration paid (Including legal 6,038

and professional fees of #502,000)

Contingent consideration payable in cash 4,548

Contingent consideration payable in 1,257

shares

Issue of 466,238 ordinary shares at 580

#1.244 per share

12,423

Summary of net cash outflows from

acquisitions

Cash paid 6,038

Cash acquired (196)

Bank overdraft acquired 376

Net cash outflow 6,218

Fair value adjustments comprise:

1 Valuation of customer relationships.

2 Deferred tax effect of valuation of customer relationships.

All fair values are provisional and will be reviewed within the 12 months from

the date of acquisition.

Graphico New Media Limited

On 29 June 2007 the Group acquired all of the ordinary shares in Graphico New

Media Limited for #9,108,000, satisfied in cash and shares. In the period since

acquisition, the subsidiary contributed net profit of #126,000 to the

consolidated net profit for the six months ended 30 September 2007.

The net assets and liabilities of Graphico New Media Limited acquired were as

follows:

Acquiree's Fair value Acquisition

book values amounts

adjustments

#000 #000 #000

Acquiree's net assets at the acquisition

date:

Other intangible assets - 3,357 3,357

Property, plant and equipment 1,314 - 1,314

Inventories 290 - 290

Trade and other receivables 1,378 - 1,378

Cash and cash equivalents 1 - 1

Bank overdraft (376) - (376)

Trade and other payables (780) - (780)

Other long term loans (868) - (868)

Tax payable (84) - (84)

Deferred tax (8) (940) (948)

Net identifiable assets and liabilities 867 2,417 3,284

Goodwill on acquisition 5,824

9,108

Satisfied by:

Cash consideration paid (Including legal 4,508

and professional fees of #270,000)

Contingent consideration payable in cash 3,825

Contingent consideration payable in 775

shares

9,108

Cash paid 4,508

Cash acquired (1)

Bank overdraft acquired 376

Net cash outflow 4,883

Hyperlaunch New Media Limited

On 29 June 2007 the Group acquired all of the ordinary shares in Hyperlaunch New

Media Limited for #3,315,000, satisfied in cash and shares. In the period since

acquisition, the subsidiary contributed net profit of #54,000 to the

consolidated net profit for the six months ended 30 September 2007.

The net assets and liabilities of Hyperlaunch New Media Limited acquired were as

follows:

Acquiree's Fair value Acquisition

book values amounts

adjustments

#000 #000 #000

Acquiree's net assets at the acquisition

date:

Other intangible assets - 1,159 1,159

Property, plant and equipment 41 - 41

Inventories 1 - 1

Trade and other receivables 430 - 430

Cash and cash equivalents 195 - 195

Trade and other payables (105) - (105)

Tax payable (73) - (73)

Deferred tax (3) (325) (328)

Net identifiable assets and liabilities 486 834 1,320

Goodwill on acquisition 1,995

3,315

Satisfied by:

Cash consideration paid (Including legal 1,530

and professional fees of #232,000)

Contingent consideration payable in cash 723

Contingent consideration payable in 482

shares

Issue of 466,238 ordinary shares at 580

#1.244 per share

3,315

Cash paid 1,530

Cash acquired (195)

Net cash outflow 1,335

6 Borrowings

30 September 30 September 31 March

2007 2006 2007

#000 #000 #000

Overdraft 4,603 - 2,664

Bank borrowings 5,492 - 10,813

10,095 - 13,477

Borrowings are repayable as follows:

Within 1 year 5,733 - 4,138

In more than 1 year but not more 1,116 - 4,917

than 2 years

In more than 2 years but not more 1,123 - 1,474

than 3 years

In more than 3 years but not more 1,134 - 1,474

than 4 years

In more than 4 years but not more 328 - 1,474

than 5 years

More than 5 years 661 - -

Due in more than 1 year 4,362 - 9,339

Average interest rates at the balance sheet date were:

30 September 30 September 31 March

2007 2006 2007

% % %

Overdraft 7.75 - 7.5

Term loan 8.6 - 8

Revolver loan - - 7.9

The borrowing facilities available to the Group amounted to #11.07m and at the

balance sheet date, taking account of credit cash balances across the Group,

there were #6.74m of undrawn borrowing facilities.

A Composite Accounting System allows debit balances on overdraft to off set

across the Group with credit balance. No hedging facility was in place at the

period end.

7 Contingencies

The Group has a liability to pay deferred consideration if certain performance

targets are met. The maximum liability is #6,805,000 and the directors have

provided #6,305,000, leaving #500,000 as an unprovided liability.

8 Accounting estimates and judgements

Impairment of goodwill

The carrying amount of goodwill is #38,712,000. The directors are confident that

the carrying amount of goodwill is fairly stated but have not carried out an

impairment review of this amount during the period.

Other intangible assets

The valuation of customer lists is based on key assumptions which the directors

have assessed, and are satisfied that the carrying value of these assets is

fairly stated.

Deferred consideration

The directors have provided an estimate of the amount payable in respect of

deferred contingent consideration. See note 7.

Recognition of revenue as principal or agent

The Directors consider that they act as a principal in transactions where the

Group assumes the credit risk. Where this is via an agency arrangement and the

Group assumes the credit risk for all billings it therefore recognises gross

billings as revenue.

REPORT ON REVIEW OF INTERIM FINANCIAL INFORMATION

Introduction

We have been instructed by the company to review the interim financial

information for the six months ended 30 September 2007 which comprises the

consolidated interim income statement, consolidated interim balance sheet,

consolidated interim statement of changes in equity and the consolidated interim

cash flow statement and the related notes 1 to 8. We have read the other

information contained in the interim report which comprises the chairman's

statement and chief executive's review and considered whether it contains any

apparent misstatements or material inconsistencies with the financial

information. Our responsibilities do not extend to any other information.

This report is made solely to the company in accordance with guidance contained

in International Standard on Review Engagements (UK and Ireland) 2410, ''Review

of Interim Financial Information Performed by the Independent Auditor of the

Entity'' issued by the Auditing Practices Board for use in the United Kingdom.

Our review work has been undertaken so that we might state to the company those

matters we are required to state to them in a review report and for no other

purpose. To the fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the company for our review work, for this

report, or for the conclusion we have formed.

Directors' responsibilities

The interim report, including the financial information therein, is the

responsibility of, and has been approved by the directors. The AIM Rules of the

London Stock Exchange require that the accounting policies and presentation

applied to the interim figures are consistent with those which will be adopted

in the annual accounts having regard to the accounting standards applicable to

such accounts.

Review work performed

We conducted our review in accordance with guidance contained in International

Standard on Review Engagements (UK and Ireland) 2410, ''Review of Interim

Financial Information Performed by the Independent Auditor of the Entity''

issued by the Auditing Practices Board for use in the United Kingdom. A review

consists principally of making enquiries of management and applying analytical

procedures to the financial information and underlying financial data and, based

thereon, assessing whether the disclosed accounting policies and presentation

have been consistently applied unless otherwise disclosed. A review excludes

audit procedures such as tests of control and verification of assets,

liabilities and transactions. It is substantially less in scope than an audit

performed in accordance with International Standards of Auditing (UK and

Ireland) and therefore provides a lower level of assurance than an audit.

Accordingly, we do not express an audit opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30 September 2007.

GRANT THORNTON UK LLP

REGISTERED AUDITOR

CHARTERED ACCOUNTANTS

SHEFFIELD

10 December 2007

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DDLFBDLBXFBD

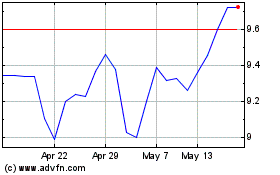

Diginfraconacc (LSE:DIGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Diginfraconacc (LSE:DIGI)

Historical Stock Chart

From Jul 2023 to Jul 2024