TIDMCYAN

RNS Number : 6904D

Cyan Holdings Plc

28 March 2011

28 March 2011

Cyan Holdings plc

("Cyan or "the Company")

Preliminary Results

for the year ended 31 December 2010

Cyan Holdings plc (AIM: Cyan.L), the integrated system design

company delivering mesh based flexible wireless solutions for

lighting control, utility metering and industrial telemetry

announces its full year results for the twelve months ended 31(st)

December 2010.

Summary of key achievements

-- Substantial progress in adoption of Cyan lighting control

products made in Q4 of 2010

-- Initial order received for 10,000 units for our wireless

monitoring and control system for outdoor public lighting from

India

-- An initial order from China for 10,000 units for our wireless

monitoring and control system for outdoor public lighting, with an

initial project requirement of up to 200,000 units over the course

of the next 18 months

-- Memorandum of Understanding entered into to establish a

partnership with a large Indian business whose lighting division

has a contract to replace up to 375,000 street lights in one

City

-- Equity fundraisings of GBP2.7 million net demonstrating

significant investor confidence

Kenn Lamb, CEO of Cyan, commented:

"I am delighted with the progress that Cyan made in the final

quarter of 2010 and we have seen substantial momentum and upswing

in order enquiries in the first quarter of 2011. Despite a

difficult two years for the Group, I am now convinced that 2011

will be a major turning point for us. Our order book for lighting

control products is growing strongly, in particular from China and

India where we are increasingly well positioned with Utility

Companies and Government Departments considering our electricity

metering solutions.

For the first time in Cyan's trading history it is both mine and

the board's view that now is the right time and that we have the

right products and are engaged in the right markets. With each new

customer and with multiple new prospects engaging we are confident

that Cyan is now well positioned to deliver substantial shareholder

value."

www.cyantechnology.com

Enquiries:

Cyan Holdings plc Tel: +44 (0) 1954 234 400

Kenn Lamb, CEO Tel: +44 (0) 1954 234 400

Cyan Holdings plc

John Read, Chairman

Cenkos Securities plc Tel: +44 (0)20 7397 8900

Stephen Keys / Adrian Hargrave

Hansard Communications Ltd Tel: +44 (0)20 7245 1100

Adam Reynolds / Nicholas Nelson

Chairman's Statement

At the time of the last Annual Report, Cyan laid out its

strategic aim to become a major supplier of solutions for lighting

control, utility metering and industrial telemetry; and I am

pleased to report the company has taken great steps towards

reaching this goal in the first two of these markets in 2010.

Since that time the Company has shipped tens of thousands of

units to wireless utility metering customers around the world. Most

of these units were installed into large-scale trials. In the

second half of 2010 a number of customers indicated to the Company

that they were bidding for tenders of substantial quantity, and

already in 2011 Cyan is aware of two new tenders for wireless

electricity meters in excess of one million units each.

Cyan has developed technology and products that deliver cost

effective ready-to-deploy solutions. These allow established

lighting and utility metering manufacturers to easily enhance their

products to support remotely managed wireless networks of

street-lights or utility-meters. There is substantial growing

global demand for such wireless management networks and in recent

years Cyan has made significant investment and has gained extensive

expertise in designing, manufacturing and deploying such

networks.

Cyan has now evolved from developing and supplying just the

wireless communication components, to providing complete system

solutions, so much so that the Company is now better described as

an integrated system design company.

Cyan has recently succeeded in initiating a program of direct

engagement with a number of utility companies and government

departments, who are working to define the requirements for their

next generation wireless electricity meters. Cyan is supported in

this by a number of established meter manufacturers in that region

who have already committed to incorporate Cyan products into their

next generation wireless electricity meters, and wish to see Cyan's

mesh technology incorporated into any new national standard.

At the start of 2010 Cyan was well positioned having design-in

programs with a number of lighting manufacturers in several

countries. Now, at the beginning of 2011, we believe that Cyan's

position is considerably stronger with a number of leading

organisations specifying Cyan wireless lighting technology for

pilot programmes and production installations due in 2011. This is

in part the result of becoming a fully integrated system design

business and the efforts and increased reputation of the Company

within these regions.

The company announced an important initial order for wireless

monitoring and control of outdoor public lighting in China. The

initial order is for 10,000 modules, and installation has begun in

Q1 2011. The customer's initial project requires the eventual

replacement of 200,000 street lights in a single city and the

installation rate is expected to exceed 10,000 units per month by

Q4 2011. This customer is a large established Chinese lighting

manufacturer who has informed Cyan's management that it has already

won, or expects to win, contracts in three further cities.

Following this contract win and the satisfactory results of the

trial, the customer now plans to market Cyan controlled HID (High

Intensity Discharge) products across the whole of China through its

network of over 2,000 agents. Cyan is currently in negotiation with

the customer to further develop their HID lighting product by

tightening the integration between Cyan lighting control and the

other elements of the HID light to create a highly integrated and

lower total cost HID lighting solution.

As previously announced, the Company has also entered into a

partnership with a large lighting manufacturer in India, to replace

375,000 street lights. The partnership agreement gives the customer

access to Cyan server technology on condition of use of Cyan

lighting control products and the active marketing of the combined

solution to other cities. An initial order of 1,000 units has been

received to set up a demonstration facility of the combined

lighting control system. Cyan is also engaged with a range of other

customers primarily in India and China but also in Africa, Europe

and the USA that have completed or undertaken further trials during

the year.

Cyan is building on its key partnerships, particularly with

Future Electronics Inc, a top three worldwide electronic component

distributor with divisions focussed on metering and lighting

products. Future Electronics provides a global distribution network

for all Cyan products. During the year we have jointly participated

in a number of exhibitions and trade shows and Cyan has trained

many of their sales people with our products.

The board believes that the company is now well positioned to

capitalise on its focus in lighting and metering markets and that

2011 will see a significant upturn in order intake, which will

result in a substantial increase in revenues.

In September, the company successfully raised GBP1.8m net at

0.75p per share to provide working capital in this time of

strategic positioning. In addition to this, since year end, in

January 2011 the Company raised a further GBP895,000 net at 1.25p

per share for the same purpose.

For the year ended 31 December 2010 both operating costs and

R&D Costs were kept at a low level resulting in an operating

loss of GBP2, 954,055 (2009: GBP3,133, 135). The loss for the year

also remained constant at GBP2,648,116 (2009: GBP2, 652, 260). Cash

at year end was GBP1,484,437 (2009: GBP1,968,072).

John Read

Chairman

28(th) March 2011

Chief Executive's Statement

Kenn Lamb, CEO of Cyan, commented:

I am delighted with the progress that Cyan made in the final

quarter of 2010 and we have seen substantial momentum and upswing

in order enquiries in the first quarter of 2011. Despite a

difficult two years for the Group, I am now convinced that 2011

will be a major turning point for us.

Our business has two principal product groups:

-- Lighting control and monitoring

-- Utility meter monitoring and control

Lighting control and monitoring (CyLux)

Cyan has developed a fully integrated wireless end-to-end system

for public lighting such as; street lights, tunnels, highways,

industrial parks and public locations, which is capable of dimming

three different types of light; HPS, HID and LED. We are confident

that the combination of features in our system makes a unique

system solution, and we already have manufacturers of the

electronic drivers for these lights producing prototype versions

incorporating Cyan wireless control; 'Cyan Inside'. CyLux allows

city authorities to remotely set lighting profiles: turning on /

off and dimming at preset times for optimised lighting intensity

through evening, late night and morning to maximise power saving.

Actual power saving is measured and reported by Cyan's system, a

very popular feature with customers as many of them are financially

incentivised based on the actual energy saving delivered. In

addition to the above functionality CyLux can accurately monitor

lamp status and proactively identify maintenance or lamp repair

requirements with interactive maps showing lamp locations and

status.

The increasing cost of energy and limitations in generating

capacity within the developing world are significant factors

restraining the potential levels of future economic growth in these

countries. Accordingly, energy efficiency has become a major focus

for the governments of developing nations. As a result of this

Governmental pressure we are experiencing a substantial increase in

enquiries from both China and India. This began towards the end of

2010 and the momentum has increased substantially during the first

quarter of 2011. Not only has our order book increased

dramatically, we are also awaiting the results of a number of

tenders that our customers and prospective customers are involved

in.

Electricity and gas meter reading (CyLec & CyGas)

Over the past three years Cyan has been at the forefront of the

development of wireless mesh network solutions for electricity and

gas metering. Cyan has chosen to utilise radio frequencies suited

for these applications which will penetrate buildings and in the

case of India and China have been specifically allocated for this

purpose. Gas metering solutions require battery operation and Cyan

has established a USP with wireless mesh networking meters

operating for years from AA batteries, a technology that is also

directly applicable to water metering. We are now seeing a

substantial increase in enquiries and new tender requirements for

these products within India and China. Multiple meter manufacturers

have adopted Cyan wireless meter solutions and Cyan's integrated

mesh metering solution is now well positioned influential

electricity boards.

A primary driver for wide deployment of remotely monitored and

managed metering systems with prepayment and tamper alert

capability is to address the problem that within the developing

world it has become very difficult to accurately check usage and

enforce payment. Cyan's metering solutions branded CyLec and CyGas

have been developed over the last two years to directly address

these problems, and contain many features developed and proven in

field trials in collaboration with meter manufacturers. As utility

companies become increasingly aware of the new capabilities of

Cyan's metering solutions we expect, and are already seeing, new

tender requirements reflecting these features. We are currently in

discussions at high levels and are aware of tender proposals within

a number of substantial electricity and gas utility companies in

India and China and I am confident that during the next twelve

months we will receive significant orders for Cyan metering

solutions.

For the first time in Cyan's trading history it is my and the

board's view that now is the right time for Cyan, that we have

chosen the right markets, and that we have developed the right

products. The level of customer orders and positive feedback makes

us confident that we are well positioned to deliver substantial

shareholder value as our revenues track the pace of growth of these

markets. The business is now very well positioned to grow

substantially and I would like to take this opportunity to thank

all of our staff and my board for their efforts and diligence, and

our shareholders for their patience and support in making Cyan a

business that we will all be proud of.

Kenn Lamb

Chief Executive Officer

28(th) March 2011

Consolidated income statement

For the year ended 31 December 2010

2010 2009

-------------------------------- ------------- ------------

GBP GBP

-------------------------------- ------------- ------------

Continuing operations

-------------------------------- ------------- ------------

Revenue 139,047 95,569

-------------------------------- ------------- ------------

Cost of sales (96,326) (62,897)

-------------------------------- ------------- ------------

Gross profit 42,721 32,672

-------------------------------- ------------- ------------

Operating costs (1,259,073) (1,633,138)

-------------------------------- ------------- ------------

Research and development costs (1, 737,703) (1,532,669)

-------------------------------- ------------- ------------

Operating loss (2,954,055) (3,133,135)

-------------------------------- ------------- ------------

Investment revenue 1,487 1,639

--------------------------------

Finance costs (85) (11)

-------------------------------- ------------- ------------

Loss before tax (2,952,653) (3,131,507)

-------------------------------- ------------- ------------

Tax 304,537 479,247

-------------------------------- ------------- ------------

Loss for the year (2,648,116) (2,652,260)

-------------------------------- ============= ============

Loss per share (pence)

--------------------------------

Basic (0.4) (0.5)

-------------------------------- ============= ============

Diluted (0.4) (0.5)

-------------------------------- ============= ============

Consolidated Statement of Comprehensive

Income For the year ended

31 December 2010 2010 2009

-------------------- ------------ ------------

GBP GBP

-------------------- ------------ ------------

Exchange

differences on

translation of

foreign

operations (66,140) 145,834

-------------------- ------------ ------------

Loss for the year (2,648,116) (2,652,260)

-------------------- ------------ ------------

Total comprehensive

income for the

period (2,714,256) (2,506,426)

-------------------- ============ ============

--------------------------------------------------

Consolidated balance sheet

At 31 December 2010

2010 2009

GBP GBP

---------------------------------------- ------------- -------------

Non-current assets

----------------------------------------

Property, plant and equipment 29,114 39,729

----------------------------------------

Current assets

---------------------------------------- ------------- -------------

Inventories 872,923 893,087

---------------------------------------- ------------- -------------

Trade and other receivables 411,848 569,601

---------------------------------------- ------------- -------------

Cash and cash equivalents 1,484,437 1,968,072

---------------------------------------- ------------- -------------

2,769,208 3,430,760

---------------------------------------- ------------- -------------

Total assets 2,798,322 3,470,489

---------------------------------------- ============= =============

Current liabilities

---------------------------------------- ------------- -------------

Trade and other payables 283,872 229,332

---------------------------------------- ------------- -------------

283,872 229,332

---------------------------------------- ------------- -------------

Total liabilities 283,872 229,332

---------------------------------------- ------------- -------------

Net assets 2,514,450 3,241,157

---------------------------------------- ============= =============

Equity

---------------------------------------- ------------- -------------

Share capital 1,847,666 1,309,565

---------------------------------------- ------------- -------------

Share premium account 20,378,625 19,026,290

---------------------------------------- ------------- -------------

Own shares held (690,191) (690,191)

---------------------------------------- ------------- -------------

Share option reserve 476,999 379,886

---------------------------------------- ------------- -------------

Translation reserve (294,254) (228,114)

---------------------------------------- ------------- -------------

Retained earnings (19,204,395) (16,556,279)

---------------------------------------- ------------- -------------

Total equity being equity attributable

to equity holders of the parent 2,514,450 3,241,157

---------------------------------------- ============= =============

Consolidated statement of changes in equity

at 31 December 2010

Share

Share Share Own Option Translation Retained

Capital Premium shares Reserve Reserve Losses Total

GBP GBP held GBP GBP GBP GBP Equity GBP

Bal at 31

December 2008 954,259 16,391,994 (690,191) 268,852 (373,948) (13,904,019) 2,646,947

---------- ----------- ---------- -------- ------------ ------------- ------------

Loss for the

year - - - - - (2,652,260) (2,652,260)

Other

comprehensive

income for the

year - - - - 145,834 - 145,834

---------- ----------- ---------- -------- ------------ ------------- ------------

Total

comprehensive

income for the

year - - - - 145,834 (2,652,260) (2,506,426)

Issue of share

capital 355,306 2,634,296 - - - - 2,989,602

Credit to

equity for

share options - - - 111,034 - - 111,034

---------- ----------- ---------- -------- ------------ ------------- ------------

Bal at 31

December 2009 1,309,565 19,026,290 (690,191) 379,886 (228,114) (16,556,280) 3,241,157

---------- ----------- ---------- -------- ------------ ------------- ------------

Loss for the

year - - - - - (2,648,116) (2,648,116)

Other

comprehensive

income for the

year - - - - (66,140) - (66,140)

---------- ----------- ---------- -------- ------------ ------------- ------------

Total

comprehensive

income for the

year (66,140) (2,648,116) (2,714,256)

Issue of share

capital 538,101 1,352,335 - - - - 1,890,436

Credit to

equity for

share options - - - 97,113 - - 97,113

---------- ----------- ---------- -------- ------------ ------------- ------------

Bal at 31

December 2010 1,847,666 20,378,625 (690,191) 476,999 (294,254) (19,204,395) 2,514,450

---------- ----------- ---------- -------- ------------ ------------- ------------

Consolidated cash flow statement

For the year ended 31 December 2010

2010 2009

-------------------------------------------- ------------ ------------

GBP GBP

-------------------------------------------- ------------ ------------

Net cash from operating activities (2,293,931) (2,400,080)

-------------------------------------------- ------------ ------------

Investing activities

-------------------------------------------- ------------ ------------

Interest received 1,487 1,639

-------------------------------------------- ------------ ------------

Purchases of property, plant and equipment (15,126) (10,927)

-------------------------------------------- ------------ ------------

Net cash from investing activities (13,639) (9,288)

-------------------------------------------- ------------ ------------

Financing activities

-------------------------------------------- ------------ ------------

Interest paid (85) (11)

-------------------------------------------- ------------ ------------

Proceeds on issue of shares 2,035,913 3,207,633

-------------------------------------------- ------------ ------------

Share issue costs (145,477) (218,031)

-------------------------------------------- ------------ ------------

Net cash from financing activities 1,890,351 2, 989,591

-------------------------------------------- ------------ ------------

Net (decrease)/increase in cash and

cash equivalents (417,219) 580,223

-------------------------------------------- ------------ ------------

Cash and cash equivalents at beginning

of year 1,968,072 1,356,886

--------------------------------------------

Effect of foreign exchange rate changes (66,416) 30,963

--------------------------------------------

Cash and cash equivalents at end of

year 1, 484,437 1,968,072

-------------------------------------------- ============ ============

Notes to the Financial Information

For the year ended 31 December 2010

1. General information

Cyan Holdings plc is a company incorporated in the England and

Wales under the Companies Act 2006. The address of the registered

office is Cyan Holdings plc, Buckingway Business Park, Swavesey

CB24 4UQ.

The financial information set out above does not constitute the

company's statutory accounts for the years ended 31 December 2010

or 2009, but is derived from those accounts. Statutory accounts for

2009 have been delivered to the Registrar of Companies and those

for 2010 will be delivered following the company's annual general

meeting. The auditors have reported on those accounts: their

reports were unqualified and did not contain statements under s498

(2) or (3) Companies Act 2006 or equivalent preceding legislation

but did contain an emphasis of matter concerning the uncertainties

around the Group's ability to continue as a going concern. While

the financial information included in this preliminary announcement

has been computed in accordance with International Financial

Accounting Standards (IFRS), this announcement itself does not

contain sufficient information to comply with IFRS. The company

expects to publish full financial statements that comply with IFRS,

a copy of which will be posted to the shareholders.

The financial statements were approved by the Board of Directors

on 25 March 2011 and authorised for issue. The Group's specific

IFRS accounting policies can be found in the 2009 annual

report.

Going concern

The directors have prepared a business plan and cash flow

forecast for the period to 31 December 2012. The forecast contains

certain assumptions about the level of future sales and the level

of gross margins and also identified the need for additional

finance to fund working capital within the next six months. These

assumptions are the directors' best estimate of the future

development of the business.

The directors acknowledge that the Group is trading in a

difficult economic environment and in markets that are new to the

Group. This may impact both the Group's ability to generate

positive cashflow and to raise new finance. There is a significant

risk that the level of sales achieved is materially lower than the

level forecast or at materially lower margins. The directors have

taken steps to satisfy themselves about the robustness of sales

forecasts but acknowledge that the timing of customer orders in the

Group's target markets is inherently uncertain. In addition, the

directors have been in communication with a number of potential

investors, including current shareholders, who have expressed

interest in providing the necessary funding upon evidence of firm

sales orders. There does remain a significant risk that the

required level of funding will not be received in the necessary

timescales or at all. The directors are of the opinion that this

business plan is achievable. On this basis, the directors have

assumed that the company is a going concern.

There is a material uncertainty related to the assumptions

described above which may cast significant doubt on the Group's

ability to continue as a going concern and, therefore, it may be

unable to realise its assets and discharge its liabilities in the

normal course of business. The financial statements do not include

the adjustments that would result if the Group was unable to

continue as a going concern. In the event the Group ceased to be a

going concern, the adjustments would include writing down the

carrying value of assets, including inventories, to their

recoverable amount and providing for any further liabilities that

might arise.

2. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Earnings

2010 2009

------------------------------------------------- -------- -------------

GBP GBP

------------------------------------------------- -------- -------------

Earnings for the purposes of basic

earnings per share being net loss

attributable to equity holders of

the parent

-------------------------------------------- ----

2,648,116 2,652,260

------------------------------------------- ============== =============

Number of shares

2010 2009

------------------- ------------------ ------------

No. No.

------------------- ------------------ ------------

Weighted average number of ordinary

shares for the purposes of basic

and diluted earnings per share 751,804,821 528,453,250

------------------------------------ -------------- ============ ============

3. Share capital

2010 2009

------------------------------------------ -------------- ------------

number number

------------------------------------------

Authorised:

------------------------------------------

Ordinary shares of 0.2 pence each 1,500,000,000 800,000,000

------------------------------------------ ============== ============

2010 2009

------------------------------------------

GBP GBP

------------------------------------------

Issued and fully paid:

------------------------------------------

923,832,983 (2009: 654,782,659) ordinary

shares of 0.2 pence each 1,847,666 1,309,565

------------------------------------------ ============== ============

4. Notes to the consolidated cash flow statement

2010 2009

----------------------------------------------- ------------ ------------

GBP GBP

--------------------------------------------- ------------ ------------

Operating loss for the year (2,954,055) (3,133,135)

--------------------------------------------- ------------ ------------

Adjustments for:

--------------------------------------------- ------------ ------------

Depreciation of property, plant and

equipment 26,017 62,232

--------------------------------------------- ------------ ------------

Share-based payment expense 97,113 111,034

--------------------------------------------- ------------

Operating cash flows before movements in

working capital (2,830,925) (2,959,869)

--------------------------------------------- ------------ ------------

(Increase)/decrease in inventories 20,164 (45,734)

--------------------------------------------- ------------ ------------

(Increase)/decrease in receivables (17,038) 48,035

---------------------------------------------

Increase/(decrease) in payables 54,540 (45,363)

--------------------------------------------- ------------ ------------

Cash reduced by operations (2,773,259) (3,002,931)

--------------------------------------------- ------------ ------------

Income taxes received 479,328 602,851

---------------------------------------------

Net cash outflow from operating activities (2,293,931) (2,400,080)

--------------------------------------------- ------------ ------------

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with maturity of

three months or less.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JAMRTMBATBRB

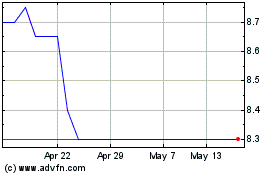

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024