RNS Number:0976A

Cyan Holdings Plc

21 March 2006

Press Release 21 March 2006

Cyan Holdings Plc

("Cyan" or "the Group")

Preliminary results for the 12 months to 31 December 2005

Cyan Holdings Plc (AIM: CYAN.L), the fabless semiconductor company specialising

in the development of low powered, configurable microcontroller chips, announces

its preliminary results for the 12 months ended 31 December 2005.

Highlights

* Turnover of #29,899 (2004: #12,116)

* Gross profit is #24,933 (2004: #3,016)

* The milestone of 100 design wins was achieved by March 2006

* eCOG1k and CyanIDE established in the market place

* Significant product development on eCOG1X

* Strengthened distribution channels in Asia and Europe

* Expanded and reputable management, sales and engineering teams

* Successful AIM IPO which raised #6.1 million

Commenting on the results, Paul Johnson, Chief Executive, of Cyan, said: "I am

pleased to report Cyan's maiden results since listing on AIM in December 2005.

The Group has made significant progress since flotation. The flotation itself

enabled us to attract higher profile customers around the world and build on our

strategic plan of developing the eCOG product range. I am confident that the

combination of all of these key attributes will enable us to maintain our

competitive advantage."

For further information:

Cyan Holdings plc

Paul Johnson, Chief Executive Officer Tel: +44 (0) 1954 234 400

www.cyantechnology.com

Collins Stewart Limited

Stephen Keys, Corporate Finance Tel: +44 (0) 20 7523 8312

www.collins-stewart.com

Media enquiries:

Abchurch Communications

Heather Salmond / Dana Thomas Tel: +44 (0) 20 7398 7700

heather.salmond@abchurch-group.com www.abchurch-group.com

Chairman's Statement

2005 was a successful year for Cyan; over two thousand copies of CyanIDE were

downloaded by people in the industry, and design wins reached 89 by the year end

after the introduction of the 16 bit eCOG1k microcontroller into the market in

2004. Twelve customers moved into production, considerable progress was made on

the development of eCOG1X for launch in 2006, and the company was floated on AIM

on 7 December 2005. Thanks are due to all our talented colleagues who made this

possible.

Our flotation was especially important, not only because it provides the finance

for our growth, but also because it has increased our customers' confidence in

our future which, in turn, encourages them to trust that our microcontrollers

will be available to support their products over the long term. We would like

to thank our initial investors for their support and confidence in us, and to

welcome our new investors. The Board is committed to enhancing shareholder

value through growth, which will be driven by the expansion of our product

range, enhancing our customers' product ranges and their product development

processes, and providing a first class, one-stop-shop for customer support.

Proceeds from the float amounted to #6.1 million, #4 million being raised

directly from the market and #2.1 million from the exercise of warrants by

existing shareholders. Cash at the year end was #5.5 million. Proceeds will be

largely applied to continuation of the product development programme, an

increased sales effort, and the funding of working capital as customers'

production quantity orders are received during 2006 and 2007.

Cyan is now making rapid progress in its strategy of providing ultra low power

and low power, high performance, 16 and 32 bit microcontrollers supported by

what we believe to be unique integrated software development tools. Our

integrated approach to microcontroller development and software tools

development provides benefits in the performance of both, and allows

particularly effective customer support. It is a novel approach in our business

area.

Sales in the year were #29,899, with a Gross Profit of #24,933 and a Net Loss of

#2,086,863 arising out of the set-up stage of the Company and the nature of its

products. Microcontrollers are components of other people's products so their

own development time is followed by the development time of the customer's

product, which might typically take 12 to 18 months, before generating

production volume orders to Cyan. Longer term however, the advantage is a

stable business model as the incorporation of a Cyan microcontroller into a

customer's product produces a stream of orders over the lifetime of that

product. This stability is enhanced by the application of our microcontrollers

to diverse product sectors and widespread geographical areas.

At the time of the Company's flotation, Cyan's current largest customer had

committed to an initial order of 100,000 units of eCOG1k which the Company

originally estimated it would begin shipping in December 2005. Delays with the

roll-out of tax control POS terminal products in China have led to a

rescheduling of the drawdown on this order but we are pleased to say that the

initial order will now be dispatched over April, May and June 2006. Further

orders for this customer are expected for delivery in the second half of 2006

but the revised shipping schedules will mean that an estimated three months of

anticipated sales from 2006 will slip into 2007 potentially affecting 2006

budgeted sales. Nonetheless we are pleased to report that 2006 will be our first

year of volume sales.

The Company is delighted to advise that it has reached a milestone in exceeding

100 design wins in March 2006, an increase of some 30 design wins since IPO.

Particularly pleasing is the quality of customers and potential volumes

involved. A design win is when a customer has entered into a relationship with

Cyan whereby the customer has purchased a development board and initial silicon

from the Company and is actively working on developing an end product for volume

production. There is of course no guarantee that any design win will result in a

significant order but Cyan believes that the quantity and quality of the design

wins within its portfolio means that such an eventuality is likely.

Cyan achieved a great deal in 2004 and 2005 - a strong management, sales, and

engineering team was established, distribution channels were put in place in

Asia and Europe, and the first product was introduced to the market. We now

look forward to our initial growth period in 2006 and 2007.

Professor Michael Hughes

Chairman

21 March 2006

Chief Executive's review

The successful AIM IPO in December 2005 was important for two reasons. Not only

did it provide the resources to take the Company forward but it gave the Company

added credibility among its suppliers and customers, effectively removing the '

start-up' label. The Company is now better placed to win substantial new

business from many more customers.

Two new revisions of CyanIDE were released last year and a third is currently in

beta release with key customers. We prototyped a test chip for our new eCOG1X

and eCOG2 product families. The eCOG1X design is currently being prepared for

production whilst the test chip is being put through its paces. Preliminary

test results are very encouraging. All the major new technology blocks are

functioning correctly and there should be a low risk in moving to final

production versions. During 2005 some customers received advance information on

eCOG1X under non-disclosure agreements. At the Embedded Systems Show in

Nuremberg during February 2006 Cyan released preliminary data to the trade.

There was great interest in the eCOG1X and we already have design wins. At the

International IC exhibition in Shenzhen, China we had our own, well positioned

stand which was manned by our own staff and staff from our distributors. About

300 design engineers registered their details and great interest was shown in

both the eCOG1k and the eCOG1X.

Cyan has performed a great deal of work on the upcoming 32 bit microcontroller

and we have the basics of the CyanIDE toolset completed. Cyan is now able to

compile customers' software programs on the 32 bit tools and compare with the

most memory efficient processor cores available today, and we are seeing

improvements in memory efficiency. This is important as memory in most 32 bit

applications is the largest part of the chip, and chip size directly relates to

cost.

Cyan is now moving into the production phase of its business and we are setting

up the manufacturing operations group. Production orders for silicon wafers

have been placed with Taiwan Semiconductor Manufacturing Company (TSMC), our

silicon wafer manufacturing partner, to satisfy production orders from our

customers.

Strategy

Cyan's approach to the microcontroller market is novel in that it has developed

and provides free-of-charge the most advanced software development tools -

CyanIDE - in the industry, whilst competitors rely on generic, third party

tools. The software makes chip integration into customer's products vastly more

simple, quick, reliable and hence less expensive, while dramatically reducing

development time. The Company also provides, as a result of extensive

experience in semiconductors and computers, a broad range of microcontrollers to

the market with minimal R&D and tooling costs. These microcontrollers are of

great importance to battery powered applications and techniques that require

ultra low power

Markets

The market for microcontrollers has steadily grown at around 10% per annum for

many years. The total market size in 2005 is estimated to be about US$14

billion, with about 7 billion units shipped. Over the next 4 years the market

is expected to grow to over US$20 billion, with the fastest growth coming from

16 and 32 bit microcontrollers, the areas on which the Company focuses. Cyan

has identified Europe and South East Asia as the largest markets for its

products and aims to have 1% of the microcontroller market within 5 years.

Customers

Cyan raised its first round of funding in early 2004 and has since been steadily

achieving design wins. These design wins are in diverse applications from asset

trackers, taxi meters, data loggers, security systems, point-of-sale terminals

to small computers for skydivers. Design wins are now starting to translate into

production. Cyan monitors the take-up of this technology and tracks website

registrations for CyanIDE downloads, and design wins. There is a strong

correlation between the two. By the end of 2005, over 2000 people in the

industry had downloaded CyanIDE.

We have been successful in winning customers in Europe and China but the biggest

potential for volume sales in 2006 and 2007 will be in China. Our largest

customer in China has included Cyan's eCOG1k in 7 of its tax control Point of

Sale (POS) terminal designs. The total available market for these products is

estimated to be in excess of 50 million units over the next few years and our

customer is tendering for some 6 million units of near term demand. We are

currently working with this customer on the second generation of tax control POS

terminals using eCOG1X.

Looking ahead

2006 will see the launch of the eCOG1X product range which will be extensive and

include more industry standard peripheral interfaces, which means an even wider

range of potential customers. We will be engaging with more distributors as we

continue to develop from a one product start-up into a listed company with an

extensive product range. Our 32 bit microcontroller (eCOG2) development will

continue and we should complete the design of the Linux operating system to run

on it.

Linux is becoming increasingly important particularly in China and India. It is

an operating system that can, in most cases, replace Microsoft Windows and has

the compelling feature of being completely free, hence the interest from China

and India. Linux is generally regarded by software professionals as being

faster and more reliable than Windows. The availability of Linux will further

increase the market for Cyan products and will make it very attractive for use

in portable entertainment products which are becoming very popular in China as

well as the rest of the world.

Dr Paul Johnson

Chief Executive Officer

21 March 2006

Consolidated Profit and Loss Account

Year ended 31 December 2005

Note 2005 2004

# #

TURNOVER: continuing operations 29,899 12,116

Cost of sales (4,966) (9,100)

Gross profit 24,933 3,016

Administrative expenses (2,228,526) (1,022,033)

OPERATING LOSS: continuing operations (2,203,593) (1,019,017)

Interest receivable and similar income 61,970 12,750

Interest payable and similar charges (12,621) (10)

LOSS ON ORDINARY ACTIVITIES BEFORE TAXATION (2,154,244) (1,006,277)

Tax on loss on ordinary activities 67,381 -

RETAINED LOSS FOR THE FINANCIAL YEAR BEING LOSS

ATTRIBUTABLE TO EQUITY HOLDERS (2,086,863) (1,006,277)

LOSS PER SHARE (pence)

Basic and diluted 2 (3.8) (2.5)

Consolidated Balance Sheet

31 December 2005

2005 2004

# #

FIXED ASSETS

Intangible assets 4,000 8,000

Tangible assets 163,236 155,801

167,236 163,801

CURRENT ASSETS

Stocks 59,583 35,396

Debtors 182,560 21,460

Investments - short term deposits 5,375,000 -

Cash at bank and in hand 192,680 203,459

5,809,823 260,315

CREDITORS: amounts falling due within one year (338,105) (89,734)

NET CURRENT ASSETS 5,471,718 170,581

TOTAL ASSETS LESS CURRENT LIABILITIES, BEING NET ASSETS 5,638,954 334,382

CAPITAL AND RESERVES

Called up share capital 168,621 81,182

Share premium account 8,598,230 1,121,634

Other reserve - shares for issue - 167,200

Profit and loss account (3,127,897) (1,035,634)

EQUITY SHAREHOLDERS' FUNDS 5,638,954 334,382

Consolidated Cash Flow Statement

31 December 2005

2005 2004

# #

Net cash outflow from operating activities (2,015,849) (931,442)

Returns on investments and servicing of finance 49,349 12,740

Taxation - -

Capital expenditure and financial investment (66,114) (57,515)

Cash outflow before management of liquid resources and

financing (2,032,614) (976,217)

Management of liquid resources (5,375,000) -

Financing 7,396,835 1,036,016

Decrease in cash in the year (10,779) 59,799

Analysis and Reconciliation of Net Funds

At 1 January 31

Cash December

2005 flow 2005

# # #

Cash at bank and in hand 203,459 (10,779) 192,680

Current asset investments - 5,375,000 5,375,000

Net funds 203,459 5,364,221 5,567,680

2005 2004

# #

(Decrease) increase in cash in the year (10,779) 59,799

Cash outflow from increase in liquid resources 5,375,000 -

Change in net funds resulting from cash flows 5,364,221 59,799

Movement in net funds in year 5,364,221 59,799

Net funds at 1 January 203,459 143,660

Net funds at 31 December 5,567,680 203,459

Consolidated Statement of Changes In Equity

Year ended 31 December 2005

Share

premium Shares for

Share capital account issue Retained loss Total

# # # # #

At 31 December 2004 81,182 1,121,634 167,200 (1,035,634) 334,382

Loss for the year - - - (2,086,863) (2,086,863)

New issue 87,439 8,317,001 (167,200) - 8,237,240

Expenses of share issue - (840,405) - - (840,405)

Currency translation difference on

foreign currency net investments - - - (5,400) (5,400)

At 31 December 2005 168,621 8,598,230 - (3,127,897) 5,638,954

During the year 43,719,762 ordinary shares were issued for #8,404,440. Share

issue costs amounted to #840,405. The resultant premium of #7,476,596 has been

credited to the share premium account.

NOTES TO THE FINANCIAL STATEMENTS

1. Accounting policies

This announcement is prepared on the basis of the accounting policies stated in

the previous year's financial statements.

The financial statements are prepared in accordance with applicable United

Kingdom accounting standards. The company has adopted FRS 21 "Events after the

balance sheet date", FRS 22 "Earnings per share", the presentation aspects of

FRS 25 "Financial instruments: disclosure and presentation", and FRS 28 "

Corresponding amounts". No restatement of the comparatives was necessary.

The particular accounting policies adopted are described below.

Accounting convention

The financial statements are prepared under the historical cost convention.

Basic of consolidation

The group financial statements consolidate the financial statements of the

company and its subsidiary undertakings drawn up to 31 December each year. The

results of subsidiaries acquired or sold are consolidated for the periods from

or to the date on which control passed. Acquisitions are accounted for under

the acquisition method.

Intangible fixed assets

The intellectual property is amortised in equal annual amounts over a period of

three years. The amortisation started in January 2004 when the exploitation of

the intellectual property commenced.

Tangible fixed assets

Depreciation is provided on cost in equal annual instalments over the estimated

useful lives of the assets. The rates of depreciation are as follows:

Leasehold property improvements 20% straight line basis

Office equipment 50% straight line basis

Plant and machinery, tools and equipment 20-25% straight line basis

Fixtures and fittings 25% straight line basis

Stocks

Stocks are stated at the lower of cost and net realisable value.

Research and development

Research and development expenditure is written off to the profit and loss

account as incurred.

Foreign exchange

Transactions denominated in foreign currencies are translated into sterling at

the rates ruling at the dates of the transactions. Monetary assets and

liabilities denominated in foreign currencies at the balance sheet date are

translated at the rates ruling at that date. Translation differences arising

are dealt with in the profit and loss account.

Investments

Investments held as fixed assets are stated at cost less provision for any

impairment in value.

Taxation

Current, including UK corporation tax and foreign tax, is provided at amounts

expected to be paid (or recovered) using the tax rates and laws that have been

enacted or substantively enacted by the balance sheet date.

Deferred tax is provided in full on timing differences, which result in an

obligation at the balance sheet date to pay more tax, or a right to pay less

tax, at a future date, at rates expected to apply when they crystallise based on

current tax rates and law. Timing differences arise from the inclusion of items

of income and expenditure in taxation computations in periods different from

those in which they are included in financial statements. Deferred tax assets

are recognised to the extent that it is regarded as more likely than not that

they will be recovered. Deferred tax assets and liabilities are not discounted.

Leases

Rentals under operating leases are charged on a straight-line basis over the

lease term, even if the payments are not made on such a basis.

Turnover

Turnover is principally derived from the sale of integrated circuits and is

stated net of trade discounts and value added tax. Revenue is recognised on

despatch, which is deemed to be the point at which the risks and rewards of

ownership are transferred.

2. Loss per share

The calculations or earnings per share are based on the following losses and

numbers of shares.

Basic and diluted

2005 2004

# #

Loss for the financial year (2,086,863) (1,006,277)

2005 2004

No No

Weighted average number of shares:

For basic and diluted loss per share 54,823,213 39,567,067

The financial information set out in the announcement does not constitute the

company's statutory accounts for the years ended 31 December 2005 or 2004. The

financial information for the year ended 31 December 2004 is derived from the

statutory accounts for that year which have been delivered to the Registrar of

Companies. The auditors reported on those accounts; their report was unqualified

and did not contain a statement under s. 237(2) or (3) Companies Act 1985. The

statutory accounts for the year ended 31 December 2005 will be finalised on the

basis of the financial information presented by the directors in this

preliminary announcement and will be delivered to the Registrar of Companies

following the company's annual general meeting.

- Ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JMMLTMMATBIF

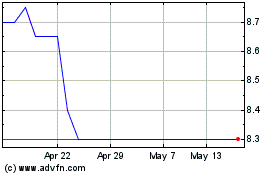

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024