TIDMCRS

RNS Number : 1800C

Crystal Amber Fund Limited

18 February 2022

18 February 2022

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Crystal Amber Fund requisitions General Meeting of Allied Minds

plc

to propose the removal of the Chairman, Harry Rein, as a

director

Crystal Amber Fund, the activist investment fund, announces that

it has sent to the board of Allied Minds plc ("Allied Minds") a

requisition notice requiring Allied Minds to convene a general

meeting at which a resolution will be proposed to remove Harry Rein

as a non-executive director.

Since November 2018, the Fund has been an investor in Allied

Minds and currently owns 18.2 per cent. of its issued share

capital.

In 2019, Allied Minds announced that it would henceforth focus

on maximising returns and shareholder distributions from its

existing portfolio, rather than continuing to invest in new

businesses. The portfolio contains three significant holdings:

Federated Wireless, BridgeComm and Orbital Sidekick.

In March 2020, Harry Rein was appointed Chairman of the Allied

Minds board, having joined the board in November 2017. In January

2021, following a strategic review, Allied Minds introduced what it

described as "a new form of governance better suited to achieve

value creation." With no Chief Executive, Allied Minds is now

managed by its three non-executive directors. The Fund considers,

in practical terms, that Harry Rein is the key decision maker. The

2020 Report and Accounts for Allied Minds states that "the Chairman

is responsible for the leadership and conduct of the board."

Since Harry Rein has become Chairman, the share price of Allied

Minds has declined by 40 per cent. Over the same period, the NASDAQ

US Small Cap Index has risen by 85 per cent. Over the last 12

months, the share price of Allied Minds has fallen by 36 per

cent.

The Fund has conveyed several concerns to Harry Rein

including:

1. Lack of updating market participants regarding core portfolio

company Federated Wireless Inc. ("Federated Wireless"), where the

current carrying value significantly exceeds the market

capitalisation of Allied Minds. In April 2021, at the Capital

Markets Day held by Allied Minds, it was disclosed that revenues

for 2021 for Federated Wireless were forecast to be $17 million

with $35 million to $45 million expected for the year to December

2022. It was stated that during Q3 of 2021, the company would have

"a really good idea" of the 2021 outturn. In August 2021, Allied

Minds reported that Federated Wireless had met its revenue

expectations for its first half and was on track to meet its full

year plan. In October 2021, house broker, Numis Securities wrote:

"Federated Wireless accounts for c.26p NAV per ALM share (but is

likely worth a multiple of this) in our view, and, most

importantly, the company keeps producing more evidence to assure

that it is on track to turn over $17m in FY21 and $40m in FY22, and

earn high, SaaS-type, profit margins." The Fund believes that price

sensitive information is being withheld.

2. The publication of a "rogue" press release by Federated

Wireless, a company also chaired by Harry Rein. In November 2021,

Federated Wireless issued a press release stating that revenue

growth was four times higher than expected. When Crystal Amber

wrote to Harry Rein to seek clarification as to why this

information had not been released to market participants, Harry

Rein responded: " A marketing manager at Federated released the

initial Federated release without the Board of Federated's

knowledge." The release was subsequently amended to exclude any

reference to revenue growth.

3. Breach of provision 20 of the 2018 UK Corporate Governance

Code. No external search consultancy was used to identify and

recruit Bruce Failing as a non-executive director.

4. Bruce Failing acts as the Senior Independent Director but the

Fund does not believe he is independent: both Bruce Failing and

Harry Rein are directors of DelliveryCare RX. Bruce Failing was

proposed by Harry Rein who advised the Fund that he "persuaded

Bruce Failing to join the board."

5. Breach of provision 24 of the 2018 UK Corporate Governance

Code. Harry Rein is a member of the Audit Committee.

6. Withdrawing of paid-for research from Edison, after the Fund

highlighted an error with the percentage holding in a portfolio

company. Edison also apologised for a previous error pointed out to

Harry Rein by the Fund: for several months, estimated net asset

value had been materially overstated, as a result of not deducting

the special dividend paid to shareholders in February 2020. It

would appear there was a lack of oversight of these figures from

Harry Rein.

7. Failure to invite investors to the 2021 Capital Markets Day:

invitations were only sent to analysts and not to investors. The

Fund was aware of two (paid for) analysts who cover Allied Minds

being sent invitations. Subsequently, investors were made aware of

the Capital Markets Day, with only a few days' notice. The

company's broker subsequently apologised to the Fund for this

error.

In its engagement with Harry Rein, the Fund has found him to be

a major impediment to value protection and realisation. Moreover,

his track record evidenced by the concerns outlined above, speaks

for itself. Over recent months, on a number of occasions, the Fund

has asked Harry Rein to announce his resignation. He has declined

to do so. Therefore, in order to safeguard against any further

erosion of shareholder value, the Fund is now seeking his

removal.

For further enquiries please contact:

Crystal Amber Fund Limited

Chris Waldron (Chairman)

Tel: 01481 742 742

www.crystalamber.com

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner

Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford

Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGZGMZKRLGZZM

(END) Dow Jones Newswires

February 18, 2022 10:15 ET (15:15 GMT)

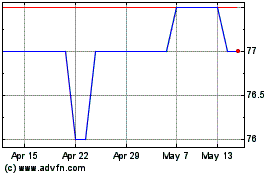

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Nov 2023 to Nov 2024