Crystal Amber Fund Limited Crystal Amber requisitions GM of Allied Minds plc

November 21 2019 - 2:00AM

UK Regulatory

TIDMCRS

21 November 2019

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Crystal Amber Fund requisitions General Meeting of Allied Minds plc:

Proposes to remove four directors and appoint two new directors

Crystal Amber Fund, the activist investment fund, announces that it has sent to

the board of Allied Minds plc ("Allied Minds") a requisition notice requiring

Allied Minds to convene a general meeting at which resolutions will be proposed

to remove Jeffrey Rohr, Fritz Foley, Joseph Pignato and Michael Turner from the

board, and to appoint Mark Lerdal and Stephen Coe to the board as non-executive

directors. The Fund expects that the proposed board will be more effective at

minimising ongoing costs and maximising distributions to shareholders from the

orderly realisation of Allied Minds' remaining investments. The proposed

removal of Allied Minds' executive directors from the board does not preclude

their continued employment as executives.

Since becoming a shareholder in Allied Minds in November 2018, the Fund has

engaged extensively with its management. Despite some necessary and long

overdue changes, the Fund has concluded that the board of Allied Minds is still

not acting in the best interests of its shareholders. This is evidenced by the

annual ongoing headquarter ("HQ") cash cost guidance from Allied Minds, which

has recently been increased to US$7.5 million. The Fund estimates that US$67

million of Allied Minds' current market capitalisation is attributable to its

non-cash net assets (i.e. after deducting parent-level cash, which the Fund

estimates to be approximately US$88 million). The annual ongoing HQ cash costs

represent more than 11% of this value. In addition to this, Allied Minds this

month awarded a US$4.9 million cash pay-out to current and ex-employees,

despite cumulative operating losses since its 2014 IPO now exceeding $460

million.

The Fund believes that it now has no alternative but to requisition a general

meeting of Allied Minds in order to address the issues identified:

* Excessive ongoing HQ costs and misaligned incentive arrangements

* Insufficient prioritisation of excess cash redistribution to shareholders

* Inability to redress the longstanding significant discount of the share

price compared to the Net Asset Value ("NAV") per share, which now stands

at over 40% despite the carrying value of the portfolio having been

verified by substantial third-party funding

Richard Bernstein, investment adviser to Crystal Amber Fund, said: "In the 11

years since the Fund was established, this is only the third time that we have

felt compelled to requisition a general meeting of an investee company to

change its board composition. The Fund hopes that, as has occurred on the

previous two occasions when the Fund felt forced to requisition a general

meeting of a company, the current board of Allied Minds will accept the Fund's

proposals without delay and without having to call a general meeting. Mark

Lerdal has an excellent track record of delivering for shareholders in a not

dissimilar situation at Leaf Clean Energy. We are confident that he can do the

same for the shareholders of Allied Minds."

Allied Minds' track record:

* Listed on the London Stock Exchange in 2014 at a valuation of GBP405m and

raised a further GBP64m via a placing in 2016. To date Allied Minds has paid

zero cash to shareholders and its market capitalisation is now around GBP120m

* Reported total consolidated operating losses of around US$590m from 2011 to

mid-2019, of which approximately US$465m since it listed in 2014

* Invested in over 40 companies but has achieved only a single successful

exit. Following many write-offs and closures, only six holdings are now

deemed to have any value, of which three plus cash at the holding company

now account for around 95% of the total NAV

* Despite having committed not to make further investments in new businesses,

Allied Minds operates with ongoing HQ cash costs of US$7.5m per annum, an

increase from its guidance of US$5-6m announced in April 2019

* Maintains misaligned management incentive schemes, including:

+ The "Phantom Plan" that pays out 10% of any gains on individual

holdings, irrespective of losses incurred across the investment

portfolio as a whole

+ Annual bonuses (worth up to 225% of salary) that are determined

independent of shareholder returns and the performance of the

portfolio, e.g. US$576,000 CEO bonus paid in respect of 2018 despite a

share price fall of 57.5% that year

+ A golden parachute scheme that would pay out upon a takeover of Allied

Minds

* Redistributing to shareholders only half of the proceeds from the disposal

of Allied Minds' stake in HawkEye 360, despite the sale triggering a

Phantom Plan pay-out of up to $4.9m to current and former management. This

will leave Allied Minds with a parent-level cash balance of around US$55m

Crystal Amber Fund's engagement with Allied Minds:

* Commenced investment in Allied Minds in November 2018, having analysed the

company over the preceding year, and now owns 16.8% of Allied Minds' total

issued share capital

* Expressed concerns regarding the urgent need to realign the excessive HQ

cost base, the unprecedented and wholly unacceptable Phantom Plan, and the

granting of long-term incentive shares that had cost around US$3.9m during

the first half of 2018

* Met with then-CEO, Jill Smith, along with the CEO of portfolio company

Federated Wireless, in February 2019

* The Fund subsequently conveyed its views that, despite a guided reduction

of over 40% in ongoing HQ cash costs, these would still be hugely excessive

at around US$13m per annum, and also that the portfolio companies SciFluor

and Precision Biopsy were likely to be significantly overvalued. Since

then, both of these portfolio companies have been written to zero, taking

around US$115m off Allied Minds' NAV

* Met with co-CEOs, Joe Pignato and Mike Turner, in August 2019 and

reiterated our views that the Phantom Plan represents a major misalignment

between management and shareholders

* The Fund was disappointed that, despite being one of Allied Minds' largest

shareholders, it was excluded from Allied Minds' consultation with

shareholders regarding preferred quantum of immediate cash distribution

following the HawkEye 360 disposal

Track record of Mark Lerdal and Stephen Coe:

* Mr Lerdal and Mr Coe have both been directors of UK-listed company Leaf

Clean Energy Co ("Leaf") since 1 April 2014: Mr Lerdal as executive

Chairman and Mr Coe as a non-executive director

* Leaf was a failed investment company that had focused primarily on US-based

private-market opportunities, similar to Allied Minds

* In the financial year that ended shortly after the appointment of Mr Lerdal

and Mr Coe, Leaf's administrative expenses were US$5.4m. These costs were

halved in the following year and have been reduced in each subsequent year,

down to a level of US$1.4m in FY2018

* After formally adopting an orderly realisation and redistribution strategy,

Leaf's investments were then monetised over the subsequent five and a half

years - a process that was prolonged by a very protracted legal dispute

relating to its largest investment, which was finally resolved in Leaf's

favour in mid-2019

* Prior to the appointment of Mr Lerdal and Mr Coe in 2014, Leaf's shares

traded at a substantial discount to its NAV. Since then, Leaf has to date

returned a total of US$128m cash to its shareholders, an impressive cash

realisation of over 100% of the rebased $116m NAV as of 30 June 2014, after

all holding company costs

Mr Lerdal is currently executive Chairman of Leaf Clean Energy Co and a

non-executive director of three private companies.

Mr Coe is currently a non-executive director of Leaf Clean Energy Co, Weiss

Korea Opportunity Fund Ltd and various private companies.

For further enquiries please contact:

Crystal Amber Fund Limited

Christopher Waldron (Chairman) Tel: 01481 742 742

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein Tel: 020 7478 9080

END

(END) Dow Jones Newswires

November 21, 2019 02:00 ET (07:00 GMT)

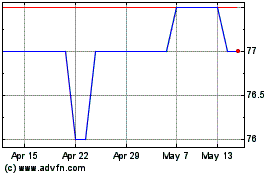

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024