TIDMCRS

5 March 2018

Crystal Amber Fund Limited

Interim results for the period ended 31 December 2017

The Company announces its interim results for the six months ended 31 December

2017.

Highlights

* NAV(1) per share fell by 6.7 per cent over the six-month period or 4.2 per

cent after adjusting for dividends declared in the period. Over the 2017

calendar year, NAV per share fell by 12.5 per cent or 10.2 per cent after

adjusting for dividends declared in the year.

* NAV per share of 190.69 pence at 31 December 2017 (204.37 pence at 30 June

2017, 218.02 pence at 31 December 2016). NAV per share of 201.29 pence at

31 January 2018.

* Dividends of 2.5 pence per share were declared in July 2017 and December

2017. The 5 pence dividend paid in respect of calendar 2017 represents a

2.6 per cent dividend yield on the 31 December 2017 NAV.

* Significant contributions to NAV performance from FairFX Group plc

("FairFX"), NCC Group plc ("NCC") and Ocado Group plc ("Ocado"), offset by

the price weakness of GI Dynamics Inc ("GI Dynamics"), STV Group plc

("STV") and Northgate plc ("Northgate").

* Successful partial exit from Sutton Harbour Holdings plc ("Sutton Harbour")

to regeneration specialists FB Investors LLP, which the Fund is pleased to

support by retaining an investment in the company. GBP0.9 million gain booked

in January 2018 from the partial exit.

* Active engagement with Hurricane Energy plc ("Hurricane") on the

appointment of a credible Chairman, exploring strategic alternatives with

Northgate and promoting the Ocado Smart Platform.

* The share buyback programme has continued and contributed to maintaining a

low average discount to NAV of 1.8 per cent over the period.

Christopher Waldron, Chairman of the Company, commented: "I am pleased to

report good progress on our engagement with key Fund holdings in my first

Interim Report as Chairman. This engagement has continued to bear fruit in the

first months of 2018, as we have seen with Ocado and Sutton Harbour, and we are

confident that this will continue for the remainder of the year."

For further enquiries please contact:

Crystal Amber Fund Limited

Christopher Waldron (Chairman) Tel: 01481 742 742

Allenby Capital Limited - Nominated Adviser

David Worlidge/Liz Kirchner Tel: 020 3328 5656

Winterflood Investment Trusts - Broker

Joe Winkley/Neil Langford Tel: 020 3100 0160

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein Tel: 020 7478 9080

(1) All capitalised terms are defined in the Glossary of Capitalised Defined

Terms unless separately defined.

Chairman's Statement

I hereby present the interim results of the Company for the six month period to

31 December 2017.

The UK economy decelerated over the period, finishing 2017 with a 1.8 per cent

annual growth rate, the slowest since 2012. Disposable consumer income has been

under pressure from increased price inflation, partially caused by the

weakening of Sterling in the aftermath of the Brexit referendum. The impact of

Brexit remains unclear: the economy has continued to grow, but it does so now

at the slowest pace of the G7 Group of wealthy countries.

NAV fell from GBP201.0 million (204.37 pence per share) at 30 June 2017 to an

unaudited GBP186.3 million (190.69 pence per share) at 31 December 2017. The

Fund's negative return (including dividends) of 4.2 per cent compares to an 8.5

per cent return on the FTSE 250 and a 7.2 per cent return on the FTSE Small Cap

Index.

Taken in isolation, this serves as a reminder that the Fund's performance is

driven by a relatively small number of carefully researched positions and does

not seek to match any particular index. This focus on absolute return will

continue to produce results that vary from passive investment. A key component

of the Fund's absolute return strategy has been the consistent purchase of FTSE

put options as insurance against a potential significant market sell-off. The

net cost of these options amounted to 1.8 per cent of NAV over the period to 31

December 2017. However, in February 2018, as equity markets declined, and

volatility rose, the value of this protection was clearly shown as the Fund

realised gains on FTSE put options of GBP6.8 million, equivalent to 6.9 pence per

share.

The buyback programme has continued with 652,482 Ordinary shares purchased

during the period at an average price of 185.36 pence per share. The programme

contributed to a low 1.8 per cent average share price to NAV discount over the

period and an increase in NAV per share of 0.025 per cent. At 31 December 2017,

the Fund held 1,287,482 Ordinary shares in Treasury.

In July 2017 and December 2017 the Fund declared interim dividends of 2.5 pence

per share continuing the Fund's policy of making distributions from income and

net realised gains from investments. Based on the NAV at 31 December 2017, this

represents a dividend yield of 2.6 per cent.

Despite the general uncertainty over the UK economy, I am encouraged by the

Fund's progress on its engagement with several investee companies and this is

discussed in greater detail in the Investment Manager's Report.

Finally, as anticipated in the last Annual Report, Bill Collins retired as

Chairman at the November AGM. Unfortunately, in early January Sarah Evans also

stepped down as a Director due to ill health. Bill and Sarah had both served

on the Board of Crystal Amber since its launch in 2008 and I'd like to take

this opportunity thank them for their invaluable contributions over the years.

Christopher Waldron

Chairman

2 March 2018

Investment Manager's Report

Strategy and performance

The Fund continues to engage closely with the management and boards of its

major holdings.

At 31 December 2017, equity investments in 17 companies represented 91.4 per

cent of NAV. The Fund also held other investments, including warrants, loan

notes and convertible instruments that accounted for 9.1 per cent of the NAV.

The Fund's net cash and accruals position came to negative GBP1.3 million,

including GBP2.4 million accrued for the dividend paid in January 2018.

The Fund participated in the July 2017 fundraising for Hurricane with a US$10

million investment, having previously realised a profit of GBP15 million from its

holding in the company. In September 2017, the Fund subscribed to a loan note

issued by Leaf Clean Energy Company ("Leaf") with a commitment of up to US$2.5

million. Three new investments were initiated and three were exited. The latter

include previously disclosed holdings in Shepherd Neame Limited and Montanaro

UK Smaller Companies Investment Trust plc. The position in Johnston Press plc

("Johnston Press"), a top ten holding at the beginning of the period, was

reduced by 51 per cent. The Fund also reduced its positions in FairFX and NCC,

realising GBP1.9 million and GBP1.2 million of profits from each respectively.

Following the period end, the Fund sold its holding in Hurricane's convertible

bond, purchased at the company's fundraising, and realised a GBP0.9 million

profit.

Portfolio

The table below lists the top ten holdings at 31 December 2017, showing the

performance contribution of each during the period. The principal positive

contributions came from FairFX (2.5 per cent), NCC (2.3 per cent) and Ocado

(1.7 per cent). The main negative contributions came from GI Dynamics (2.6 per

cent), STV (1.6 per cent) and Northgate (1.5 per cent).

Top ten shareholdings Pence per Percentage of Total Contribution

share investee return over to NAV

equity held the period performance

Hurricane Energy plc 49.9 8.0% (5%) (1.2%)

Northgate plc 26.9 5.2% (10%) (1.5%)

FairFX Group plc 19.0 15.3% 34% 2.5%

STV Group plc 18.4 14.5% (14%) (1.6%)

NCC Group plc 13.4 2.0% 45% 2.3%

Ocado Group plc 13.2 0.5% 37% 1.7%

Leaf Clean Energy 10.1 29.9% (21%) (1.4%)

Company

Sutton Harbour Holdings 7.9 29.3% 3% 0.2%

plc

GI Dynamics Inc 4.3 46.7% (56%) (2.6%)

Camellia plc 2.9 0.9% 14% 0.2%

Total of ten largest 166.0

holdings

Other investments 26.1

Cash and accruals (1.4)

Total NAV 190.7

Investee companies

Our comments on a number of our principal investments are as follows:

Hurricane

In July 2017, Hurricane completed a US$530 million deal to fully fund an early

production system for its Lancaster asset. The company proceeded to take the

final investment decision and received development and production consent in

September 2017. In December 2017, it hosted a site visit to Drydocks World,

Dubai where it is upgrading the floating production storage and offloading

vessel as well as fabricating a new buoy. The early production system remains

on time and on budget for first oil in the first half of 2019.

The early production system is expected to de-risk the company's assets as it

demonstrates that basement reservoirs in the West of Shetland can become

commercially productive. In addition, Hurricane estimates that at a US$60

barrel of oil equivalent ("BOE"), the early production system base case of

17,000 BOE produced per day should generate an annual cash flow of US$190

million.

In December 2017, Hurricane published a Competent Person's Report ("CPR"),

increasing its combined resource estimate to 2.6 billion BOE. Together with the

previously published CPR for Lancaster, Hurricane now has an updated assessment

of its licences that incorporates the results of its exploration efforts since

its initial public offering. The December 2017 assessment included the Halifax

prospect for the first time, which holds an estimated 1.2 billion BOE. The

company believes this is part of the Greater Lancaster structure, which is

targeted by the early production system under construction, and could be

monetised together with Lancaster.

In November 2017, Robert Arnott resigned as chairman of the board with

immediate effect, criticising the company's corporate governance standards, a

concern publicly shared by the Fund. The company instituted a board committee

to address these issues and has subsequently been engaging with the Fund.

Northgate

At its capital markets day in October 2017, the company's new management team

detailed its strategy to return the UK business to growth and presented its

three-year growth and margin expectations for the UK and Spain. However,

following interim results in December 2017, analysts downgraded earnings

forecasts due to lower expectations of profit from the sale of vehicles,

despite residual values having remained stable to date.

The Fund supports management's efforts to arrest market share losses in the UK,

optimise the vehicle hire site network, and maximise the opportunity presented

by the Van Monster retail network and brand. In Spain, Northgate is the clear

leader in the van flexible hire market, with a strong brand, good geographic

coverage and attractive return on assets. Management expects to achieve more

than 10 per cent annualised growth in vehicles-on-hire in Spain over the next

three years, together with a consequent further improvement in margins.

However, the Fund believes that the considerable value of Northgate's Spanish

business is not reflected in its share price. It has engaged with management

over Northgate's options to realise the value of this asset. This includes ways

that could preserve procurement synergies with the UK, such as a partial

listing of its Spanish business in Spain.

Ocado

In November 2017, Ocado announced its first international deal for its

technology solution, Ocado Smart Platform ("OSP"), with French grocer Groupe

Casino. After the period end, in January 2018, Ocado announced a second deal

for its OSP with Sobeys Inc. of Canada.

The Fund invested in Ocado in spring 2017 on the basis that the market was not

ascribing any value to its technology platform. Ocado's OSP has now been

validated by two leading international grocers and by Morrisons in the UK. With

those three deals, Ocado's partners have been able to leapfrog the competition

in terms of capability and service levels and are ready to defend themselves

from competitors like Amazon. As more grocers offer online shopping convenience

to consumers, more deals are expected to follow. We project significant scale

benefits will accrue to Ocado long-term. In our opinion, the replacement value

of Ocado's market leading capabilities and know-how continues to be well above

its market valuation and the company remains a potential takeover candidate.

Leaf

In September 2017, the Fund provided a commitment of up to US$2.5 million in an

issue of up to US$5 million of loan notes by Leaf, of which US$1 million has

been drawn down from the Fund by Leaf to date. This facility will support the

company's ongoing litigation with Invenergy Wind.

GI Dynamics

In October 2017, GI Dynamics was audited by SGS SA to assess the company's

compliance with CE Mark requirements and quality management. Despite the

favourable result of those inspections, SGS SA decided to withdraw the CE Mark

certification in November 2017 based on a negative scientific assessment of

patient risks and benefits. As a result, the company is currently precluded

from selling the EndoBarrier in Europe, its primary market, and will focus on

gaining approval for an FDA clinical trial.

This assessment contrasts with the favourable conclusions from scientific

research that have been reported throughout the year and have continued over

the period. For example, favourable clinical evidence from an NHS trial of the

ongoing benefits of EndoBarrier after the device's removal was presented at the

European Association for the Study of Diabetes conference in Lisbon in

September 2017.

In January 2018, the Fund participated in a US$1.6 million fundraising to

support the company in its application for a new clinical trial with the US

Food and Drugs Administration. The application is expected to be submitted in

the first half of 2018.

Sutton Harbour

In December 2017, Sutton Harbour announced a recommended cash offer from FB

Investors LLP for up to 70 per cent of its capital at 29.5 pence per share. FB

Investors LLP also agreed to subscribe for GBP2.8 million worth of new shares at

the same price to strengthen the company's balance sheet and bring its Sugar

House development in house.

The Fund engaged with FB Investors LLP prior to the announcement of the deal.

We were impressed by chairman Philip Beinhaker's vision for the company and his

track record of urban regeneration projects. The Fund agreed to tender its

holding in full, as that was a prerequisite for the offer. Since the offer was

oversubscribed, the Fund's tender was scaled back and the Fund is content to

retain a position of 7.2 per cent in the company and has purchased further

shares since the period end.

The Fund is pleased that as a result of its engagement with the company, Sutton

Harbour can now benefit from strengthened leadership with ambitious plans to

unlock value for the company and the city of Plymouth.

Realisations

Net realised losses after accounting for put option insurance amounted to GBP2.8

million. This figure includes gains of GBP1.9 million on FairFX and GBP1.2 million

on NCC, and a loss of GBP3.1 million on Johnston Press.

Following the period end, the Fund realised GBP0.9 million of gains from the

partial offer for Sutton Harbour, and GBP0.9 million from its investment in

Hurricane's convertible bond.

Hedging activity

The Fund continues to purchase FTSE put options as an insurance against a

potential significant market sell-off. The net cost of these options amounted

to 1.8 per cent of NAV over the period. In February, as equity markets declined

and volatility rose, the Fund realised gains on FTSE put options of GBP6.8

million, equivalent to 6.9 pence per share.

Outlook

We are encouraged that our work and engagement with Sutton Harbour in the first

half has proven to be successful with both a partial realisation and the

introduction of an impressive and experienced majority shareholder.

Our analysis of Ocado also bore fruit. We are confident that our extensive

recent work with other portfolio companies will achieve a positive outcome and

are excited by our prospects.

Crystal Amber Asset Management (Guernsey) Limited

2 March 2018

Condensed Statement of Profit or Loss and Other Comprehensive Income

(Unaudited)

For the six months ended 31 December 2017

Six months ended 31 December Six months ended 31 December

2017 2016

(Unaudited) (Unaudited)

Revenue Capital Total Revenue Capital Total

Notes GBP GBP GBP GBP GBP GBP

Income

Dividend income from 1,980,590 - 1,980,590 1,861,886 - 1,861,886

listed equity

investments

Interest income from 99,072 - 99,072 - - -

listed debt

instruments

Arrangement fee 4 46,531 - 46,531 - - -

received from debt

instruments

Interest received - - - 252 - 252

2,126,193 - 2,126,193 1,862,138 - 1,862,138

Net gains on

financial assets

designated at FVTPL

and derivatives held

for trading

Equities

Net realised gains 4 - 202,555 202,555 - 8,832,775 8,832,775

Movement in 4 - (4,348,174) (4,348,174) - 64,123,866 64,123,866

unrealised (losses)/

gains

Debt instruments

Movement in 4 - 381,233 381,233 - - -

unrealised gains

Derivative financial

instruments

Realised losses 4 - (3,045,990) (3,045,990) - (4,973,571) (4,973,571)

Movement in 4 - (227,407) (227,407) - 5,887,194 5,887,194

unrealised (losses)/

gains

- (7,037,783) (7,037,783) - 73,870,264 73,870,264

Total income/(loss) 2,126,193 (7,037,783) (4,911,590) 1,862,138 73,870,264 75,732,402

Expenses

Transaction costs - 119,851 119,851 - 214,538 214,538

Foreign exchange - 518,127 518,127 - (76,135) (76,135)

movements on

revaluation of

investments

Management fees 9 1,649,074 - 1,649,074 1,438,909 - 1,438,909

Performance fees 9 - 983,800 983,800 - 5,714,940 5,714,940

Directors' 81,232 - 81,232 58,914 - 58,914

remuneration

Administration fees 106,441 - 106,441 111,783 - 111,783

Custodian fees 45,091 - 45,091 47,655 - 47,655

Audit fees 12,320 - 12,320 10,920 - 10,920

Other expenses 154,426 - 154,426 105,546 - 105,546

2,048,584 1,621,778 3,670,362 1,773,727 5,853,343 7,627,070

Return/(loss) for 77,609 (8,659,561) (8,581,952) 88,411 68,016,921 68,105,332

the period

Basic and diluted 2 0.08 (8.83) (8.75) 0.09 68.70 68.79

earnings/(loss) per

share (pence)

All items in the above statement derive from continuing operations.

The total column of this statement represents the Company's Statement of Profit

or Loss and Other Comprehensive Income prepared in accordance with IFRS. The

supplementary information on the allocation between revenue return and capital

return is presented under guidance published by the AIC.

The Notes to the Unaudited Condensed Financial Statements form an integral part

of these Interim Financial Statements.

Condensed Statement of Financial Position (Unaudited)

As at 31 December 2017

As at As at As at

31 December 30 June 31 December

2017 2017 2016

(Unaudited) (Audited) (Unaudited)

Assets Notes GBP GBP GBP

Cash and cash equivalents 835,330 7,957,943 764,000

Trade and other receivables 448,599 48,468 797,806

Financial assets designated at 4 187,669,649 202,370,814 221,451,533

FVTPL and derivatives held for

trading

Total assets 188,953,578 210,377,225 223,013,339

Liabilities

Trade and other payables 2,623,425 9,353,420 8,555,747

Total liabilities 2,623,425 9,353,420 8,555,747

Equity

Capital and reserves attributable

to the Company's equity

shareholders

Share capital 6 989,998 989,998 989,998

Treasury shares reserve 7 (2,182,262) (972,800) (972,800)

Distributable reserve 100,156,159 105,058,397 105,058,397

Retained earnings 87,366,258 95,948,210 109,381,997

Total equity 186,330,153 201,023,805 214,457,592

Total liabilities and equity 188,953,578 210,377,225 223,013,339

NAV per share (pence) 3 190.69 204.37 218.02

The Interim Financial Statements were approved by the Board of Directors and

authorised for issue on 2 March 2018.

Christopher Waldron

Jane Le

Maitre

Chairman

Director

2 March

2018

2 March 2018

Condensed Statement of Changes in Equity (Unaudited)

For the six months ended 31 December 2017

Share Treasury Distributable Retained earnings Total

shares

Notes capital reserve reserve Capital Revenue Total equity

GBP GBP GBP GBP GBP GBP GBP

Opening balance 989,998 (972,800) 105,058,397 98,217,020 (2,268,810) 95,948,210 201,023,805

at 1 July 2017

Purchase of 7 - (1,209,462) - - - - (1,209,462)

Ordinary shares

into Treasury

Dividends paid in 8 - - (4,902,238) - - - (4,902,238)

the period

(Loss)/return for - - - (8,659,561) 77,609 (8,581,952) (8,581,952)

the period

Balance at 31 989,998 (2,182,262) 100,156,159 89,557,459 (2,191,201) 87,366,258 186,330,153

December 2017

For the six months ended 31 December 2016

Share Treasury Distributable Retained earnings Total

shares

Notes capital reserve reserve Capital Revenue Total capital

GBP GBP GBP GBP GBP GBP GBP

Opening balance at 989,998 (720,478) 109,977,886 42,151,632 (874,967) 41,276,665 151,524,071

1 July 2016

Purchase of 7 - (252,322) - - - - (252,322)

Ordinary shares

into Treasury

Dividends paid in - - (4,919,489) - - - (4,919,489)

the period

Return for the - - - 68,016,921 88,411 68,105,332 68,105,332

period

Balance at 31 989,998 (972,800) 105,058,397 110,168,553 (786,556) 109,381,997 214,457,592

December 2016

Condensed Statement of Cash Flows (Unaudited)

For the six months ended 31 December 2017

Six months Six months

ended ended

31 December 31 December

2017 2016

(Unaudited) (Unaudited)

GBP GBP

Cash flows from operating activities

Dividend income received from listed equity 1,584,253 1,519,269

investments

Interest income received from listed debt 99,072 -

instruments

Arrangement fee received from debt instruments 46,531 -

Bank interest received - 2,285

Management fees paid (1,649,074) (1,438,909)

Performance fee paid (3,338,552) -

Directors' fees paid (73,834) (58,914)

Other expenses paid (374,690) (248,542)

Net cash outflow from operating activities (3,706,294) (224,811)

Cash flows from financing activities

Purchase of Ordinary shares into Treasury (1,185,573) (252,322)

Dividends paid (2,456,619) (2,460,370)

Net cash outflow from financing activities (3,642,192) (2,712,692)

Cash flows from investing activities

Purchase of equity investments (9,957,618) (35,322,456)

Sale of equity investments 20,359,191 43,748,529

Purchase of debt instruments (6,178,430) -

Purchase of derivative financial instruments (3,869,720) (5,913,500)

Sale of derivative financial instruments - 86,079

Transaction charges on purchase and sale of (127,550) (214,538)

investments

Net cash inflow from investing activities 225,873 2,384,114

Net decrease in cash and cash equivalents during the (7,122,613) (553,389)

period

Cash and cash equivalents at beginning of period 7,957,943 1,317,389

Cash and cash equivalents at end of period 835,330 764,000

Notes to the Unaudited Condensed Financial Statements

For the six months ended 31 December 2017

General Information

The Company was incorporated and registered in Guernsey on 22 June 2007 and is

governed in accordance with the provisions of the Companies Law. The Company's

registration number is 47213 and it is regulated by the GFSC as an authorised

closed ended investment scheme. The registered office address is Heritage Hall,

Le Marchant Street, St. Peter Port, Guernsey, GYI 4HY. The Company was

established to provide shareholders with an attractive total return which is

expected to comprise primarily capital growth with the potential for

distributions of up to 5 pence per share per annum following consideration of

the accumulated retained earnings as well as the unrealised gains and losses at

that time. The Company seeks to achieve this through investment in a

concentrated portfolio of undervalued companies which are expected to be

predominantly, but not exclusively, listed or quoted on UK markets and which

have a typical market capitalisation of between GBP100 million and GBP1,000

million.

The Company's Ordinary shares were listed and admitted to trading on AIM, on 17

June 2008. The Company is also a member of the AIC.

All capitalised terms are defined in the Glossary of Capitalised Defined Terms

unless separately defined.

1. SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these Interim

Financial Statements are set out below. These policies have been consistently

applied to those balances considered material to the Interim Financial

Statements throughout the current period, unless otherwise stated.

Basis of preparation

The Interim Financial Statements have been prepared in accordance with IAS 34,

Interim Financial Reporting.

The Interim Financial Statements do not include all the information and

disclosures required in the Annual Financial Statements and should be read in

conjunction with the Company's Annual Financial Statements for the year to 30

June 2017. The Annual Financial Statements have been prepared in accordance

with IFRS.

The same accounting policies and methods of computation are followed in the

Interim Financial Statements as in the Annual Financial Statements for the year

ended 30 June 2017.

The presentation of the Interim Financial Statements is consistent with the

Annual Financial Statements. Where presentational guidance set out in the SORP

"Financial Statements of Investment Trust Companies and Venture Capital

Trusts", issued by the AIC in November 2014 and updated in January 2017, is

consistent with the requirements of IFRS, the Directors have sought to prepare

the Interim Financial Statements on a basis compliant with the recommendations

of the SORP. In particular, supplementary information which analyses the

Statement of Profit or Loss and Other Comprehensive Income between items of a

revenue and capital nature has been presented alongside the total Statement of

Profit or Loss and Comprehensive Income.

The Company does not operate in an industry where significant or cyclical

variations as a result of seasonal activity are experienced during the

financial year. Income and dividends from investments will vary according to

the construction of the portfolio from time to time.

Going concern

The Directors are confident that the Company has adequate resources to continue

in operational existence for the foreseeable future and do not consider there

to be any threat to the going concern status of the Company.

Continuation vote

The Directors have specifically considered the implications of the continuation

vote scheduled to occur every two years on the application of the going concern

basis. At the AGM held on 23 November 2017, an extraordinary resolution was

proposed and passed, that the Company continue as constituted. Therefore, the

Directors conclude that there is no material uncertainty which may cast

significant doubt on the ability of the Company to continue as a going concern.

For this reason, they continue to adopt the going concern basis in preparing

the Interim Financial Statements. The next continuation vote will be proposed

at the 2019 AGM.

Segmental reporting

Operating segments are reported in a manner consistent with internal reporting

provided to the chief operating decision maker. The chief operating decision

maker, who is responsible for allocating resources and assessing performance of

the operating segments, has been identified as the Board as a whole. The key

measure of performance used by the Board to assess the Company's performance

and to allocate resources is the total return on the Company's NAV, as

calculated under IFRS, and therefore no reconciliation is required between the

measure of profit or loss used by the Board and that contained in these Interim

Financial Statements.

For management purposes, the Company is domiciled in Guernsey and is engaged in

a single segment of business mainly in one geographical area, being investment

in UK equity instruments, and therefore the Company has only one operating

segment.

2. BASIC AND DILUTED (LOSS)/EARNINGS PER SHARE

(Loss)/earnings per share is based on the following data:

Six months Six months

ended ended

31 December 31 December

2017 2016

(Unaudited) (Unaudited)

(Loss)/return for the period GBP(8,581,952) GBP68,105,332

Weighted average number of issued Ordinary shares 98,071,325 98,999,762

Basic and diluted (loss)/earnings per share (pence) (8.75) 68.79

3. NET ASSET VALUE PER SHARE

NAV per share is based on the following data:

As at As at As at

31 December 30 June 31 December

2017 2017 2016

(Unaudited) (Audited) (Unaudited)

NAV per Condensed Statement of Financial GBP186,330,153 GBP GBP214,457,592

Position 201,023,805

Total number of issued Ordinary shares 97,712,280 98,364,762

(excluding Treasury shares) 98,364,762

NAV per share (pence) 190.69 204.37

218.02

4. FINANCIAL ASSETS DESIGNATED AT FAIR VALUE THROUGH PROFIT OR LOSS

AND DERIVATIVES HELD FOR TRADING

1 July 1 July 1 July

2017 to 2016 to 2016 to

31 December 30 June 31 December

2017 2017 2016

(Unaudited) (Audited) (Unaudited)

GBP GBP GBP

Equity investments 170,344,729 186,431,885 211,706,765

Debt instruments 10,292,085 9,502,417 -

Financial assets designated at FVTPL 180,636,814 195,934,302 211,706,765

Derivative financial instruments held 7,032,835 6,436,512 9,744,768

for trading

Total financial assets designated at 187,669,649 202,370,814 221,451,533

FVTPL and derivatives held for

trading

Equity investments

Cost brought forward 156,798,987 153,875,142 153,875,142

Purchases 8,539,686 82,612,821 34,335,995

Sales (20,359,191) (109,680,734) (43,748,529)

Net realised gains 202,555 29,991,758 8,832,775

Cost carried forward 145,182,037 156,798,987 153,295,383

Unrealised gains/(losses) brought 29,708,411 (5,852,434) (5,852,434)

forward

Movement in unrealised (losses)/ (4,348,174) 35,560,845 64,123,866

gains

Unrealised gains carried forward 25,360,237 29,708,411 58,271,432

Effect of exchange rate movements on (197,545) (75,513) 139,950

revaluation

Fair value of equity investments 170,344,729 186,431,885 211,706,765

Debt instruments

Cost brought forward 9,318,984 - -

Purchases 804,530 9,318,984 -

Cost carried forward 10,123,514 9,318,984 -

Unrealised gains brought forward 290,017 - -

Movement in unrealised gains 381,233 290,017 -

Unrealised gains carried forward 671,250 290,017 -

Effect of exchange rate movements on (502,679) (106,584) -

revaluation

Fair value of debt instruments 10,292,085 9,502,417 -

Total financial assets designated at 180,636,814 195,934,302 211,706,765

FVTPL

Derivative financial instruments held

for trading

Cost brought forward 360,001 1,023,001 1,023,001

Purchases 3,869,720 10,098,112 5,913,500

Sales - (86,082) (86,079)

Net realised losses (3,045,990) (10,675,030) (4,973,571)

Cost carried forward 1,183,731 360,001 1,876,851

Unrealised gains brought forward 6,076,511 1,980,723 1,980,723

Movement in unrealised (losses)/gains (227,407) 4,095,788 5,887,194

Unrealised gains carried forward 5,849,104 6,076,511 7,867,917

Fair value of derivatives held for 7,032,835 6,436,512 9,744,768

trading

Total derivative financial 7,032,835 6,436,512 9,744,768

instruments held for trading

Total financial assets designated at 187,669,649 202,370,814 221,451,533

FVTPL and derivatives held for

trading

On 15 June 2017, the Company purchased US$5 million of convertible loan notes

from GI Dynamics. Interest on these loan notes is accrued at a rate equal to 5

per cent per annum, compounded annually. On 20 September 2017, the Company

purchased US$1 million of loan notes from Leaf. The Company received an

arrangement fee of US$62,500, which was deducted from the advance of US$1

million loan notes to Leaf. Interest on these loan notes is accrued at a rate

equal to 12 per cent per annum, compounded annually. At the reporting date, the

Company's loan notes were classified as debt instruments and measured at FVTPL.

On 30 June 2017, the Company purchased 7 million shares of quoted convertible

bonds issued by Hurricane for US$7 million. The convertible bonds have a coupon

rate of 7.5 per cent per annum and mature on 24 July 2022. At the reporting

date, the Company's convertible bond shares were classified as debt instruments

and measured at FVTPL.

At the reporting date the Company's derivative financial instruments consisted

of two (30 June 2017: one) FTSE 100 Index Put Option positions, purchased as

protection against a significant market sell-off and two warrant instruments in

FairFX and Hurricane (30 June 2017: two) for the purchase of ordinary shares.

At the reporting date, the warrant instruments in FairFX and Hurricane were

valued using a Black Scholes valuation technique.

The following table details the Company's positions in derivative financial

instruments:

Nominal amount Value

(Unaudited) (Unaudited)

31 December 2017 GBP

Derivative financial instruments

Puts on UKX P7100 (expiry: January 2018) 2,000 70,000

Puts on UKX P7300 (expiry: February 2018) 2,000 380,000

FairFX warrant instrument 6,000,000 3,165,762

Hurricane warrant instrument 23,333,333 3,417,073

29,337,333 7,032,835

Nominal amount Value

(Audited) (Audited)

30 June 2017 GBP

Derivative financial instruments

Puts on UKX P7100 (expiry: July 2017) 1,000 290,000

FairFX warrant instrument 6,000,000 2,001,252

Hurricane warrant instrument 23,333,333 4,145,260

29,334,333 6,436,512

5. FINANCIAL INSTRUMENTS

Fair value measurements

The Company measures fair values using the following fair value hierarchy that

prioritises the inputs to valuation techniques used to measure fair value. The

hierarchy gives the highest priority to unadjusted quoted prices in active

markets for identical assets or liabilities (Level 1 measurements) and the

lowest priority to unobservable inputs (Level 3 measurements). The three levels

of the fair value hierarchy under IFRS 13 are as follows:

Level 1: Quoted price (unadjusted) in an active market for an identical

instrument.

Level 2: Valuation techniques based on observable inputs, either directly

(i.e. as prices) or indirectly (i.e. derived from prices). This category

includes instruments valued using: quoted prices in active markets for similar

instruments; quoted prices for identical or similar instruments in markets that

are considered less than active; or other valuation techniques for which all

significant inputs are directly or indirectly observable from market data.

Level 3: Valuation techniques using significant unobservable inputs. This

category includes all instruments for which the valuation technique includes

inputs that are not based on observable data, and the unobservable inputs have

a significant effect on the instrument's valuation. This category includes

instruments that are valued based on quoted prices for similar instruments for

which significant unobservable adjustments or assumptions are required to

reflect differences between the instruments.

The level in the fair value hierarchy within which the fair value measurement

is categorised in its entirety is determined on the basis of the lowest level

input that is significant to the fair value measurement. For this purpose, the

significance of an input is assessed against the fair value measurement in its

entirety. If a fair value measurement uses observable inputs that require

significant adjustment based on unobservable inputs, that measurement is a

Level 3 measurement. Assessing the significance of a particular input to the

fair value measurement in its entirety requires judgement, considering factors

specific to the asset or liability.

The determination of what constitutes 'observable' requires significant

judgement by the Company. The Company considers observable data to be that

market data that is readily available, regularly distributed or updated,

reliable and verifiable, not proprietary, and provided by independent sources

that are actively involved in the relevant market.

The objective of the valuation techniques used is to arrive at a fair value

measurement that reflects the price that would be received if an asset was sold

or a liability transferred in an orderly transaction between market

participants at the measurement date.

The following tables analyse, within the fair value hierarchy, the Company's

financial assets measured at fair value at 31 December 2017 and 30 June 2017:

Level 1 Level 2 Level 3 Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

31 December 2017 GBP GBP GBP GBP

Financial assets designated at

FVTPL and derivatives held for

trading:

Equities - listed equity 170,344,729 - - 170,344,729

investments

Debt - listed debt instruments - 5,724,929 - 5,724,929

Debt - loan notes - - 4,567,156 4,567,156

Derivatives - listed derivative 450,000 - - 450,000

instruments

Derivatives - warrant instruments - 6,582,835 - 6,582,835

170,794,729 12,307,764 4,567,156 187,669,649

Level 1 Level 2 Level 3 Total

(Audited) (Audited) (Audited) (Audited)

30 June 2017 GBP GBP GBP GBP

Financial assets designated at

FVTPL and derivatives held for

trading:

Equities - listed equity 186,431,885 - - 186,431,885

investments

Debt - listed debt instruments - 5,656,030 - 5,656,030

Debt - loan notes - - 3,846,387 3,846,387

Derivatives - listed derivative 290,000 - - 290,000

instruments

Derivatives - warrant instruments - 6,146,512 - 6,146,512

186,721,885 11,802,542 3,846,387 202,370,814

The Level 1 equity investments were valued by reference to the closing bid

prices in each investee company on the reporting date.

The Level 2 derivative investments were valued using a Black Scholes valuation

technique. The listed debt instruments were valued with reference to the last

available bid price of the convertible bond on the reporting date, which are

considered to be Level 2 investments due to the level of trading activity of

the bond.

The loan notes were classified as Level 3 debt instruments as there was no

observable market data. The Board has concluded that fair value is approximate

to cost plus accumulated interest.

For financial instruments not measured at FVTPL, the carrying amount is

approximate to their fair value.

Fair value hierarchy - Level 3

The following table shows a reconciliation from the opening balances to the

closing balances for fair value measurements in Level 3 of the fair value

hierarchy:

Six months Six months

ended ended

31 December 31 December

2017 2016

(Unaudited) (Unaudited)

GBP GBP

Opening balance at 1 July 3,846,387 4,680,103

Purchases 744,491 -

Movement in unrealised gain 119,834 1,410,007

Sales - (5,272,547)

Net realised loss - (549,193)

Effect of exchange rate movements (143,556) -

Closing balance at 31 December 4,567,156 268,370

The Company recognises transfers between levels of the fair value hierarchy on

the date of the event of change in circumstances that caused the transfer.

At the period end and assuming all other variables are held constant:

* If unobservable inputs in Level 3 investments had been 5 per cent higher/

lower (2016: 5 per cent higher/lower), the Company's return and net assets

for the six months ended 31 December 2017 would have increased/decreased by

GBP228,358 (2016: GBP13,419); and

* There would have been no impact on the other equity reserves.

6. SHARE CAPITAL AND RESERVES

The authorised share capital of the Company is GBP3,000,000 divided into 300

million Ordinary shares of GBP0.01 each.

The issued share capital of the Company is comprised as follows:

31 December 2017 30 June 2017

(Unaudited) (Audited)

Number GBP Number GBP

Issued, called up and fully paid 98,999,762 989,998 98,999,762 989,998

Ordinary shares of GBP0.01 each

7. TREASURY SHARES RESERVE

Six months ended Year ended

31 December 2017 30 June 2017

(Unaudited) (Audited)

Number GBP Number GBP

Opening balance (635,000) (972,800) (475,000) (720,478)

Treasury shares purchased (652,482) (160,000) (252,322)

during the period/year (1,209,462)

Closing balance (1,287,482) (635,000) (972,800)

(2,182,262)

During the period ended 31 December 2017, 652,482 (2016: 160,000) Treasury

shares were purchased at an average price of 185.4 pence per share (2016: 157.7

pence per share), representing an average discount to NAV at the time of

purchase of 5.2 per cent (2016: 4.5 per cent). During the period ended 31

December 2017, Nil (2016: Nil) Treasury shares were sold.

The Company purchased 136,500 of its own Ordinary shares during the period

between 1 January 2018 and 2 March 2018, which were held as Treasury shares.

Following these purchases, the total number of Ordinary shares held as Treasury

shares by the Company was 1,423,982.

8. DIVIDS

On 11 July 2017, the Company declared an interim dividend of GBP2,456,619,

equating to 2.5 pence per Ordinary share, which was paid on 18 August 2017 to

shareholders on the register as at 21 July 2017.

On 12 December 2017, the Company declared an interim dividend of GBP2,445,619,

equating to 2.5 pence per Ordinary share, which was paid on 18 January 2018 to

shareholders on the register as at 22 December 2017.

9. RELATED PARTIES

Richard Bernstein is a director and a member of the Investment Manager, a

member of the Investment Adviser and a holder of 10,000 (30 June 2017: 10,000)

Ordinary shares in the Company, representing 0.01 per cent (30 June 2017: 0.01

per cent) of the voting share capital of the Company at 31 December 2017.

During the period, the Company incurred management fees of GBP1,649,074 (2016: GBP

1,438,909) none of which was outstanding at 31 December 2017 (30 June 2017: GBP

Nil). The Company also accrued performance fees of GBPNil (2016: GBP5,714,940) none

of which was outstanding or included in trade and other payables as at 31

December 2017 (30 June 2017: GBP2,354,752 was outstanding and included in trade

and other payables). A performance fee of GBP983,800 was payable in respect of

the year ended 30 June 2017 as accrued in the August 2017 NAV and paid during

the period.

Under the terms of the IMA between the Company and the Investment Manager, if

the NAV per share at 30 June 2018 exceeds the 2018 performance hurdle, a

performance fee will be payable to the Investment Manager. The performance

hurdle represents an expected return on share capital since placing compounded

at a rate of 7 per cent up to 20 August 2013, 8 per cent up to 27 January 2015

and 10 per cent after that date.

As the NAV per share at 31 December 2017 did not exceed the performance hurdle

at that date, a performance fee has not been accrued in the Interim Financial

Statements. In the event that, on 30 June 2018, the NAV per share exceeds the

2018 performance hurdle, the performance fee will be an amount equal to 20 per

cent of the excess of the NAV per share at that date and is adjusted for

dividends declared since payment of the last performance fee, over the 2018

performance hurdle multiplied by the time weighted average number of Ordinary

shares in issue during the year ending 30 June 2018. Depending on whether the

Ordinary shares are trading at a discount or a premium to the Company's NAV per

share at 30 June 2018, the performance fee will be either payable in cash

(subject to the Investment Manager being required to use the cash payment to

purchase Ordinary shares in the market) or satisfied by the sale of Ordinary

shares out of Treasury or by the issue of new fully paid Ordinary shares at the

closing mid-market closing price on 30 June 2018, respectively.

As at 31 December 2017, the Investment Manager held 4,205,287 Ordinary shares

(30 June 2017: 4,015,606) of the Company, representing 4.30 per cent (30 June

2017: 4.08 per cent) of the voting share capital. Subsequent to the period end,

the Investment Manager sold 800,000 Ordinary shares of the Company on 16

January 2018 and now holds 3,405,287 Ordinary shares of the Company.

The interests of the Directors in the share capital of the Company at the

period/year end, and as at the date of this report, are as follows:

31 December 2017 30 June 2017

Number of Total Number of Total

Ordinary shares voting Ordinary voting

rights shares rights

William Collins(1) 25,000 0.03% 25,000 0.03%

Sarah Evans(2) 25,000 0.03% 25,000 0.03%

Christopher Waldron(3) 10,000 0.01% - -

Total 60,000 0.07% 50,000 0.06%

(1) Resigned as Chairman and Director of the Company on 23 November 2017

(2) Resigned as Chairman of the Audit Committee and Senior Independent Director

of the Company on 3 January 2018

(3) Ordinary shares held indirectly by Mr Waldron

All related party transactions are carried out on an arm's length basis.

10. POST BALANCE SHEET EVENTS

On 4 January 2018, Sarah Evans resigned as Chairman of the Audit Committee and

Senior Independent Director of the Company. Jane Le Maitre was appointed as

Chairman of the Audit Committee with effect from 4 January 2018.

On 18 January 2018, the Investment Manager sold 800,000 Ordinary shares of the

Company and now holds 3,405,287 Ordinary shares of the Company.

On 7 February 2018, the Company reported that its unaudited NAV at 31 January

2018 was 201.29 pence per share.

The Company purchased 136,500 of its own Ordinary shares during the period

between 1 January 2018 and 2 March 2018, which were held as Treasury shares.

Following these purchases, the total number of Ordinary shares held as Treasury

shares by the Company is 1,423,982.

On 2 March 2018, the Directors approved the issue of an aggregate 125,000

Ordinary shares of GBP0.01 divided equally amongst five charitable organisations,

the nominal value of which has been paid by Richard Bernstein. Application will

be made for these shares to be admitted to trading on the AIM market and

dealings are expected to commence on 9 March 2018.

11. AVAILABILITY OF INTERIM REPORT

Copies of the Interim Report will be available to download from the Company's

website www.crystalamber.com.

Glossary of Capitalised Defined Terms

"AGM" means the annual general meeting of the Company;

"AIC" means the Association of Investment Companies;

"AIM" means the Alternative Investment Market of the London Stock Exchange;

"Annual Financial Statements" means the audited annual financial statements of

the Company, including the Statement of Profit or Loss and Other Comprehensive

Income, the Statement of Financial Position, the Statement of Changes in

Equity, the Statement of Cash Flows and associated notes;

"Annual Report" means the annual publication of the Company to the shareholders

to describe their operations and financial conditions, together with the

Company's financial statements;

"Black Scholes" means the Black Scholes model, a mathematical model of a

financial market containing derivative instruments;

"Board" or "Directors" or "Board of Directors" means the directors of the

Company;

"Brexit" means the departure of the UK from the European Union;

"Company" or "Fund" means Crystal Amber Fund Limited;

"Companies Law" means the Companies (Guernsey) Law, 2008, (as amended);

"EGM" or "Extraordinary General Meeting" means an extraordinary general meeting

of the Company;

"FDA" means the Food and Drug Administration, a federal agency of the US

Department of Health and Human Services;

"FTSE" means the Financial Times Stock Exchange;

"FVTPL" means Fair Value Through Profit or Loss;

"G7 Group" means a group consisting of Canada, France, Germany, Italy, Japan,

the UK and the US;

"IAS" means international accounting standards as issued by the Board of the

International Accounting Standards Committee;

"IFRS" means the International Financial Reporting Standards, being the

principles-based accounting standards, interpretations and the framework by

that name issued by the International Accounting Standards Board, as adopted by

the European Union;

"Interim Financial Statements" means the unaudited condensed interim financial

statements of the Company, including the Condensed Statement of Profit or Loss

and Other Comprehensive Income, the Condensed Statement of Financial Position,

the Condensed Statement of Changes in Equity, the Condensed Statement of Cash

Flows and associated notes;

"Interim Report" means the Company's interim report and unaudited condensed

financial statements for the period ended 31 December;

"IMA" means the investment management agreement between the Company and the

Investment Manager, dated 16 June 2008, as amended on 21 August 2013 and

further amended on 27 January 2015;

"NAV" or "Net Asset Value" means the value of the assets of the Company less

its liabilities as calculated in accordance with the Company's valuation

policies and expressed in Pounds Sterling;

"NAV per share" means the Net Asset Value per Ordinary share of the Company and

is expressed in pence;

"NHS" means the National Health Service;

"Ordinary share" means an allotted, called up and fully paid Ordinary share of

the Company of GBP0.01 each;

"SORP" means Statement of Recommended Practice;

"Treasury" means the reserve of Ordinary shares that have been repurchased by

the Company;

"Treasury shares" means Ordinary shares in the Company that have been

repurchased by the Company and are held as Treasury shares;

"UK" or "United Kingdom" means the United Kingdom of Great Britain and Northern

Ireland;

"US" means the means the United States of America, its territories and

possessions, any state of the United States and the District of Columbia;

"US$" means United States dollars; and

"GBP" or "Pounds Sterling" or "Sterling" means British pound sterling and "pence"

means British pence.

Directors and General Information

Directors Registered Office

Christopher Waldron (Chairman with effect Heritage Hall

from 23 November 2017) Le Marchant Street

Fred Hervouet (Appointed 6 December 2017) St. Peter Port

Jane Le Maitre (Chairman of Audit Committee Guernsey GY1 4HY

with effect from 4 January 2018)

Nigel Ward (Chairman of Remuneration and Investment Manager

Management Engagement Committee) Crystal Amber Asset Management (Guernsey)

Limited

William Collins (Resigned 23 November 2017) Heritage Hall

Sarah Evans (Resigned 4 January 2018) Le Marchant Street

St. Peter Port

Investment Adviser Guernsey GY1 4HY

Crystal Amber Advisers (UK) LLP

17c Curzon Street Nominated Adviser

London W1J 5HU Allenby Capital Limited

5 St. Helen's Place

Administrator and Secretary London EC3A 6AB

Estera International Fund Managers

(Guernsey) Limited (formerly Heritage Legal Advisers to the Company

International Fund Managers Limited) As to English Law

Heritage Hall Norton Rose Fulbright LLP

Le Marchant Street 3 More London Riverside

St. Peter Port London SE1 2AQ

Guernsey GY1 4HY

As to Guernsey Law

Broker Carey Olsen

Winterflood Investment Trusts PO Box 98

The Atrium Building Carey House

Cannon Bridge House Les Banques

25 Dowgate Hill St. Peter Port

London EC4R 2GA Guernsey GY1 4BZ

Independent Auditor Custodian

KPMG Channel Islands Limited ABN AMRO (Guernsey) Limited

Glategny Court PO Box 253

Glategny Esplanade Martello Court

St. Peter Port Admiral Park

Guernsey GY1 1WR St. Peter Port

Guernsey GY1 3QJ

Identifiers

ISIN: GG00B1Z2SL48 Registrar

Sedol: B1Z2SL4 Link Asset Services (formerly Capita

Ticker: CRS Registrars (Guernsey) Limited)

Website: crystalamber.com 65 Gresham Street

London

EC2V 7NQ

END

(END) Dow Jones Newswires

March 05, 2018 02:00 ET (07:00 GMT)

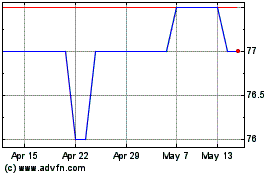

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024