Crystal Amber Fund Limited Monthly Net Asset Value and Interim Dividend Declaration

July 08 2015 - 2:00AM

UK Regulatory

TIDMCRS

8 July 2015

CRYSTAL AMBER FUND LIMITED

("Crystal Amber Fund" or the "Fund")

Monthly Net Asset Value and Interim Dividend Declaration

Crystal Amber Fund announces that its unaudited net asset value ("NAV") per

share on 30 June 2015 was 168.26p (31 May 2015: 160.84p per share).

The proportion of the Fund's NAV at 30 June 2015 represented by the ten largest

holdings, other investments and cash (including accruals), was as follows:

Top ten holdings Pence per share Percentage of investee equity

held

Grainger plc 34.9 3.4%

Hurricane Energy plc 13.1 11.8%

Leaf Clean Energy Company 12.9 29.9%

STV Group plc 12.3 6.7%

Pinewood Group plc 11.5 4.1%

Sutton Harbour Holdings plc 10.3 29.3%

Coats Group plc 9.0 2.4%

Dart Group plc 7.8 1.2%

Balfour Beatty plc 5.2 0.3%

4imprint Group plc 5.0 1.6%

Total of ten largest holdings 122.0

Other investments 31.6

Cash and accruals 14.7

Total NAV 168.3

Investment Adviser's commentary on the portfolio

Over the quarter to 30 June 2015, NAV per share increased by 13.5 per cent. The

Fund's average cash position over the quarterly period has been 5.3 per cent,

implying a return on the investment portfolio of 14.3 per cent. Over the Fund's

financial year to 30 June 2015, NAV per share has increased by 4.6 per cent or

4.9 per cent including the dividend paid.

The top three positive contributors to NAV growth over the quarter to the end

of June were Thorntons plc (5.7 per cent contribution), STV Group plc (1.3 per

cent) and Hurricane Energy plc (1.2 per cent). The three main detractors have

been Ophir Energy plc (0.7 per cent), Plus500 Ltd (0.4 per cent) and Juridica

Investments plc (0.3 per cent). The Fund sold its remaining holding in Plus 500

Ltd, realising a total profit including dividends of GBP4.3 million.

During the quarter to 30 June 2015, the Fund disclosed notifiable positions in

Grainger plc and Pinewood Group plc, increased its position in Hurricane Energy

plc, Coats Group plc and STV Group plc and sold out its holdings in Aer Lingus

Group plc and Thorntons plc.

Aer Lingus Group plc ("Aer Lingus")

In June, given the limited upside, the Fund disposed of its stake in Aer Lingus

following the favourable share price reaction to the Irish Government's

decision to dispose of its stake to IAG. The proceeds have been re-invested

elsewhere where the risk reward profile appears to be more compelling.

The Fund realised gains in Aer Lingus of EUR15 million (GBP10.8 million) and banked

dividends of EUR0.8 million (GBP0.6 million) (compared to a total investment of EUR

21.1 million (GBP15 million)).

Balfour Beatty plc ("Balfour Beatty")

Over the period, the Fund started to build a position in Balfour Beatty, the

international engineering and construction group.

Following six profit warnings over the last two years, Leo Quinn's arrival as

Chief Executive provides the opportunity to address several legacy issues in

construction and turn around a business selling on an enterprise value to sales

ratio of 0.2.

We believe that the value of Balfour Beatty's Public-to-Private Partnership

("PPP") projects provide support to the company's current stock market value.

Coats Group plc ("Coats")

Coats is the world's leading industrial thread and consumer textile crafts

business. In 1890, it listed on the London Stock Exchange.

During the quarter, the Fund increased its shareholding to 33.9 million shares,

equivalent to 2.4 per cent of Coats' issued share capital. Coats is capitalised

at GBP352 million and in the year to 31 December 2014, reported operating profits

of GBP64 million on revenues of more than GBP1 billion.

Coats had net cash of GBP206 million at 31 December 2014. During 2014,

principally as a result of a 115 basis point decrease in the discount rate,

Coats' pension liabilities increased by GBP197 million to GBP375 million. The board

of Coats is engaging with the UK Pensions Regulator following the receipt of a

Warning Notice in December 2014.

We believe that the share price currently fails to reflect the underlying value

of the business. The Fund notes recent acquisitions by Coats which it regards

as a sensible use of its cash resources.

Grainger plc ("Grainger")

In June, the Fund purchased a 3.2 per cent stake in Grainger.

Grainger was established in 1912 and is the UK's largest listed residential

property owner and manager. Its traditional reversionary business is based

predominantly on regulated tenancies which provide substantial, high quality,

predictable and resilient cash flows. Its portfolio of 7,400 reversionary

assets has a carrying value of GBP1.5 billion. As these properties become vacant,

Grainger estimates that they will generate a surplus of GBP500 million,

equivalent to 120p a share. This embedded value is the difference between

today's market value compared to the vacant possession value at today's prices.

It does not reflect any future benefit from house price inflation. This

portfolio is expected to generate GBP120 million of gross cash each year until

2030. Grainger also owns 8,400 properties as part of its market rented

portfolio valued in excess of GBP1.1 billion.

Grainger's shares trade at a 21% discount to unaudited net asset value of 293p

at 31 March 2015. The company has stated that sales prices achieved have been

6.6% higher than vacant possession value and this supports our analysis that

current market values are in excess of vacant possession values.

Grainger's stated net asset value excludes the estimated reversionary surplus

of 120p a share.

We believe that Grainger's portfolio, providing visibility of cash realisations

through to 2030, represents an attractive asset for an insurance company

seeking to match this asset profile against long- term future liabilities.

We also note that Grainger pays an average interest rate of 5.1% on its GBP1

billion of debt. This excludes commitment fees. We believe that in the current

interest rate environment, there is considerable scope to secure better terms

for shareholders, which could increase pre-tax profits by more than GBP10 million

a year.

In March, Grainger's CEO, Andrew Cunningham, announced he will step down at the

next AGM in February 2016. On 30 June, his successor was announced as Helen

Gordon, currently Head of Real Estate Asset Management at Royal Bank of

Scotland.

Pinewood Group plc ("Pinewood")

Pinewood is a leading provider of studio and related services to global

screen-based industries.

In 2011, the Fund was Pinewood's largest shareholder and held the view that

Pinewood's iconic brand and technical excellence should have enabled it to have

delivered higher profitability. Following a cash offer from Peel Holdings, the

Fund then sold its position realising a profit of GBP8.7 million.

We have continued to follow developments at Pinewood and during the quarter

acquired a 4.1% interest in Pinewood as a result of a placing.

On 30 June 2015, Pinewood announced its full year results to 31 March 2015.

While the company stated that it had delivered strong growth, the Fund notes

that of the GBP8.1 million of profit after tax, GBP3.1 million was derived from tax

credits and a further GBP1.1m from Pinewood's share of results of joint ventures.

Revenue was GBP75 million. We believe that Pinewood's core business should be

achieving a much higher level of profitability.

On 1 July 2015, the Investment Adviser to the Fund met with Pinewood's

management and expressed this view. The company has responded by saying that it

is seeking to engage constructively with the Fund and is open to the Fund's

plans.

The Fund is therefore engaging with Pinewood and is currently optimistic of a

more helpful dialogue than took place in 2010 and 2011.

Thorntons plc ("Thorntons")

On 22 June, Thorntons announced the terms of a recommended cash offer from

Ferrero International S.A. ("Ferrero") at 145p per share. As a pre-condition,

the Fund agreed to sell its entire stake in Thorntons to Ferrero on the day of

the announcement. The Fund was the largest shareholder in Thorntons owning 18.9

per cent of Thorntons' issued share capital. We believe that the ability to

deliver this holding to Ferrero was an essential element of the transaction.

In our view, the offer recognises the value that the Fund had identified in

Thorntons' brand and production capability. Thorntons' recent profit warnings

had exposed some operational challenges in growing third party grocery sales.

In our view, Ferrero will bring its expertise in this sales channel and an

international marketing and distribution capability. This should accelerate

Thorntons' growth. We believe that Ferrero, a family owned business, can bring

to Thorntons the long term focus that has made Ferrero succeed worldwide.

The Fund realised profits of GBP7.5 million on its shareholding in Thorntons (on

a total investment of GBP11.5 million).

Dividend

The Board has declared an interim dividend of 2.5p per ordinary share in

respect of the year ended 30 June 2015. The dividend will be paid on 14 August

2015 to shareholders on the register (the record date) on 17 July 2015. The

shares will be quoted ex-dividend on 16 July 2015.

Transactions in Shares

Over the period, the Fund bought back 4,455,630 shares at an average price of

146.18p per share as part of its buyback programme.

For further enquiries please contact:

Crystal Amber Fund Limited

William Collins (Chairman)

Tel: 01481 716 000

Sanlam Securities UK Limited - Nominated Adviser

David Worlidge/James Thomas

Tel: 020 7628 2200

Numis Securities Limited - Broker

Nathan Brown/Hugh Jonathan

Tel: 020 7260 1426

Crystal Amber Advisers (UK) LLP - Investment Adviser

Richard Bernstein

Tel: 020 7478 9080

END

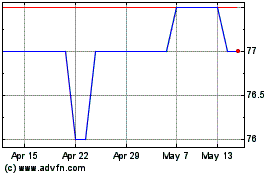

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Crystal Amber (LSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024