Custodian REIT plc : Custodian REIT sells industrial unit for GBP8.5 million, 73% ahead of valuation (1411673)

August 03 2022 - 2:00AM

UK Regulatory

Custodian REIT plc (CREI) Custodian REIT plc : Custodian REIT

sells industrial unit for GBP8.5 million, 73% ahead of valuation

03-Aug-2022 / 07:00 GMT/BST Dissemination of a Regulatory

Announcement that contains inside information in accordance with

the Market Abuse Regulation (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

3 August 2022

Custodian REIT plc

("Custodian REIT" or the "Company")

Custodian REIT sells industrial unit for GBP8.5 million, 73%

ahead of valuation

Custodian REIT (LSE: CREI), the UK property investment company

focused on smaller lot-sized regional property, is pleased to

announce the disposal of an industrial unit in Milton Keynes for

GBP8.5 million at a 73% premium to its 31 March 2022 valuation.

Custodian REIT acquired the 44,187 sq ft warehouse and

distribution unit in January 2015 for GBP2.1 million and

subsequently invested a further GBP0.9 million to fully refurbish

the property. This refurbishment included re-cladding the exterior,

replacing the roof, restoring the yard and renovating the interior

which in aggregate improved the property's energy performance

certificate ("EPC") rating from 'E' to 'C'. As a result the

property was let at a higher rent to Saint Gobain Building

Distribution for six years before a tenant break option was

exercised in June 2022. The sale of the unit to a special purchaser

was then negotiated which required the property with vacant

possession.

This disposal decreases the industrial weighting by valuation1

within the Company's highly diversified portfolio of 164 properties

to 47%, with the balance comprising 21% retail warehouse, 13%

office, 12% other and 7% high street retail, all of which are in

strong economic areas across the UK.

Commenting on the disposal, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's external fund

manager), said: "We acquired this property having clearly

identified an opportunity to create value by investing in the asset

and bringing it up to modern standards. As a result we were able to

let the property promptly and generate a healthy and growing level

of income during our seven years of ownership. When the tenant

exercised its break option we took the opportunistic decision to

dispose of the property to a special purchaser. This sale has

allowed us to crystallise a significant profit for shareholders and

further demonstrates the benefits of a smaller regional property

strategy, where in certain circumstances the vacant possession

value fully supports and sometimes exceeds the investment

value."

1 Portfolio weighting by income: industrial 38%, retail

warehouse 24%, office 16%, 11% high street and 11% other.

- Ends -

For further information, please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numiscorp.com

FTI Consulting

Richard Sunderland / Ellie Sweeney Tel: +44 (0)20 3727 1000

custodianreit@fticonsulting.com

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, listed

on the main market of the London Stock Exchange. Its portfolio

comprises properties predominantly let to institutional grade

tenants on long leases throughout the UK and is principally

characterised by properties with individual values of less than

GBP10 million at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By targeting sub GBP10 million lot size,

regional properties, the Company intends to provide investors with

an attractive level of income with the potential for capital

growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit www.custodianreit.com and

www.custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: IRS

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

Sequence No.: 178815

EQS News ID: 1411673

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1411673&application_name=news

(END) Dow Jones Newswires

August 03, 2022 02:00 ET (06:00 GMT)

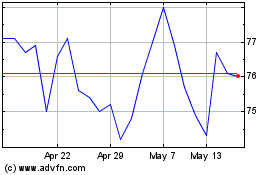

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

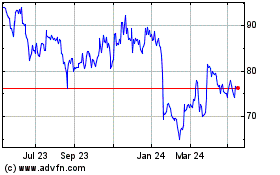

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024