Custodian REIT plc (CREI)

Custodian REIT plc : CORRECTION: Unaudited net asset value as at 30 June 2021 and dividend update

27-Jul-2021 / 08:57 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information according to REGULATION (EU) No 596/2014

(MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

The following replaces the announcement released earlier today where the NAV total return for the Period should have

read 6.0% rather than 7.3%, with a capital increase of 4.2% rather than 5.5%. The amended announcement is detailed in

full below.

27 July 2021

Custodian REIT plc

("Custodian REIT" or "the Company")

Unaudited net asset value as at 30 June 2021 and dividend update

Custodian REIT (LSE: CREI), the UK commercial real estate investment company, today reports its unaudited net asset

value ("NAV") as at 30 June 2021, highlights for the period from 1 April 2021 to 30 June 2021 ("the Period") and

dividends payable.

Financial highlights

? Dividend per share approved for the Period of 1.25p (quarter ended 31 March 2021: 1.25p), fully covered by net cash

receipts with 95% of rent collected relating to the Period, adjusted for contractual rent deferrals

? Target dividend per share of not less than 5.0p for the year ending 31 March 2022, based on rent collection levels

remaining in line with expectations

? GBP0.6m of new equity raised during the Period at a premium of 5.9% to dividend adjusted NAV per share

? EPRA earnings per share1 for the Period decreased to 1.4p (quarter ended 31 March 2021: 1.5p) due to a GBP0.3m

increase in the doubtful debt provision during the Period

? NAV total return per share2 for the Period of 6.0%, comprising 1.8% dividends paid and a 4.2% capital increase

? NAV per share of 101.7p (31 March 2021: 97.6p)

? NAV of GBP427.7m (31 March 2021: GBP409.9m)

? Net gearing3 of 24.3% loan-to-value (31 March 2021: 24.9%)

Portfolio highlights

? Property portfolio value of GBP575.4m (31 March 2021: GBP551.9m):

? GBP19.0m aggregate valuation increase for the Period (3.4% of property portfolio), comprising GBP1.4m from successful

asset management initiatives and GBP19.0m of valuation increases in the industrial sector, partially offset by GBP1.4m

aggregate decreases in the retail, office and other sectors

? Acquisition of an industrial asset in Knowsley, Liverpool for consideration of GBP4.325m4

? Disposal of a high street retail unit in Nottingham at valuation for consideration of GBP0.7m

? Since the Period end the Company has disposed of a children's day nursery in Basingstoke for GBP0.6m, GBP0.1m ahead of

valuation

? EPRA occupancy5 improved to 92.4% (31 March 2021: 91.5%) through letting four vacant properties during the Period

1 Profit after tax excluding net gains or losses on investment property divided by weighted average number of shares in

issue.

2 NAV per share movement including dividends paid during the Period.

3 Gross borrowings less cash (excluding rent deposits) divided by portfolio valuation.

4 Before acquisition costs of GBP0.3m.

5 Estimated rental value ("ERV") of let property divided by total portfolio ERV.

Net asset value

The unaudited NAV of the Company at 30 June 2021 was GBP427.7m, reflecting approximately 101.7p per share, an increase of

4.1p (4.2%) since 31 March 2021:

Pence per share GBPm

NAV at 31 March 2021 97.6 409.9

Issue of equity (net of costs) - 0.6

Valuation movements relating to:

- Asset management activity 0.3 1.4

- General valuation increases in the industrial sector 4.5 19.0

- General valuation decreases in the retail, office and other sectors (0.3) (1.4)

Net valuation movement 4.5 19.0

Acquisition costs - (0.3)

4.5 18.7

Income earned for the Period 2.2 9.3

Expenses and net finance costs for the Period5 (0.8) (3.4)

Interim dividend paid6 relating to the previous quarter (1.3) (5.3)

Additional interim dividend paid7 relating to the previous financial year (0.5) (2.1)

NAV at 30 June 2021 101.7 427.7

6 A fourth interim dividend of 1.25p per share relating to the

quarter ended 31 March 2021 was paid on 28 May 2021.

7 A fifth interim dividend of 0.5p per share relating to the

financial year ended 31 March 2021 was paid on 30 June 2021.

The NAV attributable to the ordinary shares of the Company is

calculated under International Financial Reporting Standards and

incorporates the independent portfolio valuation as at 30 June 2021

and net income for the Period. The movement in NAV reflects the

payment of fourth and fifth interim dividends totaling 1.75p per

share during the Period, but does not include any provision for the

approved dividend of 1.25p per share for the Period to be paid on

31 August 2021.

Market commentary

Commenting on the market Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's discretionary

investment manager) said:

"UK commercial property investment activity in the first half of

2021 has been at levels last seen in the first half of 2018,

according to a recent report by Carter Jonas, with over GBP20bn of

investment. Market demand has been focused on the industrial and

logistics sector where rising prices continue to indicate record

low yields, but demand for office investment is resurgent, with Q2

outstripping Q1 and the retail warehouse market is also showing a

sharp recovery in investment activity. Colliers reported GBP1bn of

investment into retail warehousing in the first half of the year

and, in common with the office sector, Q2 was stronger than Q1.

"Investment demand has been matched by occupier activity. In the

industrial and logistics sector there is a depth of demand from a

range of occupiers which, along with limited supply, restrictive

planning and build-cost inflation constraining the pipeline of new

development, is leading to sustained rental growth. These factors

have resulted in a GBP20.2m (7.5%) increase in valuation during the

Period. In strong regional office locations, where office space is

well-matched to occupier demand, rental growth is taking place and

many occupiers are starting to plan for post-pandemic working

practices. Demand for retail warehousing let off low rents is

robust despite, or perhaps due to, pandemic-restricted shopping

habits. Challenges remain on the high street, but on prime and good

secondary high streets, rents are finding a level which can attract

occupiers and maintain occupancy.

"Despite the extension of legislation granting tenants a

moratorium against eviction for non-payment of rent, which

contributed to a GBP0.3m increase in the doubtful debt provision

during the Period, it is pleasing that most tenants have stood by

their contractual rental commitments.

"The asset management of the portfolio, discussed below,

including granting new leases over vacant space and agreeing lease

renewals demonstrates the clear demand for commercial property

across all sectors. While the pandemic has had wide ranging

implications for real estate, the levels of continuing demand

support cash flow which in turn supports a fully covered

dividend."

Rent collection

95% of rent relating to the Period, net of contractual rent

deferrals, has been collected as set out below:

GBPm

Rental income (IFRS basis) 9.3

Lease incentives (0.3)

Cash rental income expected, before contractual rent deferrals 9.0

Contractual rent deferred until subsequent periods (0.1)

Contractual rent deferred from prior periods falling due during the Period 0.6

Cash rental income expected, net of contractual deferrals 9.5 100%

Outstanding rental income (0.5) (5%)

Collected rental income 9.0 95%

Outstanding rental income remains the subject of discussion with

various tenants, and some arrears are potentially at risk of

non-recovery due to disruption caused by the COVID-19 restrictions

in place during the Period and from CVAs or Administrations.

Dividends

During the Period the Company paid fourth and fifth interim

dividends of 1.25p and 0.5p per share relating to the quarter ended

31 March 2021 and the financial year ended 31 March 2021

respectively. These dividends were fully covered by net cash

collections and EPRA earnings for the respective periods.

The Board is pleased to approve an interim dividend per share of

1.25p for the Period which is fully covered by net cash receipts,

114% covered by EPRA earnings and is in line with the Board's

current policy of paying dividends at a level broadly linked to net

rental receipts.

In the absence of unforeseen circumstances and assuming rent

collection levels remain in line with forecast, the Board intends

to pay further quarterly dividends to achieve a target dividend8

per share for the year ending 31 March 2022 of at least 5.0p.

The Board's objective is to grow the dividend on a sustainable

basis, at a rate which is fully covered by projected net rental

income and does not inhibit the flexibility of the Company's

investment strategy.

The quarterly interim dividend for the Period of 1.25p per share

is payable on 31 August 2021 to shareholders on the register on 6

August 2021 and will be designated as a property income

distribution ("PID").

8 This is a target only and not a profit forecast. There can be

no assurance that the target can or will be met and it should not

be taken as an indication of the Company's expected or actual

future results. Accordingly, shareholders or potential investors in

the Company should not place any reliance on this target in

deciding whether or not to invest in the Company or assume that the

Company will make any distributions at all and should decide for

themselves whether or not the target dividend yield is reasonable

or achievable.

Asset management

Despite the ongoing economic uncertainty caused by the COVID-19

pandemic, the Investment Manager has remained focused on active

asset management during the Period, undertaking the following

initiatives: ? Completing a new five year lease with a third year

break option to Green Retreats at a vacant industrial unit in

Farnborough at an annual rent of GBP185k, increasing valuation

by GBP0.9m; ? Completing a 10 year lease renewal with a fifth year

break option with BSS Group at an industrial unit in Bristol,

increasing the annual passing rent from GBP250k to GBP255k with

an open market rent review in year five, increasing

valuation by GBP0.3m; ? Simultaneously completing a new 10 year

lease of the vacant ground floor and a five year extension of the

first

floor with Dehns at the Company's recently acquired offices in

Oxford with an aggregate annual passing rent of

GBP271k, increasing valuation by GBP0.2m; ? Completing a new 10

year lease to SpaMedica at a vacant office building in Leicester

with annual rent of GBP87k and

open market rent review in year five, with no impact on

valuation; ? Completing a new lease with Just for Pets on a vacant

retail warehouse unit in Evesham for a term of 10 years with

a break in year six, at an annual rent of GBP95k, with no impact

on valuation; ? Completing a five year lease renewal with Quantem

Consulting at an office building in Birmingham, increasing the

annual passing rent from GBP30k to GBP39k, with no impact on

valuation; and ? Completing a 10 year lease extension with a break

option in year five with Subway at a retail unit in Birmingham,

maintaining the annual passing rent of GBP14k, with no impact on

valuation.

EPRA occupancy has increased from 91.5% to 92.4% largely as a

result of these new lettings.

The positive impact of these asset management outcomes has been

partially offset by the Administration of Rapid Vehicle Repairs

during the Period which has put GBP71k (c.0.2% of the Company's

rent roll) rent at risk.

The portfolio's weighted average unexpired lease term to first

break or expiry decreased to 5.0 years from 5.1 years at 31 March

2021 with the impact of lease re-gears, new lettings and disposals

partially offsetting the natural elapse of a quarter of a year due

to the passage of time.

Borrowings

The Company operates the following loan facilities: ? A GBP35m

revolving credit facility ("RCF") with Lloyds Bank plc ("Lloyds")

expiring on 17 September 2023 with

interest of between 1.5% and 1.8% above three-month LIBOR,

determined by reference to the prevailing LTV ratio of a

discrete security pool. The RCF facility limit can be increased

to a maximum of GBP50m with Lloyds' approval; ? A GBP20m term loan

with Scottish Widows plc ("SWIP") repayable on 13 August 2025 with

interest fixed at 3.935%; ? A GBP45m term loan with SWIP repayable

on 5 June 2028 with interest fixed at 2.987%; and ? A GBP50m term

loan with Aviva Investors Real Estate Finance comprising:

a. A GBP35m tranche repayable on 6 April 2032 with fixed annual

interest of 3.02%; and

b. A GBP15m tranche repayable on 3 November 2032 with fixed

annual interest of 3.26%.

The Company is in the process of extending the term of the RCF

to expire in September 2024, which the Board expects to complete

before 30 September 2021.

Each facility has a discrete security pool, comprising a number

of the Company's individual properties, over which the relevant

lender has security and covenants: ? The maximum LTV of the

discrete security pool is between 45% and 50%, with an overarching

covenant on the Company's

property portfolio of a maximum 35% LTV; and ? Historical

interest cover, requiring net rental receipts from each discrete

security pool, over the preceding three

months, to exceed 250% of the facility's quarterly interest

liability.

The Company has GBP173.1m (30% of the property portfolio) of

unencumbered assets which could be charged to the security pools to

enhance the LTV on individual loans. The Company complied with all

loan covenants during the Period.

Portfolio analysis

At 30 June 2021 the Company's property portfolio comprised 159

assets with a net initial yield9 of 6.4% (31 March 2021: 6.6%). The

portfolio is split between the main commercial property sectors, in

line with the Company's objective to maintain a suitably balanced

investment portfolio. Sector weightings are shown below:

Valuation

Period valuation

30 Jun movement Weighting by Weighting by

2021 Weighting by value 30 Period valuation income10 income10

Jun 2021 GBPm movement 30 Jun 2021 31 Mar 2021

GBPm

Sector

Industrial 295.1 51% 20.2 7.5% 42% 41%

Retail 103.4 18% 3.6 3.6% 21% 21%

warehouse

Other11 83.7 15% (0.8) (1.0%) 16% 16%

Office 55.4 10% 0.4 0.7% 12% 12%

High street 37.8 6% (4.4) (10.5%) 9% 10%

retail

Total 575.4 100% 19.0 3.4% 100% 100%

9 Passing rent divided by property valuation plus purchaser's

costs.

10 Current passing rent plus ERV of vacant properties.

11 Comprises drive-through restaurants, car showrooms, trade

counters, gymnasiums, restaurants and leisure units.

The Company operates a geographically diversified property

portfolio across the UK, seeking to ensure that no one region

represents more than 50% of portfolio income. The geographic

analysis of the Company's portfolio at 30 June 2021 was as

follows:

Valuation Period valuation Weighting Weighting

Weighting by value 30 Jun movement by income9 by income9

30 Jun 2021 30 Jun 31 Mar

2021 GBPm Period valuation 2021 2021

movement

GBPm

Location

West Midlands 120.1 21% 2.5 2.2% 20% 20%

North-West 98.7 17% 0.9 1.0% 17% 17%

South-East 79.0 14% 7.4 10.3% 14% 14%

East Midlands 71.3 12% 1.3 1.8% 14% 14%

South-West 61.2 10% 0.4 0.6% 10% 10%

North-East 56.7 10% 3.2 6.0% 10% 10%

Scotland 50.2 9% 1.4 2.9% 9% 9%

Eastern 32.5 6% 1.6 5.1% 5% 5%

Wales 5.7 1% 0.3 5.3% 1% 1%

Total 575.4 100% 19.0 3.4% 100% 100%

For details of all properties in the portfolio please see

www.custodianreit.com/property-portfolio.

- Ends -

Further information:

Further information regarding the Company can be found at the

Company's website www.custodianreit.com or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numis.com/funds

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, which

listed on the main market of the London Stock Exchange on 26 March

2014. Its portfolio comprises properties predominantly let to

institutional grade tenants on long leases throughout the UK and is

principally characterised by properties with individual values of

less than GBP10m at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By principally targeting sub GBP10m lot-size,

regional properties, the Company seeks to provide investors with an

attractive level of income with the potential for capital

growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit www.custodianreit.com and

www.custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: DIV

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

Sequence No.: 118529

EQS News ID: 1221850

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1221850&application_name=news

(END) Dow Jones Newswires

July 27, 2021 03:57 ET (07:57 GMT)

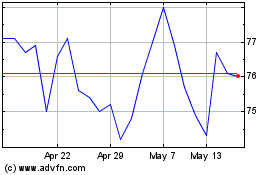

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

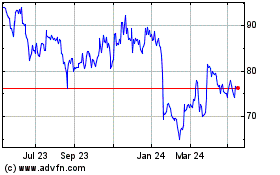

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024