Custodian REIT plc : Unaudited Net Asset Value as at 30 September 2019 (898873)

October 29 2019 - 3:00AM

UK Regulatory

Custodian REIT plc (CREI)

Custodian REIT plc : Unaudited Net Asset Value as at 30 September 2019

29-Oct-2019 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

29 October 2019

Custodian REIT plc

("Custodian REIT" or "the Company")

Unaudited Net Asset Value as at 30 September 2019

Custodian REIT (LSE: CREI), the UK commercial real estate investment

company, today reports its unaudited net asset value ("NAV") as at 30

September 2019 and highlights for the period from 1 July 2019 to 30

September 2019 ("the Period").

Financial highlights

· NAV total return per share1 for the Period of -0.04% with a 1.6625p

dividend approved for the Period being offset by a 1.7p decrease in NAV,

primarily due to property valuation decreases

· NAV per share of 104.3p (30 June 2019: 106.0p)

· NAV of GBP428.5m (3 0 June 2019: GBP432.7m)

· Net gearing2 of 20.5% loan-to-value (30 June 2019: 22.8%)

· Increase in the Company's revolving credit facility ("RCF") from GBP35m to

GBP50m for a three year term plus a two year extension option, with the

interest rate margin above three-month LIBOR reduced from 2.45% to between

1.5% and 1.8%

· GBP2.9m of new equity raised during the Period at an average premium of

11.9% to dividend adjusted NAV per share

· Market capitalisation of GBP483.0m (30 June 2019: GBP484.1m)

Property highlights

· Property value of GBP547.2m (30 June 2019: GBP568.0m):

· Disposal of two properties at valuation3 for aggregate headline

consideration of GBP15.7m4

· GBP7.0m valuation decrease (1.2% of property value), primarily due to

decreases in the estimated rental value ("ERV") of high street retail

properties and negative market sentiment for retail assets

· EPRA occupancy5 95.5% (30 June 2019: 95.9%)

· Continued focus on active asset management

· Since the Period end GBP24.65m6 invested in the acquisition of eight

distribution units

1 NAV per share movement including dividends approved for the Period.

2 Gross borrowings less cash (excluding tenant rental deposits and

retentions) divided by property valuation.

3 Before disposal costs of GBP0.1m.

4 Before rental top-ups and cost guarantees of c. GBP0.3m.

5.ERV of let property divided by total property ERV.

6 Before acquisition costs and completion balance sheet adjustments.

Net asset value

The unaudited NAV of the Company at 30 September 2019 was GBP428.5m,

reflecting approximately 104.3p per share, a decrease of 1.7p (1.6%) since

30 June 2019:

Pence per share GBPm

NAV at 30 June 2019 106.0 432.7

Issue of equity 0.1 2.9

Valuation movements relating to:

- Loss on disposal of investment (0.0) (0.1)

properties (net of disposal costs)

- Valuation movements (1.8) (7.0)

Acquisition costs7 (0.0) (0.2)

Net valuation movement (1.8) (7.3)

Income earned for the Period 2.4 9.8

Expenses and net finance costs for the (0.7) (2.8)

Period

Dividends paid8 (1.7) (6.8)

NAV at 30 September 2019 104.3 428.5

7 Acquisition costs relate to unconditional costs incurred on acquisitions

completed following the Period-end.

8 A dividend of 1.6625p per share was paid on shares in issue throughout the

Period.

The NAV attributable to the ordinary shares of the Company is calculated

under International Financial Reporting Standards and incorporates the

independent property valuation as at 30 September 2019 of GBP547.2m (30 June

2019: GBP568.0m) and income for the Period but does not include any provision

for the approved dividend of 1.6625p per share for the Period to be paid on

29 November 2019.

Acquisitions since the Period end

On 1 October 2019 the Company acquired the share capital of John Menzies

Property 4 Limited to facilitate the purchase of a portfolio of distribution

units ("the Menzies Portfolio") for an agreed purchase price of GBP24.65m via

a sale and leaseback transaction with Menzies Distribution Limited ("MDL").

The Menzies Portfolio comprises eight units across the UK with a passing

rent of GBP1.61m, reflecting a net initial yield9 ("NIY") of 6.4%. The

Portfolio's weighted average unexpired lease term to first break or expiry

("WAULT") is 8.8 years and the acquisition increased the Company's net

borrowings to 23.2% loan-to-value ("LTV").

9 Passing rent divided by property valuation plus purchaser's costs.

Property market

Commenting on the regional commercial property market, Richard

Shepherd-Cross said:

"The investment market has been notably quiet this quarter with transaction

volumes down 20% from 2018 according to Knight Frank research. While

overseas investors still make up a significant proportion of buyers,

domestic investors have increased activity to account for 53% of the market.

That said, the institutional managers of open-ended funds have recorded low

acquisition activity, with most being net sellers of (typically) larger

lot-size assets to meet current redemption pressures.

"While reduced transaction volumes tell a story about demand, it is also an

issue for supply. Opportunities that meet the investment criteria of

Custodian REIT have been in very short supply, resulting in a third quarter

where the Company made no property acquisitions.

"Custodian REIT's investment strategy has always been weighted towards

regional industrial and logistics assets, which has stood the Company in

good stead again this quarter. Valuation gains of 2.1% in this sector during

the Period point to both underlying rental growth and continued investment

demand. We expect the addition of the Menzies Portfolio, post Period-end,

will prove to be an excellent addition to this sector of the Company's

property portfolio.

"There has been much focus in the press on the woes of retailers and the

resulting impact on real estate. There is no doubt that the over-supply of

shops on the high street needs to be addressed and, while a number of

Company Voluntary Arrangements ("CVAs") have reduced rents on specific

assets, there remains widespread rental value decline as a result of this

over-supply. Notwithstanding these falls in rental value, Custodian REIT has

continued to focus on maintaining occupancy whilst securing cash flow. We

have worked with tenants to retain them in occupation following CVAs and at

lease expiry or break, resulting in 96.2% occupancy across our high street

retail property portfolio.

"We have previously forecast greater resilience in the out of town retail

market, which benefits from a restricted supply, generally free parking and

the convenience that is complementary to online sales for both 'click &

collect' and customer returns. This forecast remains robust, although the

read-across from the impact on high street retailers and investors generally

turning away from the retail sector as a whole, for the moment is in turn

having a negative impact on retail warehouse values.

"Regional offices have provided fairly stable returns over the Period.

Sustained demand coupled with low levels of development and restricted

supply of Grade A offices in regional markets has led to rental growth,

which is most apparent in the six major regional cities where Grade A rents

are hitting new headline peaks. Although the costs of office ownership

(through landlord's capital expenditure and tenant lease incentives) remain

higher for offices than other sectors, we expect to see a relatively steady

market ahead. WeWork is a relatively new entrant into the regional office

market but continues to make headlines both corporately and in new office

lettings. Time will tell whether it will be complementary or competitive to

the Custodian REIT strategy but at present it has minimal impact on the

markets in which we operate.

"Custodian REIT benefits from a balanced and diverse property portfolio with

17% of income derived from 'other' assets, which are broadly showing

resilience from occupiers and continued demand from investors seeking to

diversify out of retail.

"This diversification successfully mitigates some of the challenges in

retail, whilst the continued asset management of the property portfolio is

supporting the Company's NAV."

Asset management

Owning the right properties at the right time is one key element of

effective property portfolio management, which necessarily involves some

selling from time to time to balance the property portfolio. While Custodian

REIT is not a trader, it is important to identify opportunities to dispose

of assets significantly ahead of valuation or that no longer fit within the

Company's investment strategy.

After focused pre-sale asset management, the following two properties were

sold at valuation during the Period for a headline consideration of GBP15.7m:

· A city centre office unit with retail on the ground floor in Edinburgh

for GBP9.1m, in line with valuation; and

· An industrial unit in Wolverhampton for GBP6.6m, in line with valuation.

Since the Period-end we have promptly reinvested the proceeds from these

disposals into the Menzies Portfolio which is better aligned with the

Company's long-term investment strategy.

A continued focus on active asset management including rent reviews, new

lettings, lease extensions and the retention of tenants beyond their

contractual break clauses have partially offset the negative valuation

impact of reductions in ERVs in the high street retail sector and a

reduction in valuation yields due to worsening market sentiment. Initiatives

completed during the Period were:

· Completing a lease renewal with Laura Ashley at Colchester where the

tenant has taken a five year lease with a third year tenant only break

option, with annual passing rent falling from GBP118k to GBP106k;

· Completing a lease renewal with Specsavers in Norwich which has taken a

10 year lease with a fifth year tenant only break option, with annual

passing rent falling from GBP200k to GBP126k;

· Retained Waterstones in Scarborough beyond its contractual lease expiry

on a flexible lease arrangement whilst the unit is re-marketed, with

annual passing rent falling from GBP93k to GBP45k;

· Completed a 10 year lease extension, subject to a fifth year tenant only

break option, with Equinox Aromas in Kettering with no change to annual

passing rent; and

· Completing six electric vehicle charging point leases to Instavolt

across a number of retail warehouse sites within the property portfolio,

generating an additional GBP18k in annual contracted rent on 15 year leases.

Further initiatives on other properties currently under review are expected

to complete during the coming months.

These positive asset management outcomes have been tempered by the recent

exercise of a tenant only break option effective from August 2020 and two

tenants confirming their intention to vacate premises at lease expiry in

2020, which put annual aggregate rent of GBP650k at risk.

Property portfolio analysis

The property portfolio's WAULT fell to 5.3 years from 5.6 years in June 2019

reflecting the natural elapse of a quarter of a year due to the passage of

time.

At 30 September 2019 the Company's property portfolio comprised 153 assets

(30 June 2019: 155 assets) with a NIY of 6.7% (30 June 2019: 6.7%). The

property portfolio is split between the main commercial property sectors, in

line with the Company's objective to maintain a suitably balanced property

portfolio. Slight swings in sector weightings reflect market pricing at any

given time and the desire to maintain an opportunistic approach to

acquisitions. Sector weightings are shown below:

Valuation Weighting Period Weighting Weighting

by value valuati by by

30 Sep on income10 income10

2019 movemen 30 Sep 30 Jun

30 Sep 2019 t 2019 2019

GBPm GBPm

Sector

Industrial 226.6 41% 4.7 38% 38%

Retail 117.2 21% (5.3) 23% 22%

warehouse

Other11 92.5 17% (1.5) 17% 17%

High street 58.3 11% (4.9) 12% 12%

retail

Office 52.6 10% - 10% 11%

Total 547.2 100% (7.0) 100% 100%

10 Current passing rent plus ERV of vacant properties.

11 Includes car showrooms, petrol filling stations, children's day

nurseries, restaurants, gymnasiums, hotels and healthcare units.

The valuation decrease of GBP7.0m was primarily driven by high street retail

and retail warehouse valuations falling by GBP4.9m and GBP5.3m respectively, due

to a reduction in high street retail ERVs and a worsening of investment

market sentiment towards retail. We believe low rents per sq ft, 'big box'

formats, free parking and a complementary relationship with online through

continued growth in 'click & collect' mean retail warehouse valuations and

rents are likely to remain more robust than in the High Street during the

remainder of the year. The retail valuation declines were tempered by

industrial asset valuations increasing by GBP4.7m due to latent rental growth

and continued investor demand.

The Company operates a geographically diversified property portfolio across

the UK seeking to ensure that no one region represents an overweight

position. The geographic analysis of the Company's property portfolio at 30

September 2019 was as follows:

Valuation Weighting Period Weighting Weighting

by value valuat by income12 by income12

30 Sep ion 30 Sep 30 Jun

2019 moveme 2019 2019

30 Sep nt

2019

GBPm

GBPm

Location

West Midlands 122.2 22% (1.4) 21% 21%

North-West 93.4 17% 1.2 18% 18%

South-East 71.3 13% (4.3) 13% 13%

East Midlands 69.4 13% (0.3) 14% 13%

South-West 68.9 13% (1.6) 11% 11%

North-East 51.7 9% - 10% 10%

Scotland 37.8 7% 0.4 7% 8%

Eastern 27.2 5% (0.2) 5% 5%

Wales 5.3 1% (0.8) 1% 1%

Total 547.2 100% (7.0) 100% 100%

12 Current passing rent plus ERV of vacant properties.

For details of all properties in the portfolio please see

www.custodianreit.com/property-portfolio [1].

Activity and pipeline

Commenting on pipeline, Richard Shepherd-Cross said:

"We are considering a pipeline of opportunities and have terms agreed to

fund the development of a drive-through coffee shop in Nottingham. We

believe a selective approach to acquisitions can still yield investment

opportunities in the current market and consider the Company well positioned

with long-term debt facilities and low net gearing to take advantage of

opportunities as they arise."

Financing

Equity

The Company issued 2.5m new ordinary shares of 1p each ("the New Shares")

during the Period raising proceeds of GBP2.9m. The New Shares were issued at

an average premium of 11.9% to the unaudited NAV per share at 30 June 2019,

adjusted to exclude the dividend paid on 30 August 2019.

Debt

On 17 September 2019 the Company and Lloyds Bank plc agreed to increase the

total funds available under the Company's RCF from GBP35m to GBP50m for a term

of three years, with an option to extend the term by a further two years

subject to Lloyds Bank plc's agreement, and a reduction in the rate of

annual interest to between 1.5% and 1.8% above three-month LIBOR, determined

by reference to the prevailing LTV ratio. The RCF includes an 'accordion'

option with the facility limit initially set at GBP46m, which can be increased

to GBP50m subject to Lloyds Bank plc's agreement.

At the Period end the Company had:

· A GBP50m RCF with Lloyds Bank plc with interest of between 1.5% and 1.8%

above three-month LIBOR, determined by reference to the prevailing LTV

ratio expiring on 17 September 2022;

· A GBP20m term loan with Scottish Widows plc with interest fixed at 3.935%

and is repayable on 13 August 2025;

· A GBP45m term loan with Scottish Widows plc with interest fixed at 2.987%

and is repayable on 5 June 2028; and

· A GBP50m term loan with Aviva Investors Real Estate Finance comprising:

i) A GBP35m tranche repayable on 6 April 2032 with fixed annual interest

of 3.02%; and

ii) A GBP15m tranche repayable on 3 November 2032 with fixed annual

interest of 3.26%.

Dividends

An interim dividend of 1.6625p per share for the quarter ended 30 June 2019

was paid on 30 August 2019. The Board has approved an interim dividend

relating to the Period of 1.6625p per share payable on 29 November 2019 to

shareholders on the register on 25 October 2019.

In the absence of unforeseen circumstances, the Board intends to pay

quarterly dividends to achieve a target dividend13 per share for the year

ending 31 March 2020 of 6.65p (2019: 6.55p). The Board's objective is to

grow the dividend on a sustainable basis, at a rate which is fully covered

by projected net rental income and does not inhibit the flexibility of the

Company's investment strategy.

13 This is a target only and not a profit forecast. There can be no

assurance that the target can or will be met and it should not be taken as

an indication of the Company's expected or actual future results.

Accordingly, shareholders or potential investors in the Company should not

place any reliance on this target in deciding whether or not to invest in

the Company or assume that the Company will make any distributions at all

and should decide for themselves whether or not the target dividend yield is

reasonable or achievable.

Inside information

The Board is satisfied that any inside information which the Directors and

the Investment Manager may have has been notified to a regulatory

information service. The Company is therefore not prohibited from issuing

new securities during the closed period which ends on the date of the

announcement of the Interim Report for the period ended 30 September 2019.

- Ends -

Further information:

Further information regarding the Company can be found at the Company's

website www.custodianreit.com [2] or please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240 8740

Imlach / Ian Mattioli MBE

www.custodiancapital.com [3]

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numis.com/funds

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, which listed on the

main market of the London Stock Exchange on 26 March 2014. Its property

portfolio comprises properties predominantly let to institutional grade

tenants on long leases throughout the UK and is principally characterised by

properties with individual values of less than GBP10m at acquisition.

The Company offers investors the opportunity to access a diversified

property portfolio of UK commercial real estate through a closed-ended fund.

By targeting sub GBP10m lot-size, regional properties, the Company intends to

provide investors with an attractive level of income with the potential for

capital growth.

Custodian Capital Limited is the discretionary investment manager of the

Company.

For more information visit www.custodianreit.com [2] and

www.custodiancapital.com [3].

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 25536

EQS News ID: 898873

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=be531edfb7113375e33d32944df93de5&application_id=898873&site_id=vwd&application_name=news

2: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=44eae66ce326b2005a19503bbab5faed&application_id=898873&site_id=vwd&application_name=news

3: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=c24dec6d0ea6c746569ddd52de0eca8d&application_id=898873&site_id=vwd&application_name=news

(END) Dow Jones Newswires

October 29, 2019 03:00 ET (07:00 GMT)

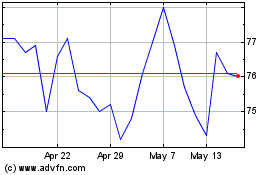

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

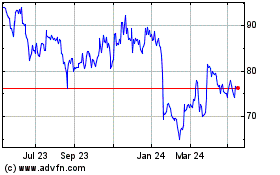

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024