Custodian REIT plc : Extension of Revolving Credit Facility (879523)

September 26 2019 - 2:00AM

UK Regulatory

Custodian REIT plc (CREI)

Custodian REIT plc : Extension of Revolving Credit Facility

26-Sep-2019 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

26 September 2019

Custodian REIT plc

("Custodian REIT" or "the Company")

Extension of Revolving Credit Facility

Custodian REIT (LSE: CREI), the UK property investment company, is pleased

to announce the extension of its revolving credit facility ("RCF").

On 25 February 2014, the Company agreed a RCF of GBP25 million with Lloyds

Bank Commercial Banking ("Lloyds Bank") for a term of five years, and on 13

November 2015, the total funds available under the RCF were increased from

GBP25 million to GBP35 million with the termination date extended to 13 November

2020. The RCF is secured by way of a first charge over a discrete portfolio

of properties, requiring a maximum loan to value ("LTV") ratio of 50% on

those properties specifically charged to it, and interest cover of at least

250%. Under the terms of the agreement the Company pays annual interest of

2.45% above three-month LIBOR on outstanding amounts drawn from time to

time.

On 17 September 2019 the Company and Lloyds Bank agreed to increase the

total funds available under the RCF from GBP35 million to GBP50 million for a

term of three years, with an option to extend the term by a further two

years subject to Lloyds Bank's agreement, and a reduction in the rate of

annual interest to between 1.5% and 1.8% above three-month LIBOR ,

determined by reference to the prevailing LTV ratio.

The RCF includes an 'accordion' option with the facility limit initially set

at GBP46 million, which can be increased to GBP50 million subject to Lloyds

Bank's agreement.

Commenting on the extension of the RCF, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's discretionary

investment manager), said:

"Since IPO, the RCF has been crucial in providing flexibility to facilitate

the Company's growth while minimising cash drag from equity issuance and

opportunistic property disposals to maintain a fully covered dividend. We

are delighted to have increased the RCF to GBP50 million and secured it for at

least three more years at a lower interest margin, which should reduce net

finance costs, provide additional capacity to exploit acquisition

opportunities and maintain the flexibility to minimise cash drag."

Richard Round, Relationship Director for Real Estate & Housing in the

Midlands at Lloyds Bank, said:

"Custodian REIT has gone from strength to strength since its IPO in 2014 and

we are pleased to have supported it throughout its journey. From loans in

2015, the first long-term financing agreement through our partnership with

Scottish Widows, and 2016 to, most recently, extending its RCF.

"This deal will ensure Custodian REIT can expand its property portfolio to

drive further growth. We look forward to seeing the business prosper in the

coming years and supporting it every step of the way."

-Ends-

For further information, please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240 8740

Imlach / Ian Mattioli MBE

www.custodiancapital.com [1]

Numis Securities Limited

Nathan Brown / Hugh Jonathan Tel: +44 (0)20 7260 1000

www.numiscorp.com

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757 4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust with a portfolio

comprising properties predominantly let to institutional grade tenants

throughout the UK, principally characterised by properties with individual

values of less than GBP10 million at acquisition.

The Company offers investors the opportunity to access a diversified

portfolio of UK commercial real estate through a closed-ended fund. By

principally targeting sub GBP10 million lot size regional properties, the

Company intends to provide investors with an attractive level of income and

the potential for capital growth, becoming the REIT of choice for private

and institutional investors seeking high and stable dividends from

well-diversified UK real estate.

Custodian Capital Limited is the discretionary investment manager of the

Company.

For more information visit www.custodianreit.com [2] and

www.custodiancapital.com [1].

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 21259

EQS News ID: 879523

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=c24dec6d0ea6c746569ddd52de0eca8d&application_id=879523&site_id=vwd&application_name=news

2: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=44eae66ce326b2005a19503bbab5faed&application_id=879523&site_id=vwd&application_name=news

(END) Dow Jones Newswires

September 26, 2019 02:00 ET (06:00 GMT)

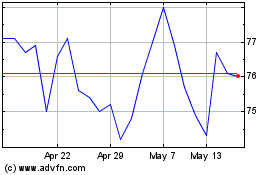

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Aug 2024 to Sep 2024

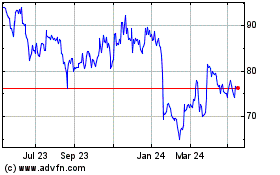

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Sep 2023 to Sep 2024