Custodian REIT PLC Purchase of Property Portfolio (7476B)

June 21 2016 - 2:00AM

UK Regulatory

TIDMCREI

RNS Number : 7476B

Custodian REIT PLC

21 June 2016

21 June 2016

Custodian REIT plc

("Custodian REIT" or "the Company")

Purchase of Property Portfolio

Custodian REIT (LSE: CREI), the UK property investment company,

is pleased to announce the acquisition of an GBP11.5 million

portfolio of three properties ("the Portfolio").

The Portfolio comprises:

-- 25,471 sq ft office on Pegasus Business Park, Castle

Donington, adjacent to East Midlands Airport and Junction 23A of

the M1, let to National Grid plc with an unexpired lease term of

6.2 years;

-- 16,470 sq ft office in Cheadle, Greater Manchester, at

Junction 3 of the M60 and nine miles from Manchester Airport, let

to Wienerberger Limited with an unexpired lease term of 2.1 years;

and

-- 119,600 sq ft industrial unit in Wolverhampton, four miles

from Junction 1 of the M54, let to Assa Abloy Limited with an

unexpired lease term of 2.1 years.

The Portfolio's current passing rent of GBP0.99 million reflects

a net initial yield of 8.04%, with an expected reversionary yield

of 9.63%.

The purchase price of GBP11.5 million was funded from the

Company's cash resources, following the drawdown of a new GBP45

million term loan on 6 June 2016. Net gearing(1) following the

acquisition has increased to 14.9%.

Commenting on the transaction, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's discretionary

investment manager), said:

"We are very pleased to have secured the Portfolio which is well

aligned to our investment strategy, comprising good quality,

smaller lot size, regional office and industrial assets. The

properties are single let and occupied by strong tenants that are

committed to the locations. The Portfolio also offers the potential

for proactive asset management, with a number of opportunities

identified and explored with stakeholders during the due diligence

process."

(1) Gross borrowings less unrestricted cash divided by property

portfolio valuation.

-Ends-

For further information, please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Nathan Tel: +44 (0)116 240

Imlach / Ian Mattioli 8740

www.custodiancapital.com

Numis Securities Limited

Nathan Brown / Hugh Jonathan Tel: +44 (0)20 7260

1000

www.numiscorp.com

Camarco

Ed Gascoigne-Pees Tel: +44 (0)20 3757

4984

www.camarco.co.uk

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, which

listed on the main market of the London Stock Exchange on 26 March

2014. Its portfolio comprises properties predominantly let to

institutional grade tenants on long leases throughout the UK and is

characterised by small lot sizes, with individual property values

of less than GBP7.5 million at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By targeting smaller lot size properties, the

Company intends to provide investors with an attractive level of

income with the potential for capital growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit www.custodianreit.com and

www.custodiancapital.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQPGUUWQUPQGQU

(END) Dow Jones Newswires

June 21, 2016 02:00 ET (06:00 GMT)

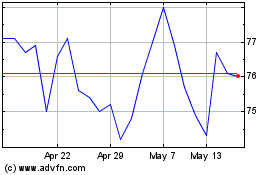

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

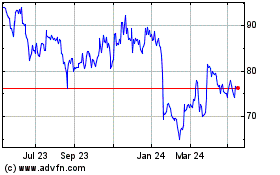

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024