TIDMCMRS TIDMBZT

RNS Number : 8148J

Caerus Mineral Resources PLC

26 August 2021

26 August 2021

Caerus Mineral Resources PLC

('Caerus' or the 'Company')

Selection of Targets for Review and Joint Venture

Caerus Mineral Resources (LON: CMRS), the exploration and

resource development company focused on developing mineral

resources in Europe to support the global "Clean Energy"

initiative, is pleased to announce that the Troulli Project has

been selected as the first project for Joint Venture in

consultation with Bezant Resources (LON: BZT) ("Bezant").

Highlights

-- The Joint Venture partners will hold site meetings during the

first two weeks of September to review the Troulli Project

-- The Project comprises the Troulli, Kokkinapetra and Anglisides Licences

-- The remaining Cypriot projects (Kalavasos, N. Mathiatis and

Mala) and their various assorted metal-bearing surface materials

and hard rock mineralisation will also be visited and reviewed.

The Joint review, which will also have input from Jubilee Metals

Group (LON: JLP), will cover all waste recycling and hard rock VMS

projects within the Caerus portfolio with an emphasis on Troulli as

the first Joint Venture project between Caerus and Bezant. A

diamond drilling and Mineral Resource Estimation programme will be

agreed for Troulli along with other detailed sampling programmes

specifically for mineralogical and metallurgical test work, bulk

sampling, site surveys and preliminary economic assessment leading

to a mining plan and processing plant design.

Martyn Churchouse, Chief Executive Officer of Caerus Mineral

Resources, commented : "The opportunity to spend time on-site with

our partners reviewing the Troulli Project in detail will be

invaluable. This represents a significant step in the development

of the Company. Our efforts over the past few months to broaden our

footprint in the Brownfield exploration space in Cyprus with two

key acquisitions has resulted in the opportunity to bundle together

licences and their associated mineralised surface materials and

hard rock resources to create projects that meet the expectations

of our preferred partners. Our dual strategy of "Waste to Revenue",

the reprocessing of waste materials, tailings and ore stockpiles

together with the ongoing delivery of hard rock VMS and gold oxide

ores gives us the ideal platform to deliver revenue-generating

Mineral Resources and projects in the shortest possible

timeframe".

For further information , please visit

www.caerusmineralresources.com or contact:

Caerus Mineral Resources plc:

Martyn Churchouse, CEO info@caerusmineralresources.com

+44 (0) 1249 782162

--------------------------------

Novum Securities

--------------------------------

Jon Belliss +44 (0) 20 7399 9425

--------------------------------

Follow us on Twitter at @CaerusMineral

Further Information

Terms of the Bezant Resources Option Agreement

Bezant is a natural resources exploration and development

company focused primarily on copper-gold with projects currently in

Namibia, Zambia, Argentina and the Philippines and a manganese

project in Botswana

-- Exclusive Option Agreement grants Bezant 18 months to assess

the merits and economic prospects of all

Caerus unexploited hard rock mining assets

-- The Agreement allows Bezant to identify one or more of

Caerus' assets to be converted into a Mine Development Project(s)

under a Joint Venture

-- Under any Joint Venture, Bezant has the responsibility to

lead the design, finance, construction and operation phases of an

open-pit or underground mining operation

-- Under the Agreement, Caerus will receive 70% of Joint Venture

cash flow until Caerus' expenditure during the pre-mining

exploration phase has been reimbursed

-- The Agreement complements the existing programme with Jubilee

Metals Group, which covers metal recovery from surface mining

residues within Caerus' licence areas under the Company's waste to

revenue strategy

Troulli Project

The Troulli Project comprises three exploration licences,

Troulli, Kokkinapetra and Anglesides.

Troulli Licence

The Troulli VMS (Volcanogenic Massive Sulphide) copper deposit,

like most copper deposits in Cyprus, was initially discovered in

Roman times as evidenced by the ancient galleries and small remnant

"slag" piles on the License. The first production of any

significance occurred in 1936 when Berdy Mining Limited first

obtained a mining licence. Berdy operated from 1936 - 1962,

erecting the first sulphide flotation plant in 1956, treating a

modest 46,500 tons of copper ore in total. Historical records

suggest that Berdy Mining also produced approximately 1,500 ounces

of gold and 6,000 ounces of silver from the oxide gossan that is

subject to the recent drilling. Sporadic exploration was undertaken

at various times until 1974, when the then-operator Geominco was

forced to close its plant and operation following the Turkish

invasion.

From 2017 to 2021, Ploutonic Resources Ltd. conducted several

phases of exploration including detailed geological mapping,

surface trenching and pitting over the oxide gold zone just to the

south of the current open pit and remnant VMS copper resources. As

a result, Ploutonic discovered a relatively continuous zone of

oxide gold mineralisation that appears to be faulted off from the

upper part of the main Troulli VMS copper deposit. This zone

remains open in all directions and at depth as only the top few

metres of the sulphide mineralisation have been tested.

Significant results from oxide zone in the previous Ploutonic

Resources work include the following:

Table 4: Ploutonic Resources Ltd Channel Sampling

Channel Length (m) Gold (g/t) Silver (g/t)

1 3 5.86 44.97

----------- ----------- -------------

2 2 2.43 11.95

----------- ----------- -------------

3 2 19.65 16.15

----------- ----------- -------------

4 2 13.91 40.35

----------- ----------- -------------

5 4 7.56 46.03

----------- ----------- -------------

6 10 5.12 22.36

----------- ----------- -------------

7 9 2.13 12.79

----------- ----------- -------------

8 5 0.92 38.72

----------- ----------- -------------

9 5 2.28 25.16

----------- ----------- -------------

10 5 5.43 12.04

----------- ----------- -------------

11 3 2.56 3.47

----------- ----------- -------------

12 3 0.61 6.37

----------- ----------- -------------

13 10 0.28 1.32

----------- ----------- -------------

Table 5: Ploutonic Resources Ltd Excavator Pit Sampling

Pit Number Depth (m) Gold (g/t) Silver (g/t)

1 4 0.97 6.2

---------- ----------- -------------

2 6 3.0 9.5

---------- ----------- -------------

3 4 0.47 5.2

---------- ----------- -------------

4 1.5 0.81 3.5

---------- ----------- -------------

5 6 0.42 3.2

---------- ----------- -------------

6 4 0.36 3.6

---------- ----------- -------------

7 2.5 0.26 2.3

---------- ----------- -------------

8 5.5 1.19 7.73

---------- ----------- -------------

9 4 0.7 1.5

---------- ----------- -------------

10 4 0.52 6.05

---------- ----------- -------------

11 2.3 1.9 19.2

---------- ----------- -------------

12 2.5 2.06 4.8

---------- ----------- -------------

13 6 0.19 1.53

---------- ----------- -------------

14 4 0.1 1.45

---------- ----------- -------------

Kokkinapetra Licence

The Kokkinapetra Project represents the geological extension of

the Troulli deposits. Oxide gold mineralisation is evidenced by

extensive surface gossans covering a reported area of 32,000m(2)

and to a depth of approximately 20m. There are also indications of

VMS-type copper - gold mineralisation located beneath the overlying

epithermal gold occurrence. Trench samples returned Au grades

ranging from 0.56 - 1.52g/t Au. Kokkinapetra according to an

independent consultant remains "a relatively unexplored target for

concealed sulphide deposits". Judicious placement of a limited

number of drill collars should quickly establish both the thickness

of the oxide gold package and the whereabouts of the underlying

Cu-Au VMS potential.

Anglesides Licence

Metal-bearing surface materials are represented by shallow

scattered waste dumps generated by underground workings in the

1930's associated with small-scale production (88 long tons @ 5.98%

cu & 1,336 short tons @ 24.5g/t Au & 86.4g/t Ag). The

remaining tonnage is unknown. There may also be unidentified waste

material derived from ancient artisanal mining.

Hard rock resources include Cu-Au sulphide mineralisation

reported to occur in a near-surface zone 25m thick, 40m wide over a

strike length of 200m associated with a NE-SW shear zone. Historic

drill results include 16m @ 1.1% Cu & 1.05g/t Au, 21m @ 0.45%

Cu & 0.72g/t Au, 1.71% Cu & 2.81g/t Au over 9m. Potentially

>500Kt @ >1% Cu eq. There is scope for a significant increase

in the Cu-Au sulphide resource. An oxide Au zone identified by

gossan records impressive grades including channel samples of 10m @

6.56g/t Au, 10m @ 4.72g/t Au, 10m @ 4.02g/t Au and 5m @ 11.9g/t Au.

A modest tonnage high-grade gold resource is evident.

Qualified Persons

The content of this news release has been reviewed, verified,

and approved by H. Andrew Daniels, P.Geo in his capacity as a

Qualified Person as defined by National Instrument 43-101.

About Caerus Mineral Resources plc

Caerus Mineral Resources is a copper - gold resource development

and exploration company with mineral exploration licences located

in Cyprus.

Cyprus is a member of the European Union that operates to

English common law. The Country has a well-developed infrastructure

and a climate conducive to year-round exploration.

With investors recognising copper as one of the cornerstone

metals for the Clean Energy Transition centred upon the Electric

Vehicle and Stationary Energy Storage sectors, Caerus is working to

rapidly expand its copper exploration and production objectives.

The Caerus licence portfolio includes 16 former mines which

operated with an average head grade of approximately 2% Cu.

Caerus' licence portfolio comprises brownfield sites where

historic mining has taken place and greenfield licences where there

has been no systematic exploration. The Brownfield sites and the

former high-grade copper-gold mines they host are evidence of rock

types and structures conducive to Volcanogenic Massive Sulphide

("VMS") mineralisation. As VMS deposits characteristically occur in

camps or clusters, it is the Company's view that its licences are

prospective for both extensions to existing or mined-out orebodies

together with new discoveries.

The combination of brown and greenfield exploration provides

optionality with multiple target types and the opportunity for the

Company to quickly build a resource portfolio that can be

commercially developed under a 'Waste to Revenue' strategy.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

JVEPPUUGRUPGPUA

(END) Dow Jones Newswires

August 26, 2021 02:00 ET (06:00 GMT)

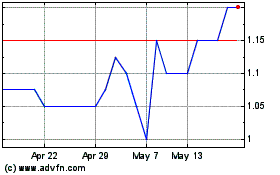

Critical Mineral Resources (LSE:CMRS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Critical Mineral Resources (LSE:CMRS)

Historical Stock Chart

From Nov 2023 to Nov 2024