Caerus Mineral Resources PLC Sale and Disposal of Nickel-Cobalt Licences (8837G)

July 29 2021 - 2:00AM

UK Regulatory

TIDMCMRS

RNS Number : 8837G

Caerus Mineral Resources PLC

29 July 2021

29 July 2021

Caerus Mineral Resources PLC

('Caerus' or the 'Company')

Sale and Disposal of Nickel-Cobalt Licences

Caerus Mineral Resources (LON: CMRS), the exploration and

resource development company focused on developing mineral

resources in Europe to help support the global "Clean Energy"

initiative, is pleased to announce the disposal of the Black Pine

nickel-cobalt project and associated licences to Aeramentum

Resources Pty. Ltd ("Aeramentum") , a private Australian company

with near-term plans to become a public listed company by way an

IPO on the Australian Stock Exchange (ASX), for a total

consideration of GBPGBP500,000. The disposal is by way of a sale

for a combination of cash and equity in Aeramentum, and at no

discount to book value.

Black Pine comprises Ni-Co-Cu massive sulphide mineralisation

hosted in serpentinised structural zones in ultramafic rocks. The

four licences presently owned by Caerus have an exploration history

over a 15km strike length, but this will extend to 45km upon issue

of two additional 25km(2) Reconnaissance Licence now under

application. Upon completion, Aeramentum will have 100% ownership

of licences that encompass all known Ni-Co-Cu mineralisation and

prospective geology in Southern Cyprus.

Reasons for Disposal

The Company's Prospectus, published at Admission, indicated that

the Black Pine licences were a 'non-core' asset and that no

exploration expenditure was budgeted in the near future. With the

licences requiring renewal in 2021, in order to protect their

value, and with areal extensions available within the same

geological province, the Company has decided to realise value for

the combined assets by an 'off-market' disposal. Nickel-cobalt,

though essential Battery Metals, do not form a part of the

Company's current plans which are focused firmly on copper-gold

projects in Cyprus.

Consideration

The transaction between the Company and Aeramentum is a disposal

for cash and equity that values the Black Pine and related licence

assets at GBPGBP500,000 (ca. AUS$0.93M), payable as follows:

The GBPGBP300,000 cash element of the transaction is payable in

two tranches, GBPGBP30,000 immediately in the form of a

non-refundable deposit, and the balance of GBPGBP270,000 on or by

31 August 2021. The equity balance of the transaction is payable to

the Company in the form of shares in Aeramentum, valued at

GBPGBP200,000 and issued to the Company at the IPO price when

Aeramentum becomes a public listed company on the ASX.

The cash injection into the Company from the Black Pine

transaction means that the cash-cost of the Cyprus Gold Mines

acquisition announced on 28 June 2021 is offset in full . The two

transactions, though unconnected per se, are financially neutral

for the Company Treasury and thus safeguard the core funds raised

at IPO specifically for copper-gold exploration as described in the

Prospectus.

Martyn Churchouse, Chief Executive Officer of Caerus Mineral

Resources, commented "This transaction successfully achieves a

number of goals. The cash component covers the full cost of the

recent acquisition of the highly prospective suite of copper-gold

licences that make up Cyprus Gold Mines, the financially neutral

transaction neatly offloads non-core assets whilst bolstering our

Cu-Au portfolio and finally, we are making available exploration

licences that has immediately resulted in further investment in the

Exploration Sector in Cyprus. As previously mentioned, Caerus is

focused on strong capital discipline and the disposal of Black Pine

allows the company to remain focused on its two-pronged strategy

whilst ensuring shareholder value."

For further information , please visit

www.caerusmineralresources.com or contact:

Caerus Mineral Resources plc:

Martyn Churchouse info@caerusmineralresources.com

Chief Executive Officer +44 (0)1249 782162

--------------------------------

Novum Securities

--------------------------------

Jon Belliss +44 (0) 20 7399 9425

--------------------------------

Follow us on Twitter at @CaerusMineral

About Caerus Mineral Resources

Caerus Mineral Resources is a copper - gold resource development

and exploration company with mineral exploration licences located

in Cyprus, a member of the European Union that operates to English

common law. The Country has a well-developed infrastructure and a

climate conducive to year-round exploration.

With investors recognising copper as one of the cornerstone

metals for the Clean Energy Transition centred upon the Electric

Vehicle and Stationary Energy sectors, Caerus is working to rapidly

expand its copper exploration and production objectives. The Caerus

licence portfolio includes 16 former mines which operated with an

average head grade of approximately 2% copper.

Caerus' licence portfolio comprises brownfield sites where

historic mining has taken place and greenfield licences where there

has been no systematic exploration. The Brownfield sites and the

former high-grade copper - gold mines they host are evidence of

rock types and structures conducive to Volcanogenic Massive

Sulphide ("VMS") mineralisation. As VMS deposits characteristically

occur in camps or clusters, it is the Company's view that its

licences are prospective for both extensions to existing or

mined-out orebodies together with new discoveries.

The combination of brown and greenfield exploration provides

optionality and the opportunity for the Company to quickly build a

resource portfolio that can be commercially developed.

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this announcement

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISSEWSIUEFSEIW

(END) Dow Jones Newswires

July 29, 2021 02:00 ET (06:00 GMT)

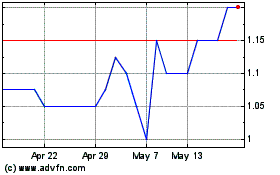

Critical Mineral Resources (LSE:CMRS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Critical Mineral Resources (LSE:CMRS)

Historical Stock Chart

From Nov 2023 to Nov 2024