Comino PLC - Interim Results

November 27 1997 - 2:34AM

UK Regulatory

RNS No 9523q

COMINO PLC

26th November 1997

COMINO ANNOUNCES MAIDEN INTERIM PROFIT

(Interim results for the half year to 30 September 1997)

Comino plc, the group of specialist computer software

companies which floated on AIM in April this year, has

reported its maiden interim results.

Turnover at #5.1million

Profit before tax increased by 40% to #830,000

Earnings per share up 11% to 5.3p

Improved performance across all subsidiary companies:

- Excelsis acquired to complement Context

- ISE and Prologic both expanded customer base

Purchased minority interest in ISE

Prospects

"The Group has established a solid platform from which it can

now move forward and generate strong results. In particular,

ISE with Workflow applications for the efficient delivery of

services to customers via 'call centre' style operations, is

now positioned to contribute to the Group's existing

applications as well as those that result from further

acquisitions."

Comino plc/1

CHAIRMAN'S STATEMENT

Comino is pleased to announce its maiden interim results since

listing on AIM in April of this year. The group has performed

well to 30 September 1997 and the improvement in performance

for the period was reflected across all subsidiary companies.

Prospects are good and in addition Comino has achieved notable

business progress.

The recent fluctuation in your company's share price reflects

speculation and general market anxieties rather than the

underlying strength of the Group. Comino's focus is business

solutions using proven technology for specific market sectors

and as such it is unaffected by a range of factors which have

caused market concern in the technology sector. The Group

continues to apply prudent accounting and revenue recognition

policies.

Immediately prior to the publication of these results, Comino

purchased the remaining 37% of Image Systems Europe (ISE) to

cement the Group's market lead in the application of

specialist Workflow and Electronic Document Management

Systems. The consideration was 802,106 shares and #880,000 in

cash and loan notes and this acquisition will enhance earnings

per share.

On 6 October 1997, Comino acquired the business of Excelsis

Ltd, a competitor in Housing Systems, and transferred this to

its Context subsidiary. The total consideration was #2.25m of

which #657,000 was paid in cash. The benefits are a strong

technical fit, the addition of 100 Housing Associations to the

existing base of 68 customers, a new product which extends the

target market to small and medium sized Housing Associations

and establishment of the Group as a force in Local Authority

Housing with twenty new sites. The gross profit from

recurring revenue in Context now exceeds #3m per annum and the

acquisition will bring the critical mass and economics of

scale important to a market leader. The acquisition will

contribute to profits in the second half and more

significantly in the next financial year.

Comino plc/2

ISE has added a further five Local Authorities and three

Pension Fund Management companies to its customer list and has

opened up the potential for Workflow in both areas. Prologic,

with its enterprise resource management solution for the

fashion and clothing industry, has performed well and added

four new names to its base of thirty-four customers.

The Group has established a solid platform from which it can

now move forward and generate strong results. In particular,

ISE with Workflow applications for the efficient delivery of

service to customers via 'call centre' style operations, is

now positioned to contribute to the Group's existing

applications as well as those that result from further

acquisition. The Board of Directors looks forward confidently

to the future and wishes to thank the hard working and

professional staff in all the Comino companies for their very

positive contribution.

MIKE BROOKE

Chairman

Comino plc

Consolidated Profit and Loss Account

6 months to 8 March 8 March

30 1996 to 1996 to

September

30 30 31 March

September September 1997

1997 1996

#'000 #'000 #'000

Turnover 5,087 3,258 7,792

Cost of sales (1,839) (1,380) (2,875)

Gross profit 3,248 1,878 4,917

Administrative expenses (2,510) (1,314) (3,563)

Operating profits 738 564 1,354

Interest receivable 92 31 71

Interest payable 0 (1) (5)

Profit on ordinary 830 594 1,420

activities before taxation

ationtaxataxation

Tax on profit on ordinary (201) (146) (292)

activities

Profit on ordinary 629 448 1,128

activities after taxation

Minority interest - equity (54) (33) (130)

Profit for the financial 575 415 998

period

Dividend proposed 0 0 (201)

Retained profit for the 575 415 797

period

Earnings per share 5.30p 4.76p 11.46p

Fully diluted earnings per 4.89p 4.25p 9.95p

share

Dividends

In line with statements made at the time of the flotation no

interim dividend will be paid in respect of the year ending 31

March 1998 but the Directors intend to propose a final

dividend to be paid in July 1998. In respect of subsequent

years, the Directors propose to pay interim dividends in

January and final dividends in July.

Comino plc

Consolidated Balance Sheet

30 30 31 March

September September

1997 1996 1997

#'000 #'000 #'000

Tangible fixed assets 254 230 256

Current assets

Freehold property 0 450 0

Stocks 226 62 175

Debtors 3,105 2,655 2,491

Cash at bank and in hand 4,005 1,012 1,894

7,336 4,179 4,560

Creditors falling due within (1,964) (1,473) (1,866)

one year

Net current assets 5,372 2,706 2,694

Total assets less current 5,626 2,936 2,950

liabilities

Creditors falling due after (201) (478) (4)

more than one year

Deferred income (2,003) (1,603) (1,667)

3,422 855 1,279

Capital and reserves

Share capital 552 479 479

Share premium account 1,867 426 426

Merger reserve (434) (379) (434)

Profit and loss account 1,372 415 797

Shareholders' fund 3,357 941 1,268

Minority interests 65 (86) 11

3,422 855 1,279

Comino plc

Consolidated Cash Flow Statement

6 months 8 March 1996 8

to to 1996to March1996

to

1996

1996to

30 30 September 31 March

September

1997 1996 1997

#'000 #'000 #'000

Net inflow from operating 589 (407) 1,006

activities

Net returns on investments

and servicing

of finance

Interest received 92 31 71

Interest paid 0 (1) (5)

92 30 66

Tax paid 0 0 (289)

Capital expenditure

Purchase of tangible fixed (81) (17) (110)

assets

Sale of tangible fixed 2 0 3

assets

Net cash outflow from (79) (17) (107)

capital expenditure

Acquisitions and deposits

Acquisition of subsidiary 0 1,135 1,135

undertakings

Disposal of subsidiary 0 0 50

undertakings

Net cash inflow from 0 1,135 1,185

acquisitions

Financing

Issue of shares (net of 1,514 0 0

costs)

Repayment of borrowings (5) 0 (6)

Net cash inflow/(outflow) 1,509 0 (6)

from financing

Management of liquid

resources

Increase in short term (2150) 0 (1,000)

deposits

Increase/(decrease in cash) (39) 741 855

Comino plc

Notes to the Interim Accounts

1 The charge for taxation is based on the estimated

effective rate for the financial year allowing for tax

losses brought forward from prior periods.

2 The calculation of earnings per share for the six months

ended 30 September 1997 is based on the profit for the

financial period of #575,000 (1996: #415,000) and on

10,860,917 (1996: 8,708,282) ordinary shares being the

average number of shares in issue during the period.

3 The interim statement, which has been prepared on the

same accounting basis as those set out in the financial

statements for the period ended 31 March 1997, was

approved by the board on 26 November 1997. The foregoing

financial information does not represent accounts within

the meaning of S240 of the Companies Act 1985 and has not

been reported on by the auditors or delivered to the

Registrar of Companies.

4 The above results for the period ended 31 March 1997 have

been abridged from the full Group accounts for that

period, which received an unqualified auditors' report

and which have been delivered to the Registrar of

Companies.

5 Copies of the interim report will be sent to shareholders

and are also available at the company's registered

office, 2 The Courtyard, Meadowbank, Furlong Road, Bourne

Road, Bucks, SL8 5AJ.

Review Report by the Auditors to Comino plc

We have reviewed the interim financial information for the six

months ended 30 September 1997 set out on pages 2 to 4 which

is the responsibility of, and has been approved by, the

Directors. Our responsibility is to report on the results of

our review.

Our review was carried out having regard to the Bulletin

'Review of Interim Financial Information' issued by the

Auditing Practices Board. This review consisted principally

of applying analytical procedures to the underlying financial

data, assessing whether accounting policies have been

consistently applied, and making enquiries of management

responsible for financial and accounting matters. The review

excluded audit procedures such as test of controls and

verification of assets and liabilities, and was therefore

substantially less in scope than an audit performed in

accordance with Auditing Standards. Accordingly, we do not

express an audit opinion on the interim financial information.

On the basis of our review:

i in our opinion the interim financial information has been

prepared using accounting policies consistent with those

adopted by Comino plc in its financial statements for the

period ended 31 March 1997; and

ii we are not aware of any material modifications that

should be made to the interim financial information as

presented.

For further information:

Garth Selvey, Chief Executive Shirley Whiting

Paul Clifford, Finance Director Citigate Communications Ltd

Comino plc Tel (today) 0171 282 8000

Tel (today) 0171 282 8000 (thereafter) 0113 297 9899

(thereafter) 01628 525433

GRANT THORNTON

REGISTERED AUDITORS

CHARTERED ACCOUNTANTS

END

IR EQFFLDFKEFKE

Cmo (LSE:CMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

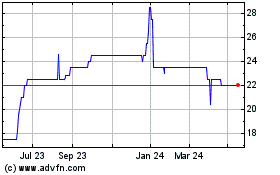

Cmo (LSE:CMO)

Historical Stock Chart

From Jul 2023 to Jul 2024