RNS Number:7710T

Comino Group PLC

08 November 2005

COMINO GROUP PLC:

INTERIM RESULTS 30 SEPTEMBER 2005

Significant improvement;

Healthy order books and substantial opportunities for growth.

Comino Group plc ("Comino"), the provider of service delivery solutions for

Local Government, Social Housing and Occupational Pensions, announces Interim

Results for the six months ended 30 September 2005.

The company has reported using the International Financial Reporting Standard

(IFRS) and has restated comparatives. During the period, the company continued

to make general progress and also gained major contracts for Liverpool and

Manchester in Social Care and Social Housing respectively.

In his Chairman's report, David Quysner said:

"I am pleased to report that the interim results of Comino Group for the six

months ended 30 September 2005 show a significant improvement compared with the

same period last year. This is reflected in profits, operating profit margin and

order books."

Financial Highlights

* H1 turnover up 7% to #13.1m (2004: #12.2m)

* Profit before tax up 65% to #1.40m (2004: #0.85m)

* Order book 44% up compared with 2004

* Interim dividend of 3.0 pence per share (2004: 2.5p).

* Cash balances at 30 September 2005 of #8.2m (2004: #7.3m).

* Earnings per share 6.8p (2004: 4.1p).

Operational Highlights

* Major contract win in Social Care with Liverpool

* Major contract win in Social Housing with Manchester

* Continuing progress in extending Comino product "council-wide"

* Comino Connect sales up 61% compared to the same period last year.

Referring to the outlook for Comino, David Quysner, Chairman, said:

"Order books are healthy and our major markets continue to provide significant

opportunities for growth. Comino is well positioned both to complete the present

year successfully and to build on its reputation for the provision of effective

Service Delivery Solutions."

Comino plc Binns & Co PR Ltd

Garth Selvey, Chief Executive Tel: 020 7786 9600 on the day Peter Binns, Paul McManus

Paul Clifford, Finance Director Thereafter: 01628 525 433 Tel: 020 7786 9600

Mob: 07980 541 893

Editor's notes:

Comino provides Service Delivery Solutions for Local Government, Social Housing

and Occupational Pensions administration. Comino's products incorporate

workflow, computerised telephony and electronic document management. Comino has

its own technology in these areas and uses it to improve customer service and

administration performance generally across a customer base of some 400

organisations.

Case oriented workflow gives the user a complete picture together with access to

relevant records and documents that allow timely decisions to be made. Business

process reengineering defines and optimises the flow of information and the

result is a more seamless and responsive organisation.

Comino's operating companies are based near Maidenhead and in Leeds, Croydon and

the West Midlands.

CHAIRMAN'S STATEMENT

I am pleased to report that the interim results of Comino Group for the six

months ended 30 September 2005 show a significant improvement compared with the

same period last year. This is reflected in profits, operating profit margin and

order books.

For the first time, these accounts are prepared in accordance with International

Financial Reporting Standards (IFRS). Comparative periods are restated. Full

details of the transition to IFRS are given later in this report but the

introduction of IFRS for Comino results in no change to revenue recognition or

cashflows and has a relatively minor effect otherwise.

Profits

Profit before tax for the six month period to 30 September 2005 was #1.40m

(2004: #849,000) an increase of 65%. Last year included an exceptional charge of

#407,000 relating to the settlement of a legal claim. If this were added back

for comparison purposes the increase would be 12%.

Cash and Dividend

At 30 September 2005, cash balances were #8.2m compared with #7.3m at the same

time last year. An interim dividend of 3.0 pence per share (2004: 2.5p) will be

paid on 26 January 2005.

Turnover and Order Books

Turnover for the half year was #13.1m (2004: #12.2m) an increase of 7%. Against

a continuing backdrop of strong recurring revenues, order intake for products

and services increased by 24% compared with the same period last year. The

closing order book finished 44% higher leaving the group well positioned as it

enters the second half.

Operational Achievements

Within Local Government, we continue to win business in established areas such

as Revenues & Benefits and Planning departments, adding 15 Local Authority

systems in the first half of the financial year. There are now 120 users of our

Revenues & Benefits product and 35 users of our Planning system. Examples of

other departmental orders added in the half year period include workflow

processes and electronic document management for Environmental Services, Human

Resources, Payroll and Social Care.

This time last year, Comino recognised that Social Care presented a major

opportunity and we have been making steady progress in this area. An earlier

contract with Warrington, to implement Electronic Social Care Records, has been

followed with an #850,000 order from Liverpool City Council working in

partnership with BT. Liverpool is an existing user of our Universal Revenues &

Benefits product and this new implementation will provide key processes for

Social Services.

Other customers such as Chester le Street, East Devon and South Staffordshire

are also extending the use of Comino products across the council.

A major contract has been won in Social Housing with Manchester City Council

with a first phase order value of #2m. Comino will deliver an integrated

Service Delivery Solution to help support the Council's ambitious plans for

Manchester's housing.

Manchester is one of the largest orders that Comino has ever won. The contract

serves to reinforce our housing product strategy and confirms its relevance to

both Local Authorities and Housing Associations.

In Occupational Pensions, the upgrading of existing sites to the latest version

of the Universal Pension Management (UPM) product continues along with a

significant new installation at the Church of England Pensions Board. Third

party pensions administrators offering services based on UPM continue to win new

business.

Turnover in Comino Connect has increased by 61% to #1.5m compared with the same

period last year. Some additional investment has held first half profits at the

same level as last year but the benefit of this investment should begin to show

in the second half. The company continues to implement and manage solutions for

telephony, teleworking and fully integrated voice and data solutions.

Outlook

Order books are healthy and our major markets continue to provide significant

opportunities for growth. Comino is well positioned both to complete the present

year successfully and to build on its reputation for the provision of effective

Service Delivery Solutions.

Staff & customers

I would like to thank our employees for their continuing efforts and our

customers for their much appreciated business and support.

David Quysner

CHAIRMAN

7 November 2005

Consolidated Income Statement

6 months to 6 months to Year to

30 September 30 September 31 March

2005 2004 2005

#000 #000 #000

Revenue 13,061 12,229 25,533

Cost of sales (2,502) (2,402) (5,012)

Gross profit 10,559 9,827 20,521

Operating costs before exceptional charge (9,342) (8,711) (18,082)

1,217 1,116 2,439

Exceptional charge - settlement of claim 0 (407) (407)

Operating profit 1,217 709 2,032

Interest received 184 140 265

Profit before income tax 1,401 849 2,297

Income tax (420) (242) (712)

Profit for the period 981 607 1,585

Attributable to:

Equity holders of the parent 950 567 1,567

Minority interest 31 40 18

981 607 1,585

Basic earnings per share 6.8p 4.1p 11.3p

Diluted earnings per share 6.6p 4.0p 11.1p

Consolidated Balance Sheet

30 September 30 September 31 March

2005 2004 2005

#000 #000 #000

Non- current assets

Property, plant and equipment 2,638 2,687 2,693

Intangible assets 2,788 2,715 2,838

Deferred tax assets 250 271 252

5,676 5,673 5,783

Current assets

Inventories 848 847 857

Trade and other receivables 7,441 6,626 7,186

Cash and cash equivalents 8,232 7,336 11,029

16,521 14,809 19,072

Current liabilities

Trade and other payables (2,920) (3,471) (3,692)

Current tax liabilities (1,422) (728) (2,079)

Deferred income (7,086) (6,615) (8,691)

(11,428) (10,814) (14,462)

Net current assets 5,093 3,995 4,610

Net assets 10,769 9,668 10,393

Equity

Share capital 699 694 697

Share premium account 4,932 4,796 4,855

Retained earnings 4,834 3,884 4,553

Total shareholders' equity 10,465 9,374 10,105

Minority interest 304 294 288

Total equity 10,769 9,668 10,393

Consolidated Cash Flow Statement

6 months to 6 months to Year to

30 September 30 September 31 March

2005 2004 2005

#000 #000 #000

Cash flows from operating activities

Operating profit 1,217 709 2,032

Share based payments expense 29 1 18

Depreciation 349 341 716

Amortisation of intangible assets 50 50 100

Loss on disposal of property, plant and 2 0 1

equipment

Decrease/(Increase) in inventories 9 5 (5)

Decrease/(Increase) in trade and other receivables (255) 691 131

(Decrease)/Increase in trade and other payables (1,605) (1,874) (349)

(Decrease)/Increase in deferred income (1,538) (2,052) 24

Cash (used in)/generated from operations (1,742) (2,129) 2,668

Interest received 184 140 265

Income tax paid (246) (282) (560)

Net cash (used in)/generated from operating (1,804) (2,271) 2,373

activities

Net cash used in investing activities

Purchase of property, plant and equipment (296) (395) (778)

Purchase of intangible assets (63) (126) (250)

Purchase of subsidiary undertaking 0 0 (158)

(359) (521) (1,186)

Net cash used in financing activities

Issue of share capital 79 0 62

Dividends paid (713) (611) (959)

(634) (611) (897)

Net (decrease)/increase in cash and cash (2,797) (3,403) 290

equivalents

Opening cash and cash equivalents 11,029 10,739 10,739

Closing cash and cash equivalents 8,232 7,336 11,029

Notes to the consolidated interim financial statements

These consolidated interim financial statements of Comino Group plc ("the

Company") for the six months ended 30 September 2005 comprise the Company and

its subsidiaries (together "the Group"). The consolidated interim financial

statements were authorised for issuance on 8 November 2005. The financial

statements are unaudited but have been reviewed by Grant Thornton UK LLP and

their report is set out below.

1. Basis of preparation

EU law (IAS Regulation EC 1606/2002) requires that the next annual consolidated

financial statements of the Group, for the year ending 31 March 2006, be

prepared in accordance with International Financial Reporting Standards ("IFRS")

adopted for use in the EU ("Adopted IFRS").

This interim financial information has been prepared on the basis of the

recognition and measurement requirements of IFRS in issue that either are

endorsed by the EU and effective (or available for early adoption) at 31 March

2006 or are expected to be endorsed and effective (or available for early

adoption) at 31 March 2006, the Group's first annual reporting date at which it

is required to use Adopted IFRS. Based on these IFRS, the directors have made

assumptions about the accounting policies expected to be applied when the first

annual IFRS financial statements are prepared for the year ending 31 March 2006.

The Adopted IFRS that will be effective (or available for early adoption) in the

annual financial statements for the year ending 31 March 2006 are still subject

to change and to additional interpretations and therefore cannot be determined

with certainty. Accordingly, the accounting policies for that annual period will

be reviewed to reflect such changes applicable as at the date of preparation of

the annual financial statements for the year ending 31 March 2006.

An explanation of how the transition to IFRS has affected the reported financial

position and financial performance of the Group is provided in note 8. This note

includes reconciliations of equity and profit or loss for the comparative

periods reported under UK Generally Accepted Accounting Practice ("UK GAAP") to

those reported for those periods under IFRS.

The policies set out below have been consistently applied to all the periods

presented.

The preparation of interim financial statements requires management to make

judgements, estimates and assumptions that affect the application of policies

and reported amounts of assets and liabilities, income and expenses. Actual

results may differ from these estimates.

The comparative figures for the financial year ended 31 March 2005 have been

extracted from the Group's statutory accounts for that year and restated under

IFRS. Those accounts, which were prepared under UK GAAP, have been reported on

by the Group's auditors and delivered to the registrar of companies. The report

of the auditors was unqualified and did not contain statements under section 237

(2) or (3) of the Companies Act 1985.

2. Accounting policies

The transition to IFRS from UK GAAP has resulted in limited changes to the

accounting policies for the Group. The accounting policies under UK GAAP were

set out in the Annual Report and Financial Statements for the year ended 31

March 2005. Significant changes resulting from the adoption of IFRS are detailed

below.

(a) Basis of consolidation

The consolidated financial statements comprise the financial statements of the

Company and all its subsidiary undertakings as at 31 March each year. The

financial statements of the subsidiaries are prepared for the same reporting

year as the parent company, using consistent accounting policies, but in

accordance with UK GAAP. The results of subsidiary undertakings acquired during

the period are included from the date of acquisition using the acquisition

method. Profits or losses on intra-group transactions are

eliminated in full. On acquisition of a business or subsidiary all of the

acquired assets and liabilities which exist at the date of acquisition are

recorded at their fair value.

(b) Business combinations and goodwill

As a matter of accounting policy, purchased goodwill first accounted for in

accounting periods ending before 23 December 1998 was eliminated from the

financial statements by immediate write-off on acquisition against reserves.

Such goodwill will be eliminated on the subsequent disposal of business to which

it relates.

Goodwill recognised under UK GAAP prior to the date of transition to IFRS (1

April 2004) is stated at net book value as at this date. Goodwill recognised

subsequent to 1 April 2004 represents the excess of the fair value of the

consideration over the fair values of the identifiable assets acquired. Goodwill

is reviewed for impairment, annually or more frequently if events or changes in

circumstances indicate that the carrying value may be impaired.

(c) Research and development

Research expenditure is recognised as an expense as incurred. Costs incurred on

the development of new or substantially improved products are capitalised as

intangible assets when it is probable that the project will be a success,

considering its commercial and technological feasibility, resources are

available to complete the development, and costs can be reliably measured. The

expenditure capitalised are the direct labour costs together with other costs

which are directly attributable to the development of the product. Other

development expenditures are recognised as an expense as incurred. Product

development costs previously recognised as an expense are not recognised as an

asset in a subsequent period.

Capitalised product development expenditure is stated at cost less accumulated

amortisation and impairment losses. Product development costs that have been

capitalised are amortised from the time of development on a straight-line basis

over the expected useful life.

(d) Share-based payments

The Group operates share based incentive plans. No expense is recognised in

respect of share incentives granted before 7 November 2002. For share incentives

granted after 7 November 2002 the fair value of the incentives granted is

recognised as an employee expense with a corresponding increase in equity. The

fair value is measured at grant date and spread over the period during which the

employees become unconditionally entitled to the incentives. The fair value of

the incentives granted is measured using a Black-Scholes model.

(e) Taxation

Income tax on the profit or loss for the periods presented comprises current and

deferred tax. Current and deferred tax are recognised in the income statement,

except when the tax relates to items charged or credited directly to equity, in

which case the tax is also dealt with in equity.

Current tax is the expected tax payable on the taxable income for the year,

using tax rates enacted or substantially enacted at the balance sheet date, and

any adjustment to tax payable in respect of previous periods.

Deferred tax is recognised on all temporary differences where the transactions

or events that give the Group an obligation to pay more tax in the future, or a

right to pay less tax in the future, have occurred by the balance sheet date.

Deferred tax assets are recognised when it is more likely than not that they

will be recovered. Deferred tax is measured using rates of tax that have been

enacted or substantially enacted by the balance sheet date.

(f) Cash and cash equivalents

Cash and cash equivalents includes cash in hand, deposits held at call with

banks and other short-term highly liquid investments with original maturities of

three months or less.

(g) Employee benefits (other than share-based payments)

Pensions costs charged against profits represent the amount of contributions

payable to schemes in respect of the accounting period. All schemes are defined

contribution schemes.

A liability for short-term compensated absences, such as holiday, is recognised

for the amount the Group may be required to pay as a result of the unused

entitlement that has accumulated at the balance sheet date.

(h) Dividends

Dividends to the Company's shareholders are recognised as a liability and

deducted from shareholders' equity in the period in which the shareholders'

right to receive payment is established.

3. Segmental reporting

6 months to 6 months to Year to

30 September 2005 30 September 2004 31 March 2005

#000 #000 #000

Revenue

Local Government 6,150 6,323 12,484

Social Housing 4,236 3,980 8,741

Occupational Pensions 1,103 857 1,991

Comino software solutions 11,489 11,160 23,216

ISP & network solutions 1,492 926 1,966

Project costing 80 143 351

13,061 12,229 25,533

Result

Comino software solutions 1,493 947 2,604

ISP & network solutions 155 155 237

Project costing (230) (136) (254)

1,418 966 2,587

Unallocated corporate expenses (201) (257) (555)

1,217 709 2,032

The result of the Comino software solutions segment for the six months ended 30

September 2004 and the year ended 31 March 2005 is after charging an exceptional

item of #407,000.

4. Tax

The charge for tax for the six months ended 30 September 2005 has been

calculated based on the anticipated effective tax rate for the financial year.

5. Dividends

An interim dividend in respect of the year to 31 March 2006 of 3.0 pence per

share (2005: 2.5p) amounting to a total dividend of #419,000 (2005: #347,000),

was declared by the directors at their meeting on 7 November 2005. This interim

dividend will be payable on 26 January 2006 to shareholders on the register at

the close of business on 6 January 2006. These financial statements do not

reflect this dividend payable.

6. Earnings per share

The calculation of earnings per share for the six months ended 30 September 2005

is based on the profit for the financial period of #950,000 (2004: #567,000) and

on 13,963,386 (2004: 13,885,802) ordinary shares being the average number of

shares in issue during the period. The calculation of the diluted earnings per

share is based on the earnings per share, adjusted to allow for the issue of

shares and the post tax effects of dividends and interest, on the assumed

conversion of all dilutive options and other dilutive potential ordinary shares.

An adjusted earnings per share has been calculated in respect of the periods to

30 September 2004 and 31 March 2005 and excludes the exceptional item of

#407,000 less taxation. The adjusted earnings per share is 6.1p for the six

months to 30 September 2004 and 13.3p for the year to 31 March 2005.

7. Consolidated Statement of Changes in Shareholders' Equity

Share Share Retained Total Minority Total

capital premium earnings interest equity

#000 #000 #000 #000 #000 #000

Balance at 1 April 2004 694 4,796 3,927 9,417 254 9,671

Profit for the period 1,567 1,567 18 1,585

Share-based payments expense 18 18 18

Issue of share capital 3 59 62 62

Minority interest in acquisition 16 16

Dividends paid (959) (959) (959)

Balance at 31 March 2005 697 4,855 4,553 10,105 288 10,393

Profit for the period 950 950 31 981

Share-based payments expense 29 29 29

Issue of share capital 2 77 79 79

Dividends paid (698) (698) (15) (713)

Balance at 30 September 2005 699 4,932 4,834 10,465 304 10,769

8. Explanation of transition to IFRS

As stated in note 1, these are the Group's first consolidated interim financial

statements prepared in accordance with IFRS. The accounting policies referred to

in note 2 have been applied in preparing the consolidated interim financial

statements for the six months ended 30 September 2005, the comparative

information for the six months ended 30 September 2004, the financial statements

for the year ended 31 March 2005 and the preparation of an opening IFRS balance

sheet at 1 April 2004, the Group's date of transition to IFRS.

In preparing its opening IFRS balance sheet, comparative information for the six

months ended 30 September 2004 and financial statements for the year ended 31

March 2005, the Group has adjusted amounts reported previously in financial

statements prepared in accordance with UK GAAP.

An explanation of how the transition from UK GAAP to IFRS has affected the

Group's financial position and financial performance is set out in the following

tables and notes.

Equity as at 1 April 30 September 31 March

2004 2004 2005

Note #000 #000 #000

Total equity under UK GAAP 9,146 9,152 9,395

Intangible assets: goodwill a 175 358

Dividend payable b 611 347 713

Staff benefits: holiday pay c (123) (8) (112)

Staff benefits_ change in deferred tax asset c 37 2 34

Share-based payments: change in deferred tax asset d 5

Total equity under IFRS 9,671 9,668 10,393

Profit for the period 6 months to Year to

30 September 31 March

Note 2004 2005

Profit for the period under UK GAAP 353 1,232

Intangible assets: goodwill a 175 358

Staff benefits: holiday pay c 115 11

Staff benefits: change in deferred tax asset c (35) (3)

Share-based payments d (1) (18)

Share-based payments: change in deferred tax asset d 5

Profit for the period under IFRS 607 1,585

a. Business combinations and goodwill; IFRS 3

The Group has taken the exemption in IFRS 1 for business combinations. As a

result, the net book value of the goodwill under UK GAAP at 1 April 2004 became

the deemed cost of goodwill at the date of transition to IFRS. Under IFRS this

balance is no longer to be amortised but is subject to impairment testing

annually or more frequently if events or changes in circumstances indicate that

the carrying value may be impaired.

The impact of adopting IFRS is to reverse the amortisation charged throughout

the year to 31 March 2005 and to increase the carrying value of goodwill in the

balance sheets dated 30 September 2004 and 31 March 2005.

b. Dividends payable

Under UK GAAP, dividends were recognised as an appropriation in the profit and

loss account. An accrual was made for dividends that were proposed by directors

after the balance sheet date but prior to the signing of the financial

statements and a corresponding expense was recognised. Under IFRS, dividends are

not recognised in the income statement but are disclosed as a component of the

movement in shareholders' equity. A liability is recorded for a final dividend

when the dividend is approved by the Company's shareholders and for an interim

dividend when the right to receive payment is established. The impact of IFRS is

to remove the accrual for the 2004 interim dividend and the 2005 final dividend

from the respective balance sheets.

c. Employee Benefits; IAS 19

Under UK GAAP, the Group made no provision for any short term compensated

absences, such as holidays. IAS 19 requires that an asset or liability is

recorded at each balance sheet date in respect of any such liabilities.

The impact of adopting IFRS is to expense a new cost in the income statements

and to create a liability for holiday pay in the balance sheet.

d. Share-based payments; IFRS 2

The primary change is that IFRS 2 requires that the fair value for share

incentives to employees be estimated and charged to the profit and loss account

over the vesting period of the incentive. The standard also requires that the

potential tax benefit to the Group from share incentives being exercised in the

future be recorded as a deferred tax asset. Tax charges and credits are only

reflected in the income statement for incentives granted after 7 November 2002

for which the fair value is charged to the profit and loss account. The Group

adopted the exemption in IFRS 1 which allows a first-time adopter to apply the

new standard only to share options and equity instruments granted after 7

November 2002.

The impact of adopting IFRS is to expense a new cost in the income statement.

e. Research and development; IAS 38 Intangible Assets

Under UK GAAP all expenditure on research and development was expensed as

incurred. Under IFRS research expenditure is recognised as an expense as

incurred but costs incurred on the development of new or substantially improved

products are capitalised as intangible assets when it is probable that the

project will be a success, considering its commercial and technological

feasibility, resources are available to complete the development and costs can

be reliably measured. Other development expenditure is recognised as an expense

as incurred. Capitalised product development expenditure is amortised over the

expected useful life. A deferred tax liability arises on the product development

expenditure that has been capitalised. To 30 September 2005, no development

costs have been capitalised, largely as Comino does not currently account for

the cost of the research phase separately from the costs of the development

phase of producing new products. IAS 38 states that if the research phase of a

project to create an intangible asset cannot be distinguished from the

development phase of the project, the company must treat all the expenditure as

if it were incurred in the research phase only.

9. Circulation to shareholders

Copies of this interim report will be sent to shareholders and copies will be

available to the public at the Company's registered office: Comino House,

Furlong Road, Bourne End, Bucks, SL8 5AQ.

Independent Review Report to Comino Group plc

INTRODUCTION

We have been instructed by the company to review the financial information for

the six months ended 30 September 2005 which comprises the consolidated income

statement, consolidated balance sheet, consolidated cashflow statement and the

related notes 1 to 9. We have read the other information contained in the

interim report which comprises only the chairman's statement and considered

whether it contains any apparent misstatements or material inconsistencies with

the financial information.

This report is made solely to the company's members, as a body, in accordance

with guidance contained in APB Bulletin 1999/4 "Review of Interim Financial

Information". Our review work has been undertaken so that we might state to the

company's members those matters we are required to state to them in a review

report and for no other purpose. To the fullest extent permitted by law, we do

not accept or assume responsibility to anyone other than the company and the

company's members as a body, for our review work, for this report, or for the

conclusion we have formed.

DIRECTORS' RESPONSIBILITIES

The interim report including the financial information contained therein is the

responsibility of, and has been approved by, the directors. The directors are

responsible for preparing the interim report in accordance with the Listing

Rules of the Financial Services Authority.

As disclosed in note 1, the next annual financial statements of the group will

be prepared in accordance with those International Financial Reporting Standards

adopted for use by the European Union.

The accounting policies are consistent with those that the directors intend to

use in the next annual financial statements. There is, however, a possibility

that the directors may determine that some changes to these policies are

necessary when preparing the full annual financial statements for the first time

in accordance with those IFRSs adopted for use by the European Union.

REVIEW WORK PERFORMED

We conducted our review in accordance with guidance contained in Bulletin 1999/4

"Review of Interim Financial Information" issued by the Auditing Practices Board

for use in the United Kingdom. A review consists principally of making

enquiries of management and applying analytical procedures to the financial

information and underlying financial data and, based thereon, assessing whether

the accounting policies and presentation have been consistently applied unless

otherwise disclosed. A review excludes audit procedures such as tests of

controls and verification of assets, liabilities and transactions. It is

substantially less in scope than an audit performed in accordance with United

Kingdom auditing standards and therefore provides a lower level of assurance

than an audit. Accordingly, we do not express an audit opinion on the financial

information.

REVIEW CONCLUSION

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30 September 2005.

GRANT THORNTON UK LLP

REGISTERED AUDITORS

CHARTERED ACCOUNTANTS

LONDON

7 November 2005

Note

1 The maintenance and integrity of the Comino Group plc website is the

responsibility of the directors: the interim review does not involve

consideration of these matters and, accordingly, the company's reporting

accountants accept no responsibility for any changes that may have occurred

to the interim report since it was initially presented on the website.

2 Legislation in the United Kingdom governing the preparation and

dissemination of the interim report differs from legislation in other

jurisdictions.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UBVBRVSRARAA

Cmo (LSE:CMO)

Historical Stock Chart

From Aug 2024 to Sep 2024

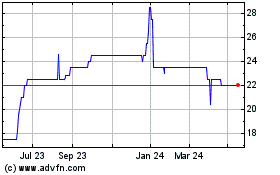

Cmo (LSE:CMO)

Historical Stock Chart

From Sep 2023 to Sep 2024