Comino Group PLC - Final Results

June 08 2000 - 3:01AM

UK Regulatory

RNS Number:8907L

Comino Group PLC

8 June 2000

COMINO GROUP plc

FINAL RESULTS ANNOUNCEMENT

Profit up 28%; EPS up 18%; Dividend up 24%; Substantial order book

Comino Group plc ("Comino"), the provider of software solutions for the social

housing, occupational pensions and local government sectors, announces final

results for the year ended 31 March 2000.

Highlights of the results

2000 1999 Increase

* Turnover #20.5m #18.6m 10%

* Turnover continuing

operations #17.1m #14.3m 20%

* Profit before tax #6.0m

Operating profit & interest - #3.47m #2.72m 28%

Profit on disposal - #2.55m

* Earnings per share 30.8p

(now fully taxed)

Operating profit & interest - 17.9p 15.2p 18%

Profit on disposal - 12.9p

* Proposed dividend 3.1p final 2.5p final

* Total dividend 4.65p 3.75p 24%

* Cash balances #12.4m #7.4m

* Sale of non core subsidiary

* Comino now focused on its 3 core sectors under one common brand and

operating structure

* New Universal Pensions Management product wins industry award and orders

* #1m investment in joint venture ISP/ASP/FM company targeting the housing

sector

* Substantial sale opportunities in social housing with existing customers,

including workflow

* Market share gains in local authorities

The Company made the following comments on its results:

"The Comino Group has completed a further year of excellent performance.. and

is resolved to make its brand name synonymous with innovative, quality

software and services.

Regarding Prospects Comino said:

"Comino starts the new financial year with clearly identifiable opportunities,

a substantial order book and a base of recurring revenue from support

contracts for existing customers."

For further information please contact:

Garth Selvey, Chief Executive tel: 020 7786 9600 on the day

Paul Clifford, Finance Director thereafter: 01628 525433

Peter Binns/Jane Mallinson, Binns & Co tel: 020 7786 9600

Chairman's Statement

The Comino Group has completed a further year of excellent performance. The

non-core business has been sold and the principal operating company, Comino

plc, is now focused on Social Housing, Local Government and Occupational

Pensions under one common brand and operating structure. The company has

established a strong technology platform and is well positioned both to serve

its existing customer base and to develop new products and markets in related

areas.

For the year ended 31 March 2000, profit before taxation was #6.02 million.

This included #3.47 million of operating profit and interest and a capital

gain of #2.55 million from the disposal of the fashion and clothing business

in November of last year. Operating profit and interest were 28% higher than

in the previous year and included #2.92 million attributable to the ongoing

core business.

As expected, sales growth was affected by a slowing in new contracts in the

period up to the millennium. Total turnover increased by 10% to #20.5 million

reflecting a partial year from the disposal. Turnover from continuing

operations increased by 20%. Gross margins were maintained at 69% and

overheads were tightly controlled.

There was a slight shift towards higher margin service revenues, which

compensated for the anticipated downturn in new housing contracts during the

period. The Group is now returning to a more normal and balanced revenue mix,

divided fairly equally amongst annual recurring support, business with the

customer base and new name contracts.

Adjusted EPS of 17.9 pence per share showed an increase of 18%, after being

subjected for the first time to a full tax charge. With the inclusion of the

capital gain, EPS was 30.8 pence per share. Cash balances at the end of the

year were #12.4 million compared with #7.4 million last year. The proposed

dividend of 3.1 pence per share will bring the total for the year to 4.65

pence, an increase of 24% over the previous year.

In Social Housing, there are substantial sales opportunities with existing

customers, where the benefits of Workflow are becoming increasingly apparent.

In Local Authorities, we continue to win market share and we are building the

customer base by the sale of two Revenue & Benefit systems per month. Last

year saw the release of Universal Pensions Management (UPM) as a new

generation product for Occupational Pensions. We enter the new year with

significant new name orders including the West Midlands Pensions Fund. UPM

has won recognition in both the private and the public sectors. It has also

been recognised by the pensions industry itself with the presentation of the

"Systems and Software Provider of the Year" award sponsored by Sun Life

Financial of Canada.

UPM shows what can be achieved in performance and efficiency when Workflow and

Electronic Document Management are used to streamline the business flow and

modernise the customer interface. UPM clearly presents a major growth

opportunity.

The company recently announced a #1 million investment in a joint-venture

company, Comino Montal. This will allow an existing, profitable business to

offer a range of new services to the Comino customer base. Comino Montal will

provide internet access and communications (ISP), facilities for software

rental (ASP), off-site server management and remote network management (FM).

We estimate that there are some 1,000 organisations in Housing alone who could

benefit from ASP services which offer a relatively low cost alternative to

managing their own IT infrastructure. Comino Montal already provides ISP

services for 30 Housing customers and has recently won its first ASP contract

based on Comino's housing software. The operation will become a central

portal to those communities who use Comino software.

Comino starts the new financial year with clearly identifiable opportunities,

a substantial order book and a base of recurring revenue from support

contracts for existing customers.

During the year Gordon Skinner was regrettably obliged to retire as Chairman

through ill health. Gordon was involved with Comino from its inception and

the Board wishes to thank him for his very considerable contribution.

Comino is resolved to make its brand name synonymous with innovative, quality

software and services in its chosen market sectors. We already provide

products which are resilient and systems that provide essential business

functionality. To this, we are now adding the features and benefits which the

internet provides. We are grateful to all our customers and staff for the

contribution which they have made to results for the year just ended and for

helping Comino position itself for an exciting future.

David Quysner

Chairman

Consolidated profit and loss account

for the year ended 31 March 2000

2000 1999

#000 #000

Turnover

Continuing operations 17,125 14,270

Discontinued operations 3,327 4,325

---------- ----------

20,452 18,595

Cost of sales (6,236) (5,784)

---------- ----------

Gross profit 14,216 12,811

Administrative expenses (11,110) (10,377)

---------- ----------

Operating profit

Continuing operations 2,558 2,043

Discontinued operations 548 391

---------- ----------

3,106 2,434

Exceptional item

Profit on disposal of subsidiary 2,549 -

Interest receivable 369 288

Interest payable (4) (4)

---------- ----------

Profit on ordinary activities

before taxation 6,020 2,718

Tax on profit on ordinary activities (1,834) (676)

---------- ----------

Profit on ordinary activities

after taxation 4,186 2,042

Dividends (635) (513)

---------- ----------

Retained profit for the financial year 3,551 1,529

====== ======

Basic earnings per share 30.8p 15.2p

====== ======

Diluted earnings per share 29.9p 14.8p

====== ======

Adjusted earnings per share 17.9p 15.2p

====== ======

The Group had no recognised gains or losses during the year ended 31 March

2000 other than the profit for the year.

Consolidated balance sheet

at 31 March 2000

2000 1999

#000 #000

Fixed assets

Tangible assets 665 649

----------- -----------

Current assets

Stocks 329 859

Debtors 4,754 6,596

Cash at bank and in hand 12,434 7,449

---------- -----------

17,517 14,904

Creditors: amounts falling due

within one year (5,507) (5,678)

----------- -----------

Net current assets 12,010 9,226

----------- -----------

Total assets less current liabilities 12,675 9,875

Creditors: amounts falling due after

more than one year (16) (55)

Deferred income (5,281) (6,545)

----------- -----------

7,378 3,275

=========== ===========

Capital and reserves

Share capital 683 678

Share premium reserve 4,375 4,334

Profit and loss account 2,320 (1,737)

---------- ----------

7,378 3,275

=========== ==========

These financial statements were approved by the Board of Directors on 7 June

2000.

G R Selvey )

Directors

P L Clifford )

Consolidated cash flow statement

for the year ended 31 March 2000

2000 1999

#000 #000

Net cash inflow from operating activities 3,044 4,134

Returns on investment and

servicing of finance

Interest received 369 288

Interest paid (4) (4)

---------- ----------

Net cash inflow from returns on

investments and servicing of finance 365 284

---------- ----------

Taxation (647) (451)

---------- ----------

Capital expenditure

Purchase of tangible fixed assets (512) (341)

Sale of tangible fixed assets 15 29

---------- ----------

Net cash outflow from capital expenditure (497) (312)

---------- ----------

Acquisitions and disposals

Disposal of subsidiary undertaking 3,277 -

---------- ----------

Net cash inflow from acquisitions

and disposals 3,277 -

---------- ----------

Equity dividends paid (550) (502)

---------- ----------

Management of liquid resources

Decrease in short term deposits - 2,200

---------- ---------

Financing

Issue of shares 46 31

Repayment of borrowings (53) (64)

---------- ----------

Net cash outflow from financing (7) (33)

---------- ----------

Increase in cash 4,985 5,320

========== ==========

Notes

1. Earnings per ordinary share have been calculated on the profit for the

financial year of #4,186,000 after taxation and minority interest and on

13,610,139 ordinary shares being the weighted number of ordinary shares

in issue during the year. The calculation of diluted earnings per share

takes account of share options that do not currently rank for dividends

but may do so in the future. The adjusted earnings per share excludes

the profit after tax of #1,750,000 on the disposal of Prologic Computer

Consultants Limited.

2. The financial information set out above does not constitute the statutory

accounts for the period ended 31 March 2000 within the meaning of Section

240 of the Companies Act 1985. Statutory accounts for the year will be

delivered to the Registrar of Companies following the Company's Annual

General Meeting.

3. The annual report and accounts will be posted to shareholders on 8 June

2000 and will also be available on request from the Company's registered

office, Comino House, Furlong Road, Bourne End, Buckinghamshire, SL8 5AJ.

4. The directors are recommending a final dividend of 3.1p per share which,

if approved, will be paid on 27 July 2000 to shareholders on the register

on 23 June 2000.

5. The Annual General Meeting will be held at Binns & Co, 16 St Helen's

Place, London, EC3A 6DF on Friday 7 July 2000 at 11:30 am.

END

FR EAXKXELKEEFE

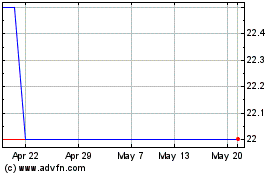

Cmo (LSE:CMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

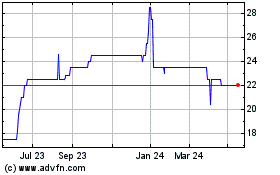

Cmo (LSE:CMO)

Historical Stock Chart

From Jul 2023 to Jul 2024