RNS Number : 3910D

City of London Investment Group PLC

15 September 2008

15 September 2008

CITY OF LONDON INVESTMENT GROUP PLC

("City of London", "the Group", or "the Company")

PRELIMINARY RESULTS FOR THE YEAR TO 31 MAY 2008

City of London Investment Group PLC (AIM: CLIG), a leading emerging market and natural resource asset management group, announces

preliminary results for the year to 31 May 2008.

SUMMARY

* Funds under management (FUM) increased by 24% during the year to US$4.706 billion (2007: US$3.793 billion)

* Profit before tax up 46% to �10.7 million

* Basic earnings per share up 46.5% to 29.3p, fully diluted earnings per share up 47.7% to 26.0p

* Recommended final dividend of 13.5p per share (2007: 7p) payable on 21st November 2008 to shareholders on the register on 31st

October, making a total for the year of 19.5p, up 95% (2007: 10p)

* Office in Dubai opened

* Further progress in developing European business

"The results for the year provide evidence of the success of the Group's strategy in a period of significant market uncertainty and

volatility and illustrate what can be achieved by our focus on investment process (rather than just talented individuals) to deliver

performance for clients whilst keeping fixed costs to a minimum."

Andrew Davison, Chairman

"Whilst in the overall scheme of things we remain a small specialist boutique manager, we do intend to continue to grow our business as

long as we do not compromise our investment performance. We have been quite successful in continuing to expand our non-US business which now

represents 28% of our total FUM as compared with 17% in March of 2006. Over the next year I would hope to be able to report further success

with particular emphasis from a product perspective in areas such as Frontier Markets, Natural Resources and our Developed Markets

closed-end fund business."

Barry Olliff, Chief Executive Officer

For further information about City of London, please visit www.citlon.co.uk or contact:

Doug Allison, Finance Director Simon Hudson / Andrew Dunn

City of London Investment Group PLC Tavistock Communications

Tel: +44 (0)20 7711 0771 Tel: +44 (0)20 7920 3150

Jeff Keating / Fred Walsh Tom Price

Landsbanki Securities (UK) Evolution Securities Limited

Nominated Adviser & Joint Broker Joint Broker

Tel: +44 (0)20 7426 9000 Tel: +44 (0)20 7071 4300

Chairman's Statement

I am pleased to report to you a year of excellent results for which Barry Olliff, the Chief Executive, and his staff deserve both our

thanks and our congratulations. Pre-tax profit increased 46% to �10.7 million (2007: �7.3 million), fully diluted earnings per share

increased 47.7% to 26p from 17.6p and dividends, subject to shareholders' approval, increased by 95% to 19.5p per share.

City of London Investment Group's directors and managers' strategy from inception to the present day has been to build a business that

could better weather the volatility inherent in the markets comprising our investment focus. The results for the year ended 31st May 2008

provide evidence of the success of this strategy in a period of significant market uncertainty and volatility and illustrate what can be

achieved by our focus on investment process (rather than just talented individuals) to deliver performance for clients whilst keeping fixed

costs to a minimum.

Results

Our Financial Statements for the year have been prepared under policies consistent with International Financial Reporting Standards

("IFRS"). As a consequence, results for comparative periods, reported under UK Generally Accepted Accounting Principles (UK GAAP), have been

restated.

Fee income increased by 36% to �24.9 million (2007: �18.3 million), reflecting the rise over the year of funds under management from

US$3.8 billion (�1.9 billion) in May 2007 to US$4.7 billion (�2.4 billion) at this year end. Profit before profit share, interest and

similar income and tax increased by 42% to �14.5 million (2007: �10.2 million). Pre-tax profit increased by 46% to �10.7 million (2007: �7.3

million), after �4.7 million of profit related staff payments (2007: �3.1 million), interest received of �0.44 million (2007: �0.18 million)

and �0.43 million (2007 restated: �0.05 million) of profits on the disposal of seed shareholdings in new funds and options traded. Earnings

per share, after a 33% tax charge of �3.6 million (2007 restated: �2.4 million representing 33% of pre-tax profit), was 29.3p (2007

restated: 20p) and fully diluted earnings per share was 26p (2007 restated: 17.6p).

Dividends

City of London's dividend policy is based on paying dividends to shareholders that are covered approximately one and a half times by

full year profit per share with an annual distribution pattern of roughly one third as an interim dividend and two thirds as a final

dividend. The Board has already declared an interim dividend of 6p per share, which was paid in March 2008 and is now pleased to recommend a

final dividend for the year of 13.5p per share payable on 21st November 2008 to shareholders on the register on 31st October 2008. This

makes a total for the year of 19.5p per share and represents a 95% increase over the 10p paid in respect of the year to end May 2007.

Listing

The Board has reviewed the listing of the Company's shares and considers that a move from AIM to a full listing on the London Stock

Exchange would benefit both City of London and its existing shareholders by improving the standing of the Company, particularly in the USA,

and by broadening the universe of potential investors in the Company and, thereby, increasing liquidity. Landsbanki Securities have been

appointed as sponsors to the Company. Accordingly, the AGM notice includes resolutions covering appropriate changes to the Company's

Articles of Association and the proposed delisting from AIM.

Review

We have again made very good progress in growing the Company through the careful and cautious diversification of our business - in terms

of clients, investment products and geographical reach. A detailed review of this progress is contained in the Chief Executive Officer's

Review below, but I set out the highlights here.

Funds under management began the year at US$3.8 billion and peaked at US$4.9 billion in October 2007 before falling slightly to US$4.7

billion at the year end as emerging markets recovered from a relatively sharp correction in the first quarter of the calendar year. The

substantial year-on-year increases in our funds under management include significant new money from Europe. However, as a result of strong

performance in the emerging and other market sectors in which the Company invests, and also the outperformance created by the Company, a

number of clients' exposures to the sector have become overweight within their overall portfolios. This imbalance was corrected by a series

of rebalancing realisations, largely replenished in our overall funds under management by new money. We believe that rebalancing has been

completed and that further new monies will therefore increase funds under management.

City of London has also diversified its geographical base, both for the management of existing funds and, in due course, for the

sourcing of new mandates, with the opening in November of the new Dubai office. After several months in temporary, serviced accommodation,

we took possession of our new offices in the Dubai International Financial Centre in July, and are already benefiting from a presence on the

ground at the centre of the fast growing Middle Eastern markets.

In order to maximise efficiencies throughout the business and across our four offices around the world, we have committed to a programme

to upgrade our IT systems. IT is a critical component of City of London's performance delivery and this year will see a complete revamp of

our network and communications infrastructure to be followed by the roll-out of a new front office and compliance system. These improvements

and upgrades result from our strategic aim to leverage proven technology to deliver tangible financial benefits to clients and

shareholders.

Finally, one of our original founder shareholders, FMH Investments NV, decided to realise its investment in the Company and in February

the entire stake, representing 29.6% of City of London's then issued share capital, was placed out. The majority of the shares were placed

with existing and new institutional investors by Landsbanki and Evolution Securities (our newly appointed joint brokers). The balance of

some 30% of the stake was bought back for cancellation or acquired by directors and the Company's ESOP. Full details of the transaction are

contained in the Financial Review below.

Board

In May, I was delighted to welcome to the Board Dr Allan Bufferd, Treasurer Emeritus of the Massachusetts Institute of Technology, as a

non-executive director. Dr Bufferd's directorships and trusteeships include Och-Ziff Capital Management Group, Ram Re Holdings, Bessemer

Trust BGO Fund, Boston Advisors, Controlled Risk Insurance Company/ Risk Management Foundation, Morgan Stanley Prime Properties Fund and the

Robert Wood Johnson Foundation. His experience, contacts and wise counsel will, I am sure, benefit City of London greatly.

Outlook

In the first three months of the current financial year, the emerging markets in which we principally invest have declined significantly

due to the deteriorating global economic outlook. This has resulted in funds under management reducing from the year end figure of US$4.7

billion to a first quarter end figure of US$3.9 billion as at 31st August 2008. This is a 16% fall and compares to a decline of 21% in the

MXEF index. The significant depreciation of sterling against the dollar since the year end should have a positive effect on earnings.

2008/9 results will be earned against a much more uncertain background than that of last year. We have already seen funds under

management fall since the year end to a level closer to that at the start of last year. We are however fortunate that the Company's strategy

has positioned us relatively favourably. With maintained focus on our core disciplines and with further diversification of our products and

client base, we hope, subject as always to the performance of our investment markets, to report satisfactory results for the current year.

Andrew Davison

Chairman

12th September 2008

Chief Executive Officer's Review

In my previous annual review, I referenced the fact that the year to May 2007 had been our first full year as a listed company and that

I was surprised that it had, to a great extent, been business as usual. This year we have been tested rather more both by way of markets and

also our clients' reaction to the events in the markets.

Market volatility

First, using the MSCI emerging markets index (MXEF) as a proxy for about 95% of our business, we have had to deal with some significant

volatility over the past year. During August and September as the index rose towards 1,350 we reduced the beta across our clients'

portfolios to around 0.7. In addition we increased cash during this period, from close to zero to nearly 5%. As a relative return manager

each of our accounts is obviously measured against a benchmark and as a result we are not prepared, or in some mandates allowed, to increase

cash to above 5%.

In terms of our beta management we had calculated that at the end of October the index was trading at a standard deviation of around 4X

expensive, this being the most expensive in around 20 years according to our calculations. Both of these risk controls assisted in the

out-performance that we achieved over the next few months and by the end of March 2008 we had achieved a significant level of

out-performance against all of our Emerging Markets benchmarks. We maintained this level of out-performance to the end of the financial

year.

Rebalancing

Second, we have over the past year dealt with a significant level of rebalancing away from our asset class as a result of our asset

class's out-performance when compared with other asset classes and also as a result of our own out-performance against the benchmarks.

Over the past 24 months, the totals were $1,059 million out and $673 million in, leading to a net outflow of $386 million. An

explanation needs to be provided to shareholders regarding these events because the amounts are very significant in terms of our total funds

under management.

As a relative return manager we are given an amount of money to manage for, let us say, an endowment. This endowment will have decided

to place, let us say, 5% of its assets in an emerging markets mandate. Let us further assume that the consultant who has both screened and

assisted in the appointment of CLIM has suggested that the allocation to the emerging markets should be maintained within a band of 4% to

6%, and that this has been agreed by the endowment's committee. At the point that, as a result of the emerging markets out performing the

other asset classes within the endowment's portfolio (further assisted by CLIM's out-performance), the exposure gets to let us say 7%, it is

quite likely that we would receive a rebalancing request thus placing the endowment's exposure to emerging markets via CLIM back within the

4% to 6% range.

In fact as referenced earlier we have replaced these departing assets with new client assets of $673 million over the past two years.

Going forward the outlook is considerably better as not only have rebalancing requests reduced significantly recently, but in addition

we are continuing to receive substantial inflows as shown below. I would further add that in the event that the Emerging Markets were to

underperform for a period (as long as our performance was maintained) we would be likely to be the beneficiary of rebalancing in the reverse

direction.

Put another way, as an institutional manager we are not subjected to the volatility of subscriptions and redemptions of many retail

houses, rather our subscriptions and redemptions (which are generally monthly events) are reflected as above. Obviously, subject to ongoing

satisfactory investment performance the existing assets should remain very sticky.

Cost control

As you are aware we try very hard to run a low cost business. Over the past few years we have reduced the cost/income ratio of our

business from 53% to 28% (as measured before profit-share and treating third party marketing commission and custody as a deduction from fees

rather than as an expense). Whilst in the overall scheme of things we remain a small specialist boutique manager, we do intend to continue

to grow our business as long as we do not compromise our investment performance.

We have been quite successful in continuing to expand our non-US business which now represents 28% of our total FUM as compared with 17%

in March of 2006. Over the next year I would hope to be able to report further success with particular emphasis from a product perspective

in areas such as Frontier Markets, Natural Resources and our Developed Markets closed-end fund business.

Charles River implementation

In keeping with our strategy for the continuing development of our business we have selected The Charles River Investment Management

System (CR IMS) to further automate front office processes and streamline the portfolio management, trading and compliance monitoring of our

global operations. CLIG will benefit from extensive portfolio management tools, integrated trade order management and real-time pre-trade

compliance testing and monitoring on a scalable platform. Implementation of the CR IMS has been initiated and we expect to complete the

first phase of this project early in the 2009 calendar year. Most fund managers would perhaps suggest that $10bn was the size at which this

would be justified, but we have based our decision on our belief that as a result of superior investment performance our FUM will continue

to grow. Obviously if we are correct, this will further reduce the earlier referenced cost/income ratio.

The financial services industry

We are continuing to watch the significant reduction in market capitalisation that is being suffered by many financial service

companies. Many of these have grown very rapidly in the past into areas that they did not understand, with inadequate systems and risk

controls in place. In many instances the pay and other rewards received by many practitioners would seem to be out of all proportion to

their expertise or experience. Further the shareholders who own these businesses do not seem to have done very well from these events

either. Even now it seems amazing that many bonuses remain so high when businesses are losing money. At some point there has to be a

realisation that in many instances these have been flawed business models, that shareholders, the owners, do need to make money, and that a

balance of reward between the various stakeholders rather than greed is what this business is all about.

I would point out that the formula that we employ within CLIG is that the Employee bonus pool is 30% of the pre tax, pre bonus profit.

Shareholders receive the balance of the earnings subject to cover for the dividend being around 1.5 times. Our established policy is to pay

this dividend approximately one third as an interim and the other two thirds as a final dividend. We believe that our clients pay the bills

and our shareholders own the business. We believe that we are charged with the role of managing that business.

A new board member

Recently, Allan Bufferd joined the Board of CLIG. We were introduced to Allan via his role as Treasurer of the Massachusetts Institute

of Technology, where he had worked for 34 years. As a result of Allan's arrival we now have some experienced US Institutional Fund

Management expertise on our Board which I believe will assist us regarding making good strategic decisions regarding the Group over the next

few years.

Currency hedging and sensitivity to our US$ exposure

There are two pieces of information that I would reference in this Statement that appear elsewhere in this announcement. First our

currency hedging programme outlined in the Financial Review below and second the sensitivity of our GBP denominated income to (primarily USD

denominated) fee income. This is also shown in the Financial Review. Obviously, USD/GBP currency sensitivity is particularly relevant at

this time of significant volatility in currencies.

My retirement

Rather than there be any misunderstanding regarding my potential retirement I thought it might be helpful to go into some detail

regarding my present intentions. Obviously I have zero ability to impose my will on either Shareholders or the Group Board, but ideally and

taking into account the previous caveat, it would be my intention to continue to work for at least another five years. Since I reached the

age of sixty, three years ago, I have repeated this each year and would intend to continue to repeat it in this Statement each year for as

long as the plan was unchanged. I would however like to make the point that I do need to start planning for retirement.

To this end it is my present intention to offer an option for 1 million of my CLIG shares to the CLIG ESOP at a price of, say, 300p for

these shares to be distributed via the ESOP according to the rules of the ESOP. Further, separate from any ESOP transaction, in the event

that the CLIG share price appreciates to 400p during the next year it would be my intention, subject to relevant Close Period restrictions,

to sell a further 500,000 shares and to undertake the same at 450p and 500p.

I'm stating this in this review because many founder employee shareholders such as myself, come in for a significant amount of criticism

as a result of these types of transaction. It's my opinion that if this is communicated well in advance of the event, that any criticism

would be unjustified. This should also be seen within the context of my own personal financial circumstances. Effectively all of my wealth

is tied up in CLIG shares, and whilst I have no present intention of retiring I would like to have the opportunity for planning for such an

event at some point in the future.

Dubai office

We opened our Dubai office last November. This office was established to enable us to continue to develop our investment process. We

were of the opinion in establishing the office that there were going to be some major investment opportunities in the region over the next

few years. Prior to the opening of the office we had decided to overweight the region in our emerging market portfolios. Subsequent to

opening the office we have further increased our weighting to the region. This over weighting is one of the major reasons for the

out-performance we have achieved in comparison to our benchmarks over the past year.

Continued growth

If one were to index our FUM from the high of the Index (MXEF 1,340 at the end of October '07) our FUM should have been around $3.17

billion at yesterday's recent low of 840. Instead, FUM were $3.52 billion, representing both the effects of our relative out-performance

versus the Index as well as the net positive subscription activity from our clients. Looking forward to the fourth calendar quarter, we have

at this juncture commitments for another $325m in the pipeline.

CLIG employees

I would like to thank CLIG employees for their continued hard work in what has been a difficult market environment. The relative success

enjoyed by the Group is entirely down to your hard work. I would like to say as a shareholder that the overall team work displayed by you

all is something of which you should be very proud.

Barry Olliff

Chief Executive Officer

12th September 2008

Financial Review

International Financial Reporting Standards

This is the Group's first complete set of annual financial statements prepared in accordance with the requirements of International

Financial Reporting Standards ("IFRS") and their interpretations issued by the International Accounting Standards Board as adopted by the

European Union. With the exception of the exemptions set out below, the Group is required to establish its IFRS accounting policies as at

1st June 2007 and to apply these retrospectively to determine prior period comparatives from 1st June 2006, the date of transition to IFRS.

The one material change arising from the adoption of IFRS is the creation of a deferred tax asset of �3.2 million (2007: �2.4 million),

to reflect the potential tax relief available to the Group as a result of the future exercise of share options. The resulting reserve is

combined with the existing share option reserve. There is no material effect on profit in the current or prior period.

In accordance with the transitional provisions of IFRS 1, the Group has taken advantage of two exemptions available from the general

requirement described above: IFRS 2 - Share-based Payments has been applied only to share-based awards granted after 7th November 2002 that

had not vested as at 1st June 2006. Second, IFRS 3 - Business Combinations has not been applied retrospectively to business combinations

that occurred prior to 1st June 2006.

Consolidated income statement

Group turnover comprises management fees charged as a percentage of funds under management (FUM) and increased by 36% over the period

under review to �24.9 million as a result of the increase in FUM, which ended the year at US$4.7 billion, compared to $3.8 billion at the

start. While US accounts continue to provide the major part of turnover, the proportion generated in Europe doubled for the second year in a

row to �2.8 million (2007: �1.4 million) and now represents 11% of Group turnover (2007: 8%), reflecting the translation of marketing

activity in Europe to new mandates won.

The operating profit derived from this increased turnover was �9.8 million (2007: �7.1 million), an increase of 39%.

Administrative expenses increased in line with turnover to �15.1m, up 34%. This is the natural result of the Group's strategy which

seeks to align a significant proportion of costs with income and profit, principally through the mechanisms of marketing commissions (up

from �2.7 million to �3.6 million) and profit-share (up from �2.9 million to �4.3 million). Overall, taking into account employment taxes on

profit-share payments (including taxes on share option exercises, which are charged to the profit-share pool) of �0.4 million (2007: �0.4

million), these two variable costs at �8.3 million in total constituted nearly 55% of total administrative expenses (2007: �5.9 million,

52%). Of the balance, the most significant element was payroll costs, excluding profit-share, which rose by 19% to �3.6 million, reflecting

an increase in the average number of employees during the year to 50 (previously 44), while the balance of "general overhead" increased from

�2.3 million to �3.2 million, for the most part due to product structuring costs in respect of the European market.

Interest receivable and similar income increased almost fourfold to �0.9 million (2007: �0.2 million), with close to half of this figure

deriving from profit arising on "sale of investments" - i.e. gains realised on the withdrawal of seed funding provided by the Group in

respect of new products, where third party funding or market growth has rendered those investments unnecessary or excessive.

The tax charge for the year was �3.6 million (2007: �2.4 million) representing 33% of profit before taxation (2007: 33%). As usual the

charge is higher than the 30% prevailing rate of UK corporation tax (28% from 1st April 2008) because net income attributable to the US

operations attracts the higher US corporate tax rate of around 45%. Profit for the period, after tax, therefore rose to �7.1 million (2007:

�4.9 million), an increase of 46%.

Consolidated balance sheet and statement of changes in shareholders' equity

While the profit after tax contributed �7.1 million to retained earnings, total equity declined by 9% to �9.8 million (2007: �10.7

million) principally because the Group took advantage of the authority to purchase its own shares and during the year invested a total of

�6.1 million (2007: �0.7 million) in ordinary shares, �5.8 million of this relating to the placing of the stake held by one of the Group's

then largest investors, FMH Investments NV. Out of 1.9 million shares purchased during the year, 1.4 million were cancelled, thereby

reducing equity by �4.5 million, while the balance was retained by the Group's Employee Share Option Trust ("the Trust"), funded by a loan

from the Group, and is classified as investment in own shares. The Trust issues options to the Group's employees and the loan, which at the

year end amounted to �2.8 million (2007: �1.6 million), is repaid as and when these options are exercised.

Dividends paid to shareholders during the year totalled �3.2 million, representing the cost of the final dividend in respect of 2007 of

7p paid in November 2007 and this year's interim dividend of 6p paid in March 2008, the latter reflecting the new dividend cover policy of

approximately 1.5x (previously 2x). The 2007 comparative was the �0.7 million cost of the interim dividend for that year of 3p per share

paid in March 2007.

Despite the share purchase and the dividends, the balance sheet remains highly liquid, with cash balances at the year end of �5.5

million (2007: �6.6 million) representing 56% of net assets (2007: 62%).

The revaluation reserve, which represents the unrealised profit on the Group's seed investments in new products, stood at an unchanged

�0.5 million, which is of course net of the �0.4 million of gains which were realised during the year, as described above.

Currency exposure

Approximately 90% of the Group's income is in US dollars, but its expenses are roughly evenly divided between sterling and US dollars

(with a small Singapore dollar and smaller UAE Dirham element). Consequently, reported sterling income is significantly exposed to movements

in the sterling/US dollar exchange rate, which during the year moved within an approximate range of US$1.93 - 2.10 to �1 (2007: US$1.80 -

2.00 to �1), and since the year end has dipped beneath 1.80.

The table below illustrates the approximate effect of moves in the exchange rate on post tax profits across a range of funds under

management levels, given the current geographical distribution of the expense base:

Funds under management - US$billion

3.5 4.0 4.5 5.0

US$/ Post-tax, �million

�

1.75 5.6 6.8 8.0 9.2

1.80 5.4 6.6 7.8 9.0

1.85 5.3 6.4 7.5 8.7

1.90 5.1 6.2 7.3 8.4

1.95 4.9 6.0 7.1 8.2

Assumes:

1. Average net fee 0.90%

2. Annual operating costs �2.8 million plus US$5.6 million

3. Profit share equivalent to 30% of operating profits

4. Average tax rate of 33%

For example, if funds under management were constant at US$4.5 billion throughout the year, then the impact on sterling post-tax profit

of a move in the exchange rate from US$1.95 to US$1.75 to �1 would be approximately plus �0.9 million on an annualised basis, assuming

unhedged exposure. There is of course a significant degree of natural hedge inherent in the Group's investment process, given that a weaker

US dollar gives an uplift to funds under management as measured in US dollars, and therefore to US dollar fees, so it is no coincidence that

FUM tends to move inversely to $ strength, ceteris paribus.

As in previous years, balance sheet currency exposure is hedged by forward sales, with a total of US$6.2 million sold forward at the

balance sheet date (2007: US$4.5 million).

Share options

As at 31st May 2008, there were 3,958,310 options on ordinary shares outstanding (2007: 4,797,675), representing 15.6% of the current

issued share capital. Of the options outstanding at the year end, 1,458,310 (2007: 2,297,675) are over shares held by the Employee Share

Option Trust and their eventual exercise will therefore result in no dilution to existing shareholders' interests. Dilutive share options

represent 9.9% of issued share capital.

Doug Allison

Finance Director

12th September 2008

Consolidated income statement

For the year ended 31st May 2008

Note Total

Total 2007

2008 (as restated)

� �

Revenue 1 24,878,839 18,304,881

Administrative expenses

Staff costs 7,925,916 5,954,730

Other administrative expenses 6,968,479 5,139,946

Depreciation 158,474 120,494

(15,052,869) (11,215,170)

Operating profit 2 9,825,970 7,089,711

Interest receivable and similar income 3 868,870 226,731

Profit before taxation 10,694,840 7,316,442

Income tax expense 4 (3,559,124) (2,420,500)

Profit for the period 7,135,716 4,895,942

Basic earnings per share 5 29.3p 20.0p

Diluted earnings per share 5 26.0p 17.6p

Consolidated balance sheet

31st May 2008

Note 2008 2007

� (as

restated)

�

Non-current assets

Property and equipment 296,740 193,362

Other financial assets 52,048 46,859

Deferred tax asset 3,208,323 2,357,851

3,557,111 2,598,072

Current assets

Trade and other receivables 3,573,214 2,613,212

Available-for-sale financial assets 1,861,375 2,231,989

Other financial assets 30,335 59,665

Cash and cash equivalents 5,498,910 6,616,824

10,963,834 11,521,690

Current liabilities

Trade and other payables (3,068,821) (2,162,168)

Current tax payable (1,487,571) (1,047,906)

Creditors, amounts falling due within one (4,556,392) (3,210,074)

year

Net current assets 6,407,442 8,311,616

Total assets less current liabilities 9,964,553 10,909,688

Non-current liabilities

Deferred tax liability (193,177) (196,059)

Net assets 9,771,376 10,713,629

Capital and reserves

Called up share capital 7 253,605 267,777

Share premium account 1,357,283 1,357,283

Investment in own shares 8 (2,811,878) (1,573,525)

Revaluation reserve 450,747 457,471

Share option reserve 3,468,673 2,519,442

Capital redemption reserve 14,172 -

Retained earnings 7,038,774 7,685,181

Total equity 9,771,376 10,713,629

Consolidated statement of changes in shareholders' equity

31st May 2008

Share Share Investment in own Revaluation Share Capital Retained earnings Total

capital premium shares reserve option redempt � �

� account � � reserve ion

� � reserve

�

Group

At 1st June 2006 267,777 1,357,283 (1,027,283) 94,154 1,010,876 - 3,525,103 5,227,910

Purchase of own shares - - (670,948) - - - - (670,948)

Share option exercise - - 124,706 - - - - 124,706

Increase in fair value* - - - 363,317 - - - 363,317

Share based payment - - - - 124,520 - - 124,520

Deferred tax - - - - 1,384,046 - - 1,384,046

Profit for the period - - - - - - 4,895,942 4,895,942

Dividends paid - - - - - - (735,864) (735,864)

At 1st June 2007 267,777 1,357,283 (1,573,525) 457,471 2,519,442 - 7,685,181 10,713,629

Purchase of own shares - - (1,590,642) - - - - (1,590,642)

Share option exercise - - 352,289 - - - - 352,289

Share cancellation (14,172) - - - - 14,172 (4,544,432) (4,544,432)

Increase in fair value* - - - 202,136 - - - 202,136

Released on disposal* - - - (208,860) - - - (208,860)

Share based payment - - - - 141,083 - - 141,083

Deferred tax - - - - 808,148 - - 808,148

Profit for the period - - - - - - 7,135,716 7,135,716

Dividends paid - - - - - - (3,237,691) (3,237,691)

At 31st May 2008 253,605 1,357,283 (2,811,878) 450,747 3,468,673 14,172 7,038,774 9,771,376

* Net of deferred tax

Cash flow statement

For the year ended 31st May 2008

Note 2008 2007

� (as

restated)

�

Cash flow from operating activities

Operating profit 9,825,970 7,089,711

Adjustments for:

Depreciation charges 158,474 120,494

Share based payment charge 141,083 124,520

Translation adjustments on investments 50,223 68,177

Cash generated from operations before changes 10,175,750 7,402,902

in working capital

Increase in trade and other receivables (960,002) (476,900)

Increase in trade and other payables 906,653 782,691

Cash generated from operations 10,122,401 7,708,693

Interest received 438,109 196,487

Interest paid (1,691) -

Taxation paid (3,161,783) (2,190,642)

Net cash generated from operating activities 7,397,036 5,714,538

Cash flow from investing activities

Purchase of property and equipment (261,852) (87,917)

Purchase of non-current financial assets - (255)

Proceeds from sale of non-current financial 14,424 29,627

assets

Purchase of current financial assets (1,208,121) (580,139)

Proceeds from sale of current financial 1,961,075 114,161

assets

Net cash generated/(used) in investing 505,526 (524,523)

activities

Cash flow from financing activities

Ordinary dividends paid 6 (3,237,691) (735,864)

Purchase and cancellation of own shares (4,544,432) -

Purchase of own shares by employee share (1,590,642) (670,948)

option trust

Proceeds from sale of own shares by employee 352,289 124,706

share option trust

Net cash used in financing activities (9,020,476) (1,282,106)

Net (decrease)/increase in cash and cash (1,117,914) 3,907,909

equivalents

Cash and cash equivalents at start of period 6,616,824 2,708,915

Cash and cash equivalents at end of period 5,498,910 6,616,824

Notes

For the year ended 31st May 2008

1..Basis of accounting

The contents of this preliminary announcement have been extracted from the Company's Annual Report, which is currently in print and will

be distributed within the next two weeks. The information shown for the years ended 31st May 2008 and 31st May 2007 does not constitute

statutory accounts within the meaning of S240 of the Companies Act 1985 and has been extracted from the full accounts for the years ended

31st May 2008 and 31st May 2007 (subject to IFRS restatements). The reports of the auditors on those accounts were unqualified and did not

contain a statement under either S237(2) or S237(3) of the Companies Act 1985. The accounts for the year ended 31st May 2007 have been filed

with the Registrar of Companies. The accounts for the year ended 31st May 2008 will be delivered to the Registrar of Companies in due

course.

As an AIM listed company, the Group is required to prepare financial statements in accordance with the requirements of International

Financial Reporting Standards ("IFRS") and their interpretations issued by the International Accounting Standards Board ("IASB") as adopted

by the European Union from 1st June 2007. Therefore, this is the Group's first set of annual financial statements under IFRS.

(a)Adoption of IFRS

(i)Under the procedures set out in IFRS 1 - "First-time adoption of IFRS", the Group is required to establish its IFRS accounting

policies as at 1st June 2007 and to apply these retrospectively to determine prior period comparatives from 1st June 2006, the date of

transition to IFRS. The Group has taken advantage of two exemptions from this general principle. These are outlined below:

* Share-based Payments - IFRS 2

The Group has not applied IFRS 2 to share-based awards and payments granted before 7th November 2002 and which had vested before 1st

June 2006.

* Business Combinations - IFRS 3

The Group has not applied IFRS 3 retrospectively to business combinations that occurred prior to the date of transition to IFRS.

As the transition date to IFRS was 1st June 2006, financial information for the financial year ended 31st May 2007 has been re-stated to

comply with the new standards. The impact of IFRS on the Group's opening balance sheet at 1st June 2006 has been shown by re-stating the

Group's equity on that date. The principal impacts of the adoption of IFRS on the comparative results are set out in Note 9.

(ii)New IFRS standards and interpretations

The Group adopted the following during the year:

IFRS 7 "Financial Instruments: Disclosures" and amendment to IAS1, "Presentation of financial statements". These introduce new

disclosures relating to financial instruments and do not have any impact on the classification and valuation of the Group's financial

instruments. As required by IFRS 7, comparative disclosures have also been made.

IFRS 2 "Share-based payments". The Group has applied the requirements of IFRS 2 and has adopted the requirements of IFRIC 11 in respect

of share-based payments.

At the date of authorisation of these financial statements, the following Standards and Interpretations, which are relevant to the

Group, were in issue but not yet effective:

IAS 1 (revised) Presentation of financial statements

IAS 27 (revised) Consolidated financial statements

IAS 28 (revised) Investments in associates

IAS32 (revised) Financial instruments

IFRS 3 (revised) Business combinations

IFRS 8 Operating segments

IFRIC 8 Scope of IFRS 2

IFRIC 10 Interim financial reporting and impairment

In addition to these, the 2007 International Accounting Standards Board improvements project has now been completed with a number of

existing Standards and Interpretations having been amended.

The directors anticipate that the adoption of these Standards and Interpretations in future periods will have no material impact on the

financial statements of the Group.

(b)Basis of consolidation and preparation

These financial statements consolidate the financial statements of the Company and all of its subsidiary undertakings. The Company's

principal subsidiaries are City of London Investment Management Company Limited and City of London US Services Limited, all other

subsidiaries being dormant at 31st May 2008.

The Company is domiciled in the UK and its shares are issued in sterling. The functional currency of the business is however US Dollars.

Management have decided that the presentational currency of the financial statements should be sterling rather than the functional currency

due to the Company being a UK registered entity.

The consolidated financial statements are prepared on the historical cost basis except for the revaluation of certain financial

instruments as outlined below.

The preparation of these financial statements in conformity with IFRS requires management to make estimates and assumptions that affect

the application of policies and reported amounts of assets and liabilities, income and expenses. Whilst estimates are based on management's

best knowledge and judgement using information and financial data available to them, the actual outcome may differ from those estimates.

The most significant areas of the financial statements that are subject to the use of estimates and assumptions are noted below:

Income taxes

Significant judgement is required in determining provisions for income taxes and in determining deferred tax assets.

Share-based payments

In order to calculate the charge for share-based compensation as required by IFRS 2, the Group makes estimates principally relating to

the assumptions used in its option pricing model.

The principal accounting polices adopted are set out below and have, unless otherwise stated, been applied consistently to all periods

presented in these accounts.

(c)Significant accounting policies

(i)Goodwill

Under IFRS 3 "Business Combinations", goodwill is no longer amortised but is instead tested annually for impairment. In accordance with

the transitional provisions of IFRS 1 the Group has not applied IFRS 3 Business Combinations retrospectively to business combinations that

occurred before 1st June 2006.

(ii)Property and equipment

For all property and equipment depreciation is calculated to write off their cost to their estimated residual values by equal annual

instalments over the period of their estimated useful lives, which are considered to be:

Short leasehold property - over the remaining life of the lease

improvements

Furniture and equipment - four years

Computer and telephone equipment - four years

(iii)Financial instruments

Under IAS 39, "Financial Instruments: Recognition and Measurement", financial instruments must be classified as either:

* Loans and receivables

* Held-to-maturity investments

* Available-for-sale financial assets

* A financial asset or liability at fair value through profit or loss

The Group has identified those assets that need to be re-classified under the new standards and these are outlined below:

The Group's investments in the funds that it manages are designated as "available-for-sale" financial assets. Such investments are

initially recognised at fair value, being the consideration given together with any acquisition costs associated with the investment. They

are subsequently carried at fair value, with any gains or losses arising from changes in fair value being recognised in equity. Fair value

is determined using the price based on the net asset value of the fund. Investments are derecognised when the rights to receive cash flows

from the investments have expired or have been transferred and the Group has transferred all risks and rewards of ownership. When

derecognition occurs a realised gain or loss is recognised in the income statement, calculated as the difference between the net sales

proceeds and the original cost of the financial asset. Any fair value gains or losses previously recognised directly in equity are recycled

into the income statement as part of this calculation of the gain or loss arising on derecognition.

The Group assesses at each reporting date whether there is objective evidence that an investment or a group of investments is impaired.

In the case of an investment classified as available-for-sale, a significant or prolonged decline in the fair value of the investment below

its cost is considered as an indicator that the investment is impaired. If any such evidence exists for available-for-sale investments, the

cumulative loss - measured as the difference between the acquisition cost and the current fair value, less any impairment loss on that

investment previously recognised in the income statement- is removed from equity and recognised in the income statement.

The Group's investments in options are designated as financial assets at fair value through profit and loss. Such investments are

accounted for in the same way as "available-for-sale" assets but any gains or losses arising from changes in fair value are recognised in

the income statement. Fair value is determined using the quoted market bid price.

The only exception is where the Group holds an investment in options on unquoted equity instruments, whose fair value cannot be reliably

measured. Such investments are measured at cost less impairment.

The Group's investments have been classified here for recognition and measurement purposes under IAS39 but are not necessarily reported

in the balance sheet under those headings.

The Group's investments are reported in the balance sheet as follows:

2008 2007

� �

Non-current assets

Other financial assets:

Investment in funds 14,129 6,737

Investment in unquoted options 37,919 40,122

52,048 46,859

Current assets

Available-for-sale financial assets:

Investment in funds 1,861,375 2,231,989

Other financial assets:

Investment in quoted options 30,335 59,665

Where the Group has invested in Delaware Statutory Trust funds there is a requirement to nominate a tax partner and as Investment

Manager, the Group has adopted this role which requires that a nominal investment be held in each fund for the life of the fund. Therefore,

such nominal investments are reported as other financial assets under non-current assets.

Where the Group has used its own cash to seed new funds, the investment is generally held until the fund's performance is established.

Such investments are reported as available-for-sale financial assets under current assets.

(iv)Trade receivables

Trade receivables are measured at initial recognition at fair value, and are subsequently carried at the lower of original fair value

and their recoverable amount. Appropriate allowances for estimated irrecoverable amounts are recognised in the income statement when there

is objective evidence that the asset is impaired.

(v)Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and demand, deposits with an original maturity of three months or less, and other

short-term highly liquid investments that are readily convertible to a known amount of cash and are subject to an insignificant risk of

changes in value.

(vi)Trade payables

Trade payables are measured at initial recognition at fair value and subsequently measured at amortised cost.

(vii)Deferred taxation

Deferred tax is provided using the balance sheet liability method, providing for temporary differences between the amounts of assets and

liabilities for financial reporting purposes and the amounts used for tax purposes. However, deferred tax is not accounted for if it arises

from goodwill or the initial recognition (other than in a business combination) of other assets or liabilities in a transaction that affects

neither the accounting nor the taxable profit or loss.

Deferred tax liabilities are generally recognised for all taxable temporary differences and deferred tax assets are recognised to the

extent that it is probable that taxable profits will be available against which deductible temporary differences can be utilised. The

carrying amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it is no longer probable that

sufficient taxable profits will be available to allow all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to apply in the period when the liability is settled or the asset

realised. The tax rates used are those that have been enacted, or substantively enacted, by the end of the reporting period. Deferred tax is

charged or credited to the income statement, except when it relates to items charged or credited directly to equity, in which case the

deferred tax is also dealt with in equity. Deferred tax assets and liabilities are offset when there is a legally enforceable right to set

off current tax assets against current tax liabilities and when they relate to income taxes levied by the same taxation authority and the

Group intends to settle its current tax assets and liabilities on a net basis.

(viii)Share-based payments

The Company operates an Employee Share Option Plan. In accordance with IFRS 2, the fair value of the employee services received in

exchange for share options is recognised as an expense. The fair value has been calculated using the Binomial pricing model, and has then

been expensed on a straight line basis over the vesting period of three years, based on the Company's estimate of the number of shares that

will actually vest.

In accordance with the transitional provisions, IFRS 2 has been applied only to grants of share options after 7th November 2002 that had

not vested as at 1st June 2006.

(ix)Revenue

Revenue arises in North America, Europe and Australia and comprises investment management fees earned. Fees are recognised in revenue as

the investment management services are provided, in accordance with the underlying agreements.

(x)Foreign currency translation

Foreign currency transactions are translated using the exchange rates prevailing at the transaction date. Foreign exchange gains and

losses resulting from the settlement of such transactions, and from the translation of period-end monetary assets and liabilities are

recognised in the income statement.

(xi)Leases

The cost of operating leases is charged to the income statement in equal periodic instalments over the periods of the leases.

(xii)Pensions

The Group operates defined contribution pension schemes covering the majority of its employees. The costs of the pension schemes are

charged to the income statement as they accrue.

2..Operating profit

The operating profit is arrived at after charging: 2008 2007

� �

Depreciation of owned assets 158,474 120,494

Auditors' remuneration:

- Statutory audit 45,000 31,510

- Taxation services 18,018 12,337

- Other services 15,228 5,575

Operating lease rentals:

- Land and buildings 231,075 135,148

- Other 9,258 6,543

Operating sublease rentals:

- Land and buildings 8,919 -

Foreign exchange (gains)/losses (94,753) 12,373

3.. Interest receivable and similar income

2008 2007

� (as

restated)

�

Interest on bank deposit 436,418 196,487

Profit on sale of investments 426,220 45,616

Fair value of investments 6,232 (15,372)

868,870 226,731

4..Tax charge on profit on ordinary activities

(a) Analysis of tax charge on ordinary activities: 2008 2007

� (as

restated)

�

Tax at 30% (2007 - 30%) based on the profit for the 3,255,640 2,260,228

year

Double taxation relief (637,640) (542,228)

Deferred tax (42,324) (37,356)

Adjustments in respect of prior years (9,882) (11,518)

2,565,794 1,669,126

Foreign tax for the current period 950,355 778,144

Adjustments in respect of prior years 42,975 (26,770)

993,330 751,374

3,559,124 2,420,500

(b)Factors affecting tax charge for the current period:

The tax assessed for the period is different to that resulting from applying the standard rate of corporation tax in the UK: 30% (prior

year: 30%). The differences are explained below:

2008 2007

� (as

restated)

�

Profit on ordinary activities before tax 10,694,840 7,316,442

Tax at 30% thereon (3,208,452) (2,194,933)

Effects of:

Expenses not deductible for tax purposes (20,122) (41,353)

Capital allowances less than depreciation (10,519) (16,733)

Unrelieved overseas tax (312,715) (235,916)

Deferred tax on share based-payments 42,324 37,356

Prior period adjustments (33,093) 38,288

Other (16,547) (7,209)

(3,559,124) (2,420,500)

5..Earnings per share

The calculation of earnings per share is based on the profit for the period of �7,135,716 (2007 restated - �4,895,942) divided by the

weighted average number of ordinary shares in issue for the year ended 31st May 2008 of 24,338,540 (2007 - 24,432,528).

As set out in Note 8 the Employee Benefit Trust held 2,013,085 ordinary shares in the Company as at 31st May 2008. The Trustees of the

Trust have waived all rights to dividends associated with these shares. In accordance with IAS 33 the ordinary shares held by the Employee

Benefit Trust have been excluded from the calculation of the weighted average of ordinary shares in issue.

The calculation of diluted earnings per share is based on the profit for the year of �7,135,716 (2007 restated - �4,895,942) divided by

the diluted weighted average of ordinary shares for the year ended 31st May 2008 of 27,404,870 (2007 - 27,823,144).

Reconciliation of the figures used in calculating basic and diluted earnings per share:

2008 2007

Number of Number of

shares shares

Weighted average number of shares - basic earnings 24,338,540 24,432,528

per share

Effect of dilutive potential shares - share 3,066,330 3,390,616

options

Weighted average number of shares - diluted 27,404,870 27,823,144

earnings per share

6..Dividend

2008 2007

� �

Dividends paid:

Interim dividend of �0.06 per share (2007 - �0.03) 1,509,883 735,864

Final dividend in respect of year ended:

31st May 2007 of �0.07 per share 1,727,808 -

3,237,691 735,864

A final dividend of 13.5p per share has been proposed, payable on 21st November 2008.

7..Share capital

Group and Company 2008 2007

Number of Number of

shares shares

Authorised

Ordinary shares of 1p each (2007 - 1p each) 90,000,000 90,000,000

� �

Ordinary shares of 1p each (2007 - 1p each) 900,000 900,000

Group and Company 2008 2007

Number of Number of

shares shares

Allotted, called up and fully paid

Ordinary shares of 1p each (2007 - 1p each) 25,360,500 26,777,800

� �

Ordinary shares of 1p each (2007 - 1p each) 253,605 267,777

During the year ended 31st May 2008 the Company repurchased 1,417,300 of its own shares at market value for cancellation.

8..Investment in own shares

Investment in own shares relates to City of London Investment Group Plc shares held by an Employee Benefit Trust on behalf of City of

London Investment Group Plc.

At 31st May 2008 the Trust held 2,013,085 ordinary 1p shares (2007 - 2,303,125), of which 1,458,310 ordinary 1p shares (2007 -

2,297,675) were subject to options in issue.

9..IFRS transition

The transition date from UK GAAP to IFRS was 1st June 2006. The tables below reconcile total shareholders' funds at 1st June 2006 and

31st May 2007 under UK GAAP to total equity under IFRS, and the pro*t after taxation for the year ended 31st May 2007 from UK GAAP to IFRS.

Group

1 June 2006 31 May 2007

� �

UK GAAP - Shareholders' funds 4,331,813 8,559,508

IFRS transition adjustments:

IAS 12 - Deferred tax on share options 936,449 2,357,851

IAS12 - Deferred tax on revaluation reserve (40,352) (196,059)

IAS 39 - Fair value of investments - (7,671)

IFRS - Total equity 5,227,910 10,713,629

Group

2007

�

UK GAAP - Pro*t on ordinary activities after taxation 4,873,958

IFRS transition adjustments:

IAS12 - Deferred tax on share options 37,356

IAS 39 - Fair value of investments (15,372)

IFRS - Profit for the period 4,895,942

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFIFAESASEFU

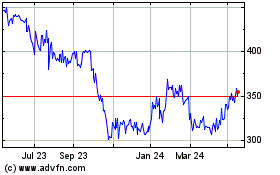

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Oct 2024 to Nov 2024

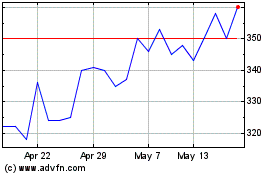

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Nov 2023 to Nov 2024