TIDMCHRY

RNS Number : 6689U

Chrysalis Investments Limited

27 November 2023

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than to professional investors in Belgium, Denmark, the

Republic of Ireland, Luxembourg, the Netherlands, Norway and

Sweden), Canada, Australia, Japan or the Republic of South

Africa.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 which forms part of

domestic law in the United Kingdom pursuant to The European Union

Withdrawal Act 2018, as amended by The Market Abuse (Amendment) (EU

Exit) Regulations 2019.

27 November 2023

Chrysalis Investments Limited ("Chrysalis" or the "Company")

Investment Management Arrangements Update

The Board of Chrysalis has been working for some time on a

significant revision to its existing structure in order to ensure

the maximisation of value for its shareholders.

The recent shareholder consultation conducted by Rothschild

& Co Equity Markets Solutions Limited ("Rothschild") provided

the Board with useful insight into issues of capital deployment,

management remuneration and approach, as well as the Company's

relationship with Jupiter Investment Management Ltd ("Jupiter"),

both as an investor in Chrysalis and as Investment Adviser. The

consultation covered approximately 60% of the non-Jupiter related

issued shares.

The purpose of the consultation was to inform the Board and

Investment Adviser of the views of shareholders ahead of a set of

proposals being put to them for approval on the date of the

forthcoming Annual General Meeting ("AGM") in Q1 2024. It is the

Company's intention to release relevant shareholder documentation

(including a final proposed Capital Allocation Policy) at the same

time as the year end accounts are published and the date for the

AGM is set. Shareholders will have the ability at that time to vote

on:

1) the continuation of the Company; and

2) the revised performance fee arrangements under the proposed

new management arrangements (as described further below).

Aside from these issues, one of the key responsibilities for

your Board has been the oversight of the Company's investment

management agreement.

At the time of the IPO, the investment management agreement was

with Merian Global Investors (UK) Limited ("Merian"). While the

sale of Merian to Jupiter in 2020 changed this position, the key

investment staff, including the two lead portfolio managers,

Richard Watts and Nick Williamson (the "Managers"), remained the

same. After considering all the implications of a potential change

in manager, including the payment of a substantial termination fee,

the Board's unanimous conclusion was that it wished the Company to

continue to be run by the existing investment team.

Since that time, the Board has worked to ensure that the best

processes are in place for the Company, resulting in the

appointment of an independent valuation committee to enhance the

quality of valuation work; the AIFM responsibility being taken in

house; and risk reporting being better tailored to the product.

There remain, however, some outstanding issues that the Board

believes need to be resolved and which could affect the potential

development of Chrysalis. These revolve, primarily, around the

provision of sufficient dedicated resources for the management

team, and the reduction of various Jupiter-managed holdings in

Chrysalis.

The Board is pleased to announce today that it has reached

agreement with Jupiter and agreed Heads of Terms with the Managers

to redraw the structure under which investment advisory services

will be provided, which foresees the Managers leaving Jupiter to

provide advisory services to the Company from a new entity.

The Board believes such a move is consistent with feedback from

the recent shareholder consultation that demonstrated strong

support for the Managers and their efforts in creating and running

Chrysalis, a view which the Board shares. While the current NAV per

share remains materially below its peak, recent events hopefully

point to a more optimistic outlook, with yields generally softening

and company specific news - such as discussion around Klarna's move

towards IPO - also providing a more upbeat prognosis. Given the

Managers' in-depth knowledge of the Company's portfolio, the Board

is of the view that they are best placed to oversee the next stage

of Chrysalis' growth.

The details of these arrangements will be set out in a

forthcoming shareholder circular; however, a summary of the

proposed new arrangements is as follows:

1) Chrysalis and Jupiter have agreed that the six months' notice

period under the existing management contract will be waived and

the contract will terminate with effect from 1 April 2024.

2) Jupiter has agreed to a reduction in the management fee,

effective from 1 October 2023, from 50bps to 15bps (given likely

limited investment activity in the current market environment

pending the continuation vote), leading to an expected saving of

approximately of GBP1.4m for Chrysalis shareholders over the

six-month period to 31 March 2024.

3) Jupiter has released the Managers from their employment

contracts and employment restrictions, effective 31 March 2024.

4) The Board has agreed, in principle, to enter into a

tripartite contract with a new investment adviser formed by the

Managers (that will also have as members and/or employ the existing

executives who are focussed on the Chrysalis portfolio either

immediately or following the end of their notice periods with

Jupiter) to take over investment advisory services from Jupiter,

and with G10 Capital Limited - part of IQ-EQ group's UK Regulatory

and AIFM platform - to take over AIFM services for the Company,

each with effect from 1 April 2024. As a consequence of this

change, Richard Watts will be solely focussed, along with Nick

Williamson, on the Company's portfolio.

5) The Company's investment advisory fee will be comprised of

(i) 50bps of net asset value per annum, which is commensurate to

the level the Company has historically paid; and (ii) an additional

AIFM fee of 5bps up the first GBP1 billion of net asset value per

annum (3bps thereafter). The latter will fund both the

significantly enhanced risk process that is anticipated to be

established in cooperation with the Managers and the oversight of

G10 Capital Limited. As noted above, the performance fee

arrangements for the new investment adviser will be subject to

shareholder approval at a meeting to be held immediately following

the AGM. The proposed performance fee terms will be the same as

those described in the Company's announcement on 13 October

2023.

6) The new investment advisor to be led by the Managers will

have a 12-month minimum initial term, following which the new

agreement will be terminable on 6 months' notice.

A further announcement will be made when this agreement is

finalised and entered into.

The new structure will allow investment in added resources for

the management team, will make the most of IQ-EQ's regulatory and

AIFM platform, which is used by a number of existing listed

investment companies, and enable the Managers to focus their time

soley on developing the Company.

The Board and the Managers believe the trends that led to the

establishment of Chrysalis five years ago remain in force,

especially the decline in IPO activity and the shrinkage of the UK

stock market as a venue for listed companies. In many cases these

trends have become more acute. It is also the Board's firm belief

that this complete package of proposals will put Chrysalis in a

better position to maximise the value of its exciting portfolio of

holdings and enable it to pursue the strategy into the future for

shareholders within a more transparent capital allocation policy in

line with that announced in October 2023. As such, the Board plans

to recommend the Company's continuation to shareholders at the vote

on this matter at the forthcoming AGM. In the event that

shareholders were to seek an orderly return of capital, a process

which could take a number of years, the Board believes that the

Managers are best placed to provide the relevant investment advice

to the Company and that the terms of their remuneration (together

with their significant alignment by virtue of their personal

shareholdings) remain competitive with any potential alternative

manager of such a strategy.

For further information, please contact:

Media

Montfort Communications: +44 (0) 7976 098 139

Charlotte McMullen / Toto Reissland chrysalis@montfort.london

/

Lesley Kezhu Wang

Jupiter Asset Management:

Nick Black +44 (0) 800 561 4000

Liberum:

Chris Clarke / Darren Vickers

/ Owen Matthews +44 (0) 20 3100 2000

Numis:

Nathan Brown / Matt Goss +44 (0) 20 7260 1000

Maitland Administration (Guernsey)

Limited:

Chris Bougourd +44 (0) 20 3530 3109

LEI: 213800F9SQ753JQHSW24

A copy of this announcement will be available on the Company's

website at https://www.chrysalisinvestments.co.uk .

The information contained in this announcement derived from the

value of the Company's investments has been provided by the

relevant underlying portfolio companies and has not been

independently verified by the Company. The information contained

herein is unaudited.

This announcement is for information purposes only and is not an

offer to invest. All investments are subject to risk. Past

performance is no guarantee of future returns. Prospective

investors are advised to seek expert legal, financial, tax and

other professional advice before making any investment decision.

The value of investments may fluctuate. Results achieved in the

past are no guarantee of future results. Neither the content of the

Company's website, nor the content on any website accessible from

hyperlinks on its website for any other website, is incorporated

into, or forms part of, this announcement nor, unless previously

published by means of a recognised information service, should any

such content be relied upon in reaching a decision as to whether or

not to acquire, continue to hold, or dispose of, securities in the

Company.

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will", or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters

that are not historical facts regarding the Company's investment

strategy, financing strategies, investment performance, results of

operations, financial condition, prospects and dividend policies of

the Company and the instruments in which it will invest. By their

nature, forward-looking statements involve risks and uncertainties

because they relate to events and depend on circumstances that may

or may not occur in the future. Forward-looking statements are not

guarantees of future performance. There are a number of factors

that could cause actual results and developments to differ

materially from those expressed or implied by these forward-looking

statements. These factors include, but are not limited to, changes

in general market conditions, legislative or regulatory changes,

changes in taxation regimes or development planning regimes, the

Company's ability to invest its cash in suitable investments on a

timely basis and the availability and cost of capital for future

investments.

The Company expressly disclaims any obligation or undertaking to

update or revise any forward-looking statements contained herein to

reflect actual results or any change in the assumptions, conditions

or circumstances on which any such statements are based unless

required to do so by FSMA, the Listing Rules, the Prospectus

Regulation Rules made under Part VI of the FSMA or the Financial

Conduct Authority or other applicable laws, regulations or

rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEADFXASKDFEA

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

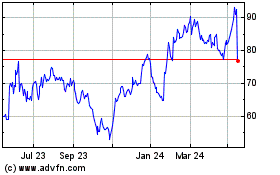

Chrysalis Investments (LSE:CHRY)

Historical Stock Chart

From Oct 2024 to Nov 2024

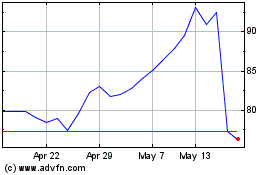

Chrysalis Investments (LSE:CHRY)

Historical Stock Chart

From Nov 2023 to Nov 2024