TIDMCCP

RNS Number : 6351P

Celtic PLC

10 February 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Celtic plc (the "Company")

INTERIM REPORT FOR THE SIX MONTHS TO 31 DECEMBER 2022

Key Operational Items

-- Currently first in the SPFL Premiership.

-- 14 home fixtures (2021: 19).

-- Participation in the UEFA Champions League group stages.

Key Financial Items

-- Revenue increased by 44.8% to GBP76.5m (2021: GBP52.9m).

-- Profit from trading was GBP28.1m (2021: GBP7.0m).

-- Profit from transfer of player registrations (shown as profit

on disposal of intangible assets) GBP1.8m (2021: GBP25.8m).

-- Profit before taxation of GBP33.9m (2021: GBP27.6m).

-- Acquisition of player registrations of GBP5.7m (2021: GBP16.8m).

-- Period end cash net of bank borrowings of GBP59.2m (2021: GBP25.6m).

For further information contact:

Celtic plc

Peter Lawwell, Celtic plc Tel: 0141 551 4235

Iain Jamieson, Celtic plc

Canaccord Genuity Limited, Nominated Adviser

Simon Bridges Tel: 0207 523 8000

CHAIRMAN'S STATEMENT

I am honoured to present my first Chairman's statement on behalf

of Celtic Football Club. Being back to chair the club that I have

always supported and served for almost 18 years as CEO, is a

privilege. I look forward to fulfilling the role, and playing my

part in our Club going forward.

The results for the six months ended 31 December 2022 show

revenues of GBP76.5m (2021: GBP52.9m) and a profit before taxation

of GBP33.9m (2021: profit before tax of GBP27.6m). The profit from

trading, representing the profit excluding player related gains and

charges, amounted to GBP28.1m (2021: profit of GBP7.0m).

The key factors driving the improvement in the underlying

trading performance in the six months to 31 December 2022 compared

to the same period last year, was the direct qualification to the

UEFA Champions League Group stages. This was the key driver in our

revenue increase over the same period last year which reflected

UEFA Europa League Group stage participation. Gains from player

trading this year of GBP1.8m (2021: GBP25.8m) were notably lower,

reflecting our strategy of assembling a new football playing squad

under our Football Manager, Ange Postecoglou. Period end net cash

at bank was GBP59.2m (2021: GBP25.6m). After adjusting for a net

trading balance on prior inbound and outbound transfers, this sum

reduces to GBP50.2m at December 2022 (2021: GBP39.7m). The

introductory page to these interim results summarises the key

events in the period.

This year is the second season under Ange and the success

delivered in season 2021/22 in securing the SPFL title ensured we

qualified directly for the UEFA Champions League Group stages for

season 2022/23. This allowed us to plan and execute our transfer

business early. Following from the permanent signings of Daizen

Maeda, Cameron Carter-Vickers and Joao Pedro Neves Filipe (Jota),

we went on to sign Alexandro Bernabei, Sead Haksabanovic, Aaron

Mooy, Benjamin Siegrist and brought in loan signings Oliver

Abildgaard and Moritz Jenz.

As the season got underway in August, we were presented with a

tough Champions League Group stage draw, alongside 14 times

Champions League winners Real Madrid, RB Leipzig and Shakhtar

Donetsk. Despite a number of strong footballing performances we all

shared Ange's disappointment in not progressing further, but took

heart from the competitive performances and experience gained by

our young team which will serve them well in future European

competition.

On domestic footballing matters, we currently sit 9 points ahead

at the top of the SPFL Premiership, have reached the Viaplay Cup

Final and have reached the fifth round of the Scottish Cup. We sit

in a satisfactory position domestically, but strive to keep

improving as a club and during the January transfer window we

further added to the squad by signing Alistair Johnston, Yuki

Kobayashi, Tomoki Iwata (loan with obligation to buy) and Hyeongyu

Oh. Josip Juranovic, Oliver Abildgaard, Moritz Jenz, Scott

Robertson and Giorgos Giakoumakis moved on to continue their

careers elsewhere and we wish them all the best for the future.

Our B Team continues to develop in the Lowland League under

Darren O'Dea and Stephen McManus. A key objective of our B Team and

Academy is to develop first team players and already this season B

Team players Bosun Lawal and Rocco Vata have made their first team

debuts. This is a major milestone and achievement for our young

players and reflects our strategy of developing Academy players

through our system. Our Women's team also continues to progress

under Fran Alonso and at the time of writing we sit second in the

league and are in the fifth round of the Scottish Cup.

As we look ahead, our immediate priority is to secure domestic

success for season 2022/23, with a view to progressing into the

Champions League Group stages for a second consecutive year. We

also wish to build upon the progress made in our Academy and the

Women's team, and are currently exploring development opportunities

at our Barrowfield training ground with a view to enhancing the

facilities for these squads.

We will also continue to contribute to the development of UEFA

European Club Competition through participation in the European

Club Association. The forthcoming changes to European Club

Competition from 2024 onwards bring a number of exciting changes

that we will embrace and look to take advantage of.

In line with the seasonality inherent in our earnings profile,

the second half of the financial year will see losses incurred, as

our earnings are biased toward the first half of the financial

year. These losses however will be in part mitigated by gains on

player trading realised from the January 2023 transfer window along

with greater revenue from operating activities than was previously

anticipated. The bias in earnings towards the first half of the

financial year reflects the fact that UEFA distributions and UEFA

match ticket income are largely recognised in the first half of the

financial year and as in previous years, the second half of the

financial year typically sees lower retail sales. Our outturn

earnings can also be materially impacted by football success and

the year end assessment of player registration carrying values.

Taking all of this into consideration, we would expect our total

outturn profit before tax for the year ending 30 June 2023 to be

significantly lower than the result posted for the first six months

of the financial year.

On behalf of the Board, I wish to thank our supporters for their

unwavering dedication and support of our Club. I wish to also thank

our shareholders and commercial partners for continuing to back the

Club as they have done over many years.

Peter Lawwell

Chairman

10 February 2023

INDEPENT REVIEW REPORT TO CELTIC PLC

Conclusion

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 December 2022 which comprises the Consolidated

Statement of Comprehensive Income, Consolidated Balance Sheet,

Consolidated Statement of Changes in Equity, Consolidated Cash Flow

Statement and related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

December 2022 is not prepared, in all material respects, in

accordance with UK adopted International Accounting Standard 34 and

the London Stock Exchange AIM Rules for Companies.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the Group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the London Stock Exchange AIM

Rules for Companies which require that the half-yearly report be

presented and prepared in a form consistent with that which will be

adopted in the Company's annual accounts having regard to the

accounting standards applicable to such annual accounts.

In preparing the half-yearly financial report, the directors are

responsible for assessing the Company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the Company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

Transparency (Directive 2004/109/EC) Regulations 2007 and for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

BDO LLP

Chartered Accountants

Glasgow, UK

Date: 10 February 2023

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE 6 MONTHS TO 31 DECEMBER 2022

2022 2021

Unaudited Unaudited

Note GBP000 GBP000

Revenue 2 76,542 52,858

Operating expenses (before intangible asset

transactions) (48,398) (45,810)

------------- -------------

Profit from trading before intangible asset

transactions 28,144 7,048

Exceptional operating (expense) / income 3 (53) 1,063

Amortisation of intangible assets 7 (6,018) (6,251)

Profit on disposal of intangible assets 1,757 25,752

Other income 3 10,000 -

Operating profit 33,830 27,612

-

Finance income 4 636 456

Finance expense 4 (611) (512)

------------- -------------

Profit before tax 33,855 27,556

Income tax expense 5 (5,767) (3,210)

-

------------- -------------

Profit and total comprehensive income for

the period 28,088 24,346

============= =============

Basic earnings per Ordinary Share 6 29.72p 25.78p

============= =============

Diluted earnings per Share 6 20.74p 18.01p

============= =============

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER 2022

2022 2021

Unaudited Unaudited

Notes GBP000 GBP000

NON-CURRENT ASSETS

Property plant and equipment 55,920 57,087

Intangible assets 7 34,324 27,522

Trade and other receivables 8 4,515 14,664

------------------- -------------

94,759 99,273

CURRENT ASSETS

Inventories 2,534 2,940

Trade and other receivables 8 30,095 32,180

Cash and cash equivalents 10 60,142 27,798

------------------- -------------

92,771 62,918

------------------- -------------

TOTAL ASSETS 187,530 162,191

=================== =============

EQUITY

Issued share capital 9 27,166 27,168

Share premium 14,990 14,951

Other reserve 21,222 21,222

Accumulated profits 39,566 29,975

------------------- -------------

TOTAL EQUITY 102,944 93,316

=================== =============

NON-CURRENT LIABILITIES

Interest bearing liabilities/

bank loans - 932

Debt element of Convertible

Cumulative Preference Shares 4,174 4,174

Trade and other payables 9,018 7,883

Lease Liabilities 163 352

Deferred tax 5 3,189 2,904

Provisions 77 99

16,621 16,344

------------------- -------------

CURRENT LIABILITIES

Trade and other payables 38,390 26,124

Current borrowings 1,048 1,336

Lease Liabilities 394 562

Provisions 7,271 6,686

Deferred income 20,862 17,823

------------------- -------------

67,965 52,531

------------------- -------------

TOTAL LIABILITIES 84,586 68,875

=================== =============

TOTAL EQUITY AND LIABILITIES 187,530 162,191

=================== =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE 6 MONTHSED 31 DECEMBER 2022

Share Share Other Accumulated Total

capital premium reserve Profits

GBP000 GBP000 GBP000 GBP000 GBP000

EQUITY SHAREHOLDERS' FUNDS

AS AT 1 JULY 2021 (Audited) 27,168 14,912 21,222 5,629 68,931

Share capital issued - 39 - - 39

Profit and total comprehensive

income for the period - - - 24,346 24,346

EQUITY SHAREHOLDERS' FUNDS

AS AT 31 DECEMBER 2021 (Unaudited) 27,168 14,951 21,222 29,975 93,316

========== =========== =========== =============== ==========

EQUITY SHAREHOLDERS' FUNDS

AS AT 1 JULY 2022 (Audited) 27,166 14,951 21,222 11,478 74,817

Share capital issued - 39 - - 39

Profit and total comprehensive

income for the period - - - 28,088 28,088

EQUITY SHAREHOLDERS' FUNDS

AS AT 31 DECEMBER 2022 (Unaudited) 27,166 14,990 21,222 39,566 102,944

----------------------------------------- ========== =========== =========== =============== ==========

CONSOLIDATED CASH FLOW STATEMENT

FOR THE 6 MONTHSED 31 DECEMBER 2022

Note 2022 2021

Unaudited Unaudited

GBP000 GBP000

Cash flows from operating activities

Profit for the period after tax 28,088 24,346

Income tax expense 5,767 3,210

Depreciation 1,292 1,320

Amortisation 6,018 6,251

Reversal of prior period impairment

charge - (1,095)

Profit on disposal of intangible assets (1,757) (25,752)

Finance costs 611 512

Finance income (636) (456)

--------------- ------------

39,383 8,336

Decrease in inventories 453 921

Decrease in receivables 4,137 1,190

Decrease in payables and deferred

income (15,522) (6,644)

--------------- ------------

Cash generated from operations 28,451 3,803

Interest paid (31) (42)

Interest received 327 19

--------------- ------------

Net cash flow from operating activities 28,747 3,780

--------------- ------------

Cash flows from investing activities

Purchase of property, plant and equipment (892) (801)

Purchase of intangible assets (14,341) (13,801)

Proceeds from sale of intangible assets 16,197 20,660

--------------- ------------

Net cash generated from investing

activities 964 6,058

--------------- ------------

Cash flows from financing activities

Repayment of debt (640) (640)

Payments on leasing activities (343) (378)

Dividend on Convertible Cumulative

Preference Shares (455) (481)

--------------- ------------

Net cash used in financing activities (1,438) (1,499)

--------------- ------------

Net increase in cash equivalents 28,273 8,339

Cash and cash equivalents at 1 July 31,869 19,459

--------------- ------------

Cash and cash equivalents at 31 December 10 60,142 27,798

=============== ============

NOTES TO THE FINANCIAL INFORMATION

1. BASIS OF PREPARATION

The financial information in this interim report comprises the

Consolidated Statement of Comprehensive Income, Consolidated

Balance Sheet, Consolidated Statement of Changes in Equity,

Consolidated Cash Flow Statement and accompanying notes. The

financial information in this interim report has been prepared

under the recognition and measurement requirements in accordance

with UK adopted international accounting standards, but does not

include all of the disclosures that would be required under those

accounting standards. The accounting policies adopted in the

financial statements for the year ended 30 June 2023 will be in

accordance with UK adopted international accounting standards.

The financial information in this interim report for the six

months to 31 December 2022 and to 31 December 2021 has not been

audited, but it has been reviewed by the Company's auditor, whose

report is set out on pages 4 and 5.

Adoption of standards effective for periods beginning 1 July

2022

The following amended standards have been adopted as of 1 July

2022

-- Amendments to IFRS 3, IAS 16 and IAS 37 - Property Plant and

Equipment Proceeds before Intended Use

-- Amendments to IFRS 1, IFRS 9, IAS 41 and Illustrative

examples accompanying IFRS 16 - Annual Improvements to IFRSs

(2019-2020 Cycle)

Going concern

The Company has sufficient financial resources available to it,

together with established contracts with a number of customers and

suppliers. As a consequence, the Directors believe that the Company

is well placed to continue managing its business risks successfully

and they have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Thus, they continue to adopt the going concern

basis of accounting in preparing the financial information in this

interim report.

2. REVENUE

6 months 6 months

to 31 to 31

Dec 2022 Dec 2021

Unaudited Unaudited

GBP000 GBP000

Football and stadium operations 28,250 23,558

Multimedia and other commercial

activities 30,866 13,973

Merchandising 17,426 15,327

76,542 52,858

=========== ===========

Number of home games 14 19

=========== ===========

3. EXCEPTIONAL OPERATING ITEMS AND OTHER INCOME

The exceptional operating expense of GBP0.05m represents

settlement payments. In the previous period an exceptional

operating credit resulted from an impairment reversal in relation

to intangible assets offset by settlement payments. These items are

deemed to be unusual in relation to what management consider to be

normal operating conditions.

Other income represents incoming cash or receivables to the

business which is not deemed to be generated from the normal course

of business and does not meet the definition of revenue under

IFRS15. In the current financial year, this is represented by the

receipt of insurance proceeds in relation to business interruption.

The amount of income is only recognised when the likelihood and

value of any receipt is virtually certain i.e. the cash or

confirmation of payment have been received.

4. FINANCE INCOME AND EXPENSE

6 months 6 months

to to

31 December 31 December

2022 2021

Unaudited Unaudited

GBP000 GBP000

Finance income:

Interest receivable on bank deposits 310 19

Notional interest income 326 437

-------------- --------------

636 456

============== ==============

6 months 6 months

to to

31 December 31 December

2022 2021

Unaudited Unaudited

GBP000 GBP000

Finance expense:

Interest payable on bank and other

loans (31) (40)

Notional interest expense (296) (188)

Dividend on Convertible Cumulative

Preference Shares (284) (284)

-------------- --------------

(611) (512)

============== ==============

5. TAXATION

Tax has been charged at 19% for the six months ended 31 December

2022 (2021: 19%) representing the best estimate of the average

annual effective tax rate expected to apply for the full year,

applied to the pre-tax profit of the six month period. After

accounting for deferred tax, this has resulted in tax expense in

the statement of comprehensive income of GBP5.8m (2021:

GBP3.2m).

6. EARNINGS PER SHARE

Basic earnings per share has been calculated by dividing the

profit for the period of GBP28.1m (2021: GBP24.3m) by the weighted

average number of Ordinary Shares in issue of 94,515,655 (2021:

94,446,660). Diluted earnings per share has been calculated by

dividing the profit for the period by the weighted average number

of Ordinary Share, Convertible Cumulative Preference Shares and

Convertible Preferred Ordinary Shares in issue, assuming conversion

at the balance sheet if dilutive.

7. INTANGIBLE ASSETS

31 December 31 December

2022 2021

Unaudited Unaudited

Cost GBP000 GBP000

At 1 July 67,511 49,559

Additions 5,650 16,760

Disposals (13,683) (19,186)

--------------- ---------------

At period end 59,478 47,133

=============== ===============

Amortisation

At 1 July 32,022 31,256

Charge for the period 6,018 6,251

Reversal of prior period impairment - 1,094

Disposals (12,886) (18,990)

--------------- ---------------

At period end 25,154 19,611

=============== ===============

Net Book Value at period end 34,324 27,522

=============== ===============

8. TRADE AND OTHER RECEIVABLES

31 December 31 December

2022 2021

Unaudited Unaudited

GBP000 GBP000

Trade receivables 21,232 34,381

Prepayments and accrued income 7,053 7,436

Other receivables 6,325 5,027

------------- -------------

34,610 46,844

============= =============

Amounts falling due after more than one year

included above are:

31 December 31 December

2022 2021

Unaudited Unaudited

GBP000 GBP000

Trade receivables 4,515 14,664

============= =============

9. SHARE CAPITAL

Authorised Allotted, called up and

fully paid

31 December 31 December

2022 2021 2022 2022 2021 2021

Unaudited Unaudited Unaudited

No No 000 No GBP000 No GBP000

000 000 000

Equity

Ordinary Shares of 1p each 223,681 223,681 94,526 945 94,457 945

Deferred Shares of 1p each 677,885 676,275 677,885 6,778 676,275 6,763

Convertible Preferred Ordinary

Shares of GBP1 each 14,721 14,722 12,718 12,718 12,734 12,734

Non-equity

Convertible Cumulative Preference

Shares of 60p each 18,298 18,297 15,797 9,478 15,797 9,479

Less reallocated to debt:

Initial debt - - - (2,753) - (2,753)

---------- ----------

934,585 932,975 800,926 27,166 799,263 27,168

========== ========== ========== =========== ========== ===========

10. ANALYSIS OF NET CASH AT BANK

The reconciliation of the movement in cash and cash equivalents

per the cash flow statement to net cash is as follows:

31 December 31 December

2022 2021

Unaudited Unaudited

GBP000 GBP000

Bank Loans due after more than

one year - (932)

Bank Loans due within one year (948) (1,236)

Cash and cash equivalents:

Cash at bank and on hand 60,142 27,798

------------- -------------

Net cash at bank at period end 59,194 25,630

============= =============

11. POST BALANCE SHEET EVENTS

Since the balance sheet date, we have acquired the permanent

registration of Hyeongyu Oh from Suwon Samsung Bluewings.

We have also permanently transferred the registrations of Josip

Juranovic to Union Berlin, Scott Robertson to Fleetwood Town and

Giorgos Giakoumakis to Atlanta United. In addition, the temporary

registrations of Moritz Jenz and Oliver Abildgaard were cancelled

and the registration of Yosuke Ideguchi was temporarily transferred

to Avispa Fukuoka.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGMZVGRGFZM

(END) Dow Jones Newswires

February 10, 2023 12:10 ET (17:10 GMT)

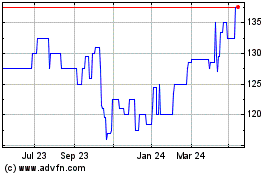

Celtic (LSE:CCP)

Historical Stock Chart

From Nov 2024 to Dec 2024

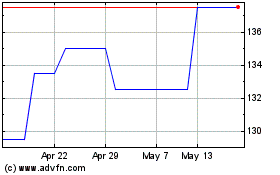

Celtic (LSE:CCP)

Historical Stock Chart

From Dec 2023 to Dec 2024