TIDMCCP

RNS Number : 8226P

Celtic PLC

12 February 2019

Celtic plc (the "Company")

INTERIM REPORT FOR THE SIX MONTHS TO 31 DECEMBER 2018

Operational Highlights

-- Currently top of the SPFL Premiership

-- Winners of the Scottish League Cup for the third season in a row

-- 17 home fixtures (2017: 19)

-- Secured European football after Christmas by qualifying for

the round of 32 of the UEFA Europa League for the second year in a

row

Financial Highlights

-- Revenue decreased by 30.1% to GBP50.0m (2017: GBP71.5m)

-- Profit from trading was GBP6.2m (2017: GBP23.7m)

-- Profit from transfer of player registrations (shown as profit

on disposal of intangible assets) GBP17.6m (2017: GBP0.5m)

-- Profit before taxation of GBP18.8m (2017: GBP19.5m)

-- Profit after taxation of GBP15.2m (2017: GBP17.4m)

-- Period end net cash at bank of GBP38.6m (2017: GBP30.9m)

-- Period end net cash, net of debt and debt like items, of GBP37.7m (2017: GBP17.0m)(1)

(1) net cash, net of debt like items, is represented by cash net

of bank borrowings of GBP38.6m (2017: GBP30.9m) further adjusted

for other debt like items, namely the net player trading balance,

other loans and remuneration balances payable to certain personnel

at the balance sheet date.

Celtic plc

CHAIRMAN'S STATEMENT

I am pleased to report on our interim results for the period

ended 31 December 2018. These show revenue of GBP50.0m (2017:

GBP71.5m) and a profit from trading of GBP6.2m (2017: GBP23.7m).

Overall, this resulted in a profit before taxation of GBP18.8m

(2017: GBP19.5m) and a period end net cash at bank of GBP38.6m

(2017: GBP30.9m). The introductory page to these interim results

summarises the main highlights.

The Club has continued to build on its historic "Double Treble"

achieved last year by adding the League Cup trophy in December

2018, the seventh consecutive trophy lifted since Brendan Rodgers

joined us, continuing our domestic clean sweep of trophies. At the

time of writing, we remain unbeaten at home in domestic

competitions this season and sit 6 points clear at the top of the

Scottish Premiership. We have also made it to the quarter finals of

the Scottish Cup. We were very disappointed not to qualify for the

group stages of the UEFA Champions League (a task that continues to

be challenging) but qualification from a very difficult group in

the UEFA Europa League was a great achievement.

These results reflect the absence of substantial UEFA Champions

League revenues in comparison to the same period last year. But

they are counter-balanced by the benefit of player trading,

significantly by the permanent transfer of the registration of

Moussa Dembele to Olympique Lyonnais. The profit on disposals of

intangible assets of GBP17.6m (2017: GBP0.5m) largely represents

this sale. Our period end net cash at bank, as indicated above, was

highly satisfactory. We also enjoyed exceptionally strong trading

across all of our commercial bases, including match day sales,

hospitality and merchandise.

Our financial commitment to the playing squad, including

transfer fees and first team salaries, and the coaching, technical

and performance departments is at an all-time high. During the

period we secured the permanent registrations of Emilio Izaguirre

and Youssouf Mulumbu and the temporary registrations of Daniel

Arzani and Philip Benkovic. Subsequently, during the January

transfer window, we have acquired the permanent registrations of

talented young international players Vakoun Bayo, Andrew Gutman,

Emanuel Perez and Marian Shved and the temporary registrations of

exciting talents Oliver Burke, Jeremy Toljan and Timothy Weah.

Furthermore, the contracts of Kristoffer Ajer, Scott Brown, Ryan

Christie, James Forrest, Leigh Griffiths, Michael Johnston, Callum

McGregor, Olivier Ntcham and Tom Rogic have been extended. We

believe that we have secured the core of a powerful squad for the

Club. In addition, we are delighted to see the continued emergence

of young graduates from our Youth Academy, with Ewan Henderson

making his first team debut and Karamoko Dembele signing his first

professional contract with the Club.

My fellow directors and I continue to be highly alert to the

uncertainties inherent in football and our long held strategy of

operating a self-sustaining financial model has delivered stability

and success. The Board and Brendan Rodgers are committed to

maintaining that crucial balance between competitive performance

for our immediate targets this season and developing the Club for

the longer term. Our key objectives for the remainder of the season

are to win the SPFL Premiership, secure The Scottish Cup and build

towards the European qualifiers in the summer.

We continue to work on our plans to develop Celtic Park and the

surrounding area for our supporters and the City as a whole. The

Fraser of Allander Institute's economic survey that was

commissioned and published in the period highlights the very

substantial economic contribution made by Celtic and its supporters

each year to the economy of Glasgow and Scotland as a whole. In

putting this important information into the public domain, we seek

to encourage the Scottish Government, Glasgow City Council and

other public agencies to recognise the contribution of football in

general and Celtic in particular.

Entirely in line with our trading seasonality, we do not expect

the same level of financial performance to be achieved during the

second half of the financial year. This is due to participating in

fewer home fixtures and receiving lower income from European

competition. However, due to the positive first half performance of

football, media and merchandise sales, the expectation is to

achieve a full year profit after tax marginally above previously

communicated market expectations, with year-end net cash at bank

expected to be lower than December, reflecting the increased

investment into football personnel. In line with previous years,

the ultimate financial performance remains subject to the outcome

of key events and fixtures, which typically are not known until the

end of the football season.

On behalf of the Board, I thank our fans, shareholders and

partners, for their outstanding support and contribution to the

ongoing success of Celtic Football Club.

Ian P Bankier

12 February 2019

Chairman

For further information contact:

Celtic plc Tel: 0141 551 4235

Ian Bankier

Peter Lawwell

Canaccord Genuity Limited, Nominated Adviser Tel: 020 7523 8350

and Broker

Simon Bridges

Richard Andrews

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Celtic plc

INDEPENT REVIEW REPORT TO CELTIC PLC

Introduction

We have been engaged by the Company to review the financial

information in the interim report for the six months ended 31

December 2018 which comprises the consolidated statement of

comprehensive income, the consolidated balance sheet, the

consolidated statement of changes in equity, the consolidated cash

flow statement and the related notes.

We have read the other information contained in the interim

report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the interim report be presented and prepared in a form consistent

with that which will be adopted in the Company's annual financial

statements having regard to the accounting standards applicable to

such annual financial statements.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the financial information in the interim report based on our

review.

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the financial information in the interim

report for the six months ended 31 December 2018 is not prepared,

in all material respects, in accordance with the rules of the

London Stock Exchange for companies trading securities on AIM.

BDO LLP

Chartered Accountants and Registered Auditors

Glasgow

United Kingdom

Date 12 February 2019

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Celtic plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE 6 MONTHS TO 31 DECEMBER 2018

2018 2017

Unaudited Unaudited

Note GBP000 GBP000

Revenue 2 50,015 71,505

Operating expenses (before intangible

asset transactions) (43,823) (47,815)

------------- -------------

Profit from trading before intangible

asset transactions 6,192 23,690

Amortisation of intangible assets (4,787) (4,227)

Profit on disposal of intangible

assets 17,563 482

Operating profit 18,968 19,945

Finance income 3 531 47

Finance expense 3 (700) (482)

Profit before tax 18,799 19,510

Income tax expense 4 (3,576) (2,130)

------------- -------------

Profit and total comprehensive

income for the period 15,223 17,380

------------- -------------

Basic earnings per Ordinary Share 5 16.22p 18.57p

============= =============

Diluted earnings per Share 5 11.36p 12.94p

============= =============

Celtic plc

Registered number SC3487

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER 2018

2018 2017

Unaudited Unaudited

Notes GBP000 GBP000

NON-CURRENT ASSETS

Property plant and equipment 58,905 56,637

Intangible assets 6 16,632 15,996

Trade and other receivables 7 7,795 -

Deferred tax asset - 891

83,332 73,524

CURRENT ASSETS

Inventories 1,991 2,039

Trade and other receivables 7 23,636 15,608

Cash and cash equivalents 9 44,676 37,410

------------- -------------

70,303 55,057

------------- -------------

TOTAL ASSETS 153,635 128,581

============= =============

EQUITY

Issued share capital 8 27,147 27,123

Share premium 14,783 14,720

Other reserve 21,222 21,222

Accumulated profits 25,083 11,817

------------- -------------

TOTAL EQUITY 88,235 74,882

============= =============

LIABILITIES

NON-CURRENT LIABILITIES

Interest bearing loans 4,800 6,350

Debt element of Convertible Cumulative

Preference Shares 4,193 4,216

Trade and other payables 6,788 10,293

Deferred tax 4 93 -

Provisions 1,300 1,082

Deferred income 71 86

------------- -------------

17,245 22,027

------------- -------------

CURRENT LIABILITIES

Trade and other payables 28,343 17,035

Current borrowings 1,380 304

Provisions 2,100 709

Deferred income 16,332 13,624

------------- -------------

48,155 31,672

------------- -------------

TOTAL LIABILITIES 65,400 53,699

============= =============

TOTAL EQUITY AND LIABILITIES 153,635 128,581

============= =============

Approved by the Board on 12 February 2019

Celtic plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Other Accumulated Total

capital premium reserve profits

GBP000 GBP000 GBP000 GBP000 GBP000

EQUITY SHAREHOLDERS' FUNDS

AS AT 1 JULY 2017 (Audited) 27,107 14,657 21,222 (5,563) 57,423

Share capital issued 1 63 - - 64

Reduction in debt element

of

convertible cumulative

preference shares 15 - - - 15

Profit and total comprehensive

income for the period - - - 17,380 17,380

EQUITY SHAREHOLDERS' FUNDS

AS AT 31 DECEMBER 2017 (Unaudited) 27,123 14,720 21,222 11,817 74,882

EQUITY SHAREHOLDERS' FUNDS

AS AT 1 JULY 2018 (Audited) 27,132 14,720 21,222 9,860 72,934

Share capital issued 1 63 - - 64

Reduction in debt element

of convertible cumulative

preference shares 14 - - - 14

Profit and total comprehensive

income for the period - - - 15,223 15,223

EQUITY SHAREHOLDERS' FUNDS

AS AT 31 DECEMBER 2018 (Unaudited) 27,147 14,783 21,222 25,083 88,235

========== =========== =========== =============== ==========

Celtic plc

CONSOLIDATED CASH FLOW STATEMENT

FOR THE 6 MONTHSED 31 DECEMBER 2018

Note 2018 2017

Unaudited Unaudited

GBP000 GBP000

Cash flows from operating activities

Profit for the period after tax 15,223 17,380

Taxation charge 3,576 2,130

Depreciation 967 881

Amortisation 4,787 4,227

Profit on disposal of intangible assets (17,563) (482)

Net finance costs 169 435

------------ ------------

7,159 24,571

Decrease in inventories 416 375

(Increase) in receivables (898) (7,028)

(Decrease) in payables and deferred

income (8,857) (364)

------------ ------------

Cash generated from operations (2,180) 11,496

Tax paid (1,200) -

Net interest received/(paid) 33 (25)

------------ ------------

Net cash flow from operating activities (3,347) 17,529

------------ ------------

Cash flows from investing activities

Purchase of property, plant and equipment (1,389) (946)

Purchase of intangible assets (6,032) (8,874)

Proceeds from sale of intangible assets 13,714 5,769

------------ ------------

Net cash generated / (used in) from

investing activities 6,293 (4,051)

------------ ------------

Cash flows from financing activities

Repayment of debt (370) (100)

Dividend on Convertible Cumulative

Preference Shares (463) (473)

------------ ------------

Net cash used in financing activities (833) (573)

------------ ------------

Net increase in cash equivalents 2,113 12,905

Cash and cash equivalents at 1 July 42,563 24,505

------------ ------------

Cash and cash equivalents at period

end 9 44,676 37,410

============ ============

Celtic plc

NOTES TO THE FINANCIAL INFORMATION

1. BASIS OF PREPARATION

The financial information in this interim report comprises the

Consolidated Statement of Comprehensive Income, Consolidated

Balance Sheet, Consolidated Statement of Changes in Equity,

Consolidated Cash Flow Statement and accompanying notes. The

financial information in this interim report has been prepared

under the recognition and measurement requirements of IFRSs as

adopted for use in the European Union but does not include all of

the disclosures that would be required under those accounting

standards. The accounting policies adopted in the financial

information are consistent with those expected to be adopted in the

Company's financial statements for the year ended 30 June 2019 and

are unchanged from those used in the Company's annual report for

the year ended 30 June 2018.

The financial information in this interim report for the six

months to 31 December 2018 and to 31 December 2017 has not been

audited, but it has been reviewed by the Company's auditor, whose

report is set out on page 4.

Adoption of standards effective in 2018

The following standards have been adopted as of 1 July 2018 and

have no material impact on the financial information for the period

under review:

IFRS 9 Financial Instruments

The Group has applied IFRS 9 from 1 July 2018. The Group has

elected not to restate comparatives on initial application of IFRS

9. The principal effect of IFRS 9 is the introduction of the

expected credit loss model. However, due to the Group's history of

low credit losses and no expectation that this trend will change in

the foreseeable future, there is no likely material change in the

provision.

IFRS 15 Revenue from Contracts with Customers

IFRS 15 establishes a single comprehensive model for entities to

use in accounting for revenue arising from contracts with

customers. IFRS 15 supersedes previous revenue recognition guidance

including IAS 18 Revenue, IAS 11 Construction Contracts and the

related Interpretations. The Group has applied IFRS 15 from 1 July

2018.

All revenue streams were reviewed to determine how the previous

approach to revenue recognition would comply with the 5 step model

under IFRS 15. It should be noted that as almost all revenue

streams are aligned to the football season, which in turn forms the

basis for the financial year, the main factor for consideration was

whether the implementation of IFRS 15 would impact materially on

the half year results which are reported for the 6 months to 31

December. The review concluded that there was no material

impact.

Assessment on adoption of standards not yet effective

At the date of authorisation of this interim report the

following standard was not effective however will be adopted in

accordance with its effective date. An update as to the Group's

assessment of the impact this standard is provided below.

IFRS 16 Leases

IFRS 16 introduces a comprehensive model for the identification

of lease arrangements and accounting treatments for both lessors

and lessees. IFRS 16 will supersede the current lease guidance

including IAS 17 Leases and the related interpretations when it

becomes effective for accounting periods beginning on or after 1

January 2019. The Group will adopt IFRS 16 for the year ending 30

June 2020. No decision has yet been made about whether to use any

of the transitional options in IFRS 16.

IFRS 16 distinguishes leases and service contracts based on

whether an identified asset is controlled by a customer.

Distinctions of operating leases (off balance sheet) and finance

leases (on balance sheet) are removed for lessee accounting, and

are replaced by a model where a right-of-use asset and a

corresponding liability have to be recognised for all leases by

lessees (i.e. all on balance sheet) except for short-term leases

and leases of low value assets.

Celtic plc

NOTES TO THE FINANCIAL INFORMATION

1. BASIS OF PREPARATION (CONTINUED)

The right-of-use asset is initially measured at cost and

subsequently measured at cost (subject to certain exceptions) less

accumulated depreciation and impairment losses, adjusted for any

re-measurement of the lease liability. The lease liability is

initially measured at the present value of the lease payments that

are not paid at that date. Subsequently, the lease liability is

adjusted for interest and lease payments, as well as the impact of

lease modifications, amongst others.

Furthermore, the classification of cash flows will also be

affected because operating lease payments under IAS 17 are

presented as operating cash flows; whereas, under the IFRS 16

model, the lease payments will be split into a principal and an

interest portion, which will be presented as financing and

operating cash flows respectively.

In contrast to lessee accounting, IFRS 16 substantially carries

forward the lessor accounting requirements in IAS 17, and continues

to require a lessor to classify a lease either as an operating

lease or a finance lease.

Based on our assessment, the net impact to the Group's financial

statements is not considered to have a material net effect;

however, this includes what would be a material grossing out on the

Balance Sheet with a corresponding increase to both assets and

liabilities. We will recognise the carrying value of the operating

leases within assets with an offsetting liability and there will be

a reallocation in the Statement of Comprehensive Income from rental

costs to depreciation within Operating Expenses and to the

unwinding discount within Finance Expense.

Going concern

The Company has considerable financial resources available to

it, together with established contracts with a number of customers

and suppliers. As a consequence, the Directors believe that the

Company is well placed to continue managing its business risks

successfully and they have a reasonable expectation that the

Company has adequate resources to continue in operational existence

for the foreseeable future. Thus, they continue to adopt the going

concern basis of accounting in preparing the financial information

in this interim report.

2. REVENUE

6 months 6 months

to 31 to 31

Dec 2018 Dec 2017

Unaudited Unaudited

GBP000 GBP000

Football and stadium operations 23,873 26,802

Multimedia and other commercial

activities 15,529 34,011

Merchandising 10,613 10,692

50,015 71,505

=========== ===========

Number of home games 17 19

=========== ===========

3. FINANCE INCOME AND EXPENSE

6 months 6 months

to to

31 December 31 December

2018 2017

Unaudited Unaudited

GBP000 GBP000

Finance income:

Interest receivable on bank deposits 128 35

Notional interest income on deferred

consideration 403 12

-------------- --------------

531 47

============== ==============

6 months 6 months

to to

31 December 31 December

2018 2017

Unaudited Unaudited

GBP000 GBP000

Finance expense:

Interest payable on bank and other

loans (110) (61)

Notional interest expense on deferred

consideration (304) (134)

Dividend on Convertible Cumulative

Preference Shares (286) (287)

-------------- --------------

(700) (482)

============== ==============

4. TAXATION

Tax has been charged at 19% for the six months ended 31 December

2018 (2017: 19%) representing the best estimate of the average

annual effective tax rate expected to apply for the full year,

applied to the pre-tax income of the six month period. A deferred

tax liability of GBP0.1m has been recognised in respect of short

term timing differences.

5. EARNINGS PER SHARE

Basic earnings per share has been calculated by dividing the

profit for the period of GBP15.2m (2017: GBP17.4m) by the weighted

average number of Ordinary Shares in issue 93,865,887 (2017:

93,591,020). Diluted earnings per share as at 31 December 2018 has

been calculated by dividing the profit for the period by the

weighted average number of Ordinary Shares, Convertible Cumulative

Preference Shares and Convertible Preferred Ordinary Shares in

issue, assuming conversion at the balance sheet date if

dilutive.

6. INTANGIBLE ASSETS

31 December 31 December

2018 2017

Unaudited Unaudited

Cost GBP000 GBP000

At 1 July 44,962 34,335

Additions 1,854 6,634

Transfer to prepayments - (605)

Disposals (5,850) (1,986)

--------------- ---------------

At period end 40,966 38,378

=============== ===============

Amortisation

At 1 July 23,999 20,408

Charge for the period 4,787 4,227

Transfer to prepayments - (371)

Disposals (4,452) (1,882)

--------------- ---------------

At period end 24,334 22,382

=============== ===============

Net Book Value at period end 16,632 15,996

=============== ===============

7. TRADE AND OTHER RECEIVABLES

31 December 31 December

2018 2017

Unaudited Unaudited

GBP000 GBP000

Trade receivables 23,430 4,421

Prepayments and accrued income 7,292 10,224

Other receivables 709 963

------------- -------------

31,431 15,608

============= =============

Amounts falling due after more than one year

included above are:

2018 2017

GBP000 GBP000

Trade receivables 7,795 -

============= =============

8. SHARE CAPITAL

Authorised Allotted, called up and

fully paid

31 December 31 December

2018 2017 2018 2018 2017 2017

Unaudited Unaudited Unaudited

No 000 No 000 No 000 GBP000 No 000 GBP000

Equity

Ordinary Shares of 1p each 223,271 223,101 93,916 939 93,696 937

Deferred Shares of 1p each 656,090 647,036 656,090 6,561 647,036 6,470

Convertible Preferred Ordinary

Shares of GBP1 each 14,883 14,923 12,896 12,896 12,936 12,936

Non-equity

Convertible Cumulative Preference

Shares of 60p each 18,371 18,459 15,871 9,523 15,959 9,576

Less reallocated to debt:

Initial debt - - - (2,772) - (2,796)

Capital reserve - - - - - -

---------- ----------

912,615 903,519 778,773 27,147 769,627 27,123

========== ========== ========== =========== ========== ===========

9. ANALYSIS OF NET CASH AT BANK

The reconciliation of the movement in cash and cash equivalents

per the cash flow statement to net cash is as follows:

31 December 31 December

2018 2017

Unaudited Unaudited

GBP000 GBP000

Bank Loans due after more than

one year (4,800) (6,350)

Bank Loans due within one year (1,280) (200)

Cash and cash equivalents:

Cash at bank and on hand 44,676 37,410

------------- -------------

Net cash at bank at period end 38,596 30,860

============= =============

Total net cash, deducting other loans of GBP0.1m (2017: GBP0.1m)

and that arising from the reclassification of equity to debt of

GBP4.2m (2017: GBP4.2m) amounted to GBP34.3m (2017: GBP26.5m).

Period-end net cash, net of debt and debt like items, of

GBP37.7m (2017: GBP17.0m). This figure is represented by cash net

of bank borrowings of GBP38.6m (2017: GBP30.9m) further adjusted

for other debt like items, namely the net player trading balance,

other loans and remuneration balances payable to certain personnel

at the balance sheet date.

The change in the aging profile of the bank loans follows the

re-negotiation of the Group banking facilities in August 2018.

10. POST BALANCE SHEET EVENTS

Since the balance sheet date, we have secured the permanent

registrations of Marian Shved, Vakoun Bayo, Emanuel Perez and

Andrew Gutman, and the temporary registrations of Timothy Weah from

Paris St Germain, Oliver Burke from West Bromwich Albion and Jeremy

Toljan from Borussia Dortmund. We have also temporarily transferred

the registrations of Youssouf Mulumbu to Kilmarnock, Lewis Morgan

to Sunderland, Calvin Miller to Ayr United, Conor Hazard to Partick

Thistle and Marian Shved to FC Karpaty. Emanuel Perez and Andrew

Gutman have also been placed on loan to clubs in the United Soccer

League in the USA.

In addition, we have temporarily transferred the registration of

development squad player Jack Aitchison to Alloa Athletic and have

cancelled the registration of Lewis Bell.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BRGDDISBBGCD

(END) Dow Jones Newswires

February 12, 2019 13:00 ET (18:00 GMT)

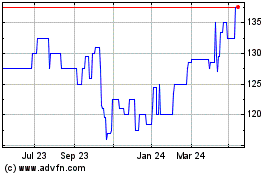

Celtic (LSE:CCP)

Historical Stock Chart

From Dec 2024 to Jan 2025

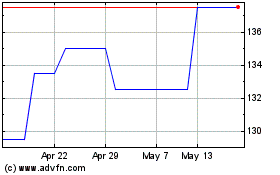

Celtic (LSE:CCP)

Historical Stock Chart

From Jan 2024 to Jan 2025