TIDMCCP

RNS Number : 6242X

Celtic PLC

11 February 2013

11 February 2013

CELTIC plc

INTERIM RESULTS FOR THE SIX MONTHS TO 31 DECEMBER 2012

Operational Highlights

-- Progression to last 16 of the European Champions League.

-- Currently top in the Clydesdale Bank Premier League.

-- Continued participation in the Scottish Cup.

-- Announcement of new shirt sponsorship deal with Magners commencing 1 July 2013.

Financial Highlights

-- Turnover increased by 71.0% to GBP50.06m (2011: GBP29.27m).

-- Operating expenses increased by 30.2% to GBP36.96m (2011: GBP28.39m).

-- Profit from trading of GBP13.10m (2011: GBP0.88m).

-- Profit on disposal of intangible assets GBP5.20m (2011: GBP3.15m).

-- Profit before taxation of GBP14.94m (2011:GBP0.18m).

-- Period end net bank debt of GBP0.13m (2011: GBP7.05m).

-- Investment in football personnel of GBP4.65m (2011: GBP4.44m).

-- 19 home fixtures (2011: 16).

For further information contact:

Ian Bankier, Celtic plc Tel: 0141 551 4235

Peter Lawwell, Celtic plc Tel: 0141 551 4235

Iain Jamieson, Celtic plc Tel: 0141 551 4235

Celtic plc

CHAIRMAN'S STATEMENT

I am pleased to report on our financial results for the six

months ended 31 December 2012. The introductory page to these

interim results summarises the main highlights.

On the pitch it has been a memorable and highly successful

period. We started the new season as Scottish Premier League

Champions and, since then, we have enjoyed impressive results. At

the time of writing, we have a healthy lead in the race to retain

our Premier League title and we remain in the Scottish FA Cup.

Of greater significance, though, has been the achievement of

qualifying for the last 16 of the UEFA Champions League, the

undoubted highlight being our victory over Barcelona at Celtic Park

in November. Celtic surpassed the expectations of many by

progressing into the competition's knockout stages from a very

tough group. Furthermore, the club's international reputation and

standing received a substantial boost. This success had a major

bearing on our financial performance in the period under

review.

The revenues generated by the team's success in Europe this year

have significantly impacted our half year results, with turnover

increasing to GBP50.06m, a 71% improvement over the previous year.

Celtic's achievements, both domestically and in Europe, have had a

similarly positive effect on merchandise and ticketing income,

notwithstanding the current difficult economic climate.

The results on the park and additional matches produced an

increase in operating expenses to GBP36.96m and our profit from

trading, before asset transactions and exceptional operating

expenses, was GBP14.94m - a significant uplift on last year's

figure of GBP0.18m for the same period.

As in previous years, we continue to make investments in the

playing squad and support services. The management of the playing

squad is an important aspect of our business model. In the period

under review we invested GBP4.65m in strengthening the first team

squad, and added to this in the January transfer window. We have a

talented first team pool, with a strong emphasis on youth. Our

scouting and player identification processes continue to bear

fruit, and our investment in state of the art medical and sport

science facilities at Lennoxtown has contributed to optimising

performance. Similarly, the ongoing strategy of investing in our

Academy is yielding its own benefits as we remain committed to

finding, coaching and developing Champions League quality

players.

Such investment and player development initiatives have further

enhanced profitability, with a profit from transfer activity of

GBP5.2m, largely as a consequence of the sale of Ki Sung Yueng to

Swansea, in comparison to GBP3.15m last year. Nevertheless, we have

managed to strike a prudent balance between trading successful,

valuable assets and retaining key talent to enhance our prospects

of football success. Our financial strength meant that we were able

to retain all our key players through the January transfer window

and further enhanced our squad with the signing of Rami Gershon,

Tomas Rogic and Viktor Noring.

The improvement in trading has impacted on our period end net

bank debt, which stood at GBP0.13m, nearly GBP7m less than at the

same point last year, well within the Company's facilities. Our

success on the park and the maintenance of our robust business

model has provided stability in a challenging environment. The

second half of the 2012/13 financial year is expected to follow a

similar trading pattern to recent years, but buoyed by on-field

success including participation in the UEFA Champions League.

Scottish Football has recently endorsed proposals to restructure

our domestic league system, with the aim of generating additional

interest and revenue for the benefit of fans and member clubs

alike. Celtic has been happy to support initiatives it sees as

being in the best interests of the Club and of the Scottish game in

general.

Off the field, the Club marked its 125th Anniversary in November

with a celebratory event held at St Mary's Church in Glasgow's

Calton where the inaugural meetings that led to the Club's

formation occurred in 1887. In addition, the Celtic Charity

Foundation launched an associated fund raising campaign aimed at

increasing donations raised for worthy causes.

In conclusion, I would wish to pay tribute to Neil Lennon and

his backroom staff, all of the players and all of the Directors,

management and staff at the Club who work tirelessly to maintain

the standards for which Celtic is rightly renowned. And finally, I

would like to thank the fans, who have continued to show their

unswerving support at a particularly turbulent but exciting time in

our history.

Ian P Bankier 11 February 2013

Chairman

Celtic plc

INDEPENDENT REVIEW REPORT TO CELTIC PLC

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 December 2012 which comprises the Consolidated

Statement of Comprehensive Income, the Consolidated Balance Sheet,

the Consolidated Statement of Changes in Equity, the Consolidated

Cash Flow Statement and the related notes. We have read the other

information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

This report is made solely to the company in accordance with the

terms of our engagement. Our review has been undertaken so that we

might state to the company those matters we are required to state

to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company for our review work, for this

report, or for the conclusions we have reached.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules of the London Stock Exchange.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared using

accounting policies consistent with those to be applied in the next

annual financial statements.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

December 2012 is not prepared, in all material respects, in

accordance with the AIM Rules of the London Stock Exchange.

PKF (UK) LLP

Glasgow, UK

11 February 2013

Celtic plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months 6 months 6months 6months 6months

to 31 to 31 to to to 31 to

December December 31 31 December December 31 December

2012 2012 December 2011 2011 2011

Unaudited Unaudited 2012 Unaudited Unaudited Unaudited

Unaudited

Operations Operations

excluding Player excluding Player

CONTINUING OPERATIONS: player trading Total player trading Total

trading trading

Note GBP000 GBP000 GBP000 GBP000 GBP000

REVENUE 2 50,058 - 50,058 29,271 - 29,271

OPERATING EXPENSES (36,961) - (36,961) (28,388) - (28,388)

----------- ----------- ----------- ------------ ----------- ------------

PROFIT FROM TRADING

BEFORE ASSET TRANSACTIONS

AND EXCEPTIONAL OPERATING

EXPENSES 13,097 - 13,097 883 - 883

AMORTISATION OF

INTANGIBLE ASSETS - (2,987) (2,987) - (3,351) (3,351)

PROFIT ON DISPOSAL OF

INTANGIBLE ASSETS - 5,204 5,204 - 3,146 3,146

LOSS ON DISPOSAL OF

PROPERTY PLANT AND

EQUIPMENT - - - (120) - (120)

----------- ----------- ----------- ------------ ----------- ------------

PROFIT BEFORE

FINANCIAL EXPENSES AND

TAXATION 13,097 2,217 15,314 763 (205) 558

=========== =========== ============ ===========

FINANCE COSTS: 3

BANK LOANS AND OVERDRAFT ( 98) (109)

CONVERTIBLE PREFERENCE

SHARES (272) (272)

----------- ------------

PROFIT BEFORE TAX 14,944 177

TAXATION 4 - -

----------- ------------

PROFIT FOR THE PERIOD

FROM CONTINUING

OPERATIONS 14,944 177

----------- ------------

PROFIT AND TOTAL

COMPREHENSIVE

INCOME FOR THE PERIOD

ATTRIBUTABLE TO THE

EQUITY HOLDERS OF THE

PARENT 14,944 177

=========== ============

BASIC EARNINGS PER

ORDINARY

SHARE 5 16.54p 0.20p

=========== ============

DILUTED EARNINGS PER

SHARE 5 11.17p 0.33p

=========== ============

Celtic plc

Registered number SC3487

CONSOLIDATED BALANCE SHEET

31 December 31 December 30 June

2012 2011 2012

Unaudited Unaudited Audited

Notes GBP000 GBP000 GBP000

NON-CURRENT ASSETS

Property plant and equipment 52,903 53,637 53,452

Intangible assets 6 8,241 10,640 7,333

------------ ------------ ----------

61,144 64,277 60,785

CURRENT ASSETS

Inventories 2,191 1,911 2,160

Receivables 7 11,340 5,576 4,981

Cash and cash equivalents 10,655 4,108 8,198

------------ ------------ ----------

24,186 11,595 15,339

------------ ------------ ----------

TOTAL ASSETS 85,330 75,872 76,124

============ ============ ==========

EQUITY

Issued share capital 8 24,265 24,266 24,264

Share premium 14,486 14,443 14,443

Other reserve 21,222 21,222 21,222

Capital reserve 2,630 2,629 2,630

Retained earnings (14,937) (22,334) (29,881)

------------ ------------ ----------

TOTAL EQUITY 47,666 40,226 32,678

============ ============ ==========

LIABILITIES

NON-CURRENT LIABILITIES

Interest bearing loans 9 10,407 10,781 10,594

Debt element of non-equity share

capital 4,441 4,441 4,441

Deferred income 91 184 121

------------ ------------ ----------

14,939 15,406 15,156

------------ ------------ ----------

CURRENT LIABILITIES

Trade and other payables 13,676 12,016 15,069

Current borrowings 493 499 493

Deferred income 8,556 7,725 12,728

------------ ------------ ----------

22,725 20,240 28,290

============ ============ ==========

TOTAL LIABILITIES 37,664 35,646 43,446

============ ============ ==========

TOTAL EQUITY AND LIABILITIES 85,330 75,872 76,124

============ ============ ==========

Approved by the Board on 11 February 2013

Celtic plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share capital Share premium Other Capital Retained Total

reserve reserve earnings

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

EQUITY SHAREHOLDERS'

FUNDS AS AT 1 JULY

2011 (audited) 24,264 14,399 21,222 2,628 (22,510) 40,003

Share capital issued - 44 - - - 44

Transfer from capital - - - - - -

reserve

Profit and total comprehensive

income for the period - - - - 177 177

EQUITY SHAREHOLDERS'

FUNDS AS AT 31 DECEMBER

2011 (Unaudited) 24,264 14,443 21,222 2,628 (22,333) 40,224

================ ================ ========== ========== =========== ==========

Transfer to capital

reserve - - - 2 - 2

Profit and total comprehensive

income for the period - - - - (7,548) (7,548)

---------------- ---------------- ---------- ---------- ----------- ----------

EQUITY SHAREHOLDERS'

FUNDS AS AT 30 JUNE

2012 (Audited) 24,264 14,443 21,222 2,630 (29,881) 32,678

================ ================ ========== ========== =========== ==========

Share capital issued 1 43 - - - 44

Profit and total comprehensive

income for the period - - - - 14,944 14,944

EQUITY SHAREHOLDERS'

FUNDS AS AT 31 DECEMBER

2012 (Unaudited) 24,265 14,486 21,222 2,630 (14,937) 47,666

================ ================ ========== ========== =========== ==========

Celtic plc

CONSOLIDATED CASH FLOW STATEMENT

6 months 6 months

to to

31 December 31 December

2012 2011

Note Unaudited Unaudited

GBP000 GBP000

Cash flows from operating activities

Profit before tax 14,944 177

Depreciation 939 981

Amortisation 2,987 3,351

Impairment of intangible assets - -

Profit on disposal of intangible assets (5,204) (3,146)

Loss on disposal of property, plant

and equipment - 120

Finance costs 370 381

------------- -------------

14,036 1,864

(Increase) / decrease in inventories (31) 339

(Increase) in receivables (4,823) (235)

(Decrease) in payables and deferred

income (3,107) (5,801)

Cash (utilised in) / generated from operations 6,075 (3,833)

Interest paid (98) (109)

Net cash flow from operating activities

- A 5,977 (3,942)

Cash flows from investing activities

Purchase of property, plant and equipment (732) (469)

Purchase of intangible assets (6,529) (5,957)

Proceeds from sale of intangible assets 4,428 4,351

Net cash used in investing activities

- B (2,833) (2,076)

Cash flows from financing activities

Repayment of debt (188) (194)

Dividends paid (499) (498)

Net cash (used) in financing activities

- C (687) (692)

Net (increase) in cash equivalents

A+B+C 2,457 (6,710)

Cash and cash equivalents at 1 July 8,198 10,818

Cash and cash equivalents at period

end 10 10,655 4,108

Celtic plc

NOTES TO THE FINANCIAL STATEMENTS

1. This Interim Report, comprising the Consolidated Statement of

Comprehensive Income, Consolidated Balance Sheet, Consolidated

Statement of Changes in Equity, Consolidated Cash Flow Statement

and accompanying Notes, has been prepared in accordance with the

AIM rules of the London Stock Exchange. The measurement and

recognition accounting policies applied are consistent with those

that will be applied in the 2013 annual accounts which will be

prepared in accordance with IFRS.

The interim results do not constitute the statutory accounts

within the meaning of s434 of the Companies Act 2006. The financial

information in this Report for the six months to 31 December 2012

and to 31 December 2011 has not been audited. The comparative

figures for the year ended 30 June 2012 are extracted from the

Group's audited financial statements for that period as filed with

the Registrar of Companies. They do not constitute the statutory

accounts within the meaning of s434 of the Companies Act 2006 for

that period. Those accounts received an unqualified audit report

which did not contain any statement under sections 498 (2) or (3)

of the Companies Act 2006.

The auditors have reviewed this Interim Report and their report

is set out earlier in this document.

2. REVENUE - SEGMENTAL INFORMATION

6 months to 6 months to

31 December 31 December

2012 2011

Unaudited Unaudited

GBP000 GBP000

Revenue comprised:

Football and stadium operations 18,598 16,446

Multimedia & other commercial

activities 21,613 5,004

Merchandising 9,847 7,821

50,058 29,271

============= =============

Number of home games 19 16

============= =============

3. FINANCE COSTS

6 months 6 months

to to

Payable as follows on: 31 December 31 December

2012 2011

Unaudited Unaudited

GBP000 GBP000

Bank loans and overdraft 98 109

Non-equity shares 272 272

Total 370 381

============= =============

4. TAXATION

After taking account of unutilised tax losses brought forward,

together with the projected performance for the next six months, no

provision for taxation is required.

5. EARNINGS PER SHARE

Basic earnings per share has been calculated by dividing the

earnings for the period by the weighted average number of Ordinary

Shares in issue 90,364,753 (2011: 90,229,640). Diluted earnings per

share as at 31 December 2012 has been calculated by dividing the

earnings for the period by the weighted average number of Ordinary

Shares, Preference Shares and Convertible Preferred Ordinary Shares

in issue, assuming conversion at the balance sheet date, and the

full exercise of outstanding share purchase options, if dilutive.

As at December 2012 and December 2011 no account was taken of

potential conversion of share purchase options, as these potential

Ordinary Shares were not considered to be dilutive under the

definitions of the applicable accounting standards.

6. INTANGIBLE ASSETS

6 months to 6 months to 12 months

31 December 31 December to 30 June

2012 2011 2012

Unaudited Unaudited Audited

Cost GBP000 GBP000 GBP000

At 1 July 28,737 29,618 29,618

Additions 4,655 4,436 5,239

Disposals (8,282) (3,937) (6,120)

------------- ------------- ------------

At period end 25,110 30,117 28,737

============= ============= ============

Amortisation

At 1 July 21,404 19,254 19,254

Charge for the period 2,987 3,351 6,367

Provision for impairment - - 301

Disposals (7,522) (3,128) (4,518)

------------- ------------- ------------

At period end 16,869 19,477 21,404

============= ============= ============

Net Book Value at period end 8,241 10,640 7,333

============= ============= ============

7. RECEIVABLES

The increase of GBP5.76m in the level of receivables from 31

December 2011 to GBP11.34m is primarily a result of an increase in

amounts due in instalments from player sales conducted in previous

transfer windows and payments due from UEFA in relation to UCL

group stage participations.

8. SHARE CAPITAL

Authorised Allotted, called up and fully paid

31 December 30 June 31 December 30 June

2012 2011 2012 2012 2012 2011 2011 2012 2012

No 000 No 000 No 000 No 000 GBP000 No 000 GBP000 No 000 GBP000

Equity

Ordinary

Shares

of 1p each 220,124 220,105 220,120 90,409 904 90,260 902 90,275 903

Deferred

Shares

of 1p each 497,110 496,184 496,924 497,110 4,971 496,184 4,962 496,924 4,969

Non-equity

Convertible

Preferred

Ordinary

Shares

of GBP1 each 15,959 15,967 15,960 13,971 13,971 13,980 13,980 13,972 13,972

Convertible

Cumulative

Preference

Shares

of 60p each 19,282 19,282 19,282 16,782 10,069 16,782 10,070 16,782 10,069

Less

reallocated

to debt

under

IAS 32 - - - - (5,650) - (5,648) (5,649)

--------- --------- ----------

752,475 751,538 752,286 618,272 24,265 617,206 24,266 617,953 24,264

========= ========= ========= ========= ========== ========= ========== ========= ==========

9. NON - CURRENT LIABILITIES

Non-current liabilities reflect the non-current element of bank

loans of GBP10.41m (December 2011: GBP10.78m, June 2012: GBP10.59m)

drawn down at the end of the period as part of the Company's bank

facility of GBP33.56m (December 2011: GBP34.31m, June 2012:

GBP33.94) and GBP4.44m (December 2011: GBP4.44m, June 2012:

GBP4.44m) as a result of the reallocation of non-equity share

capital from equity to debt following the introduction of IAS 32

and GBP0.09m (December 2011: GBP0.18m, June 2012: GBP0.12m) of

deferred income.

10. ANALYSIS OF NET DEBT

The reconciliation of the movement in cash and cash equivalents

per the cash flow statement to net bank debt is as follows:

31 December 31 December 30 June

2012 2011 2012

GBP000 GBP000 GBP000

Bank Loans due after more than

one year 10,407 10,781 10,594

Bank Loans due within one year 375 375 375

Cash and cash equivalents (10,655) (4,108) (8,198)

------------ ------------ --------

Net bank debt at period end 127 7,048 2,771

============ ============ ========

Total net debt, including other loans of GBP0.12m (2011:

GBP0.12m) and that arising from the reclassification of equity to

debt following the adoption of IAS32 of GBP4.44m (2011: GBP4.44m)

amounted to GBP4.69m (2011: 11.61m).

11. POST BALANCE SHEET EVENTS

Following 31 December 2012, Celtic acquired the permanent

registrations of Tomas Rogic in addition to entering into loan

agreements for Rami Gershon and Viktor Noring. The registration of

Mohamed Bangura was loaned to IF Elfsborg.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EFLFFXLFLBBD

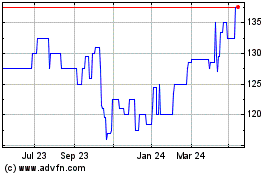

Celtic (LSE:CCP)

Historical Stock Chart

From Sep 2024 to Oct 2024

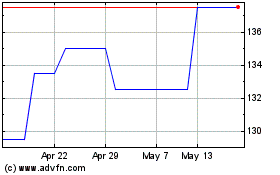

Celtic (LSE:CCP)

Historical Stock Chart

From Oct 2023 to Oct 2024