RNS Number:5522A

Cashbox PLC

29 March 2006

Press Release 29 March 2006

Cashbox plc

("Cashbox" or "the Company")

First day of dealings on the AIM market

Cashbox plc ("Cashbox" or "the Company"), an independent ATM deployer and

operator, today announces the commencement of dealings of its Ordinary Shares on

the AIM market ("AIM") of the London Stock Exchange ("Admission"). Seymour

Pierce is acting as Nominated Adviser and as Broker to the Company. The stock

market EPIC is CBOX.L

Placing Statistics

Placing Price of Ordinary Shares 20p

Number of existing Ordinary Shares prior to Admission 38,052,000

Number of Ordinary Shares being placed by the Company 22,500,000

Number of Ordinary Shares in issue following the Placing 60,927,000

Market capitalisation at the Placing Price #12.2 million

Percentage of enlarged issued share capital subject to the Placing 36.9%

Gross proceeds of the Placing to be received by the Company #4.50 million

Net proceeds of the Placing to be received by the Company #3.51 million

Carl Thomas, Chief Executive of Cashbox plc, said: "We are delighted that the

flotation of the Company has been completed successfully and that we are one of

only three 'pure play' ATM companies on the AIM market. Our sector continues to

grow apace and developments in the ATM industry make this an exciting and

dynamic industry to be in. We have a large number of sites waiting to be

supplied with ATMs and we look forward to installing these locations as quickly

as possible."

For further information:

Cashbox plc

Carl Thomas, Chief Executive Tel: +44 (0) 870 126 2274

cthomas@cashboxatm.co.uk www.cashboxatm.co.uk

Seymour Pierce Limited

Jeremy Porter, Corporate Finance Tel: +44 (0) 20 7107 8000

jeremyporter@seymourpierce.com www.seymourpierce.com

Media enquiries:

Abchurch

Henry Harrison-Topham / Ariane Comstive Tel: +44 (0) 20 7398 7700

henry.ht@abchurch-group.com www.abchurch-group.com

Introduction

Cashbox began trading in September 2003 and, as at 31 December 2005, owned and/

or operated an estate of 845 independent ATMs in the UK. The Directors

anticipate that Cashbox will have further ATM installations, and the Directors

believe there is potential for further installations (where considered viable

and subject to any landlord or other third-party consent), as shown in the table

below:

ATMs installed at Anticipated Potential

31 December ATM further ATM

installations

LINK designated category 2005 installations

Convenience (includes off licenses, convenience

stores)

265 400 3,500

Leisure (cinemas, bowling, holiday parks,

race courses, amusement arcades etc) 20 3 357

Motoring (petrol forecourts, motorway services,

car park operators)

15 0 500

Services (University Student Unions,

Colleges) 9 0 0

Social (pubs, bars, nightclubs) 433 85 1,153

Supermarket 2 0 0

Workplace (offices, canteens etc) 4 0 0

Processing (contracts won for migration of

existing ATM estates to Cashbox network) 97 108 0

--------- --------- ---------

845 596 5,510

--------- --------- ---------

Cashbox generates revenue in the following ways:

1. Transaction revenues

- Convenience Fees incurred by the cardholder at the time of withdrawing cash from an ATM; and

- Interchange Fees paid to Cashbox by the cardholder's bank or building society on ATM balance enquiries and

rejected transactions and transactions where no Convenience Fee is charged.

2. Sales of ATMs

- ATM sales to Merchants under the Sale Model.

Cashbox's sales strategy is based on selecting amongst three models (Sale Model,

Placement Model and Fully Managed Model) to aim to maximise the profit potential

of each ATM site. The Directors intend that the Placement Model will become

Cashbox's main basis for deploying self-fill ATMs, whereby the ATM is placed

with and replenished by the Merchant, eliminating the need for third party cash

handling costs. 95 transacting Placement Models were in place at 31 December

2005. The Directors believe that they have shown this model, using their

detailed site surveys, will enable Cashbox to place ATMs profitably in lower

footfall areas, which the Directors believe effectively expands the market

available to Cashbox. The Directors intend that for sites with higher footfall,

the Fully Managed Model (whereby ATMs are replenished by third party cash

handling firms) will be used.

Only sites where Cashbox's detailed survey shows an ATM is expected to generate

a gross profit contribution will be selected for ATM deployment.

History and Background of Cashbox

Cashbox was founded by Carl and Matthew Thomas in 2003. Prior to founding

Cashbox, Carl Thomas was in charge of corporate sales at Hanco. During Carl's

time at Hanco, Hanco increased the ATM installed base to over 3,600 ATMs as at

the end of June 2003, making Hanco the largest IAD in terms of numbers of ATMs

in the UK at this time.

Since 2003 Cashbox's ATM estate has grown from zero to 845 as at 31 December

2005. It won its first contract with the drinks merchant Thresher Group, and in

September 2003, Cashbox installed its first ATM. Cashbox installed its 50th ATM

during October 2003 and its 100th ATM during November 2003. The following

month, Cashbox installed its first machine for the pub group Greene King.

Cashbox was granted membership of LINK in March 2004, allowing Cashbox to

incorporate its ATMs in the LINK network. Cashbox became the first IAD in the UK

to become completely compliant with the Triple DES security standard in June

2004. Cashbox installed its 500th ATM in October 2004.

In January 2005, Cashbox introduced the Placement Model on a selected test basis

and subsequently signed contracts with companies such as Scottish & Newcastle

Pub Enterprises and Nisa Today's which, when combined, offer a significant

number of potential ATM sites. In addition, with regard to the Fully Managed

Model, Cashbox has negotiated agreement to proceed to trial installations with

an operator with over 70 potential sites. The trial installation commenced in

the first quarter of 2006.

Industry Overview

Over the five years ended 31 December 2004, the number of ATMs in the UK has

nearly doubled, with 80% of the ATMs deployed during those years being installed

in locations other than banks and building societies. By the end of 2004,

54,412 ATMs were in operation. More than 90% of new ATMs deployed during 2004

were supplied by an IAD.

Transaction volumes have grown in line with ATM deployment; 1.3 billion

transactions took place in 1994 growing to 2.5 billion in 2004. Average

Convenience Fees are currently around #1.50. The Directors believe Convenience

Fees will rise with some ATM sites already charging close to #2.00.

Currently, 50% of cash in circulation is sourced in the UK from ATMs and APACS

predicts this will rise to 75% by 2011.

The UK is the third largest ATM market in Western Europe, representing 16% of

installations and the eighth largest ATM market in the world. In 2004, the UK

was the fastest growing ATM market in Western Europe, largely driven by the

increase in remote locations due to IADs.

The Directors believe there are many different opportunities for growth and

additional sources of revenue for the surcharging ATM sector, driven by a number

of factors:

* demographic preference for younger customers to withdraw cash from ATMs;

* growth in non-bank ATM locations, resulting from the greater commercial viability of surcharging

ATMs compared with non-charging ATMs in low footfall areas;

* the sale of ATM estates by financial institutions, which could in certain cases prove profitable if

run by an IAD;

* trend for the payment of state benefits directly into bank accounts; and

* introduction of additional services provided by ATMs, including on-screen advertising, voucher and

coupon dispensing, and mobile phone top-ups.

Treasury Select Committee Report

In March 2005, the Treasury Select Committee appointed by the UK Government to

investigate ATM Convenience Fees released its findings. A memorandum submitted

by HM Treasury to the Select Committee stated that it "welcomes the changes (to

access, pricing and transparency of charges in the ATM industry) because they

have made the industry more competitive, with clear benefits for consumers".

The memorandum also mentioned the liberalisation of LINK membership criteria in

a positive light, attributing the increased competition in the market to the

introduction of independent ATM operators and noting that ATMs are now available

in locations such as pubs, shops and garages, thereby increasing consumer

choice.

The memorandum acknowledged that "there are costs to supplying an ATM service

and it would not be commercially viable for an ATM operator to offer the service

if these costs could not be recovered". It goes on to state that "in the

majority of cases, the surcharge would seem to be commercially justified".

The memorandum also stated that "the Government believes that charges are a

commercial matter for ATM operators", with specific warnings against the

introduction of direct regulation of retail prices. The main recommendation of

the Select Committee was that ATM charges should be transparent.

Competition

The Directors believe that the competition can be broadly categorised as

follows:

* high street banks and building societies; and

* other IADs such as Hanco (now owned by Royal Bank of Scotland plc), Cardpoint plc (including

Moneybox plc), TRM Corporation and Bank Machine Limited.

The Directors believe that the Cashbox ATM installation team is efficient, that

its ATMs have low cost and relatively high specification, that Cashbox focuses

on customer service and that these factors, combined with management's knowledge

of the ATM market offer significant advantages in securing ATM estates.

The Directors believe that the following factors represent deterrents to new

entrants to the market:

* membership of LINK is critical to any independent ATM operator. Requirements for membership

include:

- strict accreditation controls including conformity with LINK's technical and security standards;

- the need to operate a dispute resolution service; and

- the meeting of minimum performance standards.

* In the Directors' opinion it is not currently economically viable for either the ATM owner or the

key ATM suppliers to service a small estate of ATMs. In particular, the requirement for initial

capital, the initial cost of LINK membership and the ongoing fees are proportionally higher per ATM

for operators with a small number of ATMs.

Strategy

Cashbox's sales strategy is based on selecting amongst three models (Sale Model,

Placement Model and Fully Managed Model) to maximise the profit potential of

each ATM site. The Directors expect that the majority of new installations will

use a Placement Model whereby the ATM is placed with the Merchant and

replenished by the Merchant, eliminating the need for third party cash handling

costs. The Directors believe this model, using their detailed site surveys,

will enable Cashbox to place ATMs profitably in lower footfall areas which

effectively expands the market available to Cashbox. For sites with higher

footfall, the Fully Managed Model (whereby ATMs are replenished by third party

cash handling firms) will be used.

The Directors believe that Cashbox's sales process, which includes Cashbox's

fully employed survey team undertaking detailed site analysis before

recommending to the Merchant the appropriate deployment model (including

rejecting sites with poor prospects), provides a strong platform for growth.

The Directors are confident of the organic growth potential of Cashbox's ATM

business. The Directors also believe that there are a number of current

opportunities in the sector which could result in the management of other ATM

estates being outsourced or, in certain cases, ATM estates being sold.

Over the next 18 months, Cashbox intends:

* to market actively Cashbox's Placement and Fully Managed ATM deployment models;

* to expand significantly its ATM estate organically; and

* to explore opportunities to acquire or manage further ATM estates.

Directors

Brief biographies of the Directors are set out below.

Anthony Sharp, aged 43 - Non-Executive Chairman

Anthony has been involved in helping and investing in growing businesses since

he was 17 years of age. He has owned and managed businesses in sectors as

diverse as pubs and electronic publishing, from the 1980s to the present day and

in the UK and the United States. As part of a syndicate he has invested, at an

early stage, in companies such as lastminute.com and GoAmerica.

Anthony lived in New York City for 10 years assisting in building a publishing

business (MAID) which was later floated on the London Stock Exchange with a

secondary offering of ADRs on the NASDAQ. Latterly, he invested in and was

appointed Chairman of NMTV, also known as Silicon.com, which was sold to Cent in

2002.

Carl Thomas, aged 41 - Chief Executive and Founder

Carl established Cashbox in 2003. Carl has many years' experience in the UK ATM

sector having joined Hanco in 2001 to set up the Corporate Sales Department.

Over the two years that Carl spent at Hanco, Hanco increased the ATM installed

based to over 3,600 machines as at the end of June 2003, making Hanco the

largest IAD in the UK. Carl's career has spanned a number of disciplines

beginning with five years working in the retail sector. Carl moved into his

first sales role in the late 1980s working for Dairy Crest and ultimately

assumed responsibility for sales training. He subsequently spent a number of

years in consumer and brand marketing roles which led to his appointment as UK

Trade Marketing Manager for The Prestige Group.

Returning to the sales arena in the mid 1990s, Carl joined the Sony Corporation

where he used his fast moving consumer group skills and experience to establish

Sony Media products within the multiple retail sector, a new sector for the

company.

Carl worked for Bristol Myers and Revlon International in the late 1990s

handling their largest European accounts (Boots and Tesco), before joining

Hutamaki Van Leer where he headed up the UK and European prepared food packaging

division.

His last role prior to joining the ATM industry was as European Sales Director

for Datamonitor, a fast growing market analysis and research company and now a

publicly quoted business.

Darren Woolsgrove, aged 35 - Finance Director

Prior to his involvement in Cashbox, Darren spent two years as an independent

management consultant advising companies on financial and strategic issues.

During this time he spent 15 months as Acting Chief Executive of The Fresh Olive

Company of Provence Limited, a specialist food manufacturer, importer and

distributor. This role involved a full review of strategic direction and an

analysis and redesign of all internal systems and controls.

Before this, Darren was a founder and Finance and Operations Director of an

online media company, Silicon Media Group Limited which published an online news

service for IT professionals called silicon.com. Silicon was formed in 1998 and

went through a private funding and two VC funding rounds before being

successfully sold to CNet Networks in Sept 2002. At its peak, the company

employed 150 people in three locations and had group turnover equivalent to #10

million per year. Darren led the fundraising processes and had full

responsibility for all financial, legal and operational functions across the

group, including HR.

Prior to this, Darren spent 4 years at Ideal Hardware Plc, his final role being

that of Group Financial Controller, a year as Accountant at Anglo Nordic Burner

Products and four years as Trainee Accountant at Carton Garrigan.

Matthew Thomas, aged 34 - Operations Director

Matthew joined Cashbox in 2003 as one of the founding directors. As Operations

and IT Director Matthew has been responsible for putting together the

engineering and support teams across the Company and has developed and

implemented Cashbox's IT infrastructure.

Prior to Cashbox, Matthew held a board position with Seetech Computing Ltd, an

IT company specialising in leading edge network infrastructure and thin client

technology. Matthew focused on project management and successfully delivered a

number of large IT solutions to key accounts across the UK.

Before Seetech, Matthew worked in the entertainment industry for Stage Electrics

Ltd, a technical services Company to the entertainment industry. At the time

Stage Electrics employed 12 people and was run from its head office in Exeter.

Matthew worked closely with the management team and helped to expand the company

to the largest such technical services company in Europe ultimately employing

almost 400 people with turnover of #22 million. During Matthew's 12 years with

Stage Electrics, he set up and managed the service operation across the

company's six offices and managed the technical design commissioning and

software delivery of the company's projects, overseeing projects for customers

such as The Millennium Stadium Cardiff, The Royal Court Theatre London, The

Millennium Dome and a large number of major West End shows and theatre

installations across the country.

Charles Hallett, aged 33 - Corporate Sales Director

Charles began his career as a Recruitment Consultant with Reed Employment. He

subsequently joined Rentokil Initial's Management Development Programme, gaining

experience across a number of divisions throughout the UK. Following his time

at Rentokil Initial, Charles set up a consultancy business where he advised a

range of businesses from small enterprises to large corporations including First

Choice Holidays, Business Post, Hyster and QS plc on growth strategies.

Charles entered the ATM industry in March 2001 when he joined Hanco as Corporate

Sales Manager where he had responsibility for new business development and key

account management. Charles secured numerous important contracts, including

deals with Thresher Group, Budgens, Unwins and Unique Pub Company.

Robin Saunders, aged 43 - Non-executive Director

Robin Saunders is a London based financier who has specialised in

securitisation, capital markets and private equity for nearly 20 years. In

2004, she launched a Private Equity boutique, Clearbrook Capital Partners LLP,

with the support of high net worth investors and financial institutions across

Europe and the US. Clearbrook Capital Partners has since completed nine

acquisitions across three platform companies.

Until 2004, she was Managing Director of the Principal Finance Group at WestLB

AG. She has specialised in acquisition and securitisation financing of strong

cashflow businesses in a variety of sectors: Broadcasting Rights, Real Estate,

(pubs, cinemas, sports grounds), Utilities, (water, telecom, electricity),

Consumer Services (environmental, food analysis), Intellectual Property,

Mortgages, Leases, Banking Assets and others. Some of her investee companies and

clients have included Odeon, Wembley National Football Stadium, Whyte & MacKay,

Pubmaster, Formula 1, British Home Stores, and Telecom Italia and Olivetti Spa.

Robin has previously or currently serves on the boards of Formula One Holdings,

Pubmaster, British Home Stores, Mid Kent Water, Whyte & MacKay, Odeon Limited,

and The Office of the Rail Regulator.

Stephen Brown, aged 67 - Non-executive Director

Stephen Brown has over 30 years of experience in the investment banking

industry. In 1983 he founded S.L. Brown & Company, a private investment

partnership engaged in acquisition and merchant banking activities as principal.

The firms primary investments included the acquisition of Excelsior Truck

Leasing Company, Inc. a former subsidiary of Conrail, and the acquisition of a

control position in Franklin Capital, an American Stock Exchange listed

investment company where Mr. Brown served as Chairman and CEO from 1987 to 2004.

Mr. Brown presently is Chairman of Brimco LLC, a private investment firm in New

York, and serves on the board of directors of Copley Financial Services, advisor

to the Copley Fund Inc., a publicly traded mutual fund as well as a director of

U.S. Energy Systems, a NASDAQ Small Cap listed independent producer of

alternative fuels. Mr. Brown is a graduate of New York University School of

Law, LLB 1965, Brown University, BA 1961 and the Peddie School 1957, where he

has served as a Trustee since 1991.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPUUPGWUPQGMR

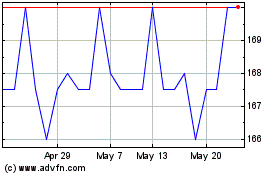

Cake Box (LSE:CBOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cake Box (LSE:CBOX)

Historical Stock Chart

From Jul 2023 to Jul 2024