TIDMBVC

RNS Number : 9895W

BATM Advanced Communications Ld

24 August 2022

LEI: 213800FLQUB9J289RU66

24 August 2022

BATM Advanced Communications Limited

("BATM" or the "Group")

Interim Results

BATM (LSE: BVC; TASE: BVC), a leading provider of real-time

technologies for networking solutions and medical laboratory

systems, announces its interim results for the six months ended 30

June 202 2 .

Financial Summary

$m H1 2022 H1 2021

Results from ongoing operations (adjusted)*

Revenue 57.5 64.2

Revenue on a constant currency

basis** 61.1 64.2

Gross profit 18.2 24.7

Gross margin 31.6% 38.4%

---------------------------------- -------- --------

Operating profit 1.5 6.7

EBITDA 3.7 8.7

---------------------------------- -------- --------

Reported results

------------------------------------------------------

Revenue 57.5 71.4

-------- --------

Gross profit 18.0 25.7

-------- --------

Gross margin 3 1.2% 36.0%

---------------------------------- -------- --------

Operating profit 1.3 20.0

---------------------------------- -------- --------

EBITDA 3.7 22.7

---------------------------------- -------- --------

Basic earnings per share (cents) 0.03c 2.72c

---------------------------------- -------- --------

Cash and financial assets 47.4 64.9

---------------------------------- -------- --------

* Adjusted to present the results on an ongoing operations basis

by excluding (1) the contribution to H1 2021 from NGSoft, a

subsidiary that the Group sold in March 2021, and (2) the

amortisation of intangible assets for both periods. The term

'ongoing operations' in this announcement is used for comparative

purposes only and is not used in the same context as in accounting

standards. For further information see Note 3 - Other Alternative

Measures.

** Revenue from ongoing operations for H1 2022 based on the

currency rates prevailing in H1 2021. Revenue during the period was

impacted by the strengthening of the US dollar against the local

currencies of subsidiaries in the Bio-Medical division.

Operational Summary

Networking & Cyber Division (23% of total revenue)

-- Revenue from ongoing operations (which excludes the

contribution from NGSoft to H1 2021) increased by 43.8% to $13.1m

(H1 2021: $9.1m), which primarily reflects growth in the Cyber

unit

-- Networking Unit

o Edgility edge computing and network function virtualisation

("NFV") platform:

-- Generated first initial revenue from Edgility

-- Established two new partnerships to boost Edgility's sales

and marketing presence through the offering of joint solutions

-- Sustained engagement with several potential customers

worldwide

-- Post period, CityFibre, the UK's largest independent

carrier-neutral Full Fibre platform, selected Edgility for piloting

ahead of an expected national deployment

o Network Edge (carrier ethernet and mobile backhaul):

-- Revenue maintained despite ongoing impact of supply chain

challenges

-- New orders received primarily from repeat customers in the

Americas and Europe

-- Cyber Unit

o Substantial growth in revenue from delivering on the

high-value contracts won in the previous year

o Significant backlog remaining for delivery in H2 and 2023

Bio-Medical Division (77% of total revenue)

-- Revenue was $44.4m (H1 2021: $ 55.1m ); o n a constant currency basis, revenue was $48.0m

-- Diagnostics Unit

o Sales increased of molecular diagnostic products not related

to COVID-19, which was offset by market-wide reduction in prices,

as well as lower demand, for COVID-19 products as the global

pandemic subsided

o New multi-respiratory test was CE registered with initial

sales expected to commence in Q4 2022

o Progressed development of new tuberculosis test kit, which was

CE approved, alongside Stop TB Partnership, an international

alliance

o Opened new state-of-the-art diagnostics laboratories and

facilities in Italy and Israel to support the activity of ADOR

Diagnostics ("ADOR"), which is developing its proprietary

isothermal diagnostic solution

o ADOR received an additional $10m of investment, of which the

Group contributed $4m (giving the Group an increased shareholding

of 37.2%)

-- Eco-Med Unit

o Accelerated progress, with the finalisation of two projects

for delivery of the Group's ISS AGRI solution and construction

advanced on two further installations

-- Distribution Unit

o Increased sales from greater volume of regular business

Commenting on the results, Dr Zvi Marom, Chief Executive Officer

of BATM, said: " During the first half of the year, the Group saw

solid performance in both its divisions. In the Networking &

Cyber division, there was increased growth primarily from the Cyber

unit. As expected, the Bio-Medical division saw a reduction in

revenue compared with the exceptional performance in the first half

of last year due to the pandemic.

"Looking ahead, the Group entered the second half with sustained

momentum and a significant backlog to be delivered against. The

Cyber unit expects to deliver solid growth and the Networking unit

expects sales to continue to grow in the second half of the year.

The Bio-Medical division is expected to return to growth in the

second half as diagnostic products remain in demand across the

globe. Whilst mindful of the potential impact of global supply

chain challenges, and the need to secure further contracts,

particularly in the Bio-Medical division, the Group remains on

track to deliver revenues for full year 2022 in line with market

expectations.

"BATM has established solid foundations in core technologies

that it believes will be market disrupters. Accordingly, the Board

of BATM remains confident in the prospects of the business and

looks forward to delivering shareholder value."

Enquiries:

BATM Advanced Communications

Dr Zvi Marom, Chief Executive Officer +972 9866 2525

-----------------

Moti Nagar, Chief Financial Officer

-----------------

Shore Capital

-----------------

Mark Percy, Anita Ghanekar, James Thomas

(Corporate Advisory)

Henry Willcocks (Corporate Broking) +44 20 7408 4050

-----------------

Gracechurch Group

-----------------

Harry Chathli, Claire Norbury +44 20 3488 7510

-----------------

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014.

Investor & Analyst Presentation

Dr Zvi Marom, CEO, Moti Nagar, CFO, and Ariel Efrati, COO of

BATM and CEO of Telco Systems, will be holding a webinar for

analysts and investors today at 1.00pm BST. To register to

participate, please contact Henry Gamble at Gracechurch Group at

henrygamble@gracechurchpr.com .

Forward-looking statements

This document contains forward-looking statements. Those

statements reflect the current opinions, evaluations and

estimations of the Group's management, and are based on the current

data regarding the Group's business as is detailed in this document

and in the Group's periodical, interim and immediate reports. The

Group does not undertake any obligation or make any representation

that actual results and events will be in line with those

statements, and stresses that they may differ materially from those

statements, due to changes in the Group's business, market,

competition, demand for the Group's products or services, general

economic factors or other factors that can influence the Group's

business and results, and due to information and factors that are

currently unknown to the Group's management and that, if known,

would affect the management's opinions, evaluations or estimations.

The Group will report the actual results and events according to

its legal, accounting and regulatory obligations, and does not

undertake any other obligation to report them or their deviations

from the forward-looking statements, or to update any of the

forward-looking statements in this document or to report that it is

not valid anymore.

Operational Review

The Group performed well during the six months to 30 June 2022.

There was strong growth from ongoing operations in the Networking

& Cyber division. In the Bio-Medical division, there was a

reduction in revenue in the Diagnostics unit, as expected, compared

with the exceptional performance in the first half of last year due

to the pandemic while there was growth in the Distribution unit and

the Eco-Med unit was broadly in line with H1 2021. The Bio-Medical

division was also impacted by currency fluctuations.

Networking & Cyber Division

Adjusted* R eported

------------------ ------------------

$m H1 2022 H1 2021 H1 2022 H1 2021

-------- --------

Revenue 13.1 9.1 13.1 16.4

Gross margin 40.1% 42.7% 39.2% 30.6%

------------------------- -------- -------- -------- --------

(1. 4

Operating profit/(loss) ) (2.7) (1.5) 10.9

* Adjusted to present the results an ongoing operations basis by

excluding (1) the contribution to H1 2021 from NGSoft, a subsidiary

that the Group sold in March 2021, and (2) the amortisation of

intangible assets for both periods.

Revenue for the first half of the year from ongoing operations

in the Networking & Cyber division (excluding the contribution

to H1 2021 from NGSoft) increased by 43.8%, primarily reflecting

growth in the Cyber unit. The reduction in revenue on a reported

basis is due to the contribution of NGSoft to the Networking unit

in H1 2021, a subsidiary that the Group sold in March 2021.

There was improvement in gross margin for both the Networking

unit and the Cyber unit respectively, and a significant increase in

the division's gross profit from ongoing operations primarily as a

result of the strong performance by the Cyber unit. The aggregate

gross margin from ongoing operations decreased due to the relative

weight of both units.

On reported basis, gross margin increased significantly by

860bps. The increase in mainly due to the lower margin nature of

the NGSoft business included in the previous period.

Operating loss from ongoing operations was reduced to $1.4m (H1

2021: $2.7m) thanks to the higher revenue. On a reported basis, the

operating loss was $1.5m compared with an operating profit of

$10.9m for H1 2021 as a result of the exceptional capital gain of

$13.0m from the sale of NGSoft.

Networking

In the Networking unit, revenue from ongoing operations

(excluding the contribution to H1 2021 from NGSoft) remained flat

at $8.6m.

Edgility - Edge Computing and NFV solutions

During the period, the Group achieved a significant milestone

for its virtualised edge compute business as it commenced

executing, and received its first revenue, on two contracts for

Edgility, which are expected to have an aggregate value of $2.7m

over a five-year period, that were awarded at the end of 2021. This

includes the first enterprise customer for Edgility, CEMEX, S.A.B,

(NYSE: CX), which is a global construction materials company, and

e-Qual, a global Managed Services Provider based in France that

operates in 55 countries.

Edgility continued to undergo evaluation with leading network

operators, multi-service providers and systems integrators

worldwide, which the Group expects will result in proof-of-concepts

and licence agreements in the second half. This included extensive

lab testing with CityFibre , the UK's largest independent

carrier-neutral Full Fibre platform, which resulted, post period,

in CityFibre piloting Edgility with selected partners ahead of an

expected national deployment to provide virtualised network

services for businesses. Edgility will enable CityFibre to begin

its edge compute journey at scale, with virtualisation of routing

and other network services over tens of thousands of disaggregated

physical edge devices.

To expand the sales and marketing reach, and provide further

routes to market, the Group continued to establish strategic

partnerships, which primarily involve Edgility being pre-integrated

with, or pre-installed on, the partner's network appliances (with

customers that use the Edgility solution contracting with the Group

directly). During the period, this includes establishing

partnerships with:

-- Advantech (TWSE: 2395), a global leader in industrial IoT,

which will provide Edgility pre-installed on a variety of its

universal edge network appliances.

-- NEXCOM International Co Ltd (TPEX: 8234), a leading supplier

of network appliances, which will provide Edgility pre-installed on

its 5G-ready device designed for the small-office-home-office and

mid-range enterprise market.

Network Edge solutions and services

Revenue from network edge solutions and services, where the

Group provides carrier ethernet and mobile backhaul platforms, was

maintained despite the ongoing impact of global electronic

components shortages causing delays to the delivery of some orders.

The Group also continued to receive new orders, which were

primarily repeat orders from customers in the Americas and Europe.

In addition, the Group launched a new multipurpose, ultra-high

capacity demarcation platform, the TM-8106. The Group has received

strong interest in this new platform, with a number of customers

having ordered units and delivery due to commence this quarter.

Cyber

The Cyber unit performed strongly with revenue increasing

substantially reflecting the execution of contracts awarded in

2021, with a significant backlog remaining to be delivered in the

second half of the year and 2023.

The Cyber unit also continued its development efforts. In

particular, it is in the process of developing a version of its

cyber security solution aimed beyond the defence industry,

including for the corporate market, which will significantly expand

the addressable market.

Bio-Medical Division

Adjusted* Reported

------------------ ------------------

$m H1 2022 H1 2021 H1 2022 H1 2021

-------- --------

Revenue 44.4 55.1 44.4 55.1

Revenue on a constant currency

basis** 48.0 55.1 - -

-------------------------------- -------- -------- -------- --------

Gross margin 29.0% 37.7% 28.8% 37.6%

-------------------------------- -------- -------- -------- --------

Operating profit 2. 9 9. 4 2. 7 9. 1

* Adjusted to exclude the amortisation of intangible assets.

** Revenue from ongoing operations for H1 2022 based on the

currency rates prevailing in H1 2021.

Revenue for the Bio-Medical division was $44.4m (H1 2021:

$55.1m). On a constant currency basis, excluding the impact of the

strengthening of the US dollar against local currencies, revenue

was $48.0m (H1 2021: $55.1m). The reduced revenue in the division

also reflects lower sales in the Diagnostics unit.

Adjusted gross margin for the division was 29.0% (H1 2021:

37.7%), primarily reflecting the contribution to revenue in H1 2021

of the higher priced COVID-19 products. The Bio-Medical division

generated an adjusted operating profit of $2. 9m for H1 2022

compared with $9. 4m for the first six months of the previous

year.

Diagnostics

Revenue in the Diagnostics unit accounted for 15.5% of the

Bio-Medical division compared with 32.3% in H1 2021. There was an

increase in revenue from the Group's range of molecular diagnostic

products that are not related to COVID-19, which were sold to

customers in Europe and the Middle East. However, this increase was

more than offset by lower demand, as well as a market-wide

reduction in prices, for COVID-19 products as the global pandemic

subsided, alongside a negative impact of the strengthening of the

US dollar against local currencies.

During the period, the Group continued with its programme to

enhance its diagnostic operations. At its Adaltis subsidiary, this

included steps to optimise the production process and expand the

molecular biology team. The Group's ADOR associate company, which

is developing the NATlab molecular biology solution, opened a new

state-of-the-art laboratory in Israel, which is focused on research

& development, and new product assembly rooms in Rome, Italy

.

The Group also continued to progress its development work. This

includes i ts new molecular diagnostics test for multiple

respiratory pathogens receiving CE certification. The Group is now

finalising the diagnostic protocols (clinical guidelines) for the

multi-respiratory kit and it expects initial sales to commence in

Q4 2022.

The Group is developing a new test for the diagnosis of

tuberculosis (TB) as part of its work with the Stop TB Partnership,

an international alliance comprising governmental and

non-governmental organisations. The new TB kit has received CE

certification.

ADOR finalised the development of its novel isothermal rolling

circle amplification ("RCA") method and incorporated it into a

multi-respiratory disease panel. The panel, which will be for

laboratory use, will be the first commercial application of this

technology. In parallel, work continued on incorporating it into

the NATlab system, which is primarily designed for use at

point-of-care.

During the period, the Group and its partners invested an

additional $10m into ADOR, of which the Group contributed $4m

(giving the Group an increased shareholding of 37.2%). The

additional investment contributed to the opening of the new

laboratory and will be used to prepare ADOR for the pre-production

stage, register additional patents (mainly in the US), progress

development of more disease panels and certifications and increase

the cooperation with international bodies, including the World

Health Organisation.

Eco-Med

The Eco-Med unit accounted for 7.5% of the Bio-Medical

division's revenues in H1 2022 compared with 7.3 % in H1 202 1

.

There was significant progress in deliveries of the Group's

solution, the ISS AGRI, for the treatment of pathogenic waste in

agricultural and pharmaceutical settings. This was primarily under

contracts that had previously been secured, but where completion

had been delayed due to the restrictions as a result of the

pandemic. The Group completed the delivery of two of its ISS AGRI

contracts and advanced the delivery of two further installations ,

which are due to complete by the end of the year.

Distribution

Revenue in the Distribution unit increased by 2.7% in H1 2022

over the same period of the prior year and accounted for

approximately 77.0% of the Bio-Medical division's revenue (H1 2021:

60.4%). There was an increase in sales from a greater volume of

regular business

Financial Review

Adjusted* Reported

------------------ --------------------

$m H1 2022 H1 2021 H1 2022 H1 2021

-------- --------

Revenue 57.5 64.2 57.5 71.4

Revenue on a constant currency

basis** 61.1 64.2 - -

-------------------------------- -------- -------- ------------------- --------

Gross margin 31.6% 38.4% 31.2% 36.0%

-------------------------------- -------- -------- ------------------- --------

Operating profit 1.5 6.7 1.3 20.0

* Adjusted to present the results an ongoing operations basis by

excluding (1) the contribution to H1 2021 from NGSoft, a subsidiary

that the Group sold in March 2021, and (2) the amortisation of

intangible assets for both periods.

** Revenue from ongoing operations for H1 2022 based on the

currency rates prevailing in H1 2021.

Total Group revenue for ongoing operations for the first half of

2022 was $57.5m (2021: $64.2m), with growth in the Networking &

Cyber division being offset by a reduction in the Bio-Medical

division, primarily reflecting lower sales in the Diagnostic unit

as well as the impact of the strengthening of the US dollar. On a

constant currency basis, revenue for ongoing operations for the

first half was $61.1m. The reduction in revenue on a reported basis

reflects the aforementioned as well as the contribution to H1 2021

revenue from NGSoft before it was sold in March 2021.

The gross margin for ongoing operations for the first half of

2022 was 31.6% compared with 38.4% for the same period of the

previous year. This reflects the contribution to H1 2021 revenue of

the high-margin COVID-19 products as well as the increased

contribution to H1 2022 profit from lower-margin units.

Sales and marketing expenses were $8.0m (H1 2021: $9.2m),

representing 13.9% of revenue compared with 12.9% in H1 2021.

General and administrative expenses were $5.4m ( H1 2021: $5.7m),

representing 9.5% of revenue (H1 2021: 8.0%). The reduction was due

to H1 2021 including three months of expenses from NGSoft. R&D

expenses were $3.4m (H1 2021: $3.7m).

Adjusted operating profit for ongoing operations was $1.5m (H1

2021: $6.7m), with the reduction primarily due to the lower revenue

from COVID-19 products. On a reported basis, operating profit

(which includes amortisation) was $1.3m compared with $20.0m for H1

2021, with the prior six-month period including a capital gain of

$13.0m from the sale of NGSoft.

As a result of the above, EBITDA was $3.7m for H1 2022 compared

with $8.7m on an ongoing operations basis and $22.7m on a reported

basis for H1 2021.

Net finance expense was $0.6m (H1 2021: $0.2m). The higher

financial expenses were mainly due to the impact on balance sheet

positions of the strengthening of the US dollar compared with H1

2021.

The Group recorded a $0.3m tax income (H1 2021: $7.5m tax

expense). The tax income is a result of an approximately $1m

non-cash tax incentive while H1 2021 included a non-recurring tax

expense related to the NGSoft transaction.

Net profit after tax attributable to equity holders of the

parent was $0.1m (H1 2021: $12.0m ) resulting in basic profit per

share of 0.03c (H1 2021: 2.72c).

As at 30 June 2022, inventory wa s in line with the position at

year end at $31.0m (31 December 2021: $31.0m; 30 June 2021:

$33.8m). Trade and other receivables were $ 34.7 m (31 December

2021: $34.9m; 30 June 2021: $38.9m) .

Intangible assets and goodwill at 30 June 2022 were $ 16.4 m (31

December 2021: $16.0m; 30 June 2021: $17.6m).

Property, plant and equipment and investment property was $18.6m

(31 December 2021: $19.8m; 30 June 2021: $16.2m), with the

reduction primarily due to the currency impact on balance sheet

positions.

The balance of trade and other payables was $ 36.6 m (31

December 2021: $47.5m; 30 June 2021: $43.6m). This includes a

dividend payment of $4.3m and a significant currency impact on

balance sheet positions.

Cash used in operating activities was $5.2m (H1 2021: $4.4m ),

with the change primarily due to the timing of payments and

collections.

At 30 June 2022, the Group had cash and cash equivalents and

financial assets of $47.4m (31 December 2021: $ 67.8m; 30 June

2021: $64.9m). Financial assets represent cash deposits of more

than three months' duration, held for trading bonds and marketable

securities. The change in cash and cash equivalents and financial

assets compared with the prior periods primarily reflects dividend

and buy-back payments of $5.1m; an additional investment in ADOR of

$4m; and the impact of the weakening of the currencies in which the

Group's subsidiaries operate compared with the US dollar .

Outlook

The Group has entered the second half with sustained momentum

across the business and a significant backlog to be delivered

against.

In particular, in the Networking & Cyber division, the Cyber

unit is expected to deliver solid growth as government agencies

continue to increase licensing of its encryption products. In the

Networking unit, the first half saw initial contributions from the

unit's Edgility platform for edge computing and virtual networking

following its launch last year. The Group expects the division's

revenue to continue to grow in the second half of the year as it

delivers against a significant backlog in both units.

The Bio-Medical division is expected to return to growth, with a

significant increase in revenue in the second half compared with

the first half, as diagnostic products remain in demand across the

globe. The division is expected to be the largest contributor to

Group's revenues for the full year.

Whilst mindful of the potential impact of global supply chain

challenges, and the need to secure further contracts, particularly

in the Bio-Medical division, the Group remains on track to deliver

revenues for full year 2022 in line with market expectations.

As stated above, the Group experienced exchange rate headwinds

in the first half of the year. BATM expects to continue to

experience significant headwinds in the second half of the year if

the exchange rates remain the same.

BATM has established solid foundations in core technologies that

it believes will be market disrupters. The Board of BATM remains

confident in the prospects of the business and is working hard to

demonstrate the substantial value that exists within BATM. As part

of this process, the Board has committed to constantly examine the

use of Group resources, including share buy-backs, and looks

forward to delivering shareholder value.

BATM ADVANCED COMMUNICATIONS LTD.

CONSOLIDATED INCOME STATEMENTS

Six months ended 30

June

2022 2021

$'000 $'000

Unaudited Unaudited

Revenues 57,515 71,448

Cost of revenues 39,565 45,754

Gross profit 17,950 25,694

--------------- ---------------

Operating expenses

Sales and marketing expenses 7,980 9,215

General and administrative expenses 5,443 5,721

Research and development expenses 3,395 3,652

Other operating income (119) (12,917)

Total operating expenses 16,699 5,671

--------------- ---------------

Operating profit 1,251 20,023

Finance income 389 305

Finance expenses (1,029) (479)

Profit before tax 611 19,849

Income tax (expenses) 347 (7,462)

Profit for the period before share of loss

of a joint venture

and associated companies 958 12,387

Share of loss of a joint venture and associated (288) _ _ (401)

companies

Profit for the period 670 11,986

Attributable to:

Owners of the Company 145 11,979

Non-controlling interests 525 7

Profit for the period 670 11,986

Profit per share (in cents):

Basic 0.03 2.72

Diluted 0.03 2.70

BATM ADVANCED COMMUNICATIONS LTD.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME/(LOSS)

Six months ended 30

June

2 0 2 2 2 0 2 1

$'000 $'000

Unaudited Unaudited

Profit for the period 670 11,986

Items that may be reclassified subsequently

to profit or loss:

Disposal of a foreign operation - (522)

Exchange differences on translating foreign ( 6,666

operations ) (2,195)

( 6 ,666

) (2,717)

Items that will not be reclassified subsequently

to profit or loss:

Re-measurement of defined benefit obligation 36 -

36 -

( 6 ,630

Total other comprehensive loss for the period ) (2,717)

Total comprehensive income (loss) for the

period (5,960) 9,269

Attributable to:

Owners of the Company (6,766) 9,190

Non-controlling interests 806 79

(5,960) 9,269

BATM ADVANCED COMMUNICATIONS LTD.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

30 June 30 June 31 December

2 0 2 2 2 0 2 1 2 0 2 1

$'000 $'000 $'000

Unaudited Unaudited Audited

Current assets

Cash and cash

equivalents 40,101 62,151 65,331

Trade and other

receivables 34,678 38, 902 34,932

Financial assets 7,263 2,742 2,432

Inventories 31,015 33,757 30,951

------------------------------ ------------------------------

113,057 137, 55 2 133,646

------------------------------ ------------------------------

Non-current assets

Property, plant and

equipment 16,962 14,379 18,107

Investment property 1,644 1,797 1,739

Right-of-use assets 5,650 6,310 6,570

Goodwill 11,129 11,407 11,385

Other intangible

assets 5,237 6,219 4,648

Investment in joint

venture and

associate 15,616 13,138 12,667

Investments carried

at fair value 1,220 1,027 1,027

Deferred tax assets 3,356 4,107 3,375

------------------------------ ------------------------------

60, 814 58,384 59,518

------------------------------ ------------------------------

Total assets 173,871 195, 93 6 193,164

============================== ============================== =============================

Current liabilities

Short-term bank

credit 4,731 4,968 1,634

Trade and other

payables 36,562 43,641 47,519

Current maturities

of lease

liabilities 1,866 1,727 2, 186

Tax liabilities 5,291 6,449 6,548

48,450 56, 785 57,887

Non-current liabilities

Long-term bank

credit 6 325 1,356

Long-term

liabilities 3,221 4,583 3,888

Long-term lease

liabilities 4,023 5,287 5,108

Deferred tax

liabilities 175 140 170

Retirement benefit

obligation 536 753 621

7,961 11,088 11,143

Total liabilities 56,411 67, 873 69,030

Equity

Share capital 1,320 1,320 1,320

Share premium

account 425, 944 425,717 425,840

Reserves ( 26,933 ) (17,112) (19,849)

Accumulated deficit ( 279,707 ) (278,111) (279,888)

------------------------------ ------------------------------

Equity attributable to

the:

Owners of the

Company 120,624 131,814 127,423

Non-controlling

interest (3, 164 ) (3,751) (3,289

============================== ==============================

Total equity 117,460 128,063 124,134

============================== ==============================

Total equity and

liabilities 173,871 195, 93 6 193,164

============================== ==============================

BATM ADVANCED COMMUNICATIONS LTD.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Six months ended 30 June 2022

Attributable

Share to owners

Share premium Translation Other Accumulated of the Non-controlling Total

capital account reserve Reserve Deficit Company interests equity

$'000

--------------------------------------------------------------------------------------------------------------------

Balance as

at 1 January

2022 1,320 425,840 (19,337) (512) (279,888) 127,423 (3,289) 124,134

Profit for

the period - - - - 145 145 525 670

Other

comprehensive

income

Re-measurement

of defined

benefit

obligation - - - - 36 36 - 36

Exchange

differences

on translating

foreign

operations - - (6,947) - - (6,947) 281 (6,666)

------------- --------- ------------- --------------- ------------- ------------- ---------------- ----------

Other

comprehensive

income (loss)

for the period - - (6,947) - 36 (6,911) 281 (6,630)

Total

comprehensive

income (loss)

for the period - - (6,947) - 181 (6,766) 806 (5,960)

Dividend paid

to

non-controlling

interest - - - - - - (681) (681)

Share buy-

back - - - (137) - (137) - (137)

Recognition

of share-based

payments - 104 - - - 104 - 104

------------- --------- ------------- --------------- ------------- ------------- ---------------- ----------

Balance as

at 30 June

2022

(unaudited) 1,320 425,944 (26,284) (649) (279,707) 120,624 (3,164) 117,460

------------- --------- ------------- --------------- ------------- ------------- ---------------- ----------

Six months ended 30 June 2021

Attributable

Share to owners

Share premium Translation Other Accumulated of the Non-controlling Total

capital account reserve Reserve Deficit Company interests equity

$'000

------------------------------------------------------------------------------------------------------------------------

Balance as

at 1 January

2021 1,320 425,686 (13,811) (512) (290,090) 122,593 (3,830) 118,763

Profit for

the period - - - - 11,979 11,979 7 11,986

Other

comprehensive

income

Disposal of

a foreign

operation - - (522) - - (522) - (522)

Exchange

differences

of

translating

foreign

operations - - (2,267) - - (2,267) 72 (2,195)

------------- --------- ------------- --------------- ------------- ------------- ---------------- --------------

Other

comprehensive

income (loss)

for the

period - - (2,789) - - (2,789) 72 (2,717)

Total

comprehensive

income for

the period - - (2,789) - 11,979 9,190 79 9,269

Recognition

of

share-based

payments - 31 - - - 31 - 31

------------- --------- ------------- --------------- ------------- ------------- ---------------- --------------

Balance as

at 30 June

2021

(unaudited) 1,320 425,717 (16,600) (512) (278,111) 131,814 (3,751) 128,063

------------- --------- ------------- --------------- ------------- ------------- ---------------- --------------

BATM ADVANCED COMMUNICATIONS LTD.

CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended 30 June

2 0 2 2 2 0 2 1

$'000 $'000

Unaudited Unaudited

Net cash from (used in) operating activities

(Appendix A) (5,198) (4,364)

Investing activities

Interest received 35 13

Proceeds on disposal of property, plant

and equipment 38 52

Proceeds on disposal of deposits 158 157

Proceeds on disposal of financial assets

carried

at fair value through profit and loss 1,021 100

Purchases of property, plant and equipment ( 1,481 ) (607)

Increase of other intangible assets ( 1,071 ) (400)

Purchases of financial assets carried

at fair value (1,529) -

through profit and loss

Purchases of deposits ( 4,659 ) (157)

Net cash outflow on acquisition of business

combinations - (309)

Investment in joint venture, associated

companies and other ( 4,180 ) (160)

Proceeds from sale of subsidiary (Appendix

B) - 18,662

Net cash from (used in) investing activities (11,668) 17,351

Financing activities

Lease payment (1, 088 ) (1,147)

Bank loan repayment ( 3,666 ) (6,774)

Bank loan received 5,678 6,573

Dividend paid (4,300) -

Dividend paid to NCI (681) -

Share buy-back (137) -

Net cash used in financing activities (4,194) (1,348)

Net increase (decrease) in cash and

cash equivalents (21,060) 11,639

Cash and cash equivalents at the beginning

of the period 65,331 50,575

Effects of exchange rate changes on

the balance

of cash held in foreign currencies ( 4,170 ) (63)

Cash and cash equivalents at the end

of the period 40,101 62,151

BATM ADVANCED COMMUNICATIONS LTD.

APPICES TO CONSOLIDATED STATEMENT OF CASH FLOWS

APPIX A

RECONCILIATION OF OPERATING PROFIT FOR THE PERIOD TO NET CASH

USED IN OPERATING ACTIVITIES

Six months ended 30

June

2022 2021

$'000 $'000

Unaudited Unaudited

Operating profit from operations 1,251 20,023

Adjustments for:

Amortisation of intangible assets 280 433

Depreciation of property, plant and equipment

and investment property 2, 127 2,226

Capital loss (gain) of property, plant and equipment 22 (22)

Profit from sale of a subsidiary - (13,035)

Gain from revaluation of investment carried (192) -

at fair value

Stock options granted to employees 104 31

Decrease in retirement benefit obligation ( 43 ) (52)

Increase (decrease) in provisions 19 (2)

Operating cash flow before movements in working

capital 3,568 9,602

Decrease (increase) in inventory (135) 136

Decrease (increase) in receivables 50 ( 5,009 )

( 5,988

Decrease in payables ) ( 4,725 )

Effects of exchange rate changes on the balance ( 1,488

sheet ) (2,259)

( 3,993

Cash used in operations ) (2,255)

Income taxes paid ( 733 ) (1,660)

Interest paid ( 472 ) (449)

( 5,198

Net cash used in operating activities ) (4,364)

APPIX B

DISPOSAL OF SUBSIDIARY - NGSoft

On 19 March 2021, the Group entered into a sale agreement to

dispose of NG Soft Ltd. ("NGSoft ( to Aztek Technologies (1984)

Ltd., a provider of ICT cloud services in Israel and a portfolio

company of SKY Fund. NGSoft is a software and digital services

company that provides creative digital and technology solutions

.

Disposal of subsidiary - N GSoft

Six months ended

30 June

2021

$'000

Unaudited

Net assets disposed

Property, plant and equipment 1,144

Right of use 3,667

Other intangible assets 968

Net working capital 73

Lease liability (3,764)

Current tax liability (584)

Deferred tax liability (540)

Goodwill 5,185

Net assets disposed of 6,149

Disposal of a foreign operation translation reserve (522)

Gain on disposal 13,035

Total consideration 18,662

Net cash inflow arising on disposal:

Consideration received in cash and cash equivalents,

net 20,903

Cash and cash equivalents disposed (2,241)

18,662

BATM ADVANCED COMMUNICATIONS LTD

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note 1 - Basis of preparation

The interim consolidated financial statements of the Group have

been prepared in conformity with International Accounting Standard

No. 34 "interim financial reporting" (hereafter "IAS 34").

In preparing these interim consolidated financial statements,

the Group implemented accounting policies, presentation principles

and calculation methods identical to those implemented in

preparation of its consolidated financial statements as of 31

December 2021 and for the period ended on that date. The condensed

interim financial statements should be read in conjunction with the

annual financial statements for the year ended 31 December 2021,

which have been prepared in accordance with IFRSs.

Note 2 - Profit per share

Profit per share is based on the weighted average number of

shares in issue for the period of 440,434,676 (H1 2021:

440,434,124). The number used for the calculation of the diluted

profit per share for the period (which includes the effect of

dilutive stock option plans) is 443,123,900 shares (H1 2021:

444,285,836).

Note 3 - Other alternative measures

1. Income statement adjustments - including (1) the contribution

to 2021 from NGSoft, a subsidiary that the Group sold in March

2021, (2) adjustments related to the amortisation of intangible

assets.

Six months ended 30 June Reported Adjustments Amortisation Adjusted

2022 results to exclude of intangible results

NGSoft assets (ongoing

operations)

(Unaudited)

US$ thousands

Gross profit 17,950 - (207) 18,157

Gross margin (%) 31.2% - - 31.6%

Other operating expenses

(income) (119) - 73 (192)

Operating profit 1,251 - (280) 1,531

Six months ended 30 June Reported Adjustments Amortisation Adjusted

2021 results to exclude of intangible results

NGSoft assets (ongoing

operations)

(Unaudited)

US$ thousands

Revenues 71,448 7,262 - 64,186

Gross profit 25,694 1,235 (207) 24,666

Gross margin (%) 36.0% 17.0% - 38.4%

Sales and marketing expenses 9,215 144 - 9,071

General and administrative

expenses 5,721 358 - 5,363

Research and development

expenses 3,652 - 108 3,544

Other operating expenses

(income) (12,917) (12,994) 77 -

Operating profit 20,023 13,727 (392) 6,688

EBITDA 22,682 13,956 - 8,726

2. EBITDA measurement

Reported Adjusted

Six months ended Six months ended 30

30 June June

US$ in thousands 2022 2021 2022 2021

------------ ------------

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

Operating profit 1,251 20,023 1,531 6,688

Amortisation of Intangible

assets 280 433 - -

Depreciation 2,127 2,226 2,127 2,038

EBITDA 3,658 22,682 3,658 8,726

Note 4 - Segments

Business Segment

Six months ended 30 June 2022

Networking Bio-Medical Unallocated Total

& Cyber

$'000 $'000 $'000 $'000

Revenues 13,104 44,411 - 57,515

Operating profit (1,491) 2,742 - 1,251

Net finance expense (640)

Profit before tax 611

Six months ended 30 June 2021

Networking Bio-Medical Unallocated Total

& Cyber

$'000 $'000 $'000 $'000

Revenues 16,377 55,071 - 71,448

Operating profit 10,889 9,134 - 20,023

Net finance expense (174)

Profit before tax 19,849

Note 5 - Revenue from major products and services

The following is an analysis of the Group's revenue from

operations from its major products and services according to IFRS

15:

Six months ended 30

June

2022 2021

$'000 $'000

Unaudited Unaudited

Telecommunication products 7,355 6,670

Software services 5,750 9,707

Distribution of medical products 34,175 33,289

Diagnostic products 6,894 17,786

Eco-Med products 3, 341 3,996

57,515 71,448

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEEFADEESELA

(END) Dow Jones Newswires

August 24, 2022 02:00 ET (06:00 GMT)

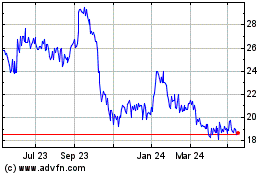

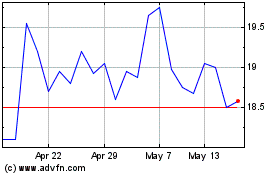

Batm Advanced Communicat... (LSE:BVC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Batm Advanced Communicat... (LSE:BVC)

Historical Stock Chart

From Jul 2023 to Jul 2024