TIDMBSRT

RNS Number : 0909Y

Baker Steel Resources Trust Ltd

18 February 2013

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE

ATTENTION. If you are in any doubt as to the action you should

take, you should consult your independent financial adviser

authorised under the Financial Services and Markets Act 2000

immediately.

If you have sold or otherwise transferred all of your

Subscription Shares in Baker Steel Resources Trust Limited, please

forward this document as soon as possible to the purchaser or

transferee or the stockbroker, bank or other agent through whom the

sale or transfer was effected for delivery to the purchaser or

transferee.

This document should be read in conjunction with, and is subject

to, the detailed provisions contained in the Company's articles of

association.

BAKER STEEL RESOURCES TRUST LIMITED

(A closed ended investment company incorporated in Guernsey

under the provisions of The Companies (Guernsey) Law, 2008 with

registered no. 51576)

Directors: Registered Office:

Howard Myles (Chairman) Arnold House

Edward Flood St Julian's Avenue

Charles Hansard St Peter Port

Clive Newall Guernsey GY1 3NF

Christopher Sherwell

14 February 2013

To Subscription Shareholders of Baker Steel Resources Trust

Limited (the Company)

FINAL EXERCISE DATE FOR SUBSCRIPTON SHARES

Dear Sir or Madam

This letter is sent to you as a registered holder of the

subscription shares of no par value in the Company (the

Subscription Shares) to remind you that the Subscription Share

Rights (the subscription rights) carried by your Subscription

Shares may be exercised up until Tuesday 2 April 2013. This is the

final exercise date of the subscription rights carried by your

Subscription Shares. Each of your Subscription Shares carries the

right (but not the obligation) to subscribe for one ordinary share

of no par value (an Ordinary Share) at an exercise price of 100

pence.

If any subscription rights are not exercised by their holders by

2 April 2013, the Company will appoint a trustee (the Trustee) in

respect of the unexercised subscription rights. If in the Trustee's

opinion the net proceeds of sale of the Ordinary Shares that would

arise on exercise of the unexercised subscription rights (after

deduction of all costs and expenses incurred by, and any fee

payable to, the Trustee) will exceed the costs of subscription, the

Trustee shall on or prior to 16 April 2013 either exercise the

subscription rights and sell in the market the Ordinary Shares

acquired on exercise or (if it appears to the Trustee that doing so

is likely to realise greater net proceeds for Subscription

Shareholders) accept any offer available to Subscription

Shareholders for the purchase of the outstanding Subscription

Shares. The Trustee shall distribute pro rata the net proceeds of

such sale (after deduction of any costs and expenses incurred by,

and any fee payable to, the Trustee) less such subscription costs

to the persons entitled to them by no later than 2 June 2013,

provided that entitlements under GBP10.00 per holder shall be

retained for the benefit of the Company. If the Trustee does not

exercise the subscription rights prior to 16 April 2013 (and so

that its decision in respect thereof shall be final and binding on

all holders of outstanding Subscription Shares), all rights

attaching to such Subscription Shares shall lapse on that date.

The subscription rights attached to each Subscription Share can

be exercised only once. Your attention is drawn to the table, in

the General Information section below, detailing the mid-market

quotations for the Ordinary Shares and the Subscription Shares.

Subscription Shares held in certificated form

If you wish to exercise some or all of your subscription rights

and you hold your Subscription Shares in certificated form, please

complete and sign the Notice of Exercise of Subscription Rights

(the Notice) on the reverse of your Subscription Share

certificate(s) (specifying how many Subscription Shares you wish to

exercise). Please send the completed Notice together with your

payment to Capita Registrars (the Registrar), at the following

address:

Capita Registrars, The Registry, 34 Beckenham Road, Beckenham,

Kent BR3 4TU, United Kingdom

Payments must be made by cheque or bankers' draft in pounds

sterling drawn on a branch in the United Kingdom of a bank or

building society which is either a member of the Cheque and Credit

Clearing Company Limited or the CHAPS Clearing Company Limited or

which has arranged for its cheques or bankers' drafts to be cleared

through the facilities provided for members of these companies.

Such cheques or bankers' drafts must bear the appropriate sort code

in the top right hand corner. Cheques, which must be drawn on the

personal account of the individual investor where they have sole or

joint title to the funds, should be made payable to Capita

Registrars Limited Re: Baker Steel Resources Trust Limited -

Subscription Shares.

Third party cheques will not be accepted with the exception of

building society cheques or bankers' drafts where the building

society or bank has confirmed the name of the account holder by

stamping or endorsing the cheque/bankers' draft to such effect.

The account name should be the same as that shown in the

Notice.

The Notice and payment must be received no later than 5.00 p.m.

on 2 April 2013 for certificated holders.

You will not be able to withdraw a completed Notice, once

lodged. If you have lost your Subscription Share certificate(s),

please contact the Shareholder Helpline on 0871 6640386 (calls cost

10p per minute plus network extras, other network providers' costs

may vary) who will send you a letter of indemnity to complete.

Lines are open from 9:00 a.m. to 5:30 p.m. (UK time) Monday to

Friday (excluding UK public holidays). If you are calling from

outside the United Kingdom, please telephone +44 20 8639 3407.

Calls to the helpline from outside the UK will be charged at the

applicable international rate. Different charges may apply to calls

from mobile telephones and calls may be recorded and randomly

monitored for security and training purposes. The Shareholder

Helpline cannot give any financial, legal or tax advice.

For a written request, please send it to Capita Registrars, The

Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU, United

Kingdom.

The completed letter of indemnity together with a covering

letter confirming your instructions relating to the exercise of

some or all of your subscription rights must be returned to the

Registrar at the above address together with a cheque for the

relevant subscription amount so as to arrive no later than 5.00

p.m. on 2 April 2013.

Subscription Shares held through CREST

Holders who wish to exercise some or all of their subscription

rights attached to Subscription Shares held in uncertificated form

(i.e. through CREST) must send an Unmatched Stock Event Instruction

(a "USE Instruction") in CREST to Capita Registrars, the Company's

receiving agent (the "Receiving Agent"), properly authenticated in

accordance with Euroclear's specifications, to transfer the

Subscription Shares in respect of which subscription rights are to

be exercised from the relevant account of the CREST Member to the

Receiving Agent. This USE Instruction should be received by not

later than 5.00 p.m. (London time) on 2 April 2013.

Once sent, a USE Instruction exercising subscription rights

shall be irrevocable, save with the consent of the Board of the

Company. To be effective, any such notice or instruction must

comply not only with the requirements set out in this notice but

also with any statutory requirements for the time being

applicable.

The USE Instruction must be authenticated in accordance with

Euroclear's specifications and, in addition to the information that

is required for settlement in Euroclear, the USE Instruction must

contain the following details:

(i) Number of Subscription Shares to be exercised;

(ii) Aggregate amount payable on exercise;

(iii) Participant ID of the Subscription Share Holder;

(iv) Member account ID of the Subscription Share Holder;

(v) Participant ID of the Receiving Agent. This is RA06;

(vi) Member account ID of the Receiving Agent. This is BSRTSUBS;

(vii) Corporate action number. This will be displayed on the corporate actions details page;

(viii) Corporate action ISIN. This is GG00B64WLC23; and

(ix) Intended settlement date. This shall be no later than 2 April 2013.

In order for a USE Instruction to be valid, the USE Instruction

must comply with the requirements as to authentication and contents

set out above and must settle by not later than 5.00 p.m. (London

time) on 2 April 2013.

A USE Instruction will be treated as having been received for

these purposes at the time at which the USE Instruction is received

by Euroclear. This will be conclusively determined by the time

stamp applied by you or your sponsor's network provider's

communications post at Euroclear on receipt of the USE

Instruction.

It is a further condition of the validity of the USE Instruction

that, at the time at which the Receiving Agent receives the USE

Instruction which is otherwise valid, neither the Company nor the

Receiving Agent receive actual notice from Euroclear of any of the

matters specified in Regulation 35(5)(a) in the Uncertificated

Securities Regulations 2001 in relation to such USE Instruction.

These matters include notice that any information contained in the

USE Instruction was incorrect or notice of lack of authority to

send the USE Instruction.

It is your responsibility to take such action as shall be

necessary to ensure that a valid USE Instruction is received by no

later than 5.00 p.m. (London time) on 2 April 2013. You are

referred in particular in this connection to Section 2, Chapter 1,

of the CREST/Euroclear manual concerning practical limitations to

the Euroclear system.

General information

If you wish to have some or all of the Ordinary Shares issued

through the exercise of subscription rights allotted to someone

else, please complete and lodge a Form(s) of Nomination, which is

available from the Registrar. A Form of Nomination must be signed

by both the registered holder and by each person who is to receive

the Ordinary Shares and must be lodged with the Registrar when you

lodge your Notice and payment. It should be noted that a Form of

Nomination may not be used in connection with the exercise of

subscription rights attached to the Subscription Shares held in

uncertificated form.

Under existing legislation, the exercise of subscription rights

attached to Subscription Shares by a UK resident or ordinarily

resident holder will not constitute a disposal for the purposes of

United Kingdom taxation of capital gains. Instead, the Ordinary

Shares acquired pursuant to the exercise of the subscription rights

will be treated as the same asset as the Subscription Shares in

respect of which the subscription rights are exercised. The base

cost of the Subscription Shares, if any, will be added to the

subscription price of 100 pence in computing the deemed base cost

of the Ordinary Shares acquired upon such exercise. Further

information relating to taxation can be found at Part VII of the

prospectus dated 31 March 2010. If you are in any doubt as to your

tax position, you are advised to consult your professional

adviser.

If you nominate a third party to be allotted the Ordinary Shares

to be issued through the exercise of subscription rights, such

nomination will constitute a disposal for the purposes of United

Kingdom taxation and you should consult your professional adviser

as to the capital gains tax, inheritance tax, stamp duty reserve

tax and other taxation consequences of such a transaction.

The Ordinary Shares acquired on exercise of the subscription

rights should be eligible to be held in a stocks and shares ISA,

subject to applicable annual subscription limits (GBP11,280 for the

2012/2013 tax year). The subscription price paid upon exercise of

the subscription rights will contribute towards the annual

subscription limit unless the subscription price is paid out of

cash already within the stocks and shares ISA or with cash

subscribed in the same tax year to a cash ISA held by you and

transferred to your stocks and shares ISA.

These statements are intended only as a general guide to the tax

treatment of shareholders on an exercise of their subscription

rights, based on current United Kingdom tax law and what is

understood to be the current practice of HM Revenue & Customs,

and they may not apply to certain shareholders. For instance,

investments held in ISAs will be free of United Kingdom tax on

capital gains. If you are resident outside the United Kingdom or

are in any doubt as to the potential tax or other consequences of

exercising your subscription rights, you should consult your own

professional adviser.

Ordinary Shares issued pursuant to the exercise of the

Subscription Shares will be allotted not later than 16 April 2013.

Application will be made to the UK Listing Authority for the new

Ordinary Shares to be admitted to the Official List and to the

London Stock Exchange plc for those securities to be admitted to

trading on the London Stock Exchange's market for listed

securities. The Company will use all reasonable endeavours to

obtain such admission no later than 16 April 2013. Certificates for

the Ordinary Shares will be posted to those holders of Subscription

Shares in certificated form not later than 30 April 2013. In the

meantime, any transfers will be certified against the respective

registers.

For CREST participants, the Registrar will, on or prior to 16

April 2013, instruct Euroclear UK & Ireland to credit your

appropriate stock account (being a stock account under the

participant ID and member account ID specified in your

Uncertificated Subscription Notice) with the Ordinary Shares issued

to you, or to which you are entitled.

The Ordinary Shares allotted to you will not rank for any

dividends or other distributions declared, paid or made on the

Ordinary Shares by reference to a record date prior to 16 April

2013 but will otherwise rank as one class of share with the

existing Ordinary Shares.

The mid-market quotations, derived from the London Stock

Exchange plc, on the first business day in each of the six months

prior to the date of this letter and as at 12 February 2013 (the

latest practicable date prior to the printing of this notice) for

one Ordinary Share and one Subscription Share were as follows:

Ordinary Shares Subscription Shares

(p) (p)

3 September 2012 84.250 10.5

1 October 2012 87.500 12.5

1 November 2012 86.375 11.5

3 December 2012 78.875 4.0

2 January 2013 83.250 4.5

1 February 2013 94.000 4.0

12 February 2013 94.250 3.0

The financial effect of conversion

The following table illustrates the basis of conversion,

applying as applicable the most recent figures given above.

Capital

Market value of Subscription Share 3.0 pence

Subscription Price 100 pence

Market value of resultant Ordinary 94.25 pence

Share

The unaudited net asset value per Ordinary Share as at 31

January 2013 was 112.4 pence. The diluted net asset value per

Ordinary Share as at 31 January 2013 was 110.3 pence.

This letter is sent by way of reminder only in order to comply

with the rights of the Subscription Shares and should not be read

by Subscription Shareholders as a recommendation to exercise their

subscription rights or otherwise. In this respect, if you require

advice, you should contact an independent financial adviser

authorised pursuant to the Financial Services and Markets Act 2000.

The full terms of the Subscription Shares are contained within Part

VI of the Prospectus issued on 31 March 2010 which can be obtained

from the Company Secretary, HSBC Securities Services (Guernsey)

Limited, Arnold House, St Julian's Avenue, St Peter Port, Guernsey

GY1 3NF, telephone +44 1481 707 000.

Yours faithfully,

for and on behalf of

Baker Steel Resources Trust Limited

Past performance is not a guide to future performance. Changes

in the rates of exchange between currencies may cause the value of

investments to fluctuate. Shares in the developing and emerging

markets in which the Company invests, can prove volatile and this

may be reflected in the Company's share price. The price of shares

and any income from them may fall as well as rise and is not

guaranteed. The investor may not get back the original amount

invested. This document does not constitute an offer or invitation

to purchase shares in the Company.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCNKFDPKBKDDBD

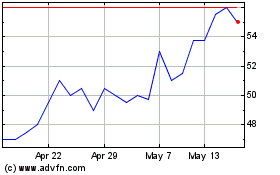

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Jul 2023 to Jul 2024