BlackRock World Mng Portfolio Update

March 15 2023 - 11:18AM

UK Regulatory

TIDMBRWM

The information contained in this release was correct as at 28 February 2023.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange website at:

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK WORLD MINING TRUST PLC (LEI - LNFFPBEUZJBOSR6PW155)

All information is at 28 February 2023 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five

Month Months Year Years Years

Net asset value -7.6% -0.1% 2.9% 123.4% 103.3%

Share price -7.3% 0.7% 2.1% 160.7% 133.7%

MSCI ACWI Metals & Mining 30% Buffer 10/40 -8.1% -0.6% 0.1% 82.9% 60.7%

Index (Net)*

* (Total return)

Sources: BlackRock, MSCI ACWI Metals & Mining 30% Buffer 10/40 Index,

Datastream

At month end

Net asset value (including income)1: 699.12p

Net asset value (capital only): 673.24p

1 Includes net revenue of 25.88p

Share price: 698.00p

Discount to NAV2: 0.2%

Total assets: £1,478.4m

Net yield3: 5.7%

Net gearing: 12.6%

Ordinary shares in issue: 188,903,036

Ordinary shares held in Treasury: 4,108,806

Ongoing charges4: 1.0%

Ongoing charges5: 0.8%

2 Discount to NAV including income.

3 Based on a first, second and third interim dividend of 5.50p per share

declared on 6 May 2022, 23 August 2022 and 16 November 2022 respectively, and a

final dividend of 23.50p per share declared on 2 March 2023 with ex-date 9

March 2023 and pay date of 26 April 2023 in respect of the year ended 31

December 2022.

4 The Company's ongoing charges are calculated as a percentage of average daily

net assets and using the management fee and all other operating expenses,

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain other non-recurring items for the year

ended 31 December 2022.

5 The Company's ongoing charges are calculated as a percentage of average daily

gross assets and using the management fee and all other operating expenses,

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain other non-recurring items for the year

ended 31 December 2022.

Country Analysis Total Sector Analysis Total

Assets (%) Assets (%)

Global 67.4 Diversified 37.4

Australasia 10.5 Copper 22.3

Latin America 7.6 Gold 12.1

United States 6.6 Steel 8.5

Canada 4.4 Industrial Minerals 7.5

Other Africa 2.4 Aluminium 4.1

Indonesia 0.9 Iron Ore 3.0

South Africa 0.5 Platinum Group Metals 2.0

United Kingdom 0.2 Mining Services 1.5

Net Current Liabilities -0.5 Nickel 1.5

----- Uranium 0.4

100.0 Zinc 0.2

===== Net Current Liabilities -0.5

-----

100.0

=====

Ten largest investments

Company Total Assets %

BHP 8.9

Vale:

Equity 6.4

Debenture 2.5

Glencore 6.6

Teck Resources 4.7

Rio Tinto 4.7

ArcelorMittal 4.4

Freeport-McMoRan 4.1

First Quantum Minerals:

Equity 2.4

Bond 1.7

Anglo American 3.1

Ivanhoe

Equity 1.9

Bond 0.9

Asset Analysis Total Assets (%)

Equity 93.1

Bonds 4.0

Preferred Stock 3.4

Net Current Liabilities -0.5

-----

100.0

=====

Commenting on the markets, Evy Hambro and Olivia Markham, representing the

Investment Manager noted:

Performance

The Company's NAV declined by 7.6% in February, outperforming its reference

index, the MSCI ACWI Metals & Mining 30% Buffer 10/40 Index (net return), which

fell by 8.1% (performance figures in GBP).

After several months of strong performance, the mining sector pulled back in

February as improvements in Chinese economic data were slower than had been

hoped. It is worth noting, however, that after the month-end, China's

Manufacturing PMI came in at 51.6, up from 49.2 in January, which has supported

the sector's performance so far in March. Broader equity markets were also down

in February but less so, with the MSCI ACWI TR Index falling -2.5%. The month

saw mined commodity prices give up some of their recent gains, with copper,

iron ore (62% fe) and gold prices declining -2.7%, -2.3% and -5.3%

respectively.

Many of the miners reported full year 2022 results during the month. Cost

inflation remained an issue, but this is expected to ease with lower energy

prices and consumables. Meanwhile, in most cases, production results were in

line with expectations, with downgrades and guidance restatements having been

well flagged last year.

Outlook

We do not expect the mining sector to be immune to deteriorating global

economic growth. However, whilst recession looms for developed markets, the

most important economy for mining, China, is moving in the opposite direction,

re-opening following a year of lockdowns and a strict zero-Covid policy.

Meanwhile, mined commodity markets are generally tight, with inventories for

many commodities at historic lows. At the same time, mined supply is being

constrained by the underinvestment of recent years and continued capital

discipline. Mining companies are in an excellent financial position, in our

view, with high levels of free cash flow, rock-solid balance sheets and a

continued focus on returning capital to shareholders.

Last year we saw greater appreciation of the role mining companies will need to

play in supplying the materials required for lower carbon technologies like

wind turbines, solar panels and electric vehicles. In 2023, we expect Brown to

Green to emerge as a key theme, where mining companies focus on reducing the

greenhouse gas emissions intensity associated with their production. We expect

to see a re-rating for the mining companies able to best navigate this and are

playing this in the portfolio.

All data points are in USD terms unless stated otherwise.

15 March 2023

Latest information is available by typing www.blackrock.com/uk/brwm on the

internet. Neither the contents of the Manager's website nor the contents of any

website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

March 15, 2023 11:18 ET (15:18 GMT)

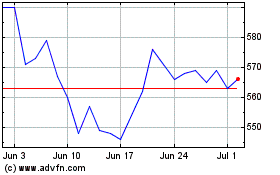

Blackrock World Mining (LSE:BRWM)

Historical Stock Chart

From Aug 2024 to Sep 2024

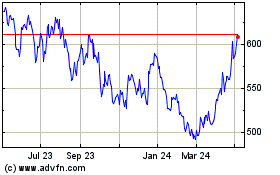

Blackrock World Mining (LSE:BRWM)

Historical Stock Chart

From Sep 2023 to Sep 2024