TIDMBRK

RNS Number : 3604S

Brooks Macdonald Group PLC

17 March 2016

BROOKS MACDONALD GROUP PLC

FINANCIAL REPORT FOR THE SIX MONTHS ENDED 31 DECEMBER 2015

Brooks Macdonald Group plc ("Brooks Macdonald" or the "Group"),

the AIM listed integrated wealth management group, today announces

its report for the six months ended 31 December 2015.

Financial Highlights

Half Half Change

year year

ended ended

31.12.15 31.12.14

Total discretionary funds

under management ("FUM") GBP7.82bn GBP6.95bn 12%

Revenue GBP38.70m GBP37.50m 3%

Underlying pre-tax profit* GBP7.13m GBP6.72m 6%

Underlying earnings per

share* 42.59p 41.25p 3%

Pre-tax profit GBP5.48m GBP4.48m 22%

Earnings per share 32.44p 26.63p 22%

Interim dividend 12p 10p 20%

*Adjustments are in respect of acquisition costs, the costs of

deferred consideration and the amortisation of intangible

assets

Business Highlights:

-- Double digit growth in FUM drove half year increases in profit and earnings per share

-- Almost all of the growth in FUM was derived from organic growth in the half year period:

o Organic growth (net new discretionary business) of GBP394m or

5.3% over the half year period excluding market growth

o Total growth of over GBP870m or 12% year on year includes

benefit of market growth and prior period acquisitions

o WMA Balanced index declined by 0.75% over the six month

period

-- Property assets under administration, managed by Braemar

Estates, of GBP1.13bn (December 2014: GBP1.09bn)

-- Third party assets under administration are now in excess of

GBP270m (December 2014: >GBP225m)

-- Interim dividend increased by 20% to 12p (2014: 10.0p)

reflecting the Board's continued confidence in the Group's progress

and the continued rebalancing between the interim and final

dividend.

Commenting on the results and outlook, Chris Macdonald, Chief

Executive, said:

"Brooks Macdonald has continued to make good progress, with

double digit growth in discretionary funds under management during

the first half driving increases in profit and earnings per share.

In uncertain markets, we have achieved strong risk adjusted returns

for our clients and have progressed a number of significant

projects across the Group which will help drive future growth."

"We have continued to see strong organic growth in the early

weeks of the second half, albeit the volatility in markets since

the New Year is likely to have impacted the Group's funds under

management."

"Our second half will benefit from the year on year growth of

funds under management, but will be impacted by the continuing

planned conversion of advisory to discretionary assets by Brooks

Macdonald International. Overall subject to the level of the

market, we expect to make further progress for the year as a

whole."

An analyst meeting will be held at 9.15 for 9.30am on Thursday,

17 March at the offices of MHP Communications, 6 Agar Street,

London, WC2N 4HN. Please contact Charlie Barker on

020 3128 8540 or e-mail brooks@mhpc.com for further details.

Enquiries to:

Brooks Macdonald Group plc www.brooksmacdonald.com

Chris Macdonald, Chief Executive 020 7499 6424

Simon Jackson, Finance Director

Andrew Shepherd, Deputy Chief

Executive

Peel Hunt LLP (Nominated Adviser

and Broker)

Guy Wiehahn / Adrian Haxby 020 7418 8900

MHP Communications

Reg Hoare / Simon Hockridge /

Giles Robinson / Charlie Barker 020 3128 8100

Notes to editors

Brooks Macdonald Group plc is an AIM listed, integrated, wealth

management group. The Group consists of six principal companies:

Brooks Macdonald Asset Management Limited, a discretionary asset

management business; Brooks Macdonald Funds Limited, a fund

management business; Brooks Macdonald Financial Consulting Limited,

a financial advisory and employee benefits consultancy; Brooks

Macdonald Asset Management (International) Limited, a Jersey and

Guernsey based provider of discretionary investment management and

stockbroking; Brooks Macdonald Retirement Services (International)

Limited, a Jersey and Guernsey based retirement planning services

provider; and Braemar Estates (Residential) Limited, an estate

management company.

CHAIRMAN'S STATEMENT

Introduction

In the six months to the end of December 2015 the Group

continued to make good progress, with positive growth in

discretionary funds under management driving increases in profit

and earnings per share. These increases were achieved despite the

impact of the planned movement of advisory clients to discretionary

mandates in Brooks Macdonald International, which reduced fee

revenues by more than anticipated.

In uncertain markets, we have achieved strong risk adjusted

returns for our clients and have progressed a number of significant

projects across the Group which will help drive future growth.

Results

Revenues have risen to GBP38.70m (2014: GBP37.50m) and

underlying pre-tax profit has increased by 6% to GBP7.13m (2014:

GBP6.72m), with underlying earnings per share up 3% to 42.59p

(2014: 41.25p).

Statutory profit before tax was GBP5.48m compared to GBP4.48m in

the same period last year.

Reconciliation of underlying profit before tax to profit before

tax

2015 2014

GBPm GBPm

Underlying profit before

tax 7.13 6.72

Amortisation of client

relationships and software (1.36) (1.35)

Finance costs of deferred

consideration (0.29) (0.47)

Changes in fair value

of deferred consideration - (0.30)

Acquisition costs - (0.12)

------- -------

Profit before tax 5.48 4.48

------- -------

Cash resources at the period end amounted to GBP15.43m (2014:

GBP11.77m). The Group had no borrowings as at 31 December 2015

(2014: GBPnil).

Dividend

The Board has declared an interim dividend of 12p (2014: 10p).

This represents an increase of 20% compared to the previous year,

reaffirming the Group's progressive dividend policy while

continuing the planned move towards a more balanced split between

interim and final. The interim dividend will be paid on 26 April

2016 to shareholders on the register as at 29 March 2016.

Funds under Management (FUM)

I am pleased to report that the Group saw continued growth in

its three core investment businesses: Asset Management,

International and Funds. This growth, which was ahead of our

expectations, comprised of GBP394m of organic new business and

GBP15m of portfolio performance over the period.

As previously announced, the Group's discretionary funds under

management rose to GBP7.82bn as at 31 December 2015 (as at 30 June

2015: GBP7.41bn), representing a rise of 5.52% compared to the WMA

index, which declined 0.75% over the same six month period.

Analysis of discretionary fund flows over the period

Six months Six months

to Year to to

31 Dec 30 Jun 31 Dec

2015 2015 2014

GBPm GBPm GBPm

Opening discretionary

FUM 7,413 6,550 6,550

Net new discretionary

business 394 645 238

Investment growth 15 218 165

----------- -------- -----------

Total FUM growth 409 863 403

Closing FUM 7,822 7,413 6,953

Organic growth (net

of markets) % 5.31% 9.8% 3.7%

Total growth % 5.52% 13.2% 6.2%

Business review

Asset Management continues to grow its professional connections

and now works with over 900 introducing firms who refer new

business to the Group. Internationally, Brooks Macdonald continues

to gain positive traction in South Africa from a distribution

perspective, managing the assets won out of its offices in the

Channel Islands.

Brooks Macdonald's Funds business continues to gain traction and

increase its FUM, with particular momentum within its Multi-Asset

Fund (MAF) range. However the business incurred a loss for the half

year, principally as a result of costs and charges incurred in two

specialist funds which have not achieved critical mass.

Braemar Estates, the Group's property management business, saw a

small decline in the value of property assets under administration

over the period to GBP1.13bn (June 2015: GBP1.14bn).

Brooks Macdonald International achieved lower profits due to the

planned conversion of advisory accounts to discretionary accounts.

Advisory accounts deliver higher short term revenues, while

discretionary accounts are charged in arrears but at higher overall

rates. This led to reduced revenues on these accounts during the

period. However, over the medium term, this focus on discretionary

accounts should enhance fee income, in line with the strategic

focus of the Group as a whole.

Financial Consulting continues to be a significant introducer of

Investment Management work across the Group. The consultancy

division had a satisfactory period, albeit the employee benefits

market remains challenging and behind our expectations.

(MORE TO FOLLOW) Dow Jones Newswires

March 17, 2016 03:00 ET (07:00 GMT)

The Group continues to pursue an organic growth strategy,

through investing in infrastructure and the long term development

of the business. The Group continues to make good progress with its

information technology upgrade and implementation plan, and has

added to the scope of the upgrade to include enhancements and to

reflect the latest regulatory thinking. The project remains on

course to be completed by the end of 2016. It also includes

investment in growing the Group's fund management capabilities

(trainees, research and investment managers), while expanding

Brooks Macdonald's new business teams both on and offshore. The

purpose for this is to ensure that the Group stays at the forefront

of the industry, delivering consistently strong investment

performance and high service levels to its clients and professional

intermediary partners.

Outlook and Summary

The Group remains focussed on delivering strong performance at

all levels of the business following good progress in the first

half. We have continued to see strong organic growth in the early

weeks of the second half, albeit volatility in markets since the

New Year has inevitably impacted the Group's funds under

management.

Our second half will benefit from the year on year growth of FUM

but will be impacted by the continuing planned conversion of

advisory to discretionary assets by Brooks Macdonald International.

Overall subject to the absolute level of the market, we expect to

make further progress for the year as a whole.

Christopher Knight

Chairman

16 March 2016

BROOKS MACDONALD GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 31 December 2015

Year ended

Six months Six months

ended 31 ended 31

Dec 2015 Dec 2014 30 Jun 2015

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 38,698 37,503 77,686

Administrative costs 5 (32,287) (32,398) (65,371)

Realised gain on investment 6 20 - 540

Other gains and losses 7 (572) (166) (754)

Operating profit 5,859 4,939 12,101

Finance income 22 60 86

Finance costs 8 (292) (471) (763)

Share of results of joint

venture 15 (107) (45) (4)

Profit before tax 5,482 4,483 11,420

Taxation 9 (1,109) (921) (2,269)

Profit for the period attributable

to equity holders of the

Company 4,373 3,562 9,151

------------- ------------- -------------

Other comprehensive income:

Items that may be reclassified

subsequently to profit or

loss

Revaluation of available

for sale financial assets - (401) -

Revaluation reserve recycled

to profit and loss - - 68

Total comprehensive income

for the period 4,373 3,161 9,219

------------- ------------- -------------

Earnings per share

Basic 10 32.44p 26.63p 68.30p

Diluted 10 32.28p 26.51p 68.14p

The accompanying notes form an integral part of these condensed

consolidated financial statements.

BROOKS MACDONALD GROUP PLC

CONDENSED Consolidated Statement of Financial Position

as at 31 December 2015

30 Jun

31 Dec 2015 31 Dec 2014 2015

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 12 65,495 65,565 65,258

Property, plant and equipment 13 3,558 2,658 3,539

Available for sale financial

assets 14 1,358 2,031 1,532

Investment in joint venture 15 221 566 628

Deferred tax assets 710 524 709

------------- ------------- -----------

Total non-current assets 71,342 71,344 71,666

Current assets

Trade and other receivables 21,866 20,054 21,402

Financial assets at fair

value through profit or

loss 16 5 328 3

Cash and cash equivalents 15,425 11,768 19,274

------------- ------------- -----------

Total current assets 37,296 32,150 40,679

Total assets 108,638 103,494 112,345

------------- ------------- -----------

Liabilities

Non-current liabilities

Deferred consideration 17 (7,890) (11,770) (9,442)

Deferred tax liabilities (4,151) (5,011) (4,694)

Other non-current liabilities (29) (42) (95)

------------- ------------- -----------

Total non-current liabilities (12,070) (16,823) (14,231)

Current liabilities

Trade and other payables (14,348) (13,769) (16,894)

Current tax liabilities (1,487) (702) (1,463)

Deferred tax liabilities (157) - (119)

Provisions 18 (5,109) (4,024) (5,474)

------------- ------------- -----------

Total current liabilities (21,101) (18,495) (23,950)

Net assets 75,467 68,176 74,164

------------- ------------- -----------

Equity

Share capital 137 136 136

Share premium account 35,623 35,163 35,600

Other reserves 5,049 4,092 5,101

Retained earnings 34,658 28,785 33,327

------------- ------------- -----------

Total equity 75,467 68,176 74,164

------------- ------------- -----------

The condensed consolidated financial statements were approved by

the Board of Directors and authorised for issue on 16 March 2016,

signed on their behalf by:

C A J Macdonald S J Jackson

Chief Executive Finance Director

Company registration number: 4402058

The accompanying notes form an integral part of these condensed

consolidated financial statements.

BROOKS MACDONALD GROUP PLC

CONDENSED Consolidated Statement of Changes in Equity

for the period 1 July 2013 to 31 December 2015

Share

Share premium Other Retained

capital account reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 July 2014 135 35,147 4,720 27,456 67,458

--------- --------- ---------- ---------- --------

Comprehensive income

Profit for the period - - 3,562 3,562

Revaluation of available

for sale financial asset - - (401) - (401)

Total comprehensive income - - (401) 3,562 3,161

Transactions with owners

Issue of ordinary shares 1 16 - - 17

Share-based payments - - 685 - 685

Share-based payments transfer - - (1,045) 1,045 -

Purchase of own shares by

employee benefit trust - - - (743) (743)

Deferred tax on share options - - 133 - 133

Dividends paid (note 11) - - - (2,535) (2,535)

--------- --------- ---------- ---------- --------

Total transactions with

owners 1 16 (227) (2,233) (2,443)

Balance at 31 December 2014 136 35,163 4,092 28,785 68,176

(MORE TO FOLLOW) Dow Jones Newswires

March 17, 2016 03:00 ET (07:00 GMT)

--------- --------- ---------- ---------- --------

Comprehensive income

Profit for the period - - - 5,589 5,589

Other comprehensive income:

Revaluation of available

for sale financial asset - - 469 - 469

--------- --------- ---------- ---------- --------

Total comprehensive income - - 469 5,589 6,058

Transactions with owners

Issue of ordinary shares - 437 - - 437

Share-based payments - - 632 - 632

Share-based payments transfer - - (291) 291 -

Deferred tax on share options - - 199 - 199

Dividends paid (note 11) - - - (1,338) (1,338)

--------- --------- ---------- ---------- --------

Total transactions with

owners - 437 540 (1,047) (70)

Balance at 30 June 2015 136 35,600 5,101 33,327 74,164

--------- --------- ---------- ---------- --------

Comprehensive income

Profit for the period - - - 4,373 4,373

--------- --------- ---------- ---------- --------

Total comprehensive income - - 4,373 4,373

Transactions with owners

Issue of ordinary shares 1 23 - - 24

Share-based payments - - 375 - 375

Share-based payments transfer - - (575) 575 -

Purchase of own shares by

employee benefit trust - - - (859) (859)

Deferred tax on share options - - 148 - 148

Dividends paid (note 11) - - - (2,758) (2,758)

--------- --------- ---------- ---------- --------

Total transactions with

owners 1 23 (52) (3,042) (3,070)

Balance at 31 December 2015 137 35,623 5,049 34,658 75,467

--------- --------- ---------- ---------- --------

The accompanying notes form an integral part of these condensed

consolidated financial statements.

BROOKS MACDONALD GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

for the six months ended 31 December 2015

Six months Six months

ended ended Year ended

31 Dec 2015 31 Dec 2014 30 Jun 2015

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Cash generated from operations 19 5,203 7,241 20,094

Taxation paid (1,443) (983) (1,756)

Net cash generated from

operating activities 3,760 6,258 18,338

Cash flows from investing

activities

Purchase of property, plant

and equipment 13 (568) (204) (1,558)

Purchase of intangible assets 12 (1,598) (823) (1,879)

Purchase of available for

sale financial assets - (250) (250)

Acquisition of subsidiary

companies, net of cash acquired - (687) 37

Deferred consideration paid 17 (1,772) (7,001) (9,218)

Interest received 22 60 86

Purchase of financial assets

at fair value through profit

or loss - - (40)

Proceeds of sale of financial

assets at fair value through

profit or loss - - 263

Investment in joint venture 15 (100) (380) (400)

------------- ------------- -------------

Net cash used in investing

activities (4,016) (9,285) (12,959)

Cash flows from financing

activities

Proceeds of issue of shares 24 17 454

Purchase of own shares by

employee benefit trust (859) (743) (742)

Dividends paid to shareholders 11 (2,758) (2,535) (3,873)

------------- ------------- -------------

Net cash used in financing

activities (3,593) (3,261) (4,161)

Net (decrease)/ increase

cash and cash equivalents (3,849) (6,288) 1,218

Cash and cash equivalents

at beginning of period 19,274 18,056 18,056

------------- ------------- -------------

Cash and cash equivalents

at end of period 15,425 11,768 19,274

------------- ------------- -------------

The accompanying notes form an integral part of these condensed

consolidated financial statements.

BROOKS MACDONALD GROUP PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the six months ended 31 December 2015

1. General information

Brooks Macdonald Group plc ('the Company') is the parent company

of a group of companies ('the Group'), which offers a range of

investment management services and related professional advice to

private high net worth individuals, charities and trusts. The Group

also provides financial planning as well as offshore fund

management and administration services and acts as fund manager to

regulated OEICs, providing specialist funds in the property and

structured return sectors and managing property assets on behalf of

these funds and other clients. The Group's primary activities are

set out in its Annual Report and Accounts for the year ended 30

June 2015.

The Group has offices in London, Edinburgh, Guernsey, Hale,

Hampshire, Jersey, Leamington Spa, Manchester, Taunton, Tunbridge

Wells and York. The Company is a public limited company,

incorporated and domiciled in the United Kingdom under the

Companies Act 2006 and listed on AIM. The address of its registered

office is 72 Welbeck Street, London, W1G 0AY.

The consolidated interim financial information was approved for

issue on 16 March 2016. It has been independently reviewed but is

not audited.

2. Accounting policies

a) Basis of preparation

The Group's condensed consolidated half yearly financial

statements are prepared and presented in accordance with IAS 34

'Interim Financial Reporting' as adopted by the European Union.

They have been prepared on a going concern basis with reference to

the accounting policies and methods of computation and presentation

set out in the Group's consolidated financial statements for the

year ended 30 June 2015, except as stated below. The half yearly

financial statements should be read in conjunction with the Group's

audited financial statements for the year ended 30 June 2015, which

have been prepared in accordance with IFRS as adopted by the

European Union.

The information in this announcement does not comprise statutory

accounts within the meaning of section 434 of the Companies Act

2006. The Group's accounts for the year ended 30 June 2015 have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The report of the auditors was unqualified

and did not draw attention to any matters by way of emphasis. It

contained no statement under section 498(2) or (3) of the Companies

Act 2006.

b) Changes in accounting policies

The Group's accounting policies that have been applied in

preparing these financial statements are consistent with those

disclosed in the Annual Report and Accounts for the year ended 30

June 2015, except as described below.

New accounting standards, amendments and interpretations adopted

in the period

In the six months ended 31 December 2015, the Group did not

adopt any new standards or amendments issued by the IASB or

interpretations issued by the IFRS Interpretations Committee (IFRS

IC) that have had a material impact on the condensed consolidated

financial statements.

(MORE TO FOLLOW) Dow Jones Newswires

March 17, 2016 03:00 ET (07:00 GMT)

Other new standards, amendments and interpretations listed in

the table below were newly adopted by the Group but have not had a

material impact on the amounts reported in these financial

statements. They may however impact the accounting for future

transactions and arrangements.

Standard, Amendment or Interpretation Effective

date

--------------------------------------------------- -----------

Contributions to defined benefit plans (amendments 1 February

to IAS 19) 2015

--------------------------------------------------- -----------

Annual improvements (2010-2012 cycle) 1 February

2015

--------------------------------------------------- -----------

Annual improvements (2011-2013 cycle) 1 January

2015

--------------------------------------------------- -----------

New accounting standards, amendments and interpretations not yet

adopted

A number of new standards, amendments and interpretations, which

have not been applied in preparing these financial statements, have

been issued and are effective for annual and interim periods

beginning after 1 July 2015:

Standard, Amendment or Interpretation Effective

date

---------------------------------------------------- ----------

Disclosure initiative (amendments to IAS 1) 1 January

2016

---------------------------------------------------- ----------

Accounting for acquisitions of interests in 1 January

joint operations (amendments to IFRS 11) 2016

---------------------------------------------------- ----------

Investment entities: applying the consolidation 1 January

exception (amendments to IFRS 10, IFRS 12 and 2016

IAS 28)

---------------------------------------------------- ----------

Clarification of acceptable methods of depreciation 1 January

and amortisation (amendments to IAS 16 and IAS 2016

38)

---------------------------------------------------- ----------

Annual improvements (2012-2014 cycle) 1 July

2016

---------------------------------------------------- ----------

Recognition of deferred tax assets for unrealised 1 January

losses (amendments to IAS 12) 2017

---------------------------------------------------- ----------

Disclosure initiative (amendments to IAS 7) 1 January

2017

---------------------------------------------------- ----------

Revenue from contracts with customers (IFRS 1 January

15) 2018

---------------------------------------------------- ----------

Financial instruments (IFRS 9) 1 January

2018

---------------------------------------------------- ----------

Leases (IFRS 16) 1 January

2019

---------------------------------------------------- ----------

Not yet endorsed for use in the EU

The impact of these changes is currently being reviewed and

there is no intention to early adopt.

Only IFRS 16 Leases is expected to have a significant impact on

the Group's future consolidated financial statements. This new

standard will require the recognition a right-of-use asset and

associated lease liability for the office premises that are leased

by the Group. The asset would be depreciated over the lease term

and the liability would accrue interest, resulting in a

front-loaded expense profile. This accounting treatment contrasts

with the current treatment for operating leases, where no asset or

liability is recognised and the lease payments are charged to the

Consolidated Statement of Comprehensive Income on a straight line

basis over the term of the lease.

3. Financial risk factors

The Group's activities expose it to a variety of financial and

non-financial risks. The principal risks faced by the Group are

described on pages 58 and 59 of the Annual Report and Accounts for

the year ended 30 June 2015. These key risks include: loss of

clients or reputational damage as a result of poor performance or

service; regulatory breaches; loss of key staff; potential service

issues with IT infrastructure; operational risk due to inadequate

processes and controls; and financial risks such as liquidity risk,

market risk and credit risk. These remain our principal risks for

the second half of the financial year. There have been no

significant changes affecting the fair value or classification of

financial assets during the period.

4. Segmental information

For management purposes the Group's activities are organised

into four operating divisions: investment management, financial

planning, fund and property management and international. The

Group's other activity, offering nominee and custody services to

clients, is included within investment management. These divisions

are the basis on which the Group reports its primary segmental

information. In accordance with IFRS 8 'Operating Segments',

disclosures are required to reflect the information which the Board

uses internally for evaluating the performance of its operating

segments and allocating resources to those segments. The

information presented in this note follows the presentation for

internal reporting to the Group Board of Directors.

Revenues and expenses are allocated to the business segment that

originated the transaction. Revenues and expenses that are not

directly originated by a particular business segment are reported

as unallocated. Sales between segments are carried out at arm's

length. Centrally incurred expenses are allocated to business

segments on an appropriate pro-rata basis. Segment assets and

liabilities comprise operating assets and liabilities, being the

majority of the balance sheet.

Fund

and

Investment Financial property

management planning management International Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Six months ended 31 Dec

2015 (unaudited)

Total segment revenues 27,908 2,103 3,146 5,747 38,904

Inter segment revenues (110) (64) (32) - (206)

------------ ---------- ------------ -------------- --------

External revenues 27,798 2,039 3,114 5,747 38,698

------------ ---------- ------------ -------------- --------

Segment result 8,504 (13) (1,061) 245 7,675

Unallocated items (2,193)

--------

Profit before tax 5,482

Taxation (1,109)

--------

Profit for the period 4,373

--------

Six months ended 31 Dec

2014 (unaudited)

Total segment revenues 25,948 1,967 2,812 6,897 37,624

Inter segment revenues (54) (46) (21) - (121)

------------ ---------- ------------ -------------- --------

External revenues 25,894 1,921 2,791 6,897 37,503

------------ ---------- ------------ -------------- --------

Segment result 6,601 (50) (457) 609 6,703

Unallocated items (2,220)

--------

Profit before tax 4,483

Taxation (921)

--------

Profit for the period 3,562

--------

Year ended 30 Jun 2015 (audited)

Total segment revenues 54,464 4,191 6,044 13,200 77,899

Inter segment revenues (101) (69) (43) - (213)

------------ ---------- ------------ -------------- --------

External revenues 54,363 4,122 6,001 13,200 77,686

------------ ---------- ------------ -------------- --------

(MORE TO FOLLOW) Dow Jones Newswires

March 17, 2016 03:00 ET (07:00 GMT)

Segment result 15,774 (68) (564) 1,315 16,457

Unallocated items (5,037)

--------

Profit before tax 11,420

Taxation (2,269)

--------

Profit for the year 9,151

--------

a) Geographic analysis

The Group's operations are located in the United Kingdom and the

Channel Islands. The following table presents external revenue

analysed by the geographical location of the Group entity providing

the service.

Six months

ended Year ended

31 Dec Six months 30 Jun

2015 ended 2015

31 Dec

(unaudited) 2014 (unaudited) (audited)

GBP'000 GBP'000 GBP'000

United Kingdom 32,951 30,606 64,486

Channel Islands 5,747 6,897 13,200

Total revenue 38,698 37,503 77,686

------------- ------------------- -----------

b) Major clients

The Group is not reliant on any one client or group of connected

clients for the generation of revenues.

5. Administrative costs

The following items are included within administrative expenses

in the Condensed Consolidated Statement of Comprehensive

Income.

Acquisition costs

Directly attributable business acquisition costs of GBPnil were

incurred in the six months ended 31 December 2015 (six months ended

31 December 2014: GBP120,000; year ended 30 June 2015:

GBP120,000).

Financial Services Compensation Scheme levies

A charge of GBPnil was incurred in respect of Financial Services

Compensation Scheme ('FSCS') levies in the six months ended 31

December 2015 (six months ended 31 December 2014: GBPnil; year

ended 30 June 2015: GBP510,000).

6. Realised gain on investment

During the six months ended 31 December 2015, the Group realised

an additional gain of GBP20,000 (six months ended 31 December 2014:

GBPnil; year ended 30 June 2015: GBP540,000) on the final disposal

of its investment in Sancus Holdings Limited through the voluntary

winding up of the company.

7. Other gains and losses

Other gains and losses represent the net changes in the fair

value of the Group's financial instruments recognised in the

Consolidated Statement of Comprehensive Income.

Six months Six months

ended ended

31 Dec 2015 31 Dec 2014 Year ended

30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Impairment of available

for sale financial assets

(note 14) (174) - (718)

Unrealised gain / (loss)

from changes in fair value

of financial assets at fair

value through profit or

loss (note 16) 2 (150) (252)

Impairment of investment

in joint venture (note 15) (400) - -

(Loss) / gain from changes

in fair value of deferred

consideration (note 17) - (16) 216

------------- ------------- -------------

Other gains and losses (572) (166) (754)

------------- ------------- -------------

8. Finance costs

Six months

ended

Six months

31 Dec 2015 ended Year ended

31 Dec 2014 30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Bank interest payable - 2 3

Finance cost of deferred

consideration 292 469 760

------------- -------------- -------------

Total finance costs 292 471 763

------------- -------------- -------------

9. Taxation

The current tax expense for the six months ended 31 December

2015 was calculated based on the estimated average annual effective

tax rate. The overall effective tax rate for this period was 20.23%

(six months ended 31 December 2014: 20.54%; year ended 30 June

2015: 19.87%).

Six months

ended

Six months

31 Dec 2015 ended Year ended

31 Dec 2014 30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Current tax

United Kingdom taxation 1,437 1,001 2,776

Under / (over) provision

in prior years 196 (196) (231)

------------- -------------- -------------

Total current taxation 1,633 805 2,545

Deferred tax

Origination and reversal

of temporary differences (190) 116 (276)

Effect of change in tax

rate on deferred tax (334) - -

Total deferred taxation (524) 116 (276)

Total income tax expense 1,109 921 2,269

------------- -------------- -------------

On 1 April 2015 the standard rate of Corporation Tax in the UK

was reduced from 21% to 20%. The Finance Act 2015 will further

reduce the main rate of UK Corporation Tax to 19% with effect from

1 April 2017 and 18% with effect from 1 April 2020. As a result the

effective rate of Corporation Tax applied to the taxable profit for

the period ended 31 December 2015 is 20.00% (six months ended 31

December 2014: 20.75%; year ended 30 June 2015: 20.75%).

Deferred tax assets and liabilities are calculated at the rate

that is expected to be in force when the temporary differences

unwind, but limited to the extent that such rates have been

substantively enacted. Consequently the tax rate used to measure

the deferred tax assets and liabilities of the Group is 18.90% (six

months ended 31 December 2014: 20.00%; year ended 30 June 2015:

20.00%) on the basis that they will materially unwind after 1 April

2020.

10. Earnings per share

The directors believe that underlying earnings per share provide

a truer reflection of the Group's performance. Underlying earnings

per share are calculated based on 'underlying earnings', which is

defined as post-tax profit attributable to equity holders of the

Company ('earnings') before acquisition costs, finance costs of

deferred consideration, changes in the fair value of deferred

consideration and amortisation of intangible non-current assets.

The tax effect of these adjustments is also considered and the tax

charge is adjusted accordingly.

Earnings for the period used to calculate earnings per share as

reported in these condensed consolidated financial statements were

as follows:

Six months

ended

Six months

31 Dec 2015 ended Year ended

31 Dec 2014 30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Earnings 4,373 3,562 9,151

Acquisition costs (note

5) - 120 120

Finance cost of deferred

consideration (note 17) 292 469 760

Changes in fair value of

deferred consideration - 302 70

Amortisation (note 12) 1,361 1,345 2,708

Tax impact of adjustments (284) (281) (571)

------------- -------------- -------------

Underlying earnings 5,742 5,517 12,238

------------- -------------- -------------

Basic earnings per share is calculated by dividing earnings by

the weighted average number of shares in issue throughout the

period. Diluted earnings per share represents the basic earnings

per share adjusted for the effect of dilutive potential shares

issuable on exercise of employee share options under the Group's

share-based payment schemes, weighted for the relevant period.

(MORE TO FOLLOW) Dow Jones Newswires

March 17, 2016 03:00 ET (07:00 GMT)

The weighted average number of shares in issue during the period

was as follows:

Six months

ended

31 Dec Six months

2015 ended Year ended

31 Dec 30 Jun 2015

(unaudited) 2014 (unaudited) (audited)

Number Number Number of

of shares of shares shares

Weighted average number

of shares in issue 13,481,029 13,375,142 13,399,031

Effect of dilutive potential

shares issuable on exercise

of employee share options 67,712 61,955 30,996

------------- ------------------- -------------

Diluted weighted average

number of shares in issue 13,548,741 13,437,097 13,430,027

------------- ------------------- -------------

Six months

ended

31 Dec Six months

2015 ended Year ended

31 Dec 30 Jun 2015

(unaudited) 2014 (unaudited) (audited)

p p p

Based on reported earnings:

Basic earnings per share 32.44 26.63 68.30

Diluted earnings per share 32.28 26.51 68.14

------------- ------------------- -------------

Based on underlying earnings:

Basic earnings per share 42.59 41.25 91.33

Diluted earnings per share 42.38 41.06 91.12

------------- ------------------- -------------

11. Dividends

Six months Six months

ended ended

31 Dec 2015 31 Dec 2014 Year ended

30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Interim dividend paid on

ordinary shares - - 1,338

Final dividend paid on ordinary

shares 2,758 2,535 2,535

------------- ------------- -------------

Total dividends 2,758 2,535 3,873

------------- ------------- -------------

An interim dividend of 12.0p (2014: 10.0p) per share was

declared by the Board of Directors on 16 March 2016. It will be

paid on 26 April 2016 to shareholders who are on the register at

the close of business on 29 March 2016. In accordance with IAS 10,

this dividend has not been included as a liability in the financial

statements at 31 December 2015.

A final dividend for the year ended 30 June 2015 of 20.5p (2014:

19.0p) per share was paid on 28 October 2015.

12. Intangible assets

Contracts

Acquired acquired

client with

relationship fund

Goodwill Software contracts managers Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 July 2014 24,793 411 32,747 3,048 60,999

Additions 11,213 349 - 474 12,036

At 31 December 2014 36,006 760 32,747 3,522 73,035

Additions - 1,056 - - 1,056

At 30 June 2015 36,006 1,816 32,747 3,522 74,091

Additions - 1,598 - - 1,598

At 31 December 2015 36,006 3,414 32,747 3,522 75,689

--------- --------- -------------- ---------- --------

Accumulated amortisation

At 1 July 2014 - 269 3,771 2,085 6,125

Amortisation charge - 53 1,084 208 1,345

--------- --------- -------------- ---------- --------

At 31 December 2014 - 322 4,855 2,293 7,470

Amortisation charge - 76 1,083 204 1,363

--------- --------- -------------- ---------- --------

At 30 June 2015 - 398 5,938 2,497 8,833

Amortisation charge - 60 1,089 212 1,361

--------- --------- -------------- ---------- --------

At 31 December 2015 - 458 7,027 2,709 10,194

--------- --------- -------------- ---------- --------

Net book value

At 1 July 2014 24,793 142 28,976 963 54,874

At 31 December 2014 36,006 438 27,892 1,229 65,565

At 30 June 2015 36,006 1,418 26,809 1,025 65,258

--------- --------- -------------- ---------- --------

At 31 December 2015 36,006 2,956 25,720 813 65,495

--------- --------- -------------- ---------- --------

a) Goodwill

Goodwill acquired in a business combination is allocated at

acquisition to the cash generating units ('CGUs') that are expected

to benefit from that business combination. The carrying amount of

goodwill in respect of these CGUs within the operating segments of

the group comprises:

31 Dec 2015

31 Dec 2014 30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Fund and property management

Braemar Group Limited ('Braemar') 3,550 3,550 3,550

Levitas Investment Management

Services Limited ('Levitas') 11,213 11,213 11,213

------------- ------------- ------------

14,763 14,763 14,763

International

Brooks Macdonald Asset Management

(International) Limited, Brooks

Macdonald Retirement Services

(International) Limited and

DPZ Capital Limited (collectively

'Brooks Macdonald International') 21,243 21,243 21,243

Total goodwill 36,006 36,006 36,006

------------- ------------- ------------

At the reporting date, there were no indicators that the

carrying amount of goodwill should be impaired.

b) Computer software

Software costs are amortised over an estimated useful life of

four years on a straight line basis.

c) Acquired client relationship contracts

This asset represents the fair value of future benefits accruing

to the Group from client relationship contracts acquired either as

part of a business combination or when separate payments are made

to third parties in exchange for a book of clients. The

amortisation of client relationship contracts is charged to the

Condensed Consolidated Statement of Comprehensive Income on a

straight line basis over their estimated useful lives (15 to 20

years).

d) Contracts acquired with fund managers

This asset represents the fair value of future benefits accruing

to the Group from contracts acquired with individual fund managers

when they are recruited by the group. Payments made to acquire such

contracts are initially recognised at cost and amortised on a

straight line basis over an estimated useful life of five

years.

13. Property, plant and equipment

During the six months ended 31 December 2015, the Group acquired

assets at a cost of GBP568,000 (six months ended 31 December 2014:

GBP204,000; year ended 30 June 2015: GBP1,531,000). The net book

value of fixed assets disposed of in the period was GBP11,000 (six

months ended 31 December 2014: GBPnil; year ended 30 June 2015:

GBPnil), resulting in a gain on disposal of GBPnil (six months

ended 31 December 2014: GBPnil; year ended 30 June 2015:

GBPnil).

14. Available for sale financial assets

The Group holds investments of 1,426,793.64 class B ordinary

shares, representing an interest of 10.88%, in Braemar Group PCC

Limited Student Accommodation Cell ('Student Accommodation fund')

and 750,000 zero dividend preference shares in GLI Finance Limited

('GLIF'), an AIM-listed company incorporated in Guernsey.

(MORE TO FOLLOW) Dow Jones Newswires

March 17, 2016 03:00 ET (07:00 GMT)

The Student Accommodation fund is promoted by Brooks Macdonald

Funds Limited, a subsidiary of the Group. At 31 December 2015, the

estimated fair value of the Group's investment was GBP608,000 (at

31 December 2014: GBP1,031,000; at 30 June 2015: GBP782,000). An

impairment loss of GBP174,000 was recognised in the Consolidated

Statement of Comprehensive Income during the six months ended 31

December 2015 (six months ended 31 December 2014: GBPnil; year

ended 30 June 2015: GBP718,000), reflecting the perceived permanent

diminution in value of the investment.

At 31 December 2015 the market value of the GLIF preference

shares was GBP750,000 (at 31 December 2014: GBPnil; at 30 June

2015: GBP750,000).

At 31 December 2014, available for sale financial assets also

included an investment in Sancus Holdings Limited, an unlisted

company incorporated in Guernsey, with a market value of

GBP1,000,000. Full details of this investment are provided in note

16 of the Group's 2015 Annual Report and Accounts.

Six months

ended

Six months

31 Dec 2015 ended Year ended

31 Dec 2014 30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

At beginning of period 1,532 2,182 2,182

Additions - 250 250

Disposals - - (250)

Loss from changes in fair

value - (401) -

Accumulated loss or revaluation

reserve recycled - - 68

Impairment loss (174) - (718)

At end of period 1,358 2,031 1,532

------------- -------------- -------------

15. Investment in joint venture

Brooks Macdonald Funds Limited, a subsidiary of Brooks Macdonald

Group plc, holds a 60% interest in North Row Capital LLP. The Group

has joint control over the partnership, with the remaining interest

owned by two individual partners who developed the investment

approach behind the IFSL North Row Liquid Property Fund, which was

launched in February 2014. The fund offers investors liquid

exposure to global real estate markets by investing predominantly

in property derivatives, as well as property equity and debt, to

gain exposure to the direct property markets.

During the six months ended 31 December 2015, the Group provided

additional working capital totalling GBP100,000 to the partnership

(six months ended 31 December 2014: GBP380,000; year ended 30 June

2015: GBP400,000), which is recognised as increase in the

investment in joint venture on the Consolidated Statement of

Financial Position. The Group's share of the loss for the period

reported by North Row Capital LLP was GBP107,000 (six months ended

31 December 2014: loss of GBP45,000; year ended 30 June 2015: loss

of GBP4,000) which has been recognised in the Condensed

Consolidated Statement of Comprehensive Income with a corresponding

reduction in the investment in joint venture in the Condensed

Consolidated Statement of Financial Position.

The carrying amount of the Group's investment in North Row

Capital LLP at 31 December 2015 has been reduced to its estimated

recoverable amount by recognition of an impairment loss of

GBP400,000 against the investment in joint venture (six months

ended 31 December 2014: GBPnil; year ended 30 June 2015: GBPnil).

The expense is included within other gains and losses on the

Condensed Consolidated Statement of Comprehensive Income. The

impairment arose as the forecast future cash flows from the

partnership are now estimated to accumulate slower than originally

anticipated and as a result it will take longer for the Group to

realise a cash return on its investment in the joint venture.

16. Financial assets at fair value through profit or loss

Financial assets at fair value through profit or loss comprise

equity share capital investments. The cost of the investments at 31

December 2015 was GBP4,000 (at 31 December 2014: GBP478,000; at 30

June 2015: GBP4,000) and their market value at 31 December 2015 was

GBP5,000 (at 31 December 2014: GBP328,000; at 30 June 2015:

GBP3,000). These investments are classified as level 1 within the

fair value hierarchy, as the inputs used to determine the fair

value are quoted prices in active markets for the equity shares at

the measurement date.

17. Deferred consideration

Deferred consideration, which is also included within provisions

in current liabilities (note 18) to the extent that it is due to be

paid within one year of the reporting date, relates to the

directors' best estimate of amounts payable in the future in

respect of certain client relationships and subsidiary undertakings

that were acquired by the Group. Deferred consideration is measured

at its fair value based on discounted expected future cash flows.

The movements in the total deferred consideration balance during

the year were as follows:

Six months

ended

Six months

31 Dec 2015 ended Year ended

31 Dec 2014 30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

At beginning of the period 13,826 11,236 11,236

Added on acquisitions during

the period - 11,264 11,264

Finance cost of deferred

consideration 292 469 760

Fair value adjustments - 16 (216)

Payments made during the

period (1,772) (7,725) (9,218)

At end of the period 12,346 15,260 13,826

------------- -------------- -------------

Analysed as:

Amounts falling due within

one year 4,456 3,490 4,384

Amounts falling due after

more than one year 7,890 11,770 9,442

At end of period 12,346 15,260 13,826

------------- -------------- -------------

Payments totalling GBP1,772,000 were made during the period (six

months ended 31 December 2014: GBP7,725,000; year ended 30 June

2015: GBP9,218,000), representing GBP524,000 to the vendor of JPAM

Limited and GBP1,248,000 to the vendors of Levitas Investment

Management Services Limited.

18. Provisions

Six months Six months

ended ended Year ended

31 Dec 2015 31 Dec 2014 30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Client compensation

At beginning of the period 701 503 503

Movement during the period (48) 31 198

------------- ------------- -------------

At end of the period 653 534 701

------------- ------------- -------------

Deferred consideration

At beginning of the period 4,384 8,293 8,293

Added on acquisitions during

the period - 2,304 2,304

Finance costs 292 120 278

Fair value adjustments - - (216)

Transfer from non-current

liabilities 1,552 498 2,943

Utilised during the period (1,772) (7,725) (9,218)

At end of the period 4,456 3,490 4,384

------------- ------------- -------------

Other provisions

At beginning of the period 389 351 351

Utilised during the period (389) (351) (472)

FSCS levy (note 5) - - 510

-------------

At end of the period - - 389

------------- ------------- -------------

Total provisions at beginning

of the period 5,474 9,147 9,147

------------- ------------- -------------

Total provisions at end

of the period 5,109 4,024 5,474

------------- ------------- -------------

a) Client compensation

Client compensation provisions relate to the potential liability

arising from client complaints against the Group. Complaints are

assessed on a case by case basis and provisions for compensation

are made where judged necessary. Complaints are on average settled

within eight months (six months ended 31 December 2014: eight

months; year ended 30 June 2015: eight months) from the date of

notification of the complaint.

b) Deferred consideration

(MORE TO FOLLOW) Dow Jones Newswires

March 17, 2016 03:00 ET (07:00 GMT)

Deferred consideration has been included within provisions as a

current liability to the extent that it is due to be paid within

one year of the reporting date. Details of the total deferred

consideration payable are provided in note 17.

A total provision for deferred consideration of GBP1,772,000 was

utilised during the six months ended 31 December 2015 (six months

ended 31 December 2014: GBP7,725,000; year ended 30 June 2015:

GBP9,218,000). This included an amount of GBP524,000 paid in

September 2015 to the vendors of JPAM Limited and GBP1,248,000 paid

in October and November 2015 to the vendors of Levitas Investment

Management Services Limited.

Details of these acquisitions are provided in the Annual Report

and Accounts for the year ended 30 June 2015 on pages 42 and

43.

c) Other provisions

Other provisions include an amount of GBPnil (at 31 December

2014: GBPnil; at 30 June 2015: GBP510,000) in respect of expected

levies by the Financial Services Compensation Scheme. The levy for

the 2016/17 scheme year has been announced by the FSCS but does not

yet meet the recognition criteria for a provision.

19. Reconciliation of operating profit to net cash inflow from operating activities

Six months Six months

ended ended Year ended

31 Dec 2015 31 Dec 2014 30 Jun 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Operating profit 5,859 4,939 12,101

Depreciation of property,

plant and equipment 549 516 990

Amortisation of intangible

assets 1,361 1,345 2,708

Other gains and losses 572 166 1,004

(Increase) / decrease in

receivables (464) 1,415 67

(Decrease) / increase in

payables (2,546) (1,432) 1,693

(Decrease) / increase in

provisions (437) (320) 236

Decrease in other non-current

liabilities (66) (73) (20)

Share-based payments 375 685 1,315

------------- ------------- -------------

Net cash inflow from operating

activities 5,203 7,241 20,094

------------- ------------- -------------

20. Related party transactions

At 31 December 2015, none of the Company's directors (at 31

December 2014: one; at 30 June 2015: one) had taken advantage of

the season ticket loan facility that is available to all staff).

The total amount outstanding at the reporting date was GBPnil (at

31 December 2014: GBPnil; at 30 June 2015: GBP5,000).

21. Share-based payment schemes

a) Long Term Incentive Scheme ('LTIS')

The Company has made annual awards under the LTIS to executive

directors and other senior executives. The conditional awards,

which vest three years after the grant date, are subject to the

satisfaction of specified performance criteria, measured over a

three year performance period. All such conditional awards are made

at the discretion of the Remuneration Committee.

b) Employee Benefit Trust

The Group established an Employee Benefit Trust ('the Trust') on

3 December 2010. The Trust was established in order to acquire

ordinary shares in the Company to satisfy rights to purchase shares

on the exercise of options awarded under the LTIS. All finance

costs and administration expenses connected with the Trust are

charged to the Condensed Consolidated Statement of Comprehensive

Income as they accrue. The Trust has waived its rights to

dividends.

A grant of 60,671 share options with an exercise price of GBPnil

was made under the scheme to directors and employees of the Group

on 29 October 2015. In respect of the six months ended 31 December

2014, a grant of 68,408 share options with an exercise price of

GBPnil was made under the scheme to directors and employees of the

Group on 14 October 2014.

As at 31 December 2015, the Company had paid GBP4,972,000 to the

Trust, which had acquired 363,590 ordinary shares on the open

market for consideration of GBP4,879,000.

In November 2015, in respect of the schemes granted in October

2011 and in October 2010, employees of the Group exercised a total

of 43,452 options and instructions were given to the Trust to

release the same number of shares. The cost of the shares released

on exercise of these options amounted to GBP529,000. At the

reporting date, the number of shares held in the Trust was 213,547

with a market value of GBP4,356,359.

In November 2014, in respect of the scheme granted in October

2011 and October 2010, employees of the Group exercised a total of

86,755 options and instructions were given to the Trust to release

the same number of shares. The cost of the shares released on

exercise of these options amounted to GBP1,002,000. At the 31

December 2014, the number of shares held in the Trust was 215,992

with a market value of GBP3,023,000.

c) Company Share Option Plan

The Company has established a Company Share Option Plan

('CSOP'), which was approved by HMRC in November 2013. The CSOP is

a discretionary scheme whereby employees or directors are granted

an option to purchase the Company's shares in the future at a price

set on the date of the grant. The maximum award under the terms of

the scheme is a total market value of GBP30,000 per recipient. The

performance conditions attached to the scheme require an increase

in the diluted earnings per share of the Company of 2% more than

the increase in the RPI over the three years starting with the

financial year in which the option is granted.

A grant of 42,501 share options with an exercise price of

GBP17.19 was made under the scheme to directors and employees of

the Group on 29 October 2015. In respect of the six months ended 31

December 2014, a grant of 22,110 share options with an exercise

price of GBP13.805 was made under the scheme to directors and

employees of the Group on 14 October 2014.

d) Other share-base payment schemes

No awards have been made under the Group's other share-based

payment schemes, details of which are provided on pages 54 to 57,

note 29 of the Annual Report and Accounts for the year ended 30

June 2015.

During the six months ended 31 December 2015, employees

exercised options over a total of 1,365 shares at a price of

GBP10.54 in respect of the 2012 Employee Sharesave Scheme and 2,400

shares at a price of GBP2.905 in respect of the Enterprise

Management Incentive Scheme 2007.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors confirm that these condensed consolidated interim

financial statements have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and that the interim

management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

consolidated financial statements, and a description of the

principal risks and uncertainties for the remaining six months of

the financial year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

The directors of Brooks Macdonald Group plc are listed on page

29.

By order of the Board of Directors

S J Jackson

Finance Director

16 March 2016

INDEPENDENT REVIEW REPORT TO BROOKS MACDONALD GROUP PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the Half Yearly Financial Report for the

six months ended 31 December 2015, which comprise the Condensed

Consolidated Statement of Comprehensive Income, Condensed

Consolidated Statement of Financial Position, Condensed

Consolidated Statement of Changes in Equity, Condensed Consolidated

Statement of Cash Flows and the related notes. We have read the

other information contained in the Half Yearly Financial Report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

Directors' responsibilities

The Half Yearly Financial Report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the Half Yearly Financial Report in accordance with

the AIM Rules for Companies, which require that the financial

information must be presented and prepared in a form consistent

with that which will be adopted in the Company's annual financial

statements.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this Half Yearly Financial Report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting", as adopted by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed consolidated set of financial statements in the Half

Yearly Financial Report based on our review. This report, including

the conclusion, has been prepared for and only for the Company for

the purpose of the AIM Rules for Companies and for no other

purpose. We do not, in producing this report, accept or assume

responsibility for any other purpose or to any other person to whom

this report is shown or into whose hands it may come save where

expressly agreed by our prior consent in writing.

Scope of review

(MORE TO FOLLOW) Dow Jones Newswires

March 17, 2016 03:00 ET (07:00 GMT)

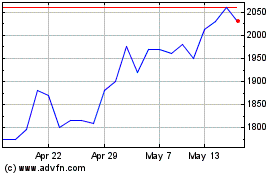

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jul 2023 to Jul 2024