TIDMBRK

RNS Number : 0924H

Brooks Macdonald Group PLC

11 March 2015

BROOKS MACDONALD GROUP PLC

HALF YEARLY FINANCIAL REPORT FOR THE SIX MONTHS ENDED 31

DECEMBER 2014

Brooks Macdonald Group plc ("Brooks Macdonald" or the "Group"),

the AIM listed integrated wealth management group, today announces

its report for the six months ended 31 December 2014.

Financial Highlights

Half year Half year Change

ended 31.12.14 ended 31.12.13

Total discretionary funds under

management ("FUM") GBP6.95bn GBP5.68bn 22.4%

Revenue GBP37.50m GBP33.39m 12.3%

Underlying pre-tax profit* GBP6.72m GBP6.16m 9.1%

Underlying earnings per share* 41.25p 40.26p 2.5%

Pre-tax profit GBP4.48m GBP4.93m (9.1%)

Earnings per share 26.63p 32.69p (18.5%)

Interim dividend 10.0p 7.0p 42.9%

*Adjustments are in respect of acquisition costs, the costs of

deferred consideration and the amortisation of intangible

assets

Business Highlights:

-- Strong growth in discretionary FUM (Asset Management, International and Funds):

o Organic growth of GBP238m or 4.6% over the six month period

excluding market growth and acquisitions

o Total growth of over GBP1.27bn or 22.4% year on year includes

benefit of market growth and prior period acquisitions

o WMA Balanced index grew by 3.15% over the six month period and

4.19% over the year

o Includes Brooks Macdonald Funds' FUM of GBP550m (December

2013: GBP447m)

-- Property assets under administration, managed by Braemar

Estates of GBP1.091bn (December 2013: GBP1.071bn)

-- Third party assets under administration are now in excess of

GBP225m (December 2013: >GBP160m)

-- Interim dividend increased by 43% to 10.0p (2013: 7.0p)

reflecting rebalancing of the dividend and the Board's continued

confidence in the Group's progress

Commenting on the results and outlook, Chris Macdonald, Chief

Executive, said:

"Brooks Macdonald is delighted to celebrate its tenth

anniversary on AIM this month. Over the period funds under

management have grown 1600% from GBP400m to over GBP7.0bn today. As

we enter the next ten year period we continue to focus on the core

strengths that have served us so well, namely our people, our

culture and our proposition. We look forward to the next ten years

of growth with optimism."

"For the remainder of the current half year, our investment in

the business for growth continues as planned and at the level

anticipated. Our expectations for the year as a whole therefore

remain unchanged."

An analyst meeting will be held at 9.15 for 9.30am on Wednesday,

11 March at the offices of MHP Communications, 60 Great Portland

Street, London, W1W 7RT. Please contact Charlie Barker on

020 3128 8540 or e-mail brooks@mhpc.comfor further details.

Enquiries to:

Brooks Macdonald Group plc www.brooksmacdonald.com

Chris Macdonald, Chief Executive 020 7499 6424

Simon Jackson, Finance Director

Peel Hunt LLP (Nominated Adviser and Broker)

Guy Wiehahn / Adrian Haxby 020 7418 8900

MHP Communications

Reg Hoare / Simon Hockridge / Giles Robinson

/ Charlie Barker 020 3128 8100

Notes to editors

Brooks Macdonald Group plc is an AIM listed, integrated, wealth

management group. The Group consists of six principal companies:

Brooks Macdonald Asset Management Limited, a discretionary asset

management business; Brooks Macdonald Funds Limited, a fund

management business; Brooks Macdonald Financial Consulting Limited,

a financial advisory and employee benefits consultancy; Brooks

Macdonald Asset Management (International) Limited, a Jersey and

Guernsey based provider of discretionary investment management and

stockbroking; Brooks Macdonald Retirement Services (International)

Limited, a Jersey and Guernsey based retirement planning services

provider; and Braemar Estates (Residential) Limited, an estate

management company.

CHAIRMAN'S STATEMENT

Introduction

The Group has made good progress over the six month period with

continued growth in discretionary funds under management, an

increase in underlying profits, strong investment performance and

further growth of its distribution capabilities.

Results

Revenues have increased by GBP4.1m to GBP37.5m compared to the

same period twelve months ago. Underlying profits have increased to

GBP6.72m compared with GBP6.16m, an increase of 9.1%. Underlying

earnings per share for the period have increased to 41.25p compared

to 40.26p (2.5%).

Statutory profit before tax - taking account of acquisition

costs, the costs of deferred consideration and the amortisation of

intangible assets - was GBP4.5m compared with GBP4.9m in the first

half of last year. Statutory earnings per share (reflecting an

increased tax charge) were 26.63p (2013: 32.69p).

Dividend

The Board has declared an interim dividend of 10.0p (2013:

7.0p), an increase of 43% compared with last year's interim

dividend. As well as reflecting the Board's continued confidence in

the Group's progress this continues our progressive dividend

policy. It is our intention that the interim dividend should over

time become a higher proportion of the total dividend paid. The

interim dividend will be paid on 21 April 2015 to shareholders on

the register on 20 March 2015.

Funds under Management

As announced on 27 January 2015 our discretionary funds totalled

GBP6.95 billion as at 31 December 2014 (2013: GBP5.68 billion).

This represents growth of 6.15% over the six month period and

growth of over GBP1.25 billion year on year (c. 22%).

Property assets under administration totalled GBP1.091 billion

(2013: GBP1.071 billion), advisory assets GBP457m (2013: GBP374m)

and third party assets under administration over GBP225m (2013:

over GBP160m).

Business review

Against a backdrop of volatile but positive investment markets

and continued regulatory change, the first half of our financial

year has been a period of solid progress for the Group with

continued growth in discretionary funds under management, further

development of our investment offering, distribution and IT

systems.

Investment markets were supportive with investment growth of

client assets adding GBP165m which combined with net new business

of GBP238m, represented total organic growth of over 6% over the

six month period.

We continue to invest in our information technology and our full

system refresh is on track to be completed in 2016. In addition we

have invested considerably over the past two years in expanding our

risk, compliance, training and oversight functions across the

Group. These have been important steps to allow us to continue to

grow the business and have a robust framework for the future.

Whilst the ICT investment will continue in 2015, overall we now

expect that our other central infrastructure costs have peaked,

certainly as a percentage of revenue. In addition, we anticipate

moving to new offices in 2015 to accommodate our growth and

following the expiry of our existing lease. This will increase

annual property costs by GBP0.65m annualised but will provide us

with greater flexibility and longer term certainty.

Our Investment Management businesses in the UK and offshore

continued to perform well, in both cases gaining further momentum

in distribution backed by good risk adjusted returns for our

clients. There have been some management changes offshore with

Darren Zaman taking on the role of CEO of Brooks Macdonald

International, replacing John Davey who is leaving the business

later this year. We are accelerating our focus offshore on the

growth of discretionary funds under management both for bespoke

clients and our International Managed Portfolio Service. Advisory

services remain an important offering for international clients but

we see material opportunities for growth around working with

fiduciaries and offshore professional advisers managing

discretionary assets.

Our Funds business (excluding Property Management) has continued

to grow. After the investment into this business over the last

three years we expect that the business will break even for the

second half of this financial year and move into profit for the

2015-16 financial year and beyond. This is important as whilst the

business has been growing well from a funds under management

perspective, it will make a net contribution to the Group for the

first time in 2016.

Financial Planning and our Property Management business have had

mixed periods. Financial Planning typically has a weaker first half

and thus we expect a stronger second half to the financial year.

Property Management has lost two low margin mandates but we

continue to invest into new business development.

As a Group we continue to raise our profile and I am pleased to

report that we now work with over 700 professional advisers and

entered into two new strategic alliances during the period bringing

the total to 17. We have been shortlisted in all our Asset

Management offices for the recent Citywire Wealth Manager Regional

Star Awards 2015 as voted for by the professional adviser community

and this is a strong endorsement of our model. We remain fully

committed to working closely with advisers across the UK and

increasingly offshore.

Outlook and Summary

We remain focussed on growing the business, delivering strong

risk adjusted returns to our clients and look forward to the future

with confidence. Investment in the business continues as planned

and at the level anticipated. Our expectations for the year as a

whole remain unchanged.

Christopher Knight

Chairman

10 March 2015

BROOKS MACDONALD GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 31 December 2014

Year ended

Six months Six months

ended 31 ended 31

Dec 2014 Dec 2013 30 Jun 2014

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 37,503 33,388 69,133

Administrative costs 5 (32,564) (28,271) (58,207)

Operating profit 4,939 5,117 10,926

Finance income 60 62 119

Finance costs (471) (182) (349)

Share of results of joint venture 13 (45) (71) (128)

Profit before tax 4,483 4,926 10,568

Taxation 6 (921) (639) (1,512)

Profit for the period attributable

to equity holders of the Company 3,562 4,287 9,056

------------- ------------- -------------

Other comprehensive income:

Revaluation of available for

sale financial assets (401) (70) (131)

Total comprehensive income for

the period 3,161 4,217 8,925

------------- ------------- -------------

Earnings per share*

Basic 7 26.63p 32.69p 69.01p

Diluted 7 26.51p 32.46p 68.67p

*Comparative amounts for the six months ended 31 December 2013

have been restated to reflect the impact of new shares issued as

consideration on the acquisition of DPZ

The accompanying notes form an integral part of these condensed

consolidated financial statements.

BROOKS MACDONALD GROUP PLC

CONDENSED Consolidated Statement of Financial Position

as at 31 December 2014

31 Dec 2014 31 Dec 2013 30 Jun 2014

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 10 65,565 44,103 54,874

Property, plant and equipment 11 2,658 2,803 2,971

Available for sale financial assets 12 2,031 1,743 2,182

Investment in joint venture 13 566 75 232

Deferred tax assets 524 825 809

------------- ------------- ------------

Total non-current assets 71,344 49,549 61,068

Current assets

Trade and other receivables 20,054 19,100 21,432

Financial assets at fair value

through profit or loss 14 328 50 478

Cash and cash equivalents 11,768 14,734 18,056

------------- ------------- ------------

Total current assets 32,150 33,884 39,966

Total assets 103,494 83,433 101,034

------------- ------------- ------------

Liabilities

Non-current liabilities

Deferred consideration 15 (11,770) (451) (2,943)

Deferred tax liabilities (5,011) (3,972) (5,117)

Other non-current liabilities (42) (67) (115)

------------- ------------- ------------

Total non-current liabilities (16,823) (4,490) (8,175)

Current liabilities

Trade and other payables (13,769) (11,809) (15,178)

Current tax liabilities (702) (1,042) (1,076)

Provisions 16 (4,024) (6,334) (9,147)

------------- ------------- ------------

Total current liabilities (18,495) (19,185) (25,401)

Net assets 68,176 59,758 67,458

------------- ------------- ------------

Equity

Share capital 136 133 135

Share premium account 35,163 31,883 35,147

Other reserves 4,092 4,404 4,720

Retained earnings 28,785 23,338 27,456

------------- ------------- ------------

Total equity 68,176 59,758 67,458

------------- ------------- ------------

The condensed consolidated financial statements were approved by

the Board of Directors and authorised for issue on 10 March 2015,

signed on their behalf by:

C A J Macdonald S J Jackson

Chief Executive Finance Director

Company registration number: 4402058

The accompanying notes form an integral part of these condensed

consolidated financial statements.

BROOKS MACDONALD GROUP PLC

CONDENSED Consolidated Statement of Changes in Equity

for the period 1 July 2013 to 31 December 2014

Share

Share premium Other Retained

capital account reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 July 2013 133 31,868 3,952 21,607 57,560

--------- --------- ---------- ---------- --------

Comprehensive income

Profit for the period - - 4,287 4,287

Revaluation of available for sale

financial asset - - (70) - (70)

Total comprehensive income - - (70) 4,287 4,217

Transactions with owners

Issue of ordinary shares - 15 - - 15

Share-based payments - - 600 - 600

Share-based payments transfer - - (9) 9 -

Purchase of own shares by employee

benefit trust - - - (572) (572)

Employee benefit trust shares

vested (109) 109 -

Deferred tax on share options - - 40 - 40

Dividends paid (note 8) - - - (2,102) (2,102)

--------- --------- ---------- ---------- --------

Total transactions with owners - 15 522 (2,556) (2,019)

Balance at 31 December 2013 133 31,883 4,404 23,338 59,758

--------- --------- ---------- ---------- --------

Comprehensive income

Profit for the period - - - 4,769 4,769

Other comprehensive income:

Revaluation of available for sale

financial asset - - (61) - (61)

--------- --------- ---------- ---------- --------

Total comprehensive income - - (61) 4,769 4,708

Transactions with owners

Issue of ordinary shares 2 3,264 - - 3,266

Share-based payments - - 688 - 688

Share-based payments transfer - - (427) 427 -

Purchase of own shares by employee

benefit trust - - - (160) (160)

Deferred tax on share options - - 116 - 116

Dividends paid (note 8) - - - (918) (918)

--------- --------- ---------- ---------- --------

Total transactions with owners 2 3,264 377 (651) 2,992

Balance at 30 June 2014 135 35,147 4,720 27,456 67,458

--------- --------- ---------- ---------- --------

Comprehensive income

Profit for the period - - - 3,562 3,562

Other comprehensive income:

Revaluation of available for sale

financial asset - - (401) - (401)

--------- --------- ---------- ---------- --------

Total comprehensive income - - (401) 3,562 3,161

Transactions with owners

Issue of ordinary shares 1 16 - - 17

Share-based payments - - 685 - 685

Share-based payments transfer - - (1,045) 1,045 -

Purchase of own shares by employee

benefit trust - - - (743) (743)

Employee benefit trust shares

vested - - -

Deferred tax on share options - - 133 - 133

Dividends paid (note 8) - - - (2,535) (2,535)

--------- --------- ---------- ---------- --------

Total transactions with owners 1 16 (227) (2,233) (2,443)

Balance at 31 December 2014 136 35,163 4,092 28,785 68,176

--------- --------- ---------- ---------- --------

The accompanying notes form an integral part of these condensed

consolidated financial statements.

BROOKS MACDONALD GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

for the six months ended 31 December 2014

Six months Six months

ended ended Year ended

31 Dec 2014 31 Dec 2013 30 Jun 2014

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Cash generated from operations 17 7,241 1,902 13,671

Taxation paid (983) (1,180) (2,318)

Net cash generated from operating

activities 6,258 722 11,353

Cash flows from investing activities

Purchase of property, plant and

equipment (204) (856) (1,342)

Purchase of intangible assets (823) (529) (552)

Purchase of available for sale

financial assets (250) (250) (750)

Purchase of financial assets at

fair value through profit or loss - (50) -

Acquisition of subsidiary companies,

net of cash acquired (687) - (3,340)

Cash contribution to joint venture - (146) -

Deferred consideration paid (7,001) - (1,866)

Interest received 60 62 119

Financial assets at fair value

through profit or loss - - (478)

Investment in joint venture (380) - (360)

Proceeds of sale of intangible

assets - - -

Proceeds of sale of available

for sale financial assets - - -

------------- ------------- -------------

Net cash used in investing activities (9,285) (1,769) (8,569)

Cash flows from financing activities

Proceeds of issue of shares 17 15 584

Purchase of own shares by employee

benefit trust (743) (572) (732)

Dividends paid to shareholders (2,535) (2,102) (3,020)

------------- ------------- -------------

Net cash used in financing activities (3,261) (2,659) (3,168)

Net decrease in cash and cash

equivalents (6,288) (3,706) (384)

Cash and cash equivalents at beginning

of period 18,056 18,440 18,440

------------- ------------- -------------

Cash and cash equivalents at end

of period 11,768 14,734 18,056

------------- ------------- -------------

The accompanying notes form an integral part of these condensed

consolidated financial statements.

BROOKS MACDONALD GROUP PLC

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

for the six months ended 31 December 2014

1. General information

Brooks Macdonald Group plc ('the Company') is the parent company

of a group of companies ('the Group'), which offers a range of

investment management services and related professional advice to

private high net worth individuals, charities and trusts. The Group

also provides financial planning as well as offshore fund

management and administration services and acts as fund manager to

regulated OEICs, providing specialist funds in the property and

structured return sectors and managing property assets on behalf of

these funds and other clients. The Group's primary activities are

set out in its Annual Report and Accounts for the year ended 30

June 2014.

The Group has offices in London, Edinburgh, Guernsey, Hale,

Hampshire, Jersey, Leamington Spa, Manchester, Taunton, Tunbridge

Wells and York. The Company is a public limited company,

incorporated and domiciled in the United Kingdom under the

Companies Act 2006 and listed on AIM. The address of its registered

office is 111 Park Street, Mayfair, London, W1K 7JL.

The consolidated interim financial information was approved for

issue on 10 March 2015. It has been independently reviewed but is

not audited.

2. Accounting policies

a) Basis of preparation

The Group's condensed consolidated half yearly financial

statements are prepared and presented in accordance with IAS 34

'Interim Financial Reporting' as adopted by the European Union.

They have been prepared on a going concern basis with reference to

the accounting policies and methods of computation and presentation

set out in the Group's consolidated financial statements for the

year ended 30 June 2014, except as stated below. The half yearly

financial statements should be read in conjunction with the Group's

audited financial statements for the year ended 30 June 2014, which

have been prepared in accordance with IFRS as adopted by the

European Union.

The information in this announcement does not comprise statutory

accounts within the meaning of section 434 of the Companies Act

2006. The Group's accounts for the year ended 30 June 2014 have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The report of the auditors was unqualified

and did not draw attention to any matters by way of emphasis. It

contained no statement under section 498(2) or (3) of the Companies

Act 2006.

b) Changes in accounting policies

The Group's accounting policies are consistent with those

disclosed within the annual financial statements for the year ended

30 June 2014, except as described below.

New accounting standards, amendments and interpretations adopted

in the period

A number of new standards and amendments issued by the IASB and

interpretations issued by the IFRS Interpretations Committee (IFRS

IC) have been applied in preparing these condensed consolidated

financial statements as set out in the table below.

None of these new standards, amendments or interpretations has

had a material impact on the amounts reported in these financial

statements, but they may impact the accounting for future

transactions and arrangements.

Standard, Amendment or Interpretation Effective

date

------------------------------------------------------ -------------

Offsetting financial assets and financial liabilities 1 January

(amendments to IAS 32) 2014

------------------------------------------------------ -------------

Consolidation of investment entities (amendments 1 January

to IFRS 10, 12 and IAS 27) 2014

------------------------------------------------------ -------------

Recoverable amount disclosures for non-financial 1 January

assets (amendments to IAS 36) 2014

------------------------------------------------------ -------------

Novation of derivatives and continuation of hedge 1 January

accounting (amendments to IAS 39) 2014

------------------------------------------------------ -------------

IFRIC 21 'Levies' 17 June 2014

------------------------------------------------------ -------------

Contributions to defined benefit plans (amendments 1 July 2014

to IAS 19)

------------------------------------------------------ -------------

Annual improvements (2010-2012 cycle) 1 July 2014

------------------------------------------------------ -------------

Annual improvements (2011-2013 cycle) 1 July 2014

------------------------------------------------------ -------------

IFRIC 21 'Levies' has changed the point at which the Group

recognises provisions in respect of the annual Financial Services

Compensation Scheme ('FSCS') levies. From 1 July 2014, the Group

will recognise such a provision at the point of the triggering

event specified in the relevant legislation. This occurs on 1 April

at the start of the new FSCS scheme year, rather than when the FSCS

initially announces its proposed levy.

New accounting standards, amendments and interpretations not yet

adopted

A number of new standards, amendments and interpretations, which

have not been applied in preparing these financial statements, have

been issued and are effective for annual and interim periods

beginning after 1 July 2014:

Standard, Amendment or Interpretation Effective

date

---------------------------------------------------- ------------

Disclosure initiative (amendments to IAS 1) 1 January

2016

---------------------------------------------------- ------------

Accounting for acquisitions of interests in joint 1 January

operations (amendments to IFRS 11) 2016

---------------------------------------------------- ------------

Sale or contribution of assets between an investor 1 January

and its associate or joint venture (amendments to 2016

IFRS 10 and IAS 28)

---------------------------------------------------- ------------

Investment entities: applying the consolidation 1 January

exception (amendments to IFRS 10, IFRS 12 and IAS 2016

28)

---------------------------------------------------- ------------

Clarification of acceptable methods of depreciation 1 January

and amortisation (amendments to IAS 16 and IAS 38) 2016

---------------------------------------------------- ------------

Annual improvements (2012-2014 cycle) 1 July 2016

---------------------------------------------------- ------------

IFRS 15 'Revenue from Contracts with Customers' 1 January

2017

---------------------------------------------------- ------------

General hedge accounting (amendments to IFRS 9) 1 January

2018

---------------------------------------------------- ------------

These changes are currently being assessed but none are expected

to have a significant impact on the Group's future consolidated

financial statements.

3. Financial risk factors

The Group's activities expose it to a variety of financial and

non-financial risks. The principal risks faced by the Group are

described on pages 56 and 57 of the Annual Report and Accounts for

the year ended 30 June 2014. These key risks include: loss of

clients or reputational damage as a result of poor performance or

service; regulatory breaches; loss of key staff; potential service

issues with IT infrastructure; operational risk due to inadequate

processes and controls; and financial risks such as liquidity risk,

market risk and credit risk. These remain our principal risks for

the second half of the financial year. There have been no

significant changes affecting the fair value or classification of

financial assets during the period.

4. Segmental information

For management purposes the Group's activities are organised

into four operating divisions: investment management, financial

planning, fund and property management and the Channel Islands. The

Group's other activity, offering nominee and custody services to

clients, is included within investment management. These divisions

are the basis on which the Group reports its primary segmental

information. In accordance with IFRS 8 'Operating Segments',

disclosures are required to reflect the information which the Board

uses internally for evaluating the performance of its operating

segments and allocating resources to those segments. The

information presented in this note follows the presentation for

internal reporting to the Group Board of Directors.

During the year ended 30 June 2014 the Group identified the

Channel Islands as being a separate reportable segment. This

comprises the results of BMI, BMRSI and DPZ. Previously, BMI and

BMRSI were included within the investment management and financial

planning segments respectively. The comparatives for the six months

ended 31 December 2013 have been restated in accordance with IFRS 8

to reflect this change.

Revenues and expenses are allocated to the business segment that

originated the transaction. Revenues and expenses that are not

directly originated by a particular business segment are reported

as unallocated. Sales between segments are carried out at arm's

length. Centrally incurred expenses are allocated to business

segments on an appropriate pro-rata basis. Segment assets and

liabilities comprise operating assets and liabilities, being the

majority of the balance sheet.

Fund and

Period ended 31 Investment Financial property Channel

Dec 2014 (unaudited) management planning management Islands Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total segment revenues 25,948 1,967 2,812 6,897 37,624

Inter segment revenues (54) (46) (21) - (121)

------------ ---------- ------------ --------- --------

External revenues 25,894 1,921 2,791 6,897 37,503

------------ ---------- ------------ --------- --------

Segment result 6,601 (50) (457) 609 6,703

Unallocated items (2,220)

--------

Profit before tax 4,483

Taxation (921)

--------

Profit for the

period 3,562

--------

Period ended 31 Fund and

Dec 2013 (unaudited Investment Financial property Channel

and restated) management planning management Islands Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total segment revenues 23,855 1,935 2,478 5,362 33,630

Inter segment revenues (78) (116) (48) - (242)

------------ ---------- ------------ --------- --------

External revenues 23,777 1,819 2,430 5,362 33,388

------------ ---------- ------------ --------- --------

Segment result 6,036 (102) 13 1,219 7,166

Unallocated items (2,240)

--------

Profit before tax 4,926

Taxation (639)

--------

Profit for the period 4,287

--------

Fund and

Year ended 30 Jun Investment Financial property Channel

2014 (audited) management planning management Islands Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total segment revenues 48,988 4,034 5,061 11,556 69,639

Inter segment revenues (156) (223) (127) - (506)

------------ ---------- ------------ --------- --------

External revenues 48,832 3,811 4,934 11,556 69,133

------------ ---------- ------------ --------- --------

Segment result 12,324 (109) (102) 2,376 14,489

Unallocated items (3,921)

--------

Profit before tax 10,568

Taxation (1,512)

--------

Profit for the year 9,056

--------

a) Geographic analysis

The Group's operations are located in the United Kingdom and the

Channel Islands. The following table presents underlying operating

income analysed by the geographical location of the Group entity

providing the service.

Six months ended Year ended

31 Dec 2014 Six months ended 30 Jun 2014

31 Dec 2013

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

United Kingdom 30,606 28,026 57,577

Channel Islands 6,897 5,362 11,556

Total operating income 37,503 33,388 69,133

----------------- ----------------- -------------

b) Major clients

The Group is not reliant on any one client or group of connected

clients for the generation of revenues.

5. Administrative costs

Acquisition costs

Administrative costs for the six months ended 31 December 2014

include GBP120,000 (six months ended 31 December 2013: GBPnil; year

ended 30 June 2014: GBP187,000) of directly attributable business

acquisition costs in relation to the exercise of the Group's option

to purchase Levitas Investment Management Services Limited (note

9).

Financial Services Compensation Scheme levies

Administrative costs for the six months ended 31 December 2014

include a charge of GBPnil (six months ended 31 December 2013:

GBP81,000; year ended 30 June 2014: GBP351,000) in respect of

Financial Services Compensation Scheme ('FSCS') levies.

6. Taxation

The current tax expense for the six months ended 31 December

2014 was calculated based on the estimated average annual effective

tax rate. The overall effective tax rate for this period was 20.54%

(six months ended 31 December 2013: 12.97%; year ended 30 June

2014: 14.31%).

Six months

ended

Six months

31 Dec 2014 ended Year ended

31 Dec 2013 30 Jun 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Current tax

United Kingdom taxation 1,001 1,111 2,477

Over provision in prior years (196) - (17)

------------- -------------- -------------

Total current taxation 805 1,111 2,460

Deferred tax

Origination and reversal of

temporary differences 116 3 (473)

Effect of change in tax rate

on deferred tax - (475) (475)

Total deferred taxation 116 (472) (948)

Total income tax expense 921 639 1,512

------------- -------------- -------------

On 1 April 2014, the standard rate of Corporation Tax in the UK

was reduced from 23% to 21%. The Finance Act 2013 (substantively

enacted on 2 July 2013) will further reduce the main rate of UK

Corporation Tax to 20% with effect from 1 April 2015. As a result

the effective rate of Corporation Tax applied to the taxable profit

for the period ended 31 December 2014 is a 'blended' rate of 20.75%

(six months ended 31 December 2013: 23.75%; year ended 30 June

2014: 22.50%).

Deferred tax assets and liabilities are calculated at the rate

that is expected to be in force when the temporary differences

unwind, but limited to the extent that such rates have been

substantively enacted. Consequently the tax rate used to measure

the deferred tax assets and liabilities of the Group is 20% (six

months ended 31 December 2013: 20%; year ended 30 June 2014: 20%)

on the basis that they will materially unwind after 1 April

2015.

7. Earnings per share

The directors believe that underlying earnings per share provide

a truer reflection of the Group's performance in the year.

Underlying earnings per share are calculated based on 'underlying

earnings', that is earnings before acquisition costs, finance costs

of deferred consideration and amortisation of intangible

non-current assets. The tax effect of these adjustments has also

been considered.

Six months

ended

Six months

31 Dec 2014 ended Year ended

31 Dec 2013 30 Jun 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Earnings attributable to ordinary

shareholders 3,562 4,287 9,056

Acquisition costs (note 5) 120 - 187

Finance cost of deferred consideration

(note 15) 469 182 349

Changes in fair value of deferred

consideration 302 - -

Amortisation (note 10) 1,345 1,050 2,212

Tax impact of adjustments (281) (238) (486)

------------- -------------- -------------

Underlying earnings attributable to

ordinary shareholders 5,517 5,281 11,318

------------- -------------- -------------

The weighted average number of shares in issue during the year

was as follows:

Six months

ended

31 Dec Six months

2014 ended Year ended

31 Dec 2013 30 Jun 2014

(unaudited) (unaudited) (audited)

Number Number of Number of

of shares shares shares

Weighted average number of shares

in issue* 13,375,142 13,138,028 13,145,314

Adjustment for issue of shares on

acquisition of DPZ - (22,417) (21,680)

------------- -------------- -------------

Weighted average number of shares

in issue 13,375,142 13,115,611 13,123,634

Effect of dilutive potential shares

issuable on exercise of employee share

options 61,955 89,521 64,289

------------- -------------- -------------

Diluted weighted average number of

shares in issue 13,437,097 13,205,132 13,187,923

------------- -------------- -------------

*2013 comparative as previously reported

2013 comparative as restated

For the six months ended 31 December 2013, the comparative

weighted average number of shares in issue has been restated to

take account of shares issued at a premium to their market value as

part of the DPZ acquisition, which was completed in April 2014. As

a result, the comparative basic earnings per share and diluted

earnings per share for the same period have been restated

accordingly.

Six months

ended

31 Dec Six months

2014 ended Year ended

31 Dec 30 Jun

(unaudited) 2013 (unaudited) 2014 (audited)

p p p

Based on reported earnings :

Basic earnings per share 26.63 32.69 69.01

Diluted earnings per share 26.51 32.46 68.67

------------- ------------------- -----------------

Based on underlying earnings :

Basic earnings per share 41.25 40.26 86.24

Diluted earnings per share 41.06 39.99 85.82

------------- ------------------- -----------------

2013 comparative as restated

8. Dividends

Six months Six months

ended ended

31 Dec 2014 31 Dec 2013 Year ended

30 Jun 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Paid interim dividend on

ordinary shares - - 918

Paid final dividend on ordinary

shares 2,535 2,102 2,102

------------- ------------- -------------

Total dividends 2,535 2,102 3,020

------------- ------------- -------------

An interim dividend of 10.0p per share was declared by the Board

of Directors on 10 March 2015. It will be paid on 21 April 2015 to

shareholders who are on the register at the close of business on 20

March 2015. In accordance with IAS 10, this dividend has not been

included as a liability at 31 December 2014.

9. Business combinations

On 31 July 2014, the Group exercised its option to acquire the

entire share capital of Levitas Investment Management Services

Limited ('Levitas'). Levitas is the sponsor of two funds known as

TM Levitas A and TM Levitas B, to which Brooks Macdonald Asset

Management Limited acts as the investment adviser. The funds were

launched in July 2012 and aggregate assets under management on

exercise of the option were GBP89m. The Levitas investment

proposition uses a blend of the two funds to match investments to a

client's specific risk rating, thus simplifying the investment and

rebalancing processes while keeping down costs.

The consideration payable by the Group is dependent on the

future assets under management in the Levitas funds, calculated at

agreed milestones up to 1 November 2018 and payable in a series of

instalments, with the final payment date being on or around 8

November 2020. Under the terms of the option agreement, the maximum

consideration payable will be GBP24,000,000. The fair value of the

liability at the acquisition date was measured at GBP11,264,000,

based on the Levitas business plan and forecasts. This included an

initial payment of GBP724,000, which was made to the vendors

following the exercise of the option.

Directly attributable acquisition costs of GBP120,000 were

incurred during the six months ended 31 December 2014 as a result

of the acquisition and have been charged to the Consolidated

Statement of Comprehensive Income.

Goodwill of GBP11,213,000 was recognised on acquisition in

respect of the expected future growth of the Levitas funds and the

resulting economic benefit to the Group in the form of sponsorship

income earned by Levitas.

The fair values of the assets acquired are the gross contractual

amounts and all are considered to be fully recoverable. The fair

value of the identifiable assets and liabilities acquired, at the

date of acquisition, are detailed in (a) below.

a) Net assets acquired through business combinations

GBP'000

Trade and other receivables 37

Cash and cash equivalents 37

Other current liabilities (23)

--------

Total net assets recognised by acquired

company 51

Net identifiable assets 51

Goodwill 11,213

--------

Total purchase consideration 11,264

--------

b) Impact on reported results from date of acquisition

Revenues

from Profit for

external the

customers year

GBP'000 GBP'000

Levitas Investment Management Services

Limited 155 60

----------- -----------

Had Levitas Investment Management Services Limited been

consolidated from 1 July 2014, the Consolidated Statement of

Comprehensive Income would show pro-forma revenue of GBP37,595,000

and post-tax profit for the period of GBP3,593,000.

c) Net cash outflow resulting from business combinations

GBP'000

Total purchase consideration (note 9a) 11,264

Less: deferred cash consideration (10,540)

---------

Cash paid to acquire subsidiary 724

Less: cash held by subsidiary acquired (37)

---------

Cash paid to acquire subsidiary net of cash acquired 687

---------

10. Intangible assets

Contracts

Acquired acquired

client with

relationship fund

Goodwill Software contracts managers Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 July 2013 20,758 333 24,872 2,574 48,537

Additions - 55 - 474 529

At 31 December 2013 20,758 388 24,872 3,048 49,066

Additions 4,035 23 7,875 - 11,933

Disposals - - - - -

--------- --------- -------------- ---------- --------

At 30 June 2014 24,793 411 32,747 3,048 60,999

Additions 11,213 349 - 474 12,036

At 31 December 2014 36,006 760 32,747 3,522 73,035

--------- --------- -------------- ---------- --------

Accumulated amortisation

At 1 July 2013 - 159 2,013 1,741 3,913

Amortisation charge - 56 826 168 1,050

--------- --------- -------------- ---------- --------

At 31 December 2013 - 215 2,839 1,909 4,963

Amortisation charge - 54 932 176 1,162

--------- --------- -------------- ---------- --------

At 30 June 2014 - 269 3,771 2,085 6,125

Amortisation charge - 53 1,084 208 1,345

--------- --------- -------------- ---------- --------

At 31 December 2014 - 322 4,855 2,293 7,470

--------- --------- -------------- ---------- --------

Net book value

At 1 July 2013 20,758 174 22,859 833 44,624

At 31 December 2013 20,758 173 22,033 1,139 44,103

At 30 June 2014 24,793 142 28,976 963 54,874

--------- --------- -------------- ---------- --------

At 31 December 2014 36,006 438 27,892 1,229 65,565

--------- --------- -------------- ---------- --------

a) Goodwill

Goodwill acquired in a business combination is allocated at

acquisition to the cash generating units ('CGUs') that are expected

to benefit from that business combination. The carrying amount of

goodwill at 31 December 2014 comprises GBP3,550,000 in respect of

the Braemar Group Limited ('Braemar') CGU, GBP17,208,000 in respect

of the Brooks Macdonald Asset Management (International) Limited

and Brooks Macdonald Retirement Services (International) Limited

(collectively 'Brooks Macdonald International') CGU and

GBP4,035,000 in respect of the DPZ Capital Limited ('DPZ') CGU and

GBP11,213,000 in respect of Levitas Investment Management Services

Limited

At the reporting date, there were no indicators that the

carrying amount of goodwill should be impaired.

b) Computer software

Software costs are amortised over an estimated useful life of

four years on a straight line basis.

c) Acquired client relationship contracts

This asset represents the fair value of future benefits accruing

to the Group from acquired client relationship contracts. The

amortisation of client relationship contracts is charged to the

Condensed Consolidated Statement of Comprehensive Income on a

straight line basis over their estimated useful lives (15 to 20

years).

d) Contracts acquired with fund managers

This asset represents the fair value of future benefits accruing

to the Group from contracts acquired with fund managers. Payments

made to acquire such contracts are stated at cost and amortised on

a straight line basis over an estimated useful life of five

years.

11. Property, plant and equipment

During the six months ended 31 December 2014, the Group acquired

assets at a cost of GBP204,000 (six months ended 31 December 2013:

GBP856,000; year ended 30 June 2014: GBP1,531,000). No assets were

disposed of in the six months ended 31 December 2014 (six months

ended 31 December 2013: GBPnil; year ended 30 June 2014: GBPnil),

resulting in a gain on disposal of GBPnil (six months ended 31

December 2013: GBPnil; year ended 30 June 2014: GBPnil).

12. Available for sale financial assets

The Group has an investment of GBP1,000,000 in Sancus Holdings

Limited, an unlisted company incorporated in the Channel Islands.

The market value of the investment at 31 December 2014 is

GBP1,000,000.

Available for sale financial assets include an investment in

Braemar Group PCC Limited Student Accommodation Cell - B shares of

GBP1,031,000. The fund is managed by Brooks Macdonald Funds

Limited, a subsidiary of the Group. Trading is currently suspended

on this fund, however the fund manager continues to publish a price

based on the fair value of the underlying assets of the fund.

Six months

ended

Six months

31 Dec 2014 ended Year ended

31 Dec 2013 30 Jun 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

At beginning of period 2,182 1,582 1,582

Additions 250 250 750

Loss from changes in

fair value (401) (89) (150)

------------- -------------- -------------

At end of period 2,031 1,743 2,182

------------- -------------- -------------

13. Investment in joint venture

The investment in joint venture relates to the 60% interest of a

subsidiary of the Group, Brooks Macdonald Funds Limited, in North

Row Capital LLP. The Group has joint control over the partnership,

with the remaining interest owned by two individual partners who

developed the investment approach behind the IFSL North Row Liquid

Property Fund, which was launched in February 2014. The fund offers

investors liquid exposure to global real estate markets by

investing predominantly in property derivatives, as well as

property equity and debt, to gain exposure to the direct property

markets.

The Group's share of the loss for the period reported by North

Row Capital LLP was GBP45,000 (six months ended 31 December 2013:

GBP71,000; year ended 30 June 2014: GBP128,000) which has been

recognised in the Condensed Consolidated Statement of Comprehensive

Income with a corresponding reduction in the investment in joint

venture in the Condensed Consolidated Statement of Financial

Position.

14. Financial assets at fair value through profit or loss

Financial assets at fair value through profit or loss comprise

of equity share capital investments. The cost of the investments at

31 December 2014 was GBP478,000 (at 31 December 2013: GBP50,000; at

30 June 2014: GBP478,000) and their market value at 31 December

2014 was GBP328,000 (at 31 December 2013: GBP50,000; at 30 June

2014: GBP478,000). The GBP150,000 loss from changes in fair value

during the period has been recognised in the Condensed Consolidated

Statement of Comprehensive Income. These investments are classified

as level 1 within the fair value hierarchy, as the inputs used to

determine the fair value are quoted prices in active markets for

the equity shares at the measurement date.

15. Deferred consideration

Deferred consideration, which is also included within provisions

in current liabilities to the extent that it is due to be paid

within one year of the reporting date (note 16), relates to the

directors' best estimate of amounts payable in the future in

respect of certain client relationships and subsidiary undertakings

that were acquired by the Group. Deferred consideration is measured

at its fair value based on discounted expected future cash flows.

The movements in the total deferred consideration balance during

the year were as follows:

Six months

ended

Six months

31 Dec 2014 ended Year ended

31 Dec 2013 30 Jun 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

At beginning of the period 11,236 7,927 7,927

Added on acquisitions during

the period 11,264 - 4,826

Finance cost of deferred

consideration 469 182 349

Fair value adjustments 16 - -

Payments made during the

period (7,725) (1,868) (1,866)

At end of the period 15,260 6,241 11,236

------------- -------------- -------------

Analysed as:

Amounts falling due within

one year 3,490 5,790 8,293

Amounts falling due after

more than one year 11,770 451 2,943

At end of period 15,260 6,241 11,236

------------- -------------- -------------

During the six months ended 31 December 2014, deferred

consideration of GBP11,264,000 (six months ended 31 December 2013:

GBPnil; year ended 30 June 2014: GBP4,826,000) was recognised,

which relates to the acquisition of Levitas Investment Management

Services Limited (note 9).

16. Provisions

Six months Six months

ended ended Year ended

31 Dec 2014 31 Dec 2013 30 Jun 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Client compensation

At beginning of the period 503 420 420

Movement during the period 31 43 83

------------- ------------- -------------

At end of the period 534 463 503

------------- ------------- -------------

Deferred consideration

At beginning of the period 8,293 2,123 2,123

Added on acquisitions during

the period 2,304 - 2,367

Interest accrued 120 - 321

Transfer from non-current

liabilities 498 5,535 5,348

Utilised during the period (7,725) (1,868) (1,866)

At end of the period 3,490 5,790 8,293

------------- ------------- -------------

Other provisions

At beginning of the period 351 240 240

Utilised during the period (351) (240) (240)

FSCS levy (note 5) - 81 351

-------------

At end of the period - 81 351

------------- ------------- -------------

Total provisions at beginning

of the period 9,147 2,783 2,783

------------- ------------- -------------

Total provisions at end of

the period 4,024 6,334 9,147

------------- ------------- -------------

a) Client compensation

Client compensation provisions relate to the potential liability

arising from client complaints against the Group. Complaints are

assessed on a case by case basis and provisions for compensation

are made where judged necessary. Complaints are on average settled

within eight months (six months ended 31 December 2013: eight

months; year ended 30 June 2014: eight months) from the date of

notification of the complaint.

b) Deferred consideration

Deferred consideration has been included within provisions as a

current liability to the extent that it is due to be paid within

one year of the reporting date.

A total provision for deferred consideration of GBP7,725,000 was

utilised during the six months ended 31 December 2014 (six months

ended 31 December 2013: GBP1,868,000; year ended 30 June 2014:

GBP1,866,000). This included an amount of GBP1,010,000 paid in

August 2014 to the vendors of JPAM Limited, GBP2,391,000 paid to

the vendors of DPZ Limited, GBP3,600,000 paid to the vendors of

Brooks Macdonald Asset Management (International) Limited and

Brooks Macdonald Retirement Services (International) Limited, and

GBP724,000 paid to the vendors of Levitas Investment Management

Services Limited.

Details of these acquisitions are provided in note 9 and in the

Annual Report and Accounts for the year ended 30 June 2014 on pages

38 and 39.

c) Other provisions

Other provisions include an amount of GBPnil (at 31 December

2013: GBP81,000; at 30 June 2014: GBP351,000) in respect of

expected levies by the Financial Services Compensation Scheme. The

levy for the 2015/16 scheme year has been announced by the FSCS but

does not yet meet the recognition criteria for a provision.

17. Reconciliation of operating profit to net cash inflow from operating activities

Six months Six months

ended ended Year ended

31 Dec 2014 31 Dec 2013 30 Jun 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Operating profit 4,939 5,117 10,926

Depreciation of property, plant

and equipment 516 473 981

Amortisation of intangible assets 1,345 1,050 2,212

Fair value losses on financial

assets at fair value through profit

or loss 150 - -

Fair value adjustments on deferred

consideration 16 - -

Decrease / (increase) in receivables 1,415 (1,326) (2,910)

(Decrease) / increase in payables (1,432) (1,970) 990

(Decrease) / increase in provisions (320) 3,551 194

Decrease in non-current liabilities (73) (5,593) (10)

Share-based payments 685 600 1,288

------------- ------------- -------------

Net cash inflow from operating

activities 7,241 1,902 13,671

------------- ------------- -------------

18. Related party transactions

At 31 December 2014, one of the Company's directors (at 31

December 2013: two; at 30 June 2014: two had taken advantage of the

season ticket loan facility that is available to all staff. The

total amount outstanding at the reporting date was GBPnil (at 31

December 2013: GBP11,000; at 30 June 2014: GBP10,000).

19. Share-based payment schemes

a) Long Term Incentive Scheme ('LTIS')

The Company has made annual awards under the LTIS to executive

directors and other senior executives. The conditional awards,

which vest three years after the grant date, are subject to the

satisfaction of specified performance criteria, measured over a

three year performance period. All such conditional awards are made

at the discretion of the Remuneration Committee.

b) Employee Benefit Trust

The Group established an Employee Benefit Trust ('the Trust') on

3 December 2010. The Trust was established in order to acquire

ordinary shares in the Company to satisfy rights to purchase shares

on the exercise of options awarded under the LTIS. All finance

costs and administration expenses connected with the Trust are

charged to the Condensed Consolidated Statement of Comprehensive

Income as they accrue. The Trust has waived its rights to

dividends.

A grant of 68,408 share options with an exercise price of

GBP14.12 was made under the scheme to directors and employees of

the Group on 14 October 2014. In respect of the six months ended 31

December 2013, a grant of 48,900 share options with an exercise

price of GBP14.64 was made under the scheme to directors and

employees of the Group on 1 November 2013.

As at 31 December 2014, the Company had paid GBP4,054,000 to the

Trust, which had acquired 314,123 ordinary shares on the open

market for consideration of GBP4,027,000.

In November 2014, in respect of the schemes granted in October

2011 and in October 2010, employees of the Group exercised a total

of 86,755 options and instructions were given to the Trust to

release the same number of shares. The cost of the shares released

on exercise of these options amounted to GBP1,002,000. At the

reporting date, the number of shares held in the Trust was 215,992

with a market value of GBP3,023,000.

In November 2013, in respect of the scheme granted in October

2010, employees of the Group exercised a total of 11,376 options

and instructions were given to the Trust to release the same number

of shares. The cost of the shares released on exercise of these

options amounted to GBP109,000. At the 31 December 2013, the number

of shares held in the Trust was 239,696 with a market value of

GBP3,542,000.

c) Company Share Option Plan

The Company has established a Company Share Option Plan

('CSOP'), which was approved by HMRC in November 2013. The CSOP is

a discretionary scheme whereby employees or directors are granted

an option to purchase the Company's shares in the future at a price

set on the date of the grant. The maximum award under the terms of

the scheme is a total market value of GBP30,000 per recipient. The

performance conditions attached to the scheme require an increase

in the diluted earnings per share of the Company of 2% more than

the increase in the RPI over the three years starting with the

financial year in which the option is granted.

A grant of 22,110 share options with an exercise price of

GBP13.805 was made under the scheme to directors and employees of

the Group on 14 October 2014. In respect of the six months ended 31

December 2013, a grant of 21,361 share options with an exercise

price of GBP14.52 was made under the scheme to directors and

employees of the Group on 1 December 2013.

d) Other share-base payment schemes

No awards have been made under other the Group's other

share-based payment schemes, details of which are provided on pages

51 to 53 of the Annual Report and Accounts for the year ended 30

June 2014.

During the six months ended 31 December 2014, employees

exercised options over a total of 1,654 shares at a price of

GBP9.16 in respect of the 2011 Employee Sharesave Scheme.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors confirm that these condensed consolidated interim

financial statements have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and that the interim

management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

consolidated financial statements, and a description of the

principal risks and uncertainties for the remaining six months of

the financial year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

The directors of Brooks Macdonald Group plc are listed in the

Half Yearly Financial Report for the six months ended 31 December

2014.

By order of the Board of Directors

S J Jackson

Finance Director

10 March 2015

INDEPENDENT REVIEW REPORT TO BROOKS MACDONALD GROUP PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the Half Yearly Financial Report for the

six months ended 31 December 2014, which comprise the Condensed

Consolidated Statement of Comprehensive Income, Condensed

Consolidated Statement of Financial Position, Condensed

Consolidated Statement of Changes in Equity, Condensed Consolidated

Statement of Cash Flows and the related notes. We have read the

other information contained in the Half Yearly Financial Report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

Directors' responsibilities

The Half Yearly Financial Report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the Half Yearly Financial Report in accordance with

the AIM Rules for Companies, which require that the financial

information must be presented and prepared in a form consistent

with that which will be adopted in the Company's annual financial

statements.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this Half Yearly Financial Report has been prepared in

accordance with International Accounting Standard 34, 'Interim

Financial Reporting', as adopted by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed consolidated set of financial statements in the Half

Yearly Financial Report based on our review. This report, including

the conclusion, has been prepared for and only for the Company for

the purpose of the AIM Rules for Companies and for no other

purpose. We do not, in producing this report, accept or assume

responsibility for any other purpose or to any other person to whom

this report is shown or into whose hands it may come save where

expressly agreed by our prior consent in writing.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the Half Yearly Financial Report for the six months ended 31

December 2014 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the AIM Rules for Companies.

PricewaterhouseCoopers LLP

Chartered Accountants

10 March 2015

7 More London Riverside, London, SE1 2RT

Notes:

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

The maintenance and integrity of the Brooks Macdonald website is

the responsibility of the directors; the work carried out by the

auditors does not involve consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred to the financial statements since they were

initially presented on the website.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGUGPWUPAGRU

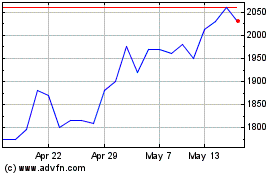

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Jul 2023 to Jul 2024