TIDMONE

RNS Number : 5661G

One Delta PLC

29 June 2012

29 June 2012

One Delta plc

("One Delta" or the "Company")

Condensed unaudited interim financial statements for the six

months ended 31 March 2012

Chairman's Statement

I am pleased to present the unaudited results for the six months

ended 31 March 2012.

Since completing the transaction to acquire One Delta Limited on

12 January 2012; the Board and the executive management team have

been focused on developing the business to take advantage of the

structural changes that are occurring in the plastic recycling

sector.

The requirement for individuals and corporates to be more

environmentally focused and the need for tight cost controls are

increasing the value of the Company's IP, products and market

position in the growing plastic recycling sector. In addition,

landfill tax has now increased to GBP64 per tonne, which is putting

more pressure on waste management companies to maximize the volume

of material that is recycled. These incentives are continuing to

work in the Company's favourand this is being reflected in the

number of discussions with waste management companies, retailers

and recyclers.

The general economic pressures that we are currently facing

have, however, increased the sales cycles for innovative products,

such as those being introduced by the Company. The Company has

encouragingly been asked to quote on a number of projects and is

hopeful that it will convert these into revenue in the near

future.

Over the past year, One Delta Limited has made considerable

progress in securing test data and approvals necessary to secure

major contracts. Testing has been completed for fire, UV, thermal,

acoustic and ballistic. I am pleased to confirm all these tests

have now been successfully completed and we have particularly

positive results in two areas. Our PXP product showed particularly

high levels of performance in the acoustic and ballistic testing.

Testing to NATO military standard (STANAG 2920/V50) showed PXP

providing resistance to fragments travelling at 344 metres per

second. This provides the basis of using the Dale Fence to defend

against explosions. In the acoustic tests (BS EN ISO 717-1) the

Dale Fence achieved industry-leading performance at 36dB loss. This

opens up a range of applications including reducing noise pollution

from transport, building and live events.

Commercialising the products has been a major focus for the

Company with the launch of the Dale Fence at the Counter Terror

Expo in May this year. The Dale Fence and PXP were featured on

three companies' stands and led to a number of new customer and

partner enquiries. I am also pleased that International interest is

showing that One Delta will have a truly global market. The Company

has been approached by a number of companies to partner both in the

UK and overseas. Two agency agreements have been signed for Japan

and Denmark. In addition, products have been exhibited in Japan

recently resulting in requests for further samples and quotes. In

the UK, a number of business development associates have been

appointed to help develop sales in specific sectors.

I am pleased to inform shareholders that the Company has signed

its first order for the Dale Fence with Fresh Wharf Estates

[Limited] ("Fresh Wharf"), a major landowner and developer based in

Essex. Fresh Wharf has ordered 140m of fencing. The contract with

Fresh Wharf is strategically important as it is the first such

order for this product and provides proof of market acceptance for

the product. The Dale Fence offers a new, sustainable product for

security, crowd control, property and event management fencing. The

Company hopes to receive further orders of this nature in the short

to medium term.

As explained previously, the business model is to bring together

the best technology to turn waste plastics into valuable products.

As an early stage company we believe the best way to achieve this

is by working with partners who have access and experience of

markets. These commercial partners will accelerate the adoption of

the Company's products.

The Board maintains a close control on the costs of the Company

and costs remain in line with the management's expectations. As the

business converts sales and secures revenues from partner

relationships; the Company's low cost base will allow the maximum

amount to reach the bottom line.

I would like to record my thanks to the Company's advisory

board, which have provided sage advice and introductions, which

will benefit the future of the Company.

Sean Reel

Executive Chairman

29 June 2012

For further information please contact:

One Delta plc

Sean Reel, Executive Chairman Tel: +44 (0) 845 0945

623

Roger King, Executive Director Tel: +44 (0)1534 511

750

Merchant Securities Limited (Nominated Adviser and Broker)

Simon Clements / Virginia Bull Tel: +44 (0) 20 7628

2200

Statement of Comprehensive Income for the six months ended 31

March 2012

(unaudited) (unaudited) (audited)

Six months Six months Year ended

ended 31 ended 31 30 September

March 2012 March 2011 2011

Total

Notes GBP GBP GBP

Interest income 4 - 2,114 2,290

Rental income - 383 380

Investment management fee 5 - (6,182) (88,288)

Rental expenses - - (70)

Other income 3,036 51,800 15,795

Other expenses (310,260) - (201,362)

Net loss on ordinary activities

before taxation (307,926) 48,115 (271,255)

Taxation 2 - - -

Provision for winding down expenses - - 265,524

Net (loss) / profit and total

comprehensive income 3 (307,926) 48,115 (5,731)

------------ ------------ --------------

Basic (loss) / earnings per share

(pence) 3 (0.22) 2.2 (0.2)

------------ ------------ --------------

Notes

(a) The total column of this statement represents the profit and loss of the Company.

(b) The Company has no recognised gains or losses other than

those disclosed in the Statement of Comprehensive Income.

Statement of Financial Position for the six months ended 31

March 2012

(unaudited) (unaudited) (audited)

31 March 31 March 30 September

2012 2011 2011

Notes GBP GBP GBP

Non-current assets

Goodwill 1,468,981 - -

------------ ------------ --------------

Current assets

Other receivables 18,210 1,275 3,375

Loans 97,368 - -

Stock 16,478 - -

Cash and cash equivalents 332,004 1,688,243 310,096

------------ ------------ --------------

464,060 1,689,518 313,471

Creditors - amounts falling due

within one year

Other payables (65,825) (84,545) (47,079)

Net current assets 398,235 1,604,973 266,392

Total net assets 1,867,216 1,604,973 266,392

------------ ------------ --------------

Equity

Stated capital 6 5,117,660 4,493,645 3,208,910

Capital reserve (706,395) (706,395) (706,395)

Issue costs reserve (679,868) (679,868) (679,868)

Revenue reserve (1,864,181) (1,502,409) (1,556,255)

Total shareholders' funds (all

equity) 7 1,867,216 1,604,973 266,392

------------ ------------ --------------

Net asset value per share (pence) 7 5.9 72.0 5.2

Cash Flow Statement for the six months ended 31 March 2012

(unaudited) (unaudited) (audited)

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2012 2011 2011

GBP GBP GBP

Cash flow from operating activities

Cash received from insurance

claim - 1,099,997 -

Rental income received - 2,292 2,268

Deposit interest received - - 2,529

Other income 3,036 - 15,787

Investment management fees paid - - (88,288)

Rental expenses - - (70)

Other expenses (297,810) (201,138) (224,692)

------------ ------------ -------------

Net cash (outflow) / inflow from

operating activities (294,774) 901,151 (292,466)

Taxation paid - - -

Cash flow from investing activities

Cash from acquisition of subsidiary 107,832 - -

Interest income received - 2,321 2,529

Deposit recovered - - 1,099,997

------------ ------------ -------------

Net cash inflow from investing

activities 107,832 2,321 1,102,526

------------ ------------ -------------

(Decrease) / increase in cash

before financing (186,942) 903,472 810,060

------------ ------------ -------------

Cash flow from financing activities

Shares issued 213,750 - 150,000

Loans repaid (4,900) - -

Redemption of shares - - (1,434,735)

------------ ------------ -------------

Net cash inflow / (outflow) from

financing activities 208,850 - (1,284,735)

------------ ------------ -------------

Net increase / (decrease) in

cash and cash equivalents 21,908 903,472 (474,675)

Cash and cash equivalents at

the start of the period 310,096 784,771 784,771

Cash and cash equivalents at

the end of the period 332,004 1,688,243 310,096

------------ ------------ -------------

Statement of changes in equity for the six months ended 31 March

2012

Stated Capital costs Revenue

capital reserves reserve reserve Total

GBP GBP GBP GBP GBP

For the six months ended 31 March

2012 (unaudited)

At 1 October 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392

Loss for the period - - - (307,926) (307,926)

Acquisition of subsidiary 231,019 231,019

Issue of consolidation shares 1,700,000 - - 1,700,000

Issue of participation shares 208,750 - - - 208,750

At 31 March 2012 5,117,660 (706,395) (679,868) (1,864,181) 1,867,216

------------ ---------- ---------- ------------ ------------

For the six months ended 31 March

2011 (unaudited)

At 1 October 2010 4,493,645 (706,395) (679,868) (1,550,524) 1,556,858

Profit for the period - - - 48,115 48,115

At 31 March 2011 4,493,645 (706,395) (679,868) (1,502,409) 1,604,973

------------ ---------- ---------- ------------ ------------

For the year ended 30 September 2011

(audited)

At 1 October 2010 4,493,645 (706,395) (679,868) (1,550,524) 1,556,858

Redemption of shares (1,434,735) - - - (1,434,735)

Issue of participation shares 150,000 150,000

Loss for the year - - - (5,731) (5,731)

At 30 September 2011 3,208,910 (706,395) (679,868) (1,556,255) 266,392

------------ ---------- ---------- ------------ ------------

Notes to the financial statements

1. Accounting Policies

(a) Basis of preparation

The consolidated interim financial statements have been prepared

under the historical cost convention, as modified to include the

revaluation of quoted investments and investment properties and in

accordance with applicable Accounting Standards as adopted by the

European Union. Applicable Accounting Standards for these purposes

are International Financial Reporting Standards ("IFRS"), as

adopted by the European Union. The financial statements have not

been prepared using the Statement of Recommended Practice for

"Financial Statements of Investment Trust Companies" as the Company

holds no investments for the purpose of financial gain.

The interim financial information has been prepared in

accordance with IAS 34 "Interim financial reporting" as adopted by

the European Union. The standards have been applied consistently

except for the basis of consolidation.

(b) Basis of consolidation

The accompanying financial statements and related notes present

the consolidated financial position as of March 31, 2012 and the

consolidated results of the operations, cash flows, changes in

partners' capital, comprehensive income and changes in accumulated

other comprehensive income for the period ended March 31, 2012. All

significant intercompany transactions have been eliminated.

(c) Inventory

Inventory is valued at the lower of cost and net realisable

value.

(d) Incomplete accounting

The initial accounting for the business combination is still

incomplete as the directors are assessing the fair value of the

identifiable intangible assets acquired. These intangibles include

licenses to exploit patents.

2. (Loss) / earnings per share

Basic earnings per share amounts are calculated by dividing the

net loss for the period attributable to ordinary equity holders of

the Company by the weighted average number of participating

ordinary shares outstanding during the year.

Diluted earnings per share are not applicable to the Company,

since there is only one participating class of share issued by the

Company.

The following reflects the income and share data used in the

basic earnings per share computation:

March March September

2012 2011 2011

(Loss)/profit attributable to GBP(307,926) GBP15,547 GBP(5,731)

ordinary shareholders

Weighted average of shares in

issue 13,910,336 2,230,637 2,869,107

Basic (loss)/earnings per share (2.2)p 2.2p (0.2)p

3. Operating segment

The Company is currently in the early stages of developing its

technology and hence only has one operating segment.

4. Income

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2012 2011 2011

GBP GBP GBP

Deposit interest - 2,114 2,290

Other income 3,036 51,800 15,795

Rental income - 383 380

----------- ----------- -------------

3,036 54,297 18,465

----------- ----------- -------------

5. Management fee

Six months Six months Year

ended ended Ended

31 March 31 March 30 September

2012 2011 2011

GBP GBP GBP

Management fee - 6,182 88,288

------------ ----------- -------------

The management fee is no longer applicable.

6. Stated capital

The Company is a no par value ('NPV') company

31 March 31 March 30 September

2012 2011 2011

Authorised: Number Number Number

Founder shares 10 10 10

99,999,990 participating shares 99,999,990 99,999,990 99,999,990

100,000,000 100,000,000 100,000,000

------------ ------------ -------------

Issued and fully paid: Number Number Number

Founder shares 2 2 2

Participating shares 31,574,356 2,230,637 5,098,830

------------ ------------ -------------

All costs associated with the issue of shares have been taken to

the issue costs reserve.

Note Number Share

of shares Capital

GBP

Opening balance at 1 October 2011 5,098,830 3,208,910

On 23 December 2011 (i) 21,250,002 1,700,000

On 23 December 2011 (ii) 3,446,875 208,750

On 23 December 2011 (iii) 1,778,649 -

------------ --------------

At 31 March 2012 31,574,356 5,117,660

------------ --------------

(i) Refer to note 7 for details of shares issued in acquisition of One Delta Limited.

(ii) On 23 December 2011, the Group made an Offer for

Subscription and raised GBP275,750 before

expenses by issuing 3,446,875 ordinary shares at GBP0.08 per

share.

(iii) On 23 December 2011, the Group issued 1,778,649 ordinary

shares in exchange for fees valued at GBP50,000.

7. Acquisition

On 23 December 2011 the Company acquired the entire shareholding

of One Delta Limited. The consideration of GBP1,700,000 was met by

the issue of 21,250,002 shares in One Delta plc. to the previous

shareholders of One Delta Limited. The results of One Delta Limited

are included within these financial statements.

GBP GBP

Cost 1,700,000

Cash 107,832

Accounts receivable 121,005

Accounts payable (15,218)

Inventory 17,400

---------

231,019

----------

Goodwill 1,468,981

----------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSEASKNASLAEFF

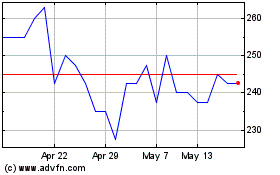

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

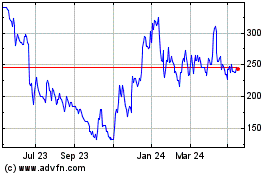

Audioboom (LSE:BOOM)

Historical Stock Chart

From Jul 2023 to Jul 2024