TIDMBOD

RNS Number : 3704X

Botswana Diamonds PLC

20 December 2023

20 December 2023

Botswana Diamonds PLC

("Botswana Diamonds" or the "Company")

Annual Results for the Year Ended 30 June 2023

Notice of Annual General Meeting

Botswana Diamonds plc (AIM: BOD) today announces its audited

annual results for the year ended 30 June 2023.

Chairman's Statement

Botswana Diamonds has been active in the period under review.

This, at a time when the market for exploration shares is virtually

non-existent and during a period of great political and economic

turmoil.

In South Africa we produced diamonds. We intend to bring our

Thorny River diamond ground into operation in 2024. We used our

adjacent Marsfontein licence as a proof-of-concept project. We

joint ventured with a competent contractor on a 15% / 20% royalty

basis depending on size. We are satisfied with the operation though

only producing 1,741 carats of diamonds. We intended to produce at

Marsfontein until all permits were issued for Thorny River.

However, a 40% fall in diamond prices combined with a 30% increase

in energy prices, eliminated positive cash flows for most diamond

producers, so the Marsfontein operation is temporarily on care and

maintenance. The current expectation is that production will start

again in January 2024.

While mining Marsfontein, we discovered a higher-grade area

which we were preparing to mine when closedown occurred. This will

be our target area when mining resumes. The intention is then to

move on to Thorny River where operations will be significantly

larger. Final approvals are, we are told, imminent.

I should remind you that Thorny River is estimated to contain

anywhere from 1.2m - 2.1m tons of ore at an expected grade between

46 and 76 carats per hundred tons. Diamond value per carat is

expected to be between US $120 and $220 per carat. The mining plan

has already been prepared. Transferring from Marsfontein to Thorny

River will take only a matter of weeks as it will use the same

mining equipment.

Botswana

Botswana is still our principal focus. We remain convinced that

more diamond deposits are still to be discovered.

In mining, improved milling, interparticle crushing and XRT

sorting will enhance recoveries. Solar power will significantly

reduce energy costs in remote locations.

In exploration, we are excited by advances in data analytics.

Botswana Diamonds owns the largest diamond data set in the country

including 375,000km of airborne geophysical data, 228,000km of soil

sample results, 606 ground geophysical surveys and 32,000km of

drill logs. This is where Artificial Intelligence ('AI'), and

Machine Learning offers huge scope. In the coming year we will

structure a way forward to mine this data.

You may recall we had a joint venture with Alrosa, they did good

work on 16 licences held in Sunland, the joint venture company, but

for corporate reasons they withdrew from Botswana in 2018. The 16

Sunland licences expired, and the ground returned to the State. We

analysed the data and identified four licences that we believe to

have significant potential. A 100% owned Botswana Diamonds

subsidiary has applied for the four licences. We are hopeful that

they will be awarded in the near future.

You will notice in the accounts a write-off of exploration

expenditure of GBP3.2m. This is a non-cash item, relating to the

closedown of the Sunland joint venture. The money was spent several

years ago. While the exploration did not find commercial deposits,

it provided us with valuable data which we used to select the four

licences currently under application with the Botswana Department

of Mines.

We own 100% of the KX36 discovery in the Kalahari. This is a 3.5

hectare kimberlite pipe with an indicated resource of 17.9 million

tonnes at 35 carats per 100 tons ('cpht'), and a further inferred

resource of 6.7 million tonnes at 36 cpht. Overall value per carat

is US $65. There is a bulk sampling plant onsite, including

crushing, screening, scrubbing Dense Media Separation and X-Ray

recovery.

No other kimberlite has yet been found in the surrounding

ground. Kimberlites occur in clusters, so the KX36 discovery is

anomalous. We therefore acquired licences surrounding KX36.

Following detailed work on the data we already held, we identified

4 high interest anomalies, all within a 6-kilometre radius of KX36.

We ran ground magnetic surveys over these anomalies. They further

confirmed our findings. We have conducted a detailed ground

geophysical survey over the four areas which, if successful, will

lead to drilling.

KX36 is only 60km away from the Ghaghoo diamond mine, which is

currently closed. Over the past two years we have studied the

economics of reopening the mine. We are seeking a partner to joint

venture the Ghaghoo mine. We would then add KX36 to the Ghaghoo

resource - enhancing the value of both. Together, they represent a

significant diamond resource. Recent turmoil in world financial

markets complicated the task, management is developing options.

Our other significant interest in Botswana is the Maibwe

project. Maibwe was a joint venture between a Botswana copper

company, BCL, a local Botswana entrepreneur and a South African

company, Siseko, where Botswana holds a 51% interest. BCL went into

liquidation due to its non-diamond activities - but not before

exploration found four kimberlite pipes containing diamonds. One of

the pipes contained significant quantities of microdiamonds.

The BCL holding has been sold to Future Minerals and Siseko.

Botswana Diamonds has therefore increased its overall stake in the

JV to 26%. Further drilling is required on the licences, especially

focusing on the kimberlite containing microdiamonds.

The Diamond Market

No review can ignore upheavals in the diamond market. Economic

uncertainty impacts consumers purchases, particularly of luxury

goods. Interest rate increases impact diamond wholesalers who

traditionally hold large debt-financed inventories. They cut back

their purchases of rough uncut stones, crashing prices in the

process.

Another concern is the impact of lab grown diamonds. They have

been around for many years, but improvements in technology and low

barriers to entry attract new entrants. One consequence has been a

dramatic fall in the prices of lab grown diamonds particularly at

the smaller end. They are becoming a commodity.

Natural diamonds on the other hand are very rare. An analogy can

be made with automobiles. A Ferrari and a Ford Mondeo are both good

cars but that's the only commonality they share.

Owning a natural diamond is an experience. They really are

forever. Owning one represents a range of human emotions and tells

a lot about the owner.

A case can be made whereby buying a lab grown diamond will

introduce a wider audience to diamonds. Remember 3 billion people

are going to enter the middle class in the coming two decades. They

represent a massive potential market for diamonds. China is already

second only to the US as a market for diamonds. The hope is that

consumers will trade up to a natural diamond.

Meanwhile, the supply of natural stones is not expected to grow.

Certainly, the life of some mines will be shortened by the drop in

prices. Botswana is the largest diamond producer in the world - by

value, producing high quality large stones. This market is least

likely to be impacted by the price falls and lab grown

diamonds.

The Future of Botswana Diamonds

We live in hope that stock market interest in diamond companies

will revive. Exploration costs money and even if successful, does

not produce revenue for many years. The collapse of interest by

investors in the AIM market in London has hurt all explorers. In

recent years the pool of new investors has shrunk dramatically

meaning little exploration. Mines have finite, often short lives,

so it is highly likely that a future scarcity of many minerals,

including diamonds, will occur. The surviving producers should

benefit.

Botswana Diamonds has a loyal but dwindling cohort of investors.

We have sought to generate revenue thereby avoiding fundraising and

developing late-stage projects such as Thorny River.

Bringing the Ghaghoo mine back into operation if it can be

achieved and this will cost a fraction of a new mine cost and take

a small fraction of the time it takes for a discovery to become a

mine.

We believe strongly that more deposits will be discovered in

Botswana. But we are not blind to other opportunities. We continue

to spend time and money in Zimbabwe, which is long known to have

diamond potential. We have made some progress.

We continue to look at older discoveries and former mines in

South Africa where, by the application of new thinking and

technology commercially viable projects can be found. We have been

granted a prospecting licence on the Reivilo cluster of kimberlites

in South Africa.

We have acquired a library of data on these kimberlites in

return for a 3% royalty. The data is now under review.

Current ongoing operations are funded by private investors, most

of whom are close to the board of directors.

Diamond prices have risen in recent weeks while operating costs

have either stabilised or dropped. There is cautious optimism for

2024. Any upswing will transform sentiment.

John Teeling

Chairman

19 December 2023

Annual Report and Notice of Annual General Meeting

The Company's Annual Report and Accounts for the year ended 30

June 2023 (the "Annual Report") will be mailed shortly only to

those shareholders who have elected to receive it. Otherwise,

shareholders will be notified that the Annual Report and Accounts

will be available on the website at www.botswanadiamonds.co.uk .

Copies of The Annual Report will also be available for collection

from the company's registered office at Suite 1, 7th Floor, 50

Broadway, London SW1H 0BL.

The Annual General Meeting ("AGM") is due to be held Wednesday

24(th) January 2024 at The Hilton London Paddington, 146 Praed St,

London W2 1EE, United Kingdom at 11.00am. A Notice of the AGM will

be included in the Annual Report.

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No 596/2014 which is part of UK law by

virtue of the European Union (Withdrawal) Act 2018. The person who

arranged for the release of this announcement on behalf of the

Company was John Teeling, Director.

A copy of this announcement is available on the Company's website, at www.botswanadiamonds.co.uk

Enquiries:

Botswana Diamonds PLC

John Teeling, Chairman +353 1 833 2833

James Campbell, Managing Director +27 83 457 3724

Jim Finn, Director +353 1 833 2833

Nominated & Financial Adviser

Strand Hanson Limited

Ritchie Balmer

Rory Murphy

David Asquith +44 (0) 20 7409 3494

Broker

First Equity Limited

Jason Robertson +44 (0) 207 374 2212

Public Relations

BlytheRay +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Said Izagaren +44 (0) 207 138 3206

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

www.botswanadiamonds.co.uk

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 30

JUNE 2023

2023 2022

GBP GBP

REVENUE

Royalties 15,231 -

Operating Expenses (5,503) -

------------ -----------

GROSS PROFIT 9,728 -

Administrative expenses (566,935) (485,612)

Impairment of exploration and evaluation assets (3,124,284) (253,380)

------------ -----------

OPERATING LOSS (3,681,491) (738,992)

LOSS FOR THE YEAR BEFORE TAXATION (3,681,491) (738,992)

Income tax expense - -

------------ -----------

LOSS AFTER TAXATION (3,681,491) (738,992)

Other Comprehensive Income

Items that may be reclassified subsequently to profit or loss

Exchange difference on translation of foreign operations 299,492 22,562

------------ -----------

TOTAL COMPREHENSIVE INCOME FOR THE YEAR (3,381,999) ( 716,430)

============ ===========

Loss per share - basic (0.38p) (0.09p)

Loss per share - diluted (0.38p) (0.09p)

============ ===========

CONSOLIDATED BALANCE SHEET AS AT 30 JUNE 2023

30 June 2023 30 June 2022

GBP GBP

ASSETS:

NON CURRENT ASSETS

Intangible assets 5,442,385 8,184,621

Plant and equipment 207,640 207,640

------------- -------------

5,650,025 8,392,261

------------- -------------

CURRENT ASSETS

Other receivables 282,553 48,981

Cash and cash equivalents 199,438 158,476

------------- -------------

481,991 207,457

------------- -------------

TOTAL ASSETS 6,132,016 8,599,718

------------- -------------

LIABILITIES:

CURRENT LIABILITIES

Trade and other payables (802,428) (734,181)

------------- -------------

TOTAL LIABILITIES (802,428) (734,181)

------------- -------------

NET ASSETS 5,329,588 7,865,537

============= =============

EQUITY

Called-up share capital - deferred shares 1,796,157 1,796,157

Called-up share capital - ordinary shares 2,609,695 2,197,680

Share premium 12,220,614 11,487,087

Share based payment reserves 111,189 111,189

Retained deficit (10,424,780) (6,443,797)

Translation reserve - (299,492)

Other reserve (983,287) (983,287)

------------- -------------

TOTAL EQUITY 5,329,588 7,865,537

============= =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30

JUNE 2023

Called-up Share Share based Retained Translation Other Total

Share Premium Payment Deficit Reserve Reserves

Capital GBP Reserve GBP GBP GBP

GBP GBP

At 30 June

2021 3,777,962 10,984,362 111,189 (5,704,805) (322,054) (983,287) 7,863,367

Issue of

shares 215,875 522,225 - - - - 738,100

Share issue

expenses - (19,500) - - - - (19,500)

Loss for the

year and

total

comprehensive

income - - - (738,992) 22,562 - (716,430)

------------- ------------- ------------ ------------- ------------- ------------- ------------

At 30 June

2022 3,993,837 11,487,087 111,189 (6,443,797) (299,492) (983,287) 7,865,537

------------- ------------- ------------ ------------- ------------- ------------- ------------

Issue of

shares 412,015 733,527 - - - - 1,145,542

Share issue - - - - - - -

expenses

Transfer of

reserves - - - (299,492) 299,492 - -

Loss for the

year and

total

comprehensive

income (3,681,491) - - (3,681,491)

------------- ------------- ------------ ------------- ------------- ------------- ------------

At 30 June

2023 4,405,852 12,220,614 111,189 (10,424,780) - (983,287) 5,329,588

============= ============= ============ ============= ============= ============= ============

CONSOLIDATED CASH FLOW STATEMENT FOR THE YEARED 30 JUNE 2023

30 June 2023 30 June 2022

GBP GBP

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the year (3,681,491) (738,992)

Foreign exchange losses 1,626 15,932

Impairment of exploration and evaluation assets 3,124,284 253,380

------------- -------------

(555,581) (469,680)

MOVEMENTS IN WORKING CAPITAL

Increase/(Decrease) in trade and other payables 68,247 (9,968)

Decrease/(Increase) in other receivables 15,344 (6,943)

------------- -------------

NET CASH USED IN OPERATING ACTIVITIES (471,990) (486,591)

------------- -------------

CASH FLOW FROM INVESTING ACTIVITIES

Additions to exploration and evaluation assets (132,322) (222,259)

------------- -------------

NET CASH USED IN INVESTING ACTIVITIES (132,322) (222,259)

------------- -------------

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from share issue 646,900 738,100

Share issue costs - (19,500)

------------- -------------

NET CASH GENERATED FROM FINANCING ACTIVITIES 646,900 718,600

------------- -------------

NET INCREASE IN CASH AND CASH EQUIVALENTS 42,588 9,750

Cash and cash equivalents at beginning of the financial year 158,476 164,658

Effect of foreign exchange rate changes (1,626) (15,932)

------------- -------------

CASH AND CASH EQUIVALENTS AT OF THE financial YEAR 199,438 158,476

============= =============

1. ACCOUNTING POLICIES

The accounting policies and methods of computation followed in

these financial statements are consistent with those published in

the Group's Annual Report for the year ended 30 June 2022. The

financial statements have also been prepared in accordance with

International Financial Reporting Standards (IFRSs) as issued by

the International Accounting Standards Board (IASB).

The financial information set out below does not constitute the

Group's financial statements for the year ended 30 June 2023 or 30

June 2022, but is derived from those accounts. The financial

statements for the year ended 30 June 2022 have been delivered to

Companies House and those for the year ended 30 June 2023 will be

delivered to Companies House shortly

The auditors have reported on the 2022 statements; their report

was unqualified and did not contain a statement under section

498(2) or 498(3) of the Companies Act 2006.

2. GOING CONCERN

The Group incurred a loss for the year of GBP3,381,999 (2022:

loss of GBP716,430) after exchange differences on retranslation of

foreign operations of GBP299,492 (2022: GBP22,562) at the balance

sheet date. The Group had net current liabilities of GBP320,437

(2022: GBP526,724) at the balance sheet date. These conditions

represent material uncertainties that may cast doubt on the Group's

ability to continue as a going concern.

The directors have prepared cashflow projections and forecasts

for a period of not less than 12 months from the date of this

report which indicate that the group will require additional

funding for working capital requirements and develop existing

projects. As the Group is not revenue or cash generating it relies

on raising capital from the public market. Subsequent to year end

the Company has raised a total of GBP380,000 from a placing.

Further details are outlined in Note 11.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include any adjustments that would

result if the Group was unable to continue as a going concern.

3. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year available to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the profit or loss after taxation for the year by the

weighted average number of ordinary shares in issue, adjusted for

the effect of all dilutive potential ordinary shares that were

outstanding during the year.

The following table sets forth the computation for basic and

diluted earnings per share (EPS):

2023 2022

GBP GBP

Numerator

For basic and diluted EPS Loss after taxation (3,681,491) (738,992)

============ ============

Denominator No.

For basic and diluted EPS 977,271,808 844,141,491

============ ============

Basic EPS (0.38p) (0.09p)

Diluted EPS (0.38p) (0.09p)

============ ============

The following potential ordinary shares are anti-dilutive and

are therefore excluded from the weighted average number of shares

for the purposes of the diluted earnings per share:

No. No.

Share options 11,410,000 11,410,000

=========== ===========

4. INTANGIBLE ASSETS

Exploration and evaluation assets:

Group Group

2023 2022

GBP GBP

Cost:

At 1 July 9,806,497 9,562,528

Additions 382,048 222,259

Transfer Vutomi investment - -

Exchange gain - 21,710

----------- ----------

At 30 June 10,188,545 9,806,497

=========== ==========

Impairment:

At 1 July 1,621,876 1,368,496

Impairment 3,124,284 253,380

----------- ----------

At 30 June 4,746,160 1,621,876

=========== ==========

Carrying Value:

At 1 July 8,184,621 8,194,032

=========== ==========

At 30 June 5,442,385 8,184,621

=========== ==========

Segmental analysis Group Group

2023 2022

GBP GBP

Botswana 3,549,716 6,635,686

South Africa 1,892,669 1,548,935

Zimbabwe - -

----------- ----------

5,442,385 8,184,621

=========== ==========

Exploration and evaluation assets relate to expenditure incurred

in exploration for diamonds in Botswana and South Africa. The

directors are aware that by its nature there is an inherent

uncertainty in exploration and evaluation assets and therefore

inherent uncertainty in relation to the carrying value of

capitalized exploration and evaluation assets.

The Group incurred expenditure to date of GBP3,124,284 on

certain licences held in Botswana. During the current year these

licences lapsed and were not renewed. The directors decided to

fully impair the expenditure and accordingly, an impairment charge

of GBP3,124,284 was recorded in the current year.

On 11 November 2014 the Brightstone block was farmed out to BCL

Investments (Proprietary) Limited, a Botswana Company, who assumed

responsibility for the work programme. Botswana Diamonds had

retained a 15% equity interest in the project. On 20 July 2022 the

Group increased its' stake to 26% equity interest in the

project.

On 6 February 2017 the Group entered into an Option and Earn-In

Agreement with Vutomi Mining Pty Ltd and Razorbill Properties 12

Pty Ltd (collectively known as 'Vutomi'), a private diamond

exploration and development firm in South Africa. Pursuant to the

terms of the Agreement, Botswana Diamonds earned a 40% equity

interest in the project. A separate agreement for funding of

exploration resulted in the Company's interest in Vutomi increasing

from 40% to 45.94%.

On 28 September 2022 the Board announced that it had exercised

its pre-emptive right to acquire the outstanding third-party

interests in Vutomi and had increased its' interest from 45.94% to

74%.

The consideration for Vutomi comprised 56,989,330 new ordinary

shares of GBP0.0025 each in the Company ("Consideration Shares").

There are no lock-in arrangements and the Consideration Shares were

issued in two tranches. 28,464,665 Consideration Shares (First

Tranche) were issued to the vendors on 28 September 2022 and the

balance of 28,524,665 (Second Tranche) were issued on 27 January

2023.

The Company also agreed that immediately on completion of the

Acquisition, the Company would sell 26% of Vutomi for a deferred

consideration of US$316,333 to the Company's local South African

Empowerment partner, Baroville Trade and Investments 02 Proprietary

Limited ("Baroville"), in order to comply with South African

requirements on empowerment ownership, which will be funded by a

loan from Botswana Diamonds. On completion, the Company therefore

owns 74% of Vutomi.

The realisation of these intangible assets is dependent on the

successful discovery and development of economic diamond resources

and the ability of the Group to raise sufficient finance to develop

the projects. It is subject to a number of significant potential

risks, as set out below.

The Group's exploration activities are subject to a number of

significant and potential risks including:

- licence obligations;

- exchange rate risks;

- uncertainties over development and operational costs;

- political and legal risks, including arrangements with

governments for licenses, profit sharing and taxation;

- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

- title to assets;

- financial risk management ;

- going concern; and

- operational and environmental risks.

Included in additions for the year are GBP71,521 (2022:

GBP71,768) of directors' remuneration which has been capitalized.

This is for time spent directly on the operations rather than on

corporate activities.

5. PLANT AND EQUIPMENT

2023 2022

GBP GBP

At 1 July 207,640 206,788

Additions - -

Exchange variance - 852

-------- --------

At 30 June 207,640 207,640

======== ========

On 18 July 2020 the Group entered into an agreement to acquire

the KX36 Diamond discovery in Botswana, along with two adjacent

Prospecting Licences and a diamond processing plant. These

interests are part of a package held by Sekaka Diamond Exploration

(Pty) Ltd. The acquisition was completed on 20 November 2020. The

diamond processing plant is a recently constructed, fit-for-purpose

bulk sampling plant on site. The sampling plant includes crushing,

scrubbing, dense media separation circuits and x-ray recovery

modules within a secured area.

6. INVESTMENT IN SUBSIDIARES

2023 2022

GBP GBP

At 1 July 224,850 224,850

Transfer from Intangible Assets 738,353

Additions 498,642

Less 26% transfer to BEE partners (248,916) -

---------- --------

At 30 June 1,212,929 224,850

========== ========

Botswana Diamonds entered into a Sale of Shares Agreement with

Petra Diamonds Limited ("Petra") and Kalahari Diamonds Limited

("Kalahari Diamonds") on 18 July 2020 to acquire the entire issued

share capital of Sekaka Diamond Exploration (Pty) Ltd ("Sekaka")

currently held by Kalahari Diamonds, a wholly-owned subsidiary of

Petra. The acquisition was completed on 20 November 2020.

On 28 September 2022 the Board announced that it had exercised

its pre-emptive right to acquire the outstanding third-party

interests in Vutomi and had increased its' interest from 45.94% to

74%. The value of the investment of GBP988,079 relates to the 74%

interest in the Vutomi project. Further information is detailed in

Note 4 above.

In the opinion of the directors, at 30 June 2023, the fair value

of the investments in subsidiaries is not less than their carrying

amounts.

7. CALLED-UP SHARE CAPITAL

Deferred Shares - nominal value of 0.75p

Number Share Capital Share Premium

GBP GBP

At 1 July 2021 and 2022 239,487,648 1,796,157 -

-------------- -------------- --------------

At 30 June 2022 and 2023 239,487,648 1,796,157 -

============== ============== ==============

Ordinary Shares - nominal value of 0.25p

Allotted, called-up and fully paid:

Number Share Capital Share Premium

GBP GBP

At 1 July 2021 792,721,902 1,981,805 10,984,362

Issued during the year 86,350,000 215,875 522,225

Share issue expenses - - (19,500)

-------------- -------------- --------------

At 30 June 2022 879,071,902 2,197,680 11,487,087

-------------- -------------- --------------

Issued during the year 164,805,997 412,015 733,527

Share issue expenses - - -

-------------- -------------- --------------

At 30 June 2023 1,043,877,899 2,609,695 12,220,614

============== ============== ==============

Movements in share capital

On 4 July 2022, a total of 1,666,667 warrants were exercised at

a price of 0.60p per warrant for GBP10,000.

On 8 September 2022, a total of 47,000,000 warrants were

exercised at a price of 0.60p per warrant for GBP282,000.

On 28 September 2022, the Company issued 28,464,665 new ordinary

shares of 0.25p each as the First Tranche of consideration shares

to be issued to the vendors of Vutomi. Further information is

detailed in Note 4.

On 27 January 2023, a total of 58,737,455 warrants were

exercised at a price of 0.60p per warrant for GBP352,425.

On 27 January 2023, the Company issued 28,524,665 new ordinary

shares of 0.25p each as the Second Tranche of consideration shares

to be issued to the vendors of Vutomi. Further information is

detailed in Note 4.

8. SHARE-BASED PAYMENTS

SHARE OPTIONS

The Group issues equity-settled share-based payments to certain

directors and individuals who have performed services for the

Group. Equity-settled share-based payments are measured at fair

value at the date of grant. Fair value is measured by use of a

Black-Scholes valuation model.

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of

grant.

30/06/2023 2023 30/06/2022 2022

Options Weighted average exercise Options Weighted average exercise

price in pence price in pence

Outstanding at beginning of

year 11,410,000 5.14 11,410,000 5.14

Issued - - - -

----------- ----------------------------- ----------- -----------------------------

Outstanding at end of the

year 11,410,000 5.14 11,410,000 5.14

=========== ============================= =========== =============================

Exercisable at end of the

year 11,410,000 5.14 11,410,000 5.14

=========== ============================= =========== =============================

WARRANTS

30/06/2023 2023 30/06/2022 2022

Warrants Weighted average exercise Warrants Weighted average exercise

price in pence price in pence

Outstanding at beginning of

year 162,816,667 1.07 139,166,667 0.60

Issued - - 55,000,000 2.0

Exercised (107,816,667) 0.60 (31,350,000) 0.60

Expired - - - -

-------------- --------------------------- ------------- ---------------------------

Outstanding at end of the

year 55,000,000 2.0 162,816,667 1.07

============== =========================== ============= ===========================

Refer to note 7 Called up Share Capital for the details of the

share options and warrants.

9. OTHER RESERVES

Share Based Payment Reserve Translation Reserve Other Reserves Total

GBP GBP GBP GBP

Balance at 30 June 2021 111,189 (322,054) (983,287) (1,194,152)

Foreign Exchange Gain/Loss 22,562 22,562

---------------------------- -------------------- --------------- ------------

Balance at 30 June 2022 111,189 (299,492) (983,287) (1,171,590)

Foreign Exchange Gain/Loss 299,492 299,492

---------------------------- -------------------- --------------- ------------

Balance at 30 June 2023 111,189 - (983,287) (872,098)

============================ ==================== =============== ============

Share Based Payment Reserve

The share based payment reserve arises on the grant of share

options under the share option plan as detailed in Note 8.

Translation Reserve

The translation reserve arises from the translation of foreign

operations.

Other Reserves

During 2010 the Company acquired certain assets and liabilities

from African Diamonds plc, a Company under common control. The

assets and liabilities acquired were recognised at their book value

and no goodwill was recognised on acquisition. The difference

between the book value of the assets acquired and the purchase

consideration was recognised directly in reserves.

10. RETAINED DEFICIT

Group

2023 2022

GBP GBP

Opening Balance (6,443,797) (5,704,805)

Transfer translation reserve (299,492) -

Loss for the year (3,681,491) (738,992)

------------- ------------

Closing Balance (10,424,780) (6,443,797)

============= ============

Retained Deficit

Retained deficit comprises of losses incurred in the current and

prior years.

11. POST BALANCE SHEET EVENTS

On 27 November 2023, the Company raised GBP380,000 through a

placing of 76,000,000 new ordinary shares at a placing price of

0.5p per share. Each placing share has one warrant attached with

the right to subscribe for one new ordinary share at a price of

0.5p for a period of two years from 27 November 2023.

There were no other significant post balance sheet events since

year end.

12. GENERAL INFORMATION

The Annual Report and Accounts will be mailed shortly only to

those shareholders who have elected to receive it. Otherwise,

shareholders will be notified that the Annual Report and Accounts

will be available on the website at www.botswanadiamonds.co.uk .

Copies of The Annual Report will also be available for collection

from the company's registered office at Suite 1, 7th Floor, 50

Broadway, London SW1H 0BL

13. ANNUAL GENERAL MEETING

The Annual General Meeting is due to be held on Wednesday 24(th)

January 2024 at The Hilton London, Paddington, 146 Praed St, London

W2 1EE, United Kingdom at 11.00am. A Notice of the Annual General

Meeting is included in the Company's Annual Report.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFUFWUEDSEDE

(END) Dow Jones Newswires

December 20, 2023 02:00 ET (07:00 GMT)

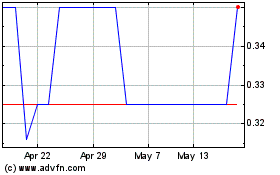

Botswana Diamonds (LSE:BOD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Botswana Diamonds (LSE:BOD)

Historical Stock Chart

From Nov 2023 to Nov 2024