Half Yearly Report

September 28 2009 - 12:10PM

UK Regulatory

TIDMBMTO TIDMBMT TIDMBMTP

RNS Number : 7974Z

Braime (T.F.& J.H.) (Hldgs) PLC

28 September 2009

T.F. & J.H. Braime (Holdings) P.L.C.

("Braime" or the "company")

Interim results for the six months ended 30th June 2009

Group sales revenue for the first six months of 2009 increased by 7% from

GBP7.28m in 2008 to GBP7.77m and the company made a profit before tax for the

first half of 2009 of GBP216,000 compared to a profit of GBP125,000 in 2008 for

the same period.

In view of the steady recovery in profitability, the directors have decided to

pay an interim dividend of 1.50p per share on 16th October 2009 to shareholders

whose names are on the register on 9th October 2009.

Performance of group companies

4B division

In spite of the recession, sales by all the subsidiaries selling the 4B brand of

components to the material handling industry held up, above forecast, and ahead

of the record levels of 2008. Profitability improved, relative to the first half

of last year, due to the combination of favourable exchange rates and a decline

in the cost of raw materials.

Since the half year, there has been a noticeable decline in activity, and sales

for the full year by this division are likely to be in line with our budget, at

a level slightly below that achieved in 2008. In view of the very high

percentage of sales made in overseas markets, exchange rates will be a major

factor in determining the contribution of this division to the group result for

2009.

Pressings division

Sales for the first six months fell by 55%, compared to the same period of 2008,

due to the particular severity of the recession in the UK. The general fall in

demand was exacerbated by the initial de-stocking carried out by all major

customers as they re-adjusted their own production to match drastically lower

sales.

This situation has forced the company to speed up its strategy of moving away

from its traditional "mid-volume" general sub-contract presswork, supplied to a

wide customer base, to instead concentrating on supplying a limited number of

customers, each requiring high volumes of specialized product. The manufacture

of the products retained will be made in totally automated production cells. The

company has notified most of its' customers of its' decision to discontinue

manufacture of their requirements and since July the company has been working at

close to full capacity supplying these customers with agreed "run-out" volumes.

Very sadly, the implementation of the above strategy also requires a large

reduction in our workforce through redundancies and the company is currently

engaged in this process. However, the painful changes being made now will result

in a long term viable future for the manufacturing business and more secure

employment for those employees that remain.

Outlook

The very recent decline in demand for components supplied to the material

handling industry is a concern. Nevertheless the primary sectors into which

these components are supplied, specifically food related industries, remain

relatively immune from the recession and the company is reasonably confident

that the fall in demand will be short term.

The restructuring of the manufacturing business will reduce the significant

losses being made by this subsidiary and stem the outflow of cash that this has

caused.

Providing exchange rates remain close to current levels, the directors believe

that the result for the full year will show a continuation in the gradual

recovery of the past two years. However, given the continuation of the

recession, the pace of the improvement in profitability is likely to be at a

slower rate than was achieved in the second half of 2008.

Condensed consolidated income statement for the six months ended 30th June 2009

+-------------------------------------------+-------------+-------------+--------------+

| | Unaudited | Unaudited | Year to |

| | 6 months | 6 months | 31st |

| | to | to | December |

| | 30th June | 30th June | 2008 |

| | 2009 | 2008 | |

+-------------------------------------------+-------------+-------------+--------------+

| | GBP | GBP | GBP |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Revenue | 7,767,714 | 7,277,564 | 15,173,891 |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Cost of sales | 6,058,988 | 5,762,076 | 11,763,969 |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Gross profit | 1,708,726 | 1,515,488 | 3,409,922 |

+-------------------------------------------+-------------+-------------+--------------+

| Other operating expenses | 1,457,991 | 1,363,285 | 2,833,884 |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Operating profit | 250,735 | 152,203 | 576,038 |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Finance expense | (144,284) | (161,247) | (312,924) |

+-------------------------------------------+-------------+-------------+--------------+

| Finance income | 109,689 | 133,623 | 264,009 |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Profit before tax | 216,140 | 124,579 | 527,123 |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Income tax expenses | (60,519) | (34,882) | (275,565) |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Profit after tax | 155,621 | 89,697 | 251,558 |

+-------------------------------------------+-------------+-------------+--------------+

| | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Earnings per share | | | |

+-------------------------------------------+-------------+-------------+--------------+

| Basic and diluted | 10.81p | 6.23p | 17.47p |

+-------------------------------------------+-------------+-------------+--------------+

Condensed consolidated statement of comprehensive income for the six months

ended

30th June 2009

+----------------------------------------------+-------------+-------------+--------------+

| | Unaudited | Unaudited | Year to |

| | 6 months | 6 months | 31st |

| | to | to | December |

| | 30th June | 30th June | 2008 |

| | 2009 | 2008 | |

+----------------------------------------------+-------------+-------------+--------------+

| | GBP | GBP | GBP |

+----------------------------------------------+-------------+-------------+--------------+

| | | | |

+----------------------------------------------+-------------+-------------+--------------+

| Profit for the period | 155,621 | 89,697 | 251,558 |

+----------------------------------------------+-------------+-------------+--------------+

| | | | |

+----------------------------------------------+-------------+-------------+--------------+

| Exchange differences on translating foreign | (146,101) | 1,236 | 436,143 |

| operations | | | |

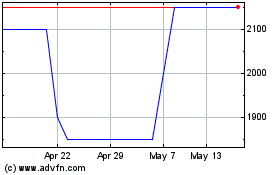

Braime (LSE:BMTO)

Historical Stock Chart

From Jan 2025 to Feb 2025

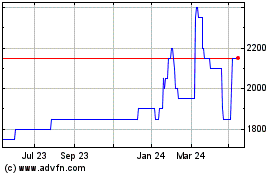

Braime (LSE:BMTO)

Historical Stock Chart

From Feb 2024 to Feb 2025