RNS Number : 7341C

Braime (T.F.& J.H.) (Hldgs) PLC

04 September 2008

Interim results for the six months ended 30th June 2008

Group sales revenue for the first six months of 2008 increased by 24% from �5.89m to �7.28m and the company made a profit before tax for

the first half of 2008 of �125,000. This compares to a profit of �67,000 in 2007 and a loss of �218,000 in 2006 in the same period.

The group was cash negative in the first half of 2008. This was caused by an increase in trade debtors, following the significant

increase in sales revenue, and an increase in inventories, due to the sudden and steep rise in the cost of raw materials. The company

continues to trade well within its borrowing facilities and we expect the group to be cash generative for the full year, ending 31st

December 2008.

The sizeable accumulated losses in 2005 and 2006 have put considerable strain on the company's financial resources, as has the need to

finance the recent large increase in group revenue. As a result, the directors have reluctantly decided that it would not be appropriate to

pay an interim dividend in 2008.

The profitability of the group continues to improve and, providing this is sustained, the directors plan to progressively restore

dividend payments to the shareholders.

Performance of group companies

4B division

The subsidiaries distributing our 4B brand of components to the material handling sector worldwide have all enjoyed substantial growth

and we expect this to continue in the second half of the year. We are fortunate that over 80% of sales of "4B" products are in overseas

markets and are primarily to customers in the agro industry or process industries, sectors benefiting from the surge in commodity prices,

insulating us from most of the consequences of the current economic problems in the UK.

The downside is that we have also seen unprecedented inflation in the cost of some of our raw materials, with UK steel prices rising 50%

and world plastic prices increasing by 100% since the start of 2008. Given our complex product mix, passing on price increases to customers

on a continuous basis is both time consuming and destabilizing and the inevitable delays in the acceptance by our customers of such large

price increases has had a short term negative effect on our margins.

Pressings division

The sales revenue of Braime Pressings has remained largely unchanged from the first half of 2007 and the losses in this company have not

been reduced. This is hugely disappointing.

Through no fault of our own, the start up of the new major product line for an automotive components supplier has been repeatedly

delayed by our customer but is now scheduled finally to come on stream from September 2008. We have made a significant capital investment in

this project and the long delay has had a serious effect on the performance of Braime Pressings both in 2007 and 2008. Equally, once this

project commences, it will have a substantial long term positive impact both on the result of Braime Pressings and of the group.

Relocation

While the company is still receiving enquiries from parties interested in developing our site in Leeds, the effect of the downturn in

the housing market makes it unlikely that a realistic offer, based on the primarily residential brief approved by the planning officers,

will be forthcoming in the foreseeable future. The company still wishes to relocate its manufacturing business to more economic premises, as

soon as this becomes a viable option, and continues to explore other alternatives.

Outlook

The UK economy appears to be entering a recession and across the world the huge inflation in commodity prices is creating economic

instability. In spite of this unfavourable general economic background, the directors believe that the group will be able to continue the

progress made over the past 18 months.

Condensed Consolidated Income Statement for the six months ended 30th June 2008

30th June 2008 30th June 2007 31st December 2007

� � �

(unaudited) (unaudited) (audited)

Revenue 7,277,564 5,887,371 11,838,813

Profit from operations 152,203 78,025 167,352

Finance costs (161,247) (162,913) (321,762)

Finance income 133,623 151,996 292,467

Result for the period before 124,579 67,108 138,057

tax

Tax expense @ 28% (2007 - 30%) (34,882) (20,132) (128,793)

for interim figures

Net result for the period 89,697 46,976 9,264

Basic profit per share 6.23p 3.26p 0.01p

Condensed Consolidated Statement of Recognised Income and Expense for the six months ended 30th June 2008

30th June 2008 30th June 2007 31st December 2007

� � �

(unaudited) (unaudited) (audited)

Exchange difference on 1,236 (9,684) 17,557

translation of foreign

operations

Actuarial gains recognised - - 118,000

directly in equity

Total income and expense 1,236 (9,684) 135,557

recognised in equity

Net income/(expense) 1,236 (9,684) 135,557

recognised in equity

Profit for period 89,697 46,976 9,264

Total recognised income and 90,933 37,292 144,821

expense for the period

Attributable to:

Equity holders of T.F. & J.H. 90,933 37,292 144,821

Braime (Holdings) P.L.C.

Consolidated Balance Sheet at 30th June 2008

30th June 2008 30th June 2007 31st December

2007

� � �

(unaudited) (unaudited) (audited)

Assets

Non-current assets

Property, plant and equipment 802,916 689,748 862,998

Employee benefits 74,000 - 97,000

Total non-current assets 876,916 689,748 959,998

Current assets

Inventories 2,656,962 2,521,209 2,535,671

Trade and other receivables 3,315,784 3,001,803 2,713,165

Cash and cash equivalents 1,419,603 1,429,619 1,493,734

Total current assets 7,392,349 6,952,631 6,742,570

Total assets 8,269,265 7,642,379 7,702,568

Liabilities

Current liabilities

Bank overdraft 1,368,047 1,294,875 1,387,668

Trade and other payables 2,604,927 2,346,046 2,162,084

Other financial liabilities 273,114 182,166 231,645

Corporation tax liability 34,882 20,132 35,667

Total current liabilities 4,280,970 3,843,219 3,817,064

Non-current liabilities

Financial liabilities 349,212 327,539 337,354

Employee benefits - 31,000 -

Total non-current liabilities 349,212 358,539 337,354

Total liabilities 4,630,182 4,201,758 4,154,418

Total net assets 3,639,083 3,440,621 3,548,150

Capital and reserves

attributable to equity holders

of the parent company

Share capital 360,000 360,000 360,000

Capital reserve 77,319 77,319 77,319

Foreign exchange reserve (7,756) (36,233) (8,992)

Retained earnings 3,209,520 3,039,535 3,119,823

Total equity 3,639,083 3,440,621 3,548,150

Consolidated Cash Flow Statement for the six months ended 30thJune 2008

31st December

30th June 2008 30th June 2007 2007

� � �

(unaudited) (unaudited) (audited)

Operating activities

Net profit from ordinary 89,697 46,976 9,264

activities

Adjustments for:

Depreciation 105,021 88,493 168,183

Grants amortised (828) (828) (1,656)

Foreign exchange 1,246 (9,810) 19,535

gains/(losses)

Investment income (133,623) (151,996) (292,467)

Interest expense 161,247 162,913 321,762

Gain on sale of plant, - - (6,123)

machinery and motor vehicles

Income tax expense 34,882 20,132 128,793

Operating profit before 167,945 108,904 338,027

changes in working capital and

provisions

Increase in trade and other (602,619) (390,066) (153,188)

receivables

Increase in inventories (121,291) (323,287) (337,749)

Increase in trade and other 454,170 499,254 327,326

payables

(Increase)/decrease in 27,000 34,000 35,000

provisions and employee

benefits

(242,740) (180,099) (128,611)

Cash generated from operations 14,902 (24,219) 218,680

Income taxes paid (35,667) (33,063) (131,397)

Investing activities

Purchases of plant, machinery (32,657) (53,682) (163,474)

and motor vehicles

Sale of plant, machinery and 35,843 8,922 10,375

motor vehicles

Interest received 28,623 27,996 59,467

31,809 (16,764) (93,632)

Financing activities

Repayment of hire purchase (47,597) (20,500) (56,026)

creditors

Interest paid (60,247) (53,913) (114,762)

Loan received 42,300 - -

(65,544) (74,413) (170,788)

Decrease in cash and cash (54,500) (148,459) (177,137)

equivalents

Cash and cash equivalents 106,066 283,203 283,203

(including overdrafts),

beginning of period

Cash and cash equivalents 51,566 134,744 106,066

(including overdrafts), end of

period

Notes to the interim financial report

Accounting policies

Basis of preparation

This interim financial report has been prepared using accounting policies that are consistent with those used in the preparation of the

full financial statements to 31st December 2007 and those which management expects to apply in the group's full financial statements to 31st

December 2008.

This interim financial report in unaudited. The comparative financial information set out in this interim financial report does not

constitute the group's statutory accounts for the period ended 31st December 2007 but is derived from the accounts. Statutory accounts for

the period ended 31st December 2007 have been delivered to the Registrar of Companies. The auditors have reported on those accounts. Their

audit report was unqualified and did not contain any statements under Section 237(2) or (3) Companies Act 1985.

4th September 2008

For further information please contact:

T.F. & J.H. Braime (Holdings) P.L.C.

David H. Brown FCA - Financial Director

0113 245 7491

W. H. Ireland Limited

Katy Mitchell LLB

0113 3946628

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFFIAFISIIT

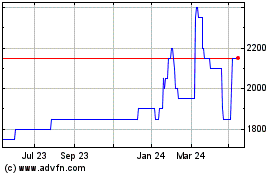

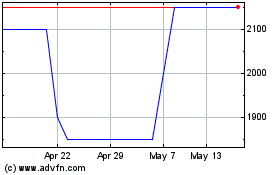

Braime (LSE:BMTO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Braime (LSE:BMTO)

Historical Stock Chart

From Feb 2024 to Feb 2025