TIDMBIRD

RNS Number : 4816L

Blackbird PLC

13 September 2021

13 September 2021

Blackbird plc

(the "Company")

Interim results

Blackbird plc (AIM: BIRD; OTCQX: BBRDF), the developer and

seller of the market-leading, patented cloud native video editing

platform Blackbird(R) , announces its interim results for the six

months ended 30 June 2021.

Ian McDonough, CEO of Blackbird plc, commented:

"I am delighted to once again deliver record revenues for the

six-month period of GBP867k, up 21% year on year. We made strong

progress in the period against our sales strategy both in OEM:

signing partnerships with EVS and LiveU and expanding our deal with

TownNews; and Direct: closing deals with, amongst others, Cheddar

News, ODK Media and BT.

"Importantly, in a landmark deal for the Company, we signed our

first 'Powered by Blackbird' licensing contract for the core video

technology post period. As well as being long term and the largest

financial deal to date for the Company at a minimum expected value

of EUR2 million, this is also of strategic importance and provides

substantial evidence of the value of our IP outside of our own

Blackbird product which we have been talking about for some time.

This deal, signed with a global broadcasting company, also provides

the Company with financial upside potential should the product

rollout be successful. It has been made technically possible by the

advancement of our API strategy which also opens up new routes to

market for our existing business as well as new potential

opportunities beyond our core strength of video editing.

"Additionally, in the period we released two strategically

important white papers highlighting Blackbird's sustainability

credentials and Total Cost of Ownership benefits.

"These are incredibly exciting times for the Company and I look

forward to working with the team to deliver further success."

Operational highlights (POST PERIOD)

-- Multi-year licensing deal for Blackbird, the Company's

technology, announced with a global broadcast company, the first of

its kind, for a minimum expected revenue of EUR2.0million

o new route to market for the Company

o opening up further opportunities in new markets beyond editing

and increasing the Company's Total Addressable Market ("TAM")

o rapid scaling opportunities in "on premise" as well as "cloud

centric" broadcasters

o upside potential through a successful global product

rollout

-- Announced our first contract with a major U.S. media company

in signing up CBS Sports, part of ViacomCBS, as a client

-- Contracted with the largest U.S. based Hispanic media

company, Univision, in a multi-year deal to deploy Blackbird to

drive large-scale video production efficiencies across its

streaming and digital media operations

-- Further expansion with TownNews taking the total overall to 75 local U.S. stations

-- Deal closed with Athletes Unlimited who chose Blackbird to

drive fast, flexible and efficient cloud native video workflows in

fast growing minority sports

-- Blackbird commences trading on the OTCQX market in the U.S.

opening up investment to North American

investors in 37 States

-- Blackbird receives the Green Economy Mark from the London Stock Exchange

Financial highlights (POST PERIOD)

-- GBP1,763k* secured revenue for 2021 at 31 August 2021 (2020 comparative: GBP1,453k)

-- Contracted but unrecognised revenues of GBP1,987k* at 31

August 2021. GBP518k relates to 2021 and

GBP893k revenue relates to 2022

* Subject to exchange rate fluctuations

Operational highlights (PERIOD)

-- Partnership launched with EVS to deploy for two international sporting events

o endorsing the OEM go to market strategy and that Blackbird is

a trusted partner for the world's most valuable content

o validating the benefits that Blackbird can bring to the Sports

sector, a key targeted market

-- Expansion of deal with TownNews to 69 local U.S. TV stations

o reaffirming the Company's "land and expand" strategy

-- Contracted with Cheddar News for ultra-efficient, flexible

and sustainable video production

o another high-profile name in one of the Company's core,

targeted sectors

-- BT contracted with the Company for ultra-fast and sustainable

cloud native video editing and publishing

-- Deal closed with ODK Media for flexible and efficient cloud

video production for their new OnDemandLatino service

-- New multi-year deals signed with e-learning companies Typsy and Boclips

-- RTL Deutschland chooses an integrated LiveU/Blackbird

solution to enhance live coverage of two of

this year's German regional elections

-- Strategic white papers released by the Company on:

o Total Cost of Ownership ("TCO"): showing Blackbird's cloud

native solution delivering up to 35% lower TCO than cloud adapted

on premise video editing

o Sustainability: highlighting Blackbird's cloud native workflow

generates up to 91% less carbon than on premise video editing

workflows

Financial highlights (PERIOD)

-- Record revenues of GBP867k for the 6 months to 30 June 2021,

up 21% year on year (6 months to 30 June 2020: GBP714k)

-- Contracted but unrecognised revenues up 6% year on year to

GBP1,974k at 30 June 2021 (GBP1,860k at 30 June 2020)

-- Increased operating costs, excluding LTIP provision, of

GBP1,444k (6 months to 30 June 2020: GBP1,359k) driven by

additional costs from strengthening of the Company's Sales, R&D

and Product teams

-- EBITDA loss, excluding LTIP provision movement, of GBP661k (6

months to 30 June 2020: GBP714k) -

increased revenue partially offset by higher operating costs

-- EBITDA loss of GBP874k (6 months to 30 June 2020: GBP714k)

with the increased loss year on year due to the increase in LTIP

provision from the rising share price partially offset by the

improvement in EBITDA pre LTIP provision mentioned above

-- Net loss before tax GBP1,168k (6 months to 30 June 2020: GBP942k)

-- Cash burn, excluding proceeds from share issues and transfers

from short term investments, up GBP97k to GBP943k year on year (6

months to 30 June 2020: GBP846k) due to timing of R&D tax

credit payment (GBP25k expected to be received in H2 2021), GBP24k

lower interest income received and the remainder from working

capital movements

-- Cash and short-term investments of GBP5,710k (30 June 2020: GBP7,183k) and no debt

Enquiries:

Blackbird plc Tel: +44 (0)20 8879

7245

Ian McDonough, Chief Executive Officer

Stephen White, Chief Operating and Financial

Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Broker) 5656

Nick Naylor/ Piers Shimwell (Corporate Finance)

Amrit Nahal (Sales and Corporate Broking)

About Blackbird plc

Blackbird plc operates in the fast-growing SaaS and cloud video

market. It has created Blackbird(R), the world's most advanced

suite of cloud-native computing applications for video, all

underpinned by its lightning-fast codec. Blackbird plc's patented

technology allows for frame accurate navigation, playback, viewing

and editing in the cloud. Blackbird(R) underpins multiple

applications, which are used by rights holders, broadcasters,

sports and news video specialists, esports, live events and content

owners, post-production houses, other mass market digital video

channels and corporations.

Since it is cloud-native, Blackbird(R) removes the need for

costly, high-end workstations and can be used from almost anywhere

on almost any device. It also allows full visibility on

multi-location digital content, improves time to market for live

content such as video clips and highlights for digital

distribution, and ultimately results in much more effective

monetisation.

Blackbird(R) is a registered trademark of Blackbird plc.

Websites

www.blackbird.video

Social media

www.linkedin.com/company/blackbird-cloud

www.twitter.com/blackbirdcloud

www.facebook.com/blackbirdplc

www.youtube.com/c/Blackbirdcloud

Chief Executive Officer's statement

I am pleased to report record revenues for the six-month period

to 30 June 2021 and continued positive momentum against our

strategy.

We have continued our sales momentum, particularly in our core

targeted markets of Sports and News.

In OEM:

-- Signing a partnership with EVS including deployment on two

prestigious Sporting events, one in mid-2021 and one in early 2022.

EVS are synonymous with the production of the world's most emotive

and high value sports content as well as global news and market

leading entertainment shows. It highlights not only the attributes

of the Blackbird technology but also the confidence that EVS has in

the Company's team to deliver on the biggest of stages

-- Further successful expansion of our deal with TownNews to 69

local U.S. TV stations compared to the 2 U.S. TV stations when the

Company started with TownNews back in 2018. This is an excellent

example of the 'Blackbird inside' OEM strategy working and a superb

endorsement of our technology in the fast-paced environment of news

production

-- A new partnership with LiveU, including a joint solution for

RTL Deutschland to enhance live coverage in two of this year's

German regional elections. LiveU is the leader in live video

streaming and remote production solutions. The world is quickly

moving to 'remote first' in its approach to sports and news

production. Quality, speed and ultimately exceptional user

experience are the core principles of both platforms and therefore

ideal for broadcasters and digital publishers alike

-- A further anonymized deal through an existing large OEM

partner together with an expansion of an existing deal in the

period. Both deals fall into the live Sports sector

In Direct:

-- Deal signed with Cheddar News who is a ground-breaking and

industry defining U.S. news brand. Blackbird will allow Cheddar's

distributed news production teams to work flexibly on a single

unified editing and publishing platform either remotely, from the

field or from centralised production locations

-- Contracted with BT for ultra-fast and sustainable cloud

native video editing and publishing. The focus is working with BT

on the fast turnaround of video on demand ("VOD") content produced

from BT's live broadcasts and Blackbird will significantly improve

speed and efficiency - providing end customers access to content in

a shorter time scale. In addition, with BT's increased focus on

remote working and migration to cloud architecture, the

flexibility, resilience and carbon efficiency of the Blackbird

technology make Blackbird an excellent and future-proofed fit

-- Deal closed with ODK Media for flexible and efficient cloud video production for their new OnDemandLatino service. Blackbird is ideally suited to the OTT streaming services market and ODK's workflow is an excellent example of how companies using the platform can seamlessly leverage globally distributed production teams to create, enrich and version content very quickly and conveniently

-- New multi-year deals signed with e-learning companies,

Australian based Typsy and UK based Bo Clips

The Company issued two strategically important and well received

white papers in the period. The first of these, titled "Video

Shouldn't cost the Earth", was on sustainability. It highlights

how, through its cloud native architecture, Blackbird can save up

to 91% carbon emissions compared to traditional on premise video

editors. We are increasingly seeing that "green" credentials is an

important part of the purchasing process for large enterprises as

this can help them achieve their own carbon targets. We received a

strong response from the industry with my own appearance on Sky

News and many other industry platforms. Various large and small

companies reached out to Blackbird to join the Company's campaign

to highlight the need for change in the industry. Post period, we

were delighted to receive the London Stock Exchange's Green Economy

mark, a further endorsement of our green technology. Only around 5%

of listed businesses in the UK have thus far been awarded the mark.

The second white paper was about "Total Cost of Ownership", and

highlighted that Blackbird is up to 35% lower cost than other cloud

based solutions due to its patented cloud native architecture.

We have made a strong start to the second half of the year,

onboarding CBS Sports, Univision and Athletes Unlimited.

Additionally, the Company has entered into its first licensing

deal. This is significant for several reasons: it is a 5-year deal

for a minimum expected revenue of EUR2million and the largest

signed by the Company to date, it further endorses the technology,

opens up a new route to market for our existing business but also,

most importantly, offers up much wider market opportunities beyond

the editing sector. The advancement of our API strategy also opens

up further possibilities which we always look to explore.

These are very exciting times for the Company and I look forward

to delivering further future success.

Ian McDonough

Chairman's statement

The Company has made encouraging financial progress in the

period. In the six-month period to 30 June 2021, we continued sales

growth momentum and booked record revenues of GBP867k up 21% year

on year. In North America, our leading market, revenue grew to

GBP554k for the period, up by 33% year on year on a like-for-like

basis, and by a further 10% from a change in a contractual regional

entity on a deal renewal. The growth rate would have been higher

but for the strengthening of the pound vs the dollar which had an

adverse impact of GBP36k or 4% on total revenues. Additionally, in

the UK, it was a tough time for the Post Production sector and due

to lower volumes of production our revenue was down GBP13k year on

year in this sector.

Our commercial success in the first half of the year was built

on our current strategy. Total invoiced sales grew by 20% to

GBP916k year on year (6 months to 30 June 2020: GBP764k). OEM

revenue in the period grew by 17% to GBP405k, with the impact of

the new partnership with EVS including the two International

Sporting events and the further expansion of our TownNews deal to

69 new stations to be seen in future periods. The Company brought

onboard several high-profile customers including BT and Cheddar

News from direct sales. Blackbird's ability to offer efficient

remote working solutions, as well of our usual core strengths, will

hold us in good stead for future growth as companies increasingly

look at hybrid solutions for their employees.

The Company's own operational response has been impressive,

continuing to market, sell and deploy seamlessly whilst working

remotely. We also strengthened the team in the period with

additional resources being brought onboard in the key areas of

R&D and Product to support the Company's growing plans.

Financial

Revenue increased by 21% to GBP867k for the six-month period

compared to the corresponding period last year (six month to 30

June 2020 GBP714k). Contracted but unrecognised revenue was

GBP1,974k at 30 June 2021, an increase of 6% compared to 30 June

2020.

Our focus on the Sports sector and News sectors, continued to

bear fruit with revenue up 37% and 26% year on year respectively at

GBP330k and GBP244k respectively. Year on year revenue growth was

held back by the fall in production volumes in the UK Broadcast

Post sector as well as the strengthening of the pound versus the

dollar as mentioned above.

Operating costs for the period were GBP1,657k versus GBP1,359k

in the corresponding period last year reflecting an increase in: i)

the LTIP provision of GBP213k, as the Company's share price rose

52% year on year and the Company's market capitalisation by

GBP36.6million; and ii) a strengthening of the team in Sales,

R&D and Product. The EBITDA loss for the period was GBP874k

versus GBP714k in the corresponding period last year due to the

increased operating costs. Excluding the increase in the LTIP

provision, the EBITDA loss would have decreased by GBP53k year on

year to GBP661k. The loss for the period was GBP1,168k versus

GBP942k mainly due to the lower EBITDA explained above, but also

from higher amortisation of capitalized R&D costs and higher

share option expenses due to the rising share price.

Cash burn in the period, excluding proceeds from share issues

and transfers from short-term investments, was GBP943k versus

GBP846k in the same period in 2020 driven by the timing of R&D

tax credit payment (previously received in H1 2020, whereas GBP25k

is expected to be received in H2 2021), GBP24k lower interest

income received due to falling interest rates and the remainder

from working capital movements.

Outlook

We continue to make good progress against our strategy and have

made a meaningful start to the second half of the year. The recent

direct deals with Univision, Athletes Unlimited and CBS Sports

Digital show that our sector focus continues to bear fruit with a

strong order book and revenue of GBP1,644k secured for the year

which is up 31% against the comparative at 30 June 2020

(GBP1,256k). By the end of August 2021, we had grown 2021 secured

revenue to GBP1,763k (2020 comparative: GBP1,453k) and had GBP893k

of contracted revenue for 2022 which is up 18% versus the 2020

comparative for 2021 (GBP756k).

More excitingly, our recently announced first technology

licensing deal opens up both a quicker expansion opportunity in our

existing market and further potential in new markets outside the

Broadcast sector. This deal clearly demonstrates the adaptability

of our technology and significantly increases the Company's TAM.

The next few years will be most interesting for the Company as our

markets recognize and respond to the flexibility, resilience and

sustainability of our core technology.

In July, we announced that the Company's shares will be traded

on the OTCQX Best Market in the U.S. This will provide enhanced

investor benefits, including easier trading access for investors

located in the U.S., and greater liquidity due to a broader

geographic pool of potential investors .

The future prospects for the Company continue to be very bright

and I look forward to working with the team to deliver these.

Andrew Bentley

UNAUDITED AND CONDENSED STATEMENT OF COMPREHENSIVE INCOME FOR

THE SIX MONTHS

ED 30 JUNE 2021

Unaudited Unaudited Audited

Half year Half year to Year to

to

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

CONTINUING OPERATIONS

Revenue 866,644 713,843 1,567,109

Cost of Sales (84,096) (68,731) (163,338)

------------------------------- ------------ ------------- ------------

GROSS PROFIT 782,548 645,112 1,403,771

Operating costs excluding

LTIP provision (1,443,816) (1,359,064) (2,721,465)

------------------------------- ------------ ------------- ------------

EARNINGS BEFORE INTEREST,

TAXATION, DEPRECIATION,

AMORTISATION AND LTIP

PROVISION (661,268) (713,952) (1,317,694)

LTIP provision (212,925) - (98,227)

------------------------------- ------------ ------------- ------------

EARNINGS BEFORE INTEREST,

TAXATION, DEPRECIATION

AND AMORTISATION (874,193) (713,952) (1,415,921)

Depreciation (54,456) (54,342) (108,681)

Amortisation (163,060) (133,184) (275,935)

Employee share option

costs (83,665) (65,649) (138,933)

------------ ------------- ------------

(301,181) (253,175) (523,549)

------------------------------ ------------ ------------- ------------

OPERATING LOSS (1,175,374) (967,127) (1,939,470)

Net Finance income 7,862 25,102 33,451

LOSS BEFORE INCOME TAX (1,167,512) (942,025) (1,906,019)

Income Tax - - 25,415

------------------------------- ------------ ------------- ------------

LOSS FOR THE PERIOD (1,167,512) (942,025) (1,880,604)

TOTAL COMPREHENSIVE LOSS

FOR THE PERIOD (1,167,512) (942,025) (1,880,604)

=============================== ============ ============= ============

Earnings per share expressed

in pence per share:

Basic - continuing and

total operations (0.35p) (0.28p) (0.56p)

=============================== ============ ============= ============

UNAUDITED AND CONDENSED STATEMENT OF FINANCIAL POSITION AT 30

JUNE 2021

Unaudited Unaudited Audited

30 June 30 June 31 December

2021 2020 2020

ASSETS GBP GBP GBP

NON-CURRENT ASSETS

Other intangible

assets 1,152,634 1,048,112 1,105,657

Property, plant

and equipment 276,043 353,786 308,565

1,428,677 1,401,898 1,414,222

------------------------- ------------- ------------- -------------

CURRENT ASSETS

Trade and other

receivables 501,414 498,402 292,834

Stock 895 15,728 15,728

Current tax assets 25,415 - 25,415

Short-term investments 1,214,302 - 1,617,820

Cash and bank

balances 4,495,923 7,182,773 4,928,021

6,237,949 7,696,903 6,879,918

------------------------- ------------- ------------- -------------

TOTAL ASSETS 7,666,626 9,098,801 8,294,040

========================== ============= ============= =============

EQUITY

Issued share capital 2,705,553 2,688,913 2,696,433

Share premium 26,614,950 26,427,733 26,516,613

Capital contribution

reserve 125,000 125,000 125,000

Retained earnings (23,282,609) (21,333,467) (22,198,762)

6,162,894 7,908,179 7,139,284

------------------------- ------------- ------------- -------------

NON-CURRENT LIABILITIES

Lease, Licence,

LTIP 496,576 301,379 324,044

496,576 301,379 324,044

------------------------- ------------- ------------- -------------

CURRENT LIABILITIES

Lease 87,074 96,884 96,905

Trade and other

payables 920,082 792,359 733,807

1,007,156 889,243 830,712

------------------------- ------------- ------------- -------------

TOTAL LIABILITIES 1,503,732 1,190,622 1,154,756

-------------------------- ------------- ------------- -------------

TOTAL EQUITY AND

LIABILITIES 7,666,626 9,098,801 8,294,040

========================== ============= ============= =============

UNAUDITED AND CONDENSED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2021

Called up Share premium Capital Retained earnings Total equity

share capital contribution

reserve

GBP GBP GBP GBP GBP

Balance

at 1 January

2020 2,681,913 26,371,502 125,000 (20,457,091) 8,721,324

Issue of

share capital 7,000 56,231 - - 63,231

Share based

payment - - - 65,649 65,649

Total comprehensive

income - - - (942,025) (942,025)

---------------------- --------------- -------------- -------------- ================== =============

Balance

at 30 June

2020 2,688,913 26,427,733 125,000 (21,333,467) 7,908,179

---------------------- --------------- -------------- -------------- ------------------ -------------

Changes

in equity

Issue of

share capital

(net of

expenses) 7,520 88,880 - - 96,400

Share based

payment - - - 73,284 73,284

Total comprehensive

income - - - (938,579) (938,579)

====================== =============== ============== ============== ================== =============

Balance

at 31 December

2020 2,696,433 26,516,613 125,000 (22,198,762) 7,139,284

====================== =============== ============== ============== ================== =============

Changes

in equity

Issue of

share capital 9,120 98,337 - - 107,457

Share based

payment - - - 83,665 83,665

Total comprehensive

income - - - (1,167,512) (1,167,512)

====================== =============== ============== ============== ================== =============

Balance

at 30 June

2021 2,705,553 26,614,950 125,000 (23,282,609) 6,162,894

====================== =============== ============== ============== ================== =============

UNAUDITED AND CONDENSED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2021

Unaudited Unaudited Audited

Half year Half year

to to Year to 31

30 June 30 June December

2021 2020 2020

GBP GBP GBP

EBITDA (874,193) (713,952) (1,415,921)

Decrease in working capital 216,287 93,241 325,975

Cash used in operations (657,906) (620,711) (1,089,946)

------------------------------------- ---------- ---------- ------------

Interest paid on lease liabilities (6,447) (8,448) (16,059)

Tax received - 32,424 32,424

Net cash from operating activities (664,353) (596,735) (1,073,581)

------------------------------------- ---------- ---------- ------------

Cash flows from investing

activities

Payments for intangible fixed

assets (218,286) (217,301) (425,848)

Payments for property, plant

and equipment (21,934) (17,083) (26,203)

Transfer from/(to) short-term

investments 403,518 - (1,617,820)

Interest received 9,922 33,570 43,172

Net cash from investing

activities 173,220 (200,814) (2,026,699)

------------------------------------- ---------- ---------- ------------

Cash flows from financing

activities

Share issue (net of expenses) 107,456 63,231 159,631

Payment of lease liabilities (48,421) (48,400) (96,821)

Net cash from financing

activities 59,035 14,831 62,810

------------------------------------- ---------- ---------- ------------

(Decrease) in cash and cash

equivalents (432,098) (782,718) (3,037,470)

Cash and cash equivalents

at beginning of period 4,928,021 7,965,491 7,965,491

Cash and cash equivalents

at end of period 4,495,923 7,182,773 4,928,021

===================================== ========== ========== ============

NOTES TO THE UNAUDITED AND CONDENSED CONSOLIDATED INTERIM

ACCOUNTS

FOR THE SIX MONTHSED 30 JUNE 2021

1. Basis of preparation and accounting policies

These interim statements have been prepared on a basis

consistent with International Financial Reporting Standards (IFRS).

They do not contain all of the information required for full

financial statements and should be read in conjunction with the

financial statements of the Company as at and for the year ended 31

December 2020. These interim financial statements do not constitute

statutory accounts within the meaning of the Companies Act.

The interim financial information has not been audited. The

interim financial information was approved by the Board of

Directors on 10 September 2021. The information for the year ended

31 December 2020 is extracted from the statutory financial

statements for that year which have been reported on by the

Company's auditors and delivered to the Registrar of Companies. The

audit report was unqualified and did not contain a statement under

s498 (2) or 498(3) of the Companies Act 2006.

The accounting policies applied by the Company in these interim

financial statements are the same as those applied by the Company

in its financial statements for the year ended 31 December

2020.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUPABUPGUBP

(END) Dow Jones Newswires

September 13, 2021 02:00 ET (06:00 GMT)

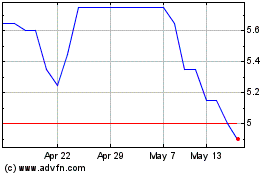

Blackbird (LSE:BIRD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Blackbird (LSE:BIRD)

Historical Stock Chart

From Jul 2023 to Jul 2024