TIDMAVG

Wednesday 9 September 2009

Avingtrans plc

("Avingtrans" or the "Group")

Final Results for the Year Ended 31 May 2009

Avingtrans plc (AIM:AVG), which designs, manufactures and supplies critical

components and associated services to the energy, medical, industrial and

global aerospace sectors, today announces its results for the twelve months

ended 31 May 2009.

Financial Highlights

* Turnover decreased by 8.9% to GBP37.6m (2008: GBP41.2m)

* Gross profit margin increased to 27.0% (2008: 26.5%)

* PBT1 increased to GBP2.0m (2008: GBP1.8m)

* Fully diluted, adjusted2 EPS of 6.2 pence per share (2008: 7.4 pence per share)

* Continued new investment of GBP2.4m in the business during the period

* Gearing reduced to 48.2% (2008: 66.8%)

1 - profit before tax adjusted to add back amortisation

2 - fully diluted earnings per share adjusted to add back amortisation and

exceptional items

Operating highlights

* New long term agreement signed with biggest Aerospace customer

* Warranty claim settled3 with former owners of B&D Patterns for GBP1.25m

* Major GBP4m Oil & Gas project successfully completed - further prospects in sight

* Metalcraft signed Letter of Intent with Cummins for supply of generator frames

* Contract extension signed with Siemens Healthcare for MRI equipment

* Jena-Tec won first major order from China - Asian market developing well

3 - post 31 May 2009

Commenting on the results, Roger McDowell, Chairman, said:

"It has been a very challenging 12 months for Avingtrans. Our performance was,

nonetheless, resilient in turbulent conditions, due to the inherent strength in

the core businesses and the actions taken by management to stabilise the Group.

I'm pleased, therefore, to report a performance in line with market

expectations. However, we expect that trading conditions will remain tough for

the foreseeable future, so steady progress is our aim over the next year."

Contacts:

Avingtrans plc

Tel. 01159 499 020

Steve McQuillan, CEO

Stephen King, Finance Director

KBC Peel Hunt Ltd

Tel. 020 7418 8900

Richard Kauffer, Corporate Finance

Matthew Tyler, Corporate Broking

Hansard Group

Tel. 020 7245 1100

Adam Reynolds

John Bick

About Avingtrans (www.avingtrans.plc.uk)

Avingtrans plc is engaged in the provision of highly engineered components and

services to the energy, medical, scientific and research communities, traffic

management, automation, machinery and aerospace industries worldwide. Organized

in three business segments:

Aerospace, engaged in the manufacture of rigid pipe assemblies and prismatic

components for aero engines and precision finishing of aircraft components;

Energy and Medical, engaged in the manufacture of machined and fabricated

pressure and vacuum vessels and components for the energy, medical, science and

research communities and design and manufacture of fabricated poles and

cabinets for roadside safety cameras and rail track signalling; and

Industrial products, engaged in the design, manufacture, distribution and

service of precision ballscrews, spindles and related linear and rotary

products servicing the original equipment and after markets in global industry.

2009 Preliminary statement

Chairman's statement

As the full impact of the financial downturn became apparent, we were forced to

revise down our view of performance earlier this year. Therefore, I'm pleased

to report that, economic gale force winds notwithstanding, we have been able to

meet those market expectations and sustain our previous year's performance,

despite reduced turnover. This is no mean feat in the current conditions,

however, we are far from complacent and further improvement is required.

Overall, it's a shame that the improvements in underlying efficiency the team

at Avingtrans have worked so hard for should be overshadowed by the state of

the global economy and its impact on the Group. Market conditions continue to

be challenging, resulting in the mixed trading results in the year to 31 May

2009. Despite this, we continue to make operational improvements that we expect

to bear fruit as the tide turns and markets pick up. The recovery cycle will be

variable across our three divisions and dependent on the activity of our blue

chip OEM customer base and our efforts in winning new business. The quality of

this base continues to give us confidence that we are well-placed when the

storm moderates.

As anticipated, our second half performance was substantially better than in

the first half, though Group revenues are down GBP3.7m year on year, due to a

slowdown in orders. A suite of lean manufacturing tools and cost cutting

measures had to be deployed aggressively to keep us on an even keel as markets

declined. In addition to our process change programme, we implemented a number

of tactical measures - eg: headcount reductions, short time working and salary

reductions, where appropriate (including at Board level). The underlying

softness in our Order Book in the second half of the year has continued into

the new financial year. However, the pace of decline has slowed and we would

expect to see modest recovery in the second half. Our pipeline of opportunities

continues to develop, for example with new Aerospace business emerging from GE,

new Industrial business from Eon and new Energy business with Cummins, amongst

others.

The strength of the team has stood us in good stead this year. We have

anticipated changes largely effectively, we're not scared to make tough

decisions and we're pragmatic enough to go for the best available course

through tricky waters, as they arise, determined to get the best shareholder

return.

We believe our strategy of building market-leading niche positions in our

defined market sectors is sound and this stance has been vindicated through the

downturn. Customers are commenting positively on our service and delivery

performance, backed by value for money and a deepening quality ethic. Further

work on the divisional strategies during this year has already brought new

business and some exciting future growth prospects. Whilst thoughts of M&A

activity have been subdued by the downturn, we continue to believe that

opportunities for complimentary acquisitions will present themselves as the

world economy rejuvenates. Executing our strategy will enable us to deliver

strong value growth to our shareholders and our market positions will allow us

to come out of the current cycle stronger than many of our competitors.

To summarise, my guarded optimism concerning our prospects at the half year

remains intact, if slightly battered by events and I look forward to steady

improvement, as the storm moderates and our markets recover.

As ever, improvements in our performance depend upon our people and it is their

dedication, skill and sheer hard work that have brought us through this

difficult period thus far. I would like once again to thank them wholeheartedly

for their continuing commitment to Avingtrans.

R S McDowell

Chairman

9 September 2009

Business Review

Group Performance

Turnover: Full year Group revenue was 9% less than the prior year, coming in at

GBP37.6m (2008: GBP41.2m). The decrease was mainly down to anticipated year on year

reductions at Metalcraft associated with the reduced volume of business from

Siemens and reduced volumes at Crown, pending approvals of the new SmartPoleTM

product. The only other area to suffer a significant decline in sales was

Aerospace, where sales to a major OEM were affected by changes in global market

conditions.

Profit: Notwithstanding the decline in turnover, our gross profit margins held

up well at 27% (2008: 26%) and operating profit was only modestly down at GBP2.4m

(2008: GBP2.6m), supported both by project completions and aggressive cost

cutting action in response to demand reductions. Profit before tax and

amortisation was actually up year on year to GBP2.0m (2008: GBP1.8m) and EBITDA was

sustained at the previous level of GBP4.1m (2008: GBP4.1m).

Earnings Per Share (EPS): Adjusted diluted earnings per share, for the period

ending 31 May 2009, was 6.2p (2008: 7.4p) based on 21.9m (diluted weighted

average) shares following the placing of 7m shares in October 2008 and the

issue of a further 850,000 shares in respect of part of the consideration for a

further 18.2% of the issued share capital of Sigma.

Funding and Liquidity: The net cash flow from operations was just GBP0.4m (2008:

GBP2.8m), but we note that working capital of GBP1.6m was still tied up in

Metalcraft's floating production system project at year end, now complete. Net

indebtedness at year end was GBP10.1m, GBP0.7m lower than at the prior year end

(2008: GBP10.8m). Balance sheet gearing was 48.2%, down from 66.8% at 31 May

2008. In addition, continued investment in the business of GBP2.4m shows our long

term confidence in our position going forward.

Taxation: The effective rate of tax was 38.3% (2008: 32.4%). As reported in the

2008 Annual Report, the withdrawal of industrial building allowances gave rise

to an additional tax charge of GBP382k for the year ending 31 May 2009. This

exceptional charge has been recognised in full. This was partly offset by GBP240k

of claims for R&D tax credits, but still resulted in a greater than would be

normally expected tax charge.

Dividend: Whilst the Board supports a progressive dividend policy, we continue

to believe that it is prudent to preserve cash in the business at present and,

consequently, recommend that no final dividend should be paid (2008: 0.75p per

share). Looking forward, the Board will keep the dividend position under

review, taking account of the on-going changes in trading position in our

markets.

Strategy

Avingtrans is a precision engineering group, operating in differentiated niches

in the supply chains of many of the world's best known OEMs. Our strategy of

building market-leading positions in our defined sectors is robust and

beginning to bear fruit. The overall strategic thrust focuses on three elements

across all divisions:

* Customers: developing our key accounts and partnering or acquiring assets

to provide customers with integrated product and service offerings

* Channels: developing new channel partners in new territories and markets

with existing product capabilities

* Capabilities: strengthening core group know-how in design and manufacturing

to reduce costs and deepen our value added to our customers.

As evidence of this strategic direction, during the past financial year, we

have:

* Secured new long term contracts with key customers in each division - eg

with a major Medical OEM in the Energy and Medical division.

* Developed new markets in Asia and North America with new partners - eg for

Industrial Products in China.

* Implemented projects to increase efficiency and reduce costs - eg lean

manufacturing initiatives in Aerospace leading to increased business with a

major OEM.

A particular strategic focus for all of our divisions is the development of the

business potential in China. We continue to invest cautiously in the Aerospace

business that we have already based there and the first real investments have

commenced for Metalcraft in the same geographic region. The Industrial Products

division has, thus far, limited itself to new channel partners and customers in

China, though we believe that wider opportunities exist to develop the linear

motion market.

Operations

Energy and Medical

The Energy and Medical Division has seen a reduction in overall business this

year, as the Siemens contract with Metalcraft stabilised at a lower level than

hitherto. We successfully concluded negotiations with Siemens concerning new

long term contract terms and conditions, including a new agreement on pricing,

which has now been extended to October 2010. Positive discussions continue on

future business. The net 16% reduction in turnover in the division - driven by

reductions from Siemens and the new product introduction at Crown - hides

growth in other sectors. We were able to improve margins at Metalcraft, despite

the reduction in medical business, by tight cost control and by making the most

of the replacement business that we won last year, some examples of which

follow.

In the medical arena, an initial order for Proton Therapy equipment secured

early in the year has been followed by an agreement to provide further systems.

We are making good progress in the energy sector, with a number of exciting

prospects. Chief amongst these is our developing relationship with Cummins to

produce generator frames for the Industrial Gas Turbine market. We expect this

to become a significant business stream for Metalcraft over the next few years,

with deliveries to commence during the next twelve months. Nuclear sector

prospects are also promising, with positive indications on repeat nuclear

decommissioning and replacement reprocessing business.

Our large scale (GBP4m) Oil and Gas project was largely completed by year end and

has since been signed off by the customer. The delivery of this very successful

project bodes well for future energy projects and we are quoting on further

projects as a result.

In the Marine sector, Metalcraft's completion of four diving bells for UK

customers and two submersible pressure hulls led to another commercial diving

contract, now under construction.

The team at Metalcraft also showed great adaptability in winning an order for

architectural steel worth just less than GBP1m, which will be completed during Q1

/Q2 of the new financial year.

Strategically, we made the first investments for our Metalcraft China facility

and we expect to commence production there during 2009. Several customers have

expressed interest in our plans and discussions are on-going regarding new

business that we will base in Chengdu.

For Crown International, order volumes for camera poles were very subdued in

the past 12 months, as OEMs minimised stock positions in anticipation of

standardising on the new SmartPoleTM design. Delays in Home Office Approvals

further impacted sales, but we have now received first orders for the new poles

from a number of OEMs, including first orders from Siemens, so order levels

should begin to replenish.

Crown also received a design contract from Balfour Beatty for the design of a

new concept motorway variable signage pole, which we expect to lead to material

orders in the coming year.

Industrial Products

Industrial Products had a very good first half year, but saw a weakening of

demand over the second half as market conditions deteriorated worldwide.

Nonetheless, with revenues up by 16% compared with last year, this was still a

very successful year for Jena-Tec, with the increase in business also carrying

through to improved margins. The division is delivering its strategy of

developing niche, high-precision engineered components, coupled with a

diversification of its product strategy to include factored products and

related equipment.

We responded to the market slowdown in the second half with headcount

reductions and cost cutting to right size the operations for current

conditions. These were largely successful in sustaining business performance to

our financial year end.

Jena-Tec has successfully opened up new sales channels in linear motion and

developed new routes to market in China, USA, Korea and India, amongst others,

with large new orders being won, eg in China, as previously announced. Our

efforts to reduce our cost base by sourcing parts from India and China have

also been successful and we will continue to expand on this initiative.

The acquisition of the trade and assets of the Moss Group in February 2009

provides access to the servicing and repair aftermarket and specialist machine

attachments that compliment the division's high precision product range. We

have already seen some new orders in this area and future prospects are bright.

The global machine tools market remains sluggish and this will slow our

development in FY10, though we will seek to counter this with wider product

offerings in linear motion and actuation solutions, directly and in conjunction

with OEM partners.

Aerospace

The Aerospace Division has had a disappointing year overall from a financial

point of view, though we can take positives out of the progress made in each

business. The decline in civil aerospace markets is quite severe from a supply

chain perspective, with each of the businesses suffering from delays and cuts

to programme volumes in various ways, resulting in an overall decline in

turnover of 13%. To improve efficiency and to manage this decline, the division

has cut costs accordingly, though this was not enough to avoid a small loss in

the year, allowing for the fact that on-going material investment in Sigma,

China continues.

The decline in global aerospace markets has put a brake on our activities in

China, with all customers significantly delaying orders and deliveries for new

programmes that had been scheduled to commence in volume by now. As a result

Sigma has not yet reached break-even as expected, though we are still making

progress - just more slowly than we previously planned. Strong support for our

Chinese capability continues to be expressed by major aerospace customers and

we have introduced over 400 new parts to date for customers. We believe that

the order flow will still allow us to achieve profitability during the new

financial year. During the year, we completed a deal to acquire most of the

remaining equity in Sigma and settle future deferred consideration obligations.

B&D Patterns has worked hard on improving quality and delivery performance this

year and this has been underpinned by a new long term agreement with their

biggest customer. However, global aerospace market conditions have meant that

the business has run hard to stand still, with sharp headcount reductions, site

consolidation and cost cutting measures all being rolled out to maintain our

position. Conversely, we made excellent progress in our lean manufacturing

deployment, as recognised by a 60% increase in business from one key customer

and we completed the certification of a new fastener product range in record

time, securing GBP0.5m of initial orders in the process.

After year end, in July 2009, we came to an agreement in our favour with the

former owners of B&D to settle our on-going warranty claim for GBP1.25m,

inclusive of costs.

Although C&H had a reasonable year overall, they also saw some softening in

demand, as the aerospace supply chain adjusted to lighter forward order books

and this necessitated headcount reductions and tight cost control. The new C&H

facility in Cheltenham ramped up capacity successfully, providing a range of

polishing services, principally to Messier Dowty at present.

People

We were delighted to welcome Steve McQuillan as CEO to the Board in October

2008. This allowed Roger McDowell to move permanently into the post of

Non-executive Chairman. Post year end, we have further strengthened the Board

with the addition of Dr Graham Thornton, as a Non-executive Director, from

September 2009. Graham's considerable experience across a number of pertinent

sectors will add greatly to the Board's strength.

We also strengthened the Divisional senior management teams in the three

divisions, as we seek to improve our long term management capability across all

the businesses. The introduction of the standard CSOP share option scheme

recently announced will allow us to align rewards for our key people with the

interests of shareholders.

Although the recession has temporarily increased the availability of skilled

engineering and production staff, we believe that a structural shortage in

these skills still exists in the UK. Therefore, Metalcraft was delighted to be

chosen to host the Fenland Engineering School of Excellence at Chatteris, which

will enable us to grow and access young technical talent as it develops in this

area.

Outlook

Given on-going global economic weakness, risks of reduced demand in the

Aerospace and Industrial Products divisions remain prevalent. Actions that we

took to cut costs were very important to insulate ourselves to some degree from

the market changes that are still taking place. The markets for our Energy and

Medical division have also been affected and, thus, they have also taken cost

reduction actions to adjust to changing sector conditions as required.

Whilst we do not expect there to be a swift recovery in any of our major

markets, the strategic development work that we have undertaken will help us to

take advantage of any fragile improvements in market conditions by using our

positions to win new business, both with existing customers and with new

accounts. Therefore, we expect steady improvement in our financial performance

for the coming year, unless there is further material deterioration in market

conditions.

Our strategy to focus on differentiated highly engineered product niches with

long term growth and sustainable competitive advantage, thus offering a degree

of protection to cyclical market weaknesses. Overall, we remain well placed to

benefit from structural changes in our markets and to grow as global industrial

markets recover.

Roger McDowell Steve McQuillan Stephen King

Chairman Chief Executive Officer Finance Director

9 September 2009 9 September 2009 9 September 2009

Consolidated Income Statement

for the year ended 31 May 2009

Year to Year to

31 May 31 May

2009 2008

GBP'000 GBP'000

Revenue 37,559 41,247

Cost of sales (27,427) (30,324)

Gross profit 10,132 10,923

Distribution costs (955) (944)

Administrative expenses (6,706) (7,249)

Operating profit before share based 2,471 2,730

payments and amortisation / impairment of

intangibles

Share based payment 88 (25)

Amortisation of intangibles from business (137) (137)

combinations

Operating profit 2,422 2,568

Finance income 2 6

Finance costs (595) (880)

Profit before taxation 1,829 1,694

Taxation (701) (549)

Profit for the financial year 1,128 1,145

Earnings per share :

From continuing operations

- Basic 5.1p 6.5p

- Diluted 5.1p 6.4p

All the above results are from continuing operations

Consolidated statement of total recognised income and expense

for the year ended 31 May 2009

Year to Year to

31 May 31 May

2009 2008

GBP'000 GBP'000

Exchange differences on translation of 338 335

foreign operations

Net movement recognised directly in equity 338 335

Profit for the financial year 1,128 1,145

Total recognised income and expense for the 1,466 1,480

year

Consolidated cash flow statement

for the year ended 31 May 2009

Note Year to Year to

31 May 31 May

2009 2008

GBP'000 GBP'000

Operating activities

Cash flows from operating activities 356 2,819

Finance costs paid (597) (902)

Income tax paid (145) (757)

Net cash (outflow)/ inflow from operating (386) 1,160

activities

Investing activities

Finance income 2 6

Acquisition of subsidiaries - (16)

Acquisition of investment - (219)

Purchase of intangible assets (420) (411)

Purchase of property, plant and equipment (2,022) (607)

Proceeds from sale of property, plant and 19 53

equipment

Proceeds from sale of investments - 19

Net cash used in investing activities (2,421) (1,175)

Financing activities

Dividends paid (132) (220)

Repayments of borrowings (642) (1,044)

Repayments of obligations under finance (1,103) (873)

leases

Proceeds from issue of ordinary shares 3,654 34

Borrowings raised 1,271 869

Net cash inflow/(outflow) from financing 3,048 (1,234)

activities

Net increase/(decrease) in cash and cash 241 (1,249)

equivalents

Cash and cash equivalents at beginning of (2,534) (1,302)

period

Effect of foreign exchange rate changes 38 17

Cash and cash equivalents at end of year (2,255) (2,534)

Cash generated from operations:

for the year ended 31 May 2009

Year to Year to

31 May 31 May

2009 2008

GBP000 GBP000

Continuing operations

Profit before income tax 1,829 1,694

Adjustments for:

Depreciation 1,434 1,287

Amortisation and impairment of intangible 264 227

assets

(Profit) on disposal of property, plant (9) (20)

and equipment

(Profit) on disposal /impairment of - (7)

investment

Finance income (2) (6)

Finance expense 595 880

Share based payment (credit)/charge (88) 25

Changes in working capital

(Increase) in inventories (255) (327)

(Increase)/decrease in trade and other (1,845) 1,660

receivables

(Decrease) in trade and other payables (1,584) (2,619)

Other non cash charges 17 25

Cashflows from operating activities 356 2,819

Summarised consolidated balance sheet

at 31 May 2009

2009 2008

GBP'000 GBP'000

Non current assets

Goodwill 10,242 10,242

Other intangible assets 1,941 1,784

Property, plant and equipment 11,308 10,560

Deferred tax 38 24

Available for sale financial assets 219 219

23,748 22,829

Current assets

Inventories 6,952 6,480

Trade and other receivables 8,914 6,984

Current tax asset 321 196

Cash and cash equivalents 634 548

16,821 14,208

Total assets 40,569 37,037

Current liabilities

Trade and other payables (6,323) (7,278)

Obligations under finance leases (1,247) (935)

Borrowings (3,543) (3,591)

Current tax liabilities (759) (489)

Total current liabilities (11,872) (12,293)

Non-current liabilities

Borrowings (4,264) (5,034)

Obligations under finance leases (1,729) (1,789)

Deferred tax (1,436) (1,003)

Deferred consideration (200) (750)

Total non-current liabilities (7,629) (8,576)

Total liabilities (19,501) (20,869)

Net assets 21,068 16,168

Equity

Share capital 1,274 882

Share premium account 9,534 6,272

Capital redemption reserve 814 814

Merger reserve 402 402

Translation reserve 636 298

Other reserves 180 180

Retained earnings 8,228 7,320

Total equity attributable to equity 21,068 16,168

holders of the parent

Notes to the preliminary statement

31 May 2009

1. Segmental analysis

Year ended 31 May 2009 Aerospace Energy and Industrial Unallocated Total

Medical Products Central

items

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 10,716 17,509 9,334 - 37,559

Operating (loss)/profit (73) 1,583 1,051 (139) 2,422

Net finance costs (593)

Taxation (701)

Profit after tax 1,128

Segment assets 14,917 17,058 8,250 344 40,569

Segment liabilities (5,243) (5,687) (3,323) (5,248) (19,501)

Net assets/ 9,674 11,371 4,927 (4,904) 21,068

(liabilities)

Capital expenditure 798 388 1,256 - 2,442

Depreciation and 726 552 420 - 1,698

amortisation

Year ended 31 May 2008 Aerospace Energy and Industrial Unallocated Total

Medical Products Central

items

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 12,333 20,863 8,051 - 41,247

Operating profit/(loss) 484 1,492 808 (216) 2,568

Net finance costs (874)

Taxation (549)

Profit after tax 1,145

Segment assets 14,540 15,407 6,746 344 37,037

Segment liabilities (6,355) (6,415) (2,428) (5,671) (20,869)

Net assets/ 8,185 8,992 4,318 (5,327) 16,168

(liabilities)

Capital expenditure 411 391 216 - 1,018

Depreciation and 712 532 270 - 1,514

amortisation

Geographical segment

2009 2008 2009 2008 2009 2008

Revenue Revenue Net Net Capital Capital

assets assets expenditure expenditure

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

United Kingdom 29,163 31,075 16,420 11,895 1,145 647

Europe 7,829 7,954 5,397 4,908 1,058 159

North America 1,407 2,607 (417) (383) - 1

Rest of the World 616 810 (332) (252) 239 211

Eliminations (1,456) (1,199) - - - -

37,559 41,247 21,068 16,168 2,442 1,018

2. Taxation

2009 2008

GBP'000 GBP'000

Current tax 283 563

Deferred tax 418 (14)

701 549

3. Earnings per share

2009 2008

No No

Weighted average number of shares - basic 21,933,317 17,604,810

Warrant/ Share Option adjustment 6,961 174,615

Weighted average number of shares - diluted 21,940,278 17,779,425

GBP'000 GBP'000

Earnings attributable to shareholders 1,128 1,145

Share-based payments (88) 25

Amortisation of intangibles 137 137

Sigma deferred consideration release (201) -

Withdrawal of IBA's 383 -

Adjusted earnings attributable to shareholders 1,358 1,307

Basic earnings per share 5.1p 6.5p

Adjusted basic earnings per share 6.2p 7.4p

Diluted earnings per share 5.1p 6.4p

Adjusted diluted earnings per share 6.2p 7.4p

4. Preliminary statement

This preliminary statement, which has been agreed with the auditors, was

approved by the Board on 9 September 2009. It is not the Group's statutory

accounts. Statutory accounts will be sent to shareholders shortly.

The statutory accounts for the two years ended 31 May 2008 and 2007 received

audit reports which were unqualified and did not contain statements under s237

(2) or (3) of the Companies Act 1985. The statutory accounts for the year ended

31 May 2008 have been delivered to the Registrar of Companies but the 31 May

2009 accounts have not yet been filed.

5. Annual report and Accounts

The Report and Accounts for the year ended 31 May 2009 will be posted to

shareholders on or around 21 September 2009. Further copies will be available

from the Avingtrans' registered office:

Precision House, Derby Road, Sandiacre, Nottingham, NG10 5HU

Copies will also available on the Group's website www.avingtrans.plc.uk

6. Annual General Meeting

The Annual General Meeting of the Group will be held at The Holiday Inn,

Bostocks Lane, Sandiacre, Nottingham NG10 5NL at 10.00 a.m. on 14 October 2008.

END

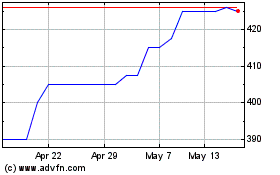

Avingtrans (LSE:AVG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Avingtrans (LSE:AVG)

Historical Stock Chart

From Jul 2023 to Jul 2024