Embargoed: 0700hhrs, 6 September 2006

Avingtrans plc

("Avingtrans" or the "Group")

Final Results for the Year Ended 31 May 2006

Highlights

* Turnover up significantly to �32.5m (2005: �24.3m)

* Profit after tax increased to �2.0m (2005: �1.3m)

* Basic earnings per share before goodwill amortisation of 16.2p (2005:

13.6p)

* Gearing reduced to 26% (2005: 41%)

* Dividend proposed - 0.5p per share (2005: 0.5p)

* Acquisition of 75% of Sigma for consideration of �0.3 million completed on

19 June 2006

Ken Baker, Chairman, commented,

"The year ended 31 May 2006 has been a further year of profitable growth and

consolidation. The acquisition of Sigma post year end has opened up new

opportunities in the aerospace industries and in China."

Contacts

Avingtrans plc Hansard Communications

Tel. 01159 499 020 Tel. 020 7245 1100

Ken Baker, Chairman Ben Simons

Stephen King, Finance Director

Chairman's statement

On behalf of the Board of Directors, I am pleased to announce the results for

Avingtrans plc for the year ended 31 May 2006 in which the Group attained a new

record level of order intake, turnover and after tax earnings since joining AIM

in June 2002.

The year under review contains the first full year of activity of our October

2004 acquisition Stainless Metalcraft Limited (SMC) and has been a period

largely concerned with integrating, managing and developing SMC and our

continuing businesses for profitable growth. A number of acquisition

opportunities were reviewed during the year and some remain active.

Demand for the Groups products remained generally strong throughout the year

with better than expected performance at both C&H Precision Limited (C&H) our

aerospace component finishing facility and the Jena group of companies which

provide ballscrew actuator products and services for the medical, aerospace and

machinery industries in the EU and USA. Order intake at Crown UK made a good

recovery in the second half of the year. Sales at SMC to its major customers

for MRI scanner components, after a good first half, were significantly lower

than planned in the last quarter due to a softening of demand in the US market

and related inventory and manufacturing adjustments by the major MRI OEMs. The

Company continued to review this situation and the broadening of the customer

base at SMC.

Financial performance

Earnings before interest, tax, depreciation and goodwill amortisation (EBITDA)

was �4.1m (2005: �3.2m) up 28% on improved turnover of �32.5m (2005: �24.3m) an

increase of 34%.

Operating profit for the period was �2.8m (2005: �2.3m). Profit after tax was �

2.0m (2005: �1.3m) an increase of 51%, representing a 15.5% return on net

assets.

Basic earnings per share before goodwill amortisation for the year was 16.2p

(2005: 13.6p) an increase of 19%.

Cash flow from operating activities for the year was �2.7m (2005: �3.9m) with

net cash at bank and in hand at the year-end of �1.2m (2005: �0.7m). The net

debt at the year-end was �3.3m (2005: �4.2m) resulting in a gearing reduction

to 26% (2005: 41%).

Dividend

In light of the financial performance highlighted above the Board is

recommending to the shareholders at the AGM a final dividend of 0.5p per share

making a total of 1.0p for the year (2005: 0.5p). This will be paid on 10

November 2006 to shareholders on the register at 15 September 2006.

Acquisitions and investments

The acquisition of 75% of Sigma for a consideration of �0.3 million was

completed after the year end on 19 June 2006. The funding for the acquisition

was from the Group's cash reserves. Sigma is currently operating as an

engineering and procurement consultancy for the EU and USA aerospace industry

with offices in Chengdu, Sichuan Province, China and Tamworth, England. Its

plan with Avingtrans is to develop a manufacturing presence in Chengdu for the

supply of precision components to the growing Chinese aerospace industry and to

cover existing and increasing demand from the EU and USA.

The Group continued its policy of investment in profit and efficiency enhancing

equipment throughout the year. Jena saw the final installation and

commissioning of a state of the art PC based Bosch test unit for high frequency

motorised spindles in its Nottingham facility. A number of new pieces of

equipment were also brought on line at SMC and Jena, Germany. Improvements to

building and the environment were carried out throughout the Group. Capital

expenditure for the year totalled �1.2 million and remains ahead of the costs

of depreciation.

Review of the year

SMC, our largest operating subsidiary, continued its strong performance during

the first nine months of the year with an increase in delivery of MRI scanner

components to a number of the worlds largest MRI scanner OEMs and the delivery

of scientific products to a number of EU companies and scientific institutions.

A long term strategic review with Siemens was completed during the year which

resulted in the raising of SMC to the status of a tier one supplier of MRI

scanner components and the signing in April 2006 of a rolling two year supply

agreement. Work continued on the broadening of the customer base at SMC with

successful bids for scientific and research projects with international

research institutions including ILL in Grenoble and CERN in Switzerland.

The Jena group of companies successfully improved its performance during the

year with improved sales of its ballscrew actuator and machine spindle products

and services in all three locations in the UK, USA and Germany. Performance and

order intake was particularly robust in Germany on the back of a strongly

recovering German engineering economy. Efforts continued in the year in our

pursuit of new customers and acquisitions in this operation.

C&H continued to strengthen its position in the aerospace market as a supplier

of precision polishing and finishing services with deliveries of finished

blades increasing significantly during the year. A new three year agreement

with Rolls Royce for the precision polishing of turbine and compressor blades

and vanes for a variety of aero engines was entered into. Other polishing and

finishing work on landing gear legs for aerospace applications was taken up in

the second half of the year as the unit continued to expand its operations to

meet with the increased demand for its services.

Crown UK Limited (Crown), the Group's Bristol based road speed camera pole and

railway signalling pole design and manufacturing facility recovered strongly in

the second half of the year following the issue of the much delayed government

report on road speed cameras in November 2005. Activity was centred on service

work and the replacement of conventional camera installations with the latest

digital cameras, which are of greater accuracy and require lower maintenance.

Railway work was still difficult to come by during the year as programmes of

development on the major inter-city routes continue to be held up in the

planning stage. A number of overseas contracts were tendered for with some

success in Canada, the mid-east and Australia.

Two prototype camera housings were manufactured by Crown for Vehicle Sensor

Technology Limited (VST) the newly formed Avingtrans Subsidiary who signed an

exclusive worldwide 5 year renewable supply and service agreement with Vehicle

Occupancy Limited, the owner of a patented system for the detection of the

number of people in a motor vehicle. The system, which is still undergoing

development, will make it easier to enforce priority lanes for car sharing

initiatives and for differential tolling on roads, bridges, tunnels and car

parks.

Directors and senior management

Avingtrans has continued to strengthen its senior management team and we

welcomed a new Managing Director to Jena Germany.

In accordance with the Articles of Association, Jeremy Hamer retires from the

Board in rotation and offers himself for re-election at the AGM scheduled for

11 October 2006.

Share warrants

K M Baker (772,000) and S J Lawrence (398,000) exercised share warrants in the

Company in February and March 2006 under investment and performance contracts

entered into in 2002. The shares were awarded at a price of 50p each. In total

748,000 were sold into the market and 422,000 were retained by the two

directors. As well as receiving the income from the issue of the shares during

the year the Company also benefited from a tax credit of �300,000 in respect of

the share issue.

Outlook

Order intake and sales continue to be very encouraging at C&H, Jena and Crown

though some work for Crown on railway signalling may be postponed until the

second half of FY 2007. The weakening US dollar and a softening US market does

appear to be slowing growth in the MRI scanner market so reducing growth

prospects at SMC in this product area. The Company has been developing other

market areas and products for SMC are expected to keep SMC at full capacity

particularly in the second half of the current year.

Since the acquisition of Sigma two managers have expatriated to China, a

Chinese management team has been put in place, the first batch of machine tools

have been ordered and we expect to be operational in a new 30,000sq/ft facility

by the end of 2006 as planned. A letter of intent to purchase components for up

to �2 million per annum has been received by Sigma.

Work also continues on the processing of suitable acquisition opportunities

with a number under review.

With most major economies remaining strong and the products and services

offered by the Group remaining in demand we look forward to another year of

profitable growth

In closing I should like once again on behalf of the Board to heartily

congratulate and thank all of the employees and co-workers for their successful

efforts in the past year.

K M Baker

Chairman

6 September 2006

Consolidated profit and loss account

for the year ended 31 May 2006

Note 2006 2005

(as

restated)

�'000 �'000

Turnover 1 32,490 24,329

Cost of sales (24,813) (17,821)

Gross profit 7,677 6,508

Selling and distribution expenses (595) (765)

Administration expenses and goodwill (4,287) (3,479)

amortisation

Operating profit:

Operating profit before goodwill 3,188 2,542

amortisation

Goodwill amortisation (393) (278)

Operating profit 2,795 2,264

Interest receivable 4 5

Interest payable (349) (300)

Profit on ordinary activities before 1 2,450 1,969

taxation

Taxation on profit on ordinary activities 2 (489) (668)

Profit for the financial year 1,961 1,301

Earnings per share - basic 3 13.5p 11.2p

Earnings per share - diluted 3 12.6p 10.6p

All the above results are from continuing operations

Consolidated statement of total recognised gains and losses

for the year ended 31 May 2006

2006 2005

�'000 �'000

Profit for the financial year 1,961 1,301

Other recognised gains and losses

- exchange gains on translation of foreign 8 37

subsidiaries

Total recognised gains and losses relating to 1,969 1,338

the year

Reconciliation of movements in shareholders' funds

2006 2005

(as restated)

�'000 �'000

Profit for the financial year 1,961 1,301

Issue of shares 585 4,144

Exchange gains on translation of foreign 8 37

subsidiaries

Dividends (148) -

Net change to shareholders' funds 2,406 5,482

Shareholders' funds at 1 June 10,240 4,758

Shareholders' funds at 31 May 12,646 10,240

Summarised consolidated cash flow statement

for the year ended 31 May 2006

2006 2005

�'000 �'000

Net cash inflow from operating activities (see 2,710 3,917

below)

Returns on investment and servicing of finance (365) (249)

Taxation (529) (266)

1,816 3,402

Capital expenditure and financial investment (396) (558)

Acquisitions (100) (8,154)

Equity dividends paid to shareholders (148) -

Management of liquid resources - -

Financing (687) 5,521

Increase in net cash (see note 4) 485 211

Note: reconciliation of operating profit to net cash inflow from operating

activities

2006 2005

�'000 �'000

Operating profit 2,795 2,264

Depreciation charges 898 627

Goodwill amortisation 393 278

(Gain)/loss on sale of tangible fixed assets (6) 1

Impairment of investment 11 33

Decrease/(increase) in stocks 1,127 (764)

Decrease/(increase) in debtors 595 (1,016)

(Decrease)/increase in creditors (3,103) 2,494

Net cash inflow from operating activities 2,710 3,917

Summarised consolidated balance sheet

at 31 May 2006

2006 2005

(as restated)

�'000 �'000

Fixed assets

Intangible assets 6,777 6,739

Tangible assets 6,203 5,869

Investments 15 26

12,995 12,634

Current assets

Stocks 3,190 4,566

Debtors 4,931 5,495

Cash at bank and in hand 1,398 909

9,519 10,970

Creditors: amounts falling due within one (6,284) (9,366)

year

Net current assets 3,235 1,604

Total assets less current liabilities 16,230 14,238

Creditors: amounts falling due after more (3,334) (3,801)

than one year

Provisions for liabilities and charges (250) (197)

Net assets 12,646 10,240

Capital and reserves

Called up share capital 771 713

Share premium account 4,310 3,783

Capital redemption account 813 813

Other reserves 180 180

Profit and loss account 6,572 4,751

Equity shareholders' funds 12,646 10,240

Notes to the preliminary statement

31 May 2006

1. Segmental analysis

Class of business

Turnover Profit before Tax Net Assets

2006 2005 2006 2005 2006 2005

�'000 �'000 �'000 �'000 �'000 �'000

By class of

business

Precision 10,189 9,454 1,161 819 3,851 3,385

Engineering

Medical and 22,301 14,875 2,065 1,510 4,213 4,042

Scientific

Unallocated central - - (431) (65) 4,582 2,813

items

Net Interest - - (345) (295) - -

Total 32,490 24,329 2,450 1,969 12.646 10,240

Turnover by geographical market

Precision Medical and Total Total

Engineering Scientific

2006 2006 2006 2005

�'000 �'000 �'000 �'000

Turnover by geographical origin

United Kingdom 5,524 22,301 27,825 20,127

Europe 4,588 - 4,588 4,124

North America 77 - 77 78

Total 10,189 22,301 32,490 24,329

Turnover by geographical destination

United Kingdom 5,341 20,118 25,459 18,483

Europe 3,929 1,548 5,477 4,655

North America 773 635 1,408 1,074

Rest of World 146 - 146 117

Total 10,189 22,301 32,490 24,329

2. Taxation

2006 2005

�'000 �'000

UK corporation tax 307 645

Foreign tax 129 -

Current taxation 436 645

Deferred taxation 53 23

Group tax on profit on ordinary activities 489 668

3. Earnings per share

2006 2005

No No

Weighted average number of shares - basic 14,544,793 11,594,530

Warrant/ Share Option adjustment 1,029,810 653,485

Weighted average number of shares - diluted 15,574,603 12,248,015

�'000 �'000

Earnings attributable to shareholders 1,961 1,301

Earnings attributable to shareholders before 2,354 1,579

goodwill amortisation

Basic earnings per share 13.5p 11.2p

Basic earnings per share before goodwill 16.2p 13.6p

amortisation

Diluted earnings per share 12.6p 10.6p

4. Analysis of net debt

1 June Cashflow Other non-cash Exchange 31 May

Move-ments

2005 Changes 2006

�'000 �'000 �'000 �'000 �'000

Cash at bank and in 909 485 - 4 1,398

hand

Bank overdrafts and (173) - - (2) (175)

loans

736 485 - 2 1,223

Bank loans (3,468) 608 - - (2,860)

Hire purchase (1,485) 664 (830) (3) (1,654)

leases

(4,953) 1,272 (830) (3) (4,514)

Net debt (4,217) 1,757 (830) (1) (3,291)

5. Preliminary statement

This preliminary statement, which has been agreed with the auditors, was

approved by the Board on 5 September 2006. It is not the Company's statutory

accounts. Statutory accounts will be sent to shareholders shortly.

The statutory accounts for the two years ended 31 May 2005 and 2004 received

audit reports which were unqualified and did not contain statements under s237

(2) or (3) of the Companies Act 1985. The statutory accounts for the year ended

31 May 2005 have been delivered to the Registrar of Companies but the 31 May

2006 accounts have not yet been filed.

END

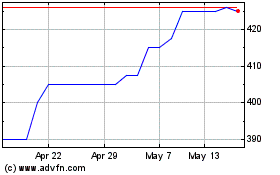

Avingtrans (LSE:AVG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Avingtrans (LSE:AVG)

Historical Stock Chart

From Jul 2023 to Jul 2024