TIDMAUK

RNS Number : 9625D

Aukett Swanke Group PLC

27 June 2023

Aukett Swanke Group Plc

("Aukett Swanke", the "Company", or, together with its

subsidiaries, the "Group")

Interim results

For the six months ended 31 March 2023

Aukett Swanke (AIM: AUK), the group providing Smart Buildings,

Architectural and Design Services, is pleased to announce its

interim results for the six-month period ended 31 March 2023.

Highlights

- Revenue from continuing operations increases to GBP4.56m (2022: GBP4.53m)

- Revenue less sub consultant costs increases to GBP4.40m (2022: GBP3.38m)

- United Kingdom increases profit before group costs to GBP130k (2022: GBP40k)

- Continental Europe increases profit before group costs to GBP257k (2022: GBP123k)

- Loss for the period GBP0.48m, impacted by one-off Torpedo

Factory Group ("TFG") acquisition costs

- Improving markets & strengthening order book

- Ranked 48(th) largest firm by number of UK architects (up from 70(th) ) in the AJ100

- Acquisition of TFG just before period end to expand Smart

Buildings strategy and broaden asset base and revenue streams

- Appointment, today, of Freddie Jenner to the board as Chief Operating Officer

Commenting, Chief Executive Nick Clark said, "I am thrilled to

have been appointed as Chief Executive, and excited by our mission

creating a UK-listed Smart Buildings group. Against a backdrop of

improving trading performance, I look forward to reporting on our

progress in the coming months."

Contacts

Aukett Swanke Group Plc

+44 (0) 20 7843 3000

Clive Carver, Chairman

Nick Clark, Chief Executive

Strand Hanson Limited, Financial and Nominated Adviser +44 (0)

20 7409 3494

Richard Johnson, James Bellman

Zeus Capital Limited, Broker +44 (0) 20 3829 5000

Simon Johnson, Louisa Waddell

Investor/Media + 44 (0) 7979 604 687

Chris Steele

An electronic version of the Interim Report will be available on

the Group's website (www.aukettswankeplc.com).

Chairman's Statement

Introduction

I am pleased to present the interim results for the six months

ended 31 March 2023.

At the end of the reporting period, we acquired Torpedo Factory

Group ("TFG"), and welcomed Nick Clark as Chief Executive. Further

below he introduces the TFG businesses and describes in more detail

the concept of Smart Buildings, and how this is being incorporated

into the Group's strategy.

The evolution of architecture

We acquired TFG in March 2023, principally as a means of

embracing the increasing use of technology in the design,

construction and management of buildings. We believe we are one of

the first in our profession to make such a move and look forward to

developing a leading presence in the Smart Buildings space, while

continuing to develop our long established architecture

businesses.

The TFG acquisition also gave us access to further funding and

has allowed us to transition key senior management positions to the

next generation, bringing the Board more into line with our staff

and clients generally.

Restructuring the architecture business completed

Restructuring work to improve the core profitability of our

traditional architecture businesses is now complete. The UAE

business has been sold and the international offices, other than

those in Germany, have either been closed or are moving onto a

licence basis with local management being responsible for

profitability.

Our core architecture businesses now comprise our design and

executive architecture businesses in the UK and our direct

investments in the Berlin and Frankfurt practices.

As set out in greater detail in the report from the Chief

Executive, we have experienced growth in each of the core

architecture markets necessitating the recruitment of 13 full time

equivalent additional architects in our UK operations since the

beginning of the financial year, which places the Group 48(th)

largest by number of UK employed architects, based on AJ100

compiled by Architects' Journal. This is a rise from 70(th) place

last year.

Smart Buildings

The Group's approach to Smart Buildings is set out in detail in

the accompanying Chief Executive's report.

Board update

During the period under review and subsequently we have welcomed

a number of new members to the Board to help deliver the growth we

seek in both the traditional architecture and the new Smart

Buildings businesses.

Nick Clark - Chief Executive

Nick, who was the founder and Chief Executive of TFG, became

Group Chief Executive on completion of the deal in April 2023. At

the same time, Robert Fry, who had acted as interim chief executive

from December 2022 to April 2023, became Deputy Chairman on a part

time basis, with principal responsibility for the Group's

international offices and the expansion of the architecture

businesses.

Freddie Jenner - Chief Operating Officer

Freddie has today been appointed to the Board as Chief Operating

Officer. Freddie was previously Chief Financial Officer at TFG,

which he joined in 2007. Further details on his appointment are

being separately announced today.

Tandeep Minhas - Non-executive director

Tandeep Minhas, a leading corporate lawyer and head of the

London corporate finance department at international lawyers Taylor

Wessing LLP, joined the Board as a non-executive director on 24

April 2023.

Further details of your full Board can be found at

https://aukettswankeplc.com/people/ .

Long term incentives

To attract and retain the team required to deliver success we

plan to introduce a new long term incentive package. This will seek

to better align the interests of shareholders generally and those

individuals on whose efforts the Group's future depends. A further

announcement in this regard will be made in due course.

Outlook

With the team in place and the strategy honed we look forward to

reporting continued progress in both our existing and acquired

businesses.

Clive Carver

Chairman

26 June 2023

Chief Executive's report

Introduction

I am delighted to have been appointed as your new Chief

Executive, and excited about the opportunities ahead of us.

Following the acquisition of TFG, our mission is to develop our

award-winning architecture businesses and become a leading force in

the provision of Smart building systems, which we firmly believe to

be a major growth area using technology to enhance the experience

of buildings owners and users.

Architects are the trusted advisors who are best placed to

convince an inherently conservative property industry that change

is not only desirable, but essential. Our Group is therefore

well-positioned to exploit the opportunities in this transformative

industry.

Architecture

Through architecture, we forge a profound connection between

people and their surroundings. It evokes a sense of place and

fosters a sense of belonging. It pushes boundaries, challenging us

to envision a better future and to explore new possibilities for a

more sustainable way of living.

Architecture also brings change with a spirit of optimism and

renewal, which is at the heart of what the Group needs to

deliver.

Aukett Swanke Limited - UK architecture and interior design

Employed an average 35 full time equivalent ("FTE") technical

staff in the 6 month period, with revenue of GBP1.89 million

(GBP1.81 million, net of sub consultant costs).

Aukett Swanke Limited is the Group's award-winning full design

service architecture business, which can trace its roots back over

a century, and offers leading design services across a wide range

of sectors.

I am pleased to report progress with new contract wins during

the period for a major masterplanning project with Network Rail and

a residential project for Ardmore at 8 Eaton Lane in London.

Completions in the period include the St. Andrew's House

apartments for Anglo American De Beers, and new starts include the

refurbishment of The Underwriting Room in the iconic Lloyd's of

London building .

Veretec - UK executive architecture

Employed an average 44 FTE technical staff in the 6 month

period, with revenue of GBP2.30 million (GBP2.28 million, net of

sub consultant costs).

Veretec is our executive architecture business, which uses the

division's technical and delivery skills to translate the designs

of others into high quality buildings.

This business also made strong progress in the period under

review completing several projects and winning others requiring a

significant increase in staffing.

Following the period end, continued recruitment required to

service new and existing contracts increased FTE technical staff to

57 in May 2023.

New projects commenced in the period include the Town Hall and

extension of the West King Street Renewal project master planned by

Rogers Stirk & Harbour and the Nine Elms School with the IBI

Group for Morgan Sindall.

Completions have included the n2Nova commercial office building

designed by Patrick Lynch Architects for Landsec and executed by

Mace.

German investments

The Group owns a 25% investment in the Berlin practice Aukett +

Heese GmbH, employing an average 106 FTE technical staff in the 6

month period, with revenue of GBP8.62 million (GBP5.5 million, net

of sub consultant costs). The studio offers a full range of

architectural design services and holds a leading position in the

regional market it serves.

The Group also owns a 50% investment in the Frankfurt practice

Aukett + Heese Frankfurt GmbH employing an average 10 FTE technical

staff in the 6 month period, with revenue of GBP0.77 million

(GBP0.46 million, net of sub consultant costs). The studio is

renowned for its architecture and interior design expertise in the

financial, corporate and high-rise building sectors in the local

market.

The revenues of these investments are not consolidated in the

Group's revenues as we do not own a majority of either

business.

Completions in Berlin included the opening of the Deutsche Bahn

restaurant in the Sony Center, renamed the Potsdamer Platz Center,

and the commencement ceremony to break ground for the 42,000 sqm

Siemensstadt Square project comprising two buildings, one

high-rise, and 20,000 sqm of open space with public amenities.

Torpedo Factory Group

As set out in more detail in the financial commentary below, the

results from the TFG audio visual businesses are only included in

these financial statements for the final 10 trading days in March

2023. However, to give shareholders a better understanding of the

what the Group now enlarged by the TFG acquisition offers we

include the following information, which is based on a full 6 month

period to 31 March 2023.

Meeting Environments

Employed an average 29 FTE staff in the 6 month period, with

revenue of GBP1.93 million.

TFG's Meeting Environments business has been renamed Intelligent

Environments to reflect our broader work beyond meeting spaces as

we reposition the business as a Master Systems Integrator looking

at workplace technologies more broadly.

Stage Technology

Employed an average 23 FTE staff in the 6 month period, with

revenue of GBP1.38 million.

The Stage Technology business has an extensive client base in

the UK's leading theatres, universities, and schools in the private

and state sectors. The current year is dominated by the delivery of

a major project, a landmark new venue in Manchester, which is due

to complete by the end of June.

Live Events

Employed an average 10 FTE staff in the 6 month period, with

revenue of GBP0.55 million.

The Live Events business did not form part of the Group's Smart

Buildings plans and was sold with effect from 31 March 2023.

Smart Buildings

Why Smart Buildings

Smart Buildings enhance efficiency, sustainability, and occupant

experience.

Smart Buildings integrate advanced technologies, data analytics,

and automation to create vibrant ecosystems. They optimise energy

consumption, streamline operations, and personalise experiences for

occupants. By leveraging the Internet of Things (IoT) and

artificial intelligence (AI), Smart Buildings offer real-time

monitoring, energy savings, improved comfort, proactive

maintenance, and cost reduction.

In contrast to a traditional architecture business, which has

high fixed costs and where once the project is completed there is

no further income, under a Smart Buildings business model, revenues

are generated monthly throughout the lifetime of a building.

Technology is used to its utmost; rapid growth is achievable

without the often time consuming and expensive recruitment of

additional staff; and short term fluctuations in economic activity

do not dictate customer buying decisions.

Market drivers

Regulation is likely to be a key driver in the growth of Smart

Buildings.

For example, since April 2023, almost all commercial buildings

in the UK are required to have an Energy Performance Certificate

(EPC) rating of E or better. Without such a rating they cannot be

rented to tenants. From 2027, this requirement rises to C, and by

2030, a rating of B or better will be needed. Knight Frank recently

estimated that 70% of the UK's commercial building stock fails to

comply with EPC B and landlords of such properties will need to

invest in upgrading their buildings.

Our Smart Buildings strategy

Our plan is to become a leading provider of Smart Building

services. Breaking this down we need to become:

-- Smart Building Systems Designers

-- Smart Building Systems Integrators

-- Smart Building Systems Operators

We intend to grow at pace; only a buy and build strategy can

deliver the speed of change that we intend to deliver.

Smart Building Systems Designers

I am pleased to report we have already made our first

appointment in this new division and expect to make further

progress before the end of the current financial year.

Smart Building Systems Operators & Smart Building Systems

Integrators

We are actively considering specific acquisition opportunities

in the sector and we look forward to updating shareholders on these

and other potential acquisitions in due course.

Group Financial results

Basis of preparation

These interim statements, which cover the six months ended 31

March 2023, are unaudited and include the full six months trading

of the Aukett Swanke Group architecture businesses and the final 10

trading days of the period from TFG.

The balance sheet as at 31 March 2023 includes both the Aukett

Swanke Group architecture businesses and the TFG businesses.

Overall assessment

While the performance across the architecture businesses as set

out below is improving as the result of new contract wins and the

restructuring of the Group in previous periods, we are still a long

way from the level of profitability required to justify a

meaningful Group valuation.

This demonstrates why the previous Aukett Swanke Group board

recognised that a new approach is needed.

Revenue

We consider revenue after subconsultant costs to be the most

relevant performance indicator in assessing the progress of the

Group's architecture businesses.

In the six months under review, revenue after subconsultants

costs grew by approximately 30% to approximately GBP4.40 million,

reflecting a general increase in activity.

Operating costs

To be able to service this increased activity and in preparation

for work won but yet to start, personnel costs increased by

approximately 29% to approximately GBP3.78 million, with the

addition of 13 FTE fee earning technical staff in the UK operations

during the 6 month period, and the average FTE technical staff 14

higher than the comparable 6 month period in the period year.

Property related costs increased by 8% to approximately GBP0.57

million while other operating costs more than doubled to

approximately GBP0.61 million reflecting the greater level of

activity.

Included in these costs are approximately GBP0.56 million group

costs, excluding those relating to the TFG acquisition.

Associates and joint ventures

The share of associates included in these interim financial

statements grew from approximately GBP0.07 million to approximately

GBP0.21 million, reflecting their increased profitability.

Trading loss

The additional contribution from associates and joint ventures

offset the additional personnel and group costs to leave the

trading loss at approximately GBP0.29m. This is slightly higher

than in the corresponding period last year, but also includes

GBP0.09m of one-off costs relating to the settlement of TFG

employees company share option costs and the loss on assets

disposed of as part of the Live Events disposal.

Acquisition costs

The costs associated with acquiring TFG were approximately

GBP0.26 million and increased the loss before tax to approximately

GBP0.55 million.

Balance sheet

While the trading impact of the TFG acquisition in these interim

financial statements was minimal, its impact on the closing balance

sheet was more significant.

Plant, property and equipment increased from approximately

GBP0.07 million to approximately GBP3.22 million, almost all of

which related to TFG assets, principally the main operating TFG

site, a freehold building valued at GBP3.02 million.

Similarly, trade and other receivables and stock increased from

approximately GBP2.61 million to approximately GBP4.84 million,

again with most of the increase due to TFG.

Cash at bank at 31 March 2023 was approximately GBP0.81 million

compared to just GBP0.04m at the end of the corresponding prior

period.

Borrowings increased from GBP0.58 million in the prior period to

GBP3.12 million consolidating the TFG CBILS loan of GBP1.17 million

and GBP1.45 million mortgage on the freehold property.

TFG trading

Although largely excluded from these interim financial

statements, we set out below a brief assessment of TFG's trading in

that period.

TFG's revenue for October 2022 to March 2023 was GBP3.86

million, 9.6% higher than in the corresponding period in 2022. The

underlying performance of the TFG businesses was just below

breakeven at EBITDA level, due in part to delays in a large project

with more of the work on it delivered in the current (April to

June) quarter.

Live Events disposal

On 4 April 2023, two weeks after the purchase of TFG, the Group

announced the disposal of TFG's Live Events business. It was the

part of the business most dramatically damaged by the Government's

pandemic restrictions. While it has been recovering well, it was

non-core to the Smart Buildings plan, and its need for investment

will be better met outside of our Group. It was personally painful

to part ways with several colleagues I had worked with for many

years, but it is undoubtedly the right way forward for all

concerned and I wish them well.

Current Trading & Outlook

Architecture

With a good stock of committed work and a growing team of

chargeable staff across both principal business areas, we expect

the second half of the year to show an improvement on the first

half.

Torpedo Factory Group

Similarly, with strong project delivery, we expect the second

half to be better than the first half. The mortgage on TFG's

freehold is due to be repaid in February 2024 and we are carefully

reviewing our options to refinance this facility.

Smart Buildings

As we are already almost 9 months into the current financial

year, it is expected that it will be into the 2023 / 24 financial

year before we see material contributions from our Smart Buildings

businesses.

Our team

I am hugely appreciative to all our staff who have coped

admirably with a period of significant change.

We are committed to shaping a sustainable, exciting, and

rewarding future for our clients and our shareholders, and our

staff and I look forward to sharing news our progress with you.

Nick Clark

Chief Executive

26 June 2023

Consolidated income statement

For the six months ended 31 March 2023

Note Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Continuing Operations

Revenue 4 4,562 4,529 8,645

Sub consultant costs (164) (1,152) (1,518)

---------------------------------- ----- ------------- ------------- --------------

Revenue less sub consultant

costs 4,398 3,377 7,127

Personnel related costs (3,781) (2,921) (6,237)

Property related costs (573) (531) (1,037)

Other operating expenses (610) (240) (483)

Other operating income 5 129 144 326

---------------------------------- ----- ------------- ------------- --------------

Operating loss (437) (171) (304)

Finance costs (55) (46) (95)

---------------------------------- ----- ------------- ------------- --------------

Loss after finance costs (492) (217) (399)

Share of results of associate

and joint ventures 205 65 327

---------------------------------- ----- ------------- ------------- --------------

Trading loss from continuing

operations (287) (152) (72)

Acquisition costs (258) - -

Goodwill impairment - - (1,752)

---------------------------------- ----- ------------- ------------- --------------

Loss before tax from continuing

operations 4 (545) (152) (1,824)

Tax credit 54 26 45

---------------------------------- ----- ------------- ------------- --------------

Loss from continuing operations (491) (126) (1,779)

Profit/(loss) from discontinued

operations 6 7 (261) (503)

---------------------------------- ----- ------------- ------------- --------------

Loss for the period (484) (387) (2,282)

---------------------------------- ----- ------------- ------------- --------------

Loss attributable to:

Owners of Aukett Swanke Group

Plc (484) (387) (2,282)

Non-controlling interests - - -

---------------------------------- ----- ------------- ------------- --------------

Loss for the period (484) (387) (2,282)

---------------------------------- ----- ------------- ------------- --------------

Basic and diluted earnings

per share for (loss)/profit

attributable to the ordinary

equity holders of the Company:

From continuing operations (0.29p) (0.07p) (1.08p)

From discontinued operations 0.00p (0.16p) (0.30p)

---------------------------------- ----- ------------- ------------- --------------

Total loss per share 7 (0.29p) (0.23p) (1.38p)

---------------------------------- ----- ------------- ------------- --------------

Consolidated statement of comprehensive income

For the six months ended 31 March 2023

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Loss for the period (484) (387) (2,282)

Other comprehensive income:

Currency translation differences

of foreign operations (1) (42) (7)

Currency translation differences

on disposal recycled to gain

on disposal of discontinued

operation - - (209)

Currency translation differences

on translation of discontinued

operations 34 (7) (168)

------------------------------------ -------------

Other comprehensive gain/(loss)

for the period 33 (49) (384)

Total comprehensive loss for

the period (451) (436) (2,666)

------------------------------------ ------------- ------------- --------------

Total comprehensive loss is

attributable to:

Owners of Aukett Swanke Group

Plc (451) (436) (2,666)

Non-controlling interests - - -

----------------------------------- ------------- ------------- --------------

Total comprehensive loss for

the period (451) (436) (2,666)

Total comprehensive profit/(loss)

attributable to the owners of

Aukett Swanke Group Plc arises

from:

Continuing operations (492) (168) (1,786)

Discontinued operations 41 (268) (880)

------------------------------------ ------------- ------------- --------------

(451) (436) (2,666)

----------------------------------- ------------- ------------- --------------

Consolidated statement of financial position

At 31 March 2023

Note Unaudited Unaudited Audited

at 31 at 31 at 30

March March September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Non current assets

Goodwill 3 1,381 1,753 -

Other intangible assets 273 217 210

Property, plant and equipment 3,218 74 69

Right-of-use assets 2,335 2,354 2,184

Investment in associate and

joint ventures 1,081 802 1,007

Loans and other financial 162 -

assets -

Deferred tax 332 265 281

--------------------------------- ----- ---------- ---------- -----------

Total non current assets 8,782 5,465 3,751

Current assets

Trade and other receivables 4,843 2,605 3,293

Inventories 336 - -

Contract assets 744 599 1,119

Cash at bank and in hand 10 805 38 28

--------------------------------- ----- ---------- ---------- -----------

6,728 3,242 4,440

Assets in disposal groups - 1,868

classified as held for sale -

Total current assets 6,728 5,110 4,440

Total assets 15,510 10,575 8,191

Current liabilities

Trade and other payables (4,978) (2,497) (3,169)

Contract liabilities (1,720) (802) (1,227)

9,

Borrowings 10 (2,258) (289) (482)

Lease liabilities (537) (539) (457)

(9,493) (4,127) (5,335)

Liabilities directly associated - (1,006)

with assets in disposal groups

classified as held for sale -

Total current liabilities (9,493) (5,133) (5,335)

Non current liabilities

Trade and other payables - - (44)

9,

Borrowings 10 (858) (292) (167)

Lease liabilities (1,961) (2,118) (1,962)

Deferred tax (183) (37) (33)

Provisions (256) (364) (249)

Total non current liabilities (3,258) (2,811) (2,455)

Total liabilities (12,751) (7,944) (7,790)

Net assets 2,759 2,631 401

--------------------------------- ----- ---------- ---------- -----------

Capital and reserves

Share capital 2,753 1,652 1,652

Merger reserve 2,884 1,176 1,176

Foreign currency translation

reserve (524) (222) (557)

Retained earnings (3,848) (1,469) (3,364)

Other distributable reserve 1,494 1,494 1,494

--------------------------------- ----- ---------- ---------- -----------

Total equity attributable

to

equity holders of the Company 2,759 2,631 401

--------------------------------- ----- ---------- ---------- -----------

Non-controlling interests - - -

--------------------------------- ----- ----------

Total equity 2,759 2,631 401

--------------------------------- ----- ---------- ---------- -----------

Consolidated statement of cash flows

For the six months ended 31 March 2023

Note Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash generated from / (expended)

by operations 8 328 (303) (1,104)

Income tax credits received - 99 99

------------------------------------- ----- ------------- ------------- --------------

Net cash inflow/(outflow)

from operating activities 328 (204) (1,005)

Cash flows from investing

activities

Purchase of property, plant

and equipment (73) (13) (48)

Acquisition of subsidiary,

net cash acquired 790 - -

Sale of investments - - 927

Dividends received 131 46 140

------------------------------------- ----- ------------- ------------- --------------

Net cash received from investing

activities 848 33 1,019

Net cash inflow/(outflow)

before financing activities 1,176 (171) 14

Cash flows from financing

activities

Principal paid on lease liabilities (241) (232) (470)

Interest paid on lease liabilities (33) (40) (76)

Repayment of bank loans (125) - (83)

Interest paid (22) (6) (19)

Net cash outflow from financing

activities (421) (278) (648)

Net change in cash and cash

equivalents 755 (449) (634)

Cash and cash equivalents

at start of period (204) 515 515

Currency translation differences 41 (81) (85)

------------------------------------- ----- ------------- ------------- --------------

Cash and cash equivalents

at end of period 10 592 (15) (204)

------------------------------------- ----- ------------- ------------- --------------

Cash and cash equivalents are

comprised of:

Cash at bank and in hand 805 38 28

Cash held within assets classified

as held for sale - 28 -

Secured bank overdrafts (213) (81) (232)

Cash and cash equivalents at end

of year 592 (15) (204)

------------------------------------ ------ ----- ------

Consolidated statement of changes in equity

For the six months ended 31 March 2023

Share Foreign Retained Other Merger Total Non Total

capital currency earnings distributable reserve controlling equity

translation reserve interests

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

At 1 October

2022 1,652 (557) (3,364) 1,494 1,176 401 - 401

Loss for the

period - - (484) - - (484) - (484)

Other

comprehensive

income - 33 - - - 33 - 33

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Total

comprehensive

profit/(loss) - 33 (484) - - (451) - (451)

Issue of

ordinary

shares in

relation

to business

combination 1,101 - - - 1,708 2,809 - 2,809

At 31 March

2023 2,753 (524) (3,848) 1,494 2,884 2,759 - 2,759

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

For the six months ended 31 March 2022

Share Foreign Retained Other Merger Total Non Total

capital currency earnings distributable reserve controlling equity

translation reserve interests

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

At 1 October

2021 1,652 (173) (1,082) 1,494 1,176 3,067 - 3,067

Loss for the

period - - (387) - - (387) - (387)

Other

comprehensive

income - (49) - - - (49) - (49)

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Total

comprehensive

loss - (49) (387) - - (436) - (436)

At 31 March

2022 1,652 (222) (1,469) 1,494 1,176 2,631 - 2,631

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

For the year ended 30 September 2022

Share Foreign Retained Other Merger Total Non Total

capital currency earnings distributable reserve controlling equity

translation reserve interests

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

At 1 October

2021 1,652 (173) (1,082) 1,494 1,176 3,067 - 3,067

Loss for the

period - - (2,282) - - (2,282) - (2,282)

Other

comprehensive

income - (384) - - - (384) - (384)

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Total

comprehensive

loss - (384) (2,282) - - (2,666) - (2,666)

At 30

September

2022 1,652 (557) (3,364) 1,494 1,176 401 - 401

--------------- --------- ------------- ---------- -------------- --------- --------- -------------- ---------

Notes to the Interim Report

1 Basis of preparation

The financial information presented in this Interim Report has

been prepared in accordance with the recognition and measurement

principles of international accounting standards in conformity with

the requirements of the Companies Act 2006 that are expected to be

applicable to the financial statements for the year ending 30

September 2023 and on the basis of the accounting policies expected

to be used in those financial statements.

2 New accounting standards, amendments and interpretations applied

A number of new or amended standards and interpretations to

existing standards became applicable for the current reporting

period. The Group did not have to change its accounting policies or

make retrospective adjustments as a result of adopting these

standards.

3 Business combination

On the 20 March 2023 the Group acquired 100% of the voting

equity instruments in Torpedo Factory Group Limited, an audio

visual and stage technology provider to organisations in the UK and

Europe.

Consideration for the acquisition comprised:

i) 110,142,286 Ordinary Shares in Aukett Swanke Group Plc at an

issue price of 2.55p based on the closing price of Aukett Swanke

Group Plc shares on 1 March 2023.

ii) Up to 3,631,124 additional consideration shares proposed to

be issued to participating TFG Option Holders, at an issue price of

2.55p.

iii) 8,400,000 share options in Aukett Swanke Group Plc

exercisable at 1p. Fair value calculated at 1.55p per share based

on the closing price of Aukett Swanke Group Plc shares on 1 March

2023.

GBP'000

-------------------------------------------- --------

Shares in Aukett Swanke Group Plc 2,809

Maximum number of additional consideration

shares to be issued to the participating

option holders 92

Share options in Aukett Swanke Group

Plc 130

--------------------------------------------- --------

Total acquisition cost 3,031

--------------------------------------------- --------

The fair values of the identifiable assets and liabilities

acquired have only been provisionally determined and are subject to

adjustment during the measurement period.

Provisional

20 Mar-23

GBP'000

--------------------------------------- ------------

Goodwill 1,381

Property, plant and equipment 3,122

Right-of-use assets 324

Other intangible assets 75

Loans and other financial assets 162

Inventories 336

Contract assets 10

Trade and other receivables 1,526

Net cash 790

------------

Assets 7,726

------------

Trade and other payables 1,180

Contract liabilities 654

Interest bearing loans and borrowings 2,611

Lease liabilities 320

Deferred tax liability 152

------------

Liabilities 4,917

------------

Total net assets 2,809

---------------------------------------- ------------

Property, Plant and Equipment includes GBP3,020k net book value

of freehold property, being the Old Torpedo Factory building in

London, last revalued in July 2021.

Acquisition related costs of GBP258k are disclosed as

acquisition costs in the consolidated income statement.

4 Operating segments

The Group historically comprised a single business segment with

separately reportable geographical segments (together with a Group

costs segment). Geographical segments being based on the location

of the operation undertaking each project.

The Group's operating geographical segments consist of the

United Kingdom, the Middle East and Continental Europe. Turkey is

included within Continental Europe together with Germany. The

Middle East segment has been re-presented as a discontinued

operation and is set out in note 5 .

With the acquisition of Torpedo Factory Group during the period,

Torpedo Factory Group operations have been disclosed as an

additional separate business segment.

Segment revenue Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

United Kingdom 4,191 4,435 8,465

Torpedo Factory Group 212 - -

Continental Europe 159 94 180

------------------------------------- ------------- ------------- --------------

Revenue from continuing operations 4,562 4,529 8,645

Discontinued operations - 1,249 1,543

------------------------------------- ------------- ------------- --------------

Revenue 4,562 5,778 10,188

------------------------------------- ------------- ------------- --------------

Segment revenue less sub consultant Unaudited Unaudited Audited

costs six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

United Kingdom 4,094 3,305 6,975

Torpedo Factory Group 212 - -

Continental Europe 92 72 152

-------------------------------------- -------------

Revenue less sub consultant

costs from continuing operations 4.398 3,377 7,127

Discontinued operations - 1,060 1,256

-------------------------------------- ------------- ------------- --------------

Revenue less sub consultant

costs 4,398 4,437 8,383

-------------------------------------- ------------- ------------- --------------

Segment result before tax Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

United Kingdom (140) (230) (329)

Continental Europe 183 49 275

Torpedo Factory Group*^ (166) - -

Group costs* (422) 29 (18)

Goodwill impairment - - (1,752)

---------------------------------- ------------- ------------- --------------

Loss before tax from continuing

operations (545) (152) (1,824)

Profit/(loss) from discontinued

operations 7 (261) (503)

---------------------------------- ------------- ------------- --------------

Total loss (538) (413) (2,327)

---------------------------------- ------------- ------------- --------------

Segment result before tax Unaudited Unaudited Audited

(before reallocation of group six months six months year to

management charges) to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

United Kingdom 130 40 211

Continental Europe 257 123 422

Torpedo Factory Group*^ (166) - -

Group costs* (766) (419) (809)

Goodwill impairment - - (1,752)

-------------------------------------- ------------- ------------- --------------

Subtotal (545) (256) (1,928)

Group management charges charged

to the

Middle East discontinued operation - 104 104

-------------------------------------- ------------- ------------- --------------

Loss before tax from continuing

operations (545) (152) (1,824)

Profit/(loss) from discontinued

operations 7 (261) (503)

-------------------------------------- ------------- ------------- --------------

Total (loss) (538) (413) (2,327)

-------------------------------------- ------------- ------------- --------------

* Segmental results before tax include GBP258k of exceptional

costs being transactional costs for the acquisition of Torpedo

Factory Group allocated as GBP208k within Group costs, and GBP50k

within Torpedo Factory Group.

^ TFG segmental result before tax includes GBP0.09m of one-off

costs relating to the settlement of TFG employees company share

option costs and the loss on assets disposed of as part of the Live

Events disposal.

5 Other operating income

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

Continuing operations GBP'000 GBP'000 GBP'000

Property rental income 44 74 147

Management charges to associate

and joint ventures 68 63 131

Licence fee income - 7 -

Other sundry income 17 - 48

Total other operating income 129 144 326

---------------------------------- ------------- ------------- --------------

6 Discontinued operations

6 (a) Description

In April 2022, the Group sold assets, as part of the Group's

disposal of JRHP constituting its John R Harris & Partners

Limited (Cyprus) subsidiary and John R Harris & Partners

(Dubai) entity, for a cash consideration of AED 5,000,000,

comprising AED 4,250,000 cash upfront and a further AED 750,000

deferred consideration paid over a 5 year period. This marked the

sale of the main trading operations in the Group's Middle East

segment. With closure costs incurred in the period relating to the

planned termination of a number of trading licenses in the Middle

East operations, the Middle East segment is presented as a

discontinued operation in the current period, and the comparative

period represented accordingly.

6 (b) Financial performance and cash flow information

Result of discontinued operations

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Revenue - 1,249 1,543

Sub consultant costs - (189) (287)

-------------------------------------- ------------- ------------- --------------

Revenue less sub consultant

costs - 1,060 1,256

Expenses 7 (1,217) (2,012)

Group management charges - (104) (104)

Gain on disposal of subsidiary - - 357

Profit/(loss) before tax 7 (261) (503)

Tax credit / (charge) - - -

------------------------------------- ------------- ------------- --------------

Profit/(loss) from discontinued

operations 7 (261) (503)

Exchange differences on disposal

recycled to gain on disposal

of subsidiary - - (209)

Exchange differences on translation

of discontinued operation 34 (7) (168)

-------------------------------------- ------------- ------------- --------------

Other comprehensive gain/(loss)

from discontinued operations 41 (268) (880)

-------------------------------------- ------------- ------------- --------------

Earnings per share from discontinued operations

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Basic and diluted gain/(loss)

per share 0.00p (0.16p) (0.30p)

Statement of cash flows

The statement of cash flows includes the following amounts

relating to discontinued operations:

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Net cash outflow from operating

activities - (174) (53)

Net cash inflow from investing

activities - - 35

Foreign exchange movements - 2 (204)

------------------------------------- ------------- ------------- --------------

Net cash outflow from discontinued

operations - (172) (222)

------------------------------------- ------------- ------------- --------------

7 Earnings per share

The calculations of basic and diluted earnings per share are

based on the following data:

Earnings Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Continuing operations (491) (126) (1,779)

Discontinued operations 7 (261) (503)

-------------------------- ------------- ------------- --------------

Loss for the period (484) (387) (2,282)

-------------------------- ------------- ------------- --------------

Number of shares Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

'000 '000 '000

Weighted average number of shares 171,907 165,214 165,214

Effect of dilutive options 221 - -

----------------------------------- ------------- ------------- --------------

Diluted weighted average number

of shares 171,128 165,214 165,214

------------------------------------ ------------- ------------- --------------

8 Reconciliation of profit before tax to net cash from operations

Unaudited Unaudited Audited

six months six months year to

to 31 March to 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Loss for the period (484) (387) (2,282)

Tax credit (54) (26) (45)

Finance costs 55 46 95

Share of results of associate

and joint ventures (205) (65) (327)

Intangible amortisation 6 19 28

Depreciation 24 56 97

Goodwill impairment - - 1,752

Amortisation of right-of-use

assets 193 192 385

Decrease in trade and other

receivables 161 565 594

Increase / (decrease) in trade

and other payables 625 (635) (815)

Change in provisions 7 (68) (586)

Net cash generated from / (expended)

by operations 328 (303) (1,104)

--------------------------------------- ------------- ------------- --------------

9 Borrowings

Unaudited Unaudited Audited

at 31 March at 31 March at

2023 2022 30 September

GBP'000 GBP'000 2022

GBP'000

Secured bank overdrafts (213) (81) (232)

Mortgage (1,445) - -

Secured bank loan (NatWest) (1,166) - -

Secured bank loan (Coutts) (292) (500) (417)

------------------------------------- ------------- ------------- --------------

Total borrowings (3,116) (581) (649)

Amounts due for settlement within

12 months (2,258) (289) (482)

------------------------------------- ------------- ------------- --------------

Current liability (2,258) (289) (482)

Amounts due for settlement between

one and two years (392) (250) (167)

Amounts due for settlement between

two and five years (466) (42) -

------------------------------------- ------------- ------------- --------------

Non current liability (858) (292) (167)

Total borrowings (3,116) (581) (649)

------------------------------------- ------------- ------------- --------------

The bank loan (Coutts) and overdrafts are secured by debentures

over all the assets of the Company and certain of its United

Kingdom subsidiaries. The bank loan and overdrafts carry interest

at 4.05% (loan) and 3% (overdrafts) above the Coutts Base rate for

the relevant currency.

The mortgage and the bank loan (NatWest) are secured by way of a

first legal charge over freehold property, a debenture and cross

guarantee from Torpedo Factory Group Limited, Torpedo Factory

Limited and TFG Stage Technology Limited. The bank loan (NatWest)

initially drawn at GBP1.75m is being repaid at GBP29k per month.

The loan is at a fixed rate of interest of 3.66%.

The mortgage initially drawn in 2018 at GBP1.73m with a duration

of 5 years has been extended for a year and is due to expire in

February 2024, and is therefore wholly shown due for settlement

within 12 months. The mortgage carries interest at base rate +

1.93%.

10 Analysis of net funds

Unaudited Unaudited Audited

at 31 March at 31 March at

2023 2022 30 September

GBP'000 GBP'000 2022

GBP'000

Cash at bank and in hand 805 38 28

Cash held within assets classified

as held for sale - 28 -

Secured bank overdrafts (213) (81) (232)

------------------------------------- ------------- ------------- --------------

Cash and cash equivalents 592 (15) (204)

Mortgage (1,445) - -

Secured bank loans (1.458) (500) (417)

------------------------------------- -------------

Net debt (2,311) (515) (621)

------------------------------------- ------------- ------------- --------------

11 Status of Interim Report

The Interim Report covers the six months ended 31 March 2023 and

was approved by the Board of Directors on 26 June 2023. The Interim

Report is unaudited.

The interim condensed set of consolidated financial statements

in the Interim Report are not statutory accounts as defined by

Section 434 of the Companies Act 2006.

Comparative figures for the year ended 30 September 2022 have

been extracted from the statutory accounts of the Group for that

period.

The statutory accounts for the year ended 30 September 2022 have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The audit report thereon was unqualified,

did not include references to matters to which the auditors drew

attention by way of emphasis without qualifying the report, and did

not contain a statement under Section 498 of the Companies Act

2006. The audit report did draw attention to the Directors'

assessment of going concern, indicating that a material uncertainty

exists that may cast significant doubt on the Group's and parent

company's ability to continue as a going concern. The audit report

was not modified in respect of this matter.

12 Further information

An electronic version of the Interim Report will be available on

the Group's website (www.aukettswankeplc.com).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDRTIRFIV

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

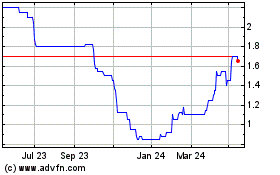

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Oct 2024 to Nov 2024

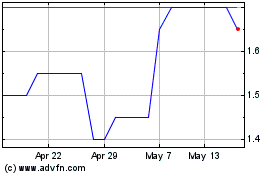

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Nov 2023 to Nov 2024