TIDMARGO

RNS Number : 3867R

ARGO Group Limited

20 August 2010

Argo Group Limited

("Argo" or the "Company")

Interim Results for the six months ended 30 June 2010

Argo today announces its interim results for the six months ended 30 June 2010.

The Company will today make available its interim report for the six month

period ended 30 June 2010 on the Company's website www.argogrouplimited.com.

Key Highlights for the six month period ended 30 June 2010

- Steady, profitable performance across the Argo funds

- Positive portfolio results in an upward trend

- Revenues of US$5.6 million (six months to June 2009: US$5.8 million)

- Operating profit of US$1.1 million (six months to June 2009: US$1.5

million)

- Profit before tax of US$1.2 million (six months to June 2009: US$2.0

million)

- Operating profit and profit before tax are stated after bonus accrual of

US$840,000 (six months to June 2009: nil)

- Maintained balance sheet strength: net assets of US$43.0 million after

dividend payment and share buyback totalling US$1.5m (December 2009: US$44.5

million)

Commenting on the results and outlook, Kyriakos Rialas, Chief Executive of Argo

said:

"As Argo's flagship fund enters its 10th year of existence the Company continues

to produce a steady and profitable performance. During the period Argo paid a

dividend and carried out a successful buyback of shares whilst still maintaining

its strong balance sheet and liquidity. We are confident that Argo is

well-positioned to take advantage of the record levels of recent inflows into

emerging markets and that the Company will continue to produce positive

results."

Enquiries

Argo Group Limited

Andreas Rialas

020 7535 4000

Panmure Gordon

Dominic Morley

020 7459 3600

CHAIRMAN'S STATEMENT

Business review

Argo is pleased to report another profitable set of interim results for the half

year ended 30 June 2010. The Company was incorporated in February 2008 in the

Isle of Man and began trading as a new group holding company on 13 June 2008. It

listed on the AIM market in November 2008.

Argo's primary business is to deliver a diversified approach to investing in

emerging markets. Its investment objective is to provide investors with absolute

returns in the six funds that it manages by investing in, inter alia, fixed

income, special situations, local currencies and interest rate strategies,

private equity, real estate, quoted equities, high yield corporate debt and

distressed debt, although not every fund invests in each of these asset classes.

Argo has a performance track record dating back to 2000 and this year celebrates

its tenth anniversary.

For the six month period ended 30 June 2010 the Group generated revenues of

US$5.6 million (six months to 30 June 2009: US$5.8 million) with management fees

accounting for US$5.1 million (six months to 30 June 2009: US$5.5 million). The

small reduction in management fees arising from lower assets under management

("AUM") was partially offset by higher incentive fees and other income. The Argo

Fund Limited ("TAF") and Argo Global Special Situations Fund SP ("AGSSF"), a

segregated portfolio of the Argo Capital Investors Fund SPC, have yet to reach

their high-water mark.

AUM decreased during the six month period ended 30 June 2010 by 8.3% to US$403.1

million from their level at 31 December 2009. Despite flat to positive fund

performance year to date the decrease of US$36.4 million was mainly due to the

continued payment of "gated" redemptions from the AGSSF.

Operational review

Record levels of funds flow into emerging markets debt and equity but the

beneficiaries so far have been long-only mutual funds. We believe that the high

volatility witnessed will hit the returns of the long-only directional mutual

funds and furthermore that emerging market inflows will in time benefit the more

actively managed traditional hedge fund strategies. Whilst our marketing team

identified a number of potential leads during the period, the market volatility

induced by the crisis in confidence towards certain peripheral European states

and, more generally, the Eurozone had the effect of once again undermining

investor sentiment. The funds are encouraged by the recent raising of new money,

admittedly small amounts.

The Group employed 25 people at the end of June 2010, one lower than the end of

2009 but 14 fewer than end-2008.

Fund performance

Performance across the range of Argo funds was mixed for the half year ended 30

June 2010, but the two main funds TAF and Argo Distressed Credit Fund ("ADCF"),

which are not gated, showed positive returns at a time when the average fund

performance was flat to negative. Argo Capital Partners Fund ("ACPF"), the

closed private equity fund, and AGSSF suffer mainly from a weakening euro

against the dollar experiencing unrealised FX losses. The generally optimistic

tone experienced in the first quarter of the year gave way to concern over the

fiscal imbalances and credit metrics of peripheral European economies, most

notably Greece. Amidst mounting speculation concerning sovereign defaults,

restructurings and the status of the Euro as a reserve currency, markets became

very volatile and difficult to trade. Our funds navigated the volatility by

maintaining some short positions and we are encouraged by the return of

confidence witnessed in the few weeks prior to the date of this statement that

is contributing to a better performance by the funds.

Argo Funds

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| Fund | | 30 | 30 | 2009 | Since | Annualised | Sharpe | Down | AUM |

| | | June | June | Year | inception | performance | ratio | months | |

| | Launch | 2010 | 2009 | total | | | | | |

| | date | 6 | 6 | | | | | | |

| | | months | months | | | | | | |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| | | % | % | % | % | CAGR % | | | US$m |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| The Argo | Oct-00 | 0.37 | 5.35 | 12.18 | 116.60 | 9.11 | 0.74 | 15 | 111.6 |

| Fund | | | | | | | | of | |

| | | | | | | | | 117 | |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| Argo Global | Aug-04 | -1.29 | 5.49 | 12.85 | 35.31 | 5.86 | 0.52 | 16 | 98.7 |

| Special | | | | | | | | of | |

| Situations | | | | | | | | 71 | |

| Fund | | | | | | | | | |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| AGSSF | Feb-09 | -5.49 | 5.75 | 7.72 | 1.81 | 1.45 | 0.20 | 9 | 76.7 |

| Holdings | | | | | | | | of | |

| | | | | | | | | 17 | |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| Argo | Oct-08 | 4.67 | 5.23 | 11.06 | 16.82 | 9.09 | 1.36 | 7 | 21.5 |

| Distressed | | | | | | | | of | |

| Credit Fund | | | | | | | | 21 | |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| Argo Real | Aug-06 | 9.47 | -60.52 | -78.47 | -69.90 | -26.35 | N/A | 24 | |

| Estate | | | | | | | | of | 35.3* |

| Opportunities | | | | | | | | 48* | |

| Fund | | | | | | | | | |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| Argo | Aug-06 | -11.65 | -4.82 | -4.17 | 14.86 | 3.68 | N/A | N/A | 59.3 |

| Capital | | | | | | | | | |

| Partners | | | | | | | | | |

| Fund | | | | | | | | | |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

| Total | | | | | | | | | 403.1 |

+---------------+--------+--------+--------+--------+-----------+-------------+--------+--------+-------+

* NAV only officially measured twice a year, March and September.

AGSSF Holdings Limited ("AHL"), the creation of which was approved by the AGSSF

board of directors in February 2009, comprises assets that are currently more

difficult to liquidate. In the six-month period ended 30 June 2010 it delivered

a year-to-date return of -5.49%, in part driven by exchange rate fluctuations,

and despite difficult market conditions we are encouraged by the progress in

creating liquidity events for investors in the fund.

AGSSF itself recorded a smaller decline of 1.29% in the six months to June 2010

but TAF had a positive year-to-date return of 0.37%. On a more constructive

note, ADCF continued to build a solid track record of returns: after the 11.06%

recorded in 2009, ADCF achieved a return of 4.67% in the six months to June

2010.

The Argo Real Estate Opportunities Fund Limited ("AREOF"), which has been

severely affected by the downturn in Eastern Europe, reported a further write

down of investment property values in the six months to 31 March 2010. The

fund's adjusted Net Asset Value was EUR28.9 million as at end-March 2010,

compared with EUR48.3 million a year earlier and EUR26.4 million six months

earlier.

Meanwhile, ACPF reported a negative return of 11.65% for the six months ended 30

June 2010 (as at 30 June 2009: -4.82%). The realisation period for the Fund was

scheduled to commence this month but, as per the Fund prospectus, this has been

extended for one year.

Outlook

The board is satisfied with the current company composition in terms of

headcount and assets under management. Costs are appropriate and are reviewed

periodically so as to optimise the efficient deployment of company resources.

More emphasis is placed on direct communication with existing and new investors

with the purchase of two databases to assist in growing the funds with

additional subscriptions.

Management has recently observed greater mobility and a new air of optimism in

the market conditions that will affect positively the workout of some of the

less liquid and private equity transactions in the funds. A significant number

of man hours is being spent on such transactions and there is continuous

communication with investors about the funds' performance. On the more actively

traded bonds we have benefitted greatly from improved performance in some of our

key countries such as Argentina, Ukraine and Venezuela.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 30 JUNE 2010

+--------------------------------------+------+---------+----------+---------+

| | | Six | | Six |

| | | months | | months |

+--------------------------------------+------+---------+----------+---------+

| | | Ended | | Ended |

+--------------------------------------+------+---------+----------+---------+

| | | 30 | | 30 |

| | | June | | June |

+--------------------------------------+------+---------+----------+---------+

| | | 2010 | | 2009 |

+--------------------------------------+------+---------+----------+---------+

| |Note | US$'000 | | US$'000 |

+--------------------------------------+------+---------+----------+---------+

| | | | | |

+--------------------------------------+------+---------+----------+---------+

| Management fees | | 5,093 | | 5,485 |

+--------------------------------------+------+---------+----------+---------+

| Incentive fees | | 257 | | 177 |

+--------------------------------------+------+---------+----------+---------+

| Other income | | 266 | | 173 |

+--------------------------------------+------+---------+----------+---------+

| Revenue | | 5,616 | | 5,835 |

+--------------------------------------+------+---------+----------+---------+

| | | | | |

+--------------------------------------+------+---------+----------+---------+

| Legal and professional expenses | | (281) | | (294) |

+--------------------------------------+------+---------+----------+---------+

| Management and incentive fees | | (94) | | (181) |

| payable | | | | |

+--------------------------------------+------+---------+----------+---------+

| Operational expenses | | (907) | | (1,004) |

+--------------------------------------+------+---------+----------+---------+

| Employee costs | | (2,910) | | (2,660) |

+--------------------------------------+------+---------+----------+---------+

| Foreign exchange gain | | 77 | | 157 |

+--------------------------------------+------+---------+----------+---------+

| Amortisation of intangible assets | 6 | (323) | | (333) |

+--------------------------------------+------+---------+----------+---------+

| Depreciation | 7 | (52) | | (54) |

+--------------------------------------+------+---------+----------+---------+

| Operating profit | | 1,126 | | 1,466 |

+--------------------------------------+------+---------+----------+---------+

| | | | | |

+--------------------------------------+------+---------+----------+---------+

| Interest income on cash and cash | | 30 | | 99 |

| equivalents | | | | |

+--------------------------------------+------+---------+----------+---------+

| Unrealised gain on investments | | 53 | | 481 |

+--------------------------------------+------+---------+----------+---------+

| Profit on ordinary activities before | | 1,209 | | 2,046 |

| taxation | | | | |

+--------------------------------------+------+---------+----------+---------+

| | | | | |

+--------------------------------------+------+---------+----------+---------+

| Taxation | 4 | (146) | | (184) |

+--------------------------------------+------+---------+----------+---------+

| Profit for the period after taxation | 5 | 1,063 | | 1,862 |

| attributable to members of the | | | | |

| Company | | | | |

+--------------------------------------+------+---------+----------+---------+

| | | | | |

+--------------------------------------+------+---------+----------+---------+

| Other comprehensive income | | | | |

+--------------------------------------+------+---------+----------+---------+

| Exchange differences on translation | | (1,018) | | 895 |

| of foreign operations | | | | |

+--------------------------------------+------+---------+----------+---------+

| Total comprehensive income for the | | 45 | | 2,757 |

| period | | | | |

+--------------------------------------+------+---------+----------+---------+

+--------------------------------------+----+----------------+----------+--------+

| | | Six | | Six |

| | | months | | months |

+--------------------------------------+----+----------------+----------+--------+

| | | Ended | | Ended |

+--------------------------------------+----+----------------+----------+--------+

| | | 30 | | 30 |

| | | June | | June |

+--------------------------------------+----+----------------+----------+--------+

| | | 2010 | | 2009 |

+--------------------------------------+----+----------------+----------+--------+

| | | US$ | | US$ |

+--------------------------------------+----+----------------+----------+--------+

| Earnings per share (basic) | 5 | 0.01 | | 0.02 |

+--------------------------------------+----+----------------+----------+--------+

| Earnings per share (diluted) | 5 | 0.01 | | 0.02 |

+--------------------------------------+----+----------------+----------+--------+

The Directors consider that all results derive from continuing activities.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2010

+--------------------------------------+------+---------+----------+----------+

| | | 30 June | | 31 |

| | | | | December |

+--------------------------------------+------+---------+----------+----------+

| | | 2010 | | 2009 |

+--------------------------------------+------+---------+----------+----------+

| |Note | US$'000 | | US$'000 |

+--------------------------------------+------+---------+----------+----------+

| | | | | |

+--------------------------------------+------+---------+----------+----------+

| Assets | | | | |

+--------------------------------------+------+---------+----------+----------+

| | | | | |

+--------------------------------------+------+---------+----------+----------+

| Non-current assets | | | | |

+--------------------------------------+------+---------+----------+----------+

| Intangible assets | 6 | 16,889 | | 17,557 |

+--------------------------------------+------+---------+----------+----------+

| Fixtures, fittings and equipment | 7 | 79 | | 136 |

+--------------------------------------+------+---------+----------+----------+

| Loans and advances receivable | | 244 | | 226 |

+--------------------------------------+------+---------+----------+----------+

| Total non-current assets | | 17,212 | | 17,919 |

+--------------------------------------+------+---------+----------+----------+

| | | | | |

+--------------------------------------+------+---------+----------+----------+

| Current assets | | | | |

+--------------------------------------+------+---------+----------+----------+

| Investments | 8 | 14,389 | | 14,337 |

+--------------------------------------+------+---------+----------+----------+

| Trade and other receivables | | 1,448 | | 1,972 |

+--------------------------------------+------+---------+----------+----------+

| Cash and cash equivalents | | 11,383 | | 13,069 |

+--------------------------------------+------+---------+----------+----------+

| Loans and advances receivable | | 5 | | 36 |

+--------------------------------------+------+---------+----------+----------+

| Total current assets | | 27,225 | | 29,414 |

+--------------------------------------+------+---------+----------+----------+

| | | | | |

+--------------------------------------+------+---------+----------+----------+

| Total assets | | 44,437 | | 47,333 |

+--------------------------------------+------+---------+----------+----------+

| | | | | |

+--------------------------------------+------+---------+----------+----------+

| Equity and liabilities | | | | |

+--------------------------------------+------+---------+----------+----------+

| | | | | |

+--------------------------------------+------+---------+----------+----------+

| Equity | | | | |

+--------------------------------------+------+---------+----------+----------+

| Issued share capital | 9 | 747 | | 769 |

+--------------------------------------+------+---------+----------+----------+

| Share premium | | 32,385 | | 32,772 |

+--------------------------------------+------+---------+----------+----------+

| Revenue reserve | | 12,585 | | 12,648 |

+--------------------------------------+------+---------+----------+----------+

| Foreign currency translation reserve | | (2,688) | | (1,670) |

+--------------------------------------+------+---------+----------+----------+

| Total equity | | 43,029 | | 44,519 |

+--------------------------------------+------+---------+----------+----------+

| | | | | |

+--------------------------------------+------+---------+----------+----------+

| Current liabilities | | | | |

+--------------------------------------+------+---------+----------+----------+

| Trade and other payables | | 1,152 | | 2,692 |

+--------------------------------------+------+---------+----------+----------+

| Taxation payable | 4 | 256 | | 122 |

+--------------------------------------+------+---------+----------+----------+

| Total current liabilities | | 1,408 | | 2,814 |

+--------------------------------------+------+---------+----------+----------+

| | | | | |

+--------------------------------------+------+---------+----------+----------+

| Total equity and liabilities | | 44,437 | | 47,333 |

+--------------------------------------+------+---------+----------+----------+

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

FOR THE SIX MONTHS ENDED 30 JUNE 2010

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | Foreign | |

| | Issued | | | currency | |

| | share | Share | Revenue | translation | |

| | capital | premium | reserve | reserve | Total |

+-----------------------+---------+---------+---------+-------------+---------+

| | 2009 | 2009 | 2009 | 2009 | 2009 |

+-----------------------+---------+---------+---------+-------------+---------+

| | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| As at 1 January 2009 | 769 | 32,772 | 9,840 | (2,455) | 40,926 |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| Total comprehensive | | | | | |

| income | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| Profit for the period | - | - | 1,862 | 895 | 2,757 |

| after taxation | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| As at 30 June 2009 | 769 | 32,772 | 11,702 | (1,560) | 43,683 |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | Foreign | |

| | Issued | | | currency | |

| | share | Share | Revenue | translation | |

| | capital | premium | reserve | reserve | Total |

+-----------------------+---------+---------+---------+-------------+---------+

| | 2010 | 2010 | 2010 | 2010 | 2010 |

+-----------------------+---------+---------+---------+-------------+---------+

| | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| As at 1 January 2010 | 769 | 32,772 | 12,648 | (1,670) | 44,519 |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| Total comprehensive | | | | | |

| income | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| Profit for the period | - | - | 1,063 | (1,018) | 45 |

| after taxation | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| Transactions with | | | | | |

| owners recorded | | | | | |

| directly in equity | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| Dividends to equity | - | - | (1,126) | - | (1,126) |

| holders (Note 9) | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| Purchase of own | (22) | (387) | - | - | (409) |

| shares (Note 9) | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

| As at 30 June 2010 | 747 | 32,385 | 12,585 | (2,688) | 43,029 |

+-----------------------+---------+---------+---------+-------------+---------+

| | | | | | |

+-----------------------+---------+---------+---------+-------------+---------+

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 30 JUNE 2010

+---------------------------------+------+----------+----------+----------+

| | | Six | | Six |

| | | months | | months |

| | | ended | | ended |

+---------------------------------+------+----------+----------+----------+

| | | 30 June | | 30 June |

+---------------------------------+------+----------+----------+----------+

| | | 2010 | | 2009 |

+---------------------------------+------+----------+----------+----------+

| |Note | US$'000 | | US$'000 |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Net cash inflow from operating | 10 | 409 | | 659 |

| activities | | | | |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Cash flows from investing | | | | |

| activities | | | | |

+---------------------------------+------+----------+----------+----------+

| Interest received on cash and | | 30 | | 99 |

| cash equivalents | | | | |

+---------------------------------+------+----------+----------+----------+

| Purchase of current asset | | - | | (11,000) |

| investments | | | | |

+---------------------------------+------+----------+----------+----------+

| Purchase of fixtures, fittings | 7 | (2) | | (23) |

| and equipment | | | | |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Net cash inflow/(outflow) from | | 28 | | (10,924) |

| investing activities | | | | |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Cash flows from financing | | | | |

| activities | | | | |

+---------------------------------+------+----------+----------+----------+

| Repurchase of own shares | | (409) | | - |

+---------------------------------+------+----------+----------+----------+

| Dividends paid | | (1,126) | | - |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Net cash used in financing | | (1,535) | | - |

| activities | | | | |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Net decrease in cash and cash | | (1,098) | | (10,265) |

| equivalents | | | | |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Cash and cash equivalents at 1 | | 13,069 | | 20,058 |

| January 2010 and | | | | |

| 1 January 2009 | | | | |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Foreign exchange (loss)/gain on | | (588) | | 974 |

| cash and cash equivalents | | | | |

+---------------------------------+------+----------+----------+----------+

| | | | | |

+---------------------------------+------+----------+----------+----------+

| Cash and cash equivalents as at | | 11,383 | | 10,767 |

| 30 June 2010 and 30 June 2009 | | | | |

+---------------------------------+------+----------+----------+----------+

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

For the six months ended 30 June 2010

1. CORPORATE INFORMATION

The Company is domiciled in the Isle of Man under the Companies Act

2006. Its registered office is at 33-37 Athol Street, Douglas, Isle of Man, IM1

1LB. The condensed consolidated interim financial statements of the Company as

at and for the six months ended 30 June 2010 comprise the Company and its

subsidiaries (together referred to as the "Group").

The consolidated financial statements of the Group as at and for the

year ended 31 December 2009 are available upon request from the Company's

registered office or at www.argogrouplimited.com.

The principal activity of the Company is that of a holding company and

the principal activity of the wider Group is that of an investment management

business. The functional and presentational currency of the Group undertakings

is US dollars. The Group has 25 employees.

Wholly owned subsidiaries

Country of incorporation

+--------------------------------------------+---------------+

| Argo Capital Management (Cyprus) Limited | Cyprus |

+--------------------------------------------+---------------+

| Argo Capital Management Limited | United |

| | Kingdom |

+--------------------------------------------+---------------+

| Argo Capital Management Property Limited | Cayman |

| | Islands |

+--------------------------------------------+---------------+

| Argo Capital Management (Asia) Pte. Ltd. | Singapore |

+--------------------------------------------+---------------+

| North Asset Management Srl | Romania |

+--------------------------------------------+---------------+

| North Asset Management Sarl | Luxembourg |

+--------------------------------------------+---------------+

| Argo Investor Services AG | Switzerland |

+--------------------------------------------+---------------+

2. BASIS OF PREPARATION

These condensed consolidated interim financial statements have been

prepared in accordance with IAS 34 Interim Financial Reporting. They do not

include all the information required for full annual financial statements and

should be read in conjunction with the consolidated financial statements of the

Group as at and for the year ended 31 December 2009.

The accounting policies applied by the Group in these condensed

consolidated interim financial statements are the same as those applied by the

Group in its consolidated financial statements as at and for the year ended 31

December 2009.

These condensed consolidated interim financial statements were

approved by the Board of Directors on 19 August 2010.

3. SEGMENTAL ANALYSIS

The Group operates as a single asset management business.

The operating results of the companies set out in note 1 above are regularly

reviewed by the directors of the Group for the purposes of making decisions

about resources to be allocated to each company and to assess performance. The

following summary analyses revenues, profit or loss, assets and liabilities:

+-------------------------+---------+------------+------------+------------+---------+---------+

| | | Argo | | Argo | | Six |

| | Argo | Capital | Argo | Capital | | months |

| | Group | Management | Capital | Management | | ended |

| | Ltd | (Cyprus) | Management | Property | Other | 30 |

| | | Limited | Limited | Limited | | June |

+-------------------------+---------+------------+------------+------------+---------+---------+

| | 2010 | 2010 | 2010 | 2010 | 2010 | 2010 |

+-------------------------+---------+------------+------------+------------+---------+---------+

| | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 | US$'000 |

+-------------------------+---------+------------+------------+------------+---------+---------+

| | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

| Revenues from external | - | 4,053 | - | 1,562 | 1 | 5,616 |

| customers | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

| Intersegment revenues | 904 | - | 1,640 | - | 228 | 2,772 |

+-------------------------+---------+------------+------------+------------+---------+---------+

| | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

| Reportable segment | 597 | 591 | (481) | 452 | 50 | 1,209 |

| profit/(loss) | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

| Intersegment | 904 | (2,759) | 1,641 | - | 227 | 13 |

| profit/(loss) | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

| Profit/(loss) excluding | (307) | 3,350 | (2,122) | 452 | (177) | 1,196 |

| inter- segment | | | | | | |

| transactions | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

| | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

| Reportable segment | 44,498 | 4,307 | 5,206 | 4,800 | 492 | 59,303 |

| assets | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

| Reportable segment | 30 | 706 | 757 | 199 | 34 | 1,726 |

| liabilities | | | | | | |

+-------------------------+---------+------------+------------+------------+---------+---------+

+------------------------------------------------------+----------+

| Revenues, profit or loss, assets and liabilities may | Six |

| be reconciled as follows: | months |

| | |

+------------------------------------------------------+----------+

| | Ended |

+------------------------------------------------------+----------+

| | 30 June |

| | 2010 |

+------------------------------------------------------+----------+

| | US$'000 |

+------------------------------------------------------+----------+

| Revenues | |

+------------------------------------------------------+----------+

| Total revenues for reportable segments | 8,388 |

+------------------------------------------------------+----------+

| Elimination of intersegment revenues | (2,772) |

+------------------------------------------------------+----------+

| Group revenues | 5,616 |

+------------------------------------------------------+----------+

| | |

+------------------------------------------------------+----------+

| Profit or loss | |

+------------------------------------------------------+----------+

| Total profit for reportable segments | 1,209 |

+------------------------------------------------------+----------+

| Elimination of intersegment profits | (13) |

+------------------------------------------------------+----------+

| Other unallocated amounts | 13 |

+------------------------------------------------------+----------+

| Profit on ordinary activities before taxation | 1,209 |

+------------------------------------------------------+----------+

| | |

+------------------------------------------------------+----------+

| Assets | |

+------------------------------------------------------+----------+

| Total assets for reportable segments | 59,303 |

+------------------------------------------------------+----------+

| Elimination of intersegment receivables | (318) |

+------------------------------------------------------+----------+

| Elimination of Company's cost of investments | (14,548) |

+------------------------------------------------------+----------+

| Group assets | 44,437 |

+------------------------------------------------------+----------+

| | |

+------------------------------------------------------+----------+

| Liabilities | |

+------------------------------------------------------+----------+

| Total liabilities for reportable segments | 1,726 |

+------------------------------------------------------+----------+

| Elimination of intersegment payables | (318) |

+------------------------------------------------------+----------+

| Group liabilities | 1,408 |

+------------------------------------------------------+----------+

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| | | Argo | | | Six |

| | Argo | Capital | Argo | | months |

| | Group | Management | Capital | | ended |

| | Ltd | (Cyprus) | Management | Other | 30 |

| | | Limited | Limited | | June |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| | 2009 | 2009 | 2009 | 2009 | 2009 |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| |US$'000 | US$'000 | US$'000 |US$'000 | US$'000 |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| Revenues from | - | 4,358 | - | 1,477 | 5,835 |

| external customers | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| Intersegment | 11,479 | - | 1,728 | 221 | 13,428 |

| revenues | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| Reportable segment | 11,971 | (9,426) | (502) | (1) | 2,042 |

| profit/(loss) | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| Intersegment | 11,479 | (13,424) | 1,728 | 221 | 4 |

| profit/(loss) | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| Profit/(loss) | 492 | 3,998 | (2,230) | (222) | 2,038 |

| excluding inter- | | | | | |

| segment | | | | | |

| transactions | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| Reportable segment | 46,550 | 2,721 | 6,702 | 7,872 | 63,845 |

| assets | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

| Reportable segment | 35 | 623 | 394 | 519 | 1,571 |

| liabilities | | | | | |

+---------------------+---------+------------+------------+---------+---------------------------------------------------------------------+

+----------------------------------------------------+------------+

| Revenues, profit or loss, assets and liabilities | Six |

| may be reconciled as follows: | months |

| | ended |

| | 30 June |

+----------------------------------------------------+------------+

| | 2009 |

+----------------------------------------------------+------------+

| | US$'000 |

+----------------------------------------------------+------------+

| Revenues | |

+----------------------------------------------------+------------+

| Total revenues for reportable segments | 19,263 |

+----------------------------------------------------+------------+

| Elimination of intersegment revenues | (13,428) |

+----------------------------------------------------+------------+

| Group revenues | 5,835 |

+----------------------------------------------------+------------+

| | |

+----------------------------------------------------+------------+

| Profit or loss | |

+----------------------------------------------------+------------+

| Total profit for reportable segments | 2,042 |

+----------------------------------------------------+------------+

| Elimination of intersegment loss | (4) |

+----------------------------------------------------+------------+

| Other unallocated amounts | 8 |

+----------------------------------------------------+------------+

| Profit on ordinary activities before taxation | 2,046 |

+----------------------------------------------------+------------+

| | |

+----------------------------------------------------+------------+

| Assets | |

+----------------------------------------------------+------------+

| Total assets for reportable segments | 63,845 |

+----------------------------------------------------+------------+

| Elimination of intersegment receivables | (327) |

+----------------------------------------------------+------------+

| Elimination of Company's cost of investments | (18,597) |

+----------------------------------------------------+------------+

| Group assets | 44,921 |

+----------------------------------------------------+------------+

| | |

+----------------------------------------------------+------------+

| Liabilities | |

+----------------------------------------------------+------------+

| Total liabilities for reportable segments | 1,571 |

+----------------------------------------------------+------------+

| Elimination of intersegment payables | (333) |

+----------------------------------------------------+------------+

| Group liabilities | 1,238 |

+----------------------------------------------------+------------+

4. TAXATION

Taxation rates applicable to the parent company and the Cypriot, UK,

Singaporean, Luxembourg, Swiss, Cayman and Romanian subsidiaries range from 0%

to 28%.

+-----------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Income | Six | | Six |

| Statement | months | | months |

+-----------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | ended | | ended |

+-----------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | 30 | | 30 |

| | June | | June |

+-----------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | 2010 | | 2009 |

+-----------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | US$'000 | | US$'000 |

+-----------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | | | |

+-----------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Taxation charge for the period on | 146 | | 184 |

| Group companies | | | |

+-----------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

The charge for the period can be reconciled to the profit per the Condensed

Consolidated Statement of Comprehensive Income as follows:

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | Six | | Six |

| | months | | months |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | Ended | | ended |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | 30 | | 30 |

| | June | | June |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | 2010 | | 2009 |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | US$'000 | | US$'000 |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | | | |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Profit before tax | 1,209 | | 2,046 |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | | | |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Applicable | - | | - |

| Isle of | | | |

| Man tax | | | |

| rate for | | | |

| Argo Group | | | |

| Limited of | | | |

| 0% | | | |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Other | (5) | | (9) |

| adjustments | | | |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Tax | 151 | | 193 |

| effect | | | |

| of | | | |

| different | | | |

| tax rates | | | |

| of | | | |

| subsidiaries | | | |

| operating in | | | |

| other | | | |

| jurisdictions | | | |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Tax | 146 | | 184 |

| charge | | | |

+---------------------------------------------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

+---------------------------------------------------------------------+------------------------------------------------------------------+----------+----------------------------------------------------------------------+

| Balance | | | |

| Sheet | | | |

+---------------------------------------------------------------------+------------------------------------------------------------------+----------+----------------------------------------------------------------------+

| | 30 | | 31 |

| | June | | December |

+---------------------------------------------------------------------+------------------------------------------------------------------+----------+----------------------------------------------------------------------+

| | 2010 | | 2009 |

+---------------------------------------------------------------------+------------------------------------------------------------------+----------+----------------------------------------------------------------------+

| | US$'000 | | US$'000 |

+---------------------------------------------------------------------+------------------------------------------------------------------+----------+----------------------------------------------------------------------+

| | | | |

+---------------------------------------------------------------------+------------------------------------------------------------------+----------+----------------------------------------------------------------------+

| Corporation tax payable | 256 | | 122 |

+---------------------------------------------------------------------+------------------------------------------------------------------+----------+----------------------------------------------------------------------+

5. EARNINGS PER SHARE

Earnings per share is calculated by dividing the net profit for the

period by the weighted average number of shares outstanding during the period.

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | Six | | Six |

| | months | | months |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | ended | | ended |

| | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | 30 | | 30 |

| | June | | June |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | 2010 | | 2009 |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | US$'000 | | US$'000 |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Net profit for the period after | 1,063 | | 1,862 |

| taxation attributable to members | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | No. of | | No. of |

| | shares | | shares |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Weighted average of ordinary shares | 76,303,599 | | 76,931,620 |

| for basic earnings per share | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Effect of dilution | - | | - |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Weighted average number of ordinary | 76,303,599 | | 76,931,620 |

| shares for diluted earnings per share | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | Six | | Six |

| | months | | months |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | Ended | | ended |

| | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | 30 | | 30 |

| | June | | June |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | 2010 | | 2009 |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | US$ | | US$'000 |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| | | | |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Earnings per share (basic) | 0.01 | | 0.02 |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

| Earnings per share (diluted) | 0.01 | | 0.02 |

+---------------------------------------+--------------------------------------------------------------------+----------+---------------------------------------------------------------------+

6. INTANGIBLE ASSETS

+--------------------------------------------------+------------+

| | Fund |

| | management |

| | contracts |

+--------------------------------------------------+------------+

| | US$'000 |

+--------------------------------------------------+------------+

| Cost | |

+--------------------------------------------------+------------+

| At 1 January 2009 | 18,490 |

+--------------------------------------------------+------------+

| Foreign exchange movement | 139 |

+--------------------------------------------------+------------+

| At 31 December 2009 | 18,629 |

+--------------------------------------------------+------------+

| Foreign exchange movement | (345) |

+--------------------------------------------------+------------+

| At 30 June 2010 | 18,284 |

+--------------------------------------------------+------------+

| | |

+--------------------------------------------------+------------+

| Amortisation and impairment | |

+--------------------------------------------------+------------+

| At 1 January 2009 | 380 |

+--------------------------------------------------+------------+

| Amortisation of Argo business intangible assets | 692 |

+--------------------------------------------------+------------+

| At 31 December 2009 | 1,072 |

+--------------------------------------------------+------------+

| Amortisation of Argo business intangible assets | 323 |

+--------------------------------------------------+------------+

| At 30 June 2010 | 1,395 |

+--------------------------------------------------+------------+

| | |

+--------------------------------------------------+------------+

| Net book value | |

+--------------------------------------------------+------------+

| At 31 December 2009 | 17,557 |

+--------------------------------------------------+------------+

| At 30 June 2010 | 16,889 |

+--------------------------------------------------+------------+

The Group tests intangible assets annually for impairment, or more frequently if

there are indications that the intangible assets may be impaired. The

recoverable amounts of the intangible assets that have been reviewed for

impairment are separately identifiable business units within the Group. The

value in use approach has been used as the businesses were not considered

saleable in their current form due to certain factors, the main being reliance

on certain key individuals.

At the balance sheet date the carrying value of goodwill was US$14.9m being

allocated to Argo Capital Management (Cyprus) Limited and Argo Capital

Management Limited as US$7.2m and US$7.7m respectively.

The key assumptions on which the directors have based their five year discounted

cash flow analysis are a pre-tax discount rate of 15%, an inflation rate of 5%

and a growth in assets under management (which determine management and

performance fee income) of 15% to 20%, with 4.5% to 6% of this estimated to be

from annual profits. The assumption of growth in assets under management has

been based on the historic performance of the funds. The calculations use cash

flow projections based on actual operating results. The result of this review

has been compared to the carrying value of goodwill and accordingly the

directors have concluded that there is no impairment to goodwill. As an added

sensitivity, if the estimated discount rate applied to the discounted cash flows

had been 25% higher or the growth rate of assets under management had been 25%

lower there would still have been no impairment of goodwill as the net present

value of future cash flows would still have been higher than the carrying value

of goodwill.

At the balance sheet date the carrying value of the Argo Real Estate

Opportunities Fund Limited management contract is US$1.9m, net of amortisation.

The intangible asset has been amortised over 5 years and 44 days, being the

remaining period of the contract.

7. FIXTURES, FITTINGS AND EQUIPMENT

+-------------------------------------------------+---------------+

| | Fixtures, |

| | fittings |

| | & |

| | equipment |

+-------------------------------------------------+---------------+

| | US$'000 |

+-------------------------------------------------+---------------+

| Cost | |

+-------------------------------------------------+---------------+

| At 1 January 2009 | 315 |

+-------------------------------------------------+---------------+

| Additions | 23 |

+-------------------------------------------------+---------------+

| Disposals | (25) |

+-------------------------------------------------+---------------+

| Foreign exchange movement | (14) |

+-------------------------------------------------+---------------+

| At 31 December 2009 | 299 |

+-------------------------------------------------+---------------+

| Additions | 2 |

+-------------------------------------------------+---------------+

| At 30 June 2010 | 301 |

+-------------------------------------------------+---------------+

| | |

+-------------------------------------------------+---------------+

| Accumulated Depreciation | |

+-------------------------------------------------+---------------+

| At 1 January 2009 | 78 |

+-------------------------------------------------+---------------+

| Depreciation charge for period | 119 |

+-------------------------------------------------+---------------+

| Disposals | (3) |

+-------------------------------------------------+---------------+

| Foreign exchange movement | (31) |

+-------------------------------------------------+---------------+

| At 31 December 2009 | 163 |

+-------------------------------------------------+---------------+

| Depreciation charge for period | 52 |

+-------------------------------------------------+---------------+

| Foreign exchange movement | 7 |

+-------------------------------------------------+---------------+

| At 30 June 2010 | 222 |

+-------------------------------------------------+---------------+

| | |

+-------------------------------------------------+---------------+

| Net book value | |

+-------------------------------------------------+---------------+

| At 31 December 2009 | 136 |

+-------------------------------------------------+---------------+

| At 30 June 2010 | 79 |

+-------------------------------------------------+---------------+

8. INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS

+---------+--------------------------+-----------+----------+-----------+

| | | 30 June | | 30 June |

+---------+--------------------------+-----------+----------+-----------+

| | | 2010 | | 2010 |

+---------+--------------------------+-----------+----------+-----------+

|Holding | Investment in management | Total | | Fair |

| | shares | cost | | value |

+---------+--------------------------+-----------+----------+-----------+

| | | US$'000 | | US$'000 |

+---------+--------------------------+-----------+----------+-----------+

| | | | | |

+---------+--------------------------+-----------+----------+-----------+

| 10 | The Argo Fund Ltd | 0 | | 0 |

+---------+--------------------------+-----------+----------+-----------+

| 10 | Argo Capital Investors | 0 | | 0 |

| | Fund SPC | | | |

+---------+--------------------------+-----------+----------+-----------+

| 10 | Argo Capital Partners | 0 | | 0 |

| | Fund | | | |

+---------+--------------------------+-----------+----------+-----------+

| 100 | Argo Distressed Credit | 0 | | 0 |

| | Fund Ltd | | | |

+---------+--------------------------+-----------+----------+-----------+

| 100 | AGSSF Holdings Ltd | 0 | | 0 |

+---------+--------------------------+-----------+----------+-----------+

| | | 0 | | 0 |

+---------+--------------------------+-----------+----------+-----------+

+---------+--------------------------+-----------+----------+-----------+

|Holding | Investment in ordinary | Total | | Fair |

| | shares | cost | | value |

+---------+--------------------------+-----------+----------+-----------+

| | | US$'000 | | US$'000 |

+---------+--------------------------+-----------+----------+-----------+

| | | | | |

+---------+--------------------------+-----------+----------+-----------+

| 66,435 | The Argo Fund Ltd | 14,343 | | 14,389 |

+---------+--------------------------+-----------+----------+-----------+

| | | 14,343 | | 14,389 |

+---------+--------------------------+-----------+----------+-----------+

+---------+--------------------------+-----------+----------+-----------+

| | | 31 | | 31 |

| | | December | | December |

+---------+--------------------------+-----------+----------+-----------+

| | | 2009 | | 2009 |

+---------+--------------------------+-----------+----------+-----------+

|Holding | Investment in management | Total | | Fair |

| | shares | cost | | value |

+---------+--------------------------+-----------+----------+-----------+

| | | US$'000 | | US$'000 |

+---------+--------------------------+-----------+----------+-----------+

| | | | | |

+---------+--------------------------+-----------+----------+-----------+

| 10 | The Argo Fund Ltd | 0 | | 0 |

+---------+--------------------------+-----------+----------+-----------+

| 10 | Argo Capital Investors | 0 | | 0 |

| | Fund SPC | | | |

+---------+--------------------------+-----------+----------+-----------+

| 10 | Argo Capital Partners | 0 | | 0 |

| | Fund Ltd | | | |

+---------+--------------------------+-----------+----------+-----------+

| 100 | Argo Distressed Credit | 0 | | 0 |

| | Fund Ltd | | | |

+---------+--------------------------+-----------+----------+-----------+

| 100 | AGSSF Holdings Ltd | 0 | | 0 |

+---------+--------------------------+-----------+----------+-----------+

| | | 0 | | 0 |

+---------+--------------------------+-----------+----------+-----------+

+---------+--------------------------+-----------+----------+-----------+

|Holding | Investment in ordinary | Total | | Fair |

| | shares | cost | | value |

+---------+--------------------------+-----------+----------+-----------+

| | | US$'000 | | US$'000 |

+---------+--------------------------+-----------+----------+-----------+

| | | | | |

+---------+--------------------------+-----------+----------+-----------+

| 66,435 | The Argo Fund Ltd | 14,343 | | 14,337 |

+---------+--------------------------+-----------+----------+-----------+

| | | 14,343 | | 14,337 |

+---------+--------------------------+-----------+----------+-----------+

9. SHARE CAPITAL

The Company's authorised share capital is unlimited with a nominal value of

US$0.01.

+---------------------+------------+---------+----------------------------------------------------------------------+----------------------------------------------------------------------+

| | 30 | 30 | 31 | 31 |

| | June | June | December | December |

+---------------------+------------+---------+----------------------------------------------------------------------+----------------------------------------------------------------------+

| | 2010 | 2010 | 2009 | 2009 |

+---------------------+------------+---------+----------------------------------------------------------------------+----------------------------------------------------------------------+

| | No. | US$'000 | No. | US$'000 |

+---------------------+------------+---------+----------------------------------------------------------------------+----------------------------------------------------------------------+

| Issued and fully | | | | |

| paid | | | | |

+---------------------+------------+---------+----------------------------------------------------------------------+----------------------------------------------------------------------+

| Ordinary shares of | 74,663,494 | 747 | 76,931,620 | 769 |

| US$0.01 each | | | | |

+---------------------+------------+---------+----------------------------------------------------------------------+----------------------------------------------------------------------+

| | 74,663,494 | 747 | 76,931,620 | 769 |

+---------------------+------------+---------+----------------------------------------------------------------------+----------------------------------------------------------------------+

The directors recommended a final dividend of 1p per share (2008: Nil) in the

financial statements for the year ended 31 December 2009. The final dividend of

US$1,125,888 was paid on 23 June 2010 to ordinary shareholders who were on the

Register of Members on 28 May 2010. Going forward, it is intended that the

Company implements a progressive dividend policy paying a final dividend each

year.

In addition the directors authorised the repurchase of 750,000 shares on 6 April

2010 and 1,518,126 shares on 3 June 2010 at respective purchase prices of

US$0.20 and US$0.18 per share.

10. RECONCILIATION OF NET CASH INFLOW FROM OPERATING ACTIVITIES TO

PROFIT ON ORDINARY ACTIVITIES BEFORE TAXATION

+------------------------------------+----------+----------+----------+

| | Six | | Six |

| | months | | months |

| | ended | | ended |

| | 30 June | | 30 June |

| | 2010 | | 2009 |

+------------------------------------+----------+----------+----------+

| | US$'000 | | US$'000 |

+------------------------------------+----------+----------+----------+

| | | | |

+------------------------------------+----------+----------+----------+

| Profit on ordinary activities | 1,209 | | 2,046 |

| before taxation | | | |

+------------------------------------+----------+----------+----------+

| | | | |

+------------------------------------+----------+----------+----------+

| Interest income | (30) | | (99) |

+------------------------------------+----------+----------+----------+

| Amortisation of intangible assets | 323 | | 333 |

+------------------------------------+----------+----------+----------+

| Depreciation | 52 | | 54 |

+------------------------------------+----------+----------+----------+

| Unrealised gains on investments | (53) | | (481) |

+------------------------------------+----------+----------+----------+

| Net foreign exchange gain | (77) | | (157) |

+------------------------------------+----------+----------+----------+

| (Decrease)/increase in payables | (1,540) | | 227 |

+------------------------------------+----------+----------+----------+

| Decrease/(increase) in receivables | 537 | | (143) |

+------------------------------------+----------+----------+----------+

| Income taxes paid | (12) | | (1,121) |

+------------------------------------+----------+----------+----------+

| Net cash inflow from operating | 409 | | 659 |

| activities | | | |

+------------------------------------+----------+----------+----------+

11. RELATED PARTY TRANSACTIONS

72% of revenue derives from funds in which two of the Company's

directors, Andreas Rialas and Kyriakos Rialas, have an influence through the

provision of investment advisory services.

Michael Kloter, the non-executive chairman, is also partner in a legal firm

which supplies services to the Group. This firm charged US$5,192 (six months

ended 30 June 2009: US$9,382) for services rendered to the Group in the period.

12. POSSIBLE CLAIM RELATING TO LAWSUIT AGAINST FORMER GROUP COMPANY

Argo Group Limited ("Argo") has been named as an additional defendant in a

lawsuit filed against Absolute Capital Management Holdings Limited (now named

ACMH Limited ("ACMH")) and others. The suit has been filed in the United States

District Court for the District of Colorado, by an investor in several of ACMH's

investment funds. This litigation arose after the demerger of Argo from ACMH.

The plaintiff, The Cascade Fund LLLP ("Cascade"), has made a number of claims

against ACMH. In the event that Cascade's claim against ACMH proves successful,

Cascade is seeking to include Argo assets as part of the ACMH asset pool

available to it by way of compensation.

Argo considers that the courts of Colorado do not have jurisdiction over it and

that the claim against Argo is wholly without merit. In April 2010 the Colorado

court dismissed Cascade's action against ACMH for failure to state a claim,

following which Cascade filed a second amended complaint. Argo subsequently

filed a motion to dismiss Cascade's second amended complaint, which motion is

pending before the court. Argo intends to continue to vigorously defend its

position.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GRGDIDSDBGGG

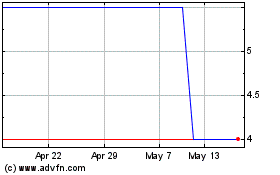

Argo (LSE:ARGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Argo (LSE:ARGO)

Historical Stock Chart

From Jul 2023 to Jul 2024