RNS Number : 4867E

Airea PLC

29 September 2008

AIREA plc

Preliminary results for the year ended 30th June 2008

Review of operations

Introduction

Over the last twelve months we have completed a number of previously advised projects. These include the sale of the specialist yarns

division, the disposal of certain freehold properties, re-engineering the residential carpets business and streamlining the management

team.

Financial statements

The consolidated financial statements are presented under International Financial Reporting Standards for the first time. There are a

number of presentational changes, the most significant of which is the analysis of the results between continuing operations and

discontinued operations on the face of the consolidated income statement.

The only significant changes to the consolidated results reported previously are changes to the deferred tax position at 30th June 2007

and the fact that goodwill is no longer amortised, with amounts previously amortised since 1st July 2006 being reinstated in the

consolidated balance sheet. Provisions for impairment of the goodwill associated with the residential floor coverings business and the

subsidiary yarn dyeing business have then been included in the income statement for the current period.

Continuing operations

Continuing operations consist of the Burmatex commercial floor coverings business and the Ryalux residential floor coverings business.

Sales reduced by 1% to �48.7m (2007: �49.3m) with growth in commercial products being offset by a decline in residential products. Burmatex

has continued to benefit from the changes to the product range and the greater focus on marketing activities implemented in recent years.

The decline in sales of residential products was partly due to range rationalisation and partly due to the difficult market conditions.

Whilst the board remains fully committed to the residential floor coverings business, in the light of the results from the business and the

challenging market conditions, it has made a significant provision for the goodwill associated with this business.

The operating profit was �1.9m (2007: �0.8m) but the year to 30th June 2008 includes an exceptional profit on sale of property of �9.9m

(2007: �nil) and a provision for impairment of goodwill of �8.0m (2007: nil). After excluding this exceptional profit, the provision for

impairment of goodwill and other exceptional costs of �0.4m (2007: �0.7m), operating profit before exceptional items was �0.5m (2007:

�1.5m).

Earnings per share from continuing operations were 0.94p (2007: 5.65p) and adjusted earnings per share, excluding the effect of the

exceptional profit on sale of property, the related deferred tax movements, the provision for impairment of goodwill and the other

exceptional costs, was 1.94p (2007: 1.03p).

Discontinued operations

Discontinued operations consist of the specialist yarns business which was sold on 2nd November 2007 and the yarn dyeing business which

was closed in May 2008. Sales to the date of disposal or closure were �6.3m (2007: �16.1m). The operating loss was �3.8m (2007: profit

�0.8m) but this includes a loss on disposal of �2.7m (2007: �nil), a provision for impairment of goodwill, consequent upon the closure of

the yarn dyeing business, of �0.8m (2007: nil) and other exceptional costs of �0.5m (2007: �45,000). After excluding these items, operating

profit was �0.2m (2007: �0.9m).

Discontinued operations generated a loss per share of 8.75p (2007: earnings per share 1.05p). Adjusted loss per share, excluding the

effect of the loss on disposal, the provision for impairment of goodwill and the other exceptional costs, was 0.42p (2007: adjusted earnings

per share 1.12p).

Group results

Total turnover for the year was �55.0m (2007: �65.3m). This represents a reduction of 16% due to the disposal of the specialist yarns

business part way through the year combined with a decline in the sales of residential carpets. The result for the year, after accounting

for the operating results described above, finance income totalling �0.6m (2007: �nil), finance costs of �0.2m (2007: 0.8m) and a tax charge

of �2.1m (2007: tax credit �2.3m), was a loss of �3.6m (2007: profit of �3.1m).

There was a net cash outflow from operating activities of �4.1m (2007: inflow of �4.5m). The main reasons for the change from last year

were an increase in working capital, compared to a reduction the previous year, and increased contributions to the defined benefit pension

scheme. After accounting for the sale of properties and the specialist yarns business there was a net increase in cash and cash equivalents

of �7.5m from �1.5m negative to �6.1m positive and an elimination of �3.7m of debt. A further substantial reduction in the pension deficit

was achieved in the year and this now stands at a gross figure of �5.5m (2007: �8.4m).

The loss per share was 7.81p (2007: earnings per share 6.70p) and adjusted earnings per share, excluding the effect of the exceptional

profit on sale of property, the related deferred tax movements, the provisions for impairment of goodwill, the loss on sale of the

specialist yarns business and other exceptional costs were 1.52p (2007: 2.15p).

An interim dividend of 0.80p per share was paid in May 2008. In view of the results for the year, the board have given careful

consideration to the level of final dividend but having taken into account the cash generated from disposals during the year, the board

consider it appropriate to propose a maintained final dividend of 1.60p per share. This gives an unchanged total dividend of 2.40p per share

for the year. If approved, this dividend will be paid on 25th November 2008 to shareholders on the register at the close of business on 24th

October 2008. The board will keep the dividend policy under review and future dividends will be based upon future levels of profitability

and cash flow.

Key performance indicators

As part of its internal financial control procedures the board monitors certain financial ratios. For the year to 30th June 2008 sales

per employee amounted to �122,000 (2007: �107,000), operating return on sales was 1.3% (2007: 3.6%), return on average net operating assets

was 2.2% (2007: 5.7%) and working capital to sales percentage was 16.1% (2007: 18.2%). Sales per employee improved due to the

rationalisation of staffing within the residential floor coverings business. The operating return on sales and the return on average net

operating assets reduced as a consequence of the challenging market conditions. The working capital ratio improved following the disposal of

the specialist yarns business.

Management and personnel

Steve Harrison, the former chief operating officer, left the group on 29th February 2008. Neil Rylance joined the group as managing

director of the floor coverings business on 2nd June 2008 and was appointed chief executive officer on 13th June 2008. We would like to

thank all our team members throughout the group for their ongoing commitment and support during a challenging period.

Current trading and future prospects

We continue to operate in highly competitive market conditions. In view of this, and the economic downturn in the UK, the start to the

new financial year has been mixed with sales ahead of last year at Burmatex but down on last year at Ryalux. Overall sales in continuing

activities are currently running approximately 5% below last year and margins remain under pressure.

Despite these challenges, we continue to focus on streamlining the business, not only to reduce cost but also to increase effectiveness,

flexibility and speed of response with a view to improving profitability and securing the future of the group.

Work on the residential business is a major priority and the current year will see further rationalisation of the product range, further

streamlining of the manufacturing operations and a renewed focus on new product development. As we move forwards, we expect the Burmatex

operation to continue to improve and the Ryalux business to start to move back into an acceptable trading position.

Enquiries:

Neil Rylance 01924 266561

Chief executive officer

Kevin Henry 01924 266561

Group finance director

Andrew Kitchingman 0845 270 8610

Managing Director - Corporate Finance

Brewin Dolphin

The financial information set out in this preliminary announcement does not constitute statutory accounts as defined in section 240 of

the Companies Act 1985.

The consolidated balance sheet at 30th June 2008 and the consolidated income statement, the statement of recognised income and expense

and the consolidated cash flow statement for the year then ended have been extracted from the Group's 2008 statutory financial statements

upon which the auditor's opinion is unqualified and does not include any statement under section 237 of the Companies Act 1985.

The announcement has been agreed with the company's auditor for release.

Consolidated Income Statement

year ended 30th June 2008

2008 2007

�000 �000

CONTINUING OPERATIONS

Revenue 48,713 49,270

Operating costs (48,648) (48,461)

Impairment of goodwill (8,012) -

Exceptional profit on sale of property 9,858 -

Operating profit after exceptional items 1,911 809

Analysed between:

Operating profit before exceptional items 484 1,511

Exceptional operating costs (419) (702)

Impairment of goodwill (8,012) -

Exceptional profit on sale of property 9,858 -

Finance income 383 -

Finance costs (237) (671)

Profit before taxation 2,057 138

Taxation (1,623) 2,475

Profit from continuing operations 434 2,613

DISCONTINUED OPERATIONS

Revenue 6,329 16,060

Operating costs (6,570) (15,243)

Impairment of goodwill (845) -

Loss on disposal of discontinued operations (2,668) -

Operating (loss)/profit after exceptional items (3,754) 817

Analysed between:

Operating profit before exceptional items 245 862

Exceptional operating costs (486) (45)

Impairment of goodwill (845) -

Loss on disposal of discontinued operations (2,668) -

Finance income 188 -

Finance costs - (166)

(Loss)/profit before taxation (3,566) 651

Taxation (481) (168)

(Loss)/profit from discontinued operations (4,047) 483

(Loss)/profit for the year (3,613) 3,096

(Loss)/earnings per share

(basic and diluted) (7.81)p 6.70p

Earnings per share from continuing operations

(basic and diluted) 0.94p 5.65p

(Loss)/earnings per share from discontinued

operations

(basic and diluted) (8.75)p 1.05p

Consolidated Balance Sheet

as at 30th June 2008

2008 2007

�000 �000 �000 �000

Non-current assets

Property, plant and equipment 8,865 10,086

Goodwill 4,000 12,857

Deferred tax asset 1,540 2,520

Loan notes 300 -

14,705 25,463

Current assets

Inventories 10,970 13,312

Trade and other receivables 8,793 10,442

Income tax receivable 448 240

Deferred tax asset - 1,260

Cash and cash equivalents 6,063 176

26,274 25,430

Non-current assets classified as 452 5,643

held for sale

Total assets 41,431 56,536

Current liabilities

Trade and other payables (10,891) (11,849)

Borrowings - (5,394)

(10,891) (17,243)

Non-current liabilities

Pension deficit (5,500) (8,400)

Deferred tax (252) (738)

(5,752) (9,138)

Total liabilities (16,643) (26,381)

24,788 30,155

Equity

Called up share capital 11,561 11,561

Share premium account 504 504

Capital redemption reserve 2,395 2,395

Retained earnings 10,328 15,695

24,788 30,155

Consolidated Cash Flow

Statement

year ended 30th June 2008

2008 2007

�000 �000

Operating activities

Cash (used in)/from operations (4,148) 4,482

Interest received/(paid) 187 (602)

Income tax received/(paid) 5 (635)

(3,956) 3,245

Investing activities

Purchase of property, plant (2,323) (2,574)

and equipment

Proceeds on disposal of 16,261 658

property, plant and equipment

Disposal of subsidiary 2,409 -

undertaking

16,347 (1,916)

Financing activities

Equity dividends paid (1,110) (1,110)

Redemption of loan notes (88) (80)

New bank loans received - 3,000

Repayment of bank loans (3,652) (2,914)

(4,850) (1,104)

Net increase in cash and cash 7,541 225

equivalents

Cash and cash equivalents at (1,478) (1,703)

start of the year

Cash and cash equivalents at 6,063 (1,478)

end of the year

Statement of Recognised Income and Expense

year ended 30th June 2008 2008 2007

�000 �000 �000 �000

(Loss)/profit attributable to shareholders of the (3,613) 3,096

group

Actuarial (losses)/gains (920) 3,620

recognised in the pension

scheme

Related deferred taxation 276 (1,086)

(644) 2,534

Total recognised income and expense relating to the (4,257) 5,630

year

Notes:

In accordance with Rule 20 of the AIM Rules, Airea confirms that the annual report and accounts for the year ended 30th June 2008 will

be posted to shareholders and will be available to view on the Company's website at www.aireaplc.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FKAKKABKDPCB

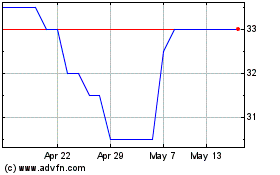

Airea (LSE:AIEA)

Historical Stock Chart

From Jun 2024 to Jul 2024

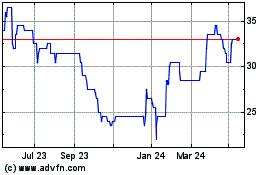

Airea (LSE:AIEA)

Historical Stock Chart

From Jul 2023 to Jul 2024