TIDMAGTA

RNS Number : 4953P

Agriterra Ltd

26 March 2009

Agriterra Ltd / Ticker: AGTA / Index: AIM / Sector: Food Producer

26 March 2009

Agriterra Ltd ('Agriterra' or 'the Company')

Interim Results

Agriterra Ltd, the AIM listed company focussed on the agricultural sector in

central and southern Africa, announces its results for the six months ended 31

December 2008.

Overview

* Changed focus to agricultural investment and development in southern Africa and

Company renamed 'Agriterra Limited'

* Acquired agricultural trading and processing companies DECA and Compagri, and

prospective cattle ranching and feedlot production entity Mozbife, all located

in Mozambique

* DECA is a cash generative operation and is being replicated at Compagri and

Maputo

* Medium term aim to achieve processing and sales of over 100,000 tonnes per annum

by 2011

* Company remains supportive and in contact with the Government of Southern Sudan

with regards to oil and gas assets, in particular Block Ba

* Results reflect impairment of oil and gas assets on change of strategy

Chairman's Statement

Since my last report much has happened in the development of your Company.

Following a strategic review, prompted by both political and economic

considerations beyond the control of the Board, the Company has changed its

focus away from the oil and gas sector to agricultural investment and

development in Africa. This area, identified by the Board as having potential

for rapid growth with the capability of generating significant returns on

investment despite the current economic downturn, is anticipated to provide

better near term returns for our shareholders.

In accordance with this strategy shift and highlighted in the final results

announced in December 2008, we proposed to shareholders the acquisition of

agricultural trading and processing companies Desenvolvimento E Comercialização

Agricola Limitada ('DECA') and Compagri Limitada ('Compagri') and prospective

cattle ranching and feedlot production entity Mozbife Limitada ('Mozbife'), all

located in Mozambique. Following shareholder approval, these acquisitions were

completed on 5 February.

DECA is a well established, cash generative business and represents an ideal

model for replication in other areas. DECA was founded as a grain buying

business based in Chimoio in the Manica Province of Mozambique in 2005. Since

inception, DECA's operations have grown significantly with its headquarters

currently being housed on a 20 hectare site and consisting of seventeen 1,000

tonne silos, seven warehouses each with capacity for 3,500 tonnes of maize, as

well as two milling plants, one workshop and a fleet of over 80 vehicles. DECA

has a strong brand and a loyal customer base which currently provides a market

outlet for some 350,000 farmers. Its operations focus on the treatment and

processing of grain purchased from local farmers, through its specialised buying

system, delivering cash directly to the smallholder farmers and thereby

stimulating economic growth in rural areas. The grain currently processed by

DECA currently sustains thousands of people in the local province and the UN

World Food Programme is one its largest customers. DECA's operations are

intended to be mirrored at Compagri, based in the Tete area of Mozambique, which

is currently being developed with infrastructure, machinery and logistics

similar to those of DECA to the south. Once brought on line in 2009 Compagri

will significantly increase group revenues and further strengthen our balance

sheet. An additional site at Maputo, which is specifically a processing

operation with an intended capacity of 50,000 tonnes, has also been initiated.

The medium term aim for the Company is to achieve processing and sales of over

100,000 tonnes per annum by 2011 and also to explore opportunities in rice,

cocoa and sorghum in countries including Mali, Tanzania and Sudan.

In addition to the grain businesses of DECA and Compagri, the board identified

cattle ranching and feedlot production as a complementary business as there is a

large and growing demand for beef in Mozambique. Mozbife was acquired to

capitalise on this demand as it currently owns and operates one farm near

Chimoio, close to DECA's operations. In addition to Mozbife's revenues from the

sale of beef to the domestic market, the business also dovetails with the

Company's other operations as the herd can be fed, at least in part, with the

chop/bran produced as a by-product from the maize meal processing at DECA and

Compagri.

Oil & Gas Exploration

The change in strategy that the Company implemented during the period, shifting

focus from oil and gas exploration in Southern Sudan to agriculture in

Mozambique, was due to certain situations beyond the control of the Board. The

volatile political situation in Southern Sudan and the current global economic

downturn and fluctuating oil price, have all contributed to undermine the

perceived value of the Company's oil and gas portfolio. For this reason, the

Board saw that shifting the Company's focus to the rapidly growing agriculture

sector was in the best interest of shareholders, as the factors affecting the

Company's early stage oil and gas exploration assets may not reach amelioration

in the foreseeable future.

As previously reported, our oil and gas exploration operations at Block Ba in

Southern Sudan were suspended pending clarification of title. The Company was

assured by the Government of Southern Sudan ('GOSS') and its representatives

that the original agreement signed for the development of Block Ba was valid.

The Company was informed that if the Company was not going to be the sole

developer of Block Ba, it would be included in a consortium and would

subsequently receive a 22.5% interest in the group from the exploration and

development of the enlarged Block B, which would include Block Ba as well as

Blocks Bb and Bc. Despite these assurances, the confirmation of the consortium

and the Company's participation therein remains outstanding. The Company has

also retained its interests in Ethiopia through the Production Sharing Agreement

with the Government of Ethiopia for a 29,000 sq km block in the Southern Rift

Basin in south-western Ethiopia.

Whilst the climate for early stage oil and gas exploration remains inclement,

the Board intends to utilise its cash balances to generate shareholder value

without jeopardising any potential future value from its oil interests, by

focussing on the buoyant agriculture sector in central and southern Africa.

Financial Results

For the period under review, the Company is reporting a pre-tax loss of GBP2.13

million which included the impairment of GBP1.36 million for the Company's oil

and gas assets (2007: loss of GBP0.79 million). Cash balances at the period end

were GBP4.9 million (2007: GBP6.5 million).

Outlook

Our focus is on capturing a larger share of the agricultural value chain in

Africa, with a long term objective of becoming one of the largest agricultural

operations in southern and central Africa. On an operational level, Agriterra

will continue to strive to enhance the livelihoods of smallholder farmers by

improving access to markets and ensuring sustainability. For our shareholders,

the agricultural and associated engineering operations sector in Africa remains

a significant investment opportunity, and we believe that DECA, Compagri and

Mozbife are ideally positioned to capitalise on increased demand for maize and

beef. We have an established cash generative business in DECA, which we intend

to develop and replicate to other sites. Of upmost importance to the Company's

future growth potential is the loyal customer base and support that we have

secured through DECA; the UN World Food Programme remains one of our biggest

customers, and we continue to receive strong support from the Mozambican

Government.

With the clear understanding of the agriculture market that we have gained

through the acquisition of DECA, I am confident that Agriterra will continue to

grow its operations through Compagri and Mozbife, further strengthening our

balance sheet and unlocking value for shareholders.

Phil Edmonds

Chairman

26 March 2009

** ENDS **

For further information please visit www.agriterra-ltd.com or contact:

+--------------------+------------------------------+-------------------------+

| Andrew Groves | Agriterra Ltd | Tel: +44 (0) 845 108 |

| | | 6060 |

+--------------------+------------------------------+-------------------------+

| Jeremy Gray | Agriterra Ltd | Tel: +44 (0) 20 3205 |

| | | 1469 |

+--------------------+------------------------------+-------------------------+

| Jonathan Wright | Seymour Pierce Ltd | Tel: +44 (0) 20 7107 |

| | | 8000 |

+--------------------+------------------------------+-------------------------+

| Hugo de Salis | St Brides Media & Finance | Tel: +44 (0) 20 7236 |

| | Ltd | 1177 |

+--------------------+------------------------------+-------------------------+

| Susie Callear | St Brides Media & Finance | Tel: +44 (0) 20 7236 |

| | Ltd | 1177 |

+--------------------+------------------------------+-------------------------+

Unaudited Income Statement

For the six months ended 31 December 2008

+------------------------------------------------+--+------------+--+------------+

| | | Six months | | Six months |

| | | ended | | ended |

| | | 31.12.08 | | 31.12.07 |

+------------------------------------------------+--+------------+--+------------+

| | | GBP'000 | | GBP'000 |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| Revenue | | - | | - |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| Operating expenses | | (1,099) | | (1,144) |

+------------------------------------------------+--+------------+--+------------+

| Other operating income | | 251 | | - |

+------------------------------------------------+--+------------+--+------------+

| Operating loss | | (848) | | (1,144) |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| Finance income | | 78 | | 346 |

+------------------------------------------------+--+------------+--+------------+

| Finance expenses | | - | | (1) |

+------------------------------------------------+--+------------+--+------------+

| Net financing income | | 78 | | 345 |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| Impairment of intangible & tangible assets | | (1,361) | | - |

+------------------------------------------------+--+------------+--+------------+

| Loss before taxation | | (2,131) | | (799) |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| Income tax expense | | - | | - |

+------------------------------------------------+--+------------+--+------------+

| Loss for the period | | (2,131) | | (799) |

+------------------------------------------------+--+------------+--+------------+

| | | ` | | |

+------------------------------------------------+--+------------+--+------------+

| Loss per share | | | | |

+------------------------------------------------+--+------------+--+------------+

| - Basic and diluted (pence) | | (0.609) | | (0.230) |

+------------------------------------------------+--+------------+--+------------+

Unaudited Statement of Recognised Income and Expense

For the six months ended 31 December 2008

+-----------------------------------------------+--+------------+--+--------------+

| | | Six months | | Six months |

| | | ended | | ended |

| | | 31.12.08 | | 31.12.07 |

+-----------------------------------------------+--+------------+--+--------------+

| | | GBP'000 | | GBP'000 |

+-----------------------------------------------+--+------------+--+--------------+

| | | | | |

+-----------------------------------------------+--+------------+--+--------------+

| Foreign exchange translation differences | | (25) | | - |

+-----------------------------------------------+--+------------+--+--------------+

| Net income recognised directly in equity | | (25) | | - |

+-----------------------------------------------+--+------------+--+--------------+

| | | | | |

+-----------------------------------------------+--+------------+--+--------------+

| Loss for the period | | (2,131) | | (799) |

+-----------------------------------------------+--+------------+--+--------------+

| Total recognised income and expense for the | | (2,156) | | (799) |

| period | | | | |

+-----------------------------------------------+--+------------+--+--------------+

| | | | | |

+-----------------------------------------------+--+------------+--+--------------+

Unaudited Balance Sheet

As at 31 December 2008

+------------------------------------------------+--+------------+--+------------+

| | | 31.12.08 | | 30.06.08 |

+------------------------------------------------+--+------------+--+------------+

| | | GBP'000 | | GBP'000 |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| ASSETS | | | | |

+------------------------------------------------+--+------------+--+------------+

| Non-current assets | | | | |

+------------------------------------------------+--+------------+--+------------+

| Property, plant and equipment | | - | | - |

+------------------------------------------------+--+------------+--+------------+

| Exploration and evaluation costs | | - | | - |

+------------------------------------------------+--+------------+--+------------+

| Total non-current assets | | - | | - |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| Current assets | | | | |

+------------------------------------------------+--+------------+--+------------+

| Trade and other receivables | | 272 | | 44 |

+------------------------------------------------+--+------------+--+------------+

| Cash and cash equivalents | | 4,937 | | 6,539 |

+------------------------------------------------+--+------------+--+------------+

| Total current assets | | 5,209 | | 6,583 |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| TOTAL ASSETS | | 5,209 | | 6,583 |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| LIABILITIES | | | | |

+------------------------------------------------+--+------------+--+------------+

| Current liabilities | | | | |

+------------------------------------------------+--+------------+--+------------+

| Trade and other payables | | (1,122) | | (340) |

+------------------------------------------------+--+------------+--+------------+

| Total current liabilities | | (1,122) | | (340) |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| NET ASSETS | | 4,087 | | 6,243 |

+------------------------------------------------+--+------------+--+------------+

| | | | | |

+------------------------------------------------+--+------------+--+------------+

| EQUITY | | | | |

+------------------------------------------------+--+------------+--+------------+

| Issued capital | | 350 | | 350 |

+------------------------------------------------+--+------------+--+------------+

| Share premium | | 53,219 | | 53,219 |

+------------------------------------------------+--+------------+--+------------+

| Share based payment reserve | | 660 | | 660 |

+------------------------------------------------+--+------------+--+------------+

| Translation reserve | | (32) | | (7) |

+------------------------------------------------+--+------------+--+------------+

| Accumulated losses | | (50,110) | | (47,979) |

+------------------------------------------------+--+------------+--+------------+

| TOTAL EQUITY | | 4,087 | | 6,243 |

+------------------------------------------------+--+------------+--+------------+

Unaudited Cash Flow Statement

For the six months ended 31 December 2008

+-------------------------------------------+------+--+------------+--+------------+

| | | | Six months | | Six months |

| | | | ended | | ended |

| | | | 31.12.08 | | 31.12.07 |

+-------------------------------------------+------+--+------------+--+------------+

| | | | GBP'000 | | GBP'000 |

+-------------------------------------------+------+--+------------+--+------------+

| | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| OPERATING ACTIVITIES | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| Loss before tax | | | (2,131) | | (799) |

+-------------------------------------------+------+--+------------+--+------------+

| Adjustments for: | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| - Impairment of Oil & Gas Interests | | | 1,361 | | - |

+-------------------------------------------+------+--+------------+--+------------+

| - Depreciation of property, plant and | | | 6 | | 182 |

| equipment | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| - Loss on foreign exchange | | | (25) | | - |

+-------------------------------------------+------+--+------------+--+------------+

| - Net financing income | | | (78) | | (345) |

+-------------------------------------------+------+--+------------+--+------------+

| Operating cash flow before movements in | | | (867) | | (962) |

| working capital | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| Working capital adjustments: | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| - (Increase)/decrease in receivables | | | (228) | | 2,022 |

+-------------------------------------------+------+--+------------+--+------------+

| - Increase/(decrease) in payables | | | 782 | | (1,488) |

+-------------------------------------------+------+--+------------+--+------------+

| Cash used in operations | | | (313) | | (428) |

+-------------------------------------------+------+--+------------+--+------------+

| Interest paid | | | - | | (1) |

+-------------------------------------------+------+--+------------+--+------------+

| Interest received | | | 78 | | 346 |

+-------------------------------------------+------+--+------------+--+------------+

| Net cash used in operating activities | | | (235) | | (83) |

+-------------------------------------------+------+--+------------+--+------------+

| | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| INVESTING ACTIVITIES | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| Purchase of intangible assets | | | (792) | | (5,311) |

+-------------------------------------------+------+--+------------+--+------------+

| Purchase of property, plant and equipment | | | (280) | | (80) |

+-------------------------------------------+------+--+------------+--+------------+

| Net cash used in investing activities | | | (1,341) | | (5,391) |

+-------------------------------------------+------+--+------------+--+------------+

| | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| FINANCING ACTIVITIES | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| Proceeds from issue of share capital | | | - | | (180) |

+-------------------------------------------+------+--+------------+--+------------+

| Net cash flow used in financing | | | - | | (180) |

| activities | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| Net decrease in cash and cash equivalents | | | (1,576) | | (5,654) |

+-------------------------------------------+------+--+------------+--+------------+

| | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| Cash and cash equivalents at start of the | | | 6,539 | | 16,729 |

| period | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

| Exchange rate adjustments | | | (26) | | - |

+-------------------------------------------+------+--+------------+--+------------+

| Cash and cash equivalents at end of the | | | 4,937 | | 11,075 |

| period | | | | | |

+-------------------------------------------+------+--+------------+--+------------+

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL INFORMATION

1. General information

Agriterra Limited (formerly known as 'White Nile Limited') and its subsidiaries

(together the 'Group') is a limited company incorporated in Guernsey. The

Company is listed on the Alternative Investment Market ('AIM') of the London

Stock Exchange. The Company is involved in agricultural and associated civil

engineering industries in Africa.

The address of its registered office is Elizabeth House, Les Ruettes Brayes, St

Peter Port, Guernsey GY1 4LX.

This condensed consolidated financial information for the separate interim

period ended 31 December 2008 was approved for issue on 25 March 2009.

These interim financial statements do not constitute statutory accounts of the

Group for the purposes of The Companies (Guernsey) Law, 2008. They should be

read in conjunction with the Group's annual financial statements for the year

ended 30 June 2008, which were prepared under IFRS and upon which an unqualified

auditors' report was given.

2. Basis of preparation

The consolidated financial results of the Group for the six months ended 31

December 2008 have been prepared in accordance with IFRS as adopted by the

European Union, IFRIC interpretations and The Companies (Guernsey) Law, 2008,

with the exception of IAS 34 'Interim financial reporting' which AIM quoted

companies need not comply with.

The consolidated financial statements have been prepared under the historical

cost convention.

3. Post balance sheet events

Change of company name and investing strategy

In December 2008, the Company announced a change in strategy of moving away from

concentrating on oil and gas exploration. The Company obtained shareholder

approval at the Extraordinary General Meeting held on 6 January 2009, for the

name change to Agriterra Limited and the adoption of a new investing strategy to

focus on agricultural and associated civil engineering industries in Africa. In

view of the changes in strategy the oil and gas assets as at 31 December 2008 in

this interim statement have been impaired similar to the Group financial

statements for the year ended 30 June 2008 and approved for issue on 19 December

2008.

Existing share certificates in the name of White Nile Limited will remain valid,

and any new share certificates issued by the Company will be issued in the name

of Agriterra Limited. The Company's name change took effect on the London Stock

Exchange on 8 January 2009.

Completion of the acquisition of DECA, Compagri and Mozbife

On February 5 2009, the Company completed the acquisition by its wholly owned

subsidiary, Agriterra (Mozambique) Limited, of a 75% shareholding of the issued

share capital of each of Desenvolvimento E Comercialização Agricola Limitada

('DECA'), Compagri Limitada ('Compagri') and Mozbife Limitada ('Mozbife') and

for the novation of certain loans from Central African Mining & Exploration

Company Plc. The aggregate consideration was US$17 million, which was satisfied

by the issue of 200,000,000 Ordinary Shares and the payment of US$2 million in

cash to the vendor.

Placing of new ordinary shares

On February 5 2009, and as announced on 30 January 2009 the Company completed a

placing of 78,688,866 new Ordinary Shares at a price of 3 pence per new Ordinary

Share ('Placing Shares'), raising GBP2,360,666 before expenses. The Placing

Shares began trading on AIM on this same day.

Holdings in the Company

On 20 March 2009, the Company announced that OppenheimerFunds, Inc. purchased

40,000,000 ordinary shares in the Company from Central African Mining &

Exploration Company Plc ('CAMEC') on 16 March 2009. Following this purchase

OppenheimerFunds, Inc. has an interest of 40,000,000 ordinary shares

representing approximately 8.44% of the Company's total voting right. CAMEC now

holds 166,700,000 ordinary shares in the Company representing approximately

35.18% of the total voting rights.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PUUCGWUPBGMA

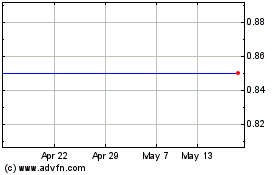

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From May 2024 to Jun 2024

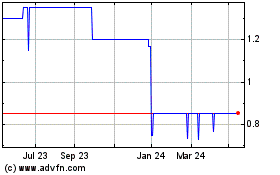

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Jun 2023 to Jun 2024