Anglo-Eastern Plantations PLC Trading Statement (0127A)

May 23 2019 - 6:52AM

UK Regulatory

TIDMAEP

RNS Number : 0127A

Anglo-Eastern Plantations PLC

23 May 2019

23 May 2019

Anglo-Eastern Plantations PLC

("AEP" or the "Company")

Trading Statement

Anglo-Eastern Plantations, a major producer of palm oil and some

rubber across Indonesia and Malaysia, today announces a trading

update in respect of the first quarter since 31 December 2018.

Operational and financial performance

For the first three months ended 31 March 2019, our own

production of fresh fruit bunches ("FFB") was 232,900mt, an

increase of 0.2% compared to the same period in 2018 (3M18:

232,400mt). Our plantations in North Sumatera and Kalimantan

experienced a better harvest whereas our plantations in the

Bengkulu and Riau regions saw a drop in production. FFB bought-in

was 196,400mt (3M18: 211,900mt), a decrease of 7% in line with a

drop in FFB harvested in the same region, especially in Bengkulu as

compared to the same period in 2018. As a result, the Crude Palm

Oil ("CPO") produced was 88,100mt, 4% lower than the corresponding

period in 2018 (3M18: 91,400mt).

The CPO price ex-Rotterdam averaged $538/mt for the first three

months to 31 March 2019. This represents a decline of 20% from the

average price of $672/mt recorded in the first quarter of 2018 but

is above $517/mt, the prevailing price at the start of 2019.

The Group's balance sheet remains strong. The Company's Long

Term Development Loans totalled $18.8m as at 31 March 2019 (31

March 2018: $25.9m). The Group has net cash of $95.3m as at 31

March 2019.

Development

AEP has plantations across Indonesia and Malaysia, amounting to

some 128,200 hectares, of which approximately 66,900 hectares

(including Plasma) are planted. The Group's new planting for the

three months ended 31 March 2019 totalled 399 hectares (including

Plasma).

The biogas plant in Kalimantan is in full operation and has

started supplying electricity to the national grid from the end of

first quarter of this year.

Earthworks for the seventh mill in North Sumatera are still in

progress amidst delay caused by heavy rainfall. The building and

the infrastructure works are expected to commence in the latter

half of the year with completion expected at the end of 2021.

Outlook

The CPO price ex-Rotterdam started the year at $517/mt and

reached a peak of $570/mt in February 2019. Since then it has

trended downwards and closed at $514/mt on 31 March 2019. Palm oil

prices are at a large price discount to soybean oil, although it

remains volatile.

Note: The information communicated in this announcement is

inside information for the purposes of Article 7 of Market Abuse

Regulation 596/2014.

For further enquiry, contact:

Anglo-Eastern Plantations PLC

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Panmure Gordon (UK) Limited

Dominic Morley +44 (0)20 7886 2954

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTBGGDUGUDBGCX

(END) Dow Jones Newswires

May 23, 2019 06:52 ET (10:52 GMT)

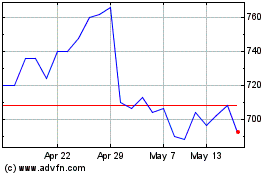

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Jun 2024 to Jul 2024

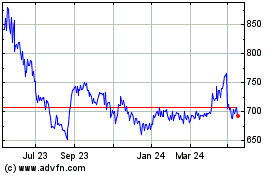

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Jul 2023 to Jul 2024