Admiral '08 Net Profit Up 14% On Better UK Business

March 03 2009 - 2:52AM

Dow Jones News

Admiral Group PLC (ADM.LN) on Tuesday posted a 14% rise in 2008

net profit, helped by continued good underwriting business in the

U.K. as well as higher profit commissions from its reinsurance

partners.

After entering several markets in Europe, the company also said

it is planning to do business in the U.S.

The Wales-based motor insurer said its net profit was at

GBP144.9 million, up from GBP127.4 million in 2007.

Pretax profit was up 11% at GBP202.5 million from GBP182.1

million previously.

The pretax profit was inline with the GBP199 million average

forecast from 12 analysts.

"For the fifth year out of five since becoming a listed company,

Admiral delivered record profits and the 2008 dividend will be the

biggest in our history," said Chief Executive Henry Engelhardt.

"As the U.K. business goes from strength to strength, we are

planting the seeds of our long-term future by taking what we know

and do well - Internet and phone delivery of car insurance to other

countries," Engelhardt said.

The company is recommending a final dividend of 26.5 pence a

share, making a total dividend of 52.5 pence a share for 2008, up

from 43.8 pence in 2007.

Admiral shares are about 16% lower than they were a year ago,

with market capitalization at around GBP2.26 billion.

Its shares closed 2.3% higher on Monday at 875 pence.

Company Web site: www.admiralgroup.co.uk

-By Vladimir Guevarra, Dow Jones Newswires, Tel. +44 (0)

2078429486, vladimir.guevarra@dowjones.com

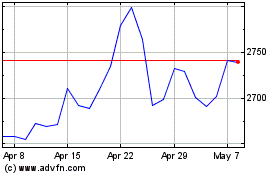

Admiral (LSE:ADM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Admiral (LSE:ADM)

Historical Stock Chart

From Jul 2023 to Jul 2024