Watermark Global Business update

September 13 2012 - 3:39AM

UK Regulatory

TIDMWET

13 September 2012

Watermark Global Plc

("Watermark" or "Company")

Business Update

Watermark Global Plc (AIM: WET), a company listed on AIM with a

focus on Acid Mine Drainage treatment and coal briquetting in South

Africa, provides an update on the development of its associate

company, Mine Restoration Investments Limited ("MRI"), which is

listed on the Johannesburg Stock Exchange

Operations

The implementation of MRI's Coal Briquetting project is

progressing well and first production is anticipated by February

2013. The pilot briquetting plant will be moved to site in the next

few weeks in order to commence production of sample batches for

final off-take evaluation and specification. This information is

required under the existing off-take agreement to enable potential

consumers to evaluate the product. By implementing the pilot plant

ahead of the main production facility, MRI will be in a position to

assess market requirements and make final adjustments to the

process before entering into full production.

Financing

Watermark signed a loan agreement with Trinity Asset Management

(Pty) Ltd ("TAM") as part of the capital raising process when

listing MRI in June 2012. Under the loan agreement, TAM agreed to

place approximately 105 million MRI shares at a minimum value of

R0.19 per share by 12 September 2012 in order to repay the loan.

Should the shares be placed at a value of more than R0.19 per

share, Watermark would receive 50% of the additional value.

Watermark also had the option of taking ownership of any of the MRI

shares not placed by 12 September 2012.

To date TAM has successfully placed approximately 25% of the

shares at an average price of R0.25 per share, a R0.06 premium to

the minimum placing price. Accordingly, Watermark will not only

receive the consideration for these shares and half of the placing

premium but also interest of R1.1million. The mid-market price of

shares in MRI was R0.28 at close of business on 12 September 2012.

In view of the fact that MRI shares continue to trade at a premium

to their issue price, the placement date for the balance of the

shares has been extended to 12 January 2013. TAM is proposing to

place the balance of the MRI shares with strategic investors in

South Africa but in view of the strengthening prospects of MRI and

the price at which MRI shares are trading the Watermark Board will

keep the position regarding the remaining MRI shares under review

and may elect to take ownership of them.

A further update will be provided as appropriate.

Enquiries

Watermark Global plc

Peter Marks, Chairman Tel: + 44(0) 20 7233 1462

Jaco Schoeman, Non-Executive Director Tel: + 44(0) 20 7233 1462

Investor Relations

Charles Zorab Tel: + 44(0) 20 7233 1462

czorab@watermarkglobalplc.com

Nominated Adviser: Cenkos Securities

Ian Soanes Tel: +44(0)20 7397 8928

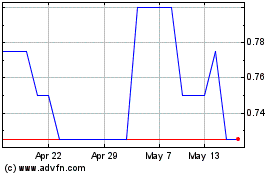

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Nov 2023 to Nov 2024