Lugman Group withdraws from purchase of “Industrial Park Fechenheim”

February 04 2025 - 1:00AM

UK Regulatory

Lugman Group withdraws from purchase of “Industrial Park

Fechenheim”

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

MUTTENZ, 4 FEBRUARY 2025

Clariant, a sustainability-focused specialty

chemical company, today announced that due to the execution of

certain pre-emption rights by the City of Frankfurt, the Lugman

Group has executed its right of withdrawal from the transaction to

purchase the real estate property “Industrial Park Fechenheim” as

announced on 17 September 2024.

As previously communicated, the transaction was

expected to result in proceeds of EUR 95 million in cash

and a book gain of around CHF 70 million in the company’s

EBITDA in 2025.

Clariant remains committed to divest the

“Industrial Park Fechenheim” as the company has no operational

activities in the industrial park. The park is located east of

Frankfurt am Main and covers approximately 428 000 square

meters.

CORPORATE MEDIA RELATIONS

Jochen Dubiel

Phone +41 61 469 63 63

jochen.dubiel@clariant.com

Ellese Caruana

Phone +41 61 469 63 63

ellese.caruana@clariant.com

Luca Lavina

Phone +41 61 469 63 63

luca.lavina@clariant.com

Follow us on X, Facebook, LinkedIn, Instagram. |

INVESTOR RELATIONS

Andreas Schwarzwälder

Phone +41 61 469 63 73

andreas.schwarzwaelder@clariant.com

Thijs Bouwens

Phone +41 61 469 63 73

thijs.bouwens@clariant.com

|

This media release contains certain statements that are neither

reported financial results nor other historical information. This

document also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials.

www.clariant.com

Clariant is a focused specialty chemical company led by the

overarching purpose of ‘Greater chemistry – between people and

planet’. By connecting customer focus, innovation, and people the

company creates solutions to foster sustainability in different

industries. On 31 December 2023, Clariant totaled a staff number of

10 481 and recorded sales of CHF 4.377 billion in the fiscal year

for its continuing businesses. As of January 2023, the Group

conducts its business through the three Business Units Care

Chemicals, Catalysts, and Adsorbents & Additives. Clariant is

based in Switzerland. |

- Clariant Media Release_Clariant divestment Fechenheim

withdrawal_20250204_EN

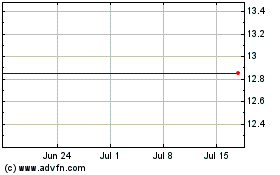

Clariant (LSE:0QJS)

Historical Stock Chart

From Jan 2025 to Feb 2025

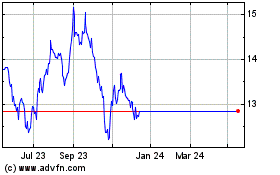

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2024 to Feb 2025