Amended Statement of Beneficial Ownership (sc 13d/a)

March 10 2022 - 8:40AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 3)

EVmo,

Inc.

(Name

of Issuer)

Common

Stock, $0.000001 par value per share

(Title

of Class of Securities)

985294107

(CUSIP

Number)

Terren

S. Peizer

Acuitas Group Holdings, LLC

120 Colorado Avenue, #230

Santa Monica, California 90404

310-444-4321

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March

9, 2022

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a Statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this Schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7(b)

for other parties to whom copies are to be sent.

| * |

The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

| CUSIP

No. 985294107 |

|

Page

2 of 5 Pages |

| 1 |

NAMES

OF REPORTING PERSONS

I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Acuitas

Group Holdings, LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY |

| 4 |

SOURCE

OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION:

California |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER:

0 |

| 8 |

SHARED VOTING POWER:

12,487,019 (1) |

| 9 |

SOLE DISPOSITIVE POWER:

0 |

| 10 |

SHARED DISPOSITIVE POWER:

12,487,019 (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON:

12,487,019 (1) |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

18.8% (1) |

| 14 |

TYPE OF REPORTING PERSON (See Instructions):

OO |

| (1) |

Please

see Item 5(a) herein. |

| CUSIP

No. 985294107 |

|

Page

3 of 5 Pages |

| 1 |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

(ENTITIES ONLY)

Terren S. Peizer |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (See Instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION:

United States of America |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER:

0 |

| 8 |

SHARED VOTING POWER:

12,487,019 (1) |

| 9 |

SOLE DISPOSITIVE POWER:

0 |

| 10 |

SHARED DISPOSITIVE POWER:

12,487,019 (1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON:

12,487,019 (1) |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions): ☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11):

18.8% (1) |

| 14 |

TYPE OF REPORTING PERSON (See Instructions):

HC; IN |

| (1) |

Please

see Item 5(a) herein. |

| CUSIP

No. 985294107 |

|

Page

4 of 5 Pages |

AMENDMENT

NO. 3 TO SCHEDULE 13D

This

Amendment No. 3 to Schedule 13D (this “Amendment”) amends and supplements the Schedule 13D previously filed by Acuitas

Group Holdings, LLC, a California limited liability company (“Acuitas”), and Terren S. Peizer (“Mr. Peizer”

and, together with Acuitas, the “Reporting Persons”) on February 4, 2021 (the “Schedule 13D”), as amended

by Amendment No. 1 to the Schedule 13D filed on March 2, 2021 and Amendment No. 2 to the Schedule 13D filed on March 8, 2022 (collectively,

the “Original Schedule”), relating to the common stock, $0.000001 par value per share (the “Shares”),

of EVmo, Inc., a Delaware corporation (the “Company”). Except as specifically amended by this Amendment, items in

the Original Schedule are unchanged. Capitalized terms used herein that are not defined have the meaning ascribed to them in the Original

Schedule.

| ITEM

3. | SOURCE

AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

Item

3 of the Original Schedule is hereby amended and supplemented to include the following paragraph to the end of the item:

On

March 9, 2022, the Reporting Persons purchased 1,192,320 Shares, in a series of open market transactions, at prices ranging from $0.38-$0.43

for an aggregate purchase price of $0.42, or $498,631.92. The source of funds used for these transactions was the working capital of

Acuitas.

| ITEM

4. | PURPOSE

OF TRANSACTION |

The

information set forth in Item 3 of this Amendment is incorporated herein by reference. Item 4 of the Original Schedule is hereby amended

and supplemented to include the following sentence to the end of the item:

The

purchase of 1,192,320 Shares on March 9, 2022 was made solely for investment purposes.

| ITEM

5. | INTEREST

IN SECURITIES OF THE ISSUER |

The

information set forth in the cover pages and Item 3 of this Amendment is incorporated herein by reference. Item 5 of the Original Schedule

is deleted in its entirety and replaced with the following:

(a)

Each of the Reporting Persons may be deemed to have beneficial ownership of 12,487,019 Shares, which Shares are held directly by Acuitas

and represent approximately 18.8% of the Shares, based on 66,321,667 Shares issued and outstanding as of the date of this Amendment,

which is the sum of (i) 35,769,524 Shares issued and outstanding as of January 3, 2022, as disclosed in the prospectus filed by the Company

with the Securities & Exchange Commission on January 5, 2022 pursuant to Rule 424(b)(4) of the Securities Act of 1933, as amended

(the “Prospectus”), (ii) 27,400,000 Shares issued by the Company in a firm commitment public offering pursuant to

that certain underwriting agreement dated January 3, 2022 by and between the Company and EF Hutton, division of Benchmark Investments,

LLC, as representative of the underwriters named on Schedule I attached thereto, as described in the Prospectus, and (iii) 3,152,143

Shares issued by the Company to the holder of 230,375 shares of Series B convertible preferred stock, par value $0.000001 per share (the

“Preferred Stock”), as the result of a partial conversion thereof, effective as of January 20, 2022, made pursuant

to the terms of Section 5(h) of the Certificate of Designations, Preferences and Rights of the Preferred Stock dated July 8, 2021.

(b)

Each of the Reporting Persons may be deemed to share the power to vote or direct the vote and dispose or direct the disposition of all

12,487,019 Shares.

(c)

Except as described in Item 3 of this Amendment, the Reporting Persons had no transactions in the Shares during the sixty (60) days preceding

the date of filing of this Amendment.

(d)

No other person is known by the Reporting Persons to have the right to receive or the power to direct the receipt of dividends from,

or the proceeds from the sale of, any Shares that are beneficially owned by the Reporting Persons.

(e)

Not applicable.

| CUSIP

No. 985294107 |

|

Page

5 of 5 Pages |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Amendment is true, complete

and correct.

| Dated: March 10, 2022 |

|

| |

|

| |

ACUITAS GROUP HOLDINGS, LLC |

| |

|

| |

By: |

/s/ Terren S. Peizer |

| |

|

Terren S. Peizer, Chairman |

| |

|

| |

/s/ Terren S. Peizer |

| |

Terren S. Peizer |

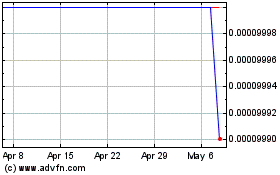

YayYo (CE) (USOTC:YAYO)

Historical Stock Chart

From Feb 2025 to Mar 2025

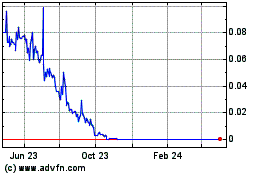

YayYo (CE) (USOTC:YAYO)

Historical Stock Chart

From Mar 2024 to Mar 2025