UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13A-16 OR 15D-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

| For the month of: |

August 2024 |

| |

|

| Commission File Number |

333-183376 |

(Translation of registrant's name into English)

Miramar Villas #21, Garden Drive, Paradise Island, Nassau, Bahamas

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ☐

EXPLANATORY NOTE

On August 6, 2024, Xtra-Gold Resources Corp. (the "Company") filed on the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedar.com the following documents:

● Unaudited consolidated interim statements for the six months ended June 30, 2024.

- 2 -

● Management's discussion and analysis of financial conditions and results of operations for the six months ended June 30, 2024.

● Form 52-109F2 - Certification of interim filings - Full Certification on for the six months ended June 30, 2024, by the Company's Chief Executive Officer ("CEO"); and

● Form 52-109F2 - Certification of interim filings - Full Certification on for the six months ended June 30, 2024, by the Company's Chief Financial Officer ("CFO").

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Date: August 6, 2024, |

XTRA-GOLD RESOURCES CORP. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ James Longshore |

| |

|

James Longshore, |

| |

|

Chief Executive Officer |

EXHIBIT 99.1

XTRA-GOLD RESOURCES CORP.

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

for the

Six Months Ended

June 30, 2024

(expressed in U.S. Dollars, except where noted)

NOTICE TO READER

The accompanying unaudited interim consolidated financial statements of Xtra-Gold Resources Corp. (the "Company") have been prepared by and are the responsibility of management. The unaudited condensed interim consolidated financial statements have not been reviewed by the Company's auditors.

INDEX TO FINANCIAL STATEMENTS

XTRA-GOLD RESOURCES CORP.

INTERIM CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. Dollars - Unaudited)

| AS AT |

|

June 30, 2024

(unaudited) |

|

|

December 31, 2023 |

|

| |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

8,176,181 |

|

$ |

7,154,462 |

|

| Investment in trading securities (Note 5) |

|

3,194,568 |

|

|

2,212,401 |

|

| Prepaids (Note 4) |

|

167,003 |

|

|

102,185 |

|

| Inventory |

|

428,213 |

|

|

817,597 |

|

| Total current assets |

|

11,965,965 |

|

|

10,286,645 |

|

| |

|

|

|

|

|

|

| Restricted cash (Note 3, 9) |

|

296,322 |

|

|

296,322 |

|

| Equipment, net (Note 6) |

|

514,313 |

|

|

543,197 |

|

| Mineral properties (Note 7) |

|

734,422 |

|

|

734,422 |

|

| |

|

|

|

|

|

|

| TOTAL ASSETS |

$ |

13,511,022 |

|

$ |

11,860,586 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current |

|

|

|

|

|

|

| Accounts payable and accrued liabilities (Note 8) |

$ |

1,511,065 |

|

$ |

1,281,060 |

|

| Due to related parties (Note 11) |

|

209,720 |

|

|

152,415 |

|

| Asset retirement obligation (Note 9) |

|

94,885 |

|

|

85,628 |

|

| Total current liabilities |

|

1,815,670 |

|

|

1,519,103 |

|

| |

|

|

|

|

|

|

| Total liabilities |

|

1,815,670 |

|

|

1,519,103 |

|

| |

|

|

|

|

|

|

| Commitment and contingencies (Note 14) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

| Capital stock (Note 10) |

|

|

|

|

|

|

| Authorized - 250,000,000 common shares with a par value of $0.001 |

|

|

|

|

|

|

| Issued and outstanding |

|

|

|

|

|

|

| 46,056,117 common shares (December 31, 2023 - 46,201,217 common shares) |

|

46,056 |

|

|

46,201 |

|

| Additional paid in capital |

|

31,728,499 |

|

|

31,704,814 |

|

| Shares in treasury |

|

(20,846 |

) |

|

(20,744 |

) |

| Accumulated deficit |

|

(20,335,575 |

) |

|

(21,511,326 |

) |

| |

|

|

|

|

|

|

| Total Xtra-Gold Resources Corp. stockholders' equity |

|

11,418,134 |

|

|

10,218,945 |

|

| Non-controlling interest |

|

277,218 |

|

|

122,538 |

|

| |

|

|

|

|

|

|

| Total equity |

|

11,695,352 |

|

|

10,341,483 |

|

| |

|

|

|

|

|

|

| TOTAL LIABILITIES AND EQUITY |

$ |

13,511,022 |

|

$ |

11,860,586 |

|

The accompanying notes are an integral part of these interim consolidated financial statements.

XTRA-GOLD RESOURCES CORP.

INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS

(Expressed in U.S. Dollars - Unaudited)

| |

|

Three Month

Period Ended

June 30, 2024 |

|

|

Three Month

Period Ended

June 30, 2023 |

|

|

Six Month

Period Ended

June 30, 2024 |

|

|

Six Month

Period Ended

June 30, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

$ |

36,580 |

|

$ |

50,739 |

|

$ |

69,741 |

|

$ |

86,520 |

|

| Exploration |

|

180,832 |

|

|

242,213 |

|

|

436,109 |

|

|

510,974 |

|

| General and administrative |

|

260,999 |

|

|

134,331 |

|

|

432,842 |

|

|

237,559 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| EXPENSES BEFORE OTHER INCOME (EXPENSES) |

|

(478,411 |

) |

|

(427,283 |

) |

|

(938,692 |

) |

|

(835,053 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSES) |

|

|

|

|

|

|

|

|

|

|

|

|

| Recovery of gold, net (Note 11) |

|

1,111,691 |

|

|

1,138,500 |

|

|

2,233,987 |

|

|

2,476,920 |

|

| Foreign exchange gain (loss) |

|

79,837 |

|

|

87,328 |

|

|

(7,016 |

) |

|

(48,712 |

) |

| Net gain (loss) on trading securities |

|

146,133 |

|

|

135,818 |

|

|

238,856 |

|

|

115,381 |

|

| Other income |

|

96,905 |

|

|

87,328 |

|

|

203,296 |

|

|

166,366 |

|

| Impairment loss on trading securities |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME FROM OTHER ITEMS |

|

1,434,566 |

|

|

1,464,042 |

|

|

2,669,123 |

|

|

2,709,955 |

|

| Income before tax |

|

956,155 |

|

|

1,036,759 |

|

|

1,730,431 |

|

|

1,874,902 |

|

| Income tax expense |

|

(200,000 |

) |

|

(261,815 |

) |

|

(400,000 |

) |

|

(461,815 |

) |

| Net income |

|

756,155 |

|

|

774,944 |

|

|

1,330,431 |

|

|

1,413,087 |

|

| Net gain attributable to non-controlling interest |

|

(91,391 |

) |

|

(69,880 |

) |

|

(154,680 |

) |

|

(154,826 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Xtra-Gold Resources Corp. |

$ |

664,764 |

|

$ |

705,064 |

|

$ |

1,175,751 |

|

$ |

1,258,261 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Basic income attributable to common shareholders

per common share |

$ |

0.01 |

|

$ |

0.02 |

|

$ |

0.03 |

|

$ |

0.03 |

|

Diluted income attributable to common shareholders

per common share |

$ |

0.01 |

|

$ |

0.02 |

|

$ |

0.03 |

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic weighted average number of common shares outstanding |

|

46,100,346 |

|

|

46,425,396 |

|

|

46,112,349 |

|

|

46,430,688 |

|

| Diluted weighted average number of common shares outstanding |

|

48,388,846 |

|

|

49,011,396 |

|

|

48,400,849 |

|

|

49,016,688 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these interim consolidated financial statements.

XTRA-GOLD RESOURCES CORP.

INTERIM CONSOLIDATED STATEMENTS OF EQUITY

(Expressed in U.S. Dollars - Unaudited)

| |

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Number

of Shares |

|

|

Amount |

|

|

Additional

Paid in

Capital |

|

|

Shares

in

Treasury |

|

|

Accumulated

Deficit |

|

|

Non-

Controlling

Interest |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, December 31, 2022 |

|

46,446,917 |

|

$ |

46,447 |

|

$ |

31,838,291 |

|

$ |

(6,892 |

) |

$ |

(21,345,398 |

) |

$ |

(58,114 |

) |

$ |

10,474,334 |

|

| Stock-based compensation |

|

- |

|

|

- |

|

|

31,782 |

|

|

- |

|

|

- |

|

|

- |

|

|

31,782 |

|

| Repurchase of shares |

|

(42,600 |

) |

|

(43 |

) |

|

(26,049 |

) |

|

6,892 |

|

|

- |

|

|

- |

|

|

(19,200 |

) |

| Shares in treasury |

|

- |

|

|

- |

|

|

- |

|

|

(22,383 |

) |

|

- |

|

|

- |

|

|

(22,383 |

) |

| Net income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,258,261 |

|

|

154,826 |

|

|

1,413,087 |

|

| Balance, June 30, 2023 |

|

46,404,317 |

|

|

46,404 |

|

|

31,844,024 |

|

|

(22,383 |

) |

|

(20,087,137 |

) |

|

96,712 |

|

|

11,877,620 |

|

| Stock-based compensation |

|

- |

|

|

- |

|

|

(8,032 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(8,032 |

) |

| Repurchase of shares |

|

(203,100 |

) |

|

(203 |

) |

|

(108,795 |

) |

|

(20,744 |

) |

|

- |

|

|

- |

|

|

(129,742 |

) |

| Shares in treasury |

|

- |

|

|

- |

|

|

(22,383 |

) |

|

22,383 |

|

|

- |

|

|

- |

|

|

- |

|

| Net loss |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(1,424,189 |

) |

|

25,826 |

|

|

(1,398,363 |

) |

| Balance, December 31, 2023 |

|

46,201,217 |

|

|

46,201 |

|

|

31,704,814 |

|

|

(20,744 |

) |

|

(21,511,326 |

) |

|

122,538 |

|

|

10,341,483 |

|

| Stock-based compensation |

|

- |

|

|

- |

|

|

139,138 |

|

|

- |

|

|

- |

|

|

- |

|

|

139,138 |

|

| Repurchase of shares |

|

(145,100 |

) |

|

(145 |

) |

|

(115,453 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(115,598 |

) |

| Shares in treasury |

|

- |

|

|

- |

|

|

- |

|

|

(102 |

) |

|

- |

|

|

- |

|

|

(102 |

) |

| Net income |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

1,175,751 |

|

|

154,680 |

|

|

1,330,431 |

|

| Balance, June 30, 2024 |

|

46,056,117 |

|

$ |

46,056 |

|

$ |

31,728,499 |

|

$ |

(20,846 |

) |

$ |

(20,335,575 |

) |

$ |

277,218 |

|

$ |

11,695,352 |

|

The accompanying notes are an integral part of these interim consolidated financial statements.

XTRA-GOLD RESOURCES CORP.

INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in U.S. Dollars - Unaudited)

| |

|

Six Month

Period Ended

June 30, 2024 |

|

|

Six Month

Period Ended

June 30, 2023 |

|

| |

|

|

|

|

|

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

| Net income for the period |

$ |

1,330,431 |

|

$ |

1,413,087 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

| Depreciation |

|

69,741 |

|

|

86,520 |

|

| Stock-based compensation |

|

139,138 |

|

|

31,782 |

|

| Unrealized foreign exchange loss (gain) |

|

78,795 |

|

|

17,053 |

|

| Net (gain) loss on sales of trading securities |

|

(238,856 |

) |

|

(115,381 |

) |

| Impairment loss on trading securities |

|

- |

|

|

- |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

| (Increase) decrease in receivables and other assets |

|

(64,818 |

) |

|

(29,164 |

) |

| Decrease (increase) in inventory |

|

389,384 |

|

|

259,904 |

|

| Change in asset retirement obligation |

|

9,257 |

|

|

(6,943 |

) |

| Increase (decrease) in accounts payable and accrued liabilities |

|

230,005 |

|

|

(40,174 |

) |

| Increase (decrease) in due from related party |

|

57,305 |

|

|

- |

|

| |

|

|

|

|

|

|

| Net cash provided by operating activities |

|

2,000,382 |

|

|

1,616,684 |

|

| |

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

| Purchase of trading securities |

|

(1,493,257 |

) |

|

(805,512 |

) |

| Proceeds on sale of trading securities |

|

671,151 |

|

|

888,222 |

|

| Acquisition of equipment |

|

(40,857 |

) |

|

- |

|

| Net cash used in investing activities |

|

(862,963 |

) |

|

82,710 |

|

| |

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

| Repurchase of capital stock |

|

(115,700 |

) |

|

(41,583 |

) |

| Net cash (used in) provided by financing activities |

|

(115,700 |

) |

|

(41,583 |

) |

| |

|

|

|

|

|

|

| Change in cash and cash equivalents and restricted cash during the period |

|

1,021,719 |

|

|

1,657,811 |

|

| |

|

|

|

|

|

|

| Cash and cash equivalents and restricted cash, beginning of the year |

|

7,450,784 |

|

|

6,077,322 |

|

| |

|

|

|

|

|

|

| Cash and cash equivalents and restricted cash, end of the period |

$ |

8,472,503 |

|

$ |

7,735,133 |

|

| |

|

|

|

|

|

|

| Reconciliation of Cash and Cash Equivalents and Restricted Cash |

|

|

|

|

|

|

| Cash and cash equivalents at beginning of year |

$ |

7,154,462 |

|

$ |

5,781,000 |

|

| Restricted cash at beginning of year |

|

296,322 |

|

|

296,322 |

|

| Cash and cash equivalents and restricted cash at beginning of year |

$ |

7,450,784 |

|

$ |

6,077,322 |

|

| |

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

$ |

8,176,181 |

|

$ |

7,438,811 |

|

| Restricted cash at end of period |

|

296,322 |

|

|

296,322 |

|

| Cash and cash equivalents and restricted cash at end of period |

$ |

8,472,503 |

|

$ |

7,735,133 |

|

Supplemental disclosure with respect to cash flows (Note 12)

The accompanying notes are an integral part of these consolidated financial statements.

1. HISTORY AND ORGANIZATION OF THE COMPANY

Xtra-Gold Resources Corp., previously Silverwing Systems Corporation, was incorporated under the laws of the State of Nevada on September 1, 1998, pursuant to the provisions of the Nevada Revised Statutes. In 2003, the Company became a resource exploration company. The Company has also engaged in recovery of gold through alluvial operations on its claims. On November 30, 2012, the Company redomiciled from the USA to the British Virgin Islands.

In 2004, the Company acquired 100% of the issued and outstanding capital stock of Canadiana Gold Resources Limited ("Canadiana") and 90% of the issued and outstanding capital stock of Goldenrae Mining Company Limited ("Goldenrae"). Both companies are incorporated in Ghana and the remaining 10% of the issued and outstanding capital stock of Goldenrae is held by the Government of Ghana. On December 21, 2005, Canadiana changed its name to Xtra-Gold Exploration Limited ("XG Exploration"). On January 13, 2006, Goldenrae changed its name to Xtra-Gold Mining Limited ("XG Mining").

2. GOING CONCERN

The Company is in development as an exploration company. It may need financing for its exploration and acquisition activities. The Company has incurred a gain of $1,175,751 for the period ended June 30, 2024, and it has an accumulated deficit of $20,335,575. Results for the period ended June 30, 2024 are not necessarily indicative of future results. The uncertainty of gold recovery and the fact the Company does not have a demonstrably viable business to provide future funds, raises substantial doubt about its ability to continue as a going concern for one year from the issuance of the financial statements. The ability of the Company to continue as a going concern is dependent on the Company's ability to raise additional capital and implement its business plan, which is typical for junior exploration companies. The financial statements do not include any adjustments related to the recoverability and classification of asset amounts or the classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Management of the Company ("Management") is of the opinion that sufficient financing will be obtained from external sources and further share issuances will be made to meet the Company's obligations. Although alluvial gold sales have contributed significantly to the Company, this funding source is nearly depleted and cannot be relied on as a source of future funding. The Company's discretionary exploration activities do have considerable scope for flexibility in terms of the amount and timing of exploration expenditure, and expenditures may be adjusted accordingly if required.

3. SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

These unaudited condensed consolidated financial statements have been prepared in conformity with generally accepted accounting principles of the United States of America ("US GAAP") for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. generally accepted accounting principles for complete annual financial statements. Therefore, these unaudited condensed consolidated financial statements should be read in conjunction with our audited consolidated financial statements and notes thereto for the year ended December 31, 2023, included in our Annual Report on Form 20-F, filed with the SEC on April 1, 2024. These statements reflect all adjustments, consisting of normal recurring adjustments, which, in the opinion of management, are necessary for fair presentation of the information contained therein. The financial statements and notes are representations of the Company's management and its board of directors, who are responsible for their integrity and objectivity.

Principles of consolidation

These consolidated financial statements include the accounts of the Company, its wholly owned subsidiaries, XG Exploration and its 90% owned subsidiary, XG Mining. All intercompany accounts and transactions have been eliminated on consolidation.

Use of estimates

The preparation of consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant areas requiring the use of estimates include the carrying value and recoverability of mineral properties, inputs used in the calculation of stock-based compensation and warrants, inputs used in the calculation of the asset retirement obligation, the valuation allowance applied to level 3 investments, and the valuation allowance applied to deferred income taxes. Actual results could differ from those estimates and would impact future results of operations and cash flows.

Cash and cash equivalents

The Company considers highly liquid investments with original maturities of three months or less to be cash equivalents. At June 30, 2024 and December 31, 2023, cash and cash equivalents consisted of cash held at financial institutions.

The Company has been required by the Ghanaian government to post a bond for environmental reclamation. This cash has been recorded as restricted cash, a non-current asset.

Prepaids

Prepaid amounts are recognized in an earlier period than they are expensed. These amounts are expensed in the period to which they relate.

Inventory

Inventories are initially recognized at cost and subsequently stated at the lower of cost or net realizable value. The Company's inventory consists of raw gold recovered from alluvial operations. Costs are determined using the first-in, first-out ("FIFO") method and includes expenditures incurred in extracting the raw gold, other costs incurred in bringing them to their existing location and condition, and the cost of reclaiming the disturbed land to a natural state.

Net realizable value is the estimated selling price in the ordinary course of business less the estimated costs necessary to make the sale. Inventories are written down to net realizable value when the cost of inventories is not estimated to be recoverable due to declining selling prices, or other issues related to the sale of gold.

Recovery of gold

Recovery of gold and other income is recognized when title and the risks and rewards of ownership to delivered bullion and commodities pass to the buyer and collection is reasonably assured. Recovery of gold, net of expenses, is not related to exploration and is not the core business of the Company, so proceeds from gold recovery are recognized as other income.

Trading securities

The Company's trading securities are reported at fair value, with realized and unrealized gains and losses included in earnings.

Non-Controlling Interest

The consolidated financial statements include the accounts of XG Mining. All intercompany accounts and transactions have been eliminated upon consolidation. The Company records a non-controlling interest which reflects the 10% portion of the earnings (loss) of XG Mining allocable to the holders of the minority interest.

Equipment

Equipment is recorded at cost and is being depreciated over its estimated useful lives, which recognizes operating conditions in Ghana, using the declining balance method at the following annual rates:

| Furniture and equipment |

20% |

| Mining and exploration equipment |

20% |

Mineral properties and exploration and development costs

The costs of acquiring mineral rights are capitalized at the date of acquisition. After acquisition, various factors can affect the recoverability of the capitalized costs. If, after review, management concludes that the carrying amount of a mineral property is impaired, it will be written down to estimated fair value. Exploration costs incurred on mineral properties are expensed as incurred. Development costs incurred on proven and probable reserves will be capitalized. Upon commencement of production, capitalized costs will be amortized using the unit-of-production method over the estimated life of the ore body based on proven and probable reserves (which exclude non-recoverable reserves and anticipated processing losses). When the Company receives an option payment related to a property, the proceeds of the payment are applied to reduce the carrying value of the exploration asset. The mineral properties do not fall under the guidance of ASC 842.

Impairment of long-lived assets

Long-lived assets are evaluated for impairment whenever events or changes in business circumstances indicate that the carrying amount of the assets may not be fully recoverable or that the useful lives of these assets are no longer appropriate. Each impairment test is based on a comparison of the undiscounted future cash flows to the recorded value of the asset. If impairment is indicated, the asset is written down to its estimated fair value.

No impairment charge was deemed necessary for mineral properties in 2024 or 2023. Assets to be disposed of are reported at the lower of their carrying amount or fair value less costs to sell.

Asset retirement obligations

The Company records the estimated rehabilitation value of an asset retirement obligation as a liability in the period in which it incurs a legal obligation associated with the retirement of tangible long-lived assets that result from the acquisition, construction, development, and/or normal use of the long-lived assets. Subsequent to the initial measurement of the asset retirement obligation, the obligation is adjusted at the end of each period to reflect the changes in the estimated future cash flows underlying the obligation (asset retirement cost).

Stock-based compensation

The Company accounts for stock compensation arrangements under ASC 718 "Compensation - Stock Compensation" using the fair value based method. Under this method, compensation cost is measured at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting period. This guidance establishes standards for the accounting for transactions in which an entity exchanges it equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity's equity instruments or that may be settled by the issuance of those equity instruments.

An individual is classified as an employee when the individual is an employee for legal or tax purposes (direct employee) or provides services similar to those performed by a direct employee, including directors of the Company.

In situations where equity instruments are issued to non-employees and some or all of the goods or services received by the entity as consideration cannot be specifically identified, they are measured at fair value of the share-based payment. Otherwise, share-based payments are measured at the fair value of the goods and services received.

We use the fair value method for equity instruments granted to non-employees and use the Black-Scholes model for measuring the fair value of options. The stock based fair value compensation is determined as of the date of the grant (measurement date) and is recognized over the vesting periods.

Warrants

The Company accounts for freestanding warrants within stockholder's equity or as liabilities based on the characteristics and provisions of each instrument. The Company evaluates outstanding warrants in accordance with ASC 480, Distinguishing Liabilities from Equity, and ASC 815, Derivatives and Hedging. If none of the criteria in the evaluation in these standards are met, the warrants are classified as a component of stockholders' equity and initially recorded at their grant date fair value without subsequent remeasurement. Warrants that meet the criteria are classified as liabilities and remeasured to their fair value at the end of each reporting period.

Share repurchases

The Company accounts for the repurchase of its common shares as an increase in shares in treasury for the market value of the shares at the time of purchase. When the shares are cancelled, the issued and outstanding shares are reduced by the $0.001 par value and the difference is accounted for as a reduction in additional paid in capital.

Income taxes

The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under the asset and liability method the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is recognized if it is more likely than not that some portion or all of the deferred tax asset will not be recognized.

Income (Loss) per share

Basic and diluted earnings or loss per share ("EPS") amounts in the consolidated financial statements are computed in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 260 - 10 "Earnings per Share", which establishes the requirements for presenting EPS. In the accompanying financial statements, basic loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the year. Diluted earnings per share is computed by dividing net income by the weighted average number of shares of common stock and potentially dilutive outstanding shares of common stock during the period to reflect the potential dilution that could occur from common stock issuable through contingent share arrangements, stock options and warrants unless the result would be antidilutive. There were no potentially dilutive shares of common stock outstanding for the period ended June 30, 2024 or the year ended December 31, 2023, respectively.

Foreign exchange

The Company's functional currency is the U.S. dollar. Any monetary assets and liabilities that are in a currency other than the U.S. dollar are translated at the rate prevailing at year end. Revenue and expenses in a foreign currency are translated at rates that approximate those in effect at the time of translation. Gains and losses from translation of foreign currency transactions into U.S. dollars are included in current results of operations.

Financial instruments

The Company's financial instruments consist of cash and cash equivalents, trading securities, receivables, accounts payable and accrued liabilities. It is management's opinion that the Company is not exposed to significant interest, currency or credit risks arising from its financial instruments. The carrying amounts of cash and cash equivalents, trading securities, receivables, accounts payable and accrued liabilities approximate their fair value due to the short-term nature of those financial instruments. Cash in Canada is primarily held in financial institutions. Balances on hand may exceed insured maximums. Cash in Ghana is held in banks with a strong international presence. Ghana does not insure bank balances.

Fair value of financial assets and liabilities

Our financial assets and liabilities that are measured at fair value on a recurring basis include cash equivalents, marketable securities, derivative contracts, and marketable debt securities. Our financial assets measured at fair value on a nonrecurring basis include non-marketable equity securities, which are adjusted to fair value when observable price changes are identified or when the non-marketable equity securities are impaired (referred to as the measurement alternative). Other financial assets and liabilities are carried at cost with fair value disclosed, if required.

Fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that is determined based on assumptions that market participants would use in pricing an asset or a liability. Assets and liabilities recorded at fair value are measured and classified in accordance with a three-tier fair value hierarchy based on the observability of the inputs available in the market used to measure fair value:

- Level 1 - Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

- Level 2 - Inputs that are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant inputs are observable in the market or can be derived from observable market data. Where applicable, these models project future cash flows and discount the future amounts to a present value using market-based observable inputs including interest rate curves, foreign exchange rates, and credit ratings.

- Level 3 - Unobservable inputs that are supported by little or no market data, which require the Company to develop its own assumptions.

The fair value hierarchy requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

Cash, Cash Equivalents, and Marketable Securities

We invest all excess cash primarily in time deposits, money market funds, corporate debt securities, equities, limited partnerships, and rights and warrants.

We classify all marketable debt securities that have stated maturities of three months or less from the date of purchase as cash equivalents and those with stated maturities of greater than three months as marketable securities on our Consolidated Balance Sheets.

We determine the appropriate classification of our investments in marketable debt securities at the time of purchase and reevaluate such designation at each balance sheet date. We have classified and accounted for our marketable debt securities as trading securities. After consideration of our risk versus reward objectives, as well as our liquidity requirements, we may sell these debt securities prior to their stated maturities. For all of our marketable debt securities we have elected the fair value option, for which changes in fair value are recorded in other income (expense), net. We determine any realized gains or losses on the sale of marketable debt securities on a specific identification method, and we record such gains and losses as a component of other income (expense), net.

The following tables summarize our investment in debt instruments, at their fair value, by significant investment categories as of June 30, 2024 and December 31, 2023:

| Level 1 - Cash equivalents |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| |

|

|

|

|

|

|

| Money market funds |

$ |

6,592,753 |

|

$ |

6,738,412 |

|

| |

$ |

6,592,753 |

|

$ |

6,738,412 |

|

Cash, cash equivalents, and investments

|

|

June 30,

2024 |

|

|

Quoted Prices

in Active

Markets

(Level 1) |

|

|

Significant

Other

Observable

Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

8,176,181 |

|

$ |

8,170,189 |

|

$ |

- |

|

$ |

- |

|

| Restricted cash |

|

296,322 |

|

|

296,322 |

|

|

- |

|

|

- |

|

| Marketable securities |

|

3,194,568 |

|

|

3,062,198 |

|

|

- |

|

|

132,370 |

|

| Total |

$ |

11,667,071 |

|

$ |

11,534,701 |

|

$ |

- |

|

$ |

132,370 |

|

| |

|

December 31,

2023 |

|

|

Quoted Prices

in Active

Markets

(Level 1) |

|

|

Significant

Other

Observable

Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

7,154,462 |

|

$ |

7,124,364 |

|

$ |

- |

|

$ |

- |

|

| Restricted cash |

|

296,322 |

|

|

296,322 |

|

|

- |

|

|

- |

|

| Marketable securities |

|

2,212,401 |

|

|

2,212,401 |

|

|

- |

|

|

- |

|

| Total |

$ |

9,663,185 |

|

$ |

9,633,087 |

|

$ |

- |

|

$ |

- |

|

The fair values of cash and cash equivalents and marketable securities are determined through market, observable and corroborated sources.

Investment in Debt Securities

We classify our marketable debt securities, which are accounted for as trading securities, within Level 1 or 2 in the fair value hierarchy because we use quoted market prices to the extent available or alternative pricing sources and models utilizing market observable inputs to determine fair value.

Investment in trading securities

The following discusses our marketable equity securities, non-marketable equity securities, gains and losses on marketable and non-marketable equity securities, as well as our equity securities accounted for under the equity method.

Our marketable equity securities are publicly traded stocks or funds measured at fair value and classified within Level 1 and 2 in the fair value hierarchy because we use quoted prices for identical assets in active markets or inputs that are based upon quoted prices for similar instruments in active markets.

Our non-marketable equity securities are investments in privately held companies without readily determinable market values. The carrying value of our non-marketable equity securities is adjusted to fair value for observable transactions for identical or similar investments of the same issuer or impairment (referred to as the measurement alternative). Non-marketable equity securities that have been remeasured during the period based on observable transactions are classified within Level 2 or Level 3 in the fair value hierarchy because we estimate the value based on valuation methods which may include a combination of the observable transaction price at the transaction date and other unobservable inputs including volatility, rights, and obligations of the securities we hold. The fair value of non-marketable equity securities that have been remeasured due to impairment are classified within Level 3.

Concentration of credit risk

The financial instrument which potentially subjects the Company to concentration of credit risk is cash. The Company maintains cash in bank accounts that, at times, may exceed federally insured limits. The Company held $6,774,063 and $6,738,412 as of June 30, 2024 and December 31, 2023, respectively, in low-risk cash and money market funds which are not federally insured. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

The Company has contracted to sell all its recovered gold through a licensed exporter in Ghana. The Company sells its raw gold to one smelter. Ownership of the gold is transferred to the smelting company at the mine site. The Company has not experienced any losses from this sole sourced smelter and believes it is not exposed to any significant risks on its gold processing.

Recent Accounting Pronouncements

In October 2021, the FASB issued ASU No. 2021-08, Accounting for Contract Assets and Contract Liabilities from Contracts with Customers (Topic 805). This ASU requires an acquirer in a business combination to recognize and measure contract assets and contract liabilities (deferred revenue) from acquired contracts using the revenue recognition guidance in Topic 606. At the acquisition date, the acquirer applies the revenue model as if it had originated the acquired contracts. The ASU is effective for annual periods beginning after December 15, 2022, including interim periods within those fiscal years. Adoption of the ASU should be applied prospectively. Early adoption is also permitted, including adoption in an interim period. If early adopted, the amendments are applied retrospectively to all business combinations for which the acquisition date occurred during the fiscal year of adoption. This ASU is currently not expected to have a material impact on our consolidated financial statements.

In June 2022, the FASB issued ASU 2022-03, ASC Subtopic "Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions". These amendments clarify that a contractual restriction on the sale of an equity security is not considered part of the unit of account of the equity security and, therefore, is not considered in measuring fair value. The amendments in this update are effective for public business entities for fiscal years, including interim periods within those fiscal years, beginning after December 15, 2023. Early adoption is permitted. The Company is currently assessing the impact of the adoption of this standard on its consolidated financial statements.

The Company has considered all other recently issued accounting pronouncements and does not believe the adoption of such pronouncements will have a material impact on its financial statements.

4. PREPAIDS

Prepaids consist of the following amounts:

| |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| Prepaid insurance |

$ |

40,760 |

|

$ |

17,581 |

|

| Prepaid permit fees |

|

40,293 |

|

|

12,515 |

|

| Legal advances |

|

81,010 |

|

|

55,690 |

|

| Other |

|

4,940 |

|

|

16,399 |

|

| |

$ |

167,003 |

|

$ |

102,185 |

|

5. INVESTMENTS IN TRADING SECURITIES

At June 30, 2024, the Company held investments classified as trading securities, which consisted of various equity securities. All trading securities are carried at fair value. All marketable securities are publicly traded and valued using Level 1 methods, except private investments, which are value using Level 3 methods.. As of June 30, 2024 and December 31, 2023 respectively, the fair value of trading securities was $3,194,568 and $2,212,401. The Company recognized a full impairment of certain investments, of $1,336,501 in 2023.

| |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| Investments in trading securities at cost |

$ |

4,227,145 |

|

$ |

3,501,195 |

|

| Unrealized gains (losses) |

|

(1,032,577 |

) |

|

(1,288,794 |

) |

| Investments in trading securities at fair market value |

$ |

3,194,568 |

|

$ |

2,212,401 |

|

The fair value carrying value of investments by category is as follows:

| |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| Marketable Equity Securities - Level 1 |

|

|

|

|

|

|

| Publicly traded investments |

$ |

3,062,198 |

|

$ |

2,212,401 |

|

| |

|

|

|

|

|

|

| Marketable Debt Securities - Level 2 |

|

|

|

|

|

|

| Corporate bonds |

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

| Non-Marketable Equity Securities - Level 3 |

|

|

|

|

|

|

| Private investments |

|

132,370 |

|

|

- |

|

| Total investments |

$ |

3,194,568 |

|

$ |

2,212,401 |

|

The gains and losses on investments by category is as follows:

| |

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| Marketable Equity Securities - Level 1 |

|

|

|

|

|

|

| Publicly traded investments - realized |

$ |

(12,510 |

) |

$ |

34,350 |

|

| Publicly traded investments - unrealized |

|

(4,672 |

) |

|

(171,732 |

) |

| |

|

|

|

|

|

|

| Non-Marketable Debt Securities - Level 2 |

|

|

|

|

|

|

| Private bonds |

|

- |

|

|

(10,438 |

) |

| |

|

|

|

|

|

|

| Non-Marketable Equity Securities - Level 3 |

|

|

|

|

|

|

| Private investments - realized |

|

- |

|

|

- |

|

| Private investments - unrealized |

|

(221,674 |

) |

|

32,439 |

|

| Total investments |

$ |

(238,856 |

) |

$ |

(115,381 |

) |

Reported as:

| |

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| |

|

|

|

|

|

|

| Net gain (loss) on trading securities |

$ |

(238,856 |

) |

$ |

(115,381 |

) |

| Impairment loss on trading securities |

|

- |

|

|

- |

|

| Other |

|

- |

|

|

- |

|

| Total gain (loss) on investments |

$ |

(238,856 |

) |

$ |

(115,381 |

) |

The Company also recorded interest and dividend income from its investment portfolio as follows:

| |

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| |

|

|

|

|

|

|

| Interest earned and dividends |

$ |

203,296 |

|

$ |

166,366 |

|

6. EQUIPMENT

| |

|

June 30, 2024 |

|

| |

|

Cost |

|

|

Accumulated

Depreciation |

|

|

Net Book

Value |

|

| |

|

|

|

|

|

|

|

|

|

| Exploration equipment |

$ |

2,282,277 |

|

$ |

1,951,415 |

|

$ |

330,862 |

|

| Vehicles |

|

841,485 |

|

|

658,034 |

|

|

183,451 |

|

| |

$ |

3,123,762 |

|

$ |

2,609,449 |

|

$ |

514,313 |

|

The company expensed $69,741 for depreciation in the six-month period ended June 30, 2024.

| |

|

December 31, 2023 |

|

| |

|

Cost |

|

|

Accumulated

Depreciation |

|

|

Net Book

Value |

|

| |

|

|

|

|

|

|

|

|

|

| Exploration equipment |

$ |

2,282,277 |

|

$ |

1,909,186 |

|

$ |

373,091 |

|

| Vehicles |

|

800,628 |

|

|

630,522 |

|

|

170,106 |

|

| |

$ |

3,082,905 |

|

$ |

2,539,708 |

|

$ |

543,197 |

|

The company expensed $165,898 for depreciation in 2023, of which $86,520 was expensed in the six months ended June 30, 2023.

7. MINERAL PROPERTIES

The Kibi, Kwabeng and Pameng Projects were purchased as a group in 2004, and the purchase price was not allocated between the properties and camp facilities. As historical option payments received for the right to purchase projects from the Company in previous years have expired unexercised there are no third-party claims against the Projects. The Mineral Properties have a value of $734,422 as at June 30, 2024 and December 31, 2023. There was no impairment in the carrying value of the properties in the period ended June 30, 2024 or the year ended December 31, 2023.

Kibi, Kwabeng and Pameng Projects

The Company holds the mineral rights over the lease area for Kibi , Kwabeng, and Pameng Projects, all of which are located in Ghana. The original Kwabeng and Pameng mining leases had an expired date of July 26, 2019, while the Apapam (the "Kibi") lease had an expiry date of December 17, 2015. Under the mineral laws, the Company has the right to apply for extensions of mining leases for up to a maximum of 30 years. The Company has applied for extensions on all three of its leases noted above for a further 15 years. The Kwabeng and Pameng extensions were filed on December 13, 2018, and the Kibi lease extension on June 17, 2015. To date, the Company has not received the extension documents from the government. Under mineral law, the old leases remain fully in force until the government issues the new lease documents. The renewal extension is in accordance with the terms of application and payment of fees to the Minerals Commission.

All gold production will be subject to a 5% production royalty of the net smelter returns ("NSR") payable to the Government of Ghana.

Banso and Muoso Projects

During the year ended December 31, 2010, the Company made an application to Mincom to convert a single prospecting license ("PL") securing its interest in the Banso and Muoso Projects located in Ghana to a mining lease covering the lease area of each of these Projects. This application was approved by Mincom who subsequently made a recommendation to the Minister of Lands, Forestry and Mines to grant an individual mining lease for each Project. On January 6, 2011, the Government of Ghana granted two mining leases for these Projects. These mining leases grant the Company mining rights to produce gold in the respective leased areas until January 5, 2025 with respect to the Banso Project and until January 5, 2024 with respect to the Muoso Project. These mining leases supersede the PL previously granted to the Company. Among other things, both mining leases require that the Company:

i) pay the Government of Ghana a fee of $30,000 in consideration of granting of each lease (paid in the March 2011 quarter);

ii) pay annual ground rent of GH¢189,146 (approximately USD$35,688) for the Banso Project and GH¢202,378 (approximately USD$38,185) for the Muoso Project;

iii) commence commercial production of gold within two years from the date of the mining leases (note: all leases were in production well before the 2 year deadline); and

iv) pay a production royalty of 5% of gold sales to the Government of Ghana.

No project acquisition costs were recorded for the acquisition of Banso and Muoso Projects. In June 2023 the Company applied for an extension of the Muoso Project. The Banso lease expires on January 5, 2025 and the Company expects to apply for an extension of the Banso lease at that time.

Mining Lease and Prospecting License Commitments

The Company is committed to expend, from time to time fees payable

(a) to the Minerals Commission for:

(i) a grant or renewal of a mining lease (currently an annual fee maximum of $1,000.00 per cadastral units/or 21.24 hectare); and

(ii) annual operating permits;

(b) to the Environmental Protection Agency ("EPA") (of Ghana) for:

i) processing and certificate fees with respect to EPA permits;

ii) the issuance of permits before the commencement of any work at a particular concession; or

iii) the posting of a bond in connection with any mining operations undertaken by the Company;

(c) for a legal obligation associated with our mineral properties for clean up costs when work programs are completed.

8. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

Trade payables and accrued liabilities are comprised as follows:

| |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| Trade payables |

$ |

3,339 |

|

$ |

2,137 |

|

| Accrued royalties and taxes |

|

1,470,584 |

|

|

1,230,012 |

|

| Accrued other liabilities |

|

37,142 |

|

|

48,911 |

|

| |

$ |

1,511,065 |

|

$ |

1,281,060 |

|

The following table shows the aging of the Company's trade payables:

| |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| Current |

$ |

3,339 |

|

$ |

2,137 |

|

| >60 days |

|

- |

|

|

- |

|

| |

$ |

3,339 |

|

$ |

2,137 |

|

9. ASSET RETIREMENT OBLIGATION

| |

|

June 30,

2024 |

|

|

December 31,

2023 |

|

| |

|

|

|

|

|

|

| Balance, beginning of year |

$ |

85,628 |

|

$ |

99,514 |

|

| Change in obligation |

|

9,257 |

|

|

(13,886 |

) |

| Accretion expense |

|

- |

|

|

- |

|

| Balance, end of period |

$ |

94,885 |

|

$ |

85,628 |

|

The Company has a legal obligation associated with its mineral properties for clean up costs when work programs are completed. Most of the cash will be spent to return the grade of disturbed land to its original state and to plant vegetation.

The rehabilitation obligation is estimated at $94,885 and $85,628 at June 30, 2024 and December 31, 2023, respectively. During 2024 and 2023, the obligation was estimated based on actual reclamation cost experience on an average per acre basis and the remaining acres to be reclaimed. It is expected that this obligation will be funded from general Company resources at the time the costs are incurred. The Company has been required by the Ghanaian government to post a bond of $296,322 which has been recorded in restricted cash.

10. CAPITAL STOCK

Authorized stock

The Company's authorized shares are 250,000,000 common shares with a par value of $0.001 per share.

Issuances of shares

The Company did not issue shares during the period ended June 30, 2024 or the year ended December 31, 2023.

Cancellation of shares

During the period ended June 30, 2024, a total of 116,600 common shares were re-purchased for $94,854 and cancelled. A further total of 28,500 common shares were re-purchased in 2023 for $20,744 were cancelled in 2024. A total of 22,300 common shares were re-purchased in 2024 for $20,846 and held in treasury. These 22,300 shares were cancelled in July 2024.

During the year ended December 31, 2023, a total of 234,200 common shares were re-purchased for $150,582 and were cancelled. A further total of 11,500 common shares that were re-purchased in 2022 for $6,892 were cancelled in 2023. A total of 28,500 common shares were re-purchased in 2023 for $20,744 and held in treasury. These 28,500 shares were cancelled in January 2024.

Stock options

At June 30, 2011, the Company adopted a new 10% rolling stock option plan (the "2011 Plan") and cancelled the 2005 equity compensation plan. Pursuant to the 2011 Plan, the Company is entitled to grant options and reserve for issuance up to 10% of the shares issued and outstanding at the time of grant. The terms and conditions of any options granted, including the number and type of options, the exercise period, the exercise price and vesting provisions, are determined by the Compensation Committee which makes recommendations to the board of directors for their approval. The maximum term of options granted cannot exceed 20 years.

The TSX's rules relating to security-based compensation arrangements require that every three years after the institution of a security-based compensation arrangement which does not have a fixed maximum aggregate of securities issuable, all unallocated options must be approved by a majority of the Company's directors and by the Company's shareholders. The Board approved all unallocated options under the Option Plan on May 5, 2023 which was approved by the Company's shareholders at the annual and special meeting held on June 29, 2023.

At June 30, 2024, the following stock options were outstanding:

Number of

Options |

Exercise

Price |

Expiry Date |

| |

|

|

| 382,000 |

|

CDN$0.15 |

|

December 31, 2032 |

| 54,000 |

|

CDN$0.60 |

|

June 1, 2040 |

| 250,000 |

|

CDN$0.20 |

|

October 8, 2035 |

| 360,000 |

|

CDN$1.23 |

|

October 23, 2040 |

| 400,000 |

|

CDN$0.40 |

|

May 5, 2036 |

| 690,000 |

|

CDN$0.30 |

|

July 1, 2037 |

| 450,000 |

|

CDN$0.81 |

|

December 14, 2042 |

| 62,500 |

|

CDN$0.92 |

|

April 27, 2043 |

| 275,000 |

|

CDN$1.30 |

|

May 13, 2044 |

| |

|

|

|

Stock option transactions and the number of stock options outstanding are summarized as follows:

| |

June 30, 2024 |

December 31, 2023 |

| |

Number of

Options |

Weighted

Average

Exercise

Price |

Number of

Options |

Weighted

Average

Exercise

Price |

| Outstanding, beginning of year |

2,648,500 |

CAD $ 0.39 |

2,586,000 |

CAD $ 0.37 |

| Granted |

275,000 |

CAD $ 1.30 |

62,500 |

CAD 0.92 |

| Exercised |

- |

- |

- |

- |

| Cancelled/Expired |

- |

- |

- |

- |

| Outstanding, end of period |

2,923,500 |

CAD $ 0.44 |

2,648,500 |

CAD $ 0.39 |

| |

|

|

|

|

| Exercisable, end of period |

2,923,500 |

CAD $ 0.44 |

2,648,500 |

CAD $ 0.39 |

The aggregate intrinsic value for options vested and for total options as of June 30, 2024 and December 31, 2023 respectively, is approximately $1,356,000 and $1,115,000. The weighted average contractual term of stock options outstanding and exercisable as at June 30, 2024 and December 31, 2023 respectively, is 9.3 years and 10.7 years.

The Company granted 275,000 stock options during the period ended June 30, 2024 at a fair value of $139,138, which has been included in general and administrative expense. The fair value of stock options granted, vested, and modified during the year ended December 31, 2023, was $23,750, which has been included in general and administrative expense.

The following assumptions were used for the Black-Scholes valuation of stock options granted or amended during the period ended June 30, 2024 and the year ended December 31, 2023:

| |

2024 |

2023 |

| |

|

|

| Risk-free interest rate |

4.52% |

3.00% |

| Expected life |

5.0 years |

5.0 years |

| Annualized volatility |

126% |

64% |

| Dividend rate |

- |

- |

On May 13, 2024 the Company granted 275,000 options to insiders and others at $0.95 (CAD$1.30) and recognized an expense of $139,138 as the options vested immediately. On April 27, 2023 the Company granted 62,500 options to insiders at $0.68 (CAD$0.92) and recognized an expense of $23,750 as the options vested immediately.

Warrants

At June 30, 2024 and December 31, 2023, there were no warrants outstanding.

11. RELATED PARTY TRANSACTIONS

During the six-month periods ended June 30, 2024 and 2023, the Company entered into the following transactions with related parties:

| |

June 30, 2024 |

|

June 30, 2023 |

| |

|

|

|

| Consulting fees paid or accrued to officers or their companies |

$ 619,168 |

|

$668,435 |

| Directors' fees |

1,104 |

|

1,115 |

| |

|

|

|

| Stock option grants to officers and directors |

175,000 |

|

62,500 |

| Stock option grant price range |

CAD $1.30 |

|

CAD $0.92 |

Of the total consulting fees noted above, $459,687 (June 30, 2023 - $477,747), was incurred by the Company to a private company of which a related party is a 50% shareholder and director. The related party was entitled to receive $229,884 (June 30, 2023 - $238,873) of this amount. As at June 30, 2024, a balance of $212,103 (December 31, 2023 - $152,415) exists to this related company and $Nil remains payable in all years to the related party for expenses earned for work on behalf of the Company.

During 2024, the Company granted 175,000 stock options to insiders at a price of $0.95 (CAD$1.30). A total of $88,543 was included in consulting fees related to these options. During 2023, the Company granted 62,500 options to insiders at a price of $0.68 (CAD$0.92). A total of $23,750 was included in consulting fees related to these options.

12. SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS

| |

|

June 30,

2024 |

|

|

June 30,

2023 |

|

| |

|

|

|

|

|

|

| Cash paid during the period for: |

|

|

|

|

|

|

| Interest |

$ |

- |

|

$ |

- |

|

| Income taxes |

$ |

276,432 |

|

$ |

575,540 |

|

During the period ended June 30, 2024, the Company paid $276,432 (December 31, 2023 - $660,540) related to income tax in the current and prior periods and accrued $400,000 in the six months ended June 30, 2024 (December 31, 2023 - $800,000), for expected income tax payments related to activities in Ghana. There were no other significant non-cash transactions during the period ended June 30, 2024 or the year ended December 31, 2023.

13. DEFERRED INCOME TAXES

This note has not been updated from December 31, 2023.

14. COMMITMENTS AND CONTINGENCIES

a) Bond deposit

The Company has been required by the Ghanaian government to post an environmental bond of US$296,322 which has been recorded in restricted cash (see Note 9).

b) Litigation

From time to time, the Company may become involved in various lawsuits and legal proceedings, which arise, in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm the Company's business. The Company is not aware of any such legal proceedings other than disclosed below that will have, individually or in the aggregate, a material adverse effect on its business, financial condition or operating results.

The Company is a party to two pending lawsuits. One lawsuit claims additional funds of GHC90,000 (approximately US$9,000) from local government for an annual business operating permit. Another lawsuit claims that workers were terminated unlawfully. The Company will defend itself in each of these lawsuits if required, and believes both cases are completely without merit and frivolous.

The Company is subject to additional legal proceedings and claims which arise in the ordinary course of its business. Although occasional adverse decisions or settlements may occur, the Company believes that the final disposition of such matters should not have a material adverse effect on its financial position, results of operations or liquidity.

On October 19, 2022, Minerals Commission issued five invoices totaling $11,714,800 to our Ghanaian subsidiary. These invoices were titled "Outstanding Annual Mineral Right Fees" for all five of our concessions (Kwabeng, Pameng, Apapam, Muoso and Banso), which Minerals Commission indicated were related to the period from 2012 to 2022, for new annual mineral fees. However, all of our mining leases all have a one-time fixed consideration fee, which was paid when our leases were granted. Our legal counsel responded to Minerals Commission (the "Letters") on November 15, 2019, objecting to the five improper invoices. Our Letters outline the specific violated terms of our leases and various mineral laws. The Minerals Commission has not responded to our Letters. Should Minerals Commission challenge our Letters, our Company could enter dispute resolution arbitration clause under the Mineral Act. We believe the invoices are not legally enforceable under the Mineral Act, and have not included any amount related to these invoices in our accounts.

Ghana Revenue Agency ("GRA") sent our Ghanaian subsidiary an updated tax assessment letter on May 11, 2023. The letter alleges a total tax liability of $1,186,701 (the "Assessment"), from 2012 to 2022. Upon a thorough review of the Assessment, we agreed that the only additional liability in the Assessment was $356,281. The balance of the Assessment was objected to by our company in letter dated June 13, 2023, (the "Objection Letter"). To date, GRA has not responded to our Objection Letter, and our company believes it has settled all amounts owing in the Assessment.

(c) Credit risk

Financial instruments that are potentially subject to credit risk consist principally of trade receivables. The Company believes the concentration of credit risk in its trade receivables is substantially mitigated by its ongoing credit evaluation process and relatively short collection terms. The Company does not generally require collateral from customers. The Company evaluates the need for an allowance for doubtful accounts based upon factors surrounding the credit risk of specific customers, historical trends and other information.

(d) Exchange rate risk

The functional currency of the Company is US$, to date the majority of the revenues and costs are denominated in Ghana and a significant portion of the assets and liabilities are denominated in both Canada and Ghana. As a result, the Company is exposed to foreign exchange risk as its revenues and results of operations may be affected by fluctuations in the exchange rate between US$ and Ghana currency. If Ghana depreciates against US$, the value of Ghana revenues and assets as expressed in US$ financial statements will decline. The Company does not hold any derivative or other financial instruments that expose to substantial market risk.

(e) Economic and political risks

The Company's operations are conducted in Ghana. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environment in Ghana, and by the general state of the Ghana economy.

The Company's operations in the Ghana are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company's results may be adversely affected by changes in the political and social conditions in Ghana, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation.

f) Commodity price risk

We are exposed to fluctuations in commodity prices for gold. Commodity prices are affected by many factors, including but not limited to, supply and demand.

g) The minerals properties lease status is as follows:

-Apapam Lease expired on December 17th 2015, and extension was submitted on June 17th 2015;

-Kwabeng and Pameng Leases expired on July 26th 2019, and extensions were submitted on June 13th 2018;

-Muoso Lease expired on January 5th 2024, and extension was submitted on June 12th 2023; and

-Banso Lease does not expire until Jan. 5th 2025.

On all the above extensions the company requested a further 15 year extension to each lease, and the old leases are fully in force until the new leases are granted by the government.

All required documentation to extend the lease for our Kibi Project (formerly known as the Apapam Project) for 15 years from December 17, 2015 has been submitted to the Ghana Minerals Commission. No additional information was requested or submitted in the period ended March 31, 2024 or the year ended December 31, 2023. As of these extensions generally take years for the regulatory review to be completed, and the Company is not yet in receipt of the renewal extension approval. However, until the Company receives the renewal extension approval, the old lease remains in force under the mineral laws. The renewal extension is in accordance with the terms of application and payment of fees to the Minerals Commission.

15. SUBSEQUENT EVENTS

From the period subsequent to June 30, 2024, to the date of filing of these financial statements, the following occurred:

- 22,300 shares which were purchased in June 2024 and held in treasury on June 30, 2024, were cancelled.

- 7,000 shares were purchased after June 30, 2024, which will be cancelled in August 2024.

EXHIBIT 99.2

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

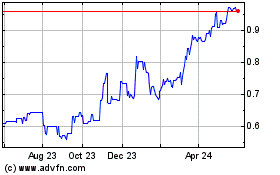

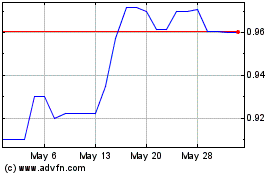

The following discussion and analysis of the interim unaudited condensed consolidated financial statements and results of operations ("MD&A") of Xtra-Gold Resources Corp. ("Xtra-Gold" or our "company") for the three and six months ended June 30, 2024 and 2023 should be read in conjunction with the interim unaudited condensed consolidated financial statements and the related notes to the company's interim unaudited condensed consolidated financial statements. The following discussion contains forward-looking statements that reflect Xtra-Gold's plans, estimates and beliefs. Our company's actual results could differ materially from those discussed in the forward-looking statements set out herein. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and as contained elsewhere in this MD&A. Our company's condensed consolidated unaudited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles ("U.S. GAAP").Additional information relating to our company, including our consolidated audited financial statements and the notes thereto for the years ended December 31, 2023, 2022 and 2021 and our annual report on Form 20-F, can be viewed on SEDARPLUS at www.sedarplus.ca and on EDGAR at www.sec.gov.