Westbridge Closes Transaction with Black Pearl Holdings, LLC

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan 10, 2014) -

Westbridge Energy Corporation

(TSX-VENTURE:WEB)(PINKSHEETS:WEGYF)(FRANKFURT:PUQ1) ("Westbridge"

or the "Company") is pleased to announce it has received final

approval from the TSX Venture Exchange and closed its acquisition

of interests from Black Pearl Holdings, LLC ("Black Pearl") as

announced on October 22, 2013, and satisfied the escrow conditions

to gain access to the initial $2,069,570 tranche of its $3.0

million private placement. Westbridge will now move forward with

securing the remaining funds of its private placement, launching

its work programs in Texas and Louisiana, and evaluating its option

to merge with Black Pearl.

Initial Work Programs

Westbridge and Black Pearl (the "Partners") intend to complete

the initial work programs over the first quarter and early second

quarter 2014 with the proceeds from the first closing of the

private placement. These programs will focus on reworks at the

Bivens Field, Beauregard Parish, Louisiana and drilling a

development well at the Wharton County Field, Wharton County,

Texas. The results from these programs are anticipated to generate

sufficient cash flow to sustain the ongoing working capital

requirements of the Partners and provide a foundation of cash flow

to reduce the overall risk of future exploration and development

initiatives.

Initially, the Partners will re-perforate the Olympia Minerals

#2 ("OM#2") well and hydraulically fracture the Middle Wilcox

10,600' Sand at the Bivens Field. Subsequent to completion of this

initial portion of the program, the Partners will hydraulically

fracture the Middle Wilcox 11,300' Sand in the Olympia Minerals #1

("OM#1") wellbore. Results from this program are expected to

increase the flow rates from these wells. This expectation is based

on the initial test rates of over 160 BOPD and 800 MCFGPD from the

OM#2 well and 240 BOPD and 1,000 MCFGPD from the OM#1 well.

Subsequent to the completion of the initial activities at Bivens

Field, the Partners will spud the Wharton County Field #3 well

("WC#3") at the Wharton County Field. This well is planned to test

the productive Lower Frio Sand 40' to 50' up dip from the Wharton

County Field #1 well ("WC#1"). The WC#3 well location will be 500'

northeast of the WC#1 and within the same seismic anomaly. There is

reason to believe that the entire 50' sand will be saturated with

light oil and capable of achieving high flow rates. This

expectation is based on the initial test rate of approximately 250

BOPD from the WC#1 on an 8/64ths choke before watering out. The

Partners intend to increase the choke to 10/64ths to further

enhance the potential flow rate of the WC#3.

National Instrument 51-101 Technical Report

A National Instrument 51-101 ("NI 51-101") has been filed on

SEDAR for the Bivens Field and Wharton County Field. Upon acquiring

leases in the Lavaca County 3D seismic area, the Company will also

prepare a NI 51-101 report for the Lavaca County Project within 45

days of acquiring these leases.

The initial gross and net share of proved and probable reserves

and net share of the future net revenue before tax is summarized as

follows:

Proven and Probable Reserves

|

Light & Medium Oil |

Natural Gas |

Natural Gas Liquids |

| Reserves |

100% |

Gross |

Net |

100% |

Gross |

Net |

100% |

Gross |

Net |

| Category |

Mbbl |

Mbbl |

Mbbl |

MMcf |

MMcf |

MMcf |

Mbbl |

Mbbl |

Mbbl |

| Proved Producing |

0 |

0 |

0 |

902 |

280 |

205 |

208 |

65 |

47 |

| Proved Undeveloped |

0 |

0 |

0 |

3,947 |

1,226 |

895 |

784 |

244 |

178 |

|

Total Proved: |

0 |

0 |

0 |

4,850 |

1,506 |

1,099 |

992 |

308 |

225 |

| Probable Undeveloped |

348 |

175 |

124 |

13,054 |

5,162 |

3,766 |

1,288 |

507 |

370 |

|

Total Proved + Probable: |

348 |

175 |

124 |

17,904 |

6,668 |

4,866 |

2,280 |

815 |

595 |

Net Revenue Before Tax

|

Discount Rate |

|

0% |

5% |

10% |

15% |

20% |

| Category |

$M |

$M |

$M |

$M |

$M |

| Proved Producing |

3,311 |

2,623 |

2,134 |

1,774 |

1,503 |

| Proved Undeveloped |

12,914 |

8,150 |

5,335 |

3,602 |

2,495 |

|

Total Proved: |

16,224 |

10,773 |

7,469 |

5,377 |

3,999 |

| Probable Undeveloped |

33,679 |

26,568 |

21,397 |

17,528 |

14,561 |

|

Total Proved + Probable: |

49,903 |

37,341 |

28,866 |

22,905 |

18,560 |

The results from this technical report provide the Company an

initial base to expand upon. The Company anticipates these numbers

will expand with the addition of the deep sands to be tested at the

Bivens Field in the third quarter of 2014 and an expanded

development plan at the Wharton County Field. The deep sands at

Bivens Field are the most productive in the trend as evidenced by

the over 20 MMBO and 64 BFC of historic production 8 miles to the

north of Bivens Field at Neale Field. In addition to the deep sands

at Bivens Field, the initial reserve numbers at the Wharton Field

only include the completion of a single development well whereas

the Partners believe 4-5 wells will be required to fully develop

the field.

Option to Merge

Westbridge is continuing to evaluate its option to merge with

Black Pearl as announced on November 27, 2013. Under the terms of

the merger option, Westbridge has 156 days remaining to exercise

its option to issue a total of 84.5 million shares to Black Pearl

or its nominees in exchange for 100% of the assets or shares of

Black Pearl. Upon consummation of the merger, the combined entity

would hold domestic US assets in Texas and Louisiana, international

assets in Namibia, and full access to 100,000 linear miles of 2D

seismic data licensed from ExxonMobil and 85 square miles of 3D

seismic in Lavaca County, Texas. The 2D data spans 7 states in the

US Gulf Coast region and has been used to identify over 500 drill

targets to date.

Upon exercise of the merger option, the completion of the merger

will be subject to conditions including, but not limited to:

- The completion of a definitive agreement;

- Completion of satisfactory due diligence on all legal,

financial, geological and technical documentation;

- TSX Venture Exchange approval; and

- Approval of the boards of Westbridge and Black Pearl.

Financing Update

As a condition to the completion of the acquisition of interests

from Black Pearl, the Company completed an initial tranche of its

non-brokered private placement (the "Private Placement") financing

of subscription receipts for gross proceeds of $2,069,570 by

issuing 34,492,833 subscription receipts at a price of $0.06 per

subscription receipt (the "Subscription Receipts"). Each

Subscription Receipt will now be exchanged into one unit of

Westbridge (a "Unit") comprising of one common share in the capital

of the Company (a "Share") and one common share purchase warrant (a

"Warrant"). Each Warrant will entitle the holder to acquire one

Share at a price of $0.09 for 24 months from the closing date on

December 17, 2013. The Warrants will also be subject to an

acceleration provision whereby if at any time after four (4) months

and one (1) day from the closing of the Private Placement, and the

conversion of the Subscription Receipts, the closing price of the

Company's shares on the TSX Venture Exchange exceeds $0.25 (on a

volume weighted basis) for 30 consecutive trading days, the Company

shall have the right to accelerate the exercise period of the

Warrants to a date that is not less than 30 days from the date the

Company provides notice to the warrant holders of its election to

accelerate the exercise period. The common shares and warrants

issued are subject to a hold period expiring April 18, 2014.

Total commissions of $40,110 and 668,000 finder's warrants have

been paid by Westbridge to finders/agents as consideration for

arranging the initial tranche of the Private Placement. Each

finder's warrant entitles the holder to purchase one commons share

of Westbridge at a price of $0.09, subject to the same terms as the

Warrants. The finder's warrants and any shares acquired upon

exercise of the finder's warrants are subject to a hold period

expiring April 18, 2014.

Westbridge continues to actively work with multiple investors

interested in the Private Placement and targets closing on the

balance of its $3 million financing in the near term.

Board and Management Appointments

Westbridge is also pleased to announce the formal appointment of

Mr. Michael Looney, President & CEO of Black Pearl to the board

of Westbridge and Mr. Darren Collins to the position of Vice

President, Business Development.

Mr. Michael Looney has over 38 years of experience as a

petroleum geologist and geophysicist with extensive experience

developing partner relationships, and directing exploration and

development efforts in the Gulf Coast states of the US. Prior to

Black Pearl, he worked for ExxonMobil, Hunt Energy, Terra

Resources, and Edge Petroleum. Mr. Looney formed his first company

in 1985 and is credited with over 500 BCF in discoveries. He holds

a Bachelors and Masters degree in geology from the University of

Texas at Austin.

Mr. Darren Collins is a corporate finance and business

development professional with experience at notable investment and

advisory firms in Toronto, Canada and London, United Kingdom. Over

the last 7 years, Mr. Collins has been involved with companies that

have completed more than a billion dollars worth of transactions in

the resource sector. He holds a Bachelor of Commerce degree in

finance from Dalhousie University.

Management Commentary

Mr. Tosan Omatsola, President & CEO of Westbridge, comments:

"The closing of this transaction with Black Pearl is the direct

result of the efforts of multiple parties and I would like to thank

all those involved in bringing this transaction together. I would

also like to welcome Michael to our board and Darren to our

management team. These additions will broaden the technical and

financial expertise of Westbridge and support the Company in

realizing its corporate objectives. The Company now moves forward

with launching work programs in Louisiana and Texas, evaluating its

option to merge with Black Pearl and securing a financial partner

for its assets in Namibia."

Mr. Michael Looney, CEO and President of Black Pearl, comments:

"Over the final quarter of 2013 and early in 2014, Black Pearl and

Westbridge have formed a strong business relationship as evidenced

by the completion of this transaction and our intentions to

complete a merger in 2014. As a shareholder of Westbridge and

representative of Black Pearl, I am also very pleased to officially

join the board of the Westbridge and look forward to being an

active participant in creating value for all parties involved in

this venture."

For additional information readers are invited to review

additional corporate and property information available at

Westbridge's website at:

www.westbridgeweb.com

On behalf of Westbridge Energy Corporation,

| Tosan Omatsola |

| President and Chief Executive Officer |

| +1 604 638 9378 |

| tomatsola@westbridgeweb.com |

|

| Peter Henry |

| Director |

| +1 818 970 6940 |

| phenry@westbridgeweb.com |

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

This news release contains "forward-looking statements" within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and "forward looking information" within the

meaning of the British Columbia Securities Act, the Alberta

Securities Act and the Ontario Securities Act. Generally, the words

"expect", "intend", "estimate", "will" and similar expressions

identify forward-looking information. By their very nature,

forward-looking statements are subject to known and unknown risks

and uncertainties that may cause our actual results, performance or

achievements, or that of our industry, to differ materially from

those expressed or implied in any of our forward looking

information. Statements in this press release regarding

Westbridge's business or proposed business, which are not

historical facts, are forward-looking information that involve

risks and uncertainties, such as estimates and statements that

describe Westbridge's future plans, objectives or goals, including

words to the effect that Westbridge or management expects a stated

condition or result to occur. Since forward-looking statements

address events and conditions, by their very nature, they involve

inherent risks and uncertainties. Actual results in each case could

differ materially from those currently anticipated in such

statements. Investors are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date they

are made. All of the Company's Canadian public disclosure filings

may be accessed via www.sedar.com and readers are urged to review

these materials, including the technical reports filed with respect

to the Company's oil and gas properties. The foregoing commentary

is based on the beliefs, expectations and opinions of management on

the date the statements are made. The Company disclaims any

intention or obligation to update or revise forward-looking

information, whether as a result of new information, future events

or otherwise.

Westbridge Energy CorporationTosan OmatsolaPresident and Chief

Executive Officer+1 604 638

9378tomatsola@westbridgeweb.comWestbridge Energy CorporationPeter

HenryDirector+1 818 970

6940phenry@westbridgeweb.comwww.westbridgeweb.com

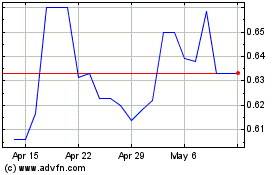

Westbridge Renewable Ene... (QX) (USOTC:WEGYF)

Historical Stock Chart

From Apr 2024 to May 2024

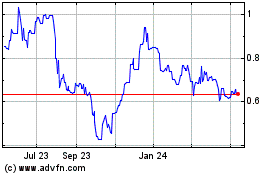

Westbridge Renewable Ene... (QX) (USOTC:WEGYF)

Historical Stock Chart

From May 2023 to May 2024