false

FY

0001308027

GA

http://fasb.org/us-gaap/2024#OperatingLeaseLiability

0001308027

2023-01-01

2023-12-31

0001308027

2023-06-30

0001308027

2024-09-06

0001308027

2023-12-31

0001308027

2022-12-31

0001308027

us-gaap:RelatedPartyMember

2023-12-31

0001308027

us-gaap:RelatedPartyMember

2022-12-31

0001308027

us-gaap:SeriesAPreferredStockMember

2023-12-31

0001308027

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001308027

us-gaap:SeriesBPreferredStockMember

2023-12-31

0001308027

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001308027

us-gaap:SeriesCPreferredStockMember

2023-12-31

0001308027

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001308027

2022-01-01

2022-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001308027

us-gaap:CommonStockMember

2021-12-31

0001308027

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001308027

us-gaap:RetainedEarningsMember

2021-12-31

0001308027

us-gaap:TreasuryStockCommonMember

2021-12-31

0001308027

VYST:TotalVystarStockholdersDeficitMember

2021-12-31

0001308027

us-gaap:NoncontrollingInterestMember

2021-12-31

0001308027

2021-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001308027

us-gaap:CommonStockMember

2022-12-31

0001308027

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001308027

us-gaap:RetainedEarningsMember

2022-12-31

0001308027

us-gaap:TreasuryStockCommonMember

2022-12-31

0001308027

VYST:TotalVystarStockholdersDeficitMember

2022-12-31

0001308027

us-gaap:NoncontrollingInterestMember

2022-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-12-31

0001308027

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001308027

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001308027

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001308027

us-gaap:TreasuryStockCommonMember

2022-01-01

2022-12-31

0001308027

VYST:TotalVystarStockholdersDeficitMember

2022-01-01

2022-12-31

0001308027

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-01-01

2023-12-31

0001308027

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001308027

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001308027

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001308027

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-12-31

0001308027

VYST:TotalVystarStockholdersDeficitMember

2023-01-01

2023-12-31

0001308027

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-12-31

0001308027

us-gaap:PreferredStockMember

us-gaap:SeriesCPreferredStockMember

2023-12-31

0001308027

us-gaap:CommonStockMember

2023-12-31

0001308027

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001308027

us-gaap:RetainedEarningsMember

2023-12-31

0001308027

us-gaap:TreasuryStockCommonMember

2023-12-31

0001308027

VYST:TotalVystarStockholdersDeficitMember

2023-12-31

0001308027

us-gaap:NoncontrollingInterestMember

2023-12-31

0001308027

VYST:RotmansMember

2022-12-31

0001308027

VYST:StevenRotmanMember

2021-12-31

0001308027

VYST:StevenRotmanMember

2023-12-31

0001308027

VYST:StevenRotmanMember

2022-12-31

0001308027

srt:MinimumMember

2023-12-31

0001308027

srt:MaximumMember

2023-12-31

0001308027

VYST:RotmansMember

2023-01-01

2023-12-31

0001308027

VYST:RotmansMember

2022-12-31

0001308027

srt:MinimumMember

VYST:PatentMember

2023-12-31

0001308027

srt:MaximumMember

VYST:PatentMember

2023-12-31

0001308027

VYST:RotmansMember

2022-01-01

2022-12-31

0001308027

VYST:OptionsToPurchaseCommonSharesMember

2023-01-01

2023-12-31

0001308027

VYST:OptionsToPurchaseCommonSharesMember

2022-01-01

2022-12-31

0001308027

VYST:WarrantsToPurchaseCommonSharesMember

2023-01-01

2023-12-31

0001308027

VYST:WarrantsToPurchaseCommonSharesMember

2022-01-01

2022-12-31

0001308027

us-gaap:ConvertiblePreferredStockMember

2023-01-01

2023-12-31

0001308027

us-gaap:ConvertiblePreferredStockMember

2022-01-01

2022-12-31

0001308027

VYST:ShareholderAndRotmanFamilyMember

2023-12-31

0001308027

VYST:ShareholderAndRotmanFamilyMember

2022-12-31

0001308027

VYST:FurnitureFixturesAndEquipmentMember

2023-12-31

0001308027

VYST:RotmansMember

VYST:FurnitureFixturesAndEquipmentMember

2023-12-31

0001308027

VYST:FurnitureFixturesAndEquipmentMember

2022-12-31

0001308027

VYST:RotmansMember

VYST:FurnitureFixturesAndEquipmentMember

2022-12-31

0001308027

VYST:ToolingAndTestingEquipmentMember

2023-12-31

0001308027

VYST:RotmansMember

VYST:ToolingAndTestingEquipmentMember

2023-12-31

0001308027

VYST:ToolingAndTestingEquipmentMember

2022-12-31

0001308027

VYST:RotmansMember

VYST:ToolingAndTestingEquipmentMember

2022-12-31

0001308027

VYST:ParkingLotsMember

2023-12-31

0001308027

VYST:RotmansMember

VYST:ParkingLotsMember

2023-12-31

0001308027

VYST:ParkingLotsMember

2022-12-31

0001308027

VYST:RotmansMember

VYST:ParkingLotsMember

2022-12-31

0001308027

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001308027

VYST:RotmansMember

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001308027

us-gaap:LeaseholdImprovementsMember

2022-12-31

0001308027

VYST:RotmansMember

us-gaap:LeaseholdImprovementsMember

2022-12-31

0001308027

us-gaap:VehiclesMember

2023-12-31

0001308027

VYST:RotmansMember

us-gaap:VehiclesMember

2023-12-31

0001308027

us-gaap:VehiclesMember

2022-12-31

0001308027

VYST:RotmansMember

us-gaap:VehiclesMember

2022-12-31

0001308027

VYST:RotmansMember

2023-12-31

0001308027

VYST:RotmansMember

2022-12-31

0001308027

us-gaap:PatentsMember

2023-12-31

0001308027

us-gaap:PatentsMember

2022-12-31

0001308027

srt:MinimumMember

us-gaap:PatentsMember

2023-12-31

0001308027

srt:MaximumMember

us-gaap:PatentsMember

2023-12-31

0001308027

VYST:ProprietaryTechnologyMember

2023-12-31

0001308027

VYST:ProprietaryTechnologyMember

2022-12-31

0001308027

VYST:TradeNameandBrandMember

2023-12-31

0001308027

VYST:TradeNameandBrandMember

2022-12-31

0001308027

srt:MinimumMember

VYST:TradeNameandBrandMember

2023-12-31

0001308027

srt:MaximumMember

VYST:TradeNameandBrandMember

2023-12-31

0001308027

srt:MinimumMember

2023-01-01

2023-12-31

0001308027

srt:MaximumMember

2023-01-01

2023-12-31

0001308027

VYST:RotmanFamilyConvertibleNotesMember

2023-01-01

2023-12-31

0001308027

VYST:RotmanFamilyNonConvertibleNotesMember

2023-01-01

2023-12-31

0001308027

VYST:ContingentlyConvertibleNotesPayableMember

2018-12-31

0001308027

VYST:ContingentlyConvertibleNotesPayableMember

2018-01-01

2018-12-31

0001308027

VYST:ContingentlyConvertibleNotesPayableMember

VYST:JanuaryTwentyTwentyMember

2018-12-31

0001308027

VYST:ContingentlyConvertibleNotesPayableMember

2022-04-01

2022-04-30

0001308027

VYST:ContingentlyConvertibleNotesPayableMember

us-gaap:SeriesBPreferredStockMember

2022-07-31

2022-07-31

0001308027

VYST:ConvertiblePromissoryNotesMember

2019-12-31

0001308027

srt:MinimumMember

VYST:ConvertiblePromissoryNotesMember

2019-12-31

0001308027

srt:MaximumMember

VYST:ConvertiblePromissoryNotesMember

2019-12-31

0001308027

VYST:ConvertiblePromissoryNotesMember

2022-04-01

2022-04-30

0001308027

VYST:ConvertiblePromissoryNotesMember

us-gaap:SeriesBPreferredStockMember

2022-07-31

2022-07-31

0001308027

VYST:ConvertiblePromissoryNotesMember

2021-12-31

0001308027

VYST:ConvertiblePromissoryNotesMember

2023-01-01

2023-12-31

0001308027

VYST:RotmanFamilyConvertibleNotesMember

2019-09-30

0001308027

VYST:RotmanFamilyConvertibleNotesMember

VYST:StevenRotmanMember

2019-09-30

0001308027

VYST:RotmanFamilyConvertibleNotesMember

VYST:GregRotmanMember

2019-09-30

0001308027

VYST:RotmanFamilyConvertibleNotesMember

us-gaap:SeriesCPreferredStockMember

VYST:StevenRotmanMember

2022-07-01

2022-07-31

0001308027

VYST:RotmanFamilyConvertibleNotesMember

us-gaap:SeriesCPreferredStockMember

VYST:GregRotmanMember

2022-07-01

2022-07-31

0001308027

VYST:RotmanFamilyConvertibleNotesOneMember

2019-07-18

0001308027

VYST:RotmanFamilyConvertibleNotesOneMember

VYST:StevenRotmanMember

2019-07-18

0001308027

VYST:RotmanFamilyConvertibleNotesOneMember

VYST:BernardRotmanMember

2019-07-18

0001308027

VYST:RotmanFamilyConvertibleNotesOneMember

VYST:RotmansMember

2019-07-18

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyConvertibleNotesOneMember

VYST:StevenRotmanMember

2022-07-01

2022-07-31

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyConvertibleNotesOneMember

VYST:StevenRotmanMember

2022-09-02

2022-09-30

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyConvertibleNotesOneMember

VYST:BernardRotmanMember

2022-07-01

2022-07-31

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyConvertibleNotesOneMember

VYST:BernardRotmanMember

2022-09-02

2022-09-30

0001308027

VYST:RotmanFamilyConvertibleNotesTwoMember

VYST:StevenRotmanMember

2019-12-19

0001308027

VYST:RotmanFamilyConvertibleNotesTwoMember

2019-12-19

0001308027

VYST:RotmanFamilyConvertibleNotesTwoMember

2022-07-01

2022-07-31

0001308027

VYST:RotmanFamilyConvertibleNotesThreeMember

VYST:StevenRotmanMember

2020-02-20

0001308027

VYST:RotmanFamilyConvertibleNotesThreeMember

2020-02-20

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyConvertibleNotesThreeMember

2022-07-01

2022-07-31

0001308027

VYST:RotmanFamilyConvertibleNotesFourMember

VYST:GregoryRotmanMember

2021-06-03

0001308027

VYST:RotmanFamilyConvertibleNotesFourMember

VYST:GregoryRotmanMember

2021-06-02

2021-06-03

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyConvertibleNotesFourMember

2022-07-01

2022-07-31

0001308027

VYST:RotmanFamilyConvertibleNotesFiveMember

VYST:JamieRotmanMember

2021-08-17

0001308027

VYST:RotmanFamilyConvertibleNotesFiveMember

2021-08-17

0001308027

VYST:RotmanFamilyConvertibleNotesFiveMember

2021-08-16

2021-08-17

0001308027

VYST:RotmanFamilyConvertibleNotesFiveMember

VYST:JamieRotmanMember

2023-12-31

0001308027

VYST:RotmanFamilyConvertibleNotesFiveMember

VYST:JamieRotmanMember

2022-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesOneMember

VYST:RotmansMember

2023-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesOneMember

VYST:StevenRotmanMember

2023-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesOneMember

VYST:BernardRotmanMember

2023-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesOneMember

VYST:StevenRotmanMember

2023-01-01

2023-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesOneMember

VYST:BernardRotmanMember

2023-01-01

2023-12-31

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyNonconvertibleNotesOneMember

VYST:StevenRotmanMember

2022-07-01

2022-07-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesOneMember

VYST:BernardRotmanMember

2023-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesOneMember

VYST:BernardRotmanMember

2022-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesTwoMember

VYST:StevenRotmanMember

2020-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesTwoMember

VYST:StevenRotmanMember

2020-01-01

2020-12-31

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyNonconvertibleNotesTwoMember

2022-07-01

2022-07-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesThreeMember

VYST:StevenRotmanMember

2021-12-31

0001308027

VYST:RotmanFamilyNonconvertibleNotesTwoMember

VYST:StevenRotmanMember

2021-01-01

2021-12-31

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:RotmanFamilyNonconvertibleNotesThreeMember

2022-07-01

2022-07-31

0001308027

VYST:BlueOarConsultingIncMember

2022-04-01

2022-04-30

0001308027

VYST:BlueOarConsultingIncMember

us-gaap:RelatedPartyMember

2022-04-30

0001308027

VYST:BlueOarConsultingIncMember

2022-04-30

0001308027

VYST:BlueOarConsultingMember

2023-12-31

0001308027

VYST:BlueOarConsultingMember

2022-12-31

0001308027

VYST:RotmanFamilyConvertibleNoteMember

2023-12-31

0001308027

VYST:RotmanFamilyConvertibleNoteMember

2022-12-31

0001308027

VYST:RotmanFamilyNonConvertibleNoteMember

2023-12-31

0001308027

VYST:RotmanFamilyNonConvertibleNoteMember

2022-12-31

0001308027

VYST:JamieRotmanMember

VYST:RotmanFamilyConvertibleNotesFiveMember

2023-01-01

2023-12-31

0001308027

VYST:BernardRotmanMember

VYST:RotmanFamilyNonconvertibleNotesOneMember

2023-01-01

2023-12-31

0001308027

VYST:TenPercentageSeriesACumulativeConvertiblePreferredStockMember

us-gaap:PrivatePlacementMember

2013-05-01

2013-05-02

0001308027

VYST:TenPercentageSeriesACumulativeConvertiblePreferredStockMember

VYST:SeriesACumulativeConvertiblePreferredStockMember

2013-05-01

2013-05-02

0001308027

VYST:TenPercentageSeriesACumulativeConvertiblePreferredStockMember

2013-05-01

2013-05-02

0001308027

VYST:TenPercentageSeriesACumulativeConvertiblePreferredStockMember

2013-05-02

0001308027

VYST:TenPercentageSeriesACumulativeConvertiblePreferredStockMember

VYST:HolderMember

2023-12-31

0001308027

VYST:TenPercentageSeriesACumulativeConvertiblePreferredStockMember

VYST:HolderMember

2023-01-01

2023-12-31

0001308027

VYST:TenPercentageSeriesACumulativeConvertiblePreferredStockMember

VYST:HolderMember

2022-12-31

0001308027

VYST:TenPercentageSeriesACumulativeConvertiblePreferredStockMember

VYST:HolderMember

2022-01-01

2022-12-31

0001308027

VYST:TenPercentageSeriesBCumulativeConvertiblePreferredStockMember

VYST:SeriesBCumulativeConvertiblePreferredStockMember

2022-04-10

2022-04-11

0001308027

VYST:TenPercentageSeriesBCumulativeConvertiblePreferredStockMember

2022-04-11

0001308027

VYST:TenPercentageSeriesBCumulativeConvertiblePreferredStockMember

2022-04-10

2022-04-11

0001308027

VYST:HolderMember

VYST:TenPercentageSeriesBCumulativeConvertiblePreferredStockMember

2023-12-31

0001308027

VYST:HolderMember

VYST:TenPercentageSeriesBCumulativeConvertiblePreferredStockMember

2023-01-01

2023-12-31

0001308027

VYST:HolderMember

VYST:TenPercentageSeriesBCumulativeConvertiblePreferredStockMember

2022-12-31

0001308027

VYST:HolderMember

VYST:TenPercentageSeriesBCumulativeConvertiblePreferredStockMember

2022-01-01

2022-12-31

0001308027

VYST:TenPercentageSeriesCCumulativeConvertiblePreferredStockMember

VYST:SeriesCCumulativeConvertiblePreferredStockMember

2022-07-07

2022-07-08

0001308027

VYST:TenPercentageSeriesCCumulativeConvertiblePreferredStockMember

2022-07-08

0001308027

VYST:TenPercentageSeriesCCumulativeConvertiblePreferredStockMember

2022-07-07

2022-07-08

0001308027

VYST:HolderMember

VYST:TenPercentageSeriesCCumulativeConvertiblePreferredStockMember

2023-12-31

0001308027

VYST:HolderMember

VYST:TenPercentageSeriesCCumulativeConvertiblePreferredStockMember

2023-01-01

2023-12-31

0001308027

VYST:HolderMember

VYST:TenPercentageSeriesCCumulativeConvertiblePreferredStockMember

2022-12-31

0001308027

VYST:HolderMember

VYST:TenPercentageSeriesCCumulativeConvertiblePreferredStockMember

2022-01-01

2022-12-31

0001308027

VYST:EquityPurchaseAgreementsMember

2022-01-01

2022-12-31

0001308027

VYST:StockSubscriptionAgreementMember

2023-12-31

0001308027

VYST:StockSubscriptionAgreementMember

2022-12-31

0001308027

VYST:StockSubscriptionAgreementMember

2020-01-01

2020-12-31

0001308027

VYST:AirPurificationUnitsMember

2023-01-01

2023-12-31

0001308027

VYST:AirPurificationUnitsMember

2022-01-01

2022-12-31

0001308027

VYST:MattressesAndToppersMember

2023-01-01

2023-12-31

0001308027

VYST:MattressesAndToppersMember

2022-01-01

2022-12-31

0001308027

VYST:RoyaltiesAndOtherMember

2023-01-01

2023-12-31

0001308027

VYST:RoyaltiesAndOtherMember

2022-01-01

2022-12-31

0001308027

VYST:EmployeeAndBoardMembersMember

2022-01-01

2022-12-31

0001308027

VYST:StockOptionPlanMember

2004-12-31

0001308027

VYST:StockOptionPlanMember

2009-04-01

2009-04-30

0001308027

VYST:StockOptionPlanMember

2023-12-31

0001308027

VYST:StockOptionPlanMember

VYST:TwoThousandFourteenMember

2023-01-01

2023-12-31

0001308027

VYST:StockOptionPlanMember

VYST:TwoThousandNineteenMember

2023-01-01

2023-12-31

0001308027

VYST:StockOptionPlanMember

2023-01-01

2023-12-31

0001308027

VYST:StockOptionsMember

2021-12-31

0001308027

VYST:StockOptionsMember

2021-01-01

2021-12-31

0001308027

VYST:StockOptionsMember

2022-01-01

2022-12-31

0001308027

VYST:StockOptionsMember

2022-12-31

0001308027

VYST:StockOptionsMember

2023-01-01

2023-12-31

0001308027

VYST:StockOptionsMember

2023-12-31

0001308027

VYST:StockWarrantsMember

2021-12-31

0001308027

VYST:StockWarrantsMember

2021-01-01

2021-12-31

0001308027

VYST:StockWarrantsMember

2022-01-01

2022-12-31

0001308027

VYST:StockWarrantsMember

2022-12-31

0001308027

VYST:StockWarrantsMember

2023-01-01

2023-12-31

0001308027

VYST:StockWarrantsMember

2023-12-31

0001308027

VYST:PerStevenRotmanEmploymentAgreementMember

VYST:PerYearMember

2019-07-21

2019-07-22

0001308027

VYST:PerStevenRotmanEmploymentAgreementMember

2019-07-21

2019-07-22

0001308027

VYST:PerStevenRotmanEmploymentAgreementMember

2023-01-01

2023-12-31

0001308027

VYST:PerStevenRotmanEmploymentAgreementMember

2022-01-01

2022-12-31

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:PerStevenRotmanEmploymentAgreementMember

2023-01-01

2023-12-31

0001308027

VYST:MrRotmanMember

2023-12-31

0001308027

VYST:BlueOarConsultingIncMember

VYST:PerMonthMember

2023-01-01

2023-12-31

0001308027

VYST:BlueOarConsultingIncMember

2023-01-01

2023-12-31

0001308027

VYST:BlueOarConsultingIncMember

2022-01-01

2022-12-31

0001308027

VYST:BlueOarConsultingIncMember

us-gaap:SeriesCPreferredStockMember

2023-01-01

2023-12-31

0001308027

VYST:GregoryRotmanMember

2023-12-31

0001308027

VYST:GregoryRotmanMember

2022-12-31

0001308027

VYST:ConvertiblePromissoryNotesMember

VYST:BernardRotmanMember

2019-07-18

0001308027

VYST:ConvertiblePromissoryNotesMember

VYST:RotmansMember

2019-07-18

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:BernardRotmanMember

2022-01-01

2022-12-31

0001308027

VYST:BernardRotmanMember

2022-01-01

2022-12-31

0001308027

VYST:BryanStoneMember

2019-05-01

2019-05-31

0001308027

VYST:BryanStoneMember

2022-07-01

2022-07-31

0001308027

us-gaap:SeriesBPreferredStockMember

VYST:BryanStoneMember

2022-07-01

2022-07-31

0001308027

us-gaap:SeriesCPreferredStockMember

VYST:BryanStoneMember

2022-01-01

2022-12-31

0001308027

VYST:BryanStoneMember

2019-05-01

0001308027

VYST:BryanStoneMember

2023-12-31

0001308027

VYST:DesigncentersMember

2023-01-01

2023-12-31

0001308027

2023-01-06

0001308027

2023-11-27

2023-11-27

0001308027

us-gaap:SalesMember

us-gaap:SupplierConcentrationRiskMember

VYST:OneMajorVendorMember

2023-01-01

2023-12-31

0001308027

us-gaap:SalesMember

us-gaap:SupplierConcentrationRiskMember

VYST:OneMajorVendorMember

2023-12-31

0001308027

VYST:PurchaseMember

us-gaap:SupplierConcentrationRiskMember

VYST:OneMajorVendorMember

2023-12-31

0001308027

VYST:PurchaseMember

us-gaap:SupplierConcentrationRiskMember

VYST:OneMajorVendorMember

2022-01-01

2022-12-31

0001308027

VYST:PurchaseMember

us-gaap:SupplierConcentrationRiskMember

VYST:OneMajorVendorMember

2022-12-31

0001308027

us-gaap:TaxYear2020Member

2023-01-01

2023-12-31

0001308027

us-gaap:DomesticCountryMember

2023-12-31

0001308027

VYST:ExpiresBeginningInTwoThousandTwentyFourMember

2023-12-31

0001308027

VYST:CarriedForwardIndefinitelyMember

2023-12-31

0001308027

VYST:GeorgiaCountryMember

2023-12-31

0001308027

VYST:MassachusettsCountryMember

2023-12-31

0001308027

VYST:ExpiresBeginningInTwoThousandTwentyNineMember

us-gaap:DomesticCountryMember

2023-12-31

0001308027

VYST:CarriedForwardIndefinitelyMember

us-gaap:DomesticCountryMember

2023-12-31

0001308027

us-gaap:StateAndLocalJurisdictionMember

VYST:ExpiredBeginningInTwoThousandAndThirtyEightMember

2023-12-31

0001308027

VYST:ConvertiblePreferredStockSeriesBMember

us-gaap:SubsequentEventMember

2024-01-04

2024-01-04

0001308027

us-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2024-01-04

2024-01-04

0001308027

us-gaap:SubsequentEventMember

2024-01-04

0001308027

us-gaap:SubsequentEventMember

2024-01-01

2024-01-31

0001308027

VYST:EmploymentAgreementMember

us-gaap:SubsequentEventMember

2024-07-22

0001308027

us-gaap:ConvertibleNotesPayableMember

us-gaap:SubsequentEventMember

2024-06-01

0001308027

us-gaap:ConvertibleNotesPayableMember

us-gaap:SubsequentEventMember

2024-06-01

2024-06-01

0001308027

us-gaap:SubsequentEventMember

2024-06-01

2024-06-01

0001308027

us-gaap:SubsequentEventMember

2024-06-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

(Mark

One)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the Fiscal Year Ended December 31, 2023

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

File No. 000-53754

VYSTAR

CORPORATION

(Exact

name of registrant as specified in its charter)

| georgia |

|

20-2027731 |

| (State

or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

| |

|

|

| 365

Shrewsbury St |

|

|

| Worcester,

MA |

|

01604 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrants

telephone number, including area code: (508) 791-9114

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| NONE |

|

NONE |

|

NONE |

Securities

registered pursuant to Section 12(g) of the Act:

Common

Stock, par value $0.0001 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No

☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained,

to the best of registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form

10-K or any amendment to this Form 10-K. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“non-accelerated filer,” “smaller reporting company, “and “emerging growth company” in Rule 12b-2

of the Exchange Act.

| Large

Accelerated Filer ☐ |

|

Accelerated

Filer ☐ |

|

Non-Accelerated

Filer ☒ |

|

Smaller

Reporting Company ☒ |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Emerging

growth Company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of

those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

☒

As

of June 30, 2023, the aggregate market value of shares held by non-affiliates of the registrant (based upon the closing sale price of

such shares on the OTC Market on June 30, 2023) was $578,399. See Item 12.

As

of September 6, 2024, there were 13,290,972 shares of the registrant’s common stock outstanding.

Vystar

Corporation

Annual

Report on Form 10-K

For

the Year Ended December 31, 2023

Table

of Contents

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain

oral and written statements made by Vystar Corporation about future events and expectations, including statements in this Annual Report

on Form 10-K (the “Report”) contain forward-looking statements, within the meaning of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”) and the Securities Act of 1933, as amended (the “Securities Act”), that involve

risks and uncertainties. For those statements, we claim the protection of the safe-harbor for forward-looking statements contained in

the Private Securities Litigation Act of 1995. In some cases, forward-looking statements are identified by words such as “believe,”

“anticipate,” “expect,” “intend,” “plan,” “will,” “may” and similar

expressions. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Report

or the statement. All of these forward-looking statements are based on information available to us at this time, and we assume no obligation

to update any of these statements. Actual results could differ from those projected in these forward-looking statements as a result of

many factors, including those identified in “Risk Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and elsewhere. We urge you to review and consider the various disclosures made by us in this

Report, and those detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), that

attempt to advise you of the risks and factors that may affect our future results. We qualify any forward-looking statements entirely

by these cautionary factors.

The

above-mentioned risk factors are not all-inclusive. Given these uncertainties and that such statements, speak only as of the date made;

you should not place undue reliance on forward-looking statements. We undertake no obligation to update publicly or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

PART

I

Overview

Vystar

Corporation (“Vystar”, the “Company”, “we,” “us,” or “our”) is based in Worcester,

Massachusetts. Vystar is the owner and manufacturer of multiple brands of eco-friendly products for the home, office and medical sectors.

Vystar is the creator and exclusive owner of the innovative technology to produce Vytex® Natural Rubber Latex (“NRL”).

Our global multi-patented technology reduces antigenic and total protein in natural rubber latex products to virtually undetectable levels.

Vytex NRL, our “ultra-low protein” natural rubber latex has been introduced throughout the worldwide marketplace that uses

NRL or latex substitutes as a raw material for end products. Natural rubber latex or latex substitutes are used in an extensive range

of products including balloons, foams, textiles, adhesives, carpet, paints, coatings, protective equipment, sporting equipment, and especially

health care products like surgical and exam gloves and condoms.

Vystar

has expanded Vytex into the consumer arena with an introduction into the bedding category, aligning with key foam manufacturers to create

mattresses, mattress toppers and pillows. Through this effort, Vystar can bring the benefits of great sleep and a more natural product

to the public.

Vystar

is also bringing peace of mind to consumers in the clean-air space. RxAir is the manufacturer of the finest air purification system in

the world and an innovative developer, manufacturer and distributor of bio technology products targeting the rapidly growing Indoor Air

Quality (“IAQ”) industry sector. RxAir’s products include the RxAir purification system for the home as well as one

of the world’s finest lines of hospital-grade HEPA filtration products. All of our products are FDA certified as Class II medical

devices and kill germs viruses and bacteria.

Vystar

has acquired the assets of Fluid Energy Conversion (FEC). FEC has taken a position as a global green energy company with a multitude

of new technologies including an array of patented, and soon-to-be patented, technology destined to change energy production and energy

usage in many arenas. Our independent research and development has focused on product solutions that harness stable vortex effects, cavitation

and other unique fluid flow phenomena to move energy application into new chapters. Our main thrust is currently in water but other applications

such as those in combustion are already being positioned as key concepts in those fields. For over 50 years, FEC’s chief scientist

has developed and patented many successful inventions, both nationally and internationally, involving fluid mechanics, fluidics, thermodynamics

and related physics. His experience has created a revolutionary extension of fluidic science that has led to patented products that are

cost effective to manufacture, simple to understand, and they deliver an outstanding performance. Most of our technology does not require

complicated processes or sophisticated electronics, making us truly unique.

Vystar

has a majority ownership in Murida Furniture Co., Inc. dba Rotmans Furniture, formerly one of the largest independent furniture stores

in the U.S.

Company

Background

In

May of 2018, Vystar acquired substantially all of the assets of UV Flu Technologies, Inc. (formerly traded on the OTC under the ticker

UVFT), whose patented ViraTech™ UV light air purification technology destroys greater than 99% of airborne bacteria, viruses and

other microorganisms and virtually eliminates concentrations of odors and volatile organic compounds (“VOCs”) and created

the RxAir division.

The

RxAir product line includes:

| |

● |

RXair™

Residential Filterless Air Purifier |

| |

|

|

| |

● |

RX400™

U.S. Food and Drug Administration (“FDA”) cleared Class II Filterless Air Purifier |

| |

|

|

| |

● |

RX800™

FDA cleared Class II Filterless Air Purifier |

| |

|

|

| |

● |

RX3000™

Commercial FDA cleared Class II Air Purifier |

RxAir

promotes a healthy lifestyle improving the quality of life of each and every customer. Independently tested by the U.S. Environmental

Protection Agency (“EPA”) and FDA-certified laboratories, the RxAir has been proven to destroy greater than 99% of bacteria

and viruses and reduce concentrations of odors and VOCs. The RxAir uses high-intensity germicidal UV lamps that destroy bacteria and

viruses instead of just trapping them, setting it apart from ordinary air filtration units. RxAir units are sold online at www.RxAir.com

and are available through multiple third-party distributors. RxAir® and ViraTech ® are registered trademarks of Vystar

Corporation.

Vystar

is the exclusive creator of Vytex Natural Rubber Latex (“NRL”), a multi-patented, all-natural, raw material that contains

significantly reduced levels of the proteins found in natural rubber latex and can be used in over 40,000 products. Vytex NRL is a 100%

renewable resource, environmentally safe, “green” and fully biodegradable. Vystar is working with manufacturers across a

broad range of consumer and medical products bringing Vytex NRL to market in adhesives, gloves, balloons, condoms, other medical devices

and natural rubber latex foam mattresses, toppers, and pillows.

In

April of 2018, Vystar acquired the assets of NHS Holdings, LLC (“NHS”) to move into direct product offerings made from Vytex®

latex. NHS was the exclusive U.S. distributor of Vystar’s Vytex® natural rubber latex foam to manufacturers for use in over

200 home furnishings products, including mattresses, toppers, pillows and upholstery, sold through multiple channels.

In

May of 2019, Vystar acquired the assets of Fluid Energy Conversion Inc. (“FEC”), primarily consisting of its patent on the

Hughes Reactor, which has the ability to control, enhance, and focus energy in flowing liquids and gases. Vystar intends to use this

technology to enhance the effectiveness of Vystar’s RxAir purification system to destroy airborne pathogens while decreasing the

cost and size of Vystar’s RxAir units.

In

July of 2019, Vystar acquired 58% of the outstanding shares of common stock of Murida Furniture Co., Inc. dba Rotmans Furniture (“Rotmans”),

formerly one of the largest independent furniture retailers in the U.S. Rotmans sold a broad line of residential furniture and decorative

accessories and served customers throughout the New England region. The acquisition enabled Vystar to capitalize on the infrastructure

already in place at Rotmans for accounting, retail sales facilities and staff, customer service, warehousing, and delivery. Rotmans closed

its showroom at the end of 2022.

In

December of 2020, Vystar selected Corrie MacColl Limited, a subsidiary of global natural rubber supply chain manager Halcyon Agri, as

its exclusive global partner for all aspects of product market development and distribution of patented Vytex deproteinized latex.

Competition

RxAir

The

residential air purification market is a highly fragmented competitive business. Vystar competes with a large number of companies on

many factors including price, quality, innovation, reputation, distribution and promotion.

Natural

Rubber Latex

Synthetic

raw materials such as ethylene, propylene, styrene and butadiene compete with NRL. Currently, it is estimated that NRL processors have

lost one-half of the overall latex market to synthetic latex. Despite the switch to non-latex alternatives, it is estimated that almost

70% of exam gloves and nearly 80% of surgical gloves used in U.S. hospitals are still made with NRL.

Intellectual

Property

Vystar

currently holds a portfolio of patents and trademarks in the U.S. and other various foreign countries. No assurance can be given that

such patent and trademark protection will provide substantial protection from competition. We are committed to aggressively challenging

any infringements of our patents and/or trademarks.

Government

Regulation

We

are not subject to direct governmental regulation other than the laws and regulations generally applicable to businesses in the domestic

and foreign jurisdictions in which we operate.

Our

RxAir400 product was cleared by the FDA as a Class II medical device in November 2008. FDA clearance to sell our product as a Class II

medical device provides invaluable credibility in the marketplace. By granting a listing, the FDA indicates it has reviewed all aspects

of a product, including efficacy of the technology, independent test results and product safety to ensure that the product complies with

our claims. Few air purification products are listed by the FDA, and it is extremely important that we expend the resources necessary

to maintain this listing as a Class II medical device with the FDA.

Seasonality

Our

business is affected by traditional retail seasonality, advertising and promotion programs and general economic trends.

Employees

As

of December 31, 2023, Vystar had one employee.

Corporate

Information

Vystar

Corporation is a Georgia corporation that was incorporated in 2003. Our predecessor company, Vystar LLC, was formed by our founder, Travis

Honeycutt, in February 2000 as a Georgia limited liability company. Our corporate office is located at 365 Shrewsbury Street, Worcester,

Massachusetts 01604. Our website address is www.vystarcorp.com.

The

information contained on, or that can be accessed through, our website is not a part of this Report. We have links on our website to

reports, information statements, and other information that we file electronically with the Securities and Exchange Commission, or SEC,

at the Internet website maintained by the SEC, www.sec.gov. In addition to visiting our website and the SEC’s website, you may

read and copy public reports we file with or furnish to the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington,

D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Our

business is subject to a number of risks and uncertainties — many of which are beyond our control — that may cause our actual

operating results or financial performance to be materially different from our expectations. If one or more of the events discussed below

were to occur, actual outcomes could differ materially from those expressed in or implied by any forward-looking statements we make in

this report or our other filings with the SEC, and our business, financial condition, results of operations or liquidity could be materially

adversely affected; furthermore, the trading price of our common stock could decline and our shareholders could lose all or part of their

investment.

Vystar

presently does not generate the cash needed to finance its current and anticipated operations.

The

Company is still in the early stage of establishing our business including attracting new customers and increasing sales. Our financial

success will be dependent upon the soundness of our business concept, our management’s ability to successfully and profitably execute

our plan, and our ability to raise additional capital.

Our

limited operating history makes it difficult to evaluate our business. We expect to make significant future operating expenditures to

develop and expand our business into areas such as OEM product lines and offerings in the mattress and furniture arenas. We may incur

significant losses in the future for a number of reasons, including due to the other risks described in this Report, and we may encounter

unforeseen expenses, difficulties, complications and delays and other unknown events. Accordingly, we may not be able to achieve or maintain

profitability, and we may incur significant losses for the foreseeable future. See additional discussion under Liquidity and Capital

Resources.

At

December 31, 2023 our cash position was $35,442 and we had an accumulated deficit of $58,243,258. We plan to finance our operations for

the next twelve (12) months through the use of cash on hand, raising capital through private placement and increased sales from RxAir

products by exploring sales partnerships with third-party wholesalers and retailers. You should consider, among other factors, our prospects

for success in light of the risks and uncertainties encountered by companies that, like us, have not generated net earnings on an annual

basis. Various factors, such as economic conditions, regulatory and legislative considerations, and competition, may also impede our

ability to expand our market presence. We may not successfully address these risks and uncertainties or successfully implement our operating

strategies. If we fail to do so, it could materially harm our business and impair the value of our common stock. Even if we accomplish

these objectives, we may not generate positive cash flows or profits we anticipate in the future.

The

following risk factors apply to our RxAir business:

We

face significant competition from multinational and regional manufacturers.

The

growing air purification market is highly competitive with companies offering wide range of air purifiers sold through e-commerce websites,

company-owned websites, retailer and their websites and distributors. Market participants compete on product performance, quality, price

and reputation.

We

are dependent upon the ability of our third-party producers to meet our requirements.

We

source our products from non-exclusive, third-party producers, many of which are located in foreign countries. We depend upon the ability

of third-party producers to secure a sufficient supply of raw materials, a skilled workforce, adequately finance the production of goods

ordered and maintain sufficient manufacturing and shipping capacity. We cannot be certain that we will not experience operational difficulties

with our manufacturers, such as insufficient quality control, failures to meet production deadlines or increases in manufacturing costs.

The

following risk factors apply to our Vytex business:

Our

Vytex operating results could fluctuate and differ considerably from our financial forecasts.

Our

business model is based on experience derived from the marketplace. There are no assurances that this experience will prove to be valid

for our future operations or plans.

Our

operating results may fluctuate significantly as a result of a variety of factors, including:

| |

● |

Acceptance

by manufacturers of the Vytex Natural Rubber Latex technology; |

| |

|

|

| |

● |

Our

ability to achieve and sustain profitability; |

| |

|

|

| |

● |

Consumer

confidence in products manufactured using our Vytex Natural Rubber Latex technology; |

| |

|

|

| |

● |

Our

ability to raise additional capital. |

Our

Vytex NRL business is totally dependent on market demand for, and acceptance of, the Vytex Natural Rubber Latex process.

We

expect to derive most of our Vytex NRL business revenue from the sales of our Vytex Natural Rubber Latex raw material to various manufacturers

of rubber and rubber end products using NRL through our distribution agreement with CMC Global. We pay natural rubber latex processors

a fee for the service of manufacturing and creating Vytex NRL for us under our manufacturing and distribution agreements. Conversely,

Vystar collects a fee under the CMC Global licensing model. Our Vytex NRL product operates within broad, diverse and rapidly changing

markets. As a result, widespread acceptance and use of product is critical to our future growth and success. If the market for our product

fails to grow or grows more slowly than we currently anticipate, demand for our product could be negatively affected.

Our

ability to generate significant revenue in the Vytex business is substantially dependent upon the willingness of consumers to make discretionary

purchases and the willingness of manufacturers to utilize capital for research and development and the retooling of their manufacturing

process, both of which are impacted by the state of the economy.

The

current state of the world economy has and likely will in the future impact upon our ability to increase revenue. Certain products that

we anticipate will be manufactured with our Vystar NRL process, such as mattresses and sponge products, are considered discretionary

consumer purchases which decline during economic downturns. Additionally, certain manufacturers who might otherwise utilize the Vytex

NRL process in the manufacturing of products with NRL have determined not to expend capital to complete the research of the Vytex NRL

process or to retool their manufacturing process because of the general downturn in the economy. As part of a strategy to increase awareness

of the Vytex NRL brand, the Company has been aggressively seeking to have end products produced and labeled “made with Vytex NRL”

such as mattresses, toppers and pillows. As these products enter the market, the Company plans to create consumer awareness of these

end products and in so doing begin to develop consumer demand pull through as part of the Company’s efforts to complete the push-pull

cycle using an ingredient branding strategy.

Assertions

by a third party that our Vytex process infringes its intellectual property, whether or not correct, could subject us to costly and time-consuming

litigation or expensive licenses.

There

is frequent litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing

competition and become increasingly visible as an operating company, the possibility of intellectual property rights claims against us

may grow.

Any

intellectual property rights claim against us or our customers, with or without merit, could be time-consuming, expensive to litigate

or settle and could divert management attention and financial resources. An adverse determination also could prevent us from offering

our process, require us to pay damages, require us to obtain a license or require that we stop using technology found to be in violation

of a third party’s rights or procure or develop substitute services that do not infringe, which could require significant resources

and expenses.

The

latex market in which we will participate is competitive and if we do not compete effectively, our operating results may be harmed.

The

markets for our product are competitive and rapidly changing. With the introduction of new technologies, increasing scrutiny of alternative

lattices such as Russian dandelion, and new market entrants, we expect competition to intensify in the future. In addition, pricing pressures

and increased competition generally could result in reduced sales, reduced license fees or the failure of our products to achieve or

maintain widespread market acceptance.

While

continued interest is strong in a new innovative product in the natural rubber latex industry, pricing and regulatory approvals remain

a key selling factor.

Our

Vytex revenue will vary based on fluctuations in commodity prices for NRL.

NRL

is a commodity and, as such, its price fluctuates daily. Our raw material revenue including licensing fees and cost of goods will also

fluctuate upward or downward based upon changing market prices for the raw material used to produce Vytex NRL. Prolonged periods of lowered

market prices can also cause manufacturers to review synthetic price drops as they look for even lower cost alternatives to NRL.

While

Vytex NRL has received 510(k) clearance from the FDA for condoms and exam gloves, there is no assurance that future applications will

be cleared.

In

order for Vytex to be used in medical device applications, the manufacturer of the end product must submit an application to the FDA.

If the device is classified by the FDA as Class II (e.g., condoms, surgical gloves, and most non-cardiac and non-renal/dialysis catheters)

and in some cases Class I (e.g., exam gloves), a 510(k) application must

be

filed with the FDA seeking clearance to market the device based on the fact that there is at least one other predicate or similar device

already marketed. If the product is classified as a Class III product (e.g., most cardiac and renal/dialysis catheters, certain adhesives

and other in vivo devices), or is otherwise a new device with no predicate on the market already, then the manufacturer of the end product

must submit a Pre-Market Approval (“PMA”) application seeking approval by the FDA to market the device. The PMA approval

process is much more in depth and lengthy and requires a greater degree of clinical data and FDA review than does a 510(k) clearance

process.

Since

Vytex is a raw material and not an end-product, Vystar is not the entity that files with the FDA for any clearance or approval to market

a device. Instead, the end-product manufacturers who will be selling and marketing the device(s) must submit applications and seek FDA

clearance or approval depending upon the device classification. Vystar’s role in this process is only as background support to

the manufacturers to supply information and any technical or test data regarding the Vytex raw material.

An

American manufacturer of condoms and exam gloves had been engaged in production work and had completed required testing and received

FDA clearance for using Vytex NRL in their condom and exam glove lines. However, this manufacturer is not currently producing products

made with Vytex NRL or any other type of raw material. Notwithstanding such approvals, we have no assurance that future products will

provide acceptable test results and even if they do, there is no certainty that the FDA will approve the applications.

Each

of the above mentioned 510(k)s have been sold to other manufacturers hence the need to pursue 510(k)s for the newer manufacturing facilities.

Vytex

may seek to have lower protein claims than what is currently on the market today for exam gloves and may ultimately seek to have latex

warnings removed from or modified on all FDA-regulated products, but it cannot guarantee that either of such actions will be approved

by the FDA.

The

FDA heavily scrutinizes any and all claims categorizing the protein levels and other claims of an NRL product. Currently, the FDA has

allowed claims only stating the level of less than 50 micrograms/gram of total extractable proteins pursuant to only one of two FDA-recognized

standards on exam or surgical gloves. Vystar intends to claim protein levels pursuant to both of the two FDA-recognized standards, which

will result in claiming the lowest level of antigenic proteins for a Hevea NRL product currently on the market. Although the FDA has

cleared such claims on the condom using Vytex NRL, the FDA rejected those claims for the exam glove. There is no guarantee that the FDA

will ultimately or ever allow these claims on an exam glove.

Additionally,

for many years, the FDA has required warnings on products containing latex due to the latex allergy issue that exists. Vystar plans on

petitioning the FDA to have that label removed from or modified on products manufactured with Vytex NRL, by filing a Citizen’s

Petition. The Petition will be filed when we see that the benefits of filing will far outweigh the costs since such Petition is likely

to require clinical test results indicating acceptable allergic reactions associated with Vytex NRL. There are no assurances that the

FDA will grant that request.

Manufacturers

are implementing trials of Vytex NRL in their facilities but final data is not yet available from all these manufacturers on its viability

for their particular environments.

Over

the past several years, samples of Vytex NRL have been made available to over 50 natural rubber latex and latex substitute end product

manufacturers, 30 of which have been in place since early 2009. Since the completion of the Vytex NRL Standard Operation Procedures (SOPs),

Vytex has been produced at Revertex (Malaysia), Occidente (Guatemala), KAPVL (India) and most recently Mardec-Yala (Thailand) and MMG

(Thailand). Under the 2020 agreement with CMC Global, that entity is responsible for manufacturing, marketing and selling Vytex exclusively

including sampling. Manufacturers that have signed a ‘sampling’ agreement with us have been provided with samples of Vytex

NRL for validating its use in their manufacturing processes.

Another

risk is the validity of the customer as testing completes. Recently Vystar has completed more than three years of a specialized version

of Vytex NRL only to have the end product manufacturer fail to upgrade their production line and fulfill their own contract. As part

of the Company’s learnings, we have found that in listening closely to customer challenges and needs, our technical team has been

able to develop solutions. The Company has come to realize that what we offer is not just a raw material but often a technology solution

to a production or product development challenge.

While

many of these new formulations look promising, there is no guarantee that these technological innovations will be successfully scaled

up or successfully implemented by the customer.

The

following risk factors apply to our company as a whole:

Our

use of foreign sources of production for a portion of our products exposes us to certain additional risks associated with international

operations.

Our

use of foreign sources for the supply of certain of our products exposes us to risks associated with overseas sourcing. These risks are

related to government regulation, volatile ocean freight costs, delays in shipments, and extended lead time in ordering. Governments

in the foreign countries where we source our products may change their laws, regulations and policies, including those related to tariffs

and trade barriers, investments, taxation and exchange controls which could make it more difficult to service our customers resulting

in an adverse effect on our earnings. We could also experience increases in the cost of ocean freight shipping which could have an adverse

effect on our earnings. Shipping delays and extended order lead times may adversely affect our ability to respond to sudden changes in

demand, resulting in the purchase of excess inventory in the face of declining demand, or lost sales due to insufficient inventory in

the face of increasing demand, either of which would also have an adverse effect on our earnings or liquidity.

Significant

fluctuations in the cost of raw materials could adversely affect our profits.

On

a global and regional basis, the raw materials used in our products are susceptible to significant price fluctuations due to supply/demand

trends, transportation costs, government regulations and tariffs, changes in currency rates, the economic and political climate and other

circumstances. Significant increases in the future could materially affect our costs and profits.

Because

our stock price may be volatile due to factors beyond our control, you could lose all or part of your investment.

Price

and volume of stock, including additional stock issuances may cause price decline and dilution.

If

we do not attract and retain highly qualified employees, we may not be able to grow effectively.

Our

ability to compete and grow depends in large part on the efforts and talents of our executive officers or employees. We require the key

employee(s) to enter into employment agreements, but in the U.S., employees are free to leave an employer at any time without penalties.

The loss of key employees or the inability to hire additional skilled employees as necessary could result in significant disruptions

of our business, and the integration of replacement personnel could be time-consuming and expensive and cause us additional disruptions.

We

do not expect to declare any dividends in the foreseeable future.

We

do not anticipate declaring any cash dividends to holders of our common stock in the foreseeable future. Consequently, shareholders must

rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their

investment. Investors seeking cash dividends should not purchase our common stock.

There

is no assurance that any significant public market for our shares of common stock will develop.

While

our shares of common stock trade on the OTC Bulletin Board under the symbol “VYST”, there is currently no significant public

market for our common stock and there is no assurance that there will be any such significant public market for our common stock in the

future.

The

utilization of our tax losses could be substantially limited if we experience an ownership change as defined in the Internal Revenue

Code.

Because

of net operating losses we have experienced for federal income tax purposes at December 31, 2023, we had federal net operating loss (“NOL”)

carry-forwards of approximately $38 million ($37.5 million for 2022) available to offset future taxable income. Our ability to utilize

NOL carry-forwards to reduce future taxable income may be limited under Section 382 of the Internal Revenue Code if certain ownership

changes in our Company occur during a rolling three-year period. These ownership changes include purchases of common stock under share

repurchase programs, the offering of stock by us, the purchase or sale of our stock by 5% shareholders, as defined in the Treasury regulations,

or the issuance or exercise of rights to acquire our stock. If such ownership changes by 5% shareholders result in aggregate increases

that exceed 50 percentage points during the three-year period, then Section 382 imposes an annual limitation on the amount of our taxable

income that may be offset by our NOL carry-forwards or tax credit carry-forwards at the time of ownership change. The limitation may

affect the amount of our deferred income tax asset and, depending on the limitation, a significant portion of our NOL carry-forwards

or tax credit carry-forwards could expire before we are able to use them. In such an event, our business, financial condition, results

of operations or cash flows could be adversely affected. We believe we have not experienced an ownership change under Section 382 of

the Internal Revenue Code as of December 31, 2023; however, the amount by which our ownership may change in the future could be affected

by purchases and sales of stock by 5% shareholders and new issuances of stock by us, should we choose to do so.

| ITEM

1B. |

UNRESOLVED

STAFF COMMENTS |

None.

Although

we believe that our current space is adequate for the foreseeable future, if additional office space is required, we believe that suitable

space will be available at market rates.

| ITEM

3. |

LEGAL

PROCEEDINGS |

EMA

Financial

On

February 19, 2019, EMA Financial, Inc. filed a lawsuit in the Southern District of New York against the Company. The lawsuit alleged

various breaches of an underlying convertible promissory note and stock purchase agreement and sought four claims for relief: (i) specific

performance to enforce a stock conversion and contractual obligations; (ii) breach of contract; (iii) permanent injunction to enforce

the stock conversion and contractual obligations; and (iv) legal fees and costs of the litigation. The complaint was filed with a motion

seeking: (i) a preliminary injunction seeking an immediate resolution of the case through the stock conversion; (ii) a consolidation

of the trial with the preliminary injunctive hearing; and (iii) summary judgment on the first and third claims for relief.

The

Company filed an opposition to the motion and upon oral argument the motion for injunctive relief was denied. The Court issued a decision

permitting a motion for summary judgment to proceed and permitted the Company the opportunity to supplement its opposition papers together

with the plaintiff who was also provided opportunity to submit reply papers. On April 5, 2019, the Company filed the opposition papers

as well as a motion to dismiss the first and third causes of action in the complaint. On March 13, 2020, the Court granted the Company’s

motion dismissing the first and third claims for relief and denied the motion for summary judgment as moot.

The

Company subsequently filed an amended answer with counterclaims. The affirmative defenses if granted collectively preclude the relief

sought. In addition, Vystar filed counterclaims asserting: (a) violation of 10(b)(5) of the Securities and Exchange Act; (b) violation

of Section 15(a)(1) of the Exchange Act (failure to register as a broker-dealer); (c) pursuant to the Uniform Declaratory Judgment Act,

28 U.S.C. §§ 2201, the Company requests the Court to declare: (i) pursuant to Delaware law, the underlying agreements are unconscionable;

(ii) the underlying agreements are unenforceable and/or portions are unenforceable, such as the liquidated damages sections; (iii) to

the extent the agreement is enforceable, Vystar in good faith requests the Court to declare the legal fee provisions of the agreements

be mutual (d) unjust enrichment; (e) breach of contract (in the alternative); and (f) attorneys’ fees.

On

June 10, 2020, EMA filed a motion for summary judgment as to its remaining claims for relief and a motion to dismiss the Company’s

affirmative defenses and counterclaims. The Company opposed the motion on July 10, 2020, and the same was fully submitted to the Court

on July 28, 2020. On March 29, 2021, the Court issued a decision granting in part and denying in part the motion. Specifically, the Court

granted that part of the motion seeking summary judgment and dismissal on the Company’s affirmative defense and counterclaim regarding

Sections 15(a)/29(b) of the Exchange Act. Two weeks later the Company filed a motion for reconsideration as to the dismissal portion

of the order, or, for the alternative, a motion for certification for the right to file a petition to the Second Circuit Court of Appeals

on the issue. The Court denied the motion for reconsideration and certification. Subsequently, fact discovery has been completed and

on June 24, 2022 both parties submitted competing motions for summary judgment.

EMA

seeks summary judgment on its breach of contract and attorneys’ fees claims, specifically seeking damages in the amount of $1,820,000

with 24% interest premised on the argument it was entitled to effectuate a January 15 and February 5, 2019, notices of conversions. EMA

further seeks to dismiss Vystar’s affirmative defenses and counterclaims. Conversely, Vystar filed its motion for summary judgment

seeking an order to dismiss the EMA complaint on the grounds: (i) the underlying note was satisfied on December 11, 2018; and (ii) EMA,

through multiple breaches of the note, over-converted the note by 36,575,555 shares equating to a request of damages against EMA and

in favor of Vystar for $4,802,000, with interest accruing at 24%, and attorneys’ fees. The briefing by the parties was fully submitted

on July 29, 2022.

On

January 6, 2023, the Court issued a series of preliminary rulings based upon the parties’ respective summary judgment motions.

Those rulings narrowed the outstanding issues (and claims) to only the parties’ breach of contract claim and counterclaim (and

affirmative defenses) regarding the conversion process. Of particular importance, the Court found EMA breached the note by failing to

effectuate the conversions in the manner outlined by the controlling note. The Court further found the principal balance at issue was

$80,000, interest accrued from the date set in the note and default interest, to the extent applicable, was to accrue at the default

rate from September 2018, forward. The Court left undecided whether EMA’s breach of the note was material, whether affirmative

defenses as previously raised by the parties were applicable to each parties’ contractual claim, and a damages analysis associated

with the same. The Court then requested a supplemental briefing as to the issues of materiality, liability and damages. The issues were

fully briefed and submitted on February 24 and March 15, 2023.

On

October 27, 2023, the Court held oral argument on the issues addressed in the supplemental briefing. On November 27, 2023, the Court

issued its order resolving the case in Vystar’s favor. The Court held while EMA breached the terms of the underlying promissory

note by virtue of the manner of its conversions, such breach was not material. The Court thereafter held the balance of the note was

paid in full by Vystar. Based upon the decision in favor of Vystar, the Court granted Vystar’s request for legal fees, and requested

a briefing on the same. Vystar subsequently submitted a motion for legal and expert fees in the amount of approximately $638,000 supported

by the relevant paperwork. The parties await the Court’s decision.

On

December 24, 2023, EMA filed a motion for reconsideration, arguing the Court failed to properly read the underlying note that, in EMA’s

belief, allowed it to effectuate the two post default conversions at issue in the case. After the matter was fully briefed by the parties,

on May 16, 2024, the Court held oral argument. On the same date after argument the Court granted EMA the procedural right for reconsideration,

and thereafter denied the substantive portion of its motion. The November 27, 2023, decision stands.

On

December 27, 2023, EMA filed a notice of appeal with the United States Court of Appeals for the Second Circuit. The appeal targets each

section of the prior decisions that fell against EMA. Vystar has until June 14, 2024, to file its notice of appeal with the same appellate

court. The appeal, if filed, will target the relevant and material decisions issued by the Court against Vystar.

On

June 13, 2024, Vystar has timely filed its notice of cross-appeal. EMA is required to file its submissions on September 20, 2024, and

Vystar thereafter has sixty days to file its opposition and cross-appeal. Thereafter the parties will submit final submissions for the

appellate court to consider.

On

August 5, 2024, the District Court denied, without prejudice to renew, the motion for attorneys’ fees, ruling that such is premature

based upon the pending appeal and cross-appeal.

| ITEM

4. |

MINE

SAFETY DISCLOSURES |

Not

applicable.

PART

II.

| ITEM

5. |

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND PURCHASES OF EQUITY SECURITIES |

Market

Price Information

Our

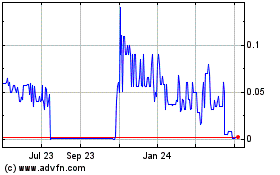

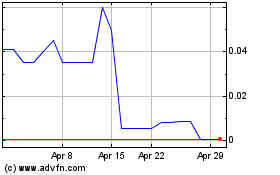

common stock is traded in the United States on the Over the Counter Bulletin Board (OTCBB) under the symbol “VYST.” The following

table shows the range of high and low closing prices for our common stock.

| | |

High | | |

Low | |

| December 31, 2022 | |

| | | |

| | |

| | |

| | | |

| | |

| First Quarter | |

$ | 1.00 | | |

$ | 0.62 | |

| | |

| | | |

| | |

| Second Quarter | |

$ | 0.78 | | |

$ | 0.41 | |

| | |

| | | |

| | |

| Third Quarter | |

$ | 0.46 | | |

$ | 0.27 | |

| | |

| | | |

| | |

| Fourth Quarter | |

$ | 0.28 | | |

$ | 0.10 | |

| | |

| | | |

| | |

| December 31, 2023 | |

| | | |

| | |

| | |

| | | |

| | |

| First Quarter | |

$ | 0.19 | | |

$ | 0.08 | |

| | |

| | | |

| | |

| Second Quarter | |

$ | 0.09 | | |

$ | 0.03 | |

| | |

| | | |

| | |

| Third Quarter | |

$ | 0.06 | | |

$ | 0.00 | |

| | |

| | | |

| | |

| Fourth Quarter | |

$ | 0.14 | | |

$ | 0.00 | |

These

quotations do not reflect retail markup, markdown or commission and may not necessarily represent the prices of actual transactions during

these quarterly periods.

Holders

of Record

As

of December 31, 2023, there were 209 holders of record of our common stock. Because some of our shares are held by brokers and other

institutions on behalf of shareholders, we are unable to estimate the total number of stockholders represented by these record holders.

Dividend

Policy

We

have never paid or declared any cash dividends on our common stock and we do not intend to pay or declare dividends on our common stock

in the near future. We presently expect to retain any future earnings to fund continuing development and growth of our business. Our

payment of dividends is subject to the discretion of our board of directors and will depend on earnings, financial condition, capital

requirements and other relevant factors.

Issuer

Purchases of Equity Securities

None.

Securities

Authorized for Issuance Under Equity Compensation Plans

Information

concerning our equity compensation plans is set forth in Item 12 of Part III of this Annual Report on Form 10-K.

Recent

Sales of Unregistered Securities

Common

Stock and Warrant Grants

There

were no common stock and warrant grants issued from January 1, 2023 through December 31, 2023.

Stock

Option Grants

There

were no stock option grants issued from January 1, 2023 through December 31, 2023.

Proceeds

from loans and shareholder, convertible and contingently convertible notes payable

There

were no proceeds from October 1, 2023 through December 31, 2023.

Application

of Securities Laws and Other Matters

No

underwriters were involved in the foregoing sales of securities. The securities described above were issued to investors in reliance

upon the exemption from the registration requirements of the Securities Act, as set forth in Section 4 (2) under the Securities Act and

Regulation D promulgated thereunder, as applicable, relative to sales by an issuer not involving any public offering, to the extent an