false

0001308027

0001308027

2023-11-27

2023-11-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 27, 2023

VYSTAR

CORPORATION

(Exact

Name of Registrant as Specified in Charter)

| Georgia |

|

000-53754

|

|

20-2027731 |

(State

or Other Jurisdiction

of

Incorporation |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

725

Southbridge Street

Worcester,

MA |

|

01610 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (508) 791-9114

n/a

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Type

of each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common |

|

VYST |

|

None |

Indicate

by checkmark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) of Rule 12B-2 of the Securities Exchange act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events

EMA

Financial

On

February 19, 2019, EMA Financial, Inc. filed a lawsuit in the Southern District of New York against the Company. The lawsuit alleged

various breaches of an underlying convertible promissory note and stock purchase agreement and sought four claims for relief: (i) specific

performance to enforce a stock conversion and contractual obligations; (ii) breach of contract; (iii) permanent injunction to enforce

the stock conversion and contractual obligations; and (iv) legal fees and costs of the litigation. The complaint was filed with a motion

seeking: (i) a preliminary injunction seeking an immediate resolution of the case through the stock conversion; (ii) a consolidation

of the trial with the preliminary injunctive hearing; and (iii) summary judgment on the first and third claims for relief.

The

Company filed an opposition to the motion and upon oral argument the motion for injunctive relief was denied. The Court issued a decision

permitting a motion for summary judgment to proceed and permitted the Company the opportunity to supplement its opposition papers together

with the plaintiff who was also provided opportunity to submit reply papers. On April 5, 2019, the Company filed the opposition papers

as well as a motion to dismiss the first and third causes of action in the complaint. On March 13, 2020, the Court granted the Company’s

motion dismissing the first and third claims for relief and denied the motion for summary judgment as moot.

The

Company subsequently filed an amended answer with counterclaims. The affirmative defenses if granted collectively preclude the relief

sought. In addition, Vystar filed counterclaims asserting: (a) violation of 10(b)(5) of the Securities and Exchange Act; (b) violation

of Section 15(a)(1) of the Exchange Act (failure to register as a broker-dealer); (c) pursuant to the Uniform Declaratory Judgment Act,

28 U.S.C. §§ 2201, the Company requests the Court to declare: (i) pursuant to Delaware law, the underlying agreements are unconscionable;

(ii) the underlying agreements are unenforceable and/or portions are unenforceable, such as the liquidated damages sections; (iii) to

the extent the agreement is enforceable, Vystar in good faith requests the Court to declare the legal fee provisions of the agreements

be mutual (d) unjust enrichment; (e) breach of contract (in the alternative); and (f) attorneys’ fees.

On

June 10, 2020, EMA filed a motion for summary judgment as to its remaining claims for relief and a motion to dismiss the Company’s

affirmative defenses and counterclaims. The Company opposed the motion on July 10, 2020, and the same was fully submitted to the Court

on July 28, 2020. On March 29, 2021, the Court issued a decision granting in part and denying in part the motion. Specifically, the Court

granted that part of the motion seeking summary judgment and dismissal on the Company’s affirmative defense and counterclaim regarding

Sections 15(a)/29(b) of the Exchange Act. Two weeks later the Company filed a motion for reconsideration as to the dismissal portion

of the order, or, for the alternative, a motion for certification for the right to file a petition to the Second Circuit Court of Appeals

on the issue. The Court denied the motion for reconsideration and certification. Subsequently, fact discovery has been completed and

on June 24, 2022 both parties submitted competing motions for summary judgment.

Thereafter,

EMA sought summary judgment on its breach of contract and attorneys’ fees claims, specifically seeking damages in the amount of

$1,820,000 with 24% interest premised on the argument it was entitled to effectuate a January 15 and February 5, 2019, notices of conversions.

EMA further sought to dismiss Vystar’s affirmative defenses and counterclaims. Conversely, Vystar filed its motion for summary

judgment seeking an order to dismiss the EMA complaint on the grounds: (i) the underlying note was satisfied on December 11, 2018; and

(ii) EMA, through multiple breaches of the note, over-converted the note by 36,575,555 shares equating to a request of damages against

EMA and in favor of Vystar for $4,802,000, with interest accruing at 24%, and attorneys’ fees. The briefing by the parties was

fully submitted on July 29, 2022.

On

January 6, 2023, the Court issued a series of preliminary rulings based upon the parties’ respective summary judgment motions.

Those rulings narrowed the outstanding issues (and claims) to only the parties’ breach of contract claim and counterclaim (and

affirmative defenses) regarding the conversion process. Of particular importance, the Court found EMA breached the note by failing to

effectuate the conversions in the manner outlined by the note. The Court further found the principal balance at issue was $80,000, interest

accrued from the date set in the note and default interest, to the extent applicable, was to accrue at the default rate from September

2018, forward. The Court left undecided whether EMA’s breach of the note was material, whether affirmative defenses as previously

raised by the parties were applicable to each parties’ contractual claim, and a damages analysis associated with the same. The

Court then requested a supplemental briefing as to the issues of materiality, liability and damages. The issues were fully briefed and

submitted on February 24 and March 15, 2023.

On

October 27, 2023, the Court held oral argument on the issues addressed in the supplemental briefing. Subsequent to argument the Court

reserved judgment and indicated a written decision would be issued shortly.

On

November 27, 2023, the Court issued its Memorandum and Opinion resolving all outstanding issues in the case. The remaining issues were

(i) EMA’s motion for summary judgment on its breach of contract claim, seeking $4,226,187 in damages, and for dismissal of Vystar’s

counterclaims and (ii) Vystar motion for summary judgment in favor of its counterclaims and for dismissal of EMA’s claim for breach

of contract.

The

Court dismissed EMA’s complaint for breach of contract thereby nullifying the claim for associated damages.

The

Court also held that Vystar satisfied its contractual obligation to repay the note while EMA breached its own mechanisms for such conversions.

While

the Court did not issue compensatory damages to Vystar, it invited Vystar to file an application for legal fees and expenses. Vystar

will also consider its options as to decisions from the Court that may be subject to an appeal before the Second Circuit.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VYSTAR

CORPORATION |

| |

|

|

| Date:

November 28, 2023 |

By: |

/s/

Steven Rotman |

| |

Name: |

Steven

Rotman |

| |

Title: |

President/Chief

Executive Officer |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

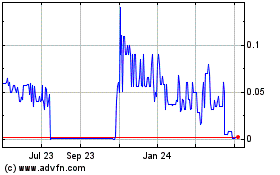

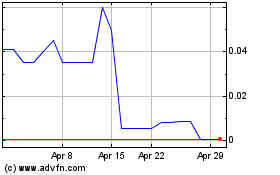

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vystar (CE) (USOTC:VYST)

Historical Stock Chart

From Jul 2023 to Jul 2024