Vivendi: Universal Music Group: Update on the proposed distribution

May 18 2021 - 3:02AM

Dow Jones News

Regulatory News:

Vivendi (Paris:VIV) will propose the setting up of a governance

structure for Universal Music Group (UMG) NV, which is expected to

list its shares on the Euronext Amsterdam stock exchange on

September 27, 2021 at the latest, consistent with the best policies

and standards, treating all shareholders on an equal basis.

Subject to Tencent's and the members of its Consortium's

approval, the following principles will be proposed by Vivendi:

-- A Board of UMG NV Directors comprised primarily of non-executive members,

a majority of whom will be independent;

-- Shareholders' meetings will be free to elect directors in accordance with

the majority conditions provided by law;

-- Neither Vivendi nor Group Bolloré intend to be represented on the

Board at this stage;

-- The principle of "one share, one vote" will be fully observed as no

preferred shares nor any other multiple voting rights will be exercised;

-- No poison pill mechanism will be put in place;

-- Board members' term of office will be limited to two business years.

Prior to the distribution of 60% of the UMG shares to Vivendi

shareholders, the group is analyzing the opportunity of selling 10%

of UMG shares to an American investor or initiating a public

offering of at least 5% and up to 10% of UMG shares. Furthermore,

Vivendi will retain 10% of the UMG share capital for a minimum

period of two years in order to remain associated with the

development of its subsidiary while benefiting from the protection

of EU legislation applicable to parent companies and subsidiaries

from different Member States.

Vivendi and UMG released UMG's financial statements for the

first quarter of 2021 showing excellent results, with an EBIT of

EUR322 million compared to EUR248 million in the first quarter of

2020, thanks to a 9.4% revenue growth and strict cost control

during the period.

UMG - First quarter ended

March 31

% change at

(in millions of constant change

euros) 2021 2020 and perimeter

Revenues 1 809 1 769 +9.4%

EBIT 322 248 +35.8%

Earnings before

provision for

income taxes 164 144 +21.9%

Earnings 136 90 +61.6%

Earnings

attributable to

shareowners 135 89 62.1%

Universal Music Group's (UMG) revenues amounted to EUR1,809

million in the first quarter of 2021, up 9.4% at constant currency

and perimeter compared to the first quarter of 2020 (+2.2% on an

actual basis).

Recorded music revenues grew by 10.8% at constant currency and

perimeter thanks to the growth in subscription and streaming

revenues (+19.6%) and despite the receipt of a digital royalty

claim in the first quarter of 2020. Physical sales were up 14.8%

compared to the first quarter of 2020 driven by better new release

and catalogue sales, while download sales declined by 16.0%.

Recorded music best sellers for the first quarter of 2021 included

new releases from King & Prince and Justin Bieber as well as

continued sales from The Weeknd, Ariana Grande and Pop Smoke.

Music publishing revenues grew by 6.9% at constant currency and

perimeter compared to the first quarter of 2020, driven by

increased subscription and streaming revenues.

Merchandising and other revenues were down 10.0% at constant

currency and perimeter compared to the first quarter 2020, due to

the continued impact of the COVID-19 pandemic on touring activity,

which was not fully offset by improved retail and

direct-to-consumer sales.

UMG EBIT of EUR322 million in the first quarter of 2021 was up

35.8% at constant currency and perimeter compared to the first

quarter of 2020 thanks to the revenue growth and cost control.

Net Cash Provided by Operating Activities Before Income Tax Paid

came in at an outflow of EUR69 million in the first quarter of

2021, 65.7% favorable at constant currency and perimeter to the

first quarter of 2020 driven by the improved operating performance

and lower content spend.

About Vivendi

Since 2014, Vivendi has been focused on building a world-class

content, media and communications group. In content creation,

Vivendi owns powerful, complementary assets in music (Universal

Music Group), movies and series (Canal+ Group), publishing (Editis)

and games (Gameloft) which are the most popular forms of

entertainment content in the world today. In the distribution

market, Vivendi has acquired the Dailymotion platform and

repositioned it to create a new digital showcase for its content.

The Group has also joined forces with several telecom operators and

platforms to maximize the reach of its distribution networks. In

communications, through Havas. the Group possesses unique creative

expertise in promoting free content and producing short formats,

which are increasingly viewed on mobile devices. In addition,

through Vivendi Village, the Group explores new forms of business

in live entertainment, franchises and ticketing that are

complementary to its core activities. Vivendi's various businesses

cohesively work together as an integrated industrial group to

create greater value. www.vivendi.com

View source version on businesswire.com:

https://www.businesswire.com/news/home/20210517006048/en/

CONTACT:

Vivendi

SOURCE: Vivendi

Copyright Business Wire 2021

(END) Dow Jones Newswires

May 18, 2021 02:47 ET (06:47 GMT)

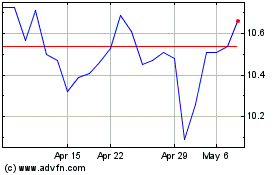

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Dec 2023 to Dec 2024